Research Article: 2023 Vol: 27 Issue: 3

A Meta Analysis of the Effect of Usage of Debt on Valuation of the Company

Shweta Goel, Delhi Institute of Advanced Studies

Citation Information: Goel, S. (2023). A meta analysis of the effect of usage of debt on valuation of the company. Academy of Accounting and Financial Studies Journal, 27(4), 1-10.

Abstract

Optimum composition of debt and equity is an important factor in assessing the valuation of the company. Companies often faced a problem in choosing the optimum amount of debt in their capital structure. This paper aimed at investigating the relationship between debt and earnings of the company using meta-analysis to ascertain what has been accounted in previous literatures. Using Forest Plot, Confidence Interval: Hypothesis Testing, Test of Heterogeneity and Publication Bias analysis and a sample of published journal articles, it is evident that the Value of business is independent of Debt usage and firms cannot increase the value of its business by increasing the level of Debt. However, increase in debt-to-equity ratio beyond a certain level will negatively affect their businesses as it increases the level of risk in the business. Therefore, capital structure is not a good fit in explaining changes in the valuation of company.

Keywords

Meta analysis, valuation of company, confidence interval, Heterogeneity.

Introduction

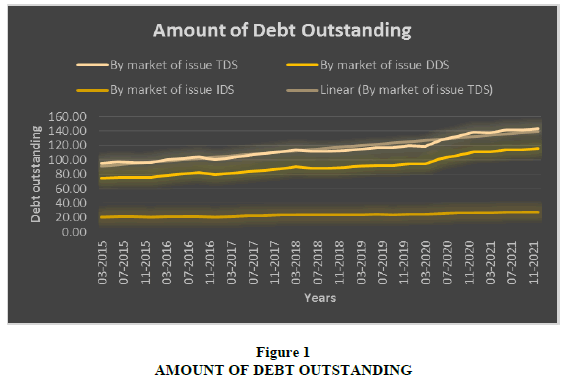

Every firm needs capital assets to operate its business. To finance capital assets, firms use a combination of debt and equity which represents the capital structure of the company. The importance of capital structure has gained momentum in the last decades. Corporate bond segment act as a stable source of finance when there is volatility in equity, and it also enable company to customize their assets and liability so as to reduce the risk to maturity. Each source of finance has its own implications. A firm with good growth opportunities can raise more capital by issuing debentures while retaining ownership and reduce overall cost of capital. Debt financing has increased as a proportion to total world’s earnings. There are various factors affecting the performance and valuation of a company. These factors can be Debt-equity ratio, EPS, bond yield, stock prices, bond rating etc. On an average, debt issuance by public sector account for two-third of the Indian debt volume. The main factors underlying the growth of debt market is public sector deficit, increasing flow of capital worldwide. Debt securities are generally categorized in terms of market of issue as international debt securities, domestic debt securities. International Debt Securities’ (IDS) are issued outside country in which the borrower resides. They include the instruments traditionally called as Eurobonds and Foreign Bonds except negotiable loans. The IDS statistics are represented by currency, maturity and interest rate, type of the issue, and nationality and residence of the issuer. 'Domestic Debt Securites' (DDS) are issued in the country in which the borrower resides, regardless of the currency in which the security is denominated.

As clearly represented in Figure 1, IDS increase by nearly 35% from March 2015 to Dec 2021. DDS grow by 55.38% from March 2015 to Dec 2021. TDS accounts for about 51% increase from March 2015 to Dec 2021 which is majorly contributed by increase in DDS.

The valuation of a company is the process of determining the worth of a business. This value is typically based on a variety of factors including revenue, earnings, assets, market conditions, and the overall economic climate. There are several methods used to value a company, including discounted cash flow analysis, comparable company analysis, and discounted earnings analysis. Ultimately, the valuation of a company is an estimation of its future financial performance and potential for growth. This paper is concerned with understanding the impact of usage of debt on the valuation and earnings of the company by integrating various studies using Meta Analysis tools.

Literature Review

As already mentioned, several factors affect a company's value, and it is recognized that the capital Structure is one of the factors that has a significant impact. optimal capital mix minimizes weighted average cost of capital. This will increase the market value per share. Capital composition usually consists of debt & Equity and changes in debt or equity levels also change the value of a company. Different empirical studies were conducted to investigate the relationship between issuance of debt and earnings of the company. They produce conflicting results. Table 1 and Table 2 presents the findings.

| Table 1 Presents The Findings |

|||||

|---|---|---|---|---|---|

| Study (Author and year of study) | Country | Period | Dependent variables used for earnings and valuation | Independent variables used for debt | Summary of findings |

| Samuel Tabot Enow (2022) | South Africa | 2005-2021 | Profitability | Capital Structure | Increasing the debt-to-equity ratio above a certain level will negatively impact their business by increasing the level of risk in the business. |

| Wang & Wang (2022) | China | 2016-2020 | Green bond Issuance | ESG rating scores | The study identified the negative effect of firm’s financial performance in green bonds issuance by incorporating the effect of ESG performance. It also reveals that companies do not priortizie ESG practices in their business strategy in short run. |

| Rohmini Indah LESTARI (2021) | Indonesia | ROA | BLTD, NIM | More debt issuance harm company performance | |

| Fahd Alduais (2020) | China | 2007-2016 | Stock return | EPS, Market Price | Earnings are positively correlated with the return of the previous period. |

| Hung The DINH (2020) | Vietnam | 2015-19 | ROE | LEV, Debt-Asset ratio | There is a link between the capital structure and the financial performance of publicly traded pharmaceutical companies in Vietnam. |

| Mary M. Nzau (2020) | Kenya | 2008-17 | ROE | Bond price, Coupon rate | The financial performance of the companies surveyed was impacted by the behavior of the components of bond issue. |

| Sakr & Bedeir (2019) | Egypt | 2003-2016 | ROA | TD | Total debt has a negative impact on the firm performance measured by ROA |

| Collins C Ngwakwe (2018) | South Africa | 2016-2017 | Bond Value | Share value | The results revealed a significant but negative relationship between the value of stocks and the value of bonds, indicating that the increase in value of the stock results in a likely decrease in bond value. |

| Soonwook Hong (2016) | South Korea | Market value of equity | ROA, LEV | The type of debt selected is among the various factors that influence firm value. | |

| Patrick Christian Feihle (2017) | Germany | 2009-19 | NI | SIZ, LEV | Issuers actually display lower post-issuance operating performance which amplifies their financial fragility |

| Rjoub et al. (2017) | Turkey | 1995-2015 | Stock prices | CAR, AQ, MQ, EAR, LIQ | Asset quality, management quality, profits are statistically significant in explaining share prices. |

| Oh & Kim (2016) | Korea | Value of firm | Leverage | Detachable Bond warrants issuance has a positive effect on firm value when it is issued in the form of a public offering. The findings suggest that the ownership structure, cash flow position, and kind of issuance of the issuing firm play significant roles in determining the association between the issuance of detachable BWs and firm value. | |

| Moghadas et al. (2013) | Iran | 2006-2010 | MV | REV Gw, AST Gw | There is a significant relationship between asset growth and increase on firm value. |

| Salim & Yadav (2012) | Malaysia | 1995-2011 | ROE, ROA, Tobin'sQ, EPS | LTD, STD, Growth | Tobin's Q (company return) is positively related to the capital structure. |

| Abhay Abhyankar (1999) | UK | 1986-1996 | Wealth | CB, CPfS | Negative wealth impacts for companies that issue convertible securities to refinance past debt or fund specific acquisitions. |

| Table 2 Source |

||

|---|---|---|

| EPS= Earnings per share | ROA= Return on assets | MV= Market value |

| LEV= Leverage | BLTD= Bonds to Long term debt | REV Gw = Revenue growth |

| TD= Total Debt | NIM= Net Interest Margin | AST Gw= Asset Growth |

| SIZ= Size | ROE= Return on equity | LTD= Long term debt |

| AQ= Asset Quality | NI= Net Income | STD= Short term debt |

| LIQ= Liquidity | CAR= Capital Adequacy Ratio | CB= Convertible Bonds |

| EAR= Earnings | MQ= Management Quality | CPfS= Convertible Preference shares |

Research Methodology

A meta-analysis is a statistical method for combining the results of multiple studies to provide a more robust and accurate estimate of the effect size of a particular intervention or treatment. The aim of a meta-analysis is to reduce the random error associated with individual studies and to increase the precision and validity of the results. The results of the meta-analysis are often reported as an overall effect size, with a corresponding measure of statistical significance, as well as a measure of the heterogeneity of the results across the individual studies. This tool was initially developed in pharmaceutical and psychological research for testing the outcomes of a treatment. However, meta-analysis is now more frequently utilized in the field of social sciences as a way to test hypotheses. However, one has to carefully look at the assumptions of meta-analytic hypothesis testing in the social sciences whether they will be met under real-life conditions or not.

Assumptions

While using the meta-analysis tool, researcher should verify that following assumptions are true:

1. Independence: The studies being analyzed should be independent of each other and not influenced by the same underlying factors.

2. Homogeneity: The studies being analyzed should have similar research designs, populations, and outcomes.

3. Normal Distribution: The effect sizes in the studies being analyzed should be approximately normally distributed.

4. Correctly calculated effect sizes: The effect sizes should be accurately calculated and reported in the studies.

5. No publication bias: The studies included in the meta-analysis should not be systematically biased towards positive results.

It's important to note that these assumptions are not always met in practice and can impact the validity of the meta-analysis results.

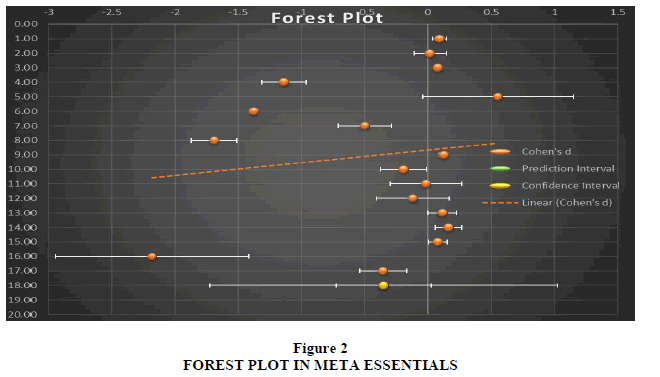

This study made use of a software known as Meta Essentials, which divides the analysis into various segments namely Forest Plot, Subgroup analysis, Moderator Analysis, Publication Analysis and Calculations. More specifically, the Forest Plot is used for a graphical display and shows the confidence interval. It also shows the extent of Heterogeneity. ‘A small effect size means that measures of capital structure can adequately account for profitability’. Also, the Chi square test is relevant in assessing the dependence of profitability on capital structure.

Using the data values from a sample of 17 published articles the following hypothesis were examined.

H0: The level of significance is more than 0.05; therefore, value of firm is related and dependent of debt usage in capital structure.

H1: The level of significance is less than 0.05; therefore, value of firm is not related and independent of debt usage in capital structure.

H2: There is some biasness in the selection of research studies that are showing statistically significant result rather than statistically non-significant result.

H3: There is no biasness in the selection of research studies that are showing statistically significant result rather than statistically non-significant result.

Data Results

The following results were obtained from the software used “Meta Essentials” Table 3.

| Table 3 Results Of Forest Plot |

||||

|---|---|---|---|---|

| Study name | Cohen's d | CI Lower limit | CI Upper limit | Weight |

| Effect of ownership change and growth on firm value at the issuance of bonds with detachable warrants | 0.09 | 0.03 | 0.15 | 6.10% |

| Wealth effects of convertible bond and convertible preference share issues: An empirical analysis of the UK market | 0.02 | -0.11 | 0.14 | 6.05% |

| An empirical study of the earnings–returns association: evidence from China’s A-share market | 0.08 | 0.06 | 0.09 | 6.11% |

| The Effect of Capital Structure on Financial Performance of Vietnamese Listing Pharmaceutical Enterprises | -1.14 | -1.32 | -0.96 | 5.99% |

| EFFECT OF BOND ISSUANCE ON FINANCIAL PERFORMANCE OF FIRMS LISTED ON NAIROBI SECURITIES EXCHANGE | 0.55 | -0.04 | 1.15 | 5.37% |

| INVESTMENT AND THE COST OF CAPITAL: NEW EVIDENCE FROM THE CORPORATE BOND MARKET | -1.38 | -1.41 | -1.34 | 6.11% |

| Stock Market Reaction to Green Bond Announcements | -0.5 | -0.71 | -0.29 | 5.94% |

| The Relationship Between Debt Securities Issuance and Operational Performance: An Empirical Study of Banks in Indonesia | -1.69 | -1.87 | -1.51 | 5.98% |

| The Effect of Debt Choice On Firm Value | 0.12 | 0.09 | 0.16 | 6.11% |

| A Study on Foreign Currency Convertible Bonds FCCBs Theory and Evidence from Corporate Bond Market of India | -0.19 | -0.38 | -0.01 | 5.98% |

| Effects of Debt on Value of a Firm | -0.02 | -0.3 | 0.26 | 5.81% |

| Announcements Effect of Corporate Bond Issuance and Its Determinants | -0.12 | -0.41 | 0.17 | 5.80% |

| The effect of capital structure on profitability: Evidence from the United States | 0.11 | 0 | 0.23 | 6.06% |

| Impact of capital structure on firm value: Evidence from Tehran Stock Exchange | 0.16 | 0.06 | 0.27 | 6.07% |

| Micro and Macroeconomic determinants of stock prices: the case of Turkish banking sector | 0.08 | 0 | 0.15 | 6.09% |

| Impact of Capital Structure on Firm’s Performance: Focusing on Non-financial Listed Egyptian Firms | -2.18 | -2.94 | -1.42 | 4.45% |

| Capital Structure and Firm Performance: Evidence from Malaysian Listed Companies | -0.35 | -0.54 | -0.17 | 5.98% |

Forest Plot

The main part of any meta-analysis is a forest plot. It is a graphical presentation of effect sizes as displayed in Figure 1. The x-axis represents the scale of effect size, plotted on the top of the plot. Each line represents the estimate of the size of the effect of a study in the form of a point using the 95% confidence interval. It is a good way to represent the results of a single study, such as an estimate of an interval in which the "true" effect is very likely. In this study also it is our assumption as mentioned before that every study in the meta-analysis is taking the probability sample of a specified population. Without fulfilling this assumption, no result can be made from the “sample” to a population and comparing the observed effect size with observations in the studies is not reliable Figure 2.

Figure 1: Amount Of Debt Outstanding.

Sources: IMF; Dealogic; Euroclear; Thomson Reuters; Xtrakter Ltd; national data; BIS debt securities statistics; BIS estimations

*DDS = domestic debt securities; IDS = international debt securities; TDS = total debt securities.

* Amount calculated in trillions of US Dollars.

*Sample of countries varies across breakdowns shown. For countries that do not report TDS, data are estimated by the BIS as DDS plus IDS. For countries that do not report either TDS or DDS, data are estimated by the BIS as IDS.

In the above Figure 2 some effect sizes are positive, and some are negative. These studies show a that majority of the studies are statistically significant. Some of them have statistically negative and statistically positive effect. In the above forest plot, Cohen’s d is -0.35 which signifies medium effect size and negative correlation between two variables. Therefore, value of firm is not related and independent of debt usage in capital structure.

Confidence interval: hypothesis testing

The combined effect size in the above forest plot includes zero. At confidence level of 95% its p-value is smaller than 0.05 and it shows that it has significant effect. The aim in this study of meta-analysis is hypothesis testing. p-values (one-tailed and two-tailed) are found and shown in the data mentioned below (measured in Meta-Essentials). Both the p values are less than 0.05.

| Z-value | -1.99 |

| One-tailed p-value | 0.023 |

| Two-tailed p-value | 0.047 |

Estimating the extent of heterogeneity

The plot in Figure 2 itself suggests that there are different effect sizes in different types of populations. In other words, the domain that is analyzed in this meta-analysis must be seen as “heterogeneous”.

| Heterogeneity | |

|---|---|

| Q | 6394.10 |

| pQ | 0.000 |

| I2 | 99.75% |

| T2 | 0.39 |

| T | 0.62 |

In this table, I2 is large i.e., 99.75%, then such an analysis is likely to be worthwhile. This is because of very high proportion showing that the studies in this meta-analysis cannot be considered to be studies of the same population. The effect size variance is shown by T2. The t statistic estimates the standard deviation of the distribution of effect sizes with the assumption that the effect sizes are normally distributed.

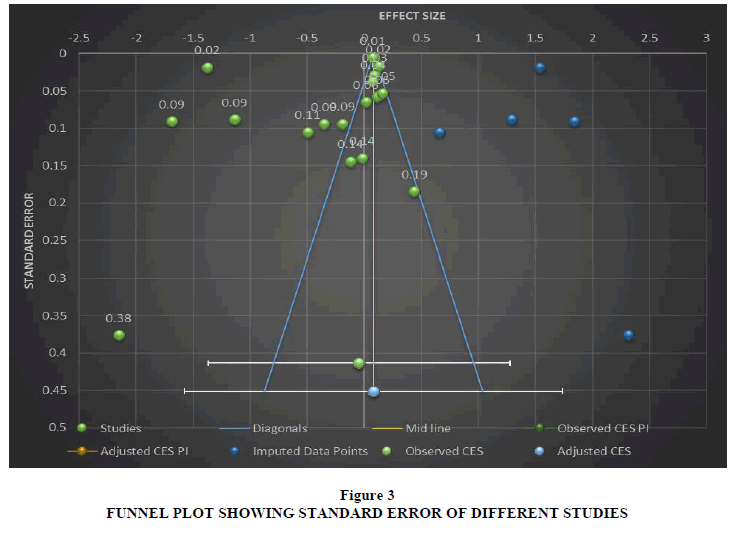

Publication bias Analysis

The research studies taken in a field of study can be biased in many ways. Publication bias analysis is concerned with selection bias that might occur due to the selection of studies, especially when some studies are published, and others are not published. There might be chances that majorly those studies have been selected which have statistically significant result rather than a statistically non-significant result or vice-versa. As a result, the study's estimated cumulative effect size may be higher than it actually is. This potential publishing bias is intended to be signaled by the publication bias analysis.

Meta-Essentials includes various analysis which indicate publication bias. One analysis is a funnel plot Figure 3. We made the assumption in our meta-analysis study that observed effect sizes with comparable standard errors should be more or less symmetrically distributed around the total effect size. In our study almost all the standard errors are closer to .05 and there are some imputed data points (based on the Trim-and-Fill method), the funnel plot indicates there is some asymmetry in the distribution of effect sizes. The Trim-and-Fill method would then impute one or more studies in this situation, adjusting the overall effect size to account for the potential absence of the missing studies. Therefore, H0 and H3 are rejected while H1 and H2 are accepted.

Conclusion

The purpose of this study was to investigate the effect of debt usage on the value of firm using a meta-analysis. This study used a sample 17 published articles across different journals investigate this relationship with a Forest Plot, Confidence Interval: Hypothesis Testing, Test of Heterogeneity and Publication Bias analysis. From the analysis, it is evident that the Value of business is independent of Debt usage and firms cannot increase the value of its business by increasing the level of Debt. However, increasing the debt-to-equity ratio beyond a specific level will negatively affect their businesses because it increases the extent of risk in the business. Although a growing business will generally have an aggressive strategy in financing its growth with debt, this should not be analyzed in line with the valuation of business.

List of Abbreviation

1. CR= Coupon Rate

2. ROA= Return on assets

3. MV= Market value

4. INF= Inflation

5. BLTD= Bonds to Long term debt

6. REV Gw = Revenue growth

7. EPS= Earnings per share

8. NIM= Net Interest Margin

9. AST Gw= Asset Growth

10. LEV= Leverage

11. ROE= Return on equity

12. LTD= Long term debt

13. TD= Total Debt

14. NI= Net Income

15. STD= Short term debt

16. SIZ= Size

17. CAR= Capital Adequacy Ratio

18. CB= Convertible Bonds

19. AQ= Asset Quality

20. MQ= Management Quality

21. CPfS= Convertible Preference shares

22. LIQ= Liquidity

23. EAR= Earnings

24. DDS = domestic debt securities;

25. IDS = international debt securities;

26. TDS = total debt securities

27. EPS= Earning per share

References

Abhyankar, A., & Dunning, A. (1999). Wealth effects of convertible bond and convertible preference share issues: An empirical analysis of the UK market. Journal of Banking & Finance, 23(7), 1043–1065.

Indexed at, Google Scholar, Cross Ref

Alduais, F. (2020). An empirical study of the earnings–returns association: Evidence from China’s A-share market. Future Business Journal, 6(1).

Indexed at, Google Scholar, Cross Ref

Collins, C.N. (2018). Analysis of the Relationship between Bond Value and Share Value in the Security Market Acta Universitatis Danubius. Œconomica, 14(1), 75-83.

DINH, H.T., & PHAM, C.D. (2020). The Effect of Capital Structure on Financial Performance of Vietnamese Listing Pharmaceutical Enterprises. The Journal of Asian Finance, Economics and Business, 7(9), 329-340.

Indexed at, Google Scholar, Cross Ref

Enow, S.T. (2022). A meta-analysis of the effect of capital structure on profitability. Academy of Accounting and Financial Studies Journal, 26(3), 1-10.

Feihle, P.C., & Lawrenz, J. (2017). The Issuance of German SME Bonds and its Impact on Operating Performance. Schmalenbach Business Review, 18(3), 227–259.

Indexed at, Google Scholar, Cross Ref

Hong, S. (2016). The Effect of Debt Choice on Firm Value. Journal of Applied Business Research (JABR), 33(1), 135–140.

Indexed at, Google Scholar, Cross Ref

Lestari, R.I. (2021). The Relationship between Debt Securities Issuance and Operational Performance: An Empirical Study of Banks in Indonesia. SSRN Electronic Journal.

Indexed at, Google Scholar, Cross Ref

Moghadas, A., & Pouraghajan, A., & Bazugir, V. (2013). Impact of capital structure on firm value: Evidence from Tehran Stock Exchange. Management Science Letters, 3.

Indexed at, Google Scholar, Cross Ref

Oh, S., & Kim, W.S. (2016). Effect of ownership change and growth on firm value at the issuance of bonds with detachable warrants. Journal of Business Economics and Management, 17, 901-915.

Indexed at, Google Scholar, Cross Ref

Rjoub, H., & Civcir, I., & Resatoglu, N. (2017). Micro and macroeconomic determinants of stock prices: The case of Turkish banking sector. Romanian Journal of Economic Forecasting, 20.

Sakr, A., & Bedeir, A. (2019). Impact of Capital Structure on Firm’s Performance: Focusing on Non-financial Listed Egyptian Firms. International Journal of Financial Research, 10(6), 78.

Indexed at, Google Scholar, Cross Ref

Salim, M., & Yadav, R. (2012). Capital Structure and Firm Performance: Evidence from Malaysian Listed Companies. Procedia - Social and Behavioral Sciences, 65, 156-166.

Indexed at, Google Scholar, Cross Ref

Wang, S., & Wang, D. (2022). Exploring the Relationship Between ESG Performance and Green Bond Issuance. Frontiers in Public Health, 10.

Indexed at, Google Scholar, Cross Ref

Received: 04-Mar-2023, Manuscript No. AAFSJ-23-13298; Editor assigned: 06-Mar-2023, PreQC No. AAFSJ-23-13298(PQ); Reviewed: 20-Mar-2023, QC No. AAFSJ-23-13298; Revised: 14-Apr-2023, Manuscript No. AAFSJ-23-13298(R); Published: 21-Apr-2023