Research Article: 2021 Vol: 20 Issue: 1

A Review on Blue Ocean Strategy Effect on Competitive Advantage and Firm Performance

Mukhlis Yunus, Faculty of Economics & Business, Universitas Syiah Kuala

Ferdi Nazirun Sijabat, Sekolah Tinggi Ilmu Ekonomi Sabang

Abstract

Many literatures acknowledge that the blue ocean strategy has influenced on competitive advantage, and subsequently the competitive advantage can predict firm performance. This study attempts to review relevant articles regarding the blue ocean strategy and link it with firm's competitive advantage and performance. Extant relevant literature of past research on blue ocean strategy in the various outlets were searched by using search strategy key words: “blue ocean strategy”, “blue ocean and competitive advantage”, “blue ocean and performance”, and “value innovation”. Collected articles were reviewed further and synthesized based on the purpose to link between the Blue Ocean and competitive advantage, and firm performance which arrive at establishing a proposed framework. This article develops a theoretical foundation for proposing a framework that links the potential effect of Blue Ocean Strategy on Competitive Advantage and its implication towards firm performance. This article provides avenue for further empirical study in examining the effect of the blue ocean strategy on firm performance and the role of competitive advantage as a mediator.

Keywords

Blue Ocean Strategy, Competitive Advantage, Firm Performance.

Introduction

“Why are some successful companies gaining high growth, and others lack success?” (Kim & Mauborgne, 1998). The quote is a critical question asked by both researchers who led them to the creation of a value innovation which later became the formation of the Blue Ocean Strategy (Kim & Mauborgne, 2005).

Based on their seminal paper in 1997 published by the MIT Sloan Management Review, Kim and Mauborgne continued to reinforce their theories by conducting case studies at a variety of companies such as Cirque du Soleil, Yellow Tail, South West Airline, Apple, Netflix, Salesforce, etc. The answer to the above question is that, “companies that are not successful focus on how to defeat competitors. However, high-growth firm is not focused on competitors but on value innovations” (Kim & Mauborgne, 1997).

Despite it is often aligned with disruptive innovation theory and value creation, Blue Ocean Strategy (BOS) is distinguished from both due to three things: 1. It is useful for creating new demand, 2. The company more emphasize on and 3. Recognizing new potential markets. In general, BOS can be identified via the following characteristics: 1. Using management buzzword, which enable authority to claim, action, and responsibility displace, 2. Performance enhancer, meaning it can be used to increase organizational performance; and lastly 3. Having the interpretive room, where everyone tends to interprete the BOS in regards to their respective point of view (Madsen & Slåtten, 2019).

Unlike previous study on BOS, this article attempts to review relevant articles regarding the blue ocean strategy and link it with firm's performance, where competitive advantage is treatened as mediating variable. This particular perspective by this far has been neglected in the literatures.

In the following section this article is organized by firstly highlight the shift to the blue ocean strategy, blue ocean strategy and firm performance, competitive advantage and firm performance, lastly the discussion on the mediating role of competitive advantage.

Shifting Blue Ocean to Quantitative Study

Recently, there are critiques that relate to BOS which considered rather qualitative and neglected the quantitative side. Therefore, many researches in this field were done in order to shade some lights by bringing the concepts into quanitative arena. Some basic concepts of BOS also sharply measured by researchers like Agnihotri (2016) who revealed that the concept of value innovations introduced by Kim & Mauborgne (1997; 2005) is not a new one, because the same concept has been introduced by previous researcher with the term hybrid value. Nevertheless, Agnihotri's criticism is later debated by Christodoulou & Langley (2019) stating that value innovation is a modern strategy concept because it is associated with the creation of a new market.

Furthermore, Agnihotri (2016), Christodoulou & Langley (2019), Idris et al. (2019), Yang & Yang (2011) had respectively taken BOS concept to be examined in different context. Agnihotri (2016) for example, has radically expanded the concepts and practices of BOS. She argues that BOS can also be achieved through radical innovations, disruptive innovation, frugal innovations, pure differentiation strategies as well as focused differentiation strategies.

Afterward, Chirstodoulou & Langley (2019) observed there is a space that needs to be inserted in the mid of moving from the red to the blue ocean. The space called as a transitional zone. The authors viewed the fact that many companies felt the strategy and stability to shift to the blue ocean, as it had already prepared itself to be a highly competitive company in the Red ocean. To overcome this problem, they introduce the term “BOS droplet”. It is a tool to assist company moving from red ocean to the blue ocean.

In contrast, Yang & Yang (2011) precisely incorporated the BOS into the Kanos model that spawned a new wider scope framework. They combine three version values (Gupta & Lehman, 2005) namely: Economic value, functional value, and psychological value with creative values (Kim & Mauborgne, 2005) so that they are transformed to be four values. These values are formed by 12 attributes that place in the form of innovative product and service attributes, product attributes and extension services. Subsequently, these values go through the four action framework eliminate-reduce-raise-create process.

Then the study undertaken by Idris et al. (2019) which taken place in the telecommunications industry in Jordania. This study is actually very limited because it is intended only to develop a multidimensional indicators of the BOS. Despite the BOS consistes of 9 useful tools, however Idris et al. (2019) study does not mention the tools entirely, but the four action frameworks consisting of eliminate, reduce, raise, and create. Idris et al. (2019) found that overall factor of the item meet the standard with an eigenvalue of more than 1. Overall items are also valid, as it is above 0.70, where the whole item has a value between 0.757-0.845.

Another study by Chang (2010) which trying to unveil the fruitful strategy of China’s bandit cellphone by adding chip produced by Mediatek, a Taiwanese chip maker, into their smartphone products. Mediatek is well known as a key source behind the success of bandit cellphone, a brand less smartphone which capable of grabing market in developing countries. It is reported that Mediatek sells large volume of chip products to mobile phone makers in China. Chang (2010) found that the smartphone product succeeded in eliminating the cost of intellectual property rights protoection and brand capital. The manufacturer can set to lower price, research and development costs, inspection costs, advertising costs, product guarantees and product cycles. In this part, Mediatek has enabled a small number of players in the industry to grow and having an astounding and sturdy design. In this case, Chang (2010) conclude that the value innovation is co-created by Mediatek and its partners.

After 20 years of research and development of the Blue Ocean Strategy (BOS), Kim & Mauborgne (2017) launched their latest book on how to undergo a company shifting process from the Red Sea to the blue ocean. In this book, they stress much on the importance of developing cognitive side of blue ocean strategy. One who wants to do a shift to blue ocean should poses a blue ocean mindset by aquiring some basic principles including: 1. Changing industry boundaries by rejecting the assumption that the industrial a given structure; 2. Focusing on going beyond competition and; 3. Leaving the old market to focus on the new market.

There are three values are added in to current Blue Ocean Shift, that are: humanness, self-confidence, and creative competence. These three dimensions are complementary to the launch the shift to the Blue Ocean. It can be done by utilizing creative knowledge with confidence support and a humanness approach. Then the shifting process is implemented through taking the following five steps: getting started, know where you are now, imagine where you could be, finding how to be there, and finally undertake the move (Kim & Maugborne, 2017).

In recent development, shifting to blue ocean ocean becomes a fierce debate among researchers. For example, Christodoulou & Langley (2019) who unveiled that the challenge is happened when the transition process does not run smooth but stuck in the middle space between the red and the blue ocean. As a result, a company has to pass through transition area which help it to discover what Christodoulou & Langley (2019) called it as “white space”. This is a transit space before a company finally moving to the blue ocean. The authors also found that many managers are not ready to get into this stage since the space can derail their status quo strategies and resources. As an alternative, the authors offer the use of “blue ocean droplets” which comprises of strategic marketing activities, strategic and perceptual reposition, strategic pricing, finding consumer value in the consumer experience cycle and map utilities.

Hersh & Abusaleem (2016) used two frameworks in testing the relationship between BOS and the competitive advantage of telecommunications companies in Saudi Arabia. It was found that the four dimensions of the BOS have a strong influence on competing excellence. Hence, the “eliminate” dimension poses the most powerful influence, followed by the “create” dimension and “raise”, while the “reduce” dimension has the least impact.

The first framework of BOS used is the four action framework consisting of Eliminate, Reduce, Raise, and Create: 1. The Eliminate dimension means that the company needs to know what business factors need to be eliminated as they no longer have value in the industry even for customers (Kim & Mauborgne, 2005; Yang & Yang, 2011); 2. Reduce, it is an elemeny that need to be reduced to the bottom level of the industry standard. It is assumed the element no longer attractive to the industry even for customers (Kim, 2005); 3. Raise, it is a business element that can be lifted at a better level than the ability of overall industry to deliver their value to customers (Kim & Mauborgne, 2005; Yang & Yang, 2011). Lastly, 4. Create, it is the final element, which is identified by ownership of a new source of value for the customers. It facilitates the creation of new demand.

Hersh & Abusaleem (2016) conducted a test of the six path of Blue Ocean strategy. They found that the t-test results of the relationship between the six principles and the competitive advantage had a correlation coefficient of 0.82, wherein the t-correlation between the two variables was 6.74, the value was much greater than the t-table value of 2.8.

Based on Hersh & Abusaleem's (2016) study, it is found that the increase in internet speed and roaming services is a response to customer complaints. The services were provided in the form of Internet communication services through fiber-optic network, it enables to provide speed and quality improvement service, as well as the service to fixed lines telephone as it has allowed telecommunication operators to connect with their customers through FTTC.

Another way of using BOS as a central conceptual approach is like the study conducted in researching BOS in the food industry in Europe. In their study, more than two BOS analytic frameworks were used including the Four Action Framework, Strategy Canvas, Sixt Path Framework, and Sequence of the BOS in discovering new markets from European Food and Vegetables Industry (EFVI). Hence the factors that need to be eliminated are business factors that have no added value. While business factors that do not support business success can be reduced to some lower level. Meanwhile, Raise and Create is an added value and creation of the superior performance of a product or service (Leavy, 2018; Kim & Mauborgne, 2005).

The use of one pillar of the six path framework is inadequate to create a new market to then be able to excel in competition. There are at least two paths used to produce a new market. Three of the four elements of FAF focus more on existing business factors, and it is merely “create” dimension which focuses on the creation of new business factor.

In the past, the discussion on the suitability of the firm in implementing BOS also unveiled. They consider that the BOS is suitable for the company that has reached the maturity which having their products or services growth is declining. The authors introduce a three-logic approach in finding the blue ocean strategy, which developed by Stabell & Fjeldstad, namely the logic of industrial efficiency, the logic of network services, the logic of solid knowledge (knowledge-intensive).

Alam & Islam (2017) found that BOS has a positive effect on organizational performance. These researchers are more of a description and review of the case studies previously undertaken by Kim & Mauborne (2005). Meanwhile, the research conducted by Lindi? et al. (2012) is more of an economic study, although the case study was conducted on two companies, namely Gazelles (Slovenia) and Amazon.com (USA) successfully enrolling BOS to achieve high business growth. In their studies, they expressed a gap between micro-and macro-level growth that recommends the need for specific changes in company size, industry, binary activity into industry cooperation, and collaboration for the creation of value innovations from unsurpassed markets.

Blue Ocean Strategy and Competitive Advantage

Kim & Mauborgne (2017) argue that the blue ocean does not directly pursue competing excellence, because generally companies that pursue competing excellence are trapped in competition. Making competitors as good a measure to be better. However, in the end, what the BOS can achieve is also a competitive advantage.

Hence there are a couple of studies in the past that relate the implementation of the BOS with the achievement of competing excellence such as the study by Shared (2019) in Saudi Arabia and Bataineh and Alomyan in Jordania. Shared (2019) aims to determine the four-dimensional influence of the BOS referred to as The Four Action Framework (FAF) on competing excellence. The author found that BOS's dimensions are positively influence the performance of Al-Rajhi Bank of Saudi Arabia. Shared also cited six paths in his research but did not test the impact of tool on competing excellence. In his studies, Shared (2019) also indicates that BOS elements (Eliminate, Reduce, Raise and Create) positively correlate to competing excellence which consist of service quality, innovation, flexibility, cost, and customer response.

Additionally, in Telecommunication sector in Irbid, Jordania also provide evidence of the strong influence of BOS' elements on competing excellence. From their funding, it is showed that the three-elements: create, raise, and reduce positively influence competing excellence. While the eliminate element which has no positive effect on competing excellence.

Some other studies have been done by Namboodiri et al. (2019), Dehkordi et al. (2012), Hanifah (2015), and Shared (2019). Bibliography study conducted by Namboodiri et al. (2019) By reviewing BOS related articles and analyse them using the grounded theory method. From the study, they collected 68 first-tier themes, and 9 second-level themes, which were recategorized to be three main themes consisting of “innovative governance”, “integration of functional complexity”, and “catalysts” or “drivers for development”.

Besides, Dehkordi et al. (2012) focuses solely on describing the differences between red ocean and blue ocean market and managers’ practical role. Hence, companies were found competing in the red ocean continuosly to win the competition amid a diminished and less attractive market share, while the blue ocean is a market where competition is not relevant.

The authors added that BOS can be used as a new business model due to its ability to increase profits by creating new market. However, its implementation requires the involvement of right staff with practical ability, emphasis on leadership. Managerial decision making process is also determined by managers’ cognitive capacity.

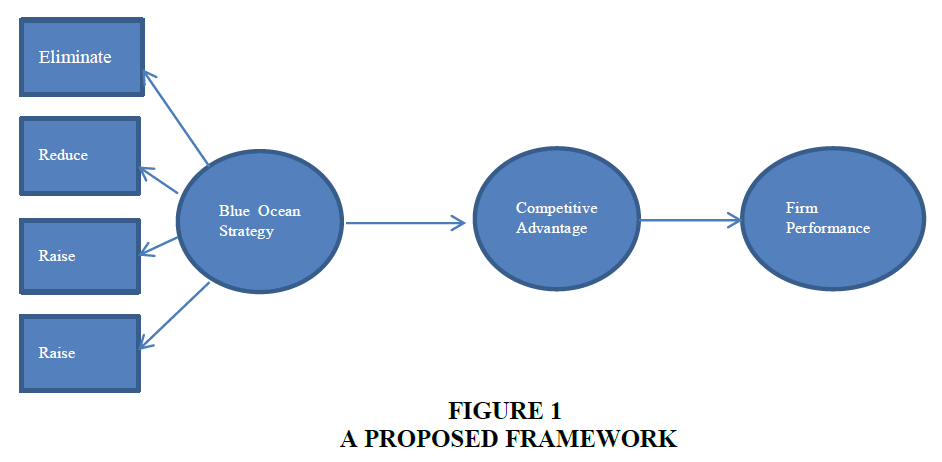

In addition, Dehkordi et al. (2012) do not indicate any specifically and clearly influence of the BOS' on competing for superiority, even though it contributes to the creation of new market. Similarly, Hanifah et al. (2015) describes the case of the BOS adoption in a Japanese companies in Indonesia. They do quote Four Action Framework (FAF), but Hanifah et al. (2015) failed to provide evidence on the company deploys the dimension of the framework in creating new market (Figure 1).

Based on the above explanation, it is concluded that the previous research results on the BOS's influence on the competitive advantage still have not resulted in a bold conclusion. Because of the varied methods and inconsistencies of the tools used by the researchers. Similarly, a review of the implications of the BOS implementation on competing for excellence and performance is still not getting adequate test.

Departing from this point of view, this study proposes a framework for study the effect of BOS on performance and the role of competitive advantage as mediating variable.

Blue Ocean Strategy and Firm Performance

The utilization of existing markets does not necessarily lead the company to better performance if it is indicated by the profit and growth of the business. Therefore, the industry needs to reform the way to find new demand (Kim & Mauborgne, 2005) and produces optimal performance beyond the competitors on the existing market (Bagheri et al., 2013).

The effect between of BOS on performance is still slightly touched by researchers. In general, research in this particular theme is more attributed to the creation of markets, values, and products. For example, a study that took place in the context of the hospitality industry in Malaysia, Radzi et al. (2016) found that there is a significant association between BOS and hotel performance. Similar findings are also unveiled by Vassilijeva et al. (2019), Crhistodoulou & Langley (2019) and Ogbogu-Asogwa et al. (2017), Altindag et al. (2014), and Yang & Yang (2011).

From Vassilijeva et al. (2019) study in the Russia’s steel industry, they found that implementation of the country's BOS is capable of maximizing the company's performance. It is indicated by the increased company profits. The authors also discover that BOS is a profitable strategy that help company generates profit up to 30.5 times greater than the ordinary one which earn aroung 2.6 times. Vassilijeva et al. (2019) stated: “Implementing the Blue Ocean Strategy, maximum company performance is achieved”.

More over, the authors also revealed that the increased output in a steel companies implementing the BOS does not followed by the increase in cost. It is confirmed that the value innovation strategy was executed effectively. Where the value improvement process for customers is done simultaneously with cost reduction. The application of BOS in the highly competitive steel industry in Russia also managed to reduce deadweight loss to zero in the production process.

Another improvement in the study of BOS is indicated by the findings of Christodoulou & Langley (2019). It is a simulational study which results in the use of ‘the Blue Ocean droplet’ approach which found that the implementation has an impact on achieving high performance. Hence, the element of the droplet is a driver of sales growth, maintaining the stability of the price, keep the cost low. Nevertheless, the company can still make a profit quickly and sustainably.

Furthermore, it is also necessary to note that the application of blue ocean is not an easy task. Meaning that when moving from the red to the blue ocean, a company will encounter many problems. Among the problems are the fact that before entering the blue ocen, a company must enter the transition first by entering white space, an area found by Christodoulou & Langley located between the red and the blue ocean. In this space, among the challenges are like high cost of production and marketing, as competitors enter the white space, they stir the profit to be scrambling, and distract customers who are not interested in the value proposition offered by a company.

What the company can do to overcome this drawback is to do repositioning itself by inserting a blue ocean droplet in it (Christodoulou & Langley, 2019). The authors simulated results and examples of not generalizable real cases in the field to other industries. Hence they offer the following proposition: the implementation of three blue ocean elements droplet affect performance improvement.

Unlike Christodoulou & Langley, Ogbogu-Asogwa et al. (2017) test the relationship between BOS and the company's value and impact of the creation of new demand on profit growth and organizational income. From 402 samples, employees of four telecommunication companies in Lagos, Nigeria, it was found to have significant links to the value of the company as well as the creation of new markets positively impacting the growth and income of telecommunications companies. Ogbogu-Asogawa also emphasized that the leader was instrumental in the implementation of the BOS in the context of the telecommunications industry in Nigeria. A leader's role is needed in communicating the BOSS to employees. The understanding this employee receives makes it easy for their involvement and caring to be facilitated through the communication built by their leaders. The research performed by Altindag et al. (2014) also showed that the implementation of BOS in the industrial sector in Marmara, Turkey has a positive effect on performance. Whilst Yang & Yang (2011) combine the implementation of the BOS with three other types of values simultaneously and associate it with the organizational performance in regards with profit and cash flow.

Competitive Advantage And Firm Performance

The work fo Porter on competitive advantage is a primary concept in the literature and a source of further development in this particular field (Stonehouse & Snowdon, 2007).

“Competitive advantage grows fundamentally out of the value a firm is able to create for its buyers that exceed the firm's cost of creating it. Value is what buyers are willing to pay, and superior value stems from offering lower prices than competitors for equivalent benefits or providing unique benefits that more than offset a higher price. There are two basic types of competitive advantage: cost leadership and differentiation”(Porter, 1985).

From year onward, competitive advantage getting great attention from researchers. To name a few is like the one conducted by Ma (2000) who found that it is no difference between competitive advantage and performance. But Ma insists that the two constructs are different. She even distinguishes competitive advantage into two divisions: Compound competitive advantage and discrete competitive advantage. The later is the farther the distance it has to influence competitive advantage, whereas compound competitive advantage has a closer and direct link to the performance. However, Ma (2000) assesses that “competitive advantage, whatever type, does not guarantee superior performance”.

In general, many researchers acknowledge the association between competitive advantage and performance (Rose et al., 2010a). Even sustainable competitive advantage can result in best performance (Fahy, 2000) and become the source of greater performance (Ismail et al., 2010).

Ten years later, Rose et al. (2010b) propose a three dimension of competitive advantage consists of cost, product and service base. They summarize the association between those elements and performance. A firm that sources their advantage from the dimensions can generate lower-cost production, produce better quality products, and provide speed delivery. Thus, it is not surprising that competitive advantage provides way for the company to earn good performance.

The most compelling view is pointed by Koch & Windsperger (2017) who indicate that traditional competitive advantage is no longer suitable for today's digital economy. Meanwhile in in practice, Zhou et al. state that the company considers its strategy based on customer response. They response to the company's offer by promoting price sensitivity. In doing such a way, the company can have a competitive approach. But, conversely, if the customer appreciates the services provided by the company, then the company utilize the data on customer orientation and competition. In his research Zhou et al. connects between competitive advantage and organizational performance.

Additionally, many literatures indicate evidences about the way performance is achieved has resulted in the rise of competitive advantage, like Potjanajaruwit (2018) who assess that start-up in Thailand can achieve the best performance by having competitive advantage, beside the role of ICT and international collaboration. Apart from that, there is also attempt to examine the effect competitive advantage on performance by adding the role of age and firm size as moderating variable.

Mediating Role of Competitive Advantage

Placing competitive advantage as a mediating role between blue ocean strategy and preformance is still lacking in the literature. It is found in the past studies that the role of competitive advantage as mediator commonly fall between the following research of interest like: Environmental variable and firm performance (López-Gamero et al., 2009), intelectual capital and performance (Kamukama et al., 2011), corporate social responsibility and firm financial performance (Saeidi et al., 2015), innovation and business performance (Setyawati & Rosiana, 2017), intelectual capital, entrepreneurial strategy and new venture performance (Anwar et al., 2018), networking and new venture performance (Anwar et al., 2018), business model innnovation and SMES performance (Anwar et al., 2018), enterprise risk management practice and firm performance (Yang & Yang, 2011), drivers and barrier and firm performance (Cantele & Cassia, 2020), promotional strategy and marketing performance (Yasa et al., 2020).The above Table 1 shows that most articles that mediated by competitive advantage are relating to the performance as the dependent varible. However it is rare in the literature where the blue ocean strategy is treatened as antecedent of performance. By having this in mind, it can be considered that filling this gap in literature could enhance and adding new insights toward to field of performance as well as the blue ocean strategy.

| Table 1 Existing Mediating Role of Competitive Advantage | |||

| No | Author | Journal | Variables Mediated by Competitive Advantage |

| 1 | Saeidi et al. (2015) | Journal of Business Research | CSR and Firm Financial Performance |

| 2 | López-Gamero et al. (2009) | Journal of Environmental Management | Environmental variable and firm performance |

| 3 | Kamukama et al. (2011) | Journal of intellectual capital | Intelectual capital and performance |

| 4 | Anwar et al. (2018) | Business and Economic Review | Intelectual Capital, Entrepreneurial Strategy and new venture performance |

| 5 | Yang & Yang, 2011 | Journal of Risk and Financial Performance | Enterprise Risk Management Practice and firm performance |

| 6 | Yasa et al. (2020) | Management Science Letter | Promotional Strategy and Marketing Performance |

| 7 | Setyawati & Rosiana (2017) | Saudi Journal Business and Management Studies | Innovation and business performance |

| 8 | Cantele & Cassia (2020) | International Journal of Hospitality Management | Drivers and barrier and firm performance |

Conclusion

Research on blue ocean strategy from 1998 until recently has gained a lot of attention from researchers. From a series of research themes associated with the Blue Ocean Strategy, we strive to set up a framework provided as a cornerstone to test the BOS impact on competitive advantage and its impact on company performance. The conceptual framework is expected to be able to lay the foundational for the next research process and further contribute to concept of blue ocean strategy, competitive advantage, and performance of the company.

Methods variation and tools inconsistencies in assessing BOS is the still open to be researched. Similarly, a review of the implications of the BOS implementation on competitive advantage and firn performance is still not getting adequate test. Through further research, it is believed that the gap can filled up and enable to confirm whether competitive advantage mediate the BOS and firm performance fully or partially.

References

- Agnihotri, A. (2016). Extending boundaries of blue ocean strategy. Journal of Strategic Marketing, 24(6), 519-528.

- Alam, S., & Islam M.T. (2017). Impact of blue ocean strategy on organizational performance: A literature review toward implementation logic. IOSR Journal of Business and Management, 19(1), 1-19.

- Altindag, E., Cengiz, S., & Ongel, V. (2014). Chaos in the blue ocean: an empirical study including implication of modern management theories in turkey. Australian Journal of Business and Management Research, 3(12), 15-25.

- Anwar, M., Khan, S.Z., & Khan, N.U. (2018). Intellectual capital, entrepreneurial strategy and new ventures performance: Mediating role of competitive advantage. Business and Economic Review, 10(1), 63-93.

- Bagheri, R., Eslami, S.P., Yarjanli, M., & Ghafoorifard, N. (2013). Factors affecting the implementation of the blue ocean strategy a case study of medicom production manufacturing company. Australian Journal of Basic and Applied Sciences, 7(4), 213-222.

- Cantele, S., & Cassia, F. (2020). Sustainability implementation in restaurants: A comprehensive model of drivers, barriers, and competitiveness-mediated effects on firm performance. International Journal of Hospitality Management, 87, 102510.

- Chang, S.C. (2010). Bandit cellphones: a blue ocean strategy. Technology in Society, 32(3), 219-322.

- Christodoulou, I., & Langley, P.A. (2019). A gaming simulation approach to understanding blue ocean strategy development as a transition from traditional competitive strategy. Journal of Strategic Marketing, 1-26.

- Dehkordi, G.J., Rezvani, S., & Behravan, N. (2012). Blue ocean strategy: A study over a strategy which help the firm to survive from competitive environment. International Journal of Academic Research in Business and Social Sciences, 2(6), 477-483.

- Hersh, A.M., & Abusaleem, K.S. (2016). Blue ocean strategy in Saudi Arabia telecommunication companies and its impact on the competitive advantage. Journal of Accounting & Marketing, 5(3), 1-8.

- Idris, W.M.S., Al-Rubaiee, L., Joma, M.H.M.A., & Al-Nabulsi, M. (2019). Investigating the measurement scale of blue ocean strategy: a structural equation modeling. International Review of Management and Business Research, 8(1), 1-16.

- Ismail. A.I., Rose, R.C., Abdullah, H., & Uli, J. (2010). The relationship between organisational competitive advantage and performance moderated by the age and size of firms. Asian Academy of Management Journal.15(2), 157-173.

- Kamukama, N., Ahiauzu, A., & Ntayi, J.M. (2011). Competitive advantage: mediator of intellectual capital and performance. Journal of Intellectual Capital, 12(1), 152-164.

- Kim, W.C. (2005). Blue ocean strategy: From theory to practice. California Management Review, 47(3), 105-121.

- Kim, W.C., & Mauborgne, R. (1998). Value innovation: the strategic logic of high growth. IEEE Engineering Management Review, 26(2), 8-17.

- Kim, W.C., & Mauborgne, R. (2005). Value innovation: a leap into the blue ocean. Journal of Business Strategy, 26(4), 22-28.

- Kim, W.C., & Mauborgne, R. (2017). Blue ocean shift: beyond competing. New York, USA: Hachette Books.

- Koch, T., & Windsperger, J. (2017). Seeing through the network: competitive advantage in the digital economy. Journal of Organizational Design, 6(6), 1-30.

- Leavy, B. (2018). Value innovation and how to successfully incubate “blue ocean” initiatives, Strategy & Leadership, 46(3), 1-20,

- López-Gamero, M.D., Molina-Azorín, J.F., & Claver-Cortés, E. (2009). The whole relationship between environmental variables and firm performance: competitive advantage and firm resources as mediator variables. Journal of Environmental Management, 90(10), 3110-3121.

- Ma, H. (2000). Competitive advantage and firm performance. Competitiveness Review, 10(2), 15-32.

- Madsen, D.O., & Slåtten, K. (2019). Examining the emergence and evolution of blue ocean strategy through the lens of management fashion theory. Social Science, 8(28), 2-23.

- Namboodiri, S., Banerjee, S., & Dasgupta, H. (2019). Coherent metasynthesis of Blue Ocean Strategy (Bos) using grounded theory approach, Academy of Strategic Management Journal, 18(4), 1-18.

- Ogbogu-Asogwa, O., Ike, R.N., Adeleke, B.S., & Ekoja, G.O. (2017). Impact of Blue Ocean Strategy on Value Innovation: A Study of Selected Firms’ in FMCG and Telecommunications Sectors in South-West Nigeria. International Journal of Scientific & Engineering Research, 8(10), 721-735.

- Porter, M.E. (1985). Competitive Advantage. New York Free Press.

- Potjanajaruwit, P. (2018). Competitive advantage effects on firm performance: A case study of startups in Thailand. Journal of International Studies, 10(1), 104-111.

- Radzi, S., Yasin, M., Zahari, M., Abas, R., Ahmat, N., & Ahmad-Ridzuan, A. (2016). Blue ocean strategy [BOS] and performance of four and five star hotels in Kuala Lumpur, Selangor and Putrajaya. Heritage, Culture and Society: Research agenda and best practices in the hospitality and tourism industry, 207.

- Rose, R.C., Abdullah, H., & Ismad, A.I. (2010a). A Review on the Relationship between organizational resources, competitive advantage and performance. Journal of International Social Research, 3(11).

- Rose, R.C., Abdullah, H., & Ismail, A. (2010b). A review on the relationship between organization resources, competitive advantage and performance. Journal of International Social Research, 3(11).488-498.

- Saeidi, S.P., Sofian, S., Saeidi, P., Saeidi, S.P., & Saaeidi, S.A. (2015). How does corporate social responsibility contribute to firm financial performance? The mediating role of competitive advantage, reputation, and customer satisfaction. Journal of Business Research, 68(2), 341-350.

- Shared, H.A. (2019). The role of the blue ocean strategy in achieving a competitive advantage: An empirical study on al - rajhi bank-KSA. International Review of Management and Business Research, 8(2),158-169.

- Stonehouse, G., & Snowdon, B. (2007). Competitive advantage revisited: Michael porter on strategy and competitiveness. Journal of Management Inquiry, 16(3),256-273.

- Vassilijeva, M.V., Ponkratov, V.V., Kuznetsov, N.V., Maramygin, M.S., & Osinovskaya, I.V. (2019). Implementation of the Blue Ocean Strategy using simulation: Firm-level evidence from russia steel market. Industrial Engineering and Management Systems, 18(4), 859-871.

- Yang, C.C., & Yang, K.J. (2011). An integrated model of value creation based on the refined Kano’s model and the blue ocean strategy. Total Quality Management & Business Excellence, 22(9), 925-940.