Research Article: 2022 Vol: 21 Issue: 5

A Systematic Review on the Role of Foreign Direct Investment on the Economy Growth of Sudan

Idris El Tahir Yousif Mohamed, University Technology Malaysia

Mohd. Effandi Bin Yusoff, University Technology Malaysia

Citation Information: Mohamed, I.E.T.Y., & Yusoff, M.E.B. (2022). A systematic review on the role of foreign direct investment on the economy growth of Sudan. Academy of Strategic Management Journal, 21(5), 1-15.

Abstract

Foreign Development Investment (FDI) plays a crucial role in promoting financial activities in the developing countries. In recent days, COVID-19 caused a huge destruction to the economy across the globe. Studies reveal that the ratio of FDI inflows in 2020 was lesser than the previous year. There is a lack of studies to explore the present economic environment and the role of FDI in the developing countries. The existing studies highlight the common factors for the economic growth and presented limited information on FDI. There is a demand for a study to outline the role of the FDI in the economic growth of the developing countries. Therefore, the study intends to extract and review literature related to the role of FDI on the economy growth in the developing countries. Specifically, researchers focus on the studies based on the Sudan economy. During the process of review, a total of 261 studies were extracted from the digital libraries include Scopus, Science Direct, and Google Scholar. Finally, a sum of 32 studies was selected and the outcome suggested that there is a positive relationship between FDI and economic growth. However, the Pandemic affected the global economy and shrank the FDI inflows. In addition, the political instability in Sudan caused a major impact on Country’s economy.

Keywords

Foreign Development Investment, Sudan, Economy Growth, FDI, Policy Framework, Developing Countries.

Introduction

Developing countries have a wide range of economic challenges include poverty, unemployment, and low per capita income remains more important to the local population (Sunde, 2017). Any country's economic and human development depends heavily on economic growth. These initiatives to increase industrial activity and energy consumption by emerging countries have become increasingly important during the past few years (Makiela & Ouattara, 2018). Foreign Development Investment (FDI) is an investment from a party in one nation into a company or corporation in another country to establish a long-term relationship. Long-term interest distinguishes FDI from passive holdings of assets from a foreign country in an investor's international portfolio (Chih et al., 2022).

Developing countries around the world have seen a surge in FDI during the past few decades (Yahia et al., 2018). However, these countries require more significant capital inflows in order to boost their economic growth. FDI facilitates the transfer of new technology, thus reducing the technological gap between developing and developed countries (Jiang et al., 2019). A number of previous studies have also claimed that FDI provides crucial avenues for the diffusion of contemporary technology. Aside from contributing to the GDP of the host country, foreign direct investment also assists in the maintenance of a healthy Balance of Payments (BOP) (Marandu et al., 2019).

In addition, it promotes the host country's per capita income, employment prospects, and Research and Development (R&D) (Jiang et al., 2019). FDI inflows should result in high-quality job opportunities for both employees and the country as a whole. An increase in wages for indigenous workers would result in a corresponding increase in income, which would help to supplement the income that indigenous organizations (Aisbett et al., 2018). In addition, with a rise in revenue comes an increase in the quality and quantity of training that may be accessed through indigenous groups. It has a cumulative effect of increasing domestic savings and investment, which raises the aggregate productivity efficiency of the host economy (Munemo, 2017).

FDI has emerged as a significant source of private external capital for developing countries. For the most part, it is motivated by the investors' long-term chances for profiting from industrial operations that they directly control, unlike other major types of private capital flows (Werner & Bermejo Carbonell, 2018). In order to bridge the gap between savings and the degree of investment necessary FDI is beneficial (Jiang et al., 2019). FDI has become increasingly important as a result of globalization, and endogenous growth theories emphasize that FDI is a crucial predictor of economic growth since it serves as a source of technology transfer from industrialized to developing countries (Bahizi et al., 2021). Researchers suggested that FDI reduces unemployment and boost productivity in the host country through improved worker skills and knowledge (Makiela & Ouattara, 2018).

In recent days, there has been increased competition between industrialized and developing countries to attract FDI through tax cuts and other incentives. Several developing countries have adopted FDI policies to enable and oversee FDI inflows (UNCTAD, 2021). There is a possibility that FDI inflows are helping these developing countries get access to better technology, management skills, and enhanced capital accumulation, exports, employment, and economic growth (Werner & Bermejo Carbonell, 2018).

According to Chih et al. (2022), a foreign investor's decision to invest in a host country is influenced by the size of the enterprise, administration and management systems, labour and transportation expenses, government policies, and institutions, as well as political stability. Foreign investors may be more concerned about the trade-off between risks and return (Abdouli & Hammami, 2018). Researchers and policymakers have emphasized the relationship between institutions and economic success for the past few decades. Economic factors such as capital accumulation, per capita income, and innovation are not the only ones responsible for a country's economic growth and development, according to Dinh et al. (2019). Economic growth is encouraged in countries with well-protected property rights, which encourages people to invest domestically and internationally. Poor institutions inhibit FDI and can operate as a tax, raising the cost of FDI by a significant margin (Tuman & Shirali, 2017). In countries where institutions favor corruption, nepotism, and red tape, investors are reluctant to invest because these factors increase the cost of operations (Alvarado et al., 2017).

Overall, COVID-19 affected the global economy and most countries are not recovered from the economic downfall (Mtiraoui, 2021; Liang et al., 2021). The existing literature covered the effect of FDI in developing countries up to 2017. There is a lack of research on FDI on financial development in emerging countries. In addition, the political unrest in Sudan leads to major economy downfall. The policy framework of Sudan offers an effective environment for investors to invest in a larger number of sectors. However, the impact of weaker political framework affects the countries development. For the first time, the study examines the role of FDI on economic growth of Sudan through the existing literature.

There are several ways that FDI may have a positive impact on a target country's economic growth and development. New employment and possibilities are created as a result of FDI. Locals may see a rise in their income and spending power as a result, which might spur growth in the economies targeted. Investment, particularly FDI, is often considered to be a major driver to economic growth. FDI has both advantages and drawbacks, and its influence is dictated by the unique characteristics of the nation in general and the policy environment in particular throughout the previous quarter century. In terms of diversification, absorption capacity, FDI targeting, and numerous links between FDI and domestic investment, this is all relevant. The goal of this review is to identify the key shortcomings of foreign direct investments in Sudan and to highlight the relevance of indicators that are mostly institutional in character. Only a limited amount of FDI had a positive impact. As a result, the report identifies a wide variety of steps that the public sector and private sector entities should do.

Based on the objective of the study, the research questions are framed as:

1. Research Question -1 (RQ1): What are the key determinants of Sudan’s economy? 2. Research Question -2 (RQ2): How FDI improves the economy status of Sudan?

Literature Review

The COVID-19 crisis led to a significant drop in FDI in 2020. When it comes to global FDI, it fell by 35%. It went down from $1.5 trillion in 2019 to $1 trillion. There has been a decline of over 20% since the global financial crisis of 2009 (UNCTAD, 2020). Global FDI declined by 58%, with the majority going to developed nations because of fluctuations caused by business affairs and intra firm financial flows (UNCTAD, 2021). FDI in developing economies declined by a relatively moderate 8%, mainly due to strong Asian flows.

Developing economies accounted for two-thirds of global FDI in 2019, up from slightly under half in the previous year. The patterns of FDI contrasted significantly with those of new project activity, as developing nations have endured the most of the global investment crisis (Marandu et al., 2019). In emerging countries, the number of new Greenfield projects declined by 42 %, while the number of foreign project financing arrangements – critical for infrastructure decreased by 14 % (Chih et al., 2021). In developed economies, Greenfield investment fell by 19%, while foreign project financing rose by 8% (Muhammad et al., 2021).

All FDI subcomponents were in decline. There was a 50% drop in equity investment flows due to the overall contraction of new project activity and a decrease in cross-border mergers and acquisitions (Shittu et al., 2022). Reinvested earnings of foreign affiliates, a significant component of FDI in average years, were down by 36 % due to lower Multinational enterprises profitability (Aust et al., 2020).

It was clear that the pandemic would have the most significant effect on global FDI in the first half of the year 2020. Cross-border mergers, acquisitions, and international project financing deals recovered in the second half of the year. In contrast, Greenfield investment that is more crucial for developing countries remained in decline throughout 2020 and into the first quarter of 2021 (Behera & Dash, 2017). For the first time in 15 years, FDI in Africa declined by 16 % to $40 billion. Critical to the region's industrialization ambitions, Greenfield project announcements decreased by 62 % (Baricako & Kedir, 2020). The most severely hit countries were those that export commodities. A 10% to 15% increase in worldwide FDI flows was predicted in 2021, following a decline in the previous year. FDI would still be 25 % below where it was in 2019. According to current forecasts, at the upper end of current expectations, FDI would return to its 2019 level in 2022. In the short term, the outlook is highly unpredictable and will be influenced by factors such as the rate of economic recovery and the probability of epidemic relapses, the potential impact of recovery expenditure packages on FDI, and policy constraints (Aluko et al., 2021).

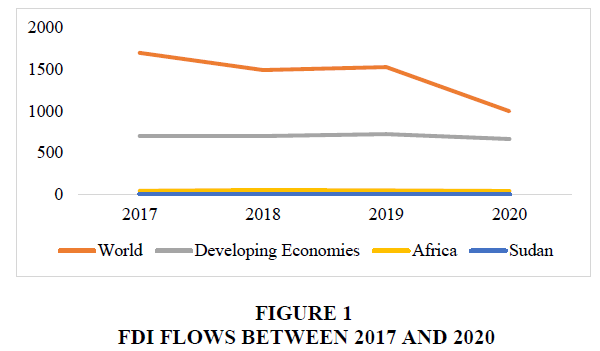

Across the globe, FDI inflows were decreased by 35%. During 2019, it was $1530 billion where as $999 billion in 2020 (Jiang et al., 2019). In addition, Table 1 presents the FDI inflows across the globe and Sudan. Figure 1 showcase the graph relevant to Table 1.

| Table 1 Fdi Inflows |

||||

|---|---|---|---|---|

| Location / Year | 2020 (Billion) | 2019 (Billion) |

2018 (Billion) |

2017 (Billion) |

| World | 999 | 1530 | 1495 | 1700 |

| Developing Economies | 663 | 723 | 699 | 701 |

| Africa | 40 | 47 | 51 | 42 |

| Sudan | 0.717 | 0.839 | 1.1 | 1.098 |

Source: (UNCTAD, 2020, 2021)

According to United Nations Conference on Trade and Development (UNCTAD), top 10 industries list, except Trade, other industries such as Energy and Gas, Construction, Automation etc., obtained negative growth rate. It is evident from the information that host countries are reluctant to invest in developing countries due to the policy framework, economy determinants, and business facilitation. Furthermore, Pandemic affected overall economy across the globe. Due to the political unrest between Sudan and United States, the FDI inflows shrank by 13% in 2020 comparing to the previous year (UNCTAD, 2021).

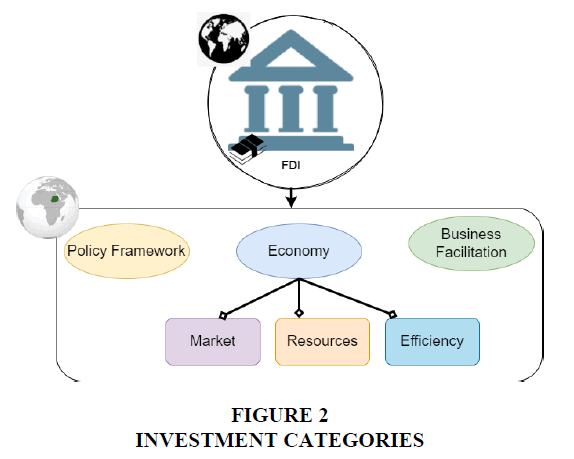

Figure 2 represents the determinants that attract FDI to promote the economic growth of the developing economies. Policy framework is one of the key determinants for a country to receive finance support from the developed countries. Due to the political instability, some countries maintain the older policy and restrict foreign countries to initiate businesses. Thus, both business facilitation and policy frameworks are interconnected. On the other hand, economy is another determinant for higher FDI inflows. Thus, these three categories are considered as the crucial determinants for the developing countries, especially African countries (Makiela & Ouattara, 2018; Munemo, 2017; Sunde, 2017).

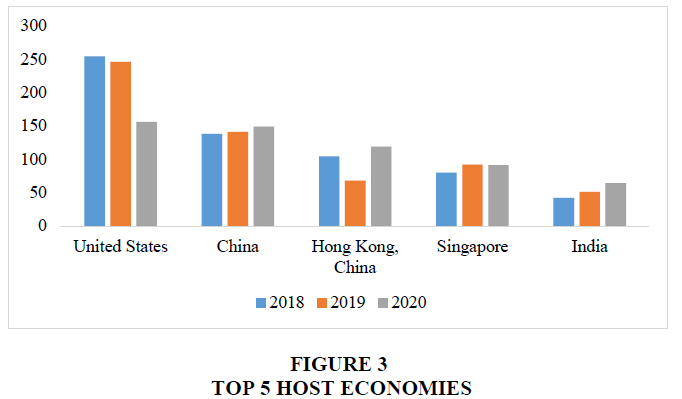

A 58% decrease to $312 billion was recorded in FDI flows to economically developed countries. The reduction was exaggerated by large variations in conduit and intra-company financial flows, as well as by business restructurings. Normally the most important form of FDI in industrialized nations, net cross-border M&A sales declined by 11% to $379 billion. As a result, announced Greenfield investments and cross-border project financing arrangements fell by a combined 16 and 28 percent. In Europe, total inflows fell by 80%, to only $73 billion. While FDI decreased in European nations with major channel flows, such as the UK (-57 %), France (47%), and Germany (47%), large economies also saw a decline (-34 %). There has been a 73% drop in the amount of FDI flowing into the European Union. As a result of lower profits being reinvested, inflows to the United States fell by 40%, reaching $156 billion. FDI inflow to developing countries declined by 8% to $663 billion. FDI inflows to China increased by 6% to $149 billion, mostly due to the countries sustained economic development, investment facilitation initiatives, and further liberalization. Table 2 and Figure 3 showcases the FDI inflows of top 5 host economies across the world.

| Table 2 Top 5 Host Economies |

|||

|---|---|---|---|

| Countries/Year | 2018 (Billion) |

2019 (Billion) |

2020 (Billion) |

| United States | 254 | 246 | 156 |

| China | 138 | 141 | 149 |

| Hong Kong, China | 104 | 68 | 119 |

| Singapore | 80 | 92 | 91 |

| India | 42 | 51 | 64 |

Source: World Investment Report (2021).

| Table 3 Features And Limitations Of Literature |

|||

|---|---|---|---|

| Authors | Category | Features | Limitation |

| Patey (2017) | Economy (Resources) | Discussed the importance of China’s national oil company investments in Sudan oil company. | There is a lack of data to ensure the effectiveness of the study. |

| Gangi & Mohammed (2017) | Economy (Market) |

Highlighted the present situation of entrepreneurship development in Sudan. | Authors presented the literature without empirical evidence. |

| Yesuf (2017) | Economy (Efficiency) | Reported the insights of the development and the present environment of Islamic financial industries in Sudan. | Author highlighted the key information of Islamic financial industry. However, there is a limited number of data related to finance industries. |

| Shay (2018) | Policy framework | Outlined the political framework of Sudan. Moreover, the relationship between Sudan and Turkey was presented. | There is a lack of discussion of the role of FDI in Sudan development. |

| Yahia et al. (2018) | Economy (Market) |

Applied the autoregressive distributed lay bounds test for evaluating the effect of FDI inflows in Sudan between 1976-2016. | The outcome of the study was evaluated in terms of exchange rate and trade openness to domestic investment. |

| De Waal (2019) | Policy framework | Analyzed the political framework of Sudan. | The study did not offer any recommendation for political market place framework. |

| Ille (2018) | Policy framework | Discussed the multiple dimensions of North Sudan. | Lack of empirical evidence. |

| Bertoncin et al. (2019) | Economy (Resources) | Analysis was based on the land, irrigation, and the political ecology of the country. | Lack of information related to the role of FDI in land and irrigation projects. |

| Adam (2021) | Policy framework | Highlighted the effect of FDI on domestic investment. | Covered the challenges of Sudan in using FDI to develop domestic products. |

| Bakari (2017) | Economy ( Market) |

Investigated the relationship between domestic investments, exports, imports, and economic growth in Sudan. | Outcome suggested that the present environment is not sufficient for economic growth in Sudan. However, there is no discussion related to the impact of FDI in the economic growth. |

| Chevrillon-Guibert et al. (2020) | Policy framework | Discussed the practices of power and negotiations under the Al-Ingaz regime between 2010 and 2019. | Presented the political instability of Sudan. Nonetheless, there is a lack of empirical evidence. |

| Mohamed (2018a) | Business facilitation | Analysed the effect of the FDI inflows using econometric methods of integration between 1978 and 2015. | Recommended the government to enable necessary infrastructure to attract foreign aids and investment |

| Ahmed (2020) | Economy (Resources) |

Discussed the benefits of foreign exchange earnings in the agricultural development. | Emphasized the policies related to resources must be revisited in order to achieve a better outcome. |

| Sirag et al. (2018) | Economy (Efficiency) |

Investigated the effect of FDI on economic growth in Sudan. Discussed the financial development between 1970 and 2014. | Stated that the government should employ FDI in the productive sectors. |

| Abdelkreem & Sisay (2021) | Economy (Market) |

Discussed the impact on economic growth in Sudan, Kenya, and Ethiopia. Authors emphasized that FDI and inflation rates affected economic growth in Kenya and Sudan. | Limited discussion related to FDI and economic growth. |

| Chih et al. (2022) | Economy and Policy framework | Employed a spatial dependency framework and examined the role of trade and natural resource endowment in determining FDI on economic growth. | Presented the positive effect of FDI on economic growth on Sub – Sahara Africa. |

| (Ibrahim & Acquah, 2021) | Economy (Finance) |

Examined the relationship among FDI, economic growth and financial sector in Africa. | Discussed the overall effect of FDI in African countries. No discussion on the role of FDI on specific sectors. |

| Liang et al. (2021) | Policy framework | Discussed the relationship between FDI and economic growth of 113 developing countries. | Authors employed data of pre-pandemic era. No discussion about post pandemic scenario. |

| Aluko (2020) | Policy framework | Outlined the relationship between FDI and globalization using the Dumitresu-Harlin Panel Granger Causality test. | Demanded a set of effective policies to promote FDI in multiple sectors in African countries. |

| Hongxing et al. (2021) | Economy (Market) |

Highlighted the relationship among FDI, trade, energy consumption, and economic growth. | Lack of empirical evidence to display the relationship between FDI and economic growth. |

| Ahmad et al. (2021) | Economy (Resource) |

Conducted a study in ten selected Muslim countries between 2005 and 2019. | Lack of empirical evidence. |

| Batrancea et al. (2021) | Business facilitation |

Performed a panel data analysis on the determinants of economic growth in 34 African co ntries. |

Lack of post – Pandemic data. |

| Aluko (2021) | Business facilitation | Discussed the relationship between the international tourism and FDI in Africa | Presented data between 1995 and 2016. No discussion about the effect of COVID-19 on the tourism. |

| Irshad & Ghafoor, (2022) | Business facilitation | Highlighted the importance of infrastructure of lower income countries to attract FDI in Africa. | Limited information is presented on FDI inflows and economic growth. Moreover, there is no discussion related to Pandemic and its effect on lower income countries. |

| Bahizi et al. (2021) | Economy (Trade) |

Examined the role of FDI on economic growth in the East Africa community between 1970-2017. | Presented the larger dataset regarding the economic growth and financial performance. However, there is a lack of discussion on the present scenario. |

| Shittu et al. (2022) | Business facilitation | Discussed the nexus between natural resources, FDI, and economic growth in the Middle East and North Africa (MENA) region. | Highlighted the growth effect of the natural resources and institution quality in the MENA region. Lack of discussion in the post – Pandemic environment. |

| Tinta et al. (2021) | Economy (Resources) |

Investigated the relationship between economic growth, financial development, and renewable energy in Sub-Sahara Africa (SSA) countries. | Highlighted the economic growth of 48 countries between 2000 and 2019. Lack of discussion on the FDI inflows. |

| Mtiraoui (2021) | Business facilitation | Studied the interaction among four indicators such as FDI, institution, Pandemic, and economic growth. | Suggested that the institution quality may attract FDI and stimulate growth in the Pandemic period. |

| Ali et al. (2021) | Economy (Resources) |

Discussed the effect of financial indicators and economy growth in low-income countries. | Outlined the financial performance of 12 low – income countries during 1980-2016. |

| Miao et al. (2021) | Policy framework | Examined the role of China’s FDI and domestic governance quality in African country’s economic growth. | Utilized a larger dataset of 44 African countries between 2003 and 2017. |

| Ojo (2021) | Policy framework | Examined the role of FDI and social instability in 20 SSA countries. | Discussed the effect of the FDI inflows between 1989 and 2019. |

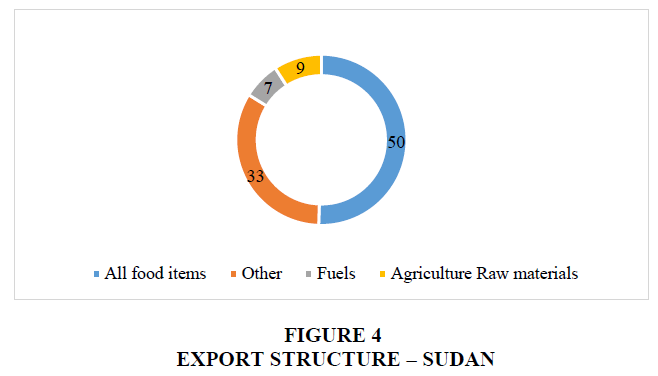

Figure 4 illustrates the export structure of Sudan during 2020. Food items have achieved 50% of Sudan exports whereas Fuel has reached 7% of export.

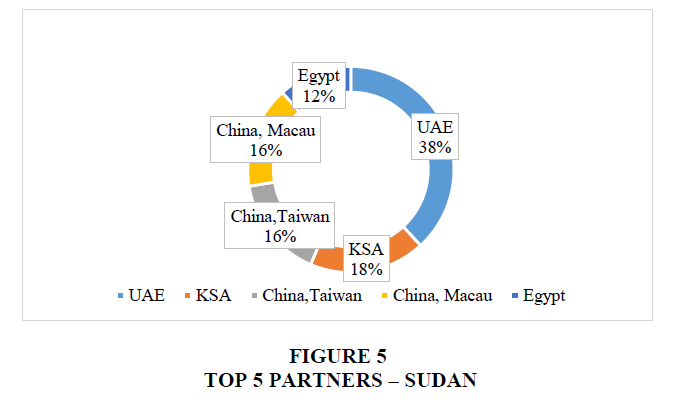

United Arab Emirates (UAE), Kingdom of Saudi Arabia (KSA), Egypt, China, Macau, and China, Taiwan were the top five partners of Sudan.

Our research fills a critical gap in the existing body of knowledge on this topic. The majority of African countries are rising and developing economies with significant development potential (Chih et al., 2022; Muhammad et al., 2021; Yin & Choi, 2022). To put it another way, the International Monetary Fund (IMF) estimates that Asian and African economies have a growth rate of 5.5% in 2019 compared to 2.2% for the United States and 1.7% for Europe, which are the two most advanced economies. In contrast, the Internet infrastructure in Asian and African countries has considerably improved in recent years (International Telecommunication Union, 2019). African economies, in particular, have implemented measures that have resulted in a significant rise in domestic Internet use. A number of academics have argued that FDI is critical to the economic growth of developing countries(Figure 5).

Methodology

Based on the RQ1 and RQ2, researcher considers research studies that are based on FDI. In order to perform the review, the researchers adhered to the Preferred Reporting Items for Systematic Reviews and Meta-Analyses (PRISMA) standards. Web of Science, Science Direct, and Google Scholar are used to extract the research studies from digital libraries. For the purpose of searching for relevant research studies, the keywords are presented below. The relevant research is selected based on a set of inclusion and exclusion criteria. Researcher considered research studies those were based on Sudan during the period between 2017 and 2021.

Set of Keywords

1. Foreign Development Investment or FDI 2. Economy growth 3. Policy framework 4. Business 5. Sudan 6. North Africa 7. Sub-Sahara Africa 8. Africa

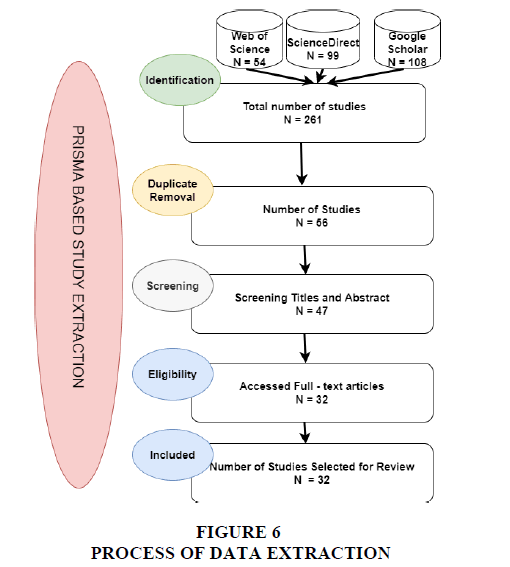

Researchers carried out a complete search of the digital libraries on December 12, 2021. Using full-text eligibility evaluation, 130 abstracts (out of a total of 261) were screened for abstracts relating FDI and Sudan economy. Among the 130 abstracts analyzed, 17 focused on the FDI and Sudan, and these abstracts were thoroughly analyzed. Review papers on DI were excluded because they were not relevant to the study's objective.

Following a preliminary review of FDI research, an anonymous screening of each article's title and abstract was conducted. As a whole, the entire articles were analyzed for FDI related to Sudan economic growth. Two individuals reviewed the abstracts and titles. If an abstract was deemed relevant by at least one screener, we considered the article in its entirety. Data relevant to Sudan was included in the systematic review and meta-analysis. At each level of the screening and review process, the number of articles is indicated in Figure 6. During the data extraction, a total of 261 articles were identified. The articles were processed and duplicate were removed. Researcher screened the articles using title and abstract and obtained a set of 47 studies. Finally, they accessed the full-text articles and retrieved a final set of 32 studies.

For RQ1 and RQ2, researchers included case studies that provided relevant information. Specifically, we investigated the studies those employed any criterion to determine the presence of FDI based on Sudan. The study did not include any articles, which were not published in English, or those were unrelated to FDI or economic development in Sudan. Furthermore, researchers ensure that their research will not resulted in systemic biases, there are certain aspects of systematic review that mandate that the findings of this study is treated with caution.

Results and Discussion

Researchers analyzed the final set of articles, manually. During the analysis, they categorized the research articles into three major categories were discussed. A total of 16 articles were considered as economy category, 9 articles as policy framework category, 1 article as economy and policy framework category, and 6 articles as business facilitation category. The categories support the proposed study to provide solutions for RQ1. The findings reveal that resources, market, and efficiency are the major determinants to receive a higher number of the FDI inflows. Studies (Ahmad et al., 2021; Ahmed, 2020; Gangi & Mohammed, 2017; Ali et al., 2021; Bakari, 2017; Bahizi et al., 2021; Chih et al., 2022; Hongxing et al., 2021; Ibrahim & Acquah, 2021; Patey, 2017; Sirag et al., 2018; Yahia et al., 2018; Yesuf, 2017; Abdelkreem & Sisay, 2021) confirmed that resources, market, and efficiency are the key determinants for the FDI inflows (Table 3).

To answer RQ2, the findings reveal that FDI plays a significant role in the economy growth of Sudan. Sudan is one of the most successful emerging countries that attracted significant FDI. The country's strategic location in the Horn of Africa, which connects Arab and African countries, as well as its vast oil and mineral deposits, its abundant animal resources and agricultural potential, all played a role in attracting foreign investment (Mohamed, 2017; Ross, 2015). In addition, Sudan has made changes in the economy in the early 1990s, implemented adjustments to the Investment Encouragement Act in 1995, started oil exploration in 1999, and signed a peace deal that ended one of the longest civil wars in Africa in 2005 (Sirag et al., 2018; World Investment Report, 2021). The outcome of the review confirms that financial development and FDI positively influenced the economy.

We observed that financial development had a more significant impact on GDP growth than other forms of development. Direct and indirect effects on output growth were found, with the latter coming from the rise of the financial sector. We observed that FDI inflows positively affected the financial growth nexus. Because foreign direct investment improves the financial sector's investment performance, this may lead to more robust economic growth. According to (Bahizi et al., 2021; Miao et al., 2021; Shittu et al., 2022; Tinta et al., 2021), higher FDI inflows contribute to an increase in countries' financial development.

Sudan's GDP growth rate is primarily due to the rise of the banking sector. FDI–growth nexus demonstrates the financial system's participation in FDI's positive impact. Financial sector development appears to be an essential prerequisite for attracting FDI. The study concluded that FDI has a favorable impact on economic growth (Mohamed, 2017). Increased FDI inflows favor Sudan's economy by expanding its financial sector and enable it more efficient and productive.

There must be a focus on encouraging FDI in more productive sectors like agriculture and manufacturing in order for the economy to get the most benefits from FDI inflows. The lifting of the US economic sanctions in October 2017 is projected to increase FDI inflows. As a result, the government should keep up its diplomatic efforts in order to foster an investment-friendly climate. The development of the financial sector must be sustained and improved so that the economy can continue to recover, especially after the cessation of South Sudan (Patey, 2017; Ross, 2015). Furthermore, the financial market requires additional attention because it is less developed than the country's banking sector. Other influences on the FDI-growth and finance-growth nexuses could be the subject of future research.

One of the critical factors that may determine how FDI or financial development affects economic growth is the degree of human capital and the quality of the institutions. Some of the biggest obstacles to FDI in Sudan are macroeconomic instability and bureaucratic procedures for obtaining licenses and granting land (Bakari, 2017; Ille, 2018). United Nations (UN) is also concerned about the political instability caused by the domestic wars in Darfur and Southern Kordofan. It is generally accepted that Sudan could have drawn more FDI, notably from Western countries, and sustained more growth had its macroeconomic management been enhanced, its internal disputes settled, and its relationships with the international community improved (Ross, 2015).

In 1959, Sudan and China established diplomatic ties for decades. During the intervening period, the relationship with China has developed on the basis of values such as mutual non-interference, mutual respect for territorial integrity and sovereignty, as well as mutual advantages and equality for both countries (Chevrillon-Guibert et al., 2020). Sudan diplomatic support for China was evident in the issue of Taiwan and the One China policy and working with other African countries during China's admission to the UN in 1971 (Sirag et al., 2018).

Sudan continues to receive encouragement from the Chinese government, as recently demonstrated in the UN and Security Council over topics that have sparked debate and disagreement among members of the international community (Baricako & Kedir, 2020). The oil industry accounts for the majority of China's Sudanese investments. Oil exports have grown tremendously, resulting in increased export revenues and fewer financial restraints on the government budget (Mohamed, 2018b). Investment in the agricultural sector, which would result in the creation of jobs for unskilled labor and an increase in the income of rural populations, both of which would have direct implications for poverty reduction, has been modest compared to other industries.

The outcome of the study indicates that market, human and natural resources, and efficiency are the crucial determinants to receive FDI. In addition to having a major impact on GDP, human capital plays a key role in boosting economic growth and establishing the foundation for further capital investment. Even in the presence of control variables, the impact of rail and telecommunications infrastructure investments on GDP is positive. Additionally, the correlation between electricity use and cost is positive. Gross fixed capital formation, FDI, and net exports all have a positive and considerable effect on economic expansion.

Economic growth will almost certainly be boosted if policymakers encourage investment in these areas. Free trade and the services supplied by transportation infrastructure increase mobility of goods and services, for instance. Investment in this area produces numerous advancements. All of these have a significant impact on the countries' economic operations. Furthermore, advancements in telecommunications have made it easier and faster to conduct information activities, such as advertising, marketing, and sales. Because of this, lower middle-income countries' economic growth and development are accelerated by the expansion of these industries.

With the shift from labor-intensive conventional agricultural primary commodities to crude petroleum exports, which are capital-intensive, the concentration of investment in the oil sector is anticipated to have adverse effects on employment, poverty, and income inequality. No evidence suggests any significant Chinese investment in Sudan's potential high-productivity sectors such as textiles (such as clothing and textiles), footwear (such as footwear), or food processing (such as vegetable oil extraction) (Baricako & Kedir, 2020).

Conclusion

The aim of the study is to find the key determinants of the developing countries to attract FDI from the developed countries. FDI has recently increased into developing countries because of their ability to attract more of this kind of investment. FDI has not had a consistent beneficial influence on local economic growth, as expected as a result of this intensification. Even more precisely, this occurred in governments that were unable of developing an effective plan to lure international investment. Many studies have shown that a planned approach to FDI may help diversify the economy, increase local businesses' absorption ability, connect domestic and international investors, and give potential for connections.

The government's ability to support policies that strengthen the domestic capability of its citizens has been exposed and has shown to be critical for recruiting investment. They said that the government should focus on encouraging specific types of FDI that can have a positive impact on the economy as a whole.

It is therefore necessary to focus more on attracting specific FDI flows, rather than the broad flow of FDI. As a result, they do not all have the same level of interest in contributing to the growth of the local economy. That's why it's so important that the growth process in a given country, and especially in developing nations, starts from within rather than from without, regardless of the benefits those FDIs provide. Many indications reveal that the most crucial indicator to attract foreign investors is a high investment in human capital accumulation and a considerable rise in infrastructure provision. The next generation of research should focus more on empirical studies and elaborate on the factors that are viewed as vital for attracting FDIs, which can be created in-country. Because of this, there is a greater emphasis on country-specific research, rather than cross-country research. Although they may be located in the same region and/or share a same history, no two countries are exactly alike. An even more essential factor in drawing in FDI is performing a sector analysis to identify the specific sectors or industries that have the greatest potential to bring in foreign investment and then working to promote those findings.

References

Abdelkreem, Y., & Sisay, D. (2021). Dynamics of inflation and its impact on economic growth in selected East African Countries: Ethiopia, Sudan and Kenya. Journal of African Studies and Development, 13(1), 1-8.

Abdouli, M., & Hammami, S. (2018). The dynamic links between environmental quality, foreign direct investment, and economic growth in the Middle Eastern and North African countries (MENA region).Journal of the Knowledge Economy,9(3), 833-853.

Indexed at, Google Scholar, Cross Ref

Adam, A.H. (2021). The effect of foreign direct investment on domestic investment: In Sudan (1976-2019).IAR Journal of Business Management,2(1).

Ahmad, N., Rahman, A.A., & Azzan, N.A. (2021). A decomposition of GDP growth in Sukuk issuing countries.

Ahmed, S.M. (2020). Impacts of drought, food security policy and climate change on performance of irrigation schemes in Sub-saharan Africa: The case of Sudan.Agricultural Water Management,232, 106064.

Indexed at, Google Scholar, Cross Ref

Aisbett, E., Busse, M., & Nunnenkamp, P. (2018). Bilateral investment treaties as deterrents of host-country discretion: the impact of investor-state disputes on foreign direct investment in developing countries.Review of World Economics,154(1), 119-155.

Indexed at, Google Scholar, Cross Ref

Ali, M., Raza, S.A.A., Puah, C.H., & Samdani, S. (2021). How financial development and economic growth influence human capital in low-income countries.International Journal of Social Economics,48(10), 1393-1407.

Indexed at, Google Scholar, Cross Ref

Aluko, O.A. (2020). The foreign aid–foreign direct investment relationship in Africa: The mediating role of institutional quality and financial development.Economic Affairs,40(1), 77-84.

Indexed at, Google Scholar, Cross Ref

Aluko, O.A. (2021). An empirical insight into the international tourism-foreign direct investment nexus in Africa.African Review of Economics and Finance,13(1), 264-278.

Aluko, O.A., Ibrahim, M., & Atagbuzia, M.O. (2021). On the causal nexus between FDI and globalization: Evidence from Africa.The Journal of International Trade & Economic Development,30(2), 203-223.

Indexed at, Google Scholar, Cross Ref

Alvarado, R., Iniguez, M., & Ponce, P. (2017). Foreign direct investment and economic growth in Latin America.Economic Analysis and Policy,56, 176-187.

Aust, V., Morais, A.I., & Pinto, I. (2020). How does foreign direct investment contribute to sustainable development goals? Evidence from African countries.Journal of Cleaner Production,245, 118823.

Indexed at, Google Scholar, Cross Ref

Bahizi, M., Safari, K., Butare, G.W., Rutikanga, C., & Bikorimana, G. (2021). Empirical analysis of foreign direct investment on economic growth: Evidence from the East African community. International Review of Economics and Management, 9(2), 114-135.

Indexed at, Google Scholar, Cross Ref

Bakari, S. (2017). Appraisal of Trade Potency on Economic Growth in Sudan: New Empirical and Policy Analysis.

Baricako, J., & Kedir, A.M. (2020). Disruptive technology, foreign direct investment and private sector development polices in Africa. InDisruptive Technologies, Innovation and Development in Africa(pp. 227-253). Palgrave Macmillan, Cham.

Indexed at, Google Scholar, Cross Ref

Batrancea, L., Rathnaswamy, M.M., & Batrancea, I. (2021). A panel data analysis of economic growth determinants in 34 African countries.Journal of Risk and Financial Management,14(6), 260.

Indexed at, Google Scholar, Cross Ref

Behera, S.R., & Dash, D.P. (2017). The effect of urbanization, energy consumption, and foreign direct investment on the carbon dioxide emission in the SSEA (South and Southeast Asian) region.Renewable and Sustainable Energy Reviews,70, 96-106.

Indexed at, Google Scholar, Cross Ref

Bertoncin, M., Pase, A., Quatrida, D., & Turrini, S. (2019). At the junction between state, nature and capital: Irrigation mega-projects in Sudan.Geoforum,106, 24-37.

Indexed at, Google Scholar, Cross Ref

Chevrillon-Guibert, R., Ille, E., & Salah, M. (2020). Practices of power, mining conflicts, and the gold economy in sudan before and after the al-ingaz regime. Politique Africaine, 158 (2), 123–148.

Chih, Y.Y., Kishan, R.P., & Ojede, A. (2022). Be good to thy neighbours: A spatial analysis of foreign direct investment and economic growth in sub?Saharan Africa.The World Economy,45(3), 657-701.

Indexed at, Google Scholar, Cross Ref

De Waal, A. (2019). Sudan: a political marketplace framework analysis.

Dinh, T.T.H., Vo, D.H., The Vo, A., & Nguyen, T.C. (2019). Foreign direct investment and economic growth in the short run and long run: Empirical evidence from developing countries.Journal of Risk and Financial Management,12(4), 176.

Indexed at, Google Scholar, Cross Ref

Gangi, Y.A., & Mohammed, H.E. (2017). The development of entrepreneurship in Sudan.Entrepreneurship in Africa, 209-231.

Hongxing, Y., Abban, O.J., & Boadi, A.D. (2021). Foreign aid and economic growth: Do energy consumption, trade openness and CO2emissions matter? A DSUR heterogeneous evidence from Africa’s trading blocs. PLoS ONE, 16 (6 June).

Ibrahim, M., & Acquah, A.M. (2021). Re-examining the causal relationships among FDI, economic growth and financial sector development in Africa.International Review of Applied Economics,35(1), 45-63.

Indexed at, Google Scholar, Cross Ref

Ille, E. (2018). Land alienation as a legal, political, economic and moral issue in the Nile Valley of North Sudan. InAnthropology of Law in Muslim Sudan(pp. 21-52). Brill.

Indexed at, Google Scholar, Cross Ref

Irshad, R., & Ghafoor, N. (2022). Infrastructure and economic growth: Evidence from lower middle-income countries.Journal of the Knowledge Economy, 1-19.

Indexed at, Google Scholar, Cross Ref

Jiang, W., Martek, I., Hosseini, M.R., Chen, C., & Ma, L. (2019). Foreign direct investment in infrastructure projects: Taxonomy of political risk profiles in developing countries.Journal of Infrastructure Systems,25(3), 04019022.

Liang, C., Shah, S.A., & Bifei, T. (2021). The role of FDI inflow in economic growth: Evidence from developing countries.Journal of Advanced Research in Economics and Administrative Sciences,2(1), 68-80.

Makiela, K., & Ouattara, B. (2018). Foreign direct investment and economic growth: Exploring the transmission channels.Economic Modelling,72, 296-305.

Indexed at, Google Scholar, Cross Ref

Marandu, E.E., Mburu, P.T., & Amanze, D. (2019). An analysis of trends in foreign direct investment inflows to Africa.International Journal of Business Administration,10(1), 20-32.

Miao, M., Borojo, D.G., Yushi, J., & Desalegn, T.A. (2021). The impacts of Chinese FDI on domestic investment and economic growth for Africa.Cogent Business & Management,8(1), 1886472.

Indexed at, Google Scholar, Cross Ref

Mohamed, E.S. (2017). Resource gaps, foreign capital flows and economic growth in Sudan: an empirical econometric analysis.African Journal of Economic and Sustainable Development,6(4), 292-316.

Mohamed, E.S. (2018a). Effect of external debt on economic growth of Sudan: Empirical analysis (1969-2015).Journal of Economic Cooperation & Development,39(1), 39-62.

Mohamed, E.S. (2018b). Energy and economic factors affecting carbon dioxide emissions in Sudan: An empirical econometric analysis (1969-2015).Journal of Economics Bibliography,5(2), 60-75.

Mtiraoui, A. (2021). Interaction between FDI, institutional quality, pandemic and economic growth inthe mena re-gion: Application on dynamic panel data (GMM).Journal of Economic Research & Reviews, 1 (1), 24,32.

Muhammad, B., Khan, M.K., Khan, M.I., & Khan, S. (2021). Impact of foreign direct investment, natural resources, renewable energy consumption, and economic growth on environmental degradation: evidence from BRICS, developing, developed and global countries.Environmental Science and Pollution Research,28(17), 21789-21798.

Indexed at, Google Scholar, Cross Ref

Munemo, J. (2017). Foreign direct investment and business start-up in developing countries: The role of financial market development.The Quarterly Review of Economics and Finance,65, 97-106.

Indexed at, Google Scholar, Cross Ref

Ojo, E. (2021). Social instability and foreign direct investment: Implication for economic growth and development in sub-Sahara Africa. IOSR Journal of Humanities And Social Science, 26 (5).

Patey, L. (2017). Learning in Africa: China’s overseas oil investments in Sudan and South Sudan.Journal of Contemporary China,26(107), 756-768.

Indexed at, Google Scholar, Cross Ref

Ross, A.G. (2015). An empirical analysis of Chinese outward foreign direct investment in Africa.Journal of Chinese Economic and Foreign Trade Studies, 8(1), 4-19.

Indexed at, Google Scholar, Cross Ref

Shay, S. (2018). Turkey-Sudan strategic relations and the implications for the region.IPS Institute For Policy and Strategy, Eri?im Tarihi,23.

Shittu, W.O., Musibau, H.O., & Jimoh, S.O. (2022). The complementary roles of human capital and institutional quality on natural resource-FDI—economic growth Nexus in the MENA region.Environment, Development and Sustainability,24(6), 7936-7957.

Indexed at, Google Scholar, Cross Ref

Sirag, A., SidAhmed, S., & Ali, H.S. (2018). Financial development, FDI and economic growth: Evidence from Sudan.International Journal of Social Economics, 45(8), 1236-1249.

Indexed at, Google Scholar, Cross Ref

Sunde, T. (2017). Foreign direct investment, exports and economic growth: ADRL and causality analysis for South Africa.Research in International Business and Finance,41, 434-444.

Indexed at, Google Scholar, Cross Ref

Tinta, A.A., Ouedraogo, S., & Thiombiano, N. (2021). Nexus between economic growth, financial development, and energy consumption in Sub-Saharan African countries: A dynamic approach. Natural Resources Forum, 45(4), 366-379.

Indexed at, Google Scholar, Cross Ref

Tuman, J.P., & Shirali, M. (2017). The political economy of Chinese foreign direct investment in developing areas.Foreign Policy Analysis,13(1), 154-167.

Indexed at, Google Scholar, Cross Ref

UNCTAD. (2020). World Investment Report 2020.

UNCTAD. (2021). World Investment Report 2021.

Werner, R.A., & Bermejo Carbonell, J. (2018). Do FDI inflows generate economic growth in large developed economies? A new empirical approach, applied to Spain.

World Investment Report. (2021). UNCTADstat Sudan.

Yahia, Y.E., Liu, H., Khan, M.A., Shah, S.S.H., & Islam, M.A. (2018). The impact of foreign direct investment on domestic investment: Evidence from Sudan.International Journal of Economics and Financial Issues,8(6), 1-10.

Yesuf, A.J. (2017). Islamic economics and finance in Sudan: An overview.Research Center for Islamic Economics (IKAM) Reports,4.

Yin, Z.H., & Choi, C.H. (2022). Has the Internet increased FDI, economic growth, and trade? Evidence from Asian economies.Information Development,38(2), 192-203.

Indexed at, Google Scholar, Cross Ref

Received: 07-Feb-2022, Manuscript No. ASMJ-22-11148; Editor assigned: 10-Feb-2022, PreQC No. ASMJ-22-11148(PQ); Reviewed: 24-Feb-2022, QC No. ASMJ-22-11148; Revised: 27-Apr-2022, Manuscript No. ASMJ-22-11148(R); Published: 07-May-2022