Research Article: 2021 Vol: 20 Issue: 2

A Value Chain Governance Framework for Economic Growth in Developing Countries

Arthur Mapanga, Walter Sisulu University

Abstract

This paper sought to develop a value chain governance framework to enhance the participation of the developing countries’ SMEs and other economic agents in the current non-inclusive global value chains. Due to their reliance on spot market transactions, SMEs in development countries continue to face economic prejudice in global markets. There is therefore a need for a value chain governance framework to further promote the upgrading of developing countries’ SMES in the global value chains. First to be done was a comprehensive literature study on the topic of value chain governance to unravel the major determinants of value chain governance. Second, a questionnaire was used to collect the data from a purposive sample of 332 managers working in the maize, cotton, soybean and tobacco value chains in Zimbabwe was employed to confirm the specific factors determining effective governance in a developing country’s value chains. The study confirmed that governance in developing countries’ value chains depended on the quality of collective action regimes, lead firms and trust present in the value chains. These factors have some important implications regarding any attempts by the managers and policymakers aimed at improving the operational efficiencies as well as deepening the integration of the developing countries’ SMEs within the value chains to ensure shared development and prosperity across the world. The study also outlines a transdisciplinary framework that can be used to enhance governance in developing countries’ value chains.

Keywords

Value Chains, Governance, Lead Firms, Collective Action Regimes, Trust, Intermediaries.

Introduction

The 21st century business landscape is for all intents and purposes characterised by ruptured industry boundaries, a feature that calls for high-levels of managerial ability to integrate and coordinate the often complex networks of business ecosystems (Holweg & Helo, 2014; Carter et al., 2015; Fayezi et al., 2017). To succeed in this bid managers have been compelled to adopt a management philosophy underpinned by the value chain approach (Kaplinsky & Morris, 2000; Gereffi, 2014; Wenzel, 2016). Such an approach entails pulling together the factors of production in response to customer demands (Donovan et al., 2015). While a lot has been talked about the value chain approach, it has all been rather too simplistic to highlight a typical value chain’s complexity (Mapanga et al., 2018). Indeed, dealing with the combined effects of the tangibles and intangibles in value chains needs to a greater extent meticulous coordination and governance to ensure optimum economic performance (Kaplinsky & Morris, 2000; Humphrey & Schmitz, 2004; Gibbon et al., 2008; Trienekens, 2011; Gereffi & Sturgeon, 2013; Gereffi, 2014 & 2019; Trienekens et al., 2017). Yet, it is not apparent, at least in a holistic manner, of any framework in literature to guide managers or policy-makers on improving the quality of value chain governance for the effective inclusion of the Small to Medium Enterprises (SMEs) in the value chains.

Unquestionably, the spot market industrial organization exposes the SMEs in the development countries to economic prejudice and therefore huge competitive disadvantages in global markets (Bianchi et al., 2017; Liegler, 2017; Pergelova et al., 2019). Especially so, in light of the contemporary value chain governance theory (Gereffi et al., 2005; Gereffi & Lee, 2016; Gardner et al., 2019) that lacks predictive power to portray a complete set the intrinsic factors deciding the behaviour of firms to coordinate value chain processes. There is therefore a need to develop a value chain framework specific to developing countries’ value chains which is not yet apparent in the current global value chain theory. This paper has a double purpose. First, it tries to unravel the diverse determinants of value chain governance. Second, it proposes a framework on to enhance value chain governance in order to encourage the SMEs and other economic agents in developing countries to participate in global value chains. The paper is structured as follows. After this introduction, the next section is the literature review on the likely factors shaping value chain governance. Subsequent to the literature review section is a discussion of the methods that were applied in this study. Following this section will be presentation of the results and next is a discussion of the conclusions and presentation of the framework for enhancing value chain governance. Lastly, a suggestion is made for further research. The next section presents the literature review.

Literature Review

As noted in the introduction, SMEs participation in value chains is highly recommended as the most realistic means to enhance sustainable industrial transformation economic growth and social development. Consequently, the essentiality of policy makers working to improve the quality of value chain governance cannot be overstated. For Gimenez & Sierra (2013), value chain governance correlates to the relations through which key economic agents create, sustain and conceivably renovate their business ecosystem to meet customer needs. Foremost in value chain governance are, inter alia, coordination, communication, distribution of (market) power, and collaboration to allow competitive upgrading, and thus the creation of greater customer value (Coe & Yeung, 2015; Pickles et al., 2016; Richey & Ponte, 2020). Naturally, the institutional economic and behavioural theories become the obvious lenses to understand the governance in value chains (Gereffi, 2014). These theories alert us to the role of the micro/meso factors and the broader institutional, regulatory and societal processes in value chain governance (Ponte & Sturgeon, 2014). On the whole, learning in the value chains is also pertinent to engendering the transformation of current routines, capabilities, and institutions (Harrison, 2007). On the whole, it is the institutions in value chains that determine the quality of governance in the value chains (Porter, 2008). Indeed, institutions imply the operational habits; rules and values (formal and informal) that guide the decisions made by the economic agents in value chains (Scott, 2013).

It is argued that these factors determine the level of coordination costs or transaction costs (Gereffi et al., 2005; Mishra & Dey, 2018) and the scope of coordination beyond price (De Langen, 2015; Parola et al., 2017) occurring in value chains. For Williamson (2014), the value chain governance structure depends on the transaction costs associated with the exchanges taking place in the value chain, that is, costs of information search, bargaining costs, monitoring costs, coordination costs, and contract enforcing costs. Logically, value chains involve high transaction costs. Thus, value chain governance seeks to offset the impact of the various transaction costs on the economic performance of the value chain.

In turn, the coordination beyond price encompasses setting standards, joint investment in skill base, cooperating on innovation projects and sharing information to thwart the often overlapping and contradictory roles of the economic agents in value chains (Mishra & Dey, 2018). Nevertheless, while it presents greater overall benefits, coordination beyond the price is simply not a spontaneous occurrence in the value chain. Ostrom (2010) alludes the cause of such a lack of spontaneity as a result of cases of uneven benefit sharing which causes some of the economic agents to feel worse off by participating in value chains giving rise general obstruction of the efforts to enlarge the scope of coordination, creeping opportunistic behaviour in which “free riders” hinder coordination efforts and lastly, the issue of undefined benefits which prompt economic agents to seek to limit further risks when confronted with indeterminate cooperation outcomes.

With regard to the presence of intermediary organizations in value chains, various scholars, for example, Kaplinsky & Morris (2000) acknowledge the essential role of intermediaries in value chains such as refining market entry conditions and improving capacity for distinct economic agents in value chains. With this in mind, it plausible that value chain intermediation enables both horizontal and vertical value chain coordination that helps to better integrate and upgrade the economic agents operating in the value chains through the facilitation and arbitration of the transactions to improve the efficiency and thwarting information asymmetry in the value chains (Cattaneo et al., 2013; Stangl et al., 2016). Such roles help to reduce uncertainty and searching costs (De Langen, 2015) as well as to avert adverse selection thereby creating trusted institutions that improve the quality of governance in value chains.

Trust helps to shape behaviour in value chains as it influences the transaction costs in the value chains through reducing economic agents’ vulnerability to the opportunistic behaviour instigated by others in the value chain (Vieira & Traill, 2008; Williamson, 2014; Cumming et al., 2020). In line with Spekman & Davis (2004); Zhao et al. (2013) also argue that building trust among value chain partners is probably the only best way to manage performance risks in any value chain. This implies that trust is a truly formal governance mechanism (Brunet & Aubry, 2016; Müller et al., 2017). Further, the presence of trust in a value chain permits inter-firm cooperation because it minimizes the relational risks and facilitates information sharing between and among the contracting partners. Of trust as a mechanism enabling managers to achieve organizational openness and ultimately, competitiveness while reducing social uncertainty and vulnerability. High-trust levels were associated with increases in cooperative behavior among logistics outsourcing partners, which in turn led to higher partnership performance levels. In short, the above claims signal that the existence of high trust levels in value chains adds to the ability of managers in value chains to coordinate the value chain activities beyond price by reducing the uncertainty and opportunistic behaviour (see for example, Ponte & Sturgeon, 2014; Trienekens et al., 2017). In comparison, the low-trust value chains experience decreased scope of coordination beyond the price because of a manifestation of uncertainty and opportunistic behaviour among the economic agents working in the value chains (Gereffi & Lee, 2016). In effect, trusting relationships are the foundation of enduring collaborative alliances among value chain economic agents making the presence of trust the governing mechanism of such relationships. According to Notteboom et al. (2013), the presence of trust is a precondition for minimising the costs of co-operation in the value chains as it overcomes the inert influences against member involvement in any co-ordination beyond market price relations between the economic agents in the value chain.

Another element of governance, outside the market price, is the presence of lead firms in value chains. By engaging in quasi-hierarchical relations with upstream and downstream firms in the value chain, lead firms determine the operational parameters of the whole value chain through identifying the opportunities, reorganising the value chain structure by assigning diverse roles to other firms thus ensuring value chain integration to efficiently meet the customer demands. Certainly, being powerful players in the value chain, lead firms take on the governance tasks, such as standard-setting and certification (Kaplinsky, 2000) which in themselves are powerful instruments for influencing other players’ behaviour. As they accrue most of the benefits of the value chain, lead firms more likely work to expand the coordination of the value chain beyond the market price. As well, it is also in their best interest to install their immense capabilities in support of activities to reduce transaction costs (Gereffi & Fernandez-Stark, 2011; Conti, 2014; Anthony, 2016). Indeed, the quality of lead firms as defined by their financial assets, buying power, key technological control or market access (Knudsen, 2017) decides the manner and form of inclusion or exclusion of certain economic agents, how particular processes are allocated among the different actors in the value chain and finally how operational and support processes are structured in the value chain to offset mounting transaction costs (Hardin, 2015).

Lastly, the theory on collective action (Olson, 2009; Ostrom, 2010; Nell, 2017) explains how collective action regimes are useful entities for value chain governance. Collective action in value chains ensures collective contributions by the economic agents to value chain outcomes. This implies the action taken in pursuit of members’ shared interests and the goal of which is to enhance their position and accomplish a collective purpose. In this way, collective action becomes a path to combat transaction costs in value chains (Fischer & Qaim, 2014; Verhofstadt & Maertens, 2014). Largely, collective action in value chains reduces costs related to the procurement of inputs, market information, new technologies and the exploitation of emerging market opportunities. Additionally, collective action enhances bargaining power thus reducing the effects of market entry barriers. Indeed, collective action helps to provide the requisite infrastructure and services in the value chains (Bijman et al., 2016).

Collective action regimes are collaborative groups that spur actors’ ability to control the operations in value chains as well as confronting and withstanding the challenges presented by the external environment (De Langen, 2015) thereby helping informal coordination across institutional boundaries in the value chains (Holland, 2014). The quality of collective of regimes depends on the available lead firms (Olson, 2009); involvement of public bodies also adds to the quality of the regimes, occurrence of community argument (Wilson, 2012) and lastly, the existence of individual firms’ voice (Poteete et al., 2010). Indeed, private firms’ voice forces the representative associations and public and public–private organisations (that face no market selection pressure) to effectively act on their responsibilities to the value chain resulting in successful coordination beyond the price and reduction in transaction costs in the value chains. Table 1 presents a summary of the variables determining the quality of value chain governance.

| Table 1 Summary of the Variables Determining the Quality of Value Chain Governance | |

| Element of governance | Effects on value chain performance |

| • Trust as a governance mechanism plays a crucial role in sharing information among business partners | |

| The presence of trusting culture |

• The presence of trust reduces the costs of coordination in value chains due to decline in the need for contract specifications. |

| • Trust decreases free-rider risks leading to the enlargement of the scope of coordination beyond price transactions in the value chains. | |

| The presence of intermediaries | • Intermediaries minimize the costs of coordination and enlarge the option for coordinating beyond price transaction due to specialized management of coordination tasks. |

| The presence of lead firms | • Lead firms generate positive external effects for firms in their network, mainly by encouraging innovation and promoting internationalization. |

| • Lead business firms leverage firms in the value chain by investing in training, education, infrastructure, innovation and regimes for collective action | |

| Quality of collective action regimes | • Quality collective action regimes add to the quality of value chain governance through the creation of common norms. principles, rules and decisions-making procedures around which economic agents’ expectations converge on given issue area (Mossberger & Stoker, 2001) |

| • Quality collective action regimes add to the quality of value chain governance through the creation of common norms. principles, rules and decisions-making procedures around which economic agents’ expectations converge on given issue area (Mossberger & Stoker, 2001) | |

| • Quality collective action regimes lead to reduction of costs, and equitable distribution of income, among the involved economic agents thus ensuring the emergence of trust and robust relationships | |

| • Capable collective action regimes motivate coordinated action among different economic agents in the value chain by protecting interests and group’s ability (power) to institutionalise their interests | |

Research Methodology

Because the factors that determine the quality of value chain governance have not all been accounted in literature or at best remain eclectic and thus not well understood, an exploratory research approach was employed. First, a comprehensive literature study on the topic of value chain governance was carried out. Factors including the roles of intermediaries, trust, lead firms, and collective action regimes in the governance of value chains were evaluated. Remarkably, much more scholarly research has been done in the area of value chain governance particularly on the classification of governance models but less on the mechanisms for governing value chains beyond the price mechanism. Second, a cross-section questionnaire survey was conducted using a purposive sample of 332 managers working in the cotton value chain in Zimbabwe to identify and confirm the critical factors that determine effective governance in value chains. To achieve this feat, a structured questionnaire was developed using the constructs identified during the literature study. However, there were no readily available measures for all the identified factors prompting the need to interview some value chain analysts and academics to develop the measurement items for the constructs. The identified constructs and their sources in value chain governance literature are presented in Table 2.

| Table 2 Constructs and Their Sources | |

| Construct | Sources |

| Lead firms | Kaplinsky, 2000; Conti, 2014; Gereffi & Fernandez-Stark, 2011; Anthony, 2016 |

| Trust | Vieira & Traill, 2008; Williamson, 2014; Brunet & Aubry, 2016; Gereffi & Lee, 2016; Müller, Zhai & Wang, 2017; Cumming et al., 2020 |

| Collective action regimes | Olson, 2000 & 2010; Fischer & Qaim, 2014; Holland, 2014; Verhofstadt & Maertens, 2014; De Langen, 2015; Nell, 2017 |

| Intermediaries | Kaplinsky & Morris, 2000; Young, 2015 |

All the items used to measure the constructs in the questionnaire employed a 1 to 5 scale, where 1 signified “strongly disagree” and 5 “strongly agree”. The questionnaire was distributed to the 420 managers operating in Zimbabwe’s cotton value chain. After for weeks a total of 340 questionnaires were received and were analysed for completeness resulting in 17 questionnaires discarded leaving a total of 323 useable questionnaires. This gave a response rate of 76.9 % which was deemed adequate to meet the demands of the extant study.

Data Analysis

This subsection reports the results of the data analysis as conducted in this study. The results of factor analysis and reliability tests are presented and considered. First, Exploratory factor analysis was carried out to pinpoint the dimensionality of each research construct, to select questionnaire items with higher factor loadings, and to match the picked items with the items suggested by theory. Item-to-total correlation and Cronbach's alpha were evaluated to identify the internal consistency and reliability of each construct. Finally, underlying roots (the Eigenvalues), were employed to determine the number of components that were extractable from the principal component factor analysis. For this study, the following benchmarks were applied (1) factor loadings =/>0.35, Eigenvalue >1, cumulatively explained variance >0.6, (2) Item-to-total correlation >0.45, and (3) Cronbach's alpha >0.70 (Yong & Pearce, 2013; Meyers et al., 2013; Kline, 2015; Reio & Shuck, 2015). The results of the factor analysis and reliability tests are indicated in Table 3.

| Table 3 Results of the Factor Analysis and Reliability Tests | |||

| Item | Variable | Factor loading | Item-to-total correlation |

| Intermediaries | |||

| Int1 | Third-party organizations are relevant to export of products | 0.600 | 0.702 |

| Int2 | Third party organizations speed delivery of goods to local customers | 0.585 | 0.676 |

| Int3 | Commercial banks facilitate payments among incumbent firms | 0.611 | 0.730 |

| Int4 | Courts are relevant for conflict resolution among the value chain firms | 0.634 | 0.698 |

| Trust | |||

| Tr1 | Incumbent firms can easily anticipate the partner behavioural changes | 0.775 | 0.700 |

| Tr2 | Incumbent firms share accurate, timely, adequate information | 0.712 | 0.760 |

| Tr3 | Incumbent firms are committed to the existing commercial relationships | 0.658 | 0.773 |

| Tr4 | Incumbent firms are prepared to share vital and proprietary information | 0.682 | 0.782 |

| Tr5 | Incumbent firms are confident with the products of their partners | 0.602 | 0.733 |

| Lead firms | |||

| LF1 | Big suppliers and buyers play a leading role in the value chain | 0.621 | 0.694 |

| LF2 | Big firms help incumbents to innovate | 0.700 | 0.734 |

| LF3 | Big international buyers enable access to export markets | 0.692 | 0.765 |

| LF4 | Big international suppliers enable access to latest technology | 0.591 | 0.793 |

| LF5 | Big firms in the chain improve the quality of products in the chain | 0.783 | 0.761 |

| LF6 | Leading corporation plays a central role in production activities | 0.790 | 0.752 |

| Collective Action regimes | |||

| CAR1 | Trade associations help Economic agents to cooperate internally | 0.788 | 0.688 |

| CAR2 | Collaborative effort brings in required inputs in the value chain | 0.634 | 0.730 |

| CAR3 | Collaborative effort helps agents to exploit emerging markets effectively | 0.814 | 0.711 |

| CAR4 | Trade associations give the agents effective bargaining power | 0.583 | 0.750 |

| CAR5 | Economic agents contribute resources to representative associations | 0.661 | 0.713 |

| CAR6 | Community argument drives performance of the value chain. | 0.700 | 0.862 |

| CAR7 | Individual voice is accommodated in policy decisions and implementation | 0.712 | 0.722 |

All the items met the yardstick as set for this study and the results show a comparatively high amount of internal consistency for all the dimensions. The Cronbach alphas for all constructs were above 0.76 thus validating the reliability of the measurement items. A subsequent Confirmatory factor analysis (CFA) through structural equation modelling (SEM) was performed to confirm that a relationship existed between the empirically derived data and the ex-ante theoretical expectations of the effect that the observed variables have on value chain governance (Kline, 2015; Meyers et al., 2013). Table 3 presents the results of confirmatory analysis on the variables influencing the value chain governance. The following benchmarks meant a good model fit of the data describing the variables influencing value chain governance. (1) Comparative fit index (CFI)> 0.90, (2) Tucker Lewis Index (TLI)>0.90 and (3) Root Mean Square Error of Approximation (RMSEA) < 0.10 (Harlow, 2014; Brown, 2015; Kline, 2015).

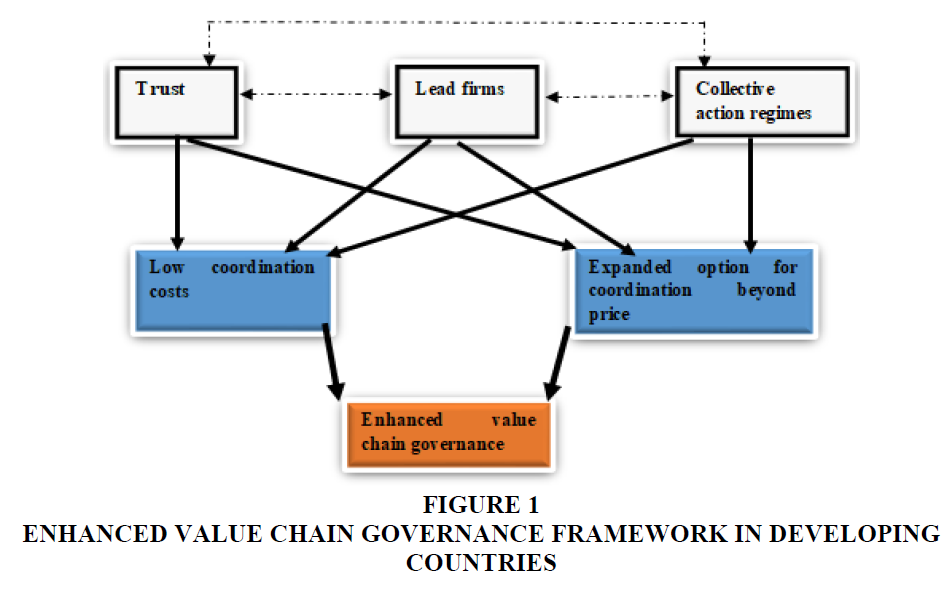

The confirmatory factor analysis results indicate that the construct of intermediaries did not meet the benchmark indices for good model fit (Table 4). Accordingly, the construct relating to the intermediaries was disregarded from the framework of factors shaping the governance of Zimbabwe’s cotton value chain while all the others variables, namely the existence of trust, lead firms and collective action regimes in developing countries’ value chains which met the benchmark indices for good model fit were incorporated in such a framework. This is certainly a curious finding especially with regard to the already determined role of the intermediary organizations in the consolidation of the value chain operational and support processes (Cattaneo et al., 2013; Gereffi & Fernandez-Stark, 2016). This interesting finding so merit further research to determine why actors in developing countries’ value chains are not confident with the intermediary’s coordinative role in the value chains. Having established the vital value chain governance in the developing countries, the next stage was to propose an enhanced value chain governance framework that takes specifically works in a developing country’s value chains. Figure 1 shows the elements of efficient value chain governance framework which focuses on the authority and power relationships influencing on how financial, material and technology, knowledge human resources are allocated or flow within a chain in a developing country context.

| Table 4 Confirmatory Analysis Results | ||||

| No of items | (CFI) | (TLI) | (RMSEA) | |

| Intermediaries | 4 | 0.797 | 0.703 | 0.140 |

| Trust | 5 | 0.890 | 0.897 | 0.082 |

| Lead firms | 6 | 0.943 | 0.914 | 0.079 |

| Collective Action regimes | 7 | 0.906 | 0.901 | 0.036 |

Governance Framework in a Developing Country’s Value Chains

Own their own firms in developing countries suffer from a limited set of capabilities, resources and knowledge to effectively succeed in the market where it is difficult to coordinate beyond the price. From this study, it is clear that the coordination problems facing developing countries’ value chains require fresh cross-sector holistic responses to overcome the coordination and flexibility difficulties which limit their success

As such, this study proposes a three-pronged value chain governance framework through which the quality of the variables presented in Figure 1 is strengthened and the proposed implementation of the framework entails efforts to strengthen the quality of Collective action regimes, lead firms and trust in the value chain as follows:

Strengthening the Quality of Collective Action Regimes

It is without doubt that the presence of non-excludable and non-rivalrous public goods in value chains presents some destructive collective action problems manifesting in the form of free-riders. This basically calls for a greater need to punish the propensity for free-riding if cooperation is to be sustained among the diverse economic agents in the value chains (Ostrom 2000). To ensure collective effort, it is imperative that some collective action regimes with capacity to offset free-riding behaviour be established. Firstly, the value chain incumbents need to realise the importance of understanding the nature of collective action problems they face and only then can responses which include effort to improve the buy-in and crafting the social penalties or incentives to encourage cooperative behaviour among the diverse incumbents in the value chain.

The ability to build lasting trust by way of involving all players in policy reforms should effectively add to quality of the involved collective action regimes in the value chain. Furthermore, there is always a need to invest in sector-specific collective action regimes to ensure that they have the requisite vertical reach to bring all stakeholders in the value chain together allowing them to build trust and so cooperate on issues affecting their mutual objectives. In addition, it is imperative that existing legal instruments be developed in such a manner that they facilitate and support collaborative spaces for collective effort to solve the problems of all the economic agents across the supply and demand side of the value chain. In fact, it is more important to strengthen the ability of these collective action regimes in monitoring and assessing the contentment of the entire value chain membership through social audits regarding the avenues by which joint action plans are developed, implemented and appraised for their performance. This later point, thus indicates the importance of lead firms as effective collective action regimes in value chains which through their power align the collective incentives and sanctions so that each economic agent in the value chain has an implicit faith in the commitment of all other actors to the success of both individual and common goals in the value chain. Achieving such is indeed an effective way to deter free-riding within sectors thereby boosting the quality of value chain.

Supporting the Lead Firms

This study has so far indicated the critical role of lead firms in moving other economic agents in the value chain forward. This means that in order to move the value chain in the right direction it is highly likely that if many of the small, medium, and large firms in the value chain should be encouraged to develop both forward and backward business ties, become key innovators, and recognized thought leaders of the industries in which they operate such that they can be the enforcers of the parameters under which other stakeholders in the value chain operate. Importantly, the basic mechanism to ensure the vitality of lead firms in value chains is to have a flexible public policy in terms of the level of the formalization of relationships between the different lead firms and their economic partners. Only the involved parties are capable of building the trust necessary to work effectively. This way, it is possible that the resultant relationships would be able to foster better integration of those fringe economic agents into the value chains. This allows the lead firms to be viewed as capable collective action regimes ensuring that customised embedded services such as training; technical support, ideas, and finance are delivered into the value chain which in the absence of lead firms would have led to collective action problems.

The foregoing indicates the importance of national industrial policy deferring to the knowledge and capability of the lead firms and only seek to engage the lead firms when to designing the strategic plans required to tackle the constrains affecting the entire value chain. In this regard, it seems advisable to ensure that all players in the value chain are brought together in order to promote honest discussions, find mutual objectives, and make commitments. When this has been achieved, policy must only then be supportive of the adjustment of lead firm models to the desired path as opposed to becoming heavily involved in the structuring of the emerging relationships and outlining the responsibilities among the value chain economic agents which has the possible effect of confusing the nature of relationships. Ideally, it would better to try to attract mostly those lead firms that command ample financial strength and having a long-term perspective to guarantee the required investments into the value chain. Lastly, it should also be imperative to encourage the other economic agents working with the lead firms to honour the trust and confidentiality vis-à-vis the lead firms’ operations, strategies, and investments so as to ensure the possibility of continued value chain steering by lead firms for the long run.

Fostering Trust Perceptions along the Value Chain

Value chain economic agents should be incentivised to develop enduring trustful relationships since as indicated in this study; the presence of trust among the economic agents can spearhead stronger partnerships. Implied here is the need to build trust across the entire value chain through a number of initiatives. Firstly, business managers working along the value chains must take upon themselves to inculcate a culture in their firms that permits an authentic appraisal of the issues impacting on the operation of the value chain. This entails the avoidance of playing blame game on the other players when things go out of hand. Secondly, by exchanging open, frequent, and accurate information to harmonize decision-making, economic agents in value chains can eradicate the many problems inhibiting the occurrence of trust in the value chains. Added to this is the need for ethical and honest behaviour, for instance, ensuring payments to business partners are done on time can help to build reputation of the incumbent economic agents.

Married to this is the need to ensure consistency in the manner the economic agents’ conduct their business with partners in the value chain as reflected in the alignment of strategic and operational level policies. Without doubt, other economic agents in the value chain value constancy of actions, decisions and behaviour of all those they have business relationships with. In this regard the presence of powerful lead firms in the value chain can help to build trust-based business relationships by thwarting opportunistic behaviour that might creep into the value chains. Last but not least, by working collaboratively, economic agents can build enough trust to smooth the coordination of the value chains. Clearly, when economic agents have trust in the policies and institutions in the value chains they are prepared to participate in the efforts to build cohesive and enduring inter-firm relationships. Towards this goal, the economic agents can be better off devising transparent processes to craft joint goals and to institutionalise performance appraisals on the way to realizing such goals. Such an inclusive culture in the value chain is without doubt imperative to any trust building initiatives meant to steer the value chain in the expected direction. Indeed, the presence of the right types of lead firms and collective action regimes add to the level of trust thus leading to the quality of the value chain governance.

Conclusion and Implications

Like other theoretical and field studies, this study supports the notion that value chain governance is dependent on a considerable number of coordination mechanisms. In particular, of the four variables readily presented in literature, this paper confirms that, in developing countries, trust, lead firms and collective action regimes are indicated as major elements influencing value chain governance. Unlike what is presented in theory, the presence of intermediary organizations in value chains seems not to have any realistic role in the coordination of value chains beyond the price mechanism. Hence, to enhance the governance in the value chain of the developing countries, it may only be necessary to concentrate on (1) building systemic capacity to inhibit the occurrence of free-rider tendencies among the economic agents via strengthening the collective action regimes, (2) developing supportive and flexible public policies to encourage the formation and development of strong buyer and buyer lead firms, and then (3) on undertaking some trust-building initiatives across the entire value chain. However, it is acknowledged that these identified elements are mainly contextual. The use of the value chains from only one developing country in the Southern African region in this study may limit the generalizations of the findings to all the developing countries across the globe. This means, may account for the observed deviation from the available literature on value chains in the developed countries. Following this limitation, subsequent empirical studies need to include more developing countries in order to account for all the contextual variables that affect the value chain governance developing countries.

References

- Anthony, A. (2016). SMEs in Indian textiles: The impact of globalization in a developing market. Springer.

- Bianchi, C., Glavas, C., & Mathews, S. (2017). SME international performance in Latin America: The role of entrepreneurial and technological capabilities. Journal of Small Business and Enterprise Development, 24(1), 176-195.

- Bijman, J., Muradian, R., & Schuurman, J. (2016). Cooperatives, Economic Democratization and Rural Development. Edward Elgar Publishing.

- Brown, T.A. (2015). Confirmatory factor analysis for applied research. Guilford publications.

- Brunet, M., & Aubry, M. (2016). The three dimensions of a governance framework for major public projects. International Journal of Project Management, 34(8), 1596-1607.

- Carter, C.R., Rogers, D. S., & Choi, T.Y. (2015). Toward the theory of the supply chain. Journal of Supply Chain Management, 51(2), 89-97.

- Cattaneo, O., Gereffi, G., Miroudot, S., & Taglioni, D. (2013). Joining, upgrading and being competitive in global value chains: a strategic framework. The World Bank.

- Coe, N.M., & Yeung, H.W.C. (2015). Global production networks: Theorizing economic development in an interconnected world. Oxford University Press.

- Conti, R. (2014). Do non?competition agreements lead firms to pursue risky R&D projects?. Strategic Management Journal, 35(8), 1230-1248.

- Cumming, D., Ge, Y., & Lai, H. (2020). Trust and quality uncertainty in global value chains. Journal of Multinational Financial Management, 100662.

- De Langen, P.W. (2015). Governance in seaport clusters. In Port Management (pp. 138-154). Palgrave Macmillan, London.

- Donovan, J., Franzel, S., Cunha, M., Gyau, A., & Mithöfer, D. (2015). Guides for value chain development: a comparative review. Journal of Agribusiness in Developing and Emerging Economies.

- Fayezi, S., Zutshi, A., & O'Loughlin, A. (2017). Understanding and development of supply chain agility and flexibility: a structured literature review. International journal of management reviews, 19(4), 379-407.

- Fischer, E., & Qaim, M. (2014). Smallholder farmers and collective action: What determines the intensity of participation?. Journal of Agricultural Economics, 65(3), 683-702.

- Gardner, T.A., Benzie, M., Börner, J., Dawkins, E., Fick, S., Garrett, R., & Mardas, N. (2019). Transparency and sustainability in global commodity supply chains. World Development, 121, 163-177.

- Gereffi, G. (2014). Global value chains in a post-Washington Consensus world. Review of international political economy, 21(1), 9-37.

- Gereffi, G. (2019). Global value chains and international development policy: Bringing firms, networks and policy-engaged scholarship back in. Journal of International Business Policy, 2(3), 195-210.

- Gereffi, G., & Fernandez-Stark, K. (2011). Global value chain analysis: a primer.

- Gereffi, G., & Lee, J. (2016). Economic and Social Upgrading in Global Value Chains and Industrial Clusters: Why Governance Matters. Journal of Business Ethics, 133(1), 25-38.

- Gereffi, G., & Sturgeon, T. (2014) Global value chain-oriented industrial policy: the role of emerging economies. Global value chains in a changing world, 329.

- Gereffi, G., Humphrey, J., & Sturgeon, T. (2005). The governance of global value chains. Review of international political economy, 12(1), 78-104.

- Gibbon, P., Bair, J., & Ponte, S. (2008). Governing global value chains: an introduction. Economy and society, 37(3), 315-338.

- Gimenez, C., & Sierra, V. (2013). Sustainable supply chains: Governance mechanisms to greening suppliers. Journal of business ethics, 116(1), 189-203.

- Gurney, G.G., Cinner, J.E., Sartin, J., Pressey, R.L., Ban, N.C., Marshall, N.A., & Prabuning, D. (2016). Participation in devolved commons management: Multiscale socioeconomic factors related to individuals’ participation in community-based management of marine protected areas in Indonesia. Environmental Science & Policy, 61, 212-220.

- Hardin, R. (2015. Collective action. Routledge.

- Harlow, L.L. (2014). The essence of multivariate thinking: Basic themes and methods. Routledge.

- Harrison, A. (2007). Globalization and poverty: An introduction. In Globalization and poverty (pp. 1-32). University of Chicago Press.

- Holland, V.D. (2014). Reform where is thy victory?: A study of the reform efforts in Summit, Allegheny and Cuyahoga Counties. Unpublished doctoral dissertation, Cleveland State University.

- Holweg, M., & Helo, P. (2014). Defining value chain architectures: Linking strategic value creation to operational supply chain design. International Journal of Production Economics, 147, 230-238.

- Humphrey, J., & Schmitz, H. (2004). Chain governance and upgrading: taking stock. Chapters.

- Kaplinsky, R., & Morris, M. (2000). A handbook for value chain research (Vol. 113). Brighton: University of Sussex, Institute of Development Studies.

- Kline, R.B. (2015). Principles and practice of structural equation modeling. Guilford publications.

- Knudsen, J.S. (2017). How do domestic regulatory traditions shape CSR in large international US and UK firms?. Global Policy, 8, 29-41.

- Lejano, R.P., & de Castro, F.F. (2014). Norm, network, and commons: The invisible hand of community. Environmental Science & Policy, 36, 73-85.

- Liegler, F. (2017). Towards an Organized Patent Market: Exploring the Road on an Evolving Asset Class to Organized Trade. Unpublished doctoral dissertation, Cleveland State University.

- Mapanga, A., Miruka, C.O., & Mavetera, N. (2018). Barriers to effective value chain management in developing countries: new insights from the cotton industrial value chain. Problems and Perspectives in Management, 16(1), 22-35.

- Meijerink, G., Bulte, E., & Alemu, D. (2014). Formal institutions and social capital in value chains: The case of the Ethiopian Commodity Exchange. Food Policy, 49, 1-12.

- Meyers, L.S., Gamst, G.C., & Guarino, A.J. (2013). Performing data analysis using IBM SPSS. John Wiley & Sons.

- Mishra, P.K., & Dey, K. (2018). Governance of agricultural value chains: Coordination, control and safeguarding. Journal of Rural Studies, 64, 135-147.

- Müller, R., Zhai, L., & Wang, A. (2017). Governance and governmentality in projects: Profiles and relationships with success. International Journal of Project Management, 35(3), 378-392.

- Neilson, J., Pritchard, B., Fold, N., & Dwiartama, A. (2018). Lead firms in the cocoa–chocolate global production network: An assessment of the deductive capabilities of GPN 2.0. Economic Geography, 94(4), 400-424.

- Nell, G.L. (2017). The Driving Force of the Collective. Palgrave Macmillan.

- Notteboom, T., De Langen, P., & Jacobs, W. (2013). Institutional plasticity and path dependence in seaports: interactions between institutions, port governance reforms and port authority routines. Journal of transport geography, 27, 26-35.

- Olson, M. (2009). The Logic of Collective Action: Public Goods and the Theory of Groups, Second Printing with a New Preface and Appendix (Vol. 124). Harvard University Press.

- Ostrom, E. (2000). Collective action and the evolution of social norms. Journal of Economic Perspectives, 14(3), 137-158.

- Ostrom, E. (2010). Analyzing collective action. Agricultural Economics, 41, 155-166.

- Parola, F., Risitano, M., Ferretti, M., & Panetti, E. (2017). The drivers of port competitiveness: a critical review. Transport Reviews, 37(1), 116-138.

- Pergelova, A., Manolova, T., Simeonova?Ganeva, R., & Yordanova, D. (2019). Democratizing entrepreneurship? Digital technologies and the internationalization of female?led SMEs. Journal of Small Business Management, 57(1), 14-39.

- Pickles, J., Barrientos, S., & Knorringa, P. (2016). New end markets, supermarket expansion and shifting social standards. Environment and Planning A: Economy and Space, 48(7), 1284-1301.

- Ponte, S., & Sturgeon, T. (2014). Explaining governance in global value chains: A modular theory-building effort. Review of International Political Economy, 21(1), 195-223.

- Porter, M.E. (2008). Value-based health care delivery. Annals of surgery, 248(4), 503-509.

- Poteete, A.R., Janssen, M.A., & Ostrom, E. (2010). Working together: collective action, the commons, and multiple methods in practice. Princeton University Press.

- Reio Jr, T.G., & Shuck, B. (2015). Exploratory factor analysis: implications for theory, research, and practice. Advances in Developing Human Resources, 17(1), 12-25.

- Richey, L.A., & Ponte, S. (2020). Brand Aid and Coffee Value Chain Development Interventions: Is Starbucks Working Aid Out of Business?. World Development, 105193.

- Romero, I., & Tejada, P. (2020). Tourism intermediaries and innovation in the hotel industry. Current Issues in Tourism, 23(5), 641-653.

- Scott, W.R. (2013). Institutions and organizations: Ideas, interests, and identities. Sage publications.

- Spekman, R.E., & Davis, E.W. (2004). Risky business: expanding the discussion on risk and the extended enterprise. International Journal of Physical Distribution & Logistics Management.

- Stangl, B., Inversini, A., & Schegg, R. (2016). Hotels’ dependency on online intermediaries and their chosen distribution channel portfolios: Three country insights. International Journal of Hospitality Management, 52, 87-96.

- Trienekens, J., van Velzen, M., Lees, N.J., Saunders, C.M., & Pascucci, S. (2017). Governance of market-oriented fresh food value chains: export chains from New Zealand.

- Trienekens, J.H. (2011). Agricultural value chains in developing countries a framework for analysis. International Food and Agribusiness Management Review, 14(1030-2016-82778), 51-82.

- Verhofstadt, E., & Maertens, M. (2014). Smallholder cooperatives and agricultural performance in Rwanda: do organizational differences matter?. Agricultural Economics, 45(S1), 39-52.

- Vieira, L. M., & Traill, W.B. (2008). Trust and governance of global value chains: The case of a Brazilian beef processor. British Food Journal, 110(4-5), 460-473.

- Wenzel, H. (2016). Analysis of strategic success factors in the internationalization process of professional German football clubs. GRIN Verlag.

- Williamson, O.E. (2014). The transaction cost economics project. Montenegrin Journal of Economics, 10(1), 7.

- Wilson, G.A. (2012). Community resilience, globalization, and transitional pathways of decision-making. Geoforum, 43(6), 1218-1231.

- Yong, A.G., & Pearce, S. (2013). A beginner’s guide to factor analysis: Focusing on exploratory factor analysis. Tutorials in Quantitative Methods for Psychology, 9(2), 79-94.

- Young, O.R. (2015). The intermediaries: Third parties in international crises. Princeton University Press.

- Zhao, L., Huo, B., Sun, L., & Zhao, X. (2013). The impact of supply chain risk on supply chain integration and company performance: a global investigation. Supply Chain Management: An International Journal, 18(2), 115-131.