Research Article: 2021 Vol: 24 Issue: 1S

Accounting System Development for Community Business to Strengthen Economy of Womens Group of Processing Fermented Fish in the Northeast of Thailand

Piyachat Thongpaeng, Sisaket Rajabhat University

Theewara Sutanthawiboon, Muban Chombueng Rajabhat University

Keywords

Development, Accounting System, Community Business, Economy Strength, Women’s Group of Processing Fermented Fish

Abstract

The purposes of the accounting system development for community business to strengthen the economy of women’s group of processing fermented fish in the Northeast of Thailand aimed to study the shortcomings of the accounting from the existing accounting system to develop into an appropriate accounting system by analyzing the weaknesses and the shortcomings. The findings from the study revealed that there was an error in money receipt, money payment, and other processes. In addition, the accounting preparation did not conform to the accounting procedures. Therefore, the researchers designed an accounting system and defined the operating procedures for the group as follows: (1) assigning distinct duties and responsibilities for the committees, (2) designing documents, account books, and financial reports, (3) defined accounting diagrams and codes, (4) defining operational methods, i.e. system of cash receipts; cash payment; production; production cost calculation; account adjustment and closing; preparation of financial statement; and liability dividend payment, (5) preparing accounting manual as a guideline and self study in the accounting. Most of the agriculturists were elderly people, so they lacked staff who had knowledge and understanding in accounting. Therefore, members who were interested in accounting participated in accounting training. In addition, the group leader should understand internal control as well.

Introduction

As per the 20-year National Strategic Framework of the 12th National Economic and Social Development Plan (2017-2021), it is a long-term strategy transferring into action in a range of five years. The main target of this National Economic and Social Development Plan is to enhance a middle-income country to a high-income country focusing on developing the human potential to support the growth of the country, reducing inequality in society, creating social growth and environmentally friendly economy, and effective public administration. In addition, it is a plan that introduces and applies the philosophy of sufficiency economy holding people in the center of participatory development, which bases on the principles of balance and sustainability with continuous research, and development by supporting research and development funding from the government for both the public and private sectors. It supports agricultural production based on local conditions, develops and strengthens knowledge in various science and technology that are appropriate for the agriculture of the country. Additionally, it supports the use of environmentally friendly production technology, promotes the creation of added value to agricultural products throughout the production chain, and supports the production and services of the community to create added value for agricultural products of food and energy. It encourages educational institutions in the area to conduct research studies together with the private sectors to support agriculturists and entrepreneurs on applying knowledge of innovation and environmentally friendly production technology for added value creation in agricultural products to enhance safety quality standards level to be equal to the international standards level. (Office of the National Economics and Social Development Council, 2017)

An effective accounting system is important in managing at all levels of an organization because it is a systemic recording process of the numerical information in each activity performed within the organization. It is used to report the financial status and performance of the business. The success of the business depends on the management and the decisions of the executives based on accounting information. In addition, accounting information can be used to make rational decisions and consideration business options, including planning and controlling operations efficiently. The organization’s model of a group of agriculturists is established to carry out various activities to generate additional income from agriculture, which is known as community enterprises. These activities relate to the manufacture of products, services, or other activities operated by a group of people who have a common way of life. Either legal or non-legal entities are a kind of self-reliance of household, own community, and other communities. However, the following obstacles occur in operating community enterprises (Department of Agricultural Extension, 2008): (1) They are not recognized by other government or private agencies because of the lack of legal support. (2) Government support does not conform to the actual needs because of uncertain target groups and needs. Nevertheless, in the past, the operations of community enterprises had faced financial management problems due to a lack of attention on accounting. The accountant did not have basic knowledge of accounting. In addition, the group leader was not aware of the importance and necessity of accounting, including the lack of continuity due to frequent change of the accountant (Cooperative Auditing Department, 2005). These problems occur with the women’s enterprise group of processing fermented fish at Ban Dong Tat Thong, Phosi Sub-district, Prang Ku District, Sisaket Province as well.

According to the problems mentioned above, they create an impact on the effective financial, accounting management, and operation of community enterprises. These cause the lack of accounting information for operating results and financial position. There is no information to use for planning and decision-making of community enterprises which can affect sustainable growth and business competitiveness. Hence, the researchers have paid attention to these problems to study and develop an appropriate accounting system to prepare business accounts for women’s enterprise group of processing fermented fish at Ban Dong Tat Thong, Phosi Sub-district, Prang Ku District, Sisaket Province, so that they can use accounting information to improve operational efficiency and increase competitiveness to strengthen the economy of the community in the future.

Materials And Methods

Stage 1: To study the accounting status of women’s group of processing fermented fish at Ban Dong Tat Thong, Phosi Sub-district, Prang Ku District, Sisaket Province, the procedures and instruments were provided as follows: (1) providing a meeting for researchers, committees, and group members to prepare and understand this research study, and (2) studying the accounting condition of women’s group of processing fermented fish at Ban Dong Tat Thong by interviewing the committees who are responsible for accounting and observing the accounting journals. The interviewing method consisted of questions related to accounting information, process, and performance evaluation, and others to estimate knowledge and understanding in preparing bookkeeping based on accounting principles. The observation method was conducted with existing accounting forms by examining from recorded documents, account books, and registers.

Stage 2: To develop/design an appropriate accounting system for community business accounting of women’s group of processing fermented fish at Ban Dong Tat Thong, Phosi Sub-district, Prang Ku District, Sisaket Province, the procedures were provided as follows: (1) studying the concepts and theories related to accounting system design from documents and research papers, (2) designing an appropriate accounting system based on operations of women’s group of processing fermented fish at Ban Dong Tat Thong, and (3) submitting to accounting experts for comments on accounting system based on operations of women’s group of processing fermented fish at Ban Dong Tat Thong for the more appropriate and complete accounting system.

Stage 3: To conduct a trial of an accounting system with women’s group of processing fermented fish at Ban Dong Tat Thong, the procedures were provided as follows: (1) providing training by preparing various documents used in accounting system process and accounting manuals, (2) carrying out training on accounting system by providing basic knowledge of accounting, and (3) conducting a trial of this accounting system with women’s group of processing fermented fish at Ban Dong Tat Thong for 3 months.

Stage 4: To evaluate the accounting system of women’s group of processing fermented fish at Ban Dong Tat Thong, the procedures were provided as follows: (1) evaluating the accounting system by observing and interviewing the committees/group members who were responsible for accounting about the problems occurred with this developed accounting system, (2) summarizing these problems, and (3) preparing a research report.

Source of Data

1. Committees/group members who were responsible for the accounting of women’s group of processing fermented fish at Ban Dong Tat Thong, Prang Ku District, Sisaket Province

2. Documents/account books/performance report of women’s group of processing fermented fish at Ban Dong Tat Thong, Prang Ku District, Sisaket Province

Research Instruments

1. The interview form was used to study the accounting condition of women’s group of processing fermented fish at Ban Dong Tat Thong, Prang Ku District, Sisaket Province in terms of comments after the trial of the accounting system.

2. Non-participatory observation was used to observe preparing accounting, account books, and registers recorded by the committees/group members in terms of issues regarding the preparation of accounting documents and accounting journals.

3. Document analysis was used to collect information from documents and research papers related to the development guideline of an appropriate accounting system for community enterprise groups.

Results and Discussion

The study method was based on primary information derived from interviewing the committees who were responsible for accounting. The secondary data was collected from studying documents, account books, registers, and the performance report. These data were analyzed, synthesized, and illustrated in data flow diagrams of the accounting process and the performance of the current activities to analyze the weaknesses and the shortcomings of the accounting system as shown in Table 1.

| Table 1 The Shortcomings of The Current Accounting System and Internal Control Concept of Women’s Group of Processing Fermented Fish At Ban Dong Tat Thong |

||

|---|---|---|

| Performances | Accounting System Concept | Internal Control Concept |

| 1. Money Receipt Process | - No receipt | - No distinctly assigned responsibilities |

| - No daily sales report | - No balance checking of cash on hand | |

| - No evidence of money receipt | ||

| - No evidence of deposit | ||

| 2. Money Payment Process | - No money requisition form | - No distinctly assigned responsibilities |

| - No payment report | - No balance checking of cash on hand | |

| - No attached evidence with payment | - No cautious money retention | |

| - No defined amount of cash payment | ||

| 3. Others | - No correct calculation of operating profit based on accounting principles | - No distinctly assigned responsibilities |

| - No financial statements | - No accounting journals auditing system | |

| - No register of group’s property | - No examining of inventory counting | |

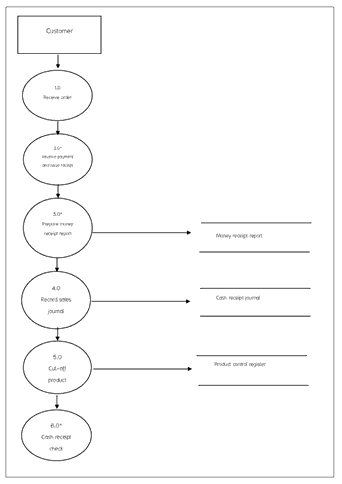

After investigating these findings, the concepts and related theories were used to develop an accounting system for the operation of women’s group of processing fermented fish at Ban Dong Tat Thong. The development result report illustrated operating procedures with the data flow diagram and document path diagram in the following summary:

1. The study of the accounting model of women’s group of processing fermented fish at Ban Dong Tat Thong, it was found shortcomings in many areas, i.e. money receipt process, money payment process, and others, including the preparation of accounts that did not conform to the accounting procedures. According to the money receipt process, there was no evidence of money receipt and remittance. Furthermore, there were no distinctly assigned responsibilities including checking money receipt list. Regarding money payment process, there was no document or evidence regarding the list of money requisition and money payment. There were no distinctly assigned responsibilities including checking balance. Besides, there were no financial statement including the incorrect calculation of profit and loss.

The development of an appropriate accounting system, the researcher designed an accounting system and defined procedures for women’s group of processing fermented fish at Ban Dong Tat Thong, Prang Ku District, Sisaket Province as follows:

The distinct responsibilities should be assigned for all 8 committees to have a clear job description, scope, and responsibility.

The design of document and evidence used for accounting journals, i.e. receipts, money requisition form, and raw material requisition form.

The design of account books and financial reports used for recording accounts, i.e. cash receipt journal and cash payment journal, fish purchase journal, production wages journal, production cost journal, dividend journal, general journal, and ledger journal. In addition, there were several registers used in the accounting system, i.e. product control register and raw material control register. Also, financial reports based on the accounting system, i.e. money receipt report, money payment report, production cost report, trial balance, profit and loss, and statement of financial position.

The defined chart of accounts and accounting codes were sorted out of accounting categories, i.e. assets, liabilities, capital, income, and expense.

The defined operation methods were classified into following parts:

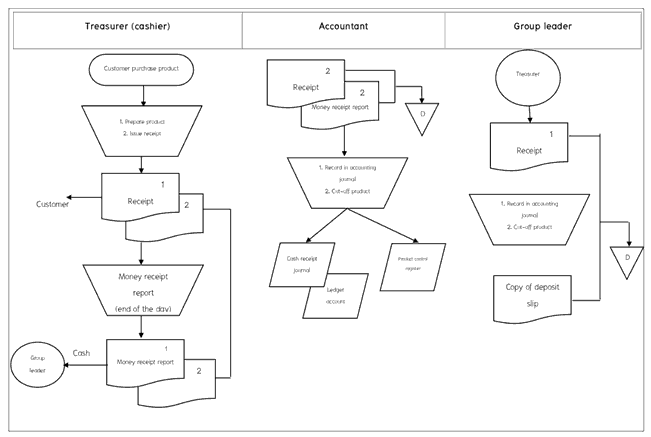

The accounting system of cash receipt, the procedures consisted of arranging products according to customer orders, money receipt, recording, and checking. The operators were treasurer, accountant, and group leader. The documents used for account book were receipt, cash receipt journal, cash ledger, sales ledger, product control register, and copy of the deposit slip from the bank.

The accounting system of cash payment, there were two types of payments: production cost and other payments. Regarding the production cost, the items were divided into 3 parts: raw material, wage, and production cost.

The operating procedures of payment for raw material consisted of purchasing raw material, payment, accounting journal, and checking, which were operated by the production supervisor, accountant, and group leader. The documents used for this procedure were money requisition form, purchase journal of sugar, payment report, cash payment journal, production cost journal, cash ledger, and raw material (fish) ledger, raw material ledger, and raw materials control register.

The operating procedures of wage payment consisted of calculating wage, payment, accounting journal, and checking, which were operated by the production supervisor, accountant, and group leader. The documents used for this procedure were money requisition form, wage book, payment report, cash payment journal, production cost journal, cash ledger, and wage ledger.

The operating procedures of production payment consisted of procurement, payment, accounting journal, and checking, which were operated by the production supervisor, accountant, and group leader. The documents used for this procedure were money requisition form, payment report, cash payment journal, production cost journal, cash ledger, and related ledger accounts.

The operating procedures of other expenses payment consisted of payments, accounting records, and checking, which were operated by the treasurer, accountant, and group leader. The documents used for this procedure were money requisition form, payment report, cash payment journal, cash ledger, and related ledger accounts.

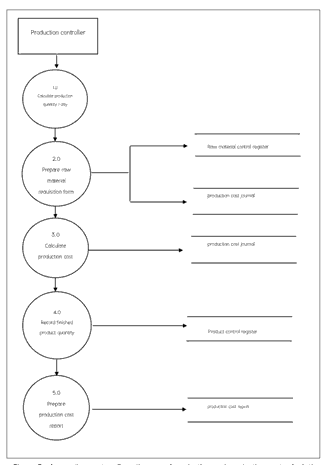

The accounting system procedures of production accounting system and calculation of production cost were production quantity calculation, journal, and production cost calculation, which were operated by the accountant. The documents used for this procedure were the raw material requisition form, fish purchase journal, wage book, payment report, production cost journal, raw material control register, and production cost report.

The account adjustment and account closing were made at the end of the period in order to adjust the list to be correct and summarized the performance by the accountant. The documents used for this procedure were all ledger accounts, trial balance, and profit and loss.

The preparation of financial statement consisted of profit and loss to show performance result and statement of financial position, which were operated by the accountant. The documents used for this procedure were all ledger accounts, profit and loss and statements of financial position.

The payment of liability dividend was carried out after 1 year of operation. A members meeting was held to allocate the net profit and pay liability dividend, which was operated by the accountant, treasurer, and group leader. The documents used for this procedure were money requisition form, profit and lost, minutes of the meeting, general journal, ledger accounts, and liability dividend payment journal.

The Accounting system trial was carried out after the accounting system had been developed successfully. The researcher organized an accounting system training for the group's accounting committees and proposed to the committees for running this system for a period of 1 month.

The evaluation was separated the evaluation of the use of accounting system from those involved in the operation. The evaluation was divided into 2 aspects: use of documents and operations. In terms of the use of documents, the accountant and group leader considered that the documents were complete and able to be checked the work in each process. In contrast, the production supervisor considered that the raw material and wage requisition form were not necessary and redundant. Besides, the treasurer often found that the buyer did not want a receipt and there was no receipt issued for the payment. Regarding operational problems, the production supervisor and the treasurer were able to perform the tasks as required, but the accountant could not record the transaction every day and the group leader could not deposit money at the bank every day. Therefore, the researcher had taken these opinions and problems to solve by reducing the overlap of documents. In case of no receipt, the recipient was allowed to sign in the money requisition form instead. Furthermore, on the operational problem, the researchers suggested that the accountant should record accounts at least twice a week and deposit money to the bank at not later than the following day. After improving the accounting system based on the evaluation results, all concerned people were satisfied to operate with this accounting system.

Regarding to the accounting committees of women’s group of processing fermented fish at Ban Dong Tat Thong, Sisaket Province, they had low knowledge in basic accounting. It resulted in preparing the group's accounting, which was not in line with the concept of accounting process. As (Sivakua et al., 2005) indicated that the accounting must be done as accounting procedures, i.e. analyzing of trade transaction, recording general journal, posting to ledger account, preparing trial balance, adjusting account, and preparing financial statement. However, some error found in the accounting procedure, i.e. recording in general journal, posting in ledger account, calculating profit and loss. The result of the aforementioned study was similar with (Namburi, 2003), who found that community businesses often lacked knowledge of accounting journals. They record in relevant documents and account books with uncomplicated account names in their accounting system.

However, the accounting journals and operation of women’s group of processing fermented fish at Ban Dong Tat Thong, Prang Ku District, Sisaket Province did not conform with the internal control concept as (Sakhakorn et al., 2005), said that the duties should be assigned properly at work in order to prevent any possible mistakes or corruption, such as the duty of securing properties should be separated from accounting tasks, the duty of item approval should be separated from securing properties, single person with several duties, the duty of accounting and operation approval, and appropriate and sufficient documented evidence system. Therefore, neither distinct assigned responsibilities nor operational monitoring system were not found in the operation of women’s group of processing fermented fish at Ban Dong Tat Thong, Prang Ku District, Sisaket Province. This was consistent with the study of (Yimthin, 2005), it was found that the housewives’ group had inadequate organizational structure without distinct assigned duties and responsibilities. There is no accurate accounting based on generally accepted accounting principles and lack of good internal control as well.

Regarding the accounting system development, the researcher designed this system based on the system development concept of (Phosawat, 2006), whose system development consisted of 5 steps: analyzing system, defining scope and objectives, designing system, conducting trial, and evaluating. In addition, the concept of accounting system of (Weerapree et al., 2006), who said that accounting system consisted of accounting forms and document, operational method, and various devices.

Finally, in the trial and evaluation stage, it was found that when applying the accounting system to the accounting committees and relevant people, some of the operations were unable to operate. This conformed with (Teowkul, 2002), who found that the members of the group lacked of knowledge and understanding in accounting. The designed accounting system required documents and reports for checking. Therefore, the group members who were responsible in accounting had been assigned more work due to more documents and reports.

Conclusion

This research aimed to study the appropriate accounting system for community business to strengthen economy of women’s group of processing fermented fish at Ban Dong Tat Thong, Prang Ku District, Sisaket Province by analyzing the shortcomings from the existing accounting system and developing an appropriate accounting system. The benefit received from this study was that the women’s group of processing fermented fish at Ban Dong Tat Thong obtained an appropriate accounting system and accounting manual for self study their operations. The study method was based on primary information derived from interviewing the committees who were responsible for accounting. And secondary data was collected by studying documents, account books, registers, and the performance report. These data were analyzed, synthesized, and illustrated in a data flow diagrams of accounting process and the performance of the current activities in order to analyze the weaknesses and the shortcomings of the accounting system. After investigating these findings, the concepts and related theories were used to develop an accounting system for the operation of women’s group of processing fermented fish at Ban Dong Tat Thong. The development result report was illustrated operating procedures with the data flow diagram and document path diagram. The findings can be summarized as follows:

The study of the accounting model of women’s group of processing fermented fish at Ban Dong Tat Thong, it was found shortcomings in many areas, i.e. money receipt process, money payment process, and others, including the preparation of accounts that did not conform to the accounting procedures.

The development of an appropriate accounting system, the researcher designed an accounting system and defined procedures for women’s group of processing fermented fish at Ban Dong Tat Thong, Prang Ku District, Sisaket Province as follows:

The distinct responsibilities should be assigned for all 8 committees to have a clear job description, scope, and responsibility.

The design of document and evidence used for accounting journals, i.e. receipts, money requisition form, and raw material requisition form.

The design of account books and financial reports used for recording accounts, i.e. cash receipt journal and cash payment journal, fish purchase journal, production wages journal, production cost journal, dividend journal, general journal, and ledger journal. In addition, there were several registers used in the accounting system.

The defined chart of accounts and accounting codes were sorted out of accounting categories, i.e. assets, liabilities, capital, income, and expense.

The defined operation methods were classified into these accounting systems: (1) cash receipt, (2) cash payment, (3) production accounting and calculation of production cost, (4) account adjustment; account closing; and performance summary, (5) preparation of financial statement, and (6) payment of liability dividend.

The Accounting system trial was proposed to the committees for running this system for a period of 1 month.

The evaluation was separated the evaluation of the use of accounting system from those involved in the operation. The evaluation was divided into 2 aspects: use of documents and operations. In terms of the use of documents, the accountant and group leader considered that the documents were complete and able to be checked the work in each process. In contrast, the production supervisor considered that the raw material and wage requisition form were not necessary and redundant. Besides, the treasurer often found that the buyer did not want a receipt and there was no receipt issued for the payment. Regarding operational problems, the production supervisor and the treasurer were able to perform the tasks as required, but the accountant could not record the transaction every day and the group leader could not deposit money at the bank every day. Therefore, the researcher had taken these opinions and problems to solve by reducing the overlap of documents. In case of no receipt, the recipient was allowed to sign in the money requisition form instead. Furthermore, on the operational problem, the researchers suggested that the accountant should record accounts at least twice a week and deposit money to the bank at not later than the following day. After improving the accounting system based on the evaluation results, all concerned people were satisfied to operate with this accounting system.

References

- Cooperative Auditing Department. (2005). Project for development of production cost management. Bangkok: The Agricultural Cooperative Community of Thailand.

- Chaisomtrakul, P. (2008). The development of small and micro community enterprise's accounting system: A Case of Kwanjai Pattana's House wife Group, Tortae Sub-district, Wat Bot District, Phitsanulok Province. Research report, Pibulsongkram Rajabhat University.

- Department of Agricultural Extension. (2008). Community enterprises.

- Namburi, N. (2003). Development of an appropriate accounting system for local industries according to OTOP policy. Bangkok: Office of the National Research Council of Thailand.

- Office of the National Economics and Social Development Council. (2017). The 12th national economic and social development plan (2017-2021).

- Phosawat, S. (2006). Accounting system implementation, (8th edition). Bangkok: Sai Than.

- Sivakua, W. (2005). Primary accounting, (3rd edition). Bangkok: Chulalongkorn University.

- Sakhakorn, C.H. (2005). Internal control and internal audit. Bangkok: TPN Press.

- Teowkul, C.H. (2002). An appropriate financial accounting system of tambol manufacturing group: A Case Study of Pabong Sub-district, Saraphi District, Chiang Mai Province. Chiang Mai. Independent Study, Chiang Mai University.

- Sethasakko, W. (2005). Accounting information system, (5th edition). Bangkok: Thammasat University.

- Weerapree, W. (2006). Accounting system, (23rd edition). Bangkok: Chulalongkorn University.

- Yimthin, S. (2005). Financial accounting system of the OTOP:A Case Study of Ban Ko Khoo Women Farmer Group. Bangkok: Independent Study, Master Degree, Kasetsart University.