Research Article: 2018 Vol: 17 Issue: 4

Achieving Energy Security through Cross Border Investments: China's Energy Infrastructure Investments across Russia & Central Asia and Lessons for India

Sunil Kumar, Indian Institute of Foreign Trade

Niti Nandini Chatnani, Indian Institute of Foreign Trade

Keywords

Energy Security, Energy Cooperation, Economic Growth, Overseas Investments, Energy Infrastructure, Oil & Gas Pipelines.

Introduction

Securing supply of fossil fuels in the form of crude oil and natural gas is an essential component towards achieving energy security. The World Energy Assessment (UNDP) defines energy security as “the continuous availability of energy in varied forms in sufficient quantities at reasonable prices”. Energy security is achieved when a country has stable energy supplies at an affordable price, whether through its own production or through reliable means of import. In this paper, henceforth, crude oil is referred as ‘oil’ and natural gas as gases.

Meeting the growing energy demands and securing an affordable energy supply for the people remains a major and on-going challenge for any country. Oil alone accounts for one-third of the world’s primary energy consumption, exceeding 95 Million Barrels Per Day (MBPD) as per BP Statistical Review of World Energy (2017). Availability of energy resources vis-à-vis demand growth is a serious concern for countries that depend on continued energy supplies from outside. Energy security applies not only to the daily availability of energy for a country to fuel its economic engine, but also to longer-term issues related to where and how the energy will be sourced. Access to global energy resources and infrastructure and availability of energy to end-users broadly defines the contours of an energy security policy.

Uneven distribution of energy resources in the world has led to significant vulnerabilities. For emerging and energy importing giants like China and India, energy security concerns are directly linked to maintaining their economic growth and welfare of the people. Rising energy demand and import dependence impact state policies, reflecting in the race for securing external energy resources and creating energy infrastructure beyond national borders. Threats that energy importers face to energy security include political instability in many energy producing countries, manipulation of energy supplies, competition over energy resources, disturbance to supply infrastructure, natural disasters, funding to some of the foreign countries’ dictators, rising terrorism, dominant countries’ reliance to the foreign oil supply etc.

Energy availability through new technological developments for alternates and discovery of new sources is a global phenomenon. Yet, a country’s energy security mostly relies on country-specific efforts to optimize energy availability, with protection against price fluctuations or concerns for availability of supply. These efforts often lead a country to develop supply side strategies in order to cultivate its own supply sources, explore alternate sources of energy or reach a new equilibrium condition to be insulated from any unforeseen energy supply or price shocks. The new equilibrium could equally entail demand side management through efficiency measures, restrictions on uses, technological advancements, focus on alternate resources etc.

China was a net exporter of oil until 1993. However, in order to make the petroleum resources accessible at all levels of society for its 1.4 billion people and to fuel the country’s economic growth, China’s energy appetite grew very fast. Between 2000 and 2010, the average growth in Gross Domestic Product (GDP) was around 10% on an annual basis, which demanded the annual growth in primary energy at the rate of more than 9% (Qinyun, 2017). Today, China is the world’s largest consumer of primary energy-it is the largest consumer of coal, second largest consumer of oil (after US) and fourth largest user of gas (after US, European Union, Russia) in the world.

Oil is globally traded commodity, transported via pipelines, road tankers, rail tankers and sea route oil tankers. Gas, was discovered as a by-product of the oil exploration process, was not easy to transport in the initial years due to technological limitations. So, early gas discoveries were flared off. By 1930, transportation became feasible and gradually more uses of gas were discovered for domestic heating/cooking, industrial application and power generation. Now, gas has even penetrated into the transportation sector. Gas is a relatively cleaner fuel than oil and coal; therefore, environmental considerations have boosted its use. Most of the traded gas is transported and distributed through pipelines. With the advent of liquefaction technology, gas is being transported as Liquefied Natural Gas (LNG) via sea route in large LNG tankers.

The next section presents a simple theoretical framework developed by the authors to serve as the foundation for further discussion on the subject of energy security.

Theoretical Framework for Energy Security

There are four major facets of energy security:

1. Effective demand.

2. Continuous long term supply.

3. Reasonable price.

4. Fulfilling energy needs through various forms of energy.

Ishida (2007) mentioned the key challenges of energy security under the framework of ensuring supply security, upgrading energy supply & demand mix, promoting energy efficiency efforts and addressing environmental issues. China increased its energy supply volume through imports and framed the policies around it for enhancing energy security. Down (2004) considers that oil price volatility and disruptions in physical supply are the two main causes of energy insecurity.

Broadly, the core elements of energy security of a country are:

1. Availability of supply.

2. Diversity of supply.

3. Affordability to pay for a type of energy.

4. Sustainability for future.

A sufficient supply of oil and gas can be ensured through domestic resources as well as through imports. Supply diversity can be ensured through various supply sources and transportation means. Being a globally traded commodity, the international price for oil and gas is determined through global demand-supply framework, while the country’s own economic condition and policies determine how energy will be made accessible and affordable to its industry and people. Sustainability refers to the optimum uses of energy within acceptable environmental norms, as oil and gas have limited known reserves. Sustainability is also characterized by climate change issues on account of fossil fuel burning and thereby rises in atmospheric temperature.

All four elements are inter-linked to meet the energy security on long term basis, refer Figure 1. At the heart of China’s energy security strategy are availability, reliability and affordability (Shaofeng, 2011).

Availability and diversity elements relate to the security of energy supply to a country. Further, a diversified source minimizes the risk on account of any supply cuts and enhances reliability and sustainability of supply.

The following Figure 1 is an illustration of the major determinants and indicators of the availability and diversity of energy supply and sources for a country. As is highlighted, availability of energy depends on domestic supply as one of the sources and there can be several other forms of external sources. Similarly, diversity of energy supply depends on the reduction of dependence on any one source, or any one means of transport of fuel. Down (2004) described two competing models of energy security for China, first deeper integration into global energy market and second efforts to reduce the reliance on these markets. Reducing reliance to one particular market correlates to diversity.

Key Indicators of cross border energy availability and diversity towards energy security: Availability:

1. Domestic vs. overseas supply.

2. Shipping of own equity oil or gas back to home.

3. Securing oil & LNG supply through long term contract.

4. Loan for oil & natural gas.

5. Oil & gas supply through energy cooperation investments.

Diversity:

1. Distribution by supply routes (Pipelines or tankers through sea route).

2. Distribution by investments (region or country based).

3. Distribution of oil imports (largest first four countries).

4. Energy cooperation initiatives.

The next section examines the energy demand forecasts, focusing on the growing demand for energy in various forms, the primary driver for ensuring energy security.

Energy Demand Forecasts

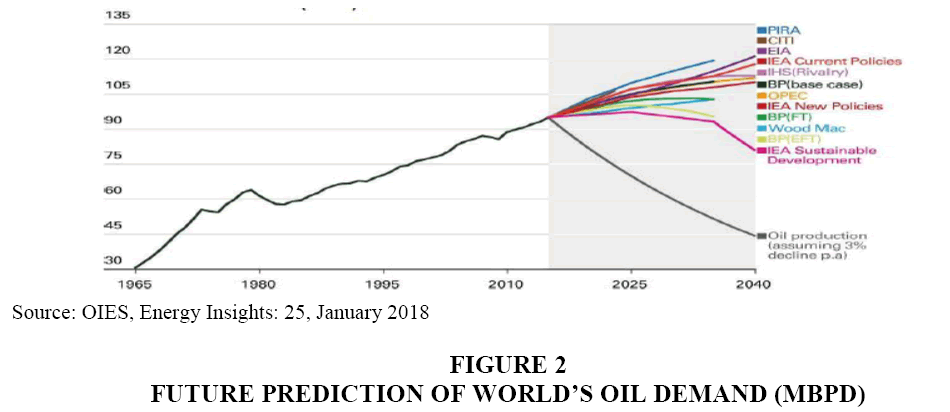

There is global consensus among various energy forecasters that oil demand for next 25 to 30 years is likely to grow. Various public and private global forecasters’ range is plotted in Figure 2.

All projections predict demand for oil to grow beyond 2040, except IEA’s sustainable development model, which represents tight climate and environmental policies and predicts for peak demand for oil in 2020. However the more realistic energy growth model i.e. IEA’s “New Policy Scenario” (IEA defines New Policy Scenario in WEO (2017) as “a scenario where a sensible and prudent policy can be adopted by government around the world”) predicts demand for oil to grow in 2040. The key point is noticeable that even some of the projections may suggest oil may peak sometime, but mostly do not predict any sharp fall.

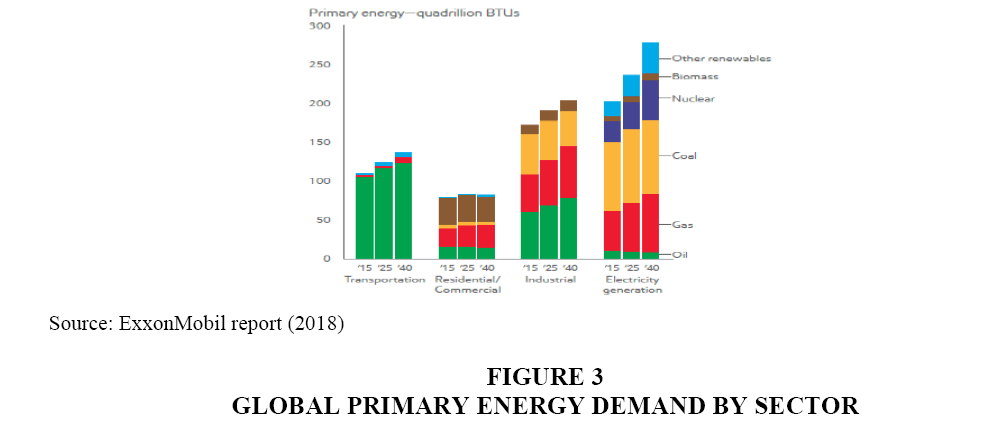

According to ExxonMobil’s Energy Outlook View to 2040, demand for oil will continue to rise (Figure 3). The report predicts a rise of 25% in demand from 2014 to 2040. This is after the reasonable consideration that steep improvement in efficiency and climate control initiatives will be taken across all demand sectors.

There is no reason for demand for oil to decrease so long as it is available in the market at affordable rates. Even though some countries are aiming to switch towards cleaner fuels, dependence of sectors such as transport/residential/commercial/electricity on oil will continue. With the increasing demand for energy, demand for gas will also grow in all sectors. However, demand for oil for electricity generation will remain stagnant.

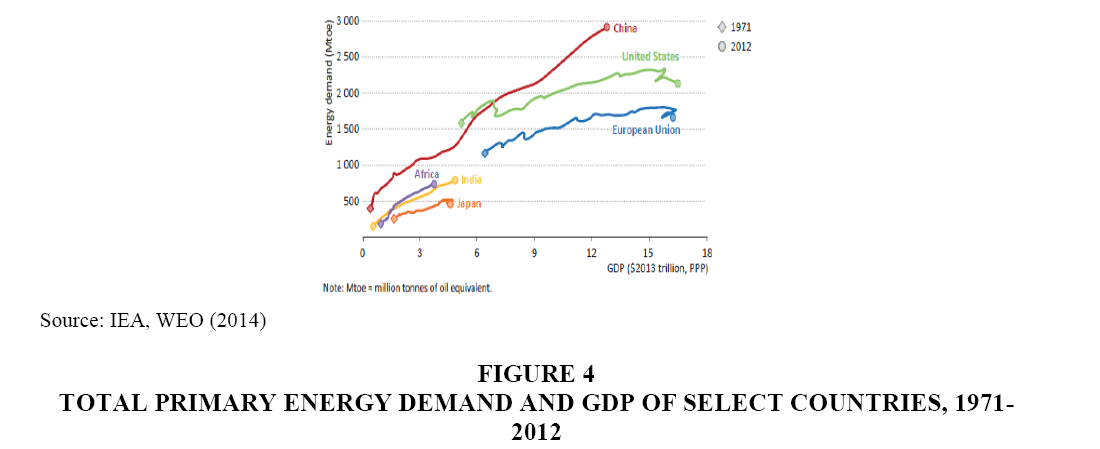

The world’s demand for energy is driven by many factors, but the two biggest is: (a) rise in population (especially the middle income group); (b) economic growth (GDP growth). By 2040, world population is expected to reach 9 billion, from about 7.2 billion in 2016, leading to increased demand for affordable and reliable energy for homes, power, industry and transportation. China and India, with the largest share of middle income group, will face the largest demand for energy.

Historical evidence of energy demand of 1971-2012 periods in relation to GDP is plotted in Figure 4. US and European Union have shown a gradual rise in energy demand against rise in GDP, whereas, China has very steep rise in energy demand in relation to GDP growth.

Therefore, it can be convincingly concluded that oil shall remain the predominant source of primary energy and the world would continue to demand large volumes of oil for many decades to come. Oil and gas are interlinked, as a portion of gas demand can be substituted by petroleum products and vice versa. However, the strategy of securing of their supplies is different by virtue of their physical forms and resource availability.

How has China approached its goal of achieving energy security? This is presented as a detailed case study in the next section.

The China Case Study

China’s energy policy is driven by the country’s perceived insecurity of energy and the country has made tremendous growth in securing equity oil from overseas countries. Equity oil refers to a proportion of oil production which a concession owner has contractual and legal right to retain.

China’s oil and gas demand growth as can be seen in the Table 1.

| Table 1 China’s Oil, Gas And Coal Demand Since 2000 and Future Projections |

||||||||

| Primary energy demand under New Policy Scenario, Million ton oil equivalent (Mtoe) | ||||||||

| Primary energy source | 2000 | 2016 | 2020 | 2025 | 2030 | 2035 | 2040 | CAGR (2016-2040) |

| Oil | 227 | 552 | 613 | 676 | 711 | 716 | 716 | 1.1% |

| Gas | 23 | 172 | 234 | 309 | 374 | 428 | 469 | 4.3% |

| Coal | 668 | 1957 | 1932 | 1908 | 1873 | 1803 | 1706 | (-) 0.6% |

| Fossil fuel Share (IEA basis) | 80% | 89% | 87% | 84% | 81% | 79% | 76% | |

Source: World Energy Outlook (WEO)-2017, Part C china energy outlook

CAGR-Compound Average Annual Growth Rate; Brent crude oil (API 38) has 7.55 barrels/metric ton

Though coal remains a predominant source of primary energy despite gradual replacement by other sources of energy, the growing demand for oil and gas in China and import dependency has created energy security concerns. Three major pillars to China’s energy security approach include:

1. Cross Border Investments.

2. Focus on Gas.

3. Energy Cooperation with Russia and Central Asia.

These are discussed in detail below:

Cross Border Investments

It is interesting to note that China’s march towards energy security has been a marked deviation from its previously existing and well-functioning market based energy trading system. The policy focuses on securing foreign oil assets and resources and has been supported by Chinese government through soft loans, petro-diplomacy and certain non-commercial approaches.

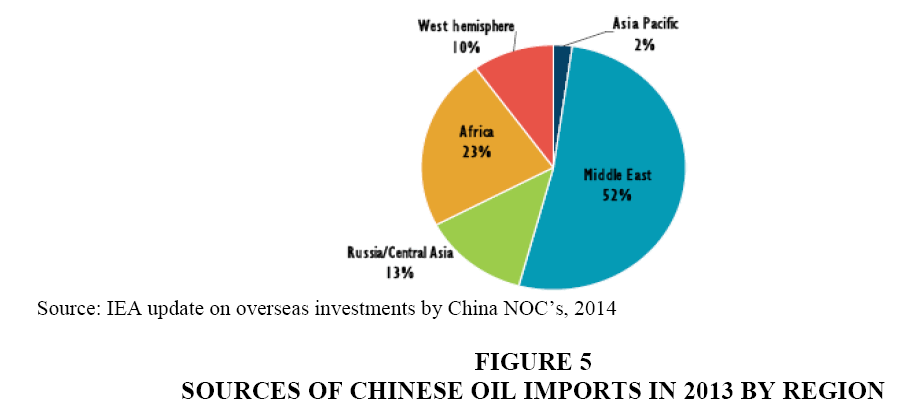

China initiated energy cooperation through its overseas investments in the former Soviet Union states, Africa and Southern American states to diversify oil import sources away from Middle East countries. Within two decades, China has established a global presence through billions of dollars of investment. During 1992-2009, China made investments of US $44 Billion in acquiring energy assets world over, of which nearly US $13 Billion was invested in Russia and Central Asia and a similar investment in Africa. However, China still relies on Saudi Arabia and some of other Middle East countries for significant part of its import (Figure 5).

China’s overseas equity oil production reached 1.7 MBPD and oil-backed loans generated additional 1.4 to 1.6 MBPD oil by 2015. Russia and Central Asia being neighbouring countries to China dominate its investment outflow and provide opportunities. The credit crunch faced by oil companies of erstwhile Soviet countries post collapse of oil prices in 2008 provided an opportunity to China’s National Oil Companies (NOCs) to acquire stake in them. China’s national banks also provided assistance to these NOCs to accelerate the growth in overseas investments.

Focus on Gas

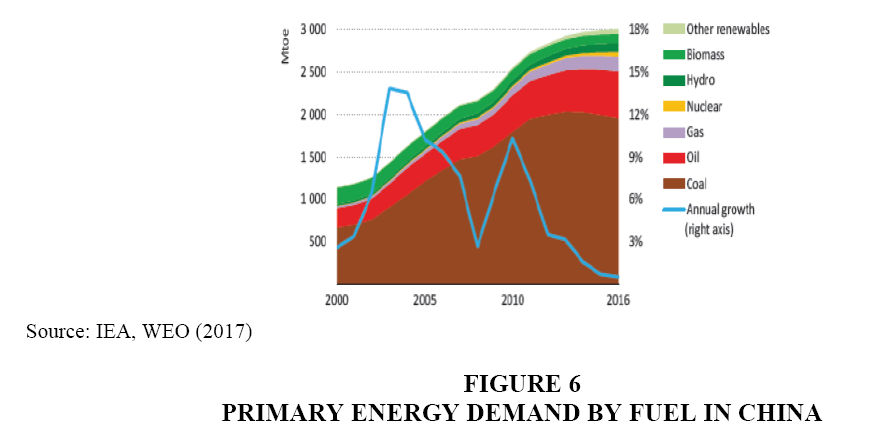

China has focused on building several transnational & cross-country pipelines and LNG re-gasification units to meet country’s gas infrastructure needs. These include pipelines from Russia, Kazakhstan and LNG facilities at various locations of eastern coast. The use of gas has increased in all sectors with power generation getting the priority for use of gas and replacing coal as a cleaner fuel. The changing pattern of primary energy consumption and overall energy demand growth is shown in Figure 6.

Rate of growth in energy demand has slowed post 2010; however energy demand has increased more than 8% per year.

Energy Cooperation with Russia & Central Asia and China’s Investments in Cross Border Energy Infrastructure towards achieving Energy Security

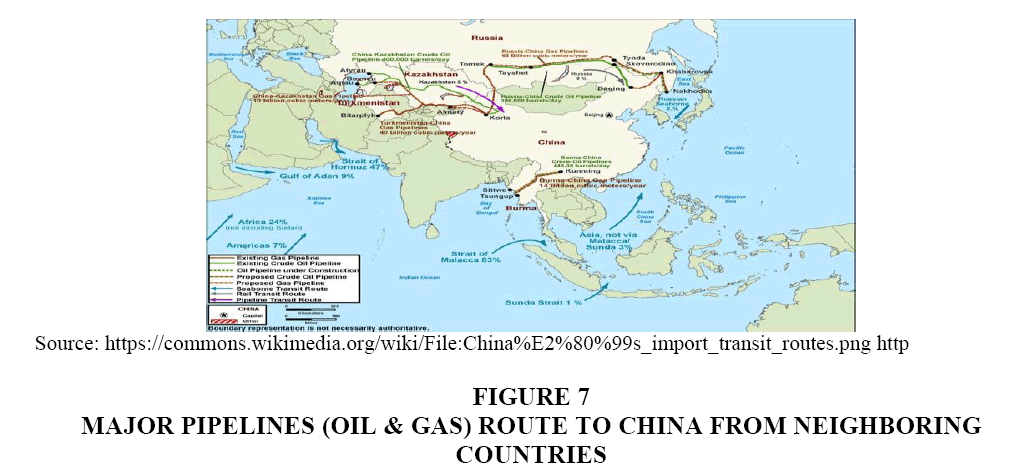

China has greatly reduced its reliance on maritime transportation by investing in cross border pipelines over the last decade e.g. pipelines from Russia, Kazakhstan and Myanmar. As per an IEA study, more than 1 MBPD oil is delivered to China via these pipelines. However, China still depends on Middle East for about half of its total import volumes which are transported through sea route (Figure 5).

Similarly for gas, China was the fourth largest gas importer in 2016, totalling 72 Billion Cubic Meter (BCM). Half of it came through LNG route and remaining via pipelines from Central Asian countries Turkmenistan, Uzbekistan and Kazakhstan and Myanmar. Pipeline gas import was started by China in 2010 and by 2016, four pipelines (3 Central Asia-China gas pipelines and one China-Myanmar pipeline) has total capacity of 67 BCM/yr. The future gas pipeline from Siberia region to Northeast China is under construction and has capacity of 38 BCM/yr.

Energy cooperation with Russia

The Petroleum Industry in Russia is one of the largest in the world, with the largest proven gas reserve as per BP Statistical Review of World Energy (2016). Among the oil exporting countries, Russia (10.9 % of total world’s export, US $73.7 billion) is next to Saudi Arabia (20.1% of world’s export, US $136.2 billion) in 2016. From 2000 to 2010, country’s oil & gas export rose by 70% and 15% respectively (Paik, 2015).

The growing dependence on income from oil & gas exports for Russia has driven the Russian government to find new markets in Asia, particularly China. Therefore, Russia’s efforts to strengthen oil and gas cooperation with China are set to increase in future years. Russia’s trade balance is dominated by oil & gas revenues and in 2014; it was accounted 74% of total exports to China. Import from Russian sources reduces the reliance for China on Malacca Strait and provides energy security against any transportation and political risks.

Oil deals in Russia: China provided a loan of US $25 billion to Russian companies Rosneft and Transneft for field development and pipeline infrastructure. Eastern Siberia Pacific Ocean (EPSO) pipeline has also facilitated Russia to make a swing supply between Western Europe and China. After EPSO pipeline, production in East Siberia onshore fields increased from 100 KBPD in 2009 to 900 KBPD in 2015. This shows diversification of Russian oil toward Asian markets. The forecast of oil production is more than 2 MBPD from East Siberia and Far East regions by 2030 (Henderson and Mitrova, 2016). ESPO pipeline provides a vital infrastructure which can utilize the East Siberian oil reserves to supply oil to China.

Russia has allocated maximum volume of oil supply to China from ESPO pipeline which caters to Asian Market. Rosneft confirmed a deal of 35 million tons for 25 years of oil supply to China, worth US $270 billion. This deal brought an upfront payment of US $60-70 billion to Rosneft. Rosneft had another supply deal of oil supply of 10 million tons/yr to China for 10 years from 2014 at value of US $85 billion. Thus, in one year time, total worth of US $355 million oil deal was signed between China and Russia.

Gas deals in Russia: In 2014, Russia and China signed two major gas deals, through which China agreed to purchase 38 BCM/yr gas from Gazprom’s East Siberian field and Sakhalin Island for US$ 400 billion over a 30 year period through pipeline supply from East Siberia to northern China gas market (Paik, 2015). This Power of Siberia (POS) contract for supply of gas to China was signed on 21 May 2014 before the oil prices tumbled in the same year. In Nov 2014, China signed a Memorandum of Understanding (MOU) to import 30 BCM/yr gas from West Siberian gas fields. These together amounts to gas supply of 68 BCM/yr to China. In 2014, Novatek sold 20% stake to CNPC in Yamal LNG and negotiated for a 20 year sale contract of 3 million tons/yr of LNG. In 2016, Novatek received Chinese financing (Euro 9.3 billion from China Development bank and Euro 1.3 billion from China Exim bank) for Yamal LNG project of 16.5 million tons/yr design capacity.

Among the investments and agreements described in above sections for oil & gas deals, both oil & gas are proved as important energy commodities between Russia and China. As of now, the share of physical movement of gas component is still low. Nevertheless, the energy cooperation between Russia and China is strategic and economically attractive for both countries. In the optimistic case, the oil and gas supply from Sino-Russian energy cooperation could be 40-45 million ton/yr and 68 BCM/yr respectively.

The factors that have contributed to China’s successful sourcing of energy from Russia can be summarized as below:

1. China’s economic growth and dire need for external supply for energy availability.

2. China’s import diversification and reducing more reliance on Malacca sea route for enhancing energy security through both diversity and availability factors.

3. Russian company’s need to diversify away from western market and explore Asian market particularly China.

4. Russia’s development strategy of East Siberia and Far East regions of Russia.

Energy cooperation with central Asia

Central Asian region possess large volumes of oil and gas, predominantly located on the east of Caspian Sea. Since Caspian Sea is landlocked, pipeline infrastructure is the best suitable transport system for oil and gas transportation from this region. So, overall this region assures a large chunk of China’s future energy needs. The oil and gas development and transportation infrastructure in Central Asia is based on win-win approach and mutual benefits of China and Central Asian countries.

Oil deals in central Asia: Kazakhstan has become a major energy partner of China. China controls about 20% of Kazakhstan oil production. China National Petroleum Corporation (CNPC) has constructed oil pipeline of 2,300 km (Kazakhstan-China oil pipeline) from Caspian Sea to Xinjiang province of west China. This pipeline has capacity of 20 million tons/yr oil. CNPC owns a significant stake in Kashagan oil field in the Caspian Sea China. In 2013, CNPC acquired 8.33% share (US $5 billion investment) in Kashagan oil project. This was followed by additional US$ 3 billion finance for the second phase of Kashagan development (Gordeyeva, 2013).

Gas deals in central Asia: The Central Asia-China Pipeline, starts from Turkmenistan and passes through Uzbekistan and Kazakhstan, connects several feeding branch pipelines from gas fields in these countries and enters Xinjiang region of China, which is integrated into China’s domestic pipeline network. Presently, there are 3 Central Asia-China pipelines-A, B and C having combined capacity of 55 BCM/yr.

In 2007, CNPC had a production sharing agreement with Turkmenistan for reserves on eastern Turkmenistan and a gas purchase agreement for 30 BCM/yr for 30 years along with Central Asia-China Pipeline. In 2009, US$ 4 billion loan was provided from China Development bank to Turkmengaz Company to develop South Yoloten Gas fields.

In 2011, new loan for a gas deal of US$ 4.1 billion was provided to secure additional 25 BCM/yr gas to be fed to Central Asia-China Pipeline by 2020. It is expected that 65 BCM/yr gas would be supplied from Turkmenistan to China by 2020. IEA has estimated that China would take 50% of Central Asia’s oil and gas production by 2020. China’s interest in oil and gas has given a new strength to this region after collapse of Soviet Union to secure energy for China. This can be argued as the authoritarian approach and use of economic power by China to create an influence and grab the opportunity.

Besides its large investments in energy assets in Russia and Central Asia, China has also built energy assets in Myanmar, though pipeline networks, as part of its strategy to achieve energy security. One major pipeline route is through Myanmar, with a capacity of 440 Thousand Barrels Per Day (KBPD) oil and will be supplied to southern part of China in Yunnan province. Myanmar is not an oil producer country; hence this pipeline serves an alternate transport route to Middle East oil supply bypassing Malacca Strait narrow passage.

After looking at how China has approached its goal of achieving energy security, the question that remains to be answered is-has China succeeded in its approach? The next section reviews the performance of this strategy.

Has china achieved energy security?-a critical review

The Energy Cooperation deals with Russia & Central Asia and China’s investment in cross border pipelines in Russia and Central Asia have brought a new dimension of energy security to China. Building cross border pipeline networks from neighbouring oil & gas producing countries has greatly contributed towards a large volume of secured energy supply to China. There are two major advantages of the pipeline network:

1. It has diversified the sources of import in terms of availability and volumes of supply.

2. It has reduced reliance on Malacca Strait for oil transport. Sea route through Malacca passage can be a bottleneck if any disruption occurs due to any political or safety reasons.

China has successfully integrated domestic pipeline network with cross border pipeline links with Russia, Central Asia and Myanmar. The diversification of oil & gas import via pipeline routes to China through neighbouring countries are shown in Figure 7.

China has executed part of bigger plans for gas import from neighbouring gas producing countries through pipelines. All three regions have large gas resources and have potential to cater to future energy needs of China towards the China’s target 2020 and vision 2050 as per Table 2.

| Table 2 Pipeline Gas Import Into China (Bcm/Yr) |

|||

| Source | Yr. 2015 | Yr. 2016 | Yr. 2035 (Note-1) |

| Russia | 0 | 38 | 58 |

| Central Asia | 65 | 90 | 90 |

| Myanmar | 12 | 12 | 12 |

| Total | 77 | 140 | 160 |

Source: Shi and Variam (2015)

Note: As per James Henderson (2014) estimate, a total of 165 bcm gas can reach by 2030 with increased flow from Russia (68 bcm) and less flow from Central Asia (85 bcm)

Success of Russia-China energy cooperation on gas import to China is still to be realized through Power of Siberia (POS) 1 & 2 pipelines. As per Table 2, China’s pipeline import capacity would go up to 160 BCM/yr in 2035. Central Asia (Turkmenistan) is the largest gas supply source.

In summary, China is expected to receive around 2 MBPD oil and around 160 BCM/yr of gas from neighbouring country’s supply through pipelines (Table 3).

| Table 3 Summary Table |

||||

| Pipeline supply in 2030 | Total demand in 2030 | % pipeline supply | Remarks | |

| Oil | 2.1 MBPD | 14.3 MBPD | 14.7% | 80% of ESPO capacity assumed to reach China |

| Gas | 160 BCM/yr | 374 BCM/yr | 42.7% | |

Source: Researcher’s analysis

Overseas Energy investments in energy resources and gas infrastructure in neighbouring countries (Russia, Central Asia and Myanmar) have greatly contributed towards energy security of China and commitments towards China’s clean energy initiatives. Diversification of supply sources and supply routes has reduced reliance on constrained transportation route through Malacca Strait. Therefore, China has achieved the key elements of energy security towards both energy availability and energy diversity.

This leads to the question-Are there any takeaways for India from the above?

Lessons for India

With a population of 1.3 billion and a growing economy, India faces the same challenges of energy security as China. Economic growth of India has been close to average 6-7% (2012-2017) following the China’s level of average annual growth rate of 8-9% in the same period. It is expected that India may even exceed the China’s growth rate in years to come on consistently. Coal has been prime driver of meeting the primary energy needs and constitutes more than 50%for both countries for next several years. Both countries have significant reserves of coal. On the other hand, both China and India have large dependency on imported petroleum energy sources. Focus on gas has been given in both countries which is relatively cleaner than other fossil fuel sources. China has built large network of gas infrastructure meeting the energy needs. India has even larger dependency on imported sources of petroleum energy as domestic production of oil & gas is declining-oil production dropped from 37.8 million tons in 2013-14 to 36 million tons in 2016-17, while gas production reduced from 97 to 87.4 Million Metric Standard Cubic Meter per Day (MMSCMD) during the same period (McKinsey & Company report, 2017). India had 78% import dependence for meeting oil needs in 2015 and around 7% share of gas in total primary energy basket.

Country’s energy needs, geographical location and buying capabilities, all are important towards making an energy securing strategy. China has advantages of financial power and proximity to Russia and Central Asia through land route. India does not have advantages of proximity of energy rich countries through land routes. However, major region of India is accessible through open sea route and shipment of energy in the form of crude oil or LNG is feasible. The two most important challenges for India on securing overseas supply security of energy remain: 1) how to reduce dependence on open market buying; 2) how to increase share of gas in the energy portfolio.s

There are two main takeaways from the China case for India. Firstly, using advantage of accessible sea route, diversification towards physical storage of oil as per international standards (IEA member countries follow 90 days storage of net imports) and filling them at an appropriate favourable market situation can be used for security against short term supply shocks and price hikes. Equity based overseas asset or long term production sharing contract or supply contract would provide a rightful ownership to ship the oil to home.

Secondly and on the flip side, India does not have opportunity that China has for using neighbouring oil rich nations like Russia and Kazakhstan to source oil through pipelines.

Similarly, on the gas front, India does not have a favourable geopolitical situation to use land route for gas supply from gas resourceful nations. In the past, India lost the opportunity to transport its own equity gas from Myanmar through Bangladesh due to political disagreements. A pipeline through Pakistan is still unlikely, though Iran and Turkmenistan offer such opportunities. The option that remains is to import LNG and build gas infrastructure within country. There is global opportunity to secure LNG as there is an oversupply situation in the market. India needs to build a policy around LNG as availability, diversity and sustainability can be assured, but needs to look at affordability aspects.

Co-relative analysis based on similarities and differences guide that both China and India have similar needs and similar lack of domestic resources, however geographical location demands different approaches towards securing energy. India needs more maritime based energy infrastructure and diversity of supply sources. However, China’s approach towards national reforms, state funding for overseas acquisitions, diplomatic initiatives, energy collaborations and speed of project execution are worth being adopted.

In conclusion, India has to adopt a two-pronged strategy for energy security. The long-term focus must be on enhancement of the gas infrastructure both within country and cross border, gas pricing issues for various industrial and domestic users and energy cooperation engagements with energy resource rich countries on long term basis. For oil side, enhancement of storage reserves within country and acquiring equity based stakes in foreign oil resources can diversify the supply sources and provide energy security. Long term strategy will need to be backed by a shorter-term approach, focusing on the next five years and including creation of LNG re-gasification terminals and cross country gas pipeline infrastructure to make use of gas effectively.

References

- BP statistical review of world energy, 65th edition (2016).

- BP statistical review of world energy, 66th edition (2017).

- Down, E.S. (2004). The Chinese energy security debate. The China Quarterly, 177, 21-41.

- ExxonMobil report (2018). Outlook for energy: A view to 2040.

- Gordeyeva, M. (2013). China buys into giant Kazakh oilfield for US $5 billion.

- Henderson, J., & Mitrova, T. (2016). Energy relations between Russia and China: Playing chess with the dragon. The Oxford Institute of Energy Studies.

- Henderson, J., & Pirani, S. (2014). Russian gas matrix. Oxford University Press.

- IEA (2015). Special data release with revisions for People’s Republic of China.

- IEA, WEO (2015). India energy outlook focus.

- IEA, WEO (2017). China energy outlook focus.

- Ishida, H. (2007). Energy strategies in China and India and major countries views. IEEJ.

- McKinsey & Company Report (2017). Building new energy security architecture. FICCI’s fourth national conference on energy security.

- Paik, K.W. (2015). Sino-Russian gas and oil cooperation: Entering into a new era of strategic partnership? The Oxford Institute for Energy Studies.

- Qinyun (2017). China’s energy transition. Energy Research Institute, NDRC China.

- Shaofeng, C. (2011). Has China’s foreign energy quest enhanced its energy security? The China Quarterly, 207, 600-625.

- Shi, X., & Variam, H.M.P. (2015). China’s gas market liberalization: The impact on China-Australia gas trade. China’s domestic transformation in a global context, 137-174.