Research Article: 2022 Vol: 21 Issue: 6S

Adoption of Quantitative Analytics for Decision Making Among Entrepreneurs in the Information Age

Samson Nambei Asoba, Walter Sisulu University

Nteboheng Patricia Mefi, Walter Sisulu University

Citation Information: Asoba, S.N., & Mefi, N.P. (2022). Adoption of quantitative analytics for decision making among entrepreneurs in the information age. Academy of Strategic Management Journal, 21(S6), 1-6.

Keywords

Quantitative Analytics, Metrics, Decision Making, Entrepreneurship

Abstract

Information overload in the Fourth Industrial revolution has ignited the need for increased use of quantitative tools and analytics for decision making to manage complexity among entrepreneurs. Faced with a pressing need to build and maintain competitive advantage, entrepreneurs need effective tools to make decisions of high quality. This has led to increased popularity and use metrics and quantitative analytics for decision making. The study adopted the qualitative approach and data was collected through interviews with the objective of establishing the perceptions entrepreneurs on the effective use of metrics and quantitative analytics for decision making among entrepreneurs. It also sought to establish whether there is increased use of metrics and quantitative analytics models among the entrepreneurs. telephone interviews were conducted with eight entrepreneurs. The results indicated that despite high agreement that quantitative analytics are important in improving decision making, the actual use of these techniques and models is still low among the entrepreneurs. Following this study, entrepreneurs are encouraged to increase the use of quantitative analytics and models for decision making

Introduction

Kennet & Redman (2019) commented out that the success of organizations in this information age is now based on data based decisions. Data analysts and scientist have become important in organizations. With reports that many entrepreneurs fail to sustain the tough business environment, the need for data scientist has become critical. Some analysts have reported that 75% of South African SMMEs fail after being in existence for only 42 months (Bruwer & Van, 2017). Entrepreneurs often face various significant in their formative days. This can be one of the reasons for failure. Decision making remains a challenge in many enterprises especially during this information age which is characterized by information overload. Hicks (2004) asserted that decision making means making a selection between various courses of action. A decision is defined by (Robbins & Judge, 2009) as ‘the choice that one selects from the available alternatives’ (Robbins & Judge, 2009). Most writers about decision making comment that making a choice is not always easy. It is well argued in the literature that decision making is really a challenge. Terry cited in Diwan (2008) argued that managerial life is a perpetual choice-making challenge. Boninelli & Meyer (2004) noted that choices may have to be measured and weighed up during decision making. This argument is supported by the idea that ‘if you cannot measure it, u cannot manage it.’ Measuring quantities and weighing them up is arguably a mathematical activity. Some links between decision making and mathematics can be inferred at this point. The link between decision making and mathematics can also be deduced from (Khait, 2005)’s argument that numbers and mathematical thought allow the quantification and objective analysis of relations. Most writers about decision making comment that making a choice is not always easy. It is well argued in the literature that decision making is really a challenge to many entrepreneurs. Terry cited in Diwan (2008) argued that the entrepreneurial life is a perpetual choice-making challenge. Boninelli & Meyer (2004) noted that choices may have to be measured and weighed up during decision making. This argument is supported by the idea that ‘if you cannot measure it, u cannot manage it.’ Measuring quantities and weighing them up is arguably a mathematical activity. Some links between decision making and mathematics can be inferred at this point. The link between decision making and mathematics can also be deduced from (Khait, 2005)’s argument that numbers and mathematical thought allow the quantification and objective analysis of relations.

Literature Review

Entrepreneurial Decision Making

Entrepreneurship involves the profitable exploitation of factors of production in a way that evades risks and uncertainty (Acheampong & Esposito, 2014). This calls for effective decision making among entrepreneurs to ensure their survival. Buchanan & O’Connell (2006) argued that decision making is a challenge because of the risk and opportunity cost associated with selecting an alternative at the expense of another or the uncertainty associated with choice selection. In this view, each alternative selected has consequences which the manager has to be ready for. In agreement with this view, Morse (2006) asserts that decision making involves calculations of risks and rewards in the brain. Writings on the history of decision making which were done by Buchanan & O’Connell (2006) reveal that in historical times, the calculation of risk in decision making was based on faith, hope and guesswork but today risk has become a game of numbers. This idea that decision making has become ‘a game of numbers’ is important for this research becomes it affirms the possible role of mathematical skills in decision making. Buchanan & O’Connell (2006) further remarked that people used to rely on stars, dreams, smoke, folklores and myth to make decisions but presently, more so with the scientific revolution and technological developments, people have turned to support systems, computational tools, statistics, probability theory and computer software as thinking machines in making decisions (Buchanan & O’Connell, 2006).

The Quantitative and Analytics Approach To Decision Making Risks.

Bryant (2010) hypothesises that the quantitative and analytics approach offers tools for decision making. These include ratios, rates, proportions, graphs, formulas, vectors, matrices, averages, statistical models and many others. Recent literature on the nature of analytics describe it as ‘the science that draws necessary conclusions’ based on facts, figures and theorems (The Wikipedia, Free Encyclopedia, 2013). The North Central Regional Educational Laboratory defines quantitative analytics as ‘…a study of patterns and relationships; a science and a way of thinking; an art, characterized by order and internal consistency; a language, using carefully defined terms and symbols; and a tool.’ These snapshots of what analytics are can be seen to suggest that analytics provide quantitative, logical and thinking capability to decision makers.

Models of Decision Making

According to Buchanan & O’Connell (2006), the study of managerial decision making started with such theorists as Chester Banard, James March, Herbert Simon and Henry Mintzberg. Chester Banard is credited for having first used the term ‘decision making’ in the business world. It is said that the term was adopted from public administration and used to replace the terms ‘resource allocation and policy making’. Scholars provide many models in decision making which Polic (2009) classified into: rational decision making models, descriptive models and decision models in natural settings. These models are based on choice among many known alternatives and selective behaviour. According to Polic (2009) rational models were dominant during the period 1955 – 1975. Diwan (2008) concurs with Robbins & Judge (2008) that most studies on decision making now focus on the rational decision making model. Most writings on decision making in the literature focuses on suggesting the steps during the rational process: three steps, four step, five step, six step and seven step models have been provided (Diwan, 2008). Robbins and Judge provided a six step model with the following steps: defining the problem, identifying the decision criteria, allocating weights to the criteria, developing alternatives, evaluating the alternatives and selecting the best alternatives. Polic (2009) argues that these rational models were based on logical deduction and inference, for instance the Bayesian model of statistical inference. The problem with such models is that they assumed that the decision maker has complete information and chooses alternatives without any bias (Robbins & Judge, 2009). Polic (2009) is of the opinion that these models were ‘laboratory like’ in nature and they were normally detached from the actual situation. They focus on the logic of alternatives. It is widely known that entrepreneurial decision analytics involve a series of steps, patterns and algorithms whereby a step is deduced from the preceding one. This resembles the rational decision making process in some way. Plummer (2008) held that most important tasks in mathematics aim to discover and characterize regular patterns or sequences. It can be argued that mathematics can help people engage in rational decision making through practicing mathematics algorithms, studying patterns and solving sequence problems. These models oppose the rational models and argue that people do not make clear steps and alternative selection as suggested by the rational models. This group of models include heuristic or institutive models of decision making and bounded rationality. These models also take into consideration the influence of bias and perception in decision making (Polic, 2009). Robbins & Judge (2009) also identifies the theory of bounded rationality as one that involves decision making under situations of limited information whereby the decision maker just focus on the essentialities of a situation. Both Polic (2009) and Robbins & Judge (2009) argue that intuitive decision making is based on unconscious mental processes created from distilled experience.

According to Polic (2009), this approach starting in 1980s and considers decision making in dynamic natural settings to achieve a wider goal. Naturalistic decision making and related concepts were classified under the concept of macro cognition. In naturalistic decision making, decisions are made under conditions of: Ill-defined goals and ill-structured tasks, uncertainty, ambiguity and missing data, shifting and competing goals, dynamic and continually changing conditions, action-feedback loops (real-time reactions to changed conditions), time stress, high stakes, multiple players, organizational goals and norms, experienced decision makers (Polic, 2009). This model asserts that the failure of classical decision making models stem from their neglect of complexity on one side, and emphasis on abstract rationality on the other side. It is clearly obvious that this type of natural decision making demand high mental effort and creativity.

Aim of the Study

Given the review above, the aim of this study was to establish the perceptions of entrepreneurs on the impact of quantitative analytics on the quality of entrepreneurship decisions as well as to explore the use of quantitative analytical models among the entrepreneurs.

Methodology

The study was set to establish the perceptions of entrepreneurs on whether the use of quantitative analytics has enhanced the quality of a recent decision that they have made in their enterprises and also explore whether they are using quantitative analytics. The qualitative research model was adopted for the study. The qualitative model is based on the analysis of perceptions of individuals and their attitudes or opinions towards a specific issue (Creswell & Creswell, 2018; Trafford, Leshem, 2008). Based on convenience and purposive sampling techniques, eight (8) entrepreneurs were selected from one of the industrial areas in Cape Town, the entrepreneurs were interviewed telephonically to explore use of quantitative analytics as well as to establish whether use of quantitative analytics has enhanced decision making among the entrepreneurs. An interview guide was developed to guide the thirty minute interviews conducted to collect data. The entrepreneurs were from various sectors and they provided detailed information related to the study

Discussion

The interviewees were asked to provide information on whether quantitative analytics have influenced the quality of a decision that they recently made. The results of this question were as shown in Table 1.

| Table 1 Entrepreneurs’ Perceptions on Whether the use of Quantitative Analytics Has An Influence on Their Decision Making |

|

|---|---|

| Analytical skills have been critical in your ability to make and interpret decisions | Percentage Frequency |

| strongly agree | 55 |

| Agree | 25 |

| strongly disagree | 20 |

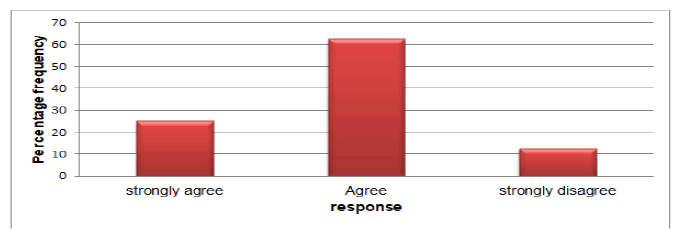

Figure 1 is a graphical presentation on how the entrepreneurs perceived the impact of quantitative analytics in improving the effectiveness decisions made by the entrepreneur. It can be seen from Figure 1 that about fifty percent (55) of the managers strongly thought quantitative analytics related skills influence their ability to make quality decisions while twenty five per cent (25%) just agreed that quantitative analytics influenced the quality of their decision making.

Figure 1: Entrepreneurs’ Perceptions on Whether Quantitative Analytics have An Influence on the Quality of Their Decisions

The study also explored the level of use of quantitative analytics. Generally, the use of quantitative analytics was low among the entrepreneurs. It was found in the literature on quantitative analytics that entrepreneurship is changing owing to the increased use of 4th industrial revolution technologies. A question in the interview guide that required participants to indicate the quantitative analytics that they use showed their very low use in decision making in contrast with what is in the literature. Participants were asked to name to name areas for which they perform calculations and analytics to aid their decisions showed that there is very limited use of metrics and quantitative analytics The Table 2 below shows the results recorded on the quantitative analytics used by entrepreneurs who were interacted with. (Table 2)

| Table 2 Quantitative Analytics and Metrics used by the Entrepreneurs |

|

|---|---|

| Entrepreneur | Use of quantitative analytics for decision making |

| Entrepreneur A | Does not use all quantitative analytics for decision making. Lacks both the knowledge and skills to use HR analytics |

| Entrepreneur B | Uses only a few quantitative analytics tools to make decisions involving cost of leave, overtime and compensation and other financials |

| Entrepreneur C | Does not use quantitative tools and analytics |

| Entrepreneur D | Uses only a few quantitative analytics tools to make decisions involving cost of leave, overtime and compensation and other financials |

| Entrepreneur E | Does not use all quantitative analytics for decision making. Lacks both the knowledge and skills to use HR analytics |

| Entrepreneur F | Does not use all quantitative analytics for decision making. Lacks both the knowledge and skills to use HR analytics |

| Entrepreneur G | Prefers to use non-quantitative methods of decision making involving heuristic method and other unprogrammed |

| Entrepreneur H | Does not use all quantitative analytics for decision making. Lacks both the knowledge and skills to use HR analytics |

The results indicated a very low use of quantitative analytics among entrepreneurs. Therefore the fact that there was low use of quantitative analytics among the entrepreneurs also make it logical that no relationship will be found between use of quantitative analytics and quality of decision making. Entrepreneurs, when considering the results of this research, are not using quantitative analytics and metrics as much as the literature postulates. As such no relationship between use of quantitative analytics and quality of decision making and could be found. Actually, the entrepreneurs were not using quantitative analytics for decision making as much as what the literature postulates. The research could not establish whether the low use of quantitative analytics and metrics was due to lack of mathematical skills or it was just out of their irrelevance. Most of the metrics and analytics being used related to compensation and therefore most entrepreneurs needed general quantitative and analytical skills which are basic for them to make calculations, this is likely to be the reason why the entrepreneurs’ perception on whether quantitative skills had a role in their decision making resulted in highly pronounced positive responses.

Conclusion

This study investigated the relationship between use of quantitative analytics and quality of decision making among selected entrepreneurs. The research problem was that there is a lack of or limited knowledge on the relationship between use of quantitative analytics and quality of decision making among entrepreneurs in the context of the rising use of metrics and the increased availability of technological tools for quantifying and analysing information in the 4th industrial revolution. This study found that there is very low use of quantitative analytics among the entrepreneurs even though most of them believed that using quantitative analytics for decision making increased the quality of decisions that can be made by the entrepreneurs.

Recommendations

Entrepreneurs are recommended to improve on the use of quantitative analytics as essential tools for decision making. Entrepreneurs should adopt appropriate quantitative models to encourage decision making and increase entrepreneurial activities among entrepreneurs.

References

Acheampong, G., & Esposito, M. (2014). The nature of entrepreneurship in bottom of the pyramid markets. International Journal of Entrepreneurship and Small business, 21(4), 437-456.

Crossref, GoogleScholar, Indexed at

Buchanan, L., & O’Connel, A. (2006). A Brief History of Decision Making. Havard Business Review, Jan, 84(1), 32 – 41.

Boudreau, J.W., & Ramstad, P.M. (2007). Beyond HR: The new science of Human Capital. Massachusetts: Havard Business School Press.

Boninelli, I., & Meyer, T. (2004). Building Human Capital: South African perspectives. Randburg: Knowers Publishing.

Clark, R.J. (2005). Research Models and Methodologies. HRD seminar series, Faculty of Commerce Spring session 2005.

Creswell, J.W., & Creswell, J.D. (2018). Research design: Qunatitative, qualitative and mixed methods approaches. London: Sage Books.

Creswell, J.W. (2003). Rsearch designs: Qualitative, quantitative and mixed methodology approaches. Thousand Oaks: Sage Publishers.

Dowding, D., & Thompson, C. (2003). Measuring the Quality of Judgement and Decision-making in Nursing Journal of Advanced Nursing, 44. (1), 49-57.

Crossref, Google scholar, Indexed at

Diwan, P. (2008). Management Principles and Practices. New Delhi: Excel Books.

Drucker, P. (1980). Managing in Turbulent Times. Oxford: Butterworth-Heinemann.

Greenberg, J. (2011). Behaviour in Organisations. Global Edition. (10th Edition). Cape Town: Pearson.

Hicks, M.J. (2004). Problem Solving and Decision Making: Hard, Soft and Creative Approaches. (2nd Edition). London: Thomson.

Kennet, R.S., & Redman, T.C. (2019). The real of work: Turning data into information, better decisions and organisations. Wiley. [20/05/2021]

Khait, A. (2005). The Definition of Mathematics: Philosophical and Pedagogical Aspects. Science and Education, 2005(14), 137-159.

Crossref, Google scholar, Indexed at

Morse, G. (2006). Decisions and Desire. Havard BusinessReview. Jan, 84(1), 42 -52.

Meyer, M. (2013). Help us to make HR standards and metrics. South African Board of People Practice.

Mintzberg, H. (1973). The Nature of Managerial work. New York: Harper and Row.

Patel, S. (2010). Empowering human capital management through HR metrics. Electric Light and Power, 88, 24-27.

Pedrini, M.2007.Human capital convergences in intellectual capital and sustainability reports. Journal of Intellectual Capital, 8(2), 346 – 366. Emerald.

Crossref, Google scholar, Indexed at

Polic, M. (2009). Decision making: Rationality and Reality. Interdisciplinary Description of Complex Systems, 7(2), 78-89.

Robbins, S.P., & Judge, T.A. (2009). Organizational Behaviour. Pearson International Edition. (13th Edition). New Jersey: Pearson Education.

Singh, S. (1998). Fermat’s Last Theorem. London: Fourth Estate.

Truss, C., Mankin, D., & Kelliher, C. (2012). Strategic Human Resource Management. New York. Oxford University Press.

Crossref, Google scholar, Indexed at

Trafford, V., & Leshem, S. (2008). Stepping stones to achieving your doctorate: Focusing on your viva from the start. Berkshire: McGraw Hill Open University Press.

Received: 04-Apr-2022, Manuscript No. ASMJ-21-6243; Editor assigned: 06- Apr -2022, PreQC No. ASMJ-21-6243 (PQ); Reviewed: 20- Apr - 2022, QC No. ASMJ-21-6243; Revised: 27-Apr-2022, Manuscript No. ASMJ-21-6243 (R); Published: 05-May-2022