Research Article: 2019 Vol: 22 Issue: 3

Analysis of the Role and Responsibility of Sharia Supervisory Board (DPS) on Sharia Compliance Supervision in Islamic Banks in Indonesia

Neni Sri Imaniyati, Postgraduate of Bandung Islamic University (UNISBA)

Harits Numan, Faculty of Engineering, Bandung Islamic University (UNISBA)

Lina Jamilah, Faculty of Law, Bandung Islamic University (UNISBA)

Abstract

Islamic banks are banks that operate using Sharia principles, namely the principles of Islamic law in banking activities. Sharia principles must be implemented in all banking activities supervised by the Sharia Supervisory Board (DPS). DPS has the responsibility to ensure Sharia compliance with Islamic banks. The purpose of this article is to analyze the roles and responsibilities of SSB in supervising Sharia compliance with Islamic Banks. The research method in this article is a descriptive analysis with a normative juridical approach. While the data sources in this article are primary data obtained from the results of the FGD (Focus Group Discussion) at the UNISBA Postgraduate Building on May 15, 2018 which was attended by representatives of the OJK, Islamic Banks, DPS, Academics, MES, Asbisindo and the Religious Courts. From this article, it can be concluded that the roles and responsibilities of DPS in supervising Sharia compliance in Islamic Banks are not optimal due to the quality of integrity problems and the competence of DPS. Based on this, DPS can be subject to sanctions from aspects of civil law and consumer protection law. If the DPS does not carry out its obligations, it can be subject to sanctions from the aspect of civil law, namely responsibility on the basis of an error known as unlawful acts (onrechtmatigedaad). Whereas, according to the law, consumer protection is a professional responsibility or professional liability and criminal liability. However, the Sharia Banking Act stipulates as administrative liability.

Keywords

Supervision, Sharia Compliance, DPS, Responsibility and Islamic Banks.

Introduction

The practice of Islamic finance is believed to be a potential alternative for the development of a more applicable and sustainable economic system (Sakti, 2017). The development of Islamic banking has shown changes and dynamics of rapid growth. Some developed countries, such as the United States, United Kingdom, European Union, Canada, and Singapore have implemented the Islamic financial system. Islamic financial instruments can be accepted globally, due to the impact and consequences of economic globalization and the financial crisis that has occurred in the world in recent years (Sukardi, 2013).

Initially, the development of Islamic finance moved in Muslim-oriented countries but gradually reached non-Muslim countries. The number of Islamic financial institutions has increased to more than 300 institutions in 75 countries. Islamic financial innovation has been concentrated mainly in the Middle East and Southeast Asia (Bahrain and Malaysia as the largest centers). Recent evolution can be seen in Europe and the United States. The global Islamic financial industry reached $ 1.14 trillion in accordance with the 2011 Global Islamic Finance Report and is expected to continue to grow by around 15 percent per year. This growth includes “Takaful” and “Sukuk” (Mohnot, 2015).

According to Rama (2015), Indonesia and Malaysia are the two countries that are driving the development of the Islamic banking and financial industry in the Southeast Asia Region. According to the IFSB Financial Stability Report 2017, Indonesia with the largest Muslim population in the world is believed to have significant potential and role in the global Islamic financial market along with Malaysia, Pakistan and Bangladesh. Indonesia will experience expansion in Sharia Key Market as a country that has global influence. But among the public there is still doubt, whether Islamic banks are in accordance with sharia principles or not? Abdurrahman (2016) says that many Islamic banking practices are not compatible with sharia requirements. Based on the market share, the position of Indonesia is lower than Malaysia. Its population is 60% Muslim and its market share of Islamic bank is above 20%. While Indonesian population are 7% Muslim and its market share of sharia bank is 5.57% (Imaniyati, 2017).

Islamic banking is a financial institution derived from Islamic economic system. According to Iqbal cited in Al-Ghifari (2015), the Islamic economic system aims at giving the same emphasis on the ethical, moral, social, and spiritual dimensions in an effort to improve society justice and construction as a whole. On the contrary, the conventional financial system focuses only on the aspects of financial and economic transactions. Furthermore, in the early stages, sharia banking cannot be simplified as a free-interest bank only. It will reduce the function of sharia bank in financial transactions only. Stakeholders must realize that in Islamic banking governance, Allah SWT is being served because Islamic banks carry out Islamic symbols (Sukardi, 2013).

In addition to provide halal financial services for Muslim, Islamic banking system is expected to contribute to social goals achievement (humanitarian) of Islamic economic system. Hence, the emergence of banking institutions, which uses the name of sharia, is not only based on market demand or financial and economic orientation, but also human values that are capable of solving the economic problems experienced by society and able to improve human dignity. Therefore, the existence of Islamic banking will be able to bring the Muslim economic changes in much better direction (Laldin, 2016).

The effort to realize the aforementioned values is by establishing DPS in the organizational structure of Islamic Financial Institutions, including on Islamic banks. It becomes one of the differences between conventional and Islamic banks. According to Hafidhuddin (2005), this is the main differentiator of the structure of Islamic and conventional banks.

As for DPS duties in carrying out their functions as sharia supervisors written in article 47 paragraph (1) and (2) Bank Indonesia Regulation No. 11/33/PBI/2009 concerning Implementation of Good Corporate Governance for Sharia Commercial Banks and Sharia Business Units, in this case consists of: (1) Supervising the activities of Islamic Banks in accordance with sharia principles, in terms of making and implementing bank operational guidelines; product development; mechanism for the collection and distribution of funds and bank services; and request relevant information from each work unit regarding aspects of sharia compliance in each of its duties; (2) Providing advice and advice to the Board of Directors regarding the management of Islamic Banks in order to be consistent with the principles of prudence and sharia principles. (3) Become a representative of an Islamic Bank in communicating and requesting a fatwa on products to DSN-MUI (National Sharia Board-Indonesian Council of Ulam? Fatw?) and becoming a representative of an Islamic Bank in terms of submitting a DPS Supervision Report per semester to Bank Indonesia.

Considering the strategic role of DPS in Islamic banking, DPS should carry out its roles and obligations based on Article 47 of Bank Indonesia Regulation. However, based on the results of the FGD (Focus Group Discussion) at the UNISBA Postgraduate Building on May 15, 2018 attended by representatives of the OJK (Financial Services Authority), Islamic Banks, DPS, Academics, MES (Islamic Economic Community), Asbisindo (Indonesian Islamic Bank Association) and Religious Courts. Representatives from Islamic Banks complained about the performance (roles and obligations) of DPS. For this reason, it is necessary to conduct research with the aim of analyzing the roles and responsibilities of DPS against the supervision of Sharia compliance by DPS on Islamic Banks.

Method

This article is the result of a study in the form of a FGD (Focus Group Discussion) with the theme “Sharia in the Islamic Banking Legal System and Its Impact on Islamic Bank Products in Indonesia” attended by representatives from OJK, Islamic Banks, DPS, Academics, MES, Asbisindo and Courts Religion. The nature of the research in this article is descriptive analytical because this study was conducted to find data about the characteristics of a situation or symptoms that can help find DPS responsibility in enforcing sharia compliance in Islamic banks. The approach used in this study is a normative jurisdiction approach because this research is a legal research that fully uses secondary data. In addition, this study uses legal conceptions as principles, norms and rules (Soekamto, 1995). The normative juridical approach is carried out through a philosophical, systematic, and critical analysis approach (Hanityio, 1985). In accordance with the normative juridical approach, data collection was carried out using interview techniques to representatives from the OJK, Islamic Banks, DPS, Academics, MES, Asbisindo and the Religious Courts that attended the FGD event held on 15 May 2018 at the UNISBA Postgraduate Building. This technique is carried out to obtain primary data. In accordance with the purpose of the study, data analysis techniques used normative qualitative analysis, namely legal material collected in accordance with the problems studied and then analysed qualitatively so that it can produce a conception of the concept used to answer the problems discussed.

Results and Discussion

Based on Article 1 number 7 of Act No. 21 year 2008 concerning Islamic banks in which Islamic bank is a Bank conducting its business activities based on Sharia Principles and by type consisting of Islamic Commercial Bank and Islamic Financing Bank. The definition of sharia principles based on Article 1 number 12 is the principle of Islamic law in banking activities based on fatwas issued by institutions that have authority in the determination of fatwas in Islamic banking1. Article 2 of Act concerning Islamic Banking explains that sharia principles in bank business activities, i.e., business activities that do not contain elements, usury, “maysir, gharar, haram and zalim” (Husaeni, 2018).

Sharia principle is included in the Islamic Banking Law. Therefore, sharia principle has become a positive law. Subsequent to Article 24 paragraph (1) sub-paragraph a, Article 24 paragraph (2) sub-paragraph a and Article 25 sub-paragraph a of Act expressly stipulate that Islamic banks are prohibited from conducting business activities that are contrary to Sharia Principles. Thus, sharia contracts established between Islamic banks with customers must not contain terms and conditions in contradiction to sharia principles. Related to Article 56 of Islamic banking, which impedes or fails to implement the sharia principles in conducting its business or duties and fails to fulfill its obligations as stipulated in the Islamic Banking Law, the Islamic Bank-now Financial Services Authority (OJK)-impose administrative sanctions.

DPS shall be established in Islamic bank and conventional bank having Islamic Business Unit. This is in accordance with the provisions of Article 32. DPS is appointed by General Meeting of Shareholders on the recommendation of the National Sharia Board-Indonesian Council of Ulam? (DSN-MUI)2. In its performance, DPS has the following functions:

1. Controlling daily bank operations to conform to sharia provisions;

2. Making a statement periodically (usually every year) that the bank under supervision has been running in accordance with sharia provisions;

3. Investigating and making new product recommendations from the banks supervised.

DPS duty gives advice and suggestion to directors and supervises bank activities in accordance with sharia principles or ensures that any muamalah contract between the bank and its customers shall not contain terms and conditions on the contrary to sharia principles as established by National Sharia Board-Indonesian Council of ‘Ulam? (DSN-MUI) (Sjahdaeni, 2010).

The provision of Article 32 of Islamic Banking Law is further stipulated in Bank Indonesia Regulation No.11/3/PBI/2009 which is a replacement of PBI No.6/24/PBI/2004 concerning BUS Conducting Business Based on Sharia Principles. Article 34 of the PBI explains that:

1. Banks are required to establish a DPS domiciled in the bank’s head office.

2. Members of DPS are compulsory to meet the following requirements:

1. Integrity, at least:

1. Having good character and morals;

2. Having commitment to comply with sharia banking regulations and other applicable laws and regulations;

3. Committing to the development of healthy and sustainable bank;

4. Not being included in the list of fails as regulated in the provisions concerning fit and proper test determined by Bank Indonesia.

2. Competence, at least having knowledge and experience in the field of sharia muamalah and knowledge in banking and/or finance in general;

3. Financial reputation, at least:

1. Not being included in the list of bad debts;

2. Has never been being declared bankrupt or become a shareholder, a member of the Board of Commissioners, or a member of the Board of Directors who was found guilty of causing a company to be declared bankrupt within the last 5 (five) years before being nominated.

Islamic banking is a business entity as a part of the national banking system. One of essential supporting facilities is the regulatory facility. The regulation on Islamic banking should be able to provide legal certainty for the existence of Islamic banking in the pattern of institutional, productive, service, or operational in accordance with sharia principles. Islamic banking has a need to maintain public trust in the implementation of banking intermediation function and at the same time provide a sense of security for the people to invest their productive funds (Arifin and Nasution, 2015).

Sharia principles are the character of Islamic banking in various business activities as an implementation of DSN-MUI Fatwa. Various aspects of Islamic banking have obtained regulations that strengthen its institutional and business activities and products, including sharia compliance submitted through the establishment of DPS in every unit of Islamic business. In Indonesia, there are some banks that have been named sharia, but do not use sharia principles. In fact, the use of sharia term is only to distinguish Islamic and conventional bank, whereas several facilities still use common principles or law, not sharia. The reason expressed by some sharia banks is the slight difference between Islamic and conventional banks; hence a conventional system has still been adapted for several sharia banks.

Yet if it is studied further and deeper, the slight difference can actually be leaned to the system of sharia, does not the conventional. For example when in the case of buying and selling through banks, the contract that can be used is the sale and purchase agreement with the taking profit in advanced, hence in their payment, either cash or credit, the price remains the same. However, something happened during this time, lending or credit from sharia banks, in fact; still provide a different price which is what makes that transaction including usury.

Practice of Islamic banking is expected to realize public trust and raise public awareness of Islamic banking; hence various economic activities always use Islamic financial institution in the form of Islamic bank as its facility. Islamic banking that used to be an alternative should become the solution needed in national and international economic activities (Arifin and Nasution, 2015). Stakeholders including DPS must realize that in Islamic banking governance, Allah SWT is being served because Islamic banks carry Islamic symbols. Thus, the role of DPS is very strategic in accordance with the concept of supervision in the Islamic view, i.e., straightening the not straight, correcting the wrong, and justifying the right (Abdurrahman, 2013).

Based on the results of previous studies, DPS currently has not played an optimal role in overseeing the operations of sharia financial institutions. This can be seen from the existence of several banks or sharia units participating in the syndicated credit of the project and will earn interest on the financing per year. The Bank Indonesia report said that some sharia banks had followed the syndicated credit of Indosat Project using the interest system. After being confirmed, the bank argued that it must be conducted with an emergency meaning. Whereas any interest-bearing transaction should not be executed by a sharia bank though it is forcibly reasoned and the interest income earned cannot be considered as bank income as it should be distributed for social purposes, and Islamic bank management must disclose in its financial statements about the reason for the transaction (Nurhasanah, 2011).

Other studies revealed the existence of moral hazard cases, Asymmetric Information, and Agency Problem at Islamic bank. Some problems in sharia compliance were the fulfillment of sharia compliance on murabahah scheme in Islamic bank, namely the problem of double taxation occurred in the implementation of murabahah system, the implementation of collateral on murabahah products, expensive administrative costs, tied installments to the term of payment, the principle of time value of money on repayment credit. There is also a problem in one of Islamic Business Unit, which is related to derivative transactions on its conventional parent.

Another problem is the less control of sharia banking especially about the practices in sharia banks products (Sukardi, 2013). In addition, DPS has difficulties in performing supervisory and monitoring roles because their role is limited to public opinion on sharia compliance with products and services offered by Islamic banks (Srairi, 2015). The DPS’ supervision has not been optimum yet because of the following factors (Nurhasanah, 2011):

Human Resources (HR)

DPS has a lack of understanding of the system and operational mechanism of Islamic financial institutions because DPS is placed only in its capacity as charismatic ulema and fiqh science experts only. In fact, to become a member of DPS is not enough to rely solely on the ability of fiqh muamalah normatively, but also must have knowledge in the field of finance and banking systems and other financial institutions, especially operational mechanisms.

Performance

DPS is not directly involved in the implementation of the management of Islamic financial institutions, but it is the editorial that is directly responsible for its operations. DPS only provides input to the implementing agency. Some members of DPS rarely came to the Islamic bank where they are assigned, and did not perform their function as supervisors; hence it is not surprising if there is still found Islamic banking practices that deviate from Islamic provisions. According to Husaeni (2018), the performance of ulema, clerics who are listed as DPS in sharia bank is not optimal yet. Some of them do not play any role at all in overseeing Islamic banking operations, even there is no special table for DPS’ member. The dominance of senior ulema have less role of DPS, while the powerful young ulema and high capacity of them in banking sector are rarely involved as DPS.

Other factors are raised by Sukardi (2013), namely:

1. Limitations of Total DPS: DPS in charge of supervising the operational of sharia banks is very limited and some of them do not focused on working due to many positions they hold.

2. Lack of improvements of DPS quality in Islamic Financial Institutions (Islamic banks, insurance, capital markets, pawnshops, insurance, non- Islamic bank financial institutions).

Srairi (2015) proposed five DPS characters, which influenced the implementation of supervisory function as follow:

1. A number of DPS’ members of Islamic bank;

2. DPS’s membership in several Islamic banks;

3. DPS's term of office in a bank;

4. DPS’s competences (accounting/financial knowledge);

5. Frequency of DPS attendance or meeting at the bank.

According to Hafidhuddin (2005), there are three keys of supervision, namely: coaching people, the accuracy of people selection, and a good system. This is the key to an effective oversight. However, based on the aforementioned factors, supervision key must be reviewed. If it is related to the provision of Article 34 of Bank Indonesia Regulation No.11/3/PBI/2009, the implementation of sharia compliance supervision by DPS in Islamic bank is not yet optimal since the requirement of integrity and competence has not been fulfilled yet. Integrity is the commitment of DPS to comply with sharia banking and other laws regulations and commitment to the development of healthy and sustainable banks. Competence is knowledge and experience in muamalah and knowledge in banking or finance in general.

Responsibility of DPS in the Implementation of Sharia Compliance Supervision on Islamic Banks

According to Keuangan (2017), DPS is the core of Islamic bank’s corporate governance system as it is the liaison between shareholders, managers and stakeholders. DPS ensures the compliance of all bank activities with sharia regulations. DPS, as a part of internal governance structure in Islamic bank, acts as an independent control mechanism to protect the interests of depositors and hold the board of directors and other governance agencies for risk-taking activities.

Research conducted by Imaniyati (2002) suggests that a series of financial crises and corporate failures over the last decade have raised global and regional awareness of the importance of corporate governance. Some studies have concluded that poor governance, such as weak board supervision, is responsible for the financial crisis. According to Imaniyati (2016), the current global financial crisis can be attributed to failures and weaknesses in corporate governance arrangements in financial services firms.

This needs attention because DPS has some roles and responsibility as consultant, supervision, monitoring, audit and fatwa’s giver on the product to be launched. The most essential task is to ensure compliance with sharia. The risk of sharia non-compliance can affect the stability of banks and have serious consequences for the continuity of activities in Islamic financial institutions. The immediate consequences of non-compliance can be withdrawal and cancellation of investment contracts that lead to a decline in profits, performance, and negative exposure of Islamic banks and the risk of distrust to Islamic banks. Sharia non-compliance also poses reputational risk that could make the Islamic financial sector vulnerable to instability and trigger bank failures (Arifin and Nasution, 2015).

If the consequences of ineffective supervision conducted by DPS generate losses for other parties, such as sharia bank or customer, this is densely studied from the civil law aspect. Based on the general principle in civil law, anyone whose actions harm the other party shall provide compensation to the party who suffered the loss. When it comes to concepts and theories in law science, the following causes generated the financial loss:

1. The non-compliance of an agreement that has been made (which is generally known as one-achievement). In this case, the board of directors represents the relationship between DPS and Islamic bank.

2. Appeared because the act violates the provisions of legislation (or otherwise known as unlawful deeds)3. It occurs if DPS does not perform its functions as regulated in Article 32 of Islamic banking law and Bank Indonesia Regulation No.11/3/PBI/2009 (Widjaja and Yani, 2001).

The aforementioned causes have significant difference of legal consequences. In the first act, there is already a legal relationship among the parties. One party in the legal relationship has committed an act that harms the other, by not fulfilling its obligations, as it should be performed under the agreement they have reached. This detrimental act entitles the lose party to request the cancellation of agreement, along with the replacement of any costs and damages.

Especially for unlawful acts, provided for in Chapter III, Book III, and the Civil Code under the title "Born-in-Bundles for the Law", from Articles 1365 to 1380. Based on the provisions of Article 1353 of the Civil Code, the unlawful act breeds the bond between the party who commits the act unlawfully and the party against whom the unlawful act is committed. Thus, the engagement was born when the unlawful act was committed.

In general, there are three principles of responsibilities in law science, namely the liability based on fault principle, the rebuttable presumption of liability principle and absolute liability principle (no fault liability or strict liability). Suriaatmadja (2004) explains those principles of responsibility based on procedural law through evidentiary obligation that is by viewing the presence or absence of obligation to prove and perceiving someone who should prove in the process of demands.

The Liability Based on Fault Principle

The proving the defendant’s fault must be performed by the plaintiff (the aggrieved). For example, this principle in Indonesia is adopted in Article 1365 of the Civil Code (Article 1401 BW of Netherlands), which is known as the article on unlawful acts “onrechtmatigedaad”. This Article requires that the fulfillment of elements to make an unlawful act may be claimed for the following compensation:

1) The existence of defendant’s unlawful acts;

2) The existence of act that may be blamed on her;

3) The loss suffered as a result of fault.

The application of provisions of Article 1365 of the Civil Code provides the burden on the plaintiff (the aggrieved) to prove that the loss arises from the unlawful act of the defendant.

The Rebuttable Presumption of Liability Principle

The defendant is always considered guilty unless it can prove the things that can be free from mistakes. This principle is almost the same as the first principle. Its difference is that the defendant is the one who must prove not guilty.

The Absolute Liability Principle

The defendant is always responsible regardless of whether there is a mistake or not or who is at fault. Imaniyati (2002) cited in Suriaatmadja (2004) said that absolute responsibility principle views mistakes as irrelevant to question whether the facts exist or not.

The responsibility of DPS if its actions harm customers can be studied also from consumer protection laws because the bank as a business actor4 and customer as a consumer5. Before being elaborated on the bank’s responsibilities to customers, it is necessary to describe in advance the rights of customers as consumers according to UN-Guidelines for Consumer Protection and Law No. 8 year 1999 through the following rhetoric (Table 1).

According to Setyowati (2015), in the perspective of Islamic banking services, based on consumer the rights over the convenience, security and safety of goods and/or services and the right to advocacy and protection, hence the customers of Islamic banks have the right to security from the sharia aspects. This is in accordance with the principle of balance as one of the principles of consumer protection, namely the balance in the material and spiritual sense. Thus, if the bank does not perform with sharia compliance and the customer feels aggrieved, the customer may sue the bank.

The Civil Code argues for the existence of a right, (in this case, the consumer as the aggrieved party), then the consumer must prove that:

1. The consumer has actually suffered a loss;

2. The consumer shall also prove that such loss occurs as a result of the inappropriate use, utilization or usage of certain goods and/or services;

3. The inappropriateness of the use, utilization or usage of such goods and/or services is the responsibility of certain business actors;

4. The consumer does not "contribute", either directly or indirectly to the loss suffered.

Perceiving the aforementioned provisions, the obligation to prove the existence or absence of fault is the responsibility of consumer or the customer. However, in the law of consumer protection, the evidentiary obligation is "reversed" to be the burden and responsibility of the entrepreneurs entirely. In such case, if the entrepreneurs cannot prove that the fault is not an error lies on their part, in terms of law; they shall be responsible and compensate for such losses.

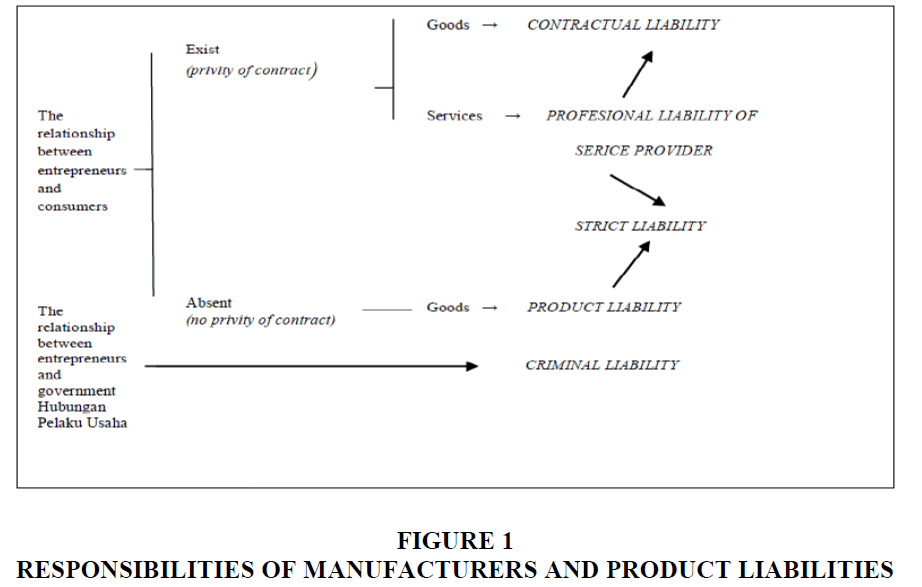

The form of bank’s responsibility to customers, it can be seen from the following concept of the Product Liabilities:

Based on the Figure 1 above, the product provided by the bank to the customer is in the form of services and there is a contract or agreement between the bank and customer. Furthermore, the responsibility of the bank is included in Professional Liability. There is no agreement between the bank and customer, but the bank takes action that is contrary to the laws and regulations, hence there is a legal relationship between banks and government. As a result, it prevails criminal liability.

With respect to the violation of sharia principles, Article 56 of Islamic Banking Law stipulates that Bank Indonesia shall impose administrative sanctions to the Islamic bank or Islamic Business Unit, members of Commissioners Board, members of DPS, Board of Directors, or employees of Islamic or Conventional Commercial Bank having Islamic Business Unit that deter or do not conduct their responsibilities to implement sharia principles in carrying out its business or duties or failing to fulfill its obligations as defined in the Act. The sanctions may be in the form of financial penalties, written warning, decreasing healthy level of Islamic Banks and Islamic Business Unit, prohibition to participate in clearing activities, freezing of certain business activities, whether for certain branch offices or Islamic Bank and Islamic Business Unit overall, dismissal of Islamic and Conventional Commercial Bank having a Islamic Business Unit (Article 58 of the Islamic Banking Law).

From the aforementioned description, the responsibility of DPS in implementing sharia compliance supervision in sharia bank can be studied from the aspects of civil law and consumer protection law. Based on the civil law aspect, the sharia compliance supervision is absolute responsibility, called strict liability. Based on consumer protection law, it includes professional and criminal liability, but the Islamic Banking Law stipulates as administrative liability. Thus, to maintain the mission and reputation of Islamic banks, the development of a comprehensive framework of sharia governance requires a strong sharia council (members with additional knowledge in finance or accounting, cross-members) whose role is not limited to consult the council, but also to supervise and monitor bank manager.

Conclusion

Based on data processing and analysis conducted in the previous chapter, the conclusions are as follows: (1) The implementation of DPS supervision in conducting sharia compliance in Islamic bank was not optimal due to the integrity and competence factor of DPS; (2) The responsibility of DPS in implementing sharia compliance supervision in Islamic banks can be assessed from the aspects of civil law and consumer protection law. Based on the aspect of civil law, the responsibility of DPS is absolute, called strict liability. Based on consumer protection law, it is professional and criminal liability, but the Islamic Banking Law specifies it as an administrative liability.

Endnotes

1. The institution in question has the authority in determining the fatwa in Islamic banking is the National Sharia Board-Indonesian Council of ‘Ulam? (DSN-MUI).

2. National Sharia Board (DSN) is the autonomous body of the Indonesian Council of ‘Ulam? (MUI), which is chaired ex officio by the Chairman of MUI. To carry out daily activities is designated DSN Daily Executing Agency (Imaniyati and Adam, 2016).

3. The requirements for lawsuits based on unlawful acts are: a) there must be action; b) unlawful; c) there are mistakes; d) there must be a causal relationship between the mutation and the loss; e) there must be a loss (Patrick, 1994).

4. Article 1 number 3 of Law Number 8 Year 1999 concerning Consumer Protection, Business Actor is any individual or business entity either in the form of a legal entity or non-legal entity established and domiciled or conducting activities within the territory of the Republic of Indonesia, either alone or together through an agreement to conduct business activities as an economic field.

5. Article 1 point 2 Consumer is any user of the goods or services available in the community, whether for self-interest, family, other people, or other living beings and not for sale.

References

- Abdurrahman, H. (2016). Sharia red report card, criticism on the fatwa of sharia banking products. Bogor: Al-Azhar Press.

- Abdurrahman, N.H. (2013). Sharia business management and entrepreneurship. Bandung: Pustaka Setia.

- Al-Ghifari, M.H. (2015). Analysis of the performance of Islamic banking in Indonesia and Malaysia with the maqashid index approach. Journal of Islamic Economics and Banking, 3(2), 107-136.

- Arifin, M., & Nasution, N. (2015). The dynamics study of regulations on syariah banking Indonesia. International Journal of Humanities and Social Science, 5(3), 30-56.

- Hafidhuddin, D. (2005). Sharia management in practice. Jakarta: Gema Insani.

- Hanityio, R. (1985). Legal research methodology. Jakarta: Ghalia Indonesia.

- Husaeni, U.A. (2018). Law on fee (Ujrah) in gratuitous contract: Study on national sharia board-Indonesian council of ulam? fatwa. Journal of Shariah Law Research, 3(1), 125-138.

- Imaniyati, N.S. (2002). Islamic economic and economic law. Bandung: Mandar Maju.

- Imaniyati, N.S. (2016). Introduction to Indonesian banking law. Bandung: Refika Aditama.

- Imaniyati, N.S. (2017). Business Law is complemented by Islamic Business Law Studies. Bandung: Refika Aditama.

- Imaniyati, N.S. (2017). Sharia principles in the national banking legal system. FGD.

- Keuangan, O.J. (2017).Sharia banking development direction and policy. National seminar and deed making training and sharia banking legal aspects for notaries in the era of free markets.

- Laldin, M.A. (2016). Innovation versus replication: some notes on the approached in defining sharia compliance in Islamic finance. Al-Jami'ah: Journal of Islamic Studies, 54(2), 1-12.

- Mohnot, R. (2015). Resilience of Islamic financial system during crisis period. International Journal of Excellence in Islamic Banking & Finance, 5(2), 1-12.

- Nurhasanah, N. (2011). Optimizing the role of the sharia supervisory board (DPS) in sharia financial institutions. Syiar Law, 13(3), 1-11.

- Patrik, P. (1994). Alliance law fundamentals (alliance born of agreement and act). Bandung: Mandar Maju.

- Rama, A. (2015). Descriptive analysis of Islamic finance development in Southeast Asia countries. The Journal of Tauhidinomics, 1(2), 1-15.

- Sakti, D. (2017). Product dynamics and Islamic finance contracts in Indonesia. Jakarta: Rajawali Pers.

- Setyowati, R.W. (2015). Access to Justice for Sharia Banking Customers (customer spiritual rights perspective). Semarang: Pustaka Magister.

- Sjahdaeni, S.R. (2010). Islamic banking products and legal aspects. Jakarta: Jayakarta Agung Offset.

- Soekamto, S. (1995). Normative legal research: A brief review. Jakarta: Raja Grafindo Persada.

- Srairi, S. (2015). The influence of the sharia supervisory board on bank risktaking: Evidence from Islamic banks in GCC countries. International Journal of Excellence in Islamic Banking & Finance, 5(2), 1-20.

- Sukardi, B. (2013). Corporate governance engineering of Islamic banking and finance: The challenges of the globalization of the economic system and the free market. Tsaqafah, 9(1), 1-11.

- Suriaatmadja, T.T. (2004). Air cargo transport: The responsibility of the carrier in the dimensions of national and international air law. Bandung: Pustaka Bani Quraisy.

- Widjaja, G., & Yani, M. (2001). Law on consumer protection. Jakarta: Gramedia Pustaka Utama.