Research Article: 2023 Vol: 22 Issue: 2

Analyzing the Impact of Working Capital Management on the Firms Profitability: An Empirical Analysis of Cement Sector of Pakistan

Sheryar Hussain, ILMA University

Citation Information: Hussain, S. (2023). Analyzing the impact of working capital management on the firms profitability: An empirical analysis of cement sector of Pakistan. Academy of Strategic Management Journal, 22(S2), 1-11.

Abstract

The object of this research is to find out empirical impact of the relationship between working capital management and firm profitability of Pakistan cement sector. The sample period of the study is five years i-e from 2017 to 2021. The data was taken from dissimilar sources that used in this study from Karachi Stock Exchange, Published reports of SBP and respected firm site. The dependent variable of the study is Return on equity which is used as a proxy for firm financial performance. There are independent variables are cash collection cycle, average collection period, average payable period, inventory turnover in days, and sales growth. Panal Data methodology used to analyze the impact of Working Capital Management on performance or profitability of Cement sector. Results showed that CCC, ACP, APP, ITID, SG have positive relation with firm performance and is significant.

Keywords

Cash Conversion Cycle, Average Collection Period, Average Payable Period, Inventory Turnover in Days, Sales Growth, Return on Equity.

Introduction

The difference between a company's current assets and current liabilities is its working capital, commonly referred to as net working capital or working capital, or by subtracting current assets from current liabilities. This correlation demonstrates the company's ability to cover short-term commitments with short - term assets. The usage and management of working capital has an impact on a number of short- and long-term economic success factors, including setting aside funds for sustainable growth and paying suppliers and employees (Soukhakian & Khodakarami, 2019). In other words, working capital may be viewed as a source of funding for a business to meet its immediate or short-term commitments. Working-capital, thus, serves as both a strong indicator of a company's present financial situation and a gauge of its overall success.

Management of working capital is essential to a business' daily operations. Successful business operations require proactive management. A business's ability to manage its working capital effectively affects many different aspects of its operations, including timely inventory ordering, cash payment and collection, and even sales management. Greater financial performance is a result of all of these factors, and better financial performance stimulates business growth. Growth and profitability both indicate the state of a company's operations (Siraj et al., 2019; Sathyamoorthi et al., 2018).

No firm can be properly operated without working capital management because working capital is as essential to life as blood and the nervous system. Businesses that effectively and regularly manage their working capital may retain liquidity via continuous production without ever experiencing a financial crisis due to short-term liabilities like wages, salary payments, raw material purchases, overhead, and so on. Any business's operations benefit from having working capital as a lubricant (Sarwat et al., 2017; Gitman et al., 2015).

To ensure the sustainability and effective operation of firms, W. C. M is the act of managing current - assets and current - liabilities. W. C. M is one of several elements that determine a company's profitability. Consequently, W. C. M is a crucial element of business feat, since it can increase profitability. To effectively manage working capital, including its component, the cash – conversion - cycle (short - term trade payables, short - term account receivables, and merchandises and sales growth). Due to the crucial significance these factors play in a company's performance and how they help a company achieve strong liquidity, corporate growth, and increased shareholder wealth (Shafique et al., 2018; Islam et al., 2022; Khalid et al., 2018; Kumari & Anthuvan, 2017).

Impact of Covid-19 on Working Capital Management

Organizations required making prompt decisions on working capital management practises during a financial crisis like the one brought on by the Covid '19. Working capital management (WCM) is the term for the management of a company's short-term finance, or current assets and current liabilities. It is a gauge of the company's liquidity. Working capital management (WCM) is the study of how well businesses use their current assets and liabilities to satisfy short-term obligations and expenses. The goal of working capital management is to maintain an organization's operations so that it has sufficient funds to pay both maturing short-term debt and impending operating needs (Shah, 2016; Shah et al., 2018; Abosede & Luqman, 2014). The growth of working capital (WC) can be attributed to successful business operations, the sale of long-term assets, long-term borrowings, and owner capital infusions. Contrarily, it will fall from losing commercial ventures, buying long-term assets without long-term funding, paying off long- term debt, and giving dividends to owners (Arunkumar & Ramanan, 2013).

Complete or partial lockdowns and movement restrictions have generally had a negative impact on businesses and have contributed to financial crises around the world. The non-medical measures have significantly decreased both domestic and foreign economic activity. First, Covid 19 has caused global supply chains to break down and/or stall down as borders have closed. When the lockdown was partially implemented in 2020, it led to a decline in or partial prohibition on the transportation modes that are essential to the global supply chain: air, road, water, and railway. Due to border closures and the employment of unofficial middlemen by traders, the price of their goods increased. Second, the decline in exports and remittances was responsible for the decline in business activities. Remittances decreased by 30% in 2020, according to World Bank reports as a result of the loss of approximately 305 million jobs worldwide (Afeef, 2011; Afza, 2011).

Problem Statement

The following is the problem statement to-be explored in this research: “To identify the effect of W.C.M (Working capital management) on Profitability of Cement Industry in Pakistan?.”

Literature Review

In this study, the performance of Pakistan's non-financial enterprises is examined in relation to the effects of working capital management, which includes inventory management, receivables management, and payable management. Between 2000 and 2016, panel data of 280 nonfinancial companies registered on the Pakistan Stock Exchange were examined. Return on assets and return on equity were close indicators of a company's profitability, whereas sales growth and asset growth were indicators of growth. Working Capital Management's constituent policies, such as Inventory Management, Receivable Management, and Payable Management, is what measure the impact of the practise. Leverage, firm size, and liquidity are all employed as controls. The findings imply that working capital management has a major impact on a firm's financial success in terms of growth and profitability. Inventory management does have an impact on a company's growth, and accounts payable management has a big impact on a company's profitability when looking at component-wise results. However, the single factor that affects both profitability and growth is receivable management (Siraj et al., 2019; Vohra et al., 2014)

It is impossible to ignore the role that working capital management plays in establishing business profitability. This study intends to experimentally evaluate how working capital management affects the pharmaceutical industry's profitability in Pakistan. The study used secondary data from 2011 to 2016 that spans a six-year timeframe. Working capital management was modeled using the current ratio, cash conversion cycle, and the proportion of current assets to total assets. Return on asset was used as the dependent variable to model company profitability. This study's panel regression analysis revealed that the current ratio, the cash conversion cycle, and the ratio of current assets to total assets all significantly affect the profitability of corporations. These results provide information on controlling business profitability by taking the current ratio and cash conversion cycle into account. The pharmaceutical industry in Pakistan should benefit from this study because investor and public health depend on the success and longevity of this industry (Shafique et al., 2018; Shahzad et al., 2015; Sharma & Kumar, 2011).

The purpose of this study is to determine how working capital management affects profitability. Profitability is gauged by return on assets. The current ratio, debt to equity ratio, operating profit to debt ratio, and inventory turnover ratios of the companies are additional variables included in this study. For a period of six years, from 2007 to 2012, secondary data on electrical equipment companies listed on the Karachi Stock Exchange were collected. On the data, regression analysis was used. The tests for normality and linearity were also used. Results were overwhelmingly favourable. It is determined that working capital management positively and significantly affects the businesses' profitability (Raheman & Nasr, 2007; Rehman & Anjum, 2013; Nguyen, 2020).

The cement industry has a significant contribution to the economic progress in Bangladesh. The profitability of this industry is significantly dependent on effective working capital management. However, the industry’s profitability is not satisfactory. This research brings to light the profitability and working capital situation of the cement industry, as well as the relationship between the two and if working capital management influences profitability. Ratio analysis, Correlation matrix, and Regression Analysis have been used to show the position of profitability and working capital and the association between these two. The authors used secondary data from the company’s annual reports for this research. According to the findings, the profitability and working capital management positions of the cement companies are not satisfactory. There is a link between working capital management and profitability. Proper working capital management has a beneficial influence on profitability, according to the study (Iqbal et al., 2014; Malik & Bukhari, 2014; Muhammad, 2012; Namalathasan, 2010).

W.C (Working Capital) is an essence of every organization; its’ impossible to run a successful business deprived of it. Because the interaction effect among both liquidity and profitability exists, a company's working capital position must/ought to be carefully maintained to confirm that operations function smoothly without disturbing profits. There have been studies that show both the importance and the insignificance of working capital management in terms of firm’s profitability. Researchers have recently conducted extensive research on W.C.M. In the context of Pakistan's cement industry, the purpose of this investigation is to identify the component-by- component link between effective W.C.M and productivity. From 2007 to 2011, panel-data from 18 businesses registered on the Korean. Stock Exchange (KSE) in the cement sector was collected. Return on Assets, a dependent variable, is used to determine a company's profitability (ROA). W. C. M’s efficiency is measured using six ratios of accounting. The panal LSM least- square-method of regression is utilized in the investigation. The findings reveal that the A. T. O (Assets Turnover-Ratio), C.R (current ratio), and company - size are all related to return on assets in a positive and significant way (ROA). The most critical parts of working capital, inventory, accounts receivable, and payment, were found to be minor. As a consequence of this research, it can be stated that W.C.M efficiency does not play a significant role in enhancing business revenue in Pakistan's cement industry (Sarwat et al., 2017; Harris, 2005; Hillier et al., 2010; Huynh, 2012).

The influence of good W.C.M on financial performance of Pakistan's cement sector is examined in this investigation. The research / investigation covers a five-year tenure, from 2007 - 2011. The information for this study came from a variety of businesses, including the Karachi Stock Exchange. SBP published reports, and a reputable firm's website. The study's dependent variable is R. O. A, which is determined to use as an aspects for firm financial performance. ARID, ITID, (CCC), & PTID are all independent factors. The influence of W.C.M on the cement-industry's corporate financial performance was investigated using the Panal Data technique. The findings demonstrate that CCC, NTC, and ARID have a significant and strong interaction with results, but inventory turnover and PTID have an insignificant relationship with corporate performance (Tariq et al., 2013).

The purpose of this investigation is to see how the W. C. M profitability connection affects the cement business in Pakistan. In order to examine a research hypothesis, this study used a quantitative approach of research. Between 2004 and 2010, the survey used rations from 21 listed cement companies on the KSE. The study's findings revealed a substantial negative link among W.C.M and firm-profitability (Arshad & Gondal, 2013).

The study considered at the association amongst working capital management and profitability in manufacturing small firms, utilising a mature manufacturing firm as a case study. From 1998 to 2003, the connected study lasted six years. Payable days, receivable days, inventory turnover, and C C C are employed as independent variables, whereas R. O. A is used as a D.V. To determine the final consequences, they apply regression analysis. They keep the printing sector profitable by putting a lot of money into inventories and receivables (Padachi, 2006; Sial & Chaudhry, 2012).

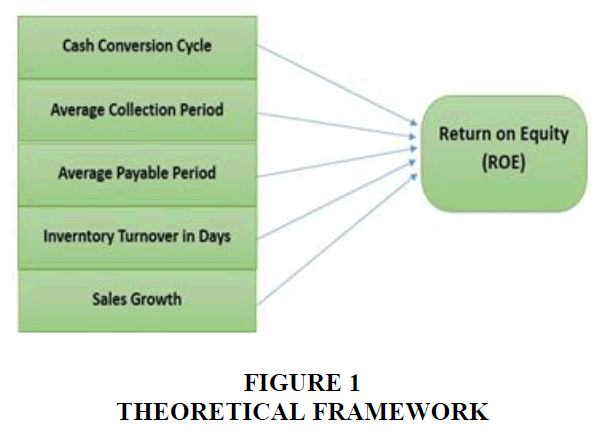

Independent Variables

1. Cash Conversion Cycle

2. Average Collection Period

3. Average Payable Period

4. Inventory Turnover in Days

5. Sales Growth

Dependent variable

1. Return on Equity (Figure 1)

Research Methods

This chapter will cover the methods we'll use to collect data as well as the size of the sample that we'll be aiming for the test that will be used to assess the data's reliability and correctness will also be covered. The framework draws attention to the independent and dependent factors.

Method of Data Collection

Study based on secondary data to analyze the impact of working capital management on firm’s profitability. A quantitative method was used for financial statements and data was downloaded from the respective companies’ website and KSE. Then the data was evaluated through E-views Software.

Sampling Technique

The sampling technique was used as simple probability sampling from registered cement companies.

Sample Size

The sample size will be based on financial statements of cement companies listed on KSE and data was collected from cement industry financial statements from the period of 2017-2021

Instrument of Data Collection

Secondary data was collected from Financial Statements from KSE or company’s website of cement industries for the period 2017 to 2021. The main justification for picking only publicly traded companies is the accessibility and dependability of their financial statements, as publicly traded companies are compelled to disclose any gains they may have in order to attract additional investors to their shares. The information was gathered from the annual reports and financial statements of the cement manufacturers.

Statistical Technique

In this statistical model, Regression technique were used

Where; ROE: Return on Equity; CCC: Cash Conversion Cycle; ACP: Average Collection Period; APP: Average Payment Period; ITID: Inventory Turnover in Days; SG: Sales Growth; e: Error

Results

Finding and Interpretation of the Results

In the said study, there are 5 independent variables such as Cash Conversion Cycle, Average Collection Period, Average Payable Period, Inventory Turnover in Days, Sales Growth were bringing into consideration for assessing their impact on Firm Profitability (Return on Equity) which was considered as dependent variable.

Eviews version 12 was used to analyze the dependent & independent variables. Empirical results through E-views software are following (Table 1).

| Table 1 Results Eviews Version 12 | ||||||

| ROE | CCC | ACP | APP | SG | ITID | |

| Mean | 6.895882 | -89.29588 | 19.25882 | 147.8941 | 0.162893 | 39.33941 |

| Median | 6.690000 | -56.95000 | 13.00000 | 108.0000 | 0.058700 | 26.12000 |

| Maximum | 29.58000 | 79.00000 | 198.0000 | 891.0000 | 2.470300 | 209.0000 |

| Minimum | -55.69000 | -891.0000 | 0.000000 | 18.00000 | -0.670000 | 0.000000 |

| Std. Dev. | 13.82748 | 144.5592 | 31.95315 | 143.1659 | 0.547620 | 34.68147 |

| Skewness | -1.636424 | -3.021290 | 4.039801 | 2.730911 | 2.577948 | 2.321185 |

| Kurtosis | 8.150856 | 14.93468 | 20.93053 | 11.92830 | 10.83507 | 9.531175 |

| Jarque-Bera | 131.9018 | 633.7789 | 1369.859 | 387.9756 | 311.5661 | 227.4028 |

| Probability | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 |

| Sum | 586.1500 | -7590.150 | 1637.000 | 12571.00 | 13.84590 | 3343.850 |

| Sum Sq. Dev. | 16060.73 | 1755379. | 85764.31 | 1721704. | 25.19056 | 101035.6 |

| Observations | 85 | 85 | 85 | 85 | 85 | 85 |

Descriptive Stats

The descriptive statistics of ROE of cement sectors of Pakistan from the period 2017 to 2021 has been given in above table. Furthermore, the values of each variable such as Mean, Median, Maximum, Minimum, and Standard Deviation are presented in it. From the above given table, the median (average) ROE is 6.69, CCC is -56.95, APP is 108.00, ACP is 13.00, ITID is 26.12 and SG is 0.0587, although the mean defines the data normality of each variable and that are important for the correctness of result are given below;

Correlation

Covariance Analysis: Spearman rank-order Sample: 2017 2021; Included observations: 85 (Table 2).

| Table 2 Covariance Analysis: Spearman Rank-Order | ||||||

| Correlation | ROE | CCC | ACP | APP | ITID | SG |

| ROE | 1.000000 | |||||

| CCC | 0.173895 | 1.000000 | ||||

| ACP | -0.255029 | 0.114037 | 1.000000 | |||

| APP | -0.295741 | -0.909758 | 0.040201 | 1.000000 | ||

| ITID | -0.084023 | 0.275154 | 0.109971 | -0.012715 | 1.000000 | |

| SG | 0.344344 | 0.106021 | -0.100989 | -0.131657 | 0.052419 | 1.000000 |

| t-Statistic | ROE | CCC | ACP | APP | ITID | SG |

| ROE | ----- | |||||

| CCC | 1.608772 | ----- | ||||

| ACP | -2.402878 | 1.045746 | ----- | |||

| APP | -2.820495 | -19.96506 | 0.366544 | ----- | ||

| ITID | -0.768200 | 2.607422 | 1.007995 | -0.115853 | ----- | |

| SG | 3.341477 | 0.971374 | -0.924777 | -1.209985 | 0.478214 | ----- |

| Probability | ROE | CCC | ACP | APP | ITID | SG |

| ROE | ----- | |||||

| CCC | 0.0111 | ----- | ||||

| ACP | 0.0185 | 0.2987 | ----- | |||

| APP | 0.0060 | 0.0000 | 0.7149 | ----- | ||

| ITID | 0.0445 | 0.0108 | 0.3164 | 0.9080 | ----- | |

| SG | 0.0013 | 0.3342 | 0.3578 | 0.2297 | 0.6338 | ----- |

The link between construct variables is ascertained through correlation analysis. It is crucial to carry out the correlation analysis after this test to confirm that the hypothesis result is reliable before moving on to the analysis of model regression.

As shown in above table, ROE and CCC is 0.174 which indicates that they’re weakly positively correlated. Significant ROE is associated with cash conversion cycle. ROE and APP is -0.0295 which indicates that they’re weakly negatively correlated. ROE and ACP is -0.0255 which indicates that they’re weakly negatively correlated. ROE and ITID is -0.084 which indicates that they’re weakly negatively correlated. ROE and SG is 0.344 which indicates that they’re moderately positively correlated.

Regression

Dependent Variable: ROE; Method: Panel EGLS (Period random effects) Sam ple: 2017 2021; Periods included: 5; Cros s -s ections included: 17; Total panel (balanced) observations: 85; Swam y and Arora estimator of com ponent variances (Table 3).

| Table 3 Regression Analysis | ||||

| Variable | Coefficient | Std. Error | t-Statis tic | Prob. |

| C | 14.08532 | 1.996654 | 7.054465 | 0.0000 |

| CCC | -0.065777 | 0.029581 | -2.223569 | 0.0290 |

| ACP | -0.133026 | 0.032995 | -4.031715 | 0.0001 |

| APP | -0.016931 | 0.007363 | -2.299519 | 0.0241 |

| ITID | -0.067211 | 0.029569 | -2.273005 | 0.0257 |

| SG | 3.195330 | 1.883461 | 1.696521 | 0.0437 |

The 2SLS regression analysis shows that Cash Conversion Cycle, Average Collection Period, Average Payable Period, Inventory Turnover in Days and Sales Growth are significant variables as their p values are less than 0.05.

According- to the table below, which displays the results of the random effect model, the Coefficient of CCC is -0.0657, t- statistics is -2.2235 and probability is 0.0290. As a result, probability of CCC is 0.0290, it is less than 0.05 it means CCC has significant effect on ROE therefore we conclude null hypothesis will not accept and alternative hypothesis will be accepted.

H1: Cash conversion cycle significantly influences Return on Equity.

According- to the table above, which displays the results of the random effect model, the Coefficient of ACP is -0.1330, t- statistics is -4.0317 and probability is 0.0001. As a result, probability of ACP is 0.0001, it is less than 0.05 it means ACP has significant effect on ROE therefore we conclude null hypothesis will not accept and alternative hypothesis will be accepted.

H2: Average Collection Period significantly influences Return on Equity.

According- to the table above, which displays the results of the random effect model, the Coefficient of APP is -0.0169, t- statistics is -2.2995 and probability is 0.0241. As a result, probability of APP is 0.0241, it is less than 0.05 it means APP has significant effect on ROE therefore we conclude null hypothesis will not accept and alternative hypothesis will be accepted.

H3: Average Payable Period significantly influences Return on Equity.

According- to the table above, which displays the results of the random effect model, the Coefficient of ITID is -0.0672, t- statistics is -2.2730 and probability is 0.0257. As a result, probability of ITID is 0.0257, it is less than 0.05 it means ITID has significant effect on ROE therefore we conclude null hypothesis will not accept and alternative hypothesis will be accepted.

H4: Inventory Turnover in Days significantly influences Return on Equity.

According- to the table above, which displays the results of the random effect model, the Coefficient of SG is 3.1953, t- statistics is 1.6965 and probability is 0.0437. As a result, probability of SG is 0.0437, it is less than 0.05 it means SG has significant effect on ROE therefore we conclude null hypothesis will not accept and alternative hypothesis will be accepted.

H5: Sales Growth significantly influences Return on Equity.

Conclusion

The study examines the effect of working capital management on the performance of Pakistan's cement industry. From 2017 through 2021, the study will be conducted. The Karachi Stock Exchange provided the information for this study. To examine the effect of working capital management on a company's profitability, return on equity was utilized as the dependent variable. CCC, ACP, APP ITID, and SG were independent variables.

The effect of working capital management on the performance or profitability of the cement sector is investigated using the panal data approach. Results indicate a positive association between CCC, ACP, APP, ITID, and SG and profitability. These findings showed that working capital management is one of the most essential components of financial management for the long-term viability and profitability of every firm. Any business that doesn't keep enough working capital on hand to pay its obligations risks going out of business. Therefore, it is crucial for all firms to have adequate working capital management. Strong working capital allows businesses to meet their short-term obligations without jeopardising their profitability.

Policy Implication

The policy implication of the work is that the increase in the number of days required for making a payment could lead to enhance the earning of firms. However, negotiation is crucial in this context so that the overall image of the company cannot be affected. They should be able to deal with uncertainty like the covid shook the market as well as working capital in 2020 as the excessive lockdown was imposed by the govt. Further, the concerned managers should reduce the days required to collect the cash from customers by giving the discount, and the inventory should be selling in a smaller number of days. Besides the short cycle of cash conversion, there is a demand for increasing the earning of the firms

Future Research

The results are consistent with those of Eljelly (2004) and Shin & Soenan (1998), who found a markedly inverse relationship between working capital management metrics, such as the average collection period, inventory turnover in days, average payment period, and cash conversion cycle, and corporate profitability.

Based on the study above, we can also draw the conclusion that these outcomes may be enhanced even more if the businesses manage their working capital more effectively. "Managing current assets and current obligations, and financing these current assets" are the definitions of working capital management. These businesses will ultimately become more profitable if they handle their cash, accounts receivables, and inventories efficiently. In Pakistan, there is still considerable work to be done about working capital. We advise conducting more study on the same subject using various firms, various IV & DV, and expanding the sample years. The management of working capital components, such as marketable securities and cash flows, may be included in the scope of future study.

References

Abosede, S., & Luqman, O. (2014). A comparative analysis on working capital management of brewery companies in Nigeria. International Journal of Finance and Accounting, 3(6), 356-371.

Afeef, M. (2011). Analyzing the impact of working capital management on the profitability of SME's in Pakistan. International Journal of Business and Social Science, 2(22).

Afza, T. (2011). Working capital management efficiency of cement sector of Pakistan. Journal of Economics and Behavioral studies, 2(5), 223-235.

Arshad, Z., & Gondal, M.Y. (2013). Impact of working capital management on profitability a case of the Pakistan cement industry. Interdisciplinary Journal of Contemporary Research in Business, 5(2), 384-390.

Indexed at, Google Scholar, Cross Ref

Arunkumar, O.N., & Ramanan, T.R. (2013). Working capital management and profitability: A sensitivity analysis. International Journal of Research and Development, 2(1), 52-58.

Bhutto, N.A., Abbas, G., ur Rehman, M., & Shah, S.M.M. (2015). Relationship of cash conversion cycle with firm size, working capital approaches and firm’s profitability: a case of Pakistani industries. Pakistan Journal of Engineering, Technology & Science, 1(2).

Eljelly, A.M. (2004). Liquidity‐profitability tradeoff: An empirical investigation in an emerging market. International Journal of Commerce and Management, 14(2), 48-61.

Indexed at, Google Scholar, Cross Ref

Gitman, L.J., Juchau, R., & Flanagan, J. (2015). Principles of managerial finance. Pearson Higher Education AU.

Harris, A. (2005). Working capital management: difficult, but rewarding. Financial Executive, 21(4), 52-54.

Hillier, D.J., Ross, S.A., Westerfield, R.W., Jaffe, J., & Jordan, B.D. (2010). Corporate finance (No. 1st Eu). McGraw Hill.

Huynh, N.T. (2012). The influence of working capital management on profitability of listed companies in the Netherlands.

Iqbal, N., Ahmad, N., Kanwal, M., Anwar, S., & Hamad, N. (2014). Impact of working capital management on firm’s profitability: Evidences from textile sector of Pakistan. Arabian Journal of Business and Management Review (Nigerian chapter), 2(5), 111-123.

Islam, I.M.M., Abdullah-Al-Masum, M., & Azad, M.S. (2022). Nexus between working capital management and firm profitability: Evidence from the cement industry in Bangladesh.

Khalid, R., Saif, T., Gondal, A.R., & Sarfraz, H. (2018). Working capital management and profitability. Mediterranean Journal of Basic and Applied Sciences, 2(2), 117-125.

Kumari, N.N., & Anthuvan, M.V.L. (2017). A study on the impact of the working capital management on the profitability of the leading listed automobile companies in India. International Journal of Scientific Research and Management, 5(8), 6744-6757.

Malik, M.S., & Bukhari, M. (2014). The impact of working capital management on corporate performance: A study of firms in cement, chemical and engineering sectors of Pakistan. Pakistan Journal of Commerce and Social Sciences (PJCSS), 8(1), 134-148.

Muhammad, M., Jan, W.U., & Ullah, K. (2012). Working capital management and profitability an analysis of firms of textile industry of Pakistan. Journal of Managerial Sciences, 6(2).

Namalathasan, B. (2010). Capital structure and its impact on profit ability: a study of listed manufacturing companies in SRI Lanka. Ekonomika, Journal for Economic Theory and Practice and Social Issues, 56(1350-2019-2397), 83-92.

Nguyen, A.H., Pham, H.T., & Nguyen, H.T. (2020). Impact of working capital management on firm's profitability: Empirical evidence from Vietnam. The Journal of Asian Finance, Economics and Business, 7(3), 115-125.

Indexed at, Google Scholar, Cross Ref

Padachi, K. (2006). Trends in working capital management and its impact on firms’ performance: an analysis of Mauritian small manufacturing firms. International Review of Business Research Papers, 2(2), 45-58.

Raheman, A., & Nasr, M. (2007). Working capital management and profitability: Case of Pakistani firms. International Review of Business Research Papers, 279-300.

Rehman, M.U., & Anjum, N. (2013). Determination of the impact of working capital management on profitability: An empirical study from the cement sector in Pakistan. Asian Economic and Financial Review, 3(3), 319-332.

Sarwat, S., Iqbal, D., Durrani, B.A., Shaikh, K.H., & Liaquat, F. (2017). Impact of working capital management on the profitability of firms: Case of Pakistan’s cement sector. Journal of Advanced Management Science, 5(3).

Sathyamoorthi, C.R., Mapharing, M., & Selinkie, P. (2018). The impact of working capital management on profitability: Evidence from the listed retail stores in Botswana. Applied Finance and Accounting, 4(1), 82-94.

Shafique, A., Farhan, A., & Sahabia, K. (2018). Corporate profitability-working capital management tie: empirical evidence from pharmaceutical sector of Pakistan. Asian Journal of Empirical Research, 8(7), 259-270.

Shah, B., Gujar, M.A., & Sohu, N.U. (2018). The impact of working capital management on profitability: case study of pharmaceutical and chemical firms listed on Karachi stock exchange. International Journal of Economics, Commerce and Management, 6(3), 200-220.

Shah, N. (2016). Impact of working capital management on firms profitability in different business cycles: evidence from Pakistan. Journal of Finance & Economics Research, 1(1), 58-70.

Shahzad, F., Fareed, Z., & Zulfiqar, B. (2015). Impact of working capital management on firm’s profitability: A case study of cement industry of Pakistan. European Researcher, (2), 86-93.

Indexed at, Google Scholar, Cross Ref

Sharma, A.K., & Kumar, S. (2011). Effect of working capital management on firm profitability: Empirical evidence from India. Global Business Review, 12: 159.

Indexed at, Google Scholar, Cross Ref

Shin, H.H., & Soenen, H.L. (1998). Efficiency of working capital and corporate profitability.

Sial, M., & Chaudhry, A. (2012). Relationship between working capital management and firm profitability: Manufacturing sector of Pakistan.

Siraj, M., Mubeen, M., & Sarwat, S. (2019). Working capital management and firm performance: evidence from non-financial firms in Pakistan. Asian Journal of Empirical Research, 9(2), 27-37.

Soukhakian, I., & Khodakarami, M. (2019). Working capital management, firm performance and macroeconomic factors: Evidence from Iran. Cogent Business & Management, 6(1), 1684227.

Indexed at, Google Scholar, Cross Ref

Tariq, H., Mumtaz, R., & Rehan, M.F. (2013). Working capital management and firm performance: evidence from Pakistan. European Journal of Business and Management, 5(20), 86-91.

Vohra, M., Raza, H., Aslam, M.F., & Mubeen, M. (2014). Impact of working capital management on financial charges: empirical evidence of manufacturing industry of Pakistan. Research Journal of Finance and Accounting, 9(20), 110-119.

Received: 29-Oct-2022, Manuscript No. ASMJ-22-12774; Editor assigned: 31-Oct-2022, PreQC No. ASMJ-22-12774(PQ); Reviewed: 14- Nov-2022, QC No. ASMJ-22-12774; Revised: 20-Dec-2022, Manuscript No. ASMJ-22-12774(R); Published: 25-Dec-2022