Research Article: 2021 Vol: 20 Issue: 5

Bank Lending Transaction and Financial System Controls in an Evolving Economy

Cordelia Onyinyechi Omodero, Covenant University

Asiriuwa Osariemen, Covenant University

Francis Odianonsen Iyoha, Covenant University

Abstract

Fund availability for private sector operations is determined by a nation’s financial system under the control of the Central Bank. The private sector investment and operations depend on the amount of funds accessible by the operators. Bank credit to the private sector is indispensable in every functioning economy to remain viable. To a considerable extent, private sector credit plays a significant role in ensuring the economic stability of a nation. In Nigeria, the scenario is the same. Thus, this study examines the extent to which monetary policy instruments affect the lending power of banks, especially to the major beneficiaries who are the private sectors. The study applies the relevant econometric techniques, which include a test of validity, normality and stability of the model used. The ordinary least squares method is employed to test the causality effect of the financial policy instruments on private sector credit. The study covered a period from 1998 to 2019. The findings indicate that interest and exchange rates are positively insignificant in affecting the credit banks provide to the private sector. The study also finds that money supply significantly and positively influences private sector credit. The study recommends that the money supply should be watched to avoid excess money in circulation while ensuring sufficient credit availability to the private sector for operations.

Keywords

Bank Policy, Money Supply, Monetary Policy, Financial System Controls.

JEL Classification Codes

E50, E51, E52, E58, E59

Introduction

Bank lending transaction is one of the primary functions of banks to generate revenue. The private sector existence and financial stability have always remained a function of banks' ability to make finance available to them. However, bank credit's availability to the private sector depends on financial system controls in place at every given time. The monetary policy determines the extent of credit availability and accessibility by the private sector in a country. In a more explicit form, the funding access and opportunities firms would have depended on the long term policies introduced to manage the loaning undertakings of banks (Ndigwe et al., 2020). Monetary policy or financial control system in a country has a prominent role in determining the amount of money in circulation and level of credit available to private sector operations (European Central Bank, 2011). The ultimate reason is to ensure price stability in an economy. The use of legal reserve requirements helps the monetary authorities to control the quantity of money that banks can maintain. At the same time, the open market operation minimizes the actual amount of money banks can give (Central Bank of Nigeria, 2011). Thus, the practice leads to a reduction or increase in the lending capacity of banks.

Several scholars have studied the relationship between banking credit to the private sector and monetary policy interferences in the past. For instance, Nwakanma et al. (2014) established a long-run relationship between private sector credit and economic growth in Nigeria. Mamman & Hashim (2013) noticed that bank credit to the private sector has a statistically significant impact on growth in Nigeria. In Kenya, Olwenyi & Chiluwe (2012) observed that monetary policy and private sector investment had a positive relationship. The findings of scholars like (Bellalah et al., 2013; Emenike, 2016) revealed a long term association between monetary policy and private sector credit. The study of Rasheed (2011) proved that private sector credit could give room for money to be in reserve. Gopalan & Rajan (2017) expressed an opinion that national fiscal policy is very imperative, especially in emerging economies where exchange and interest rates are the primary monetary policy tools for macroeconomic management.

The three channels of financial policy identified by Bernanke & Gertler (1995) include the bank-lending channel, the credit channel and balance sheet channel. According to Olweny & Chiluwe (2012), the balance sheet channel centres on financial strategy impacts on the obligation side of the debtors' balance sheets and statement of income, including variables such as borrowers' net worth, cash flow and liquid assets whilst the bank lending channel centres on the probable consequence of monetary policy arrangements on the number of credits by bank organizations. The majority of the studies on this subject area focused on the nexus between private sector credit and the money in circulation. However, to satisfy the curiosity of policymakers, this present study would want to confirm the reaction of private sector credit to monetary policy changes. The Nigerian financial system is controlled by the Country’s Monetary Authority whose responsibility is to vary and apply from time to time the appropriate monetary policy instrument to stabilize the economy. The issue of how it affects the bank credit to the private sector is what this study investigates.

Literature Review

Conceptual Review

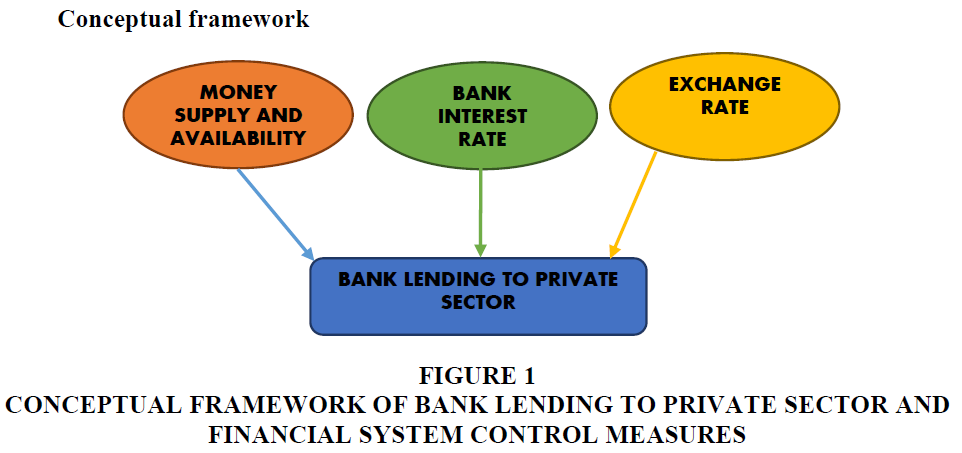

Every economy has a monetary arrangement that comprises established measures intended to transmute reserves into money-making ventures by directing resources in excess economic segments to sectors of the economy that have a shortage of resources for operations (Adeniyi et al., 2018). The financial system control is an authorized structure which has legal guideline and principles that determine the flow of financial resources as controlled by a country’s apex bank (Obadeyi et al., 2016). According to Jegede (2014), the banking industry is a subsystem of the financial system, which plays indispensable roles of carrying out the monetary policy measures in an economy (Figure 1). The apex bank in Nigeria determines bank lending transaction through the strict application of monetary policy tools such as exchange rate, interest rate and amount of money supply at a predetermined period. Therefore, monetary policy is essential in an economic environment and financial system of a nation to aid the operation of money deposit banks and other financial institution that have the legal authority to lend money to the private sectors. Economic strategy is a cautious mechanism of the financial powers of a nation to determine the magnitude, rate and accessibility of cash and credit. The aim is to attain favourite macroeconomic goals and maintain economic stability required internally and externally. The Central Bank of Nigeria executes this function by controlling the cost, quantity and worth of money in the economy to realize desired macroeconomic goals (Central Bank of Nigeria, 2011). Monetary policy is necessary to mitigate the effect of inflation by regulating money supply with the ultimate aim of preventing excess money in circulation (Akinjare et al., 2016; Omodero, 2020). Thus, the function of monetary authority is also to regulate the amount of money made available to the private sector through appropriate monetary policy mechanisms.

Figure 1 Conceptual Framework of Bank Lending to Private Sector and Financial System Control Measures

Theoretical Framework

The theory underpinning this study is the Credit Channel Theory. Credit Channel Theory was developed by Bernanke & Gertler (1995) as an outcome of empirical research which established that the accepted belief of the influence of monetary policy on GDP is not very robust. Credit Channel Theory emerged as a product of roughness of the market and private sector requirements for internal and external funding sources. The scrutiny of the connection between fiscal policy and productivity discloses that bank credit plays a substantial role in private sector operations (Olweny & Chiluwe, 2012). The usual variations in temporary interest rates the Central Bank allow, utilizing open-market functions adjusts the cost of capital, which eventually alters the fixed value of inventory and housing investments (Khan, 2011). The monetary policy influences the supply of money and the cost of lending the same to the private sector.

Khan (2011) corroborates the fact that the credit transmission channel explains why monetary policy affects the availability of bank loans for the firm's usage. Other scholars (Ezeaku et al., 2018) claim that interest rate channel and credit channel are transmission channels that predict the changes in banking invariably relies on monetary policy arrangements. Thus, banks are forced to comply with the requirements of the monetary policy, which sometimes make it difficult for smaller firms to access loans for more investments. Generally, in developed financial markets, firms have access to various springs of funding. The Nigeria situation is such that financial markets are not adequately established, and only big companies can borrow from foreign markets. At the same time, smaller firms only have access to domestic fund sources. The point to note is that private sector finances react to monetary policy through its interaction with the opportunities embedded in the economy.

Empirical Review

Olweny & Chiluwe (2012) used quarterly macroeconomic data from 1996 to 2009 to investigate the relationship between monetary policy and private sector investment in Kenya. The study employed co-integration testing and Error Correction Model to determine the short-run and long-run dynamic relationship. The research established that domestic debt and the Treasury bill rate had an inverse relationship with private sector investment. Emenike (2016) evaluated the type of connection existing between monetary policy and private sector credit. The study applied error correction model and granger causality test. The results indicated that the occurrence of a long term relationship between monetary policy and credit to the private sector. The findings further disclosed that the variations in credit to the private sector had a significant positive effect on changes in the monetary policy.

Adeniyi et al. (2018) examined the relationship between monetary policy and bank lending to the private sector in Nigeria. The study covered 1981 to 2016 and found that bidirectional relationship is existing between the monetary policy rate and bank lending. Further findings showed that monetary policy affected bank credit positively and significantly. Ezeaku et al. (2018) assessed monetary policy transmission and industrial sector growth from 1981 to 2014. The study employed Johansen Co-integration and the Error Correction Model as the econometric tools for analysis. The regression estimates revealed that the private sector credit, interest and exchange rates negatively affected real output growth both in the short and long terms.

Mahathanaseth & Tauer (2019) studied monetary policy transmission through the bank lending channel in Thailand from 2007 to 2016. The study found that retail interest rates increased the cost of bank lending, which was not commensurate with the returns. As a result, banks contracted their lending, which was found to be more intensive with smaller banks than the bigger ones. Ndigwe et al. (2020) used the ARDL and error correction model to examine the relationship between the monetary policy and credit availability to firms in Nigeria from 1986-2019. The study found that bank lending capacity had a significant negative relationship with private sector credit.

Material and Methods

Bank lending transaction and financial system control in an evolving economy is the focus of this research. The research shows the role of monetary policy in determining the extent of credit banks can allow for private sector operations and investments. Monetary policy instruments which are the independent variables applied for this study is the money supply, interest and exchange rates. The dependent variable is the bank credit to the private sector in Nigeria. The research made use of existing data of past events to determine the causality effect of monetary policy instruments employed on private sector credit. The research design is ex post facto because all the circumstances through which the data emanate from had already occurred. The study collected data on private sector credit and money supply from the Central Bank of Nigeria Statistical Bulletin, 2019 edition.

In comparison, the study also sourced data on the interest rate and exchange rate from the World Bank Economic Indicators. All data collected spanned from 1998 to 2019. The research made use of ordinary least squares regression technique to determine the effect of financial system controls on bank credit to the private sector. The study also performed diagnostic tests to establish the validity, normality and stability of the model specification.

Model Specification

The functional and econometric relationship between the dependent variable and the explanatory variables are explained in the equation below:

PBCR = f (MSPY, INTR, EXGR) ………………………………………………………. (1)

LOGPBCR=β0+β1LOGMSPY+β2LOGINTR+β3LOGEXGR+ε………………………..... (2)

Where:

PBCR = Private Sector Bank Credit

MSPY = Money supply;

INTR = Interest rate;

EXGR = Exchange rate;

β0 = Constant; β1-β3 = Regression coefficients; ε= Error term.

On the a priori, we expect; β1 > 0, β2> 0, β3 > 3.

Results and Interpretation

Diagnostic Tests for Validity and Stability

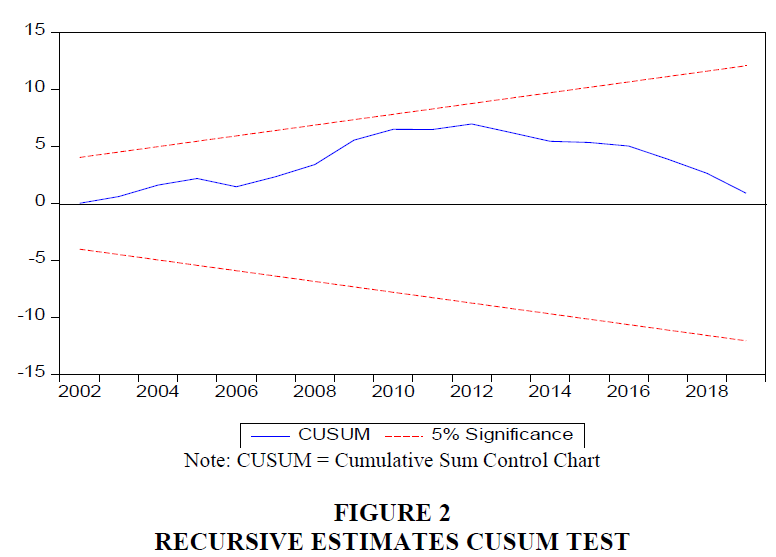

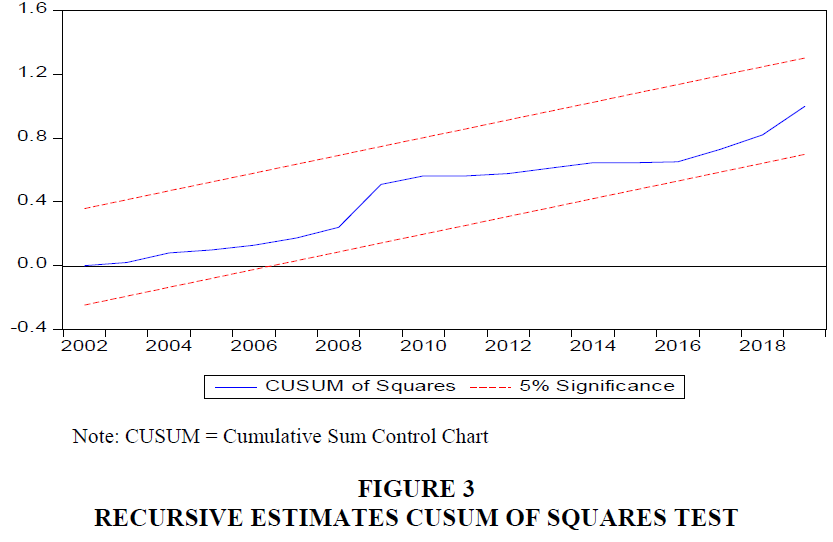

In this study, serial correlation occurrence if any tests using Breusch-Godfrey Serial Correlation Lagrange Multiplier (LM) Test as specified on Table 1 above. The result that the model applied in this study does not have a serial correlation. The result of Durbin-Watson of 1.78 confirms that there is an absence of autocorrelation in the model. The next check for Heteroskedasticity in Table 2 discloses that the study model is homoskedastic. Ramsey reset test is shown in Table 3. The results are appropriate and validate that our general findings are not misleading but useful for decision making and economic policies (Table 4). The p values of the t-test, F statistics, and the Likelihood ratio in Table 5 show that the null hypothesis that the model is suitably stated is accepted. Thus, there is no specification error in the model. The Cumulative Sum Control Chart (CUSUM) and CUSUM of Squares in Figure 2 & 3 provide further evidence that the model specified is stable and appropriate. That is, the graphs in Figures 2 & 3 show the stability of the model used for this study. The model stability is clarified with the blue line within the upper and lower bound red lines. The blue line appearing between the red lines, which are the boundaries of the 5% level of significance, reveals the appropriateness of the model and the stability of the data set. The result in Table 4 also indicates the absence of multicollinearity. The Variance Inflation Factors (VIF) of all the independent variables is below the value of 4, which implies that there is no inter-relationship among the explanatory variables.

| Table 1 Breusch-Godfrey Serial Correlation LM Test | |||

| F-statistic | 1.944988 | Prob. F(2,16) | 0.1753 |

| Obs*R-squared | 4.302642 | Prob. Chi-Square(2) | 0.1163 |

| Table 2 Heteroskedasticity Test: Breusch-Pagan-Godfrey | |||

| F-statistic | 0.464890 | Prob. F(3,18) | 0.7103 |

| Obs*R-squared | 1.582020 | Prob. Chi-Square(3) | 0.6635 |

| Scaled explained SS | 0.910210 | Prob. Chi-Square(3) | 0.8230 |

| Table 3 Ramsey Reset Test | |||

| Value | df | Probability | |

| t-statistic | 0.727287 | 17 | 0.4769 |

| F-statistic | 0.528947 | (1, 17) | 0.4769 |

| Likelihood ratio | 0.674086 | 1 | 0.4116 |

Source: Authors’ computation, 2020

| Table 4 Variance Inflation Factors | |||

| Variable | Coefficient Variance | Uncentered VIF | Centered VIF |

| MSPY_LOG | 0.000706 | 93.99495 | 2.164063 |

| INTR_LOG | 0.102150 | 1474.812 | 2.698250 |

| EXGR_LOG | 0.009482 | 346.8498 | 1.382586 |

| C | 0.345872 | 3155.167 | NA |

Source: Authors’ computation, 2020

| Table 5 Regression Result | ||||

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

| MSPY_LOG | 1.068187 | 0.071925 | 14.85135 | 0.0000 |

| INTR_LOG | 0.243412 | 0.365182 | 0.666551 | 0.5146 |

| EXGR_LOG | 0.094791 | 0.120466 | 0.786872 | 0.4429 |

| C | -0.882499 | 0.760150 | -1.160955 | 0.2627 |

| AR(1) | 0.646442 | 0.250824 | 2.577269 | 0.0203 |

| SIGMASQ | 0.001412 | 0.000873 | 1.616632 | 0.1255 |

| R-squared | 0.996429 | Mean dependent var | 3.648144 | |

| Adjusted R-squared | 0.995313 | S.D. dependent var | 0.643546 | |

| S.E. of regression | 0.044057 | Akaike info criterion | -3.155051 | |

| Sum squared resid | 0.031057 | Schwarz criterion | -2.857494 | |

| Log likelihood | 40.70556 | Hannan-Quinn criter. | -3.084955 | |

| F-statistic | 892.9294 | Durbin-Watson stat | 1.795969 | |

| Prob(F-statistic) | 0.000000 | |||

Source: Authors’ computation, 2020

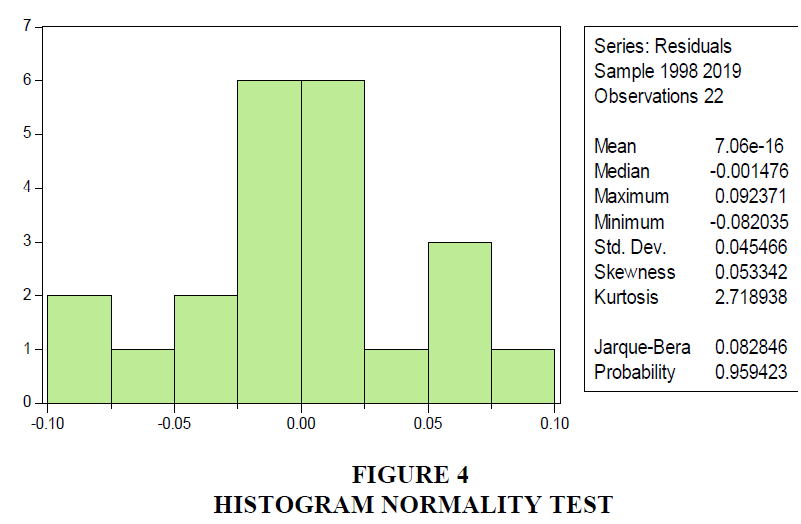

The histogram normality test presented in Figure 4 indicates that Jarque-Bera has a p-value of 0.96, which above 0.05 level of materiality. The result provides evidence that the series used in this study are normally distributed. The normality of the data distribution is confirmed by the result of the Kurtosis which is approximately 3 and the moderately positive Skewness of 0.053.

From the regression result displayed in Table 5, the correlation (R) representing the square root of R-squared is 99.8%. The value is very robust and signifies a stable relationship existing between financial system control tools and bank lending transaction. In other words, bank lending to private sector is 99.8% a function of the monetary policy adjustments from time to time. The R-squared is the coefficient of determination, and the value is 99.6%. The result implies that monetary policy determines 99.6% of the level of credit banks can make available for private sector investments and operations. However, other factors that are not considered in this model account for the remaining 0.4%. The Standard Error of regression is 0.04<1, suggesting that the regression line is free from error. This result denotes that the study forecasts and predictions are very accurate. The result is confirmed by the Durbin-Watson (DW) statistics which is approximately 2, implying the absence of autocorrelation. The stationarity of data is also established as the DW > R2. From the regression result in Table 5, F-statistic has the value of 892.93 while the p-value is 0.00 < 0.05.

The result shows that the model is statistically significant and suitable for this study. It is also an indication that the independent variables jointly affect the private sector credit.

The t-statistic is applied to test how each independent variable affects the response variable. Thus, the regression result in Table 5 indicates that the t-statistic of money supply (MSPY_LOG) is 14.85, while the p-value is 0.00 < 0.05. This result discloses that money supply favourably and significantly affects bank lending to the private sector. The result confirms the findings of Adeniyi et al. (2018). The interest rate t-statistic is 0.67 with a p-value of 0.51; the exchange rate is 0.79, with a p-value of 0.44. Both the interest rate and the exchange rate are insignificant in explaining the effect of monetary policy on private sector credit for the period covered by this study.

Conclusion and Recommendations

This study examined the extent to which financial policy instruments affect bank lending to the private sector. The study covered a period from 1998—2019. The findings revealed that money supply significantly and positively impacts on credits banks make available to private sector. The interest and exchange rates were favourable but had an immaterial influence on the personal sector credit. However, the apex bank of the country determines bank lending capacity through monetary policy manipulations. The interest can increase or decrease, likewise the money supply and other devises. These variations significantly affect the amount of money available for banks to lend to private firms for their operations. The policy issue is that money supply should remain under strict control while ensuring sufficient circulation. The interest and exchange rates have always been an issue of concern which the apex should ensure the instability is minimized to accommodate and expand bank lending transactions.

Acknowledgement

The authors highly appreciate the open access support of this paper by Covenant University Ota, Ogun State, Nigeria.

References

- Adeniyi, A.M., Kayode, A.K., Salawudeen, O.S., & Fagbemi, T.O. (2018). Monetary policy and Bank credit in Nigeria: A Toda-Yamamoto Approach. Acta Universitatis Danubius Œconomica, 14(5), 717-735.

- Akinjare, V., Babajide, A.A., Isibor, A.A. & Okafor, T. (2016). Monetary policy and its Effectiveness on economic development in Nigeria. International Business Management, 10(22), 5336-5340.

- Bellalah, M., Ali, S. A., & Masood, O. (2013). Sensitivity analysis of domestic credit to private sector in Pakistan: A variable replacement approach application with con-integration. THEMA (THéorie Economique, Modélisation et Applications), Université de Cergy-Pontoise.

- Bernanke, B.S., & Gertler, M. (1995). Inside the black box: the credit channel of monetary policy transmission. Journal of Economic perspectives, 9(4), 27-48.

- Central Bank of Nigeria. (2011). Understanding Monetary Policy Series no 1: What is Monetary Policy? Abuja: CBN Publishers.

- Emenike, K.O. (2016). How does monetary policy and private sector credit interact in a developing economy?. Intellectual Economics, 10(2), 92-100.

- European Central Bank. (2011). The supply of money bank hehaviour and the implications of the Monetary analysis. Monthly Bulletin October.

- Ezeaku, H.C., Ibe, I.G., Ugwuanyi, U.B., Modebe, N.J., & Agbaeze, E.K. (2018). Monetary policy transmission and industrial sector growth: Empirical evidence from Nigeria. Sage Open, 8(2), 2158244018769369.

- Gopalan, S., & Rajan, R. S. (2017). Does foreign bank presence affect interest rate pass-through in emerging and developing economies?. Journal of Macroeconomics, 54, 373-392.

- Jegede, C.A. (2014). Effects of monetary policy on the commercial banks lending in Nigeria. Review of Public Administration and Management, 3(5), 134-146.

- Khan, M.S. (2011). The design and effects of monetary policy in Sub-Saharan African countries. Journal of African Economies, 20(suppl_2), ii16-ii35.

- Mahathanaseth, I., & Tauer, L.W. (2019). Monetary policy transmission through the bank lending channel in Thailand. Journal of Asian Economics, 60, 14-32.

- Mamman, A., & Hashim, Y.A. (2013). Impact of private sector credit on real sector of Nigeria. International Journal of Business and Social Research, 3(5), 105-116.

- Ndigwe, C., Omankhanlen, A.E., Isibor, A., OkafoR, T., Ehikioya, B.I., & Uzoma, A.B. (2020). Financial systems theory and control of finances: Policy initiatives for access to finance in Nigeria.

- Nwakanma, P.C., Nnamdi, I.S., & Omojefe, G.O. (2014). Bank credit to the private sector: Potency and relevance in Nigeria’s economic growth process. Accounting and Finance Research, 3(2), 23-35.

- Obadeyi, J.A., Okhiria, A.O. & Afolabi, V.K. (2016). Evaluating the impact of monetary policy On the growth of emerging economy: Nigerian experience. American Journal of Economics, 6(5), 241-249.

- Olweny, T., & Chiluwe, M. (2012). The effect of monetary policy on private sector investment In Kenya. Journal of Applied Finance & Banking, 2(2), 239-287.

- Omodero, C.O. (2020). Capital market response to monetary policy shocks: Evidence from Nigeria. Academy of Accounting and Financial Studies Journal, 24(3), 1-11.

- Rasheed, M.A. (2011). The relationship between money and real variables: Pakistan’s experience. Pakistan Business Review, 7(1), 715-724.