Research Article: 2022 Vol: 21 Issue: 2S

Bank Loan and Its Role in Real Investments in the Economy of the Russian Federation

Fiapshev Alim Borisovich, Financial University under the Government of the Russian Federation

Kumekhov Konstantin Kolumbievich, Moscow State Institute of International Relations (University) of the Ministry for Foreign Affairs of Russia (Odintsovo branch)

Petrovskaya Maria Vladimirovna, Peoples’ Friendship University of Russia

Keywords

Investments, Non-Financial Sector of the Economy, Bank Lending To Non-Financial Organizations

Citation Information

Borisovich, F.A., Kolumbievich, K.K., & Vladimirovna, P.M. (2022). Bank loan and its role in real investments in the economy of the Russian federation. Academy of Strategic Management Journal, 21(S2), 1-12.

Abstract

Introduction: Low investment in the real sector of the Russian economy is associated with insufficient performance of bank loans.

Methods: When performing the study, the methods of generalization, deduction, induction, synthesis, comparison, measurement, evaluation were used.

Results: The relationship between the volume of bank lending to non-financial organizations, their investments and innovative activity is weak.

Discussion: The role of bank loans in stimulating investment is constrained by factors that go beyond the monetary sphere for the most part.

Summary: A gap was recorded in the development of the banking system and the non-financial sector of the Russian economy. The increase in loan investments in the economy is not a factor in its growth and overcoming inequality. Solving these problems requires accelerating structural and institutional transformations and forms the basis for increasing the impact of bank loans on economic and investment dynamics.

Introduction

Investments of business entities are an important factor in economic growth. Bank lending has traditionally been the main resource for this activity of non-financial organizations. This conditionality also takes place in emerging markets, but it is often aggravated by the factors that accompany the emergence of these markets. In this part, there are both general factors that manifest themselves in different countries in different ways, as well as specific ones, due to the national characteristics of the sectoral and territorial structure of the economy, implemented economic practices, the quality of market institutions, and the effectiveness of public administration. These and other circumstances can have a restraining effect on the role of bank loans in supporting macroeconomic and investment dynamics, and this often does not directly affect the state of the banking system, the volume of lending operations of its institutions.

In this regard, the assessment of the role of bank loans in increasing opportunities for the development on a sustainable and balanced basis, formed mainly by the growth of investment activity, seems to be an urgent task. And not only in terms of fixing the greater or lesser importance of this form of loan in solving the problems of the modern Russian economy. It is also important from the standpoint of identifying the factors constraining the effectiveness of this tool, searching for possible solutions to neutralize them in order to give a bank loan the role in solving investment problems, which it is designed to play in full accordance with the purpose of the banking business in a modern market economy.

Literature Review

A considerable number of studies have been devoted to the theoretical understanding of the role of loans, most of which are based on the message that this role is incorrect and inadmissible to confuse this role with one of the forms of the analyzed phenomenon. The immutability of this setting does not diminish the importance of assessments built in relation to certain types of loans. At the same time, with all this in the economic literature, the role in relation to loans is most often defined as the value, importance of its presence and functioning in the system of economic relations. Often this role is interpreted as a force, the corresponding influence on socio-economic processes, which in turn often leads to the fact that the role of loans is interpreted as a result of its functioning. This understanding of the role of loans has certain grounds, given that the result appears as a product, the receipt of which is connected with the implementation of any actions. In this interpretation, the role of loans is considered from the quantitative side, mainly from the position of its place in the sources of capital formation of economic entities. At the same time, this role should be considered not as a result of the functioning of loans, but as its purpose in the economy. This formulation shifts the focus in the analysis of loans and their role from “an event that has already occurred – the actual use of loans, to the preliminary stage of loan processes, to find out what it should be used for” (Lavrushina, Travkina & Knorus, M., 2020). Ignoring such a statement, both in assessing the loan practice of banks and the activities of the regulator, carries the threat of the one-sided presentation of the role of loans, mainly from the position of the place of corresponding operations in the activities of loan institutions. In order to prevent it, it is recommended to include relative values, indicators of the development of those areas, in which, in fact, the loan is oriented, in assessing the quantitative parameters of the mentioned operations (Lavrushina, & Knorus, 2013). This is a non-financial sector, investments of organizations of which constitute an undoubted factor of economic growth and sustainable development on a socially oriented basis.

The issue of the role of banks and their lending operations in solving problems of economic development has always remained in the focus of relevant studies. At the same time, these studies focused on studying the factors of development of banking systems that contribute to ensuring financial stability. In this part, it is necessary to highlight foreign studies carried out on the example of European countries (Athanasoglou, Brissimis, Delis 2008; Lozano-Vivas & Pastor, 2010; Lozano-Vivas, Pastor & Hasan, 2001; Lozano-Vivas, Pastor & Pastor, 2002), Japan (Altunbas, Liu, Molyneux & Seth, 2000), China (Berger, Hasan & Zhou 2009). The increase in the efficiency of loan institutions, expressed in such indicators as the structure of the bank’s assets and liabilities, the quality of bank risk management, the capital of banks, etc., was associated with the factors of the macro environment. Russian authors were not aloof from the process of popularizing this research area. A number of works are devoted to the analysis of the factors accompanying the development of Russian banks, their infrastructure, and their influence on the results of their activities (Mamonov & Vernikov, 2015; Mamonov M., Akhmetov, Pankova, Solntsev, Pestova & Deshko, 2018; Ponomarenko & Sinyakov, 2018; Styrin, 2005; Fiapshev & Afanasyeva, 2019). Most of these studies are focused on the problems of the banking system, the effectiveness of its institutions, factors of their stability, the provision of which is considered as one of the conditions for sustainable development of the economy. But this stability on the part of the banking system is also achieved by massive loan support for the investment process. This meaningful setting of regulatory practice, implemented by a set of tools that stimulate financial institutions to such support, is often obscured by the grounds fixed in the legislative regulation of the functional of monetary authorities. In addition, the underdevelopment of market institutions, the short duration of traditions of conducting economic activities on a market basis, are accordingly reflected in the priorities in the choice of regulatory instruments.

In these conditions, priority is often given to direct, administrative methods used in the budget and tax process. At the same time, indirect methods and tools affecting the motivation of potential participants in the investment process are assigned a repaired role.

These circumstances provoke the instability of investment and, as a result, macroeconomic dynamics. They also subordinate the loan process in banks to opportunistic considerations within the framework of the established restrictions to ensure financial stability. And in itself, this attitude is not a flaw in their activities within the limits beyond which a pronounced dichotomy is formed in the dynamics of the financial and real sectors of developing economies. In these conditions, the problem of identifying the factors that hinder the effectiveness of the generally recognized tools for enhancing the investment process, which include a bank loan, becomes urgent. The solution to this problem should be considered as an important condition for ensuring stable and balanced economic dynamics.

Materials and Methods

The objectives of the study required the involvement of materials related to the problem areas of investment activity, its quantitative and qualitative parameters, as well as a bank loan. The first part contains data on macroeconomic dynamics, investment activity, and its quantitative and qualitative parameters. The choice of these data was dictated by the need to assess macroeconomic dynamics and compare with the scale and pace of investment activity. The second block of materials used is presented by information on the state and dynamics of development of the sphere of bank lending. The linkage of the materials involved in the analysis is implemented by comparing investment dynamics and the growth rate of bank lending. Separately, a regional cut of individual indicators for bank lending was calculated and presented in order to demonstrate regional gaps in the corresponding indicators.

In this work general methods of scientific knowledge were used. The questions underlying the analyzed problems, having both a general nature (macroeconomic dynamics, investments) and a sectoral one (the sphere of bank loans), determined the logic of the study – from general questions to specific ones. The conclusions on the latter were in confirmation or correction of the previously formulated estimates. In the analysis of statistical material, empirical research methods were used – observation, comparison and assessment.

Results

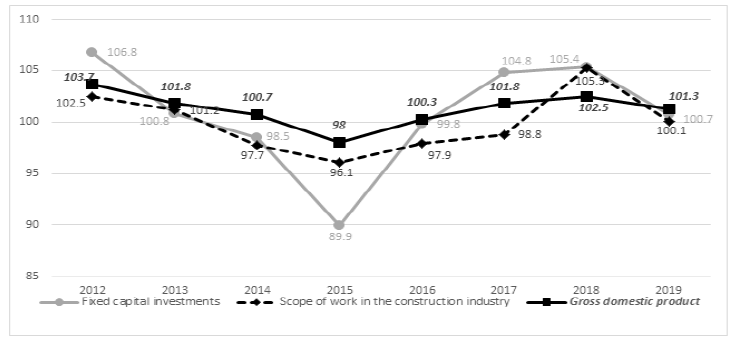

Today, the organizations of the non-financial sector of the Russian economy satisfy a significant part of the needs for investment resources at their own expense. This was facilitated by the insufficient availability of loans, which has remained for a long time and is taking place now, despite a noticeable improvement in the price situation. Figure 1 shows the dynamics of the gross domestic product, indicators of investment in fixed assets and the volume of work performed in the type of “Construction” activity in comparable prices. Indicators for the construction industry were not chosen by chance, they are often considered as indicators of the quality of economic dynamics. Investments and, partly, construction grew at a faster pace than GDP, but at the end of the analyzed period their damping dynamics was also expressed. The increase in these indicators that has taken place cannot be qualified as sufficient for economic growth, and qualitative for the stability of the latter. In essence, this growth was ensured by the active use of budgetary funds, at the expense of which well-known large-scale projects, including those of an infrastructure nature, were implemented. The loan mechanism was assigned a peripheral role in this part. At the same time, real investments, as well as the volume of construction work in all conditions, are most often supported by loans. At the same time, in some years there were obvious and impressive failures caused by various shocks, usually of external origin, but each time demonstrating the vulnerability of the national economy and obvious defects in its structure. The sectoral cut of these indicators demonstrates that their insignificant growth is provided mainly by an increase in investments of budgetary origin.

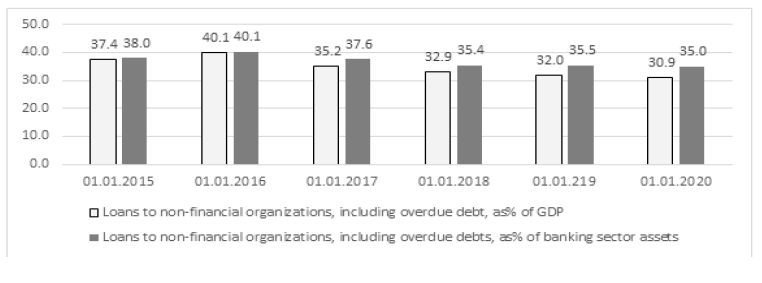

In terms of the share of loans in GDP and banking sector assets, the Russian banking sector shows a significant lag behind many countries. The data presented in Figure 2 show that lending to the non-financial sector has not recovered and it is still far from pre-crisis values. Although its absolute volumes are increasing, it is inferior in terms of the dynamics of lending to individuals. The reorientation of banks’ loan policy is clearly visible, which, however, does not mean an increase in the role of loans in a particular area, but only indicates that they are actively looking for more promising niches for their active operations.

Figure 2: Loans To Non-Financial Organizations In% Of Gdp And Assets Banking Sector

Source: Bank of Russia

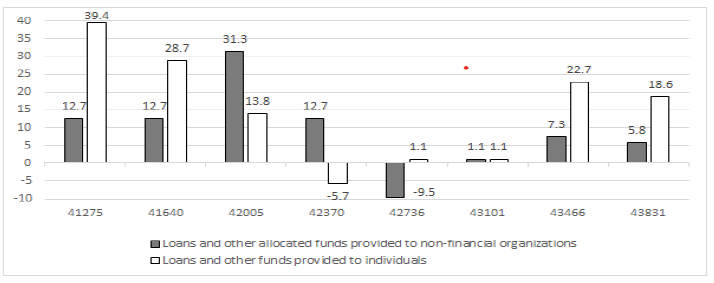

At the same time, in Russia, about 60-70% of the loan portfolio of banks falls on loans to legal entities and bank lending in general is growing at a significant rate (Figure 3). There was a noticeable failure in 2015-2016, when almost all macroeconomic indicators sagged due to political and economic shocks and changes in the price situation on foreign energy markets. Nevertheless, bank lending to the population and the non-financial sector is growing more significantly than GDP and investment. It can also be seen that a significant expansion of the loan activity in relation to the population does not act as a stimulating factor in the economic and investment activity of non-financial organizations through a possible increase in consumption.

Figure 3: Growth Rates Of Loans Provided By Banks To The Population And Non-Financial Organizations, %

Source: Bank of Russia

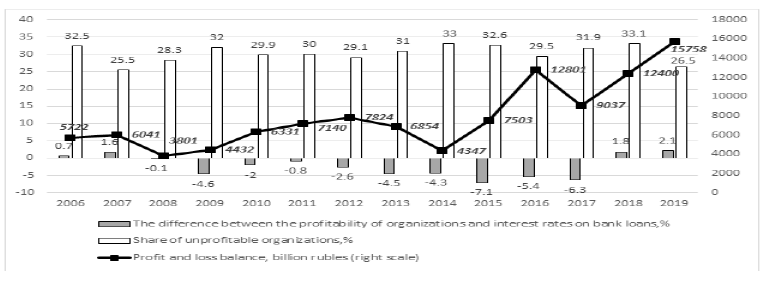

Insufficient availability of loans for non-financial organizations, including for making investments, is confirmed by the continuing gap in terms of profitability of goods, products, works, services sold and weighted average interest rates on bank loans extended to them for more than 1 year (Figure 4). Although the value of this ratio entered the positive zone in 2018-2018, it is still not enough for a large-scale increase in investment activity with the use of a bank loan.

Figure 4: Changes In Individual Indicators Characterizing The Development Of Non-Financial Organizations Of The Russian Economy (Excluding Small Businesses)

Sources: Rosstat, Bank of Russia

Figure 4 also draws attention to the dynamics of the share of unprofitable enterprises and absolute indicators of the balance of profits and losses of non-financial organizations. Changes in the share of unprofitable enterprises are insignificant, while it is clear that profits have increased almost threefold. Such a gap indicates defects in the sectoral structure of the Russian economy, which are expressed in the conservation of the size of the unprofitable sector, which mainly covers industries with an existing and potentially high level of competition, as well as the presence of obvious oligopolistic signs in the industries that form the current architecture of economic growth in the Russian Federation. In other words, the insignificant growth is provided by a few business organizations. The softening of the interest rate policy of the Bank of Russia in recent years, the measures it received to support banks and their borrowers during the pandemic did not significantly contribute to an increase in the role of loans in the development of the non-financial sector. As a result, macroeconomic dynamics does not receive significant investment impulses for its acceleration. Moreover, these impulses until recently came mainly from the budget system. Loan instruments were assigned an essentially subordinate role; their effectiveness was largely constrained by the strict policy of the regulator in all areas from decisions on the key rate to supervisory practice.

In the structure of investments of business entities, investments in fixed assets naturally prevail. Financial investments, having increased more than three times over the past 10 years, retain an insignificant share in the investments of organizations in the non-financial sector of the Russian economy. At the same time, the dynamics of financial investments in the past five years has been much more uneven than the dynamics of investments in fixed assets. It is obvious that this kind of activity, being not quite typical for organizations in the non-financial sector, was basically determined by the same speculative motive. At the same time, bank deposits dominated in the structure of these investments. By the end of 2019, their share approached 45%. Moreover, within the framework of the latter, an insignificant part (less than 1%) was made up of long-term investments. In the total volume of financial investments of organizations throughout the entire period, the share of short-term financial investments was at the level of 90%. The noticeable prevalence of short-term investments in the structure of financial investments, with the exception of investments in stocks, shares, etc., indicates an opportunistic motive in the respective activities of non-financial organizations. All these investments in their overwhelming volume, on the one hand, cannot be qualified as a sustainable resource for subsequent redistribution for investment purposes, and on the other hand, they can be regarded as the presence of significant obstacles, including non-economic properties, for the real investment of these funds by the economic entities themselves.

In general, investments in non-financial assets are markedly dominated by investments in fixed assets (Table 1). The share of investments for innovative purposes is extremely insignificant, which indicates the quality of the positive macroeconomic dynamics that have taken place in recent years. The same circumstance gives quite clear ideas about the possibility of improving this quality in the foreseeable investment perspective.

| Table 1 The Structure Of Investments In Non-Financial Assets, In% Of Total |

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | |

| Investments in non-financial assets, total | 100 | 100 | 100 | 100 | 100 | 100 | 100 | 100 | 100 | 100 |

| Fixed capital investments | 98.7 | 98.4 | 98.2 | 98.7 | 98.5 | 97.7 | 98.7 | 98.6 | 98.9 | 98.8 |

| Investments in intellectual property | 0.4 | 0.5 | 0.5 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| R&D costs | 0.4 | 0.4 | 0.5 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Investments in other non-financial assets | 0.5 | 0.7 | 0.7 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Investments in non-produced non-financial assets | 0.0 | 0 | 0.0 | 1.3 | 1.5 | 2.3 | 1.3 | 1.4 | 1.1 | 1.1 |

The share of investments allocated for reconstruction and modernization in the total volume of investments has been steadily decreasing for more than a decade. The same trend took place in the dynamics of the share of investments in machinery, equipment, etc. in the amount of investments that were used for modernization and reconstruction. The increase in the volume of bank lending to non-financial organizations did not lead to changes in the structure of their investments. The innovative orientation of the latter was and remains poorly expressed.

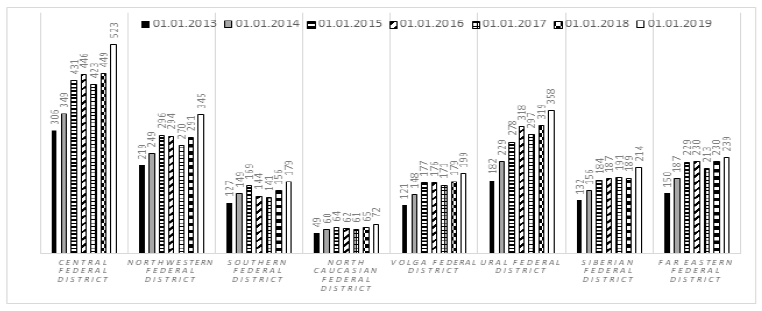

Since 2014, a significant decrease in the number of loan institutions has been observed in the Russian banking system. How this practice of the national regulator affects the availability of bank loans for business organizations, including meeting their investment needs, is a separate problem. Although, it is obvious that it fits into the general set of circumstances that restrain the investment process. At least, the optimization of the relevant business processes in banks, interpreted by the regulator as a result of this practice, is not a factor that softens the restrictions imposed on real investments in the Russian economy. This is evidenced by the data presented above. The mentioned changes in the institutional saturation of the Russian banking system mainly affected its regional segment. And in this regard, it is important to assess how the shifts in the territorial distribution of banks affected the role of loans in the development of regions, at the level of which the main driving force of the national economy is actually taking shape. On closer inspection, this effect is minimal. This is evidenced by the estimates presented by the domestic regulator in the form of a set of indices characterizing the availability of banking services in the regional context (Report on the development of the banking sector and banking supervision (2018); The main directions of the unified state monetary policy for 2020 and the period of 2021 and 2022). At the same time, the indicators calculated by us for loans provided to non-financial organizations and individuals per person living in each of the federal districts indicate significant regional discrepancies and at least their conservation at a fairly high level (Figure 5).

Figure 5: Loans And Other Allocated Funds Provided To Resident Organizations And Individuals ? Residents, Thousand Rubles For 1 Person

Source: Authors’ calculations

The regional dynamics of these indicators is approximately the same across all Russian territories. But, it should be borne in mind that the regions in this movement are repelled by a different quantitative base, largely due to the more global gaps that characterize the extreme heterogeneity of the socio-economic situation in them. Investment opportunities of economic entities in the overwhelming number of regions do not change against the background of growth in the quantitative indicators of bank loans. Most often, they are decreasing, which provokes a further increase in gaps in the development of regions.

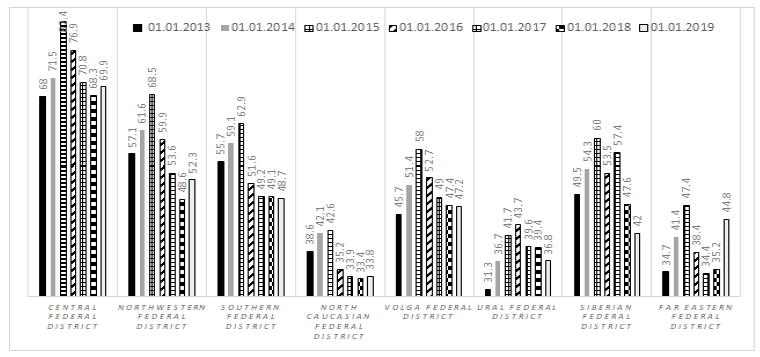

The data in Figure 6, characterizing the dynamics of the indicators of loans to the non-financial sector and individuals, reduced to the values of the district indicators of the gross regional product, complement the picture of regional discrepancies in the indicators of the volumes of basic services provided by banks. The existing situation can be explained by the immanence of regional gaps for a large and extremely heterogeneous in many, not only economic, aspects of the country, its traditional polarization, often considered as the result of a long-supported irrational and narrow economic specialization of individual territorial entities. And at the same time, the conclusion that the increase in the lending activity of banks does not in the slightest affect the mitigation of the severity of the problem of territorial asymmetry is obvious. In this part, a bank loan, along with the undoubted priority of financial equalization, must be considered among the tools for smoothing the analyzed imbalances.

Figure 6: Loans And Other Allocated Funds Provided To Resident Organizations And Individuals ? Residents In% To Grp

Source: Authors’ calculations

At the same time, it is clear that the dynamics in the federal districts is relatively synchronized. This was predetermined by the development of the macroeconomic situation, the well-known external shocks in relation to it, which affected the entire domestic financial market. It is noteworthy that by the beginning of 2019 the values of the presented territorial indicators had barely returned to the pre-crisis period. If we take into account that the institutional field of the banking system has been substantially cleared during the entire past time, then the conclusion that the vacated market niches were successfully occupied by large and partly other regional banks is confirmed. And for the most part the values of the gaps remain; it indicates the insufficient effectiveness of the efforts of these banks to expand these niches or their weak motivation to do so.

The indicators, reduced to the GRP values, show the extreme spread across the country of the possibilities of a bank loan in solving a set of situations that arise in a particular territory. It can be seen that territorial lags are not decreasing; they constitute an integral feature of modern Russian reality. The investment opportunities of the territories, if not decreasing, are conserved at a level that does not allow coping or minimizing the consequences of the socio-economic depression. Under the current conditions, it is natural that measures of direct government influence on economic processes are considered as priority ones. Budget financing essentially replaces the tools inherent in the regulation of processes in a balanced and institutionally consistent market environment.

At the same time, the effectiveness of these measures is limited by the circumstances accompanying the practices of operating with budgetary funds that have already become traditional for domestic reality. And in this part – in regional development, the stability and balance of which is determined by the investment opportunities of territorial agglomerates, the problem of increasing the role of loans should also be considered in conjunction with problems of a more general order, which enclose the need for solutions in the field of institutional modernization and the formation of a favorable investment climate throughout the entire and a heterogeneous territorial layer of the national economy. It is clear that in view of the latter circumstance, the dynamics and scale of these decisions will be different in different geographical points of the Russian Federation, which does not negate their need and active advancement along this path in order to overcome the gaps in the level of development of numerous Russian territories.

Discussion

The development of emerging market economies has common features that are well studied and structured. For the most part, they are predetermined by the peculiarities of the transitional stage in the evolution of their economic structures. Moreover, this transition is carried out from different starting conditions accompanying this transformation. But despite this, these features are expressed in underdeveloped and often weak market institutions, inefficiency of public administration, expressed in well-known and often ingrained practices of making economic, political, administrative, judicial and other decisions, etc. These circumstances hinder the effectiveness of indirect methods and instruments of state influence on socio-economic processes, aimed at liberating the motivation of participants in the same investment process. In such conditions, bank loans, being the object of predominantly indirect influence of the monetary authorities, occupies a subordinate position to the understandable methods of a directional nature; they are considered in not very mature political and economic conditions. These conditions are inevitably superimposed on a complex of specific national characteristics that arise from various spheres of social life, from the economy with its structure and deep-rooted economic practices to the traditions of resolving contradictions, etc. Often these features burden the transitional transformation, do not make it possible to reach a stable and progressive dynamics markets. A similar influence is typical for Russia. The measures taken by the monetary authorities to solve the problem of stimulating investment are not enough. The softening of their policies does not create sufficient incentives in volume and quality for an investment breakthrough.

The growth of the Russian economy today is mainly provided by outdated economic structures, the conservation of which is enhanced by the low efficiency of public administration, institutional instability, and lagging behind in regional development. Stimulation of investment activity is carried out mainly with the use of funds of budgetary origin. At the same time, the resource and financial basis of the corporate sector is distributed extremely unevenly throughout the sectoral and territorial sections of the domestic economy. The restrictions imposed on external borrowing and access to technological innovations in foreign markets together with the conservation of the sectoral and territorial structure of the economy make a breakthrough in a significant build-up of the above-mentioned basis. More problematic in these circumstances are the prospects for a large-scale transfer of the economy to innovative development rails.

The analysis of the role of bank loans in supporting the investment process has shown its multidimensionality. Its solution is not limited to a quantitative aspect and involves the need to influence many factors accompanying the functioning of the national economy, including factors of a non-economic nature. Among the most important measures that can ensure the effectiveness of solving this problem are the following:

- Reorientation of the budgetary and tax process and the ongoing monetary policy towards a large-scale reduction of restrictions on the growth of the resource and financial potential of economic organizations. The authors are talking about loan expansion while maintaining control over inflationary risks. Revision of the priorities in the policy of budgetary expenditures, unloading their unproductive part without prejudice to the traditional areas of human capital formation, in parallel with the creation of significant tax impulses for the investment process and the activation of innovative activities;

- Improving legislation and increasing the effectiveness of law enforcement practice in the field of protecting the interests of owners and shareholders of companies. Significant progress in this direction will strengthen investment motives, including foreign participants in the relevant process. This measure is regarded as a key one in the development of the institutional environment, within which economic and investment activity is carried out, and its implementation will be associated with an increase in the resource base of sustainable, balanced and socially oriented development;

- Increasing the efficiency of public administration and privatization of economic objects owned by the state. These essentially different measures are combined into one block of measures, since the denationalization of the economy relieves the state apparatus and can contribute to the growth of its effectiveness in key areas of activity, the meaning and list of which have been developed by the best foreign practices. These measures are considered as an important condition for expanding the private sector of the Russian economy, increasing the investment attractiveness of its industries and territorial agglomerates and, accordingly, more involvement of loan resources in the investment process;

- Development of mechanisms blocking the processes of increasing territorial depression, including and mainly through the implementation of the principles of budgetary federalism in order to improve the quality of state and municipal governance, reorientation of the economic vector of lagging regions, which in the new conditions will show more significant potential in the production of investments, in including with the use of the loan mechanism.

Conclusion

Over the past decade, multidirectional trends have been observed in the Russian economy. Its significant growth, due to a number of reasons associated with economic and political shocks external to it (the latter eventually had pronounced economic consequences), was replaced by a protracted stagnation, which naturally caused a deterioration in the social situation. Investment for the Russian economy in its current capacity is seen as a decisive factor in its growth. However, the Russian economy, in contrast to the economies of other emerging market countries, has a number of peculiarities, which are expressed in the insufficient effectiveness of certain instruments for regulating economic, and in particular investment, processes.

In the course of the analysis, the synchronization of macroeconomic dynamics and changes in the quantitative indicators of investments in the real sector of the economy was recorded. This background is superimposed on the low quality of expanded reproduction supported by Russian enterprises, in which its innovative orientation is poorly expressed. At the same time, the volumes of bank lending to non-financial organizations and the population, with the exception of certain years, grew at an increasing pace. This was noticeably promoted by the unprecedented easing of the monetary policy of the Bank of Russia in comparison with the previous stages of economic development. At the same time, bank loans did not become a factor in the growth of the Russian economy, an increase in investments in its real sector. The socio-economic situation in the country as a whole shows indifference to the expansion of the sphere of bank loans.

The calculation of indicators characterizing the regional aspect of the development of the banking sector has shown that significant gaps between Russian regions persist. The regional cross-section of the problem seems to be important due to the fact that it is at the level of a specific territorial agglomeration that investment activity is initiated and developed, which also has a significant quantitative dispersion between numerous Russian territories. This cut is also important because a progressive and steady increase in investment activity, which ensures the growth of the entire economy, is possible when this activity manifests itself throughout the territorial layer of the national economy.

The insufficient role of bank loan in supporting investment, therefore, is constrained not so much by its volume as by factors that lie outside the monetary sphere. Today, a significant part of resources of loans origin are directed by enterprises not for investment purposes, but for the purpose of covering the cash gap in their financial flows. At the same time, investments of an innovative orientation, as the authors have shown, occupy an insignificant part in their total volume. The increase in lending to the population does not lead to any significant increase in consumption, which could stimulate production and investment. The only exceptions are certain segments of the loan market, in particular mortgages. In general, over the past few years, consumer loan has been the driver of growth in lending to the population, its functionality being reduced to replenishing the shortfall in income of Russian citizens.

The increase in the role of bank loans in the socio-economic development of the country and support of the investment process is not associated solely with its volume and the softening of loan conditions. The effectiveness of this instrument is constrained by a combination of macroeconomic circumstances and non-economic factors, which actually preserve unfavorable conditions for investments. The latter today is mainly carried out through the use of budgetary resources provided as part of the implementation of program mechanisms with the broad participation of development institutions. These tools are important, especially at the stages of imperfect market institutions. But, as these institutions mature, they must replace these centralized ways to support the investment process. It seems that while in Russia there is an underestimation of this conditionality, as well as the importance of market mechanisms for stimulating investment activity. As long as this situation persists, as long as there is incompleteness in the institutional and structural transformations, which were mentioned above, it will be difficult to achieve a breakthrough in solving the investment problem with the use of such a traditional instrument for the market economy as bank loans.

References

Athanasoglou, P.P., Brissimis, S.N., & Delis, M.D. (2008). Bank-specific, industry-specific and macroeconomic determinants of bank profitability.Journal of International Financial Markets, Institutions and Money, 18(2), 121–136.

Altunbas, Y., Liu, M.H., Molyneux, P., & Seth, R. (2000). Efficiency and risk in Japanese banking. Journal of Banking & Finance, 24(10), 1605–1628.

Berger A.N., Hasan I., & Zhou M. (2009). Bank Ownership and Efficiency in China: What Will Happen in the World’s Largest Nation?. Journal of Banking & Finance, 33(1), 113–130.

Fiapshev, A.B., & Afanasyeva O.N. (2019) Factors of development of the banking system of russia and accounting of their coherence when forecasting its short-term prospects. Journal of Advanced Research in Dynamical and Control Systems, 11(02), 476-488.

Lavrushina, O.I., Travkina, E.V., & Knorus, M. (2020). Loan relations in the modern economy: Monograph, 354.

Lavrushina, O.I. & Knorus, M. (2013). The role of loans and the modernization of banks’ activities in the field of lending: Textbook / team of authors; ed. O. I. Lavrushina. - 2nd ed., Erased. - M .: KNORUS, 2013 .-- 272 .

Lozano-Vivas A., & Pastor J.T. (2010). Do Performance and Environmental Conditions Act as Barriers for Cross-Border Banking in Europe?. Omega, 38(5), 275–282.

Lozano-Vivas A., Pastor J.T., & Hasan I. (2001). European bank performance beyond country borders: What really matters?. European Finance Review, 5(1– 2), 141–165.

Lozano-Vivas A., Pastor J.T., & Pastor J.M. (2002). An efficiency comparison of european banking systems operating under different environmental conditions. Journal of Productivity Analysis, 18(1), 59–77.

Mamonov M., & Vernikov A.V. (2015) Bank ownership and cost efficiency in Russia, Revisited. Working papers by Bank of Finland Institute for Economies in Transition. Series DP «BOFIT Discussion Papers» No. 22/2015.

Mamonov, M., Akhmetov, R., Pankova, V., Solntsev, O., Pestova A., & Deshko, A. (2018). Search for the optimal depth and structure of the financial sector in terms of economic growth, macroeconomic and financial stability. Money and Loans, 3, 89-123.

Ponomarenko A., & Sinyakov, A. (2018). The impact of strengthening banking supervision on the structure of the banking system: Conclusions based on agent-based modeling. Money and loans, 1, 26-50.

Report on the development of the banking sector and banking supervision in 2018 [Electronic resource].

Styrin K. (2005). What Explains Differences in Efficiency Across Russian Banks? M.: EERC. P. 1–29.

Received: 22-Nov-2021, Manuscript No. asmj-21-9224; Editor assigned: 25- Nov -2021, PreQC No. asmj-21-9224 (PQ); Reviewed: 11- Nov -2021, QC No. asmj-21-9224; Revised: 18-Dec-2021, Manuscript No. asmj-21-9224 (R); Published: 06-Jan-2022