Research Article: 2021 Vol: 20 Issue: 3

Bankruptcy Risk of Shariah Banks in Indonesia

Erick, Universitas Brawijaya

Ubud Salim, Universitas Brawijaya

Nur Khusniyah Indrawati, Universitas Brawijaya

Sumiati, Universitas Brawijaya

Abstract

The aim was to examine the effect of performance, liquidity, governance, and moderation of deposit insurance rates on bankruptcy risk in shariah banking in Indonesia. This research was conducted on shariah book II banks operation in Indonesia by taking samples of shariah banks' quarterly financial reports on website www.ojk.go.id for the period 2014-2019. This study found that variable Operating Expenses to Operating Revenue (OEOR) influences the bankruptcy risk of shariah banking in Indonesia, while return on assets, and net income margin do not affect the bankruptcy risk in shariah banking. Liquidity as measured by financing to deposit ratio does not affect the bankruptcy risk of shariah banking. Shariah banking governance as measured by the GCG rating does not affect the bankruptcy risk of shariah banking. The deposit insurance rate (DIR) as moderation weaken the effect of operating expenses to operating revenue on bankruptcy risk in shariah banking.

Keywords

Shariah Banking Performance, Liquidity, Governance, Bankruptcy Risk, Indonesian Shariah Banking.

Introduction

Muslims are the majority population (87.2%) in Indonesia (www.indonesia.go.id, 2019). Therefore, Muslims economic empowerment needs shariah-based institutions. The shariah banking system must comply with the banking system principles and risks mitigation. The Islamic Bank of South Africa went bankrupt in 1997 due to liquidity problems and bad bank management (Rahman & Zada, 2016; ). However, there are several factors the shariah bank was not hit by the financial crisis, one of them not exposed to foreign exchange.

Shariah banks have grown since the establishment until 2019 to become 14 banks. However, June 2018 showed the market share of shariah financial reached 8.47% or the equivalent of US $83.62 billion of Indonesia's total financial assets (Financial Services Authority, 2018). Gunawan Yasni, a member of National Shariah Council of Indonesian Ulema Council (DSN-MUI) confirmed that the market share of shariah banking in early 2019 fell below 6% (Novika, 2019).

This lower market share due to inability of shariah banks to compete with conventional banks. This was reflected in lower performance of shariah banking compared to conventional banking. Business Director of Bank Negara Indonesia Shariah stated that profitability of shariah banks is lower than conventional banks due to higher operation costs. In addition, funds cost was relatively higher than conventional banks.

The operations of shariah banks are influenced by other conventional bank interest policies (Natalia et al., 2014; Mifrahi, & Tohirin, 2017) and interest rates of Bank Indonesia (Iskandar & Firdaus, 2014). This shows that macro policy on bank interest rates set by the government, either the Bank Indonesian (BI) interest rate or LPS’s Deposit Insurance Rate (DIR) affects the financial performance of shariah banks, which in principle do not use interest in their operations.

The market share of shariah banks is not growing, and the performance continues to slow down. It indicates a lower ability of shariah banks with the potential cause uncertainty regarding the ability of the bank to continue its operation activities, which brings shariah banks closer to bankruptcy risk (Lesmana, 2003).

The indication of lower performance can be seen from the company operation income to cover the company's operational costs. The operation income of a shariah bank that insufficient to cover operational costs indicates that shariah banking failure and leading to bankruptcy (Brigham & Houston, 2001).

This research aims to examine the effect of performance, liquidity and governance on bankruptcy risk in shariah banking in Indonesia. Deposit insurance rates (DIR) become moderation the effect of operating expenses to operating revenue on bankruptcy risk. This research novelty is the first research to examine shariah bank bankruptcy in Indonesia moderated by the deposit insurance rate.

Literature Review

Financial Service Authority (OJK) has the authority to determine the status of bank supervision. This has been regulated in OJK Regulation Number 15/POJK.03/2017 on the Determination of status and follow-up of commercial bank supervision. The bank under intensive supervision or a bank under difficulties that endanger the continuity of a business should meets one or more of criteria below.

1. Capital Adequacy Ratio (CAR) is lower than 8%; and/or

2. The Minimum Statutory Reserves (MSR) in rupiah is less than the ratio set for MSR in rupiah that must be fulfilled by banks and based on OJK assessment.

A bank is experiencing bankruptcy or approaching bankruptcy if Capital Adequacy Ratio (CAR) is below the provisions set by the OJK and/or the bank fails to comply with the statutory reserve requirements. This research is focused on indication of bankruptcy if the CAR ratio is below OJK regulations. Afiqoh & Laila (2018) found financial performance as measured by the variable Capital Adequacy Ratio, Financing to Deposit Ratio, Leverage, Bank Size, Loan to Asset Ratio, and Return on Asset had a simultaneous effect on bankruptcy risk. Hidayat & Firmansyah (2016) showed that trend of Altman Z Score from 2010 to 2015 tended to decline. This indicates that without significant improvement, the shariah banking will become bankrupt. The liquidity and performance factors have a positive effect on potential bankruptcy.

Financial ratios and liquidity had a significant effect on early warning of shariah bank bankruptcy, but the Good Corporate Governance (GCG) variable had no effect. Damayanti et al. (2014) found that liquidity has a significant negative effect on capital. Meanwhile Putri (2018) found that liquidity had no significant effect on probability of potential bankruptcy of Shariah Commercial Banks in Indonesia. Yastynda & Murni (2016) found that shariah banking governance does not have a significant effect on probability to predict financial distress at shariah banks. Putri (2018) also found that shariah banking governance has no effect on early warning of bankruptcy.

The above studies showed that shariah banking governance has no effect on bankruptcy risk of shariah commercial banks in Indonesia. It is moderation with the general premise of world banking that bad governance can lead to bankruptcy (Lu & Chang, 2009). Based on above descriptions above, the hypotheses can be formulated below.

H1 Higher performance will decrease the bankruptcy risk.

H2 Higher liquidity will increase the bankruptcy risk.

H3 Better shariah banking GCG will decrease the bankruptcy risk.

The proxy measure performance is Return on Assets (ROA), Net Income Margin (NIM), and Operating Expenses to Operating Revenue (OEOR). Therefore, hypotheses for each proxy are below.

H1a Higher return on assets will decrease the bankruptcy risk.

H1b Higher net income margin will decrease the bankruptcy risk.

H1c Higher operating expenses to operating revenue will decrease the bankruptcy risk.

Ferdian Satyagraha, Finance Director of Bank Jatim stated that biggest effect of higher interest rates affect on funds cost of bank. The funds cost will erode the bank's Net Income Margin (NIM) (Kartika, 2018). The relationship between NIM and deposit interest was also stated by the Deposit Insurance Corporation (Laucereno, 2018).

There are many researches examine the relationship between NIM and ROA (Bilian & Purwanto, 2014; Marginingsih, 2018; Suci, 2019; Almaskati et al., 2021) and relationship between profitability and capital (Damayanti et al., 2014; Yokoyama & Mahardika, 2019; Fatimah, 2013; Primary, 2016; Putri, 2018). These studies proved that deposit insurance rate affects on profitability and capital/bankruptcy risk. Therefore, the hypothesis can be stated below.

H4 Higher performance will decrease the bankruptcy risk moderated by the deposit insurance rate.

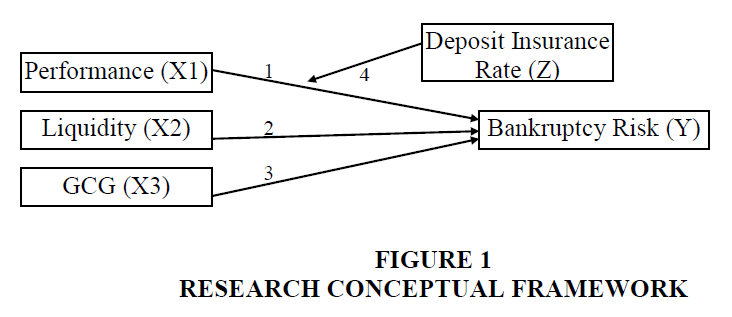

Based on background, literature review, and hypotheses formulated, Figure 1 shows the research conceptual framework.

Methodology

This research uses a quantitative approach with inferential statistical methods to test a population based on sample. This test aims to prove to accept or reject research hypotheses. This research uses panel data as a combination of time series and cross section data. Time series data is financial ratios of ROA, NIM, OEOR, FDR, GCG rating, DIR, and CAR. The cross section data is 7 shariah banks in BUKU II category: Bank BCA Syariah, Bank BNISyariah, Bank BRI Syariah, Bank Mega Syariah, Bank Muamalat Indonesia Tbk, Bank Panin Dubai Syariah Tbk, and Bank Tabungan Pensiunan Nasional Syariah Tbk.

Data was collected by documentation, namely by collecting Bank Indonesia Banking Reports and Indonesian Banking Statistics issued by the Financial Services Authority (OJK) quarterly for 6 years.

Output testing is done to panel data as combination of cross-section data and time series data. If the efficiency of estimator is considered more important than unbiased and consistent under the conditions of heteroscedasticity, then the GLS estimation model is appropriate. There are two basic forms of GLS estimation model, namely transforming the basic data analysis and applying the Ordinary Least Square (OLS) model to the transformed data. There are 6 outputs that will be re-tested for the moderation variable.

Results and Discussion

The samples are 7 shariah banks and divided into quarterly reports in 2014-2019 periods. Therefore, the data panel has 168 observational data. Diverse data distribution can cause heteroscedasticity and auto correlation. Therefore, the panel data model uses GLS, where the application will automatically use GLS and sort data (Greene, 2008). The output summary is shown in Table 1

| Table 1 Output Summary | ||||||

| Variables | Output 1 | Output 2 | Output 3 | Output 4 | Output 5 | Output 6 |

| ROA | 1.152** | |||||

| NIM | -0.601** | -1.809 * | ||||

| OEOR | -0.339** | -0.366** | -0.387* | -0.316** | ||

| FDR | 0.427** | 0.486** | 0.394** | |||

| GCG | -5.522** | -4.445** | -4.941 ** | |||

| DIR | 3.372** | |||||

| DIROEOR | 0.004** | |||||

| R-sq | 0.754* | 0.280** | 0.661** | 0.788* | 0.769* | 0.844* |

Effect of Performance on Bankruptcy Risk

Table 1 show that none of return on assets, net income margin, and operating expenses to operating revenue variables are significant to bankruptcy risk if combined with liquidity variables and governance variables.

Damayanti et al. (2014) and Yokoyama & Mahardika (2019) showed that performance has a significant positive effect on bank capital. Similarly, Fatimah (2013); Pratama (2016) and Putri (2018) concluded that performance has a negative and significant effect on probability of potential bankruptcy of Shariah Commercial Banks in Indonesia. There is a strong relationship between performance and capital or the bankruptcy risk. The relationship between these variables is supported by a good level of significance. However, the coefficient of NIM is negative, namely 1.809. It provides anomalous information because NIM is a function of income at shariah bank. The negative NIM coefficient is not consistent with bank financial theory and conventional accounting mechanisms. Therefore, performance variable with the NIM proxy is rejected.

The correlation between the performances proxied by OEOR on bankruptcy risk is significant. It shows performance proxied by OEOR determines the bankruptcy risk of shariah banks. The high influence of OEOR on bankruptcy risk of shariah banks indicates that shariah banks operate with high levels of cost. Therefore, OEOR is a very significant variable in relation to bankruptcy risk of shariah banks.

Effect of Liquidity on Bankruptcy Risk

The liquidity is proxied by loan to funding ratio (LFR) or known as the financing to deposit ratio in shariah banking. The bank with FDR above 92% has a higher bankruptcy risk. Table 1 shows that FDR does not significantly affect the bankruptcy risk. There are various explanations regarding this FDR. Damayanti et al. (2014) and Yokoyama & Mahardika (2019) stated that liquidity has a significant negative effect on capital. Meanwhile, Putri (2018) concluded that liquidity has no significant effect on probability of potential bankruptcy of Shariah Commercial Banks in Indonesia.

The inconsistent findings relate with the liquidity variable affect capital not in a linear form. Good liquidity can obtain optimum results. Regulation in PBI Number 17/11/PBI/2015 stated that optimum liquidity of FDR is 78% to 92%. Furthermore, grouping of FDR level of each bank during the 2014-2019 periods per quarter is stated normal for FDR range of 78% to 92%, Low category for FDR below 78%, and High category for FDR above 92 %.

There are 10% of shariah banks has low category. 51% of shariah banks in High category, and 39% of shariah banks have Normal category. Data distribution shows that shariah banking has FDR in high category. None of shariah bank during the 2014-2019 periods did not exceed the FDR standard (78% to 92%). It indicates that FDR has no effect on bankruptcy risk.

Effect of Governance on Bankruptcy Risk

The findings show GCG rating has insignificant effect on bankruptcy risk. These findings are unusual because banking governance in general and shariah banking is specifically established and enforced to minimize the risk of fraud and ensure the bank operations at a healthy level.

Lu & Chang (2009); Fatmawati et al. (2020) and Almaskati et al. (2021) showed that corporate governance can predict financial distress. Adversely, Lu & Chang (2009); Yastynda & Murni (2016) showed that shariah banking governance had insignificant effect on the probability to predict financial distress in Shariah Banks. Putri (2018) also found that shariah banking governance has no effect on early warning of bankruptcy.

The inconsistent relationship between governance and bankruptcy risk shows the GCG ratings do not reflect the true quality of governance. The GCG assessment is done by the bank management itself. It will have a subjectivity and bias potential because the management wants create good bank's image.

The Effect of Performance on Bankruptcy Risk Moderated by the Deposit Insurance Rate

The test of performance variable with OEOR proxy to determine the effect of moderation variable with the deposit insurance rate proxy on bankruptcy risk is not significant. The deposit insurance rate is not significant to OEOR proxy and bankruptcy risk because during the 2014-2019 periods, deposit insurance rate was well maintained by the Government at a low level between 5.75% to 7.75%. The 2% difference in deposit insurance rates does not affect the performance of shariah banking. Therefore, even though the deposit insurance rate affects the preferences of customers save, this does not significantly affect the bankruptcy risk.

Conclusion

The results of this study indicate conclusions below.

1. The performance of shariah banking as indicated by operating expenses to operating revenue increases the bankruptcy risk of shariah banking.

2. Liquidity management as measured by financing to deposit ratio does not affect the bankruptcy risk of shariah banking.

3. Shariah banking governance as measured by the GCG rating does not affect the bankruptcy risk of shariah banking.

4. The deposit insurance rate (DIR) becomes moderation potential (homologous potential). DIR does not moderate operating expenses to operating revenue on the bankruptcy risk.

This research has some limitation that should be improved. First, the samples are limited to shariah bank in Indonesia. Future research can collaborate the shariah bank from other country with Islam become majority. Second, the analysis is limited to moderation; future research can use mediation analysis to examine the direct and indirect effect of the variables.

References

- Afiqoh, L., & Laila, N. (2018). The effect of financial performance on the risk of bankruptcy of islamic commercial banks in Indonesia (Modified Altman Z-Score Method for the 2011-2017 Period). Journal of Islamic Economics and Business, 4 (2), 166-183.

- Almaskati, N., Bird, R., Yeung, D., & Lu, Y. (2021). A horse race of models and estimation methods for predicting bankruptcy. Advances in Accounting, 52, 100513.

- Brigham, E., & Houston, J.F. (2001). Financial management II. Jakarta: Salemba Empat.

- Damayanti, R.K., Sujarwo, & Ichsan, T. (2014). Effect of Profitability and Liquidity on Capital Adequacy at PT Bank Syariah Mandiri 2009-2014 Period. Accounting Journal, (2012), 416-423.

- Fatimah, S. (2013). Effect of profitability, efficiency and liquidity on capital adequacy of islamic commercial banks. Al-Iqtishad: Journal of Islamic Economics, 6(1), 42-58.

- Fatmawati, D., Ariffin, N.M., Abidin, N.H.Z., & Osman, A.Z. (2020). Shariah governance in Islamic banks: Practices, practitioners and praxis. Global Finance Journal, 100555.

- Greene, W.H. (2000). Econometric analysis 4th edition. International edition, New Jersey: Prentice Hall, 201-215.

- Hidayat, I.P., & Firmansyah, I. (2016). Prediction Analysis of Potential Islamic Bank Bankruptcy in Indonesia.

- Iskandar, D., & Firdaus, I. (2014). The influence of interest rates, inflation, and rupiah exchange rate on mudharabah deposits and conventional bank deposits in indonesian banking. Journal of Economics and Social Affairs , 2 (3), 336-344.

- Kartika, H. (2018). Because the cost of funds rose, the NIM of banks was shrinking. Retrieved from https://keuangan.kontan.co.id/news/gara-gara-biaya-dana-naik-nim-perbankan-menyusut

- Laucereno, S. F. (2018). High BI interest decreases bank net interest income. Retrieved December 9, 2019, from https://finance.detik.com/moneter/d-4273295/bunga-bi-tinggi-bikin-pendapatan-bunga-bersih-bank-turun

- Lesmana, R. (2003). Guidelines for assessing performance for companies Tbk, foundations, BUMN, BUMD, and other organizations (Pert Edition). Jakarta: Elex Media Komputindo.

- Lu, Y.C., & Chang, S.L. (2009). Corporate governance and quality of financial information on the prediction power of financial distress of listed companies in Taiwan. International Research Journal of Finance and Economics, 32(1), 121-139.

- Marginingsih, R. (2018). Factors affecting the profitability of islamic commercial banks in Indonesia. Jurnal Ecodemica, 2(1), 74-85.

- Natalia, E., Dzulkirom, M.A., & Mangesti, S.R. (2014). The influence of sharia bank time deposit profit sharing rate and commercial bank deposit interest rate on mudharabah deposits. Journal of Business Administration, 9(1), 1-7.

- Novika, S. (2019). The market share of Islamic banking in the first quarter of 2019 fell. Retrieved April 30, 2019, from https://www.alinea.id/bisnis/market-share-perbankan-syariah-kuartal-i-2019-turun-b1XeF9j1v

- Pratama, R. (2016). Analysis of the influence of financial ratios to predict financial distress conditions for islamic commercial banks using the LOGIT model in Indonesia. STIE Perbanas, 1-17.

- Putri, A.A. (2018). Analysis of risk based bank rating (RBBR) proxy variables on the potential probability of islamic commercial bank bankruptcy. Journal of Economics and Business, 1-23.

- Rahman, S.U., & Zada, N. (2016). The bankruptcy of an islamic financial institution: A case study of islamic bank limited (IBL). Tahdhib Al Afkar The Bankruptcy of an Islamic Financial, 2(1), 41-53.

- Suci, D.P. (2019). Pengaruh car, npl, nim, bopo dan ldr terhadap profitabilitas perbankan di indonesia yang terdaftar di bei periode 2014-2017.

- Yastynda, E.P., & Murni, N.S.I.M. (2016). Prediksi financial distress pada bank umum syariah dengan analisis risk profile, good coporate governance, earnings and capital. Journal of Economics and Finance, 1-6.