Research Article: 2020 Vol: 19 Issue: 4

Bond Market Development in Bangladesh: Capacity Building, Challenges and Policy Initiatives

Shafiqul Hassan, Prince Sultan University

Md. Anowar Hossain Bhuiyan, National University Bangladesh

Md. Abud Darda, National University Bangladesh

Md. Belal Hossain, China Three Gorges University

Md. Wahidul Habib, ASA University Bangladesh

Abstract

Development of Bond Market is pre-requisite not only for development of capital market, but also for development of economy of any country. Unfortunately, the size and maturity level of bond market of Bangladesh is much debased compared to other neighboring countries of South Asia. The objective of this study is to make an investigation of the challenges, opportunities and related issues of bond market in Bangladesh and also make a critical analysis of policy initiatives of bond market development. The study is based on secondary data obtained from various sources. The study revealed that the corporate bond market of Bangladesh is still very small and the dominating role of banking sector in corporate finance is inevitable. Interest rates on government bonds are repressed and government yield curve is not able to highlight the actual level of risk free rates in the economy, inflation scenarios and other macroeconomic circumstances. It is also revealed that Islamic bond issued for shorter tenures to promote domestic Islamic financial institutions. Bangladesh government should initiate necessary regulations so that the foreign and domestic investors feel encouraged for more investment in bond market. Bangladesh bank should regularly publish the reports on bond market including the information on debt securities and money market.

Keywords

Bond, Capital Market, Bangladesh, Policy, Risk Free, Islamic Finance.

Introduction & Literature Review

Financial market is considering as symbol for supporting economic growth and financial stability in a country. Financial market encourages the people for saving and optimal use of capital which ensure successful flow of money in economy. It provides capital for government, private sector and public sector. The capital market of a country develop on the basis of own characteristics, culture, history, and legal framework to continue common economic growth (Hossain, 2012).

Every country is giving proper attention and providing necessary support to domestic financial market for ensuring financial stability and well-beings. In this aspect, it is important to understand the policy intervention of local bond market and its impacts on financial market structure. Hardie & Rethel (2019) addressed that three important stakeholders namely government, international investors and domestic financial actors are related to develop bond market in a country. Government commitment to the adequate movement of capital and acceptance level of foreign currency deposits is helpful for developing the strong bond market. Again, government invests in bond to control and ensures profitability in capital market. International investors give emphasize on liquidity of government bond for market development (Hardie & Rethel, 2019).

The big economy country like China has highlighted bond market to attract international investors in recent years (Livingston et al., 2018). The price increment of government bond makes market balance and inherits positive impact for undertaking market development (Andritzky, 2012). Mu et al. (2013) addressed that bond market helps to finance in government deficits, maintain economic stability, infrastructure development, and provide capital for long-term growth. The domestic actors for influencing the bond market are banks, pension, mutual and hedge funds.

Bond market integration focus on the co-movement aspects of bond returns. Several researchers (For instance, Piljak, 2013; Bunda et al., 2009; Yang & Hamori, 2014) have analyzed the co-movement dynamics of bond returns. Piljak (2013) pointed that macro-economic features and monetary policy can more influence rather than global forces to the bond market of a country. Bunda et al. (2009) identified that external factors are emerging into the bond market during the financial crisis period of a country. Moreover, Yang & Hamori (2014) revealed that short-term interest rates are less capable for bond market integration rather than long-term interest rates.

Lee (2020) addressed that the investors in capital market usually consider the factors related to default risk and loss. Again, bond spreads also influence by default risk, recovery value and firm level risk. Bhattacharyay (2013) addressed that bond market helps the economy of a country during financial collapse situation and diversified financing at corporate level. Moreover, bond market increases financial efficiency of the country (Mihaljek et al., 2002), generates finance for long-term (Aman et al., 2019) and enhances credit expansion and tend of exchange rates (Mu et al., 2013). Furthermore, bond market can attract foreign capital to reduce investment uncertainty (Burger & Warnock, 2007), develop financial infrastructure for the country (Aman et al., 2020) and convert the savings into investments to recover the economic crisis (Bhattacharyay, 2013).

The strong and effective bond market development in a country is based on some factors such as stable government, effective fiscal and monetary policy, update and efficient regulatory procedures for tax and duties, and liberalized financial system (Hossain, 2012). Misir et al. (2010) addressed some pre-requisites elements for bond market development in a country. The pre-requisites are- well-functioning market, suitable opportunities for investors, diversified intermediaries, market infrastructure, monetary policies, risk management system, market participants.

Bond markets in most of the Asian countries are weak due to lack of proper regulations, failure to develop long-term funds, and unpredictable demand (Aman et al., 2020). In this circumstance, Burger & Warnock (2006) emphasized on government legislation to protect investors’ rights and Fidora et al. (2007) pointed on stable inflation rate for strong bond market development. Hossain (2012) identified that weak regulations and market infrastructure, limited number of investors, capital gain, alternative sources of debt financing, illiquid assets in secondary market, underdeveloped tax system, high interest rate, cheap syndicated loans, default on interest payment, high inflation, and limited private management of pension fund are significant barriers to develop bond market in Bangladesh. Again, Mortaza & Shadat (2016) addressed that the obstacles for bond market development in Bangladesh are- high issue cost, high cost of trading, high interest rate in government borrowing, high interest rate in saving, and absence of alternative financial instruments. Akter et al. (2019) found that some important factors like risk and return factor, government policy, liquidity, management factor, and investment policy are related for weak range of bond market in Bangladesh.

The usefulness of bond market is crucial for any country to understand the actual return and potential portfolios of investors (Bekti? & Regele, 2018). Some previous studies (for instance, Misir et al., 2010; Jahur & Quadir, 2010; Hossain, 2012; Mortaza & Shadat, 2016; Akter et al., 2019) have been addressed several aspects of bond market in Bangladesh from various viewpoints. Misir et al. (2010) and Hossain (2012) addressed some pre-requisites for bond market development in Bangladesh. Jahur & Quadir (2010) identified the government dominance for bond market development in Bangladesh. Moreover, Mortaza & Shadat (2016) revealed the obstacles for bond market and Akter et al. (2019) pointed the important factors for bond market development in Bangladesh. Therefore, it is necessary to understand the challenges for bond market development in Bangladesh and identify the requirements/suggestions for capacity building as well as formulating policy initiatives.

The present study makes an investigation of the existing bond market scenario and identifies the challenges, opportunities and capacity building issues of bond market development in Bangladesh. Discussion has been made on the existing corporate bond market, government bond market and Islamic bonds. Capacity of bond market in Bangladesh has been compared to some selected neighbouring countries of South Asia. Some policy guidelines are given in the conclusion section.

Methodology

The study is a descriptive research initiative in nature. It uses empirical data and existing literature based on extensive search from various sources. Secondary data from Bangladesh Bank, annual reports of various commercial banks and financial companies in Bangladesh are also investigated. Relevant information available in research articles, research reports and working papers have been organized and consulted in this study.

Discussion

Compared to the neighboring countries, the bond market in Bangladesh is smaller and playing inadequate role in economy. The bond market development is still remaining at an initial stage in the country. This market not yet flourishes due to lower participants, limited base market, and non-diversified products. The types of bond depend on options, rate, provisions, conversion etc. Most of the portions of bond market have dominated by government securities in Bangladesh. Approximately, 30 percent of the domestic savings in the country go to treasury debt instruments which are dominated by government (Jahur & Quadir, 2010).

Asian Development Bank (ADB) and the Government of Bangladesh (GOB) have been following two types’ interventions- market stabilization and sustainable market development for enhancing the role of capital market in the economy. This initiative is pursuing under a program namely ‘Third Capital Market Development Program of the Asian Development Bank’ to enhance the capacity of capital market with strong legal and regulatory framework. ADB has been allocated USD of 250 million for this program with 26 policy actions under the four outputs- market stability, market facilitation, supply measure, and demand measure (ADB, 2015).

By the year 2016, about 221 treasury bonds, eight debentures and three corporate bonds (perpetual corporate bond by Islami Bank, 25% convertible bond of BRAC bank and ACI 20% convertible zero-coupon bond) have been traded in the country’s capital market.

Corporate Bond Market

The corporate bond market is very small in Bangladesh due to dominating role of banking sector in corporate finance. There are shortcomings like diversifying debt instruments and absence of proper guidelines for bonds and debentures in Bangladesh. These are creating obstacle for corporate bond market development.

Bangladesh Capital Market Development Master Plan identified that high level of interest rates are consisting with the corporate bonds. The other constraints for corporate bond market development in Bangladesh are changing circumstances of market conditions, long delay in registration process, and high cost of issuance and lack of market awareness (SEC, 2012). Yoshitomi & Shirai (2001) revealed that the success of corporate bond market depend on relationship between corporate and banking sector, rules and regulation of financial market and proper protection to investors. There are mentionable advantages are remaining in an economy and financial system due to corporate bond market. These advantages are source of capital, investment opportunities, and lower cost of capital, reduce risks during the crises period of banking sector, pressure to reduce bank interest rates, and encourage the companies for corporate citizenship (Sharma, 2001; Yoshitomi & Shirai, 2001).

At present, there are only three corporate bonds operating in Bangladesh. These are- Mudaraba Perpetual Bond issued by Islami Bank Bangladesh Ltd. (IBBL), BRAC Bank Convertible Bond, and ACI Zero-coupon Bond. Tables 1-3 represents the basic information of issuing corporate bonds in Bangladesh.

| Table 1 Basic Information of Mudaraba Perpetual Bond | |

| Features | Description |

| Name | Islami Bank Bangladesh Limited |

| Issuing Year | 2007 |

| Issue Size: Private placement | BDT. 1500 million |

| IPO (Initial Public Offerings) | BDT. 1500 million |

| Total | BDT. 3000 million |

| Face value/ Par value | BDT. 1000 |

| Term | Perpetual |

| Maturity | No maturity period |

| Cash Dividend | 10.34% (Profit rate-2017) |

| Credit Rating | MPB has been rated A+ Credit Rating Information and Services Limited (CRISL) |

| Table 2 Basic Information of Brac Bank Convertible Bond | |

| Features | Description |

| Name | BRAC Bank Limited |

| Issue Size | BDT 300 million |

| Issuing Year | 2011 |

| Face Value/ Par Value | Tk. 1000 |

| Paid-up Capital | Tk. 2850.15 million |

| Market Lot | 1 |

| Interest Floor | The interest Margin plus the Reference Rate will be set at 12.50% (The Interest Floor) at all times. |

| Latest Cash Dividend status (%) | 3.09% (interest rate on 2017) |

| Table 3 Basic Information of Aci Zero-Coupon Bond | |

| Features | Description |

| Name | ACI Limited |

| Issuing Year | 2010 |

| Total Issue Size | BDT. 1.34 million |

| Issue Price | BDT. 3,743.00 |

| Face value | BDT.5,000.00 |

| Market lot | 5 |

| Discount rate | 10.5% |

| Mode of Issue | 60% Private placement and 40% Public Offer |

| Maturity | 5 years with yearly redemption |

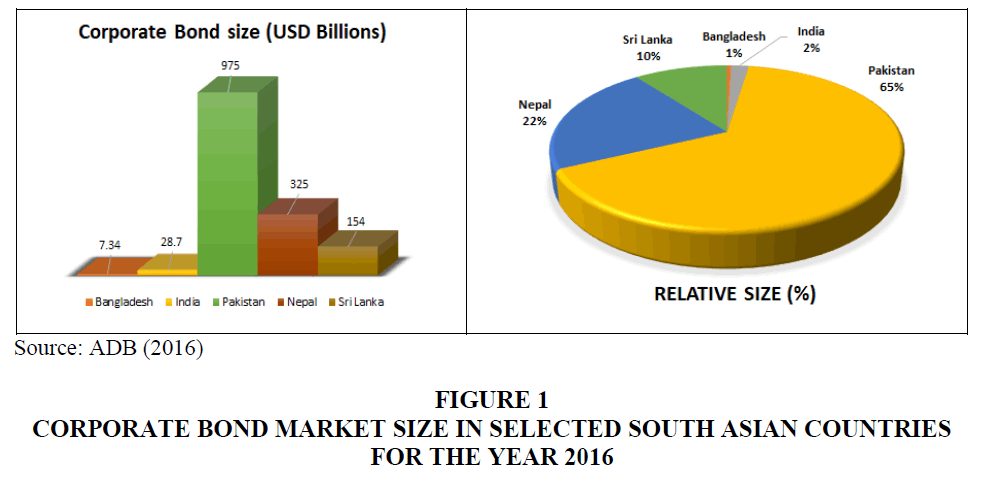

Figure 1 shows the corporate bond market size (USD billion) and relative size (%) of corporate bond market for the five South Asian countries for the year 2016. The smallest size of corporate bond market is remaining in Bangladesh (7.34 USD billion) and relative size of this market is the least (Approximately 1% only) among the five countries (Figure 1).

Government Bond Market

Government of Bangladesh (GOB) issues Special Bonds, Treasury Bonds, and Treasury Bills to cover in financing budget deficit for government cash position unaffected. Moreover, Bangladesh bank, the central bank of the country maintains a pretty cash account namely ‘Ways and Means Advance’ (WMA). The GOB borrows money first from WMA then from Treasury Bills (Hossain, 2012). Bangladesh Capital Market Development Master Plan revealed that interest rates on government bonds are repressed and government yield curve is not able to highlights the actual level of risk free rates in the economy, inflation scenarios and other macroeconomic circumstances. The financial institutions are bound to purchase government bonds at a lower rate than market-determined yield (SEC, 2012). Blommestein (2017) identified that some indicators are responsible for liquidity problems in government bond market. These indicators are increased market volatility, lower turnover, and trade size reduction, lower number of investors, higher yields, trade fails, and price-gapping.

Table 4 reveals the monthly data on trading of government bonds for the period July’2018 to June’2019. The monthly turnover amount is showing fluctuate level of amount. During the showing period, highest amount of turnover is showing in the month of December’2018.

| Table 4 Monthly Data on Trading of Government Bonds | ||

| Sl. | Month | *Turnover (Tk. In Million) |

| 1. | July, 2018 | 16,947.20 |

| 2 | August, 2018 | 13,920.00 |

| 3 | September, 2018 | 9,414.60 |

| 4 | October, 2018 | 16,894.40 |

| 5 | November, 2018 | 10,072.00 |

| 6 | December, 2018 | 44,006.20 |

| 7 | January, 2019 | 17,956.40 |

| 8 | February, 2019 | 8,700.00 |

| 9 | March, 2019 | 2,509.60 |

| 10 | April, 2019 | NA |

| 11 | May, 2019 | 1,478.00 |

| 12 | June, 2019 | 41,199.80 |

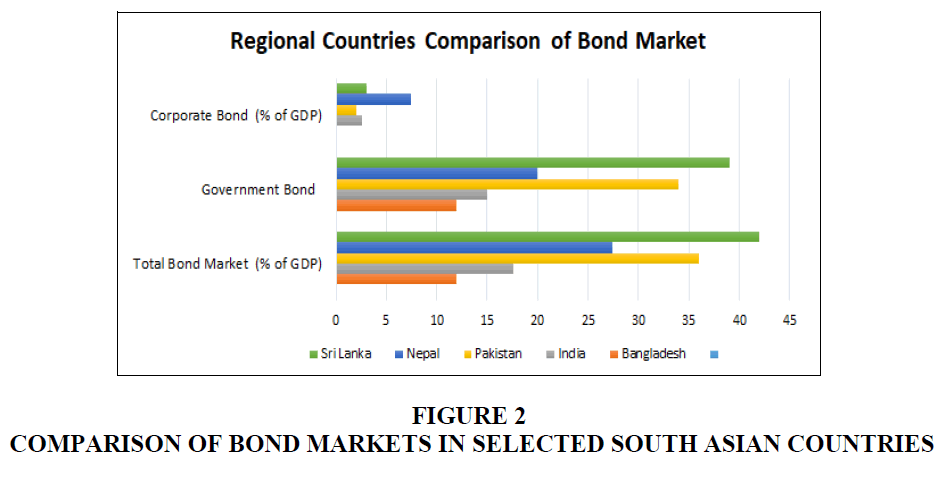

Table 5 highlights the regional comparisons of government and corporate bond markets in the South Asia for the year 2016. The table shows the contribution of bond market in GDP for five countries of South Asia. It is revealed that Bangladesh is staying behind among the selected countries considering the bond market contribution to GDP whereas; Sri Lanka is staying at the top. In Bangladesh, government bond (12%) is contributing highly in GDP rather than corporate bond (0.01%).

| Table 5 Regional Comparisons of Government and Corporate Bond Markets in Selected South Asian Countries for the Year 2016 | |||

| Country | Total Bond Market (% of GDP) |

Government Bond (% of GDP) |

Corporate Bond (% of GDP) |

| Bangladesh | 12 approx. | 12 | 0.01 |

| India | 17.65 | 15 | 2.65 |

| Pakistan | 36 | 34 | 2 |

| Nepal | 27.4 | 20 | 7.4 |

| Sri Lanka | 42 | 39 | 3 |

Among the selected South Asian countries, Sri Lanka and Nepal are showing highest amount contribution in GDP from government bond and corporate bond respectively (Figure 2). Although India has a larger economy, the bond market contribution to GDP for India is comparatively smaller than Sri Lanka, Nepal and Pakistan.

Islamic Bond Market

Islamic capital market becomes important in the global economy where ‘sukuk’ plays significant part in this market. Sukuk means 100% tangible assets to deliver assets fully backed to investors. The Islamic Fiqh Academy of the Organization of Islamic Conference (OIC) defined sukuk as combination of assets which represented in written financial instruments and sold at market price where majority of tangible assets (Radzi, 2018). Sukuk has unique features such as safe fund, less speculation, low trading turnover and less volatile (Qizam & Fong, 2019). The significant contributing countries for susuk market according to market share are Malaysia (62.5%), Saudi Arabia (9.7%), UAE (7.3%), Indonesia (6.4%), Bahrain (2.8%), Qatar (2.6%) and Turkey (2%) (IIFM, 2018). The growth of Sukuk market has operated by corporates, financial institutions and sovereigns. This market is considered as alternative form of financing for business, projects, banks and financial institutions as stable funding sources (Standard & Poor's Corporation, 2010). Sukuk has use as a tool in the Islamic money market which serves liquidity management facilities to banks and other financial institutions. In Bangladesh, Sukuk issued for shorter tenures to promote domestic Islamic finance institutions.

In 2004, Bangladesh introduced Bangladesh Government Islamic Investment Bond (BGIIB) with the objective to develop a sound foundation for the Islamic bond market and also to convert excess liquidity into investment through Islamic bonds (Sarker et al., 2019). According to the Bangladesh Bank Islamic Investment Bond Guidelines 2004 (Amended 2014), the maturity period of Islamic bonds is at 3 months and 6 months. The Islamic bonds are issued based on the profit sharing ratio through open auction. In order to boost Islamic finance further, Bangladesh Bank (BB) launched a weekly sukuk programme in 2015, thus providing local lenders with a new short-term liquidity management tool. As per Bangladesh Bank data, currently two Islamic bonds are available in operation such as, three-month Bangladesh Government Islamic Investment Bond (BGIIB) and six-month BGIIB. The outstanding balance of these two bonds stood at more than Tk 12.3 million USD as on May 25, 2019 (Rahman, 2019).

Challenges for Bond Market Development in Bangladesh

The bond market in Bangladesh is not playing effective role for capital formation in financial market. Due to lacking of proper instruments, absence of necessary guidelines, and dominance and acceptability of banking sector are the main challenges for bond market development in Bangladesh. The bond market in Bangladesh is comparatively small rather than other countries in South Asia. The main challenges for corporate bond development in Bangladesh are high interest rate, lack of market awareness, presence of limited company, and changing market circumstances. On the other hand, government bond market is facing some challenges like interest rate, inflation scenario, and unfavorable turnover. Although Islamic banking is famous in Bangladesh, but Islamic bond (susuk) not yet developed in the country due to lack of awareness, shorter tenures, and presence of limited companies.

Policy Initiatives

Both the Islamic bond (susuk) and conventional bonds (corporate bond and government bond) can significantly contribute in the stock market of Bangladesh based on their suitability. The study of Ariff et al. (2017) pointed that both susuk and conventional bonds are important for and country and traded from the same stock market for clearing processes.

Proper monetary and fiscal policies are necessary for effective bond market development in Bangladesh. The GOB should be formulated policy guidelines for the issuers and customers to enhance the bond market in the country. Several studies (Laopodis, 2009; Chatziantoniou et al., 2013) have emphasized on monetary and fiscal policies to analyze the performance of bond market in different economic conditions. Laopodis (2009) addressed that the actions of fiscal policy can determine the behavior of different bonds in stock market. Moreover, Chatziantoniou et al. (2013) identified that both fiscal and monetary policy have explained directly or indirectly the behavior of bonds in stock market.

Aman et al. (2020) identified that bond market development in a country depends on several factors or conditions such as foreign direct investment, exports, size of economy, stage of economic development, interest rate, government spending, banking system, current account balance, and stock market development. The above mentioned factors also important in Bangladesh for strong bond market development. But in the country not consider the factors during the formulation of regulations for bond market development. The main consideration for GOB is to give priority the related factors which influence the bond market of the country.

Ariff et al. (2017) addressed three characteristics for susuk bond such as susuk issuing companies registered under special requirements, all investors share profit and losses, and issuing cost is higher than conventional bonds. Leverage is considering as most influential factors for positive effect on susuk rating in terms of asset ratio, income growth, asset and depreciation growth, operating income (Qizam & Fong, 2019). These characteristics are applicable in Bangladesh. The country has special legal arrangements Islamic banking system. So, susuk bond issuing system can take guidelines from Islamic banking system. Again, necessary guidelines should be taken by Securities Exchange Commission to reduce the issuing cost for susuk bond.

Moreover, several factors and conditions are need to consider for bond market development in Bangladesh such as regulatory pressure, interest rate, capital structure, macro-economic situation, and market volatility on bond yields. There are need of regulatory pressure to deliver quality products and useful credit rating for bond market (Livingston et al., 2018). Interest rate is one of the significant features to determine the proper motion of bond market (Wang et al., 2016). Mu et al. (2013) addressed some perquisites for bond market development such as well-capitalized banking system, stable exchange rates, and capital control. Moreover, some explanatory factors like macroeconomic stability, protection of investors, privatization of pension also important in this regard. Asgharian et al. (2016) identified that several macro-finance features like interest and inflation rate, liquidity, market uncertainty, and state economy are related to bond market in a country. Jubinski & Lipton (2012) revealed the effect of stock market volatility on bond yields. The study identified that increasing volatility in the equity market will maintain high quality bonds by investors.

Finally, some influencing policy initiatives based on some previous studies (for instance, Bae, 2012; Mu et al., 2013; Smaoui & Khawaja, 2017) is presented in Table 6 for bond market development in Bangladesh.

| Table 6 Influencing Policy Initiatives for Bond Market Development | |

| Types of Bond | Policy Initiatives |

| Corporate bond market | Domestic credit, credit share, investment profile, well-stablish banking sector. |

| Government bond market | Domestic interest rate, capital control, public debt, composite risk, GDP per capita, fiscal balance, macroeconomic condition, higher deficits. |

| Islamic bond or Sukuk | Macroeconomic condition, portfolio diversification, economic size, Muslim population, investment profile, interest rate, |

Conclusion

Bond market is not developed in Bangladesh as compared to other neighboring countries of South Asia. The country is not able to build a risk-free sovereign yield curve to provide guidance regarding range of maturity. The borrowers and lenders are not getting credit information easily due to lack of credit information index and legal right. Bangladesh can take some reasonable and suitable steps for boosting bond market in the country.

Benchmarking help to increase the maturity of bonds with proper pricing. Till date, Bangladesh has not developed pricing base benchmarking instruments for the bond market. Government can issue diversified debt instruments in the bond market such as, different maturities treasury bills, medium and long-term securities to attract the customers in bond market.

Bond market is one of the best places for investment. Bangladesh government should adopt necessary regulations so that the foreign and domestic investors get encouraged and make more investment in bond market. Bangladesh bank should publish reports on bond market that include the information on debt securities and money market. A bond index can compare the performance of the participants in the bond market through their different classes of assets. Finally, the government should develop the qualitative strength for bond market in terms of macro-economic situation, institutional capacity, equity market, accountability in financial sector and corporate governance.

References

- ACI. (2011). Annual Report, 2011. ACI Formulations Limited, Dhaka, Bangladesh. Retrieved from https://www.aci-bd.com/assets/files/ACI-FL/financial/fl-annual-report-2011.pdf

- ADB. (2015). Report and Recommendations of the President to the Board of Directors on Proposed Policy-based Loans and Administrations of Technical Assistance Grant to the People’s Republic of Bangladesh for the Third Capital Market Development Program. Manila.

- ADB. (2016). Asian Bond Monitor, November 2016. Asian Development Bank, Manila.

- Akter, A., Himo, R.H., & Siddik, A.B. (2019). Corporate Bond Market: The Case of Bangladesh. World Review of Business Research, 9 (1), 73, 85.

- Aman, A., Isa, M.Y., & Naim, A.M. (2020). The role of macroeconomic and financial factors in bond market development in selected countries. Global Business Review, 0972150920907206.

- Aman, A., Naim, A.M., & Isa, M.Y. (2019). What determines bond market development? New theoretical insights. SEISENSE Journal of Management, 2(1), 99-106.

- Andritzky, M.J.R. (2012). Government bonds and their investors: what are the facts and do they matter? International Monetary Fund.

- Ariff, M., Chazi, A., Safari, M., & Zarei, A. (2017). Significant difference in the yields of Sukuk bonds versus conventional bonds. Journal of Emerging Market Finance, 16(2), 115-135.

- Asgharian, H., Christiansen, C., & Hou, A. J. (2016). Macro-finance determinants of the long-run stock–bond correlation: The DCC-MIDAS specification. Journal of Financial Econometrics, 14(3), 617-642.

- Bae, K.H. (2012). Determinants of Local Currency Bonds and Foreign Holdings: Implications for Bond Market Development in the People’s Republic of China, ADB Working Paper Series on Regional Economic Integration No. 97. Asian Development Bank, Manila.

- Bektic, D., & Regele, T. (2018). Exploiting uncertainty with market timing in corporate bond markets. Journal of Asset Management, 19(2), 79-92.

- Bhattacharyay, B. N. (2013). Determinants of bond market development in Asia. Journal of Asian Economics, 24, 124-137.

- Blommestein, H. (2017). Impact of regulatory changes on government bond market liquidity. Journal of Financial Regulation and Compliance, 25 (3), 307-317

- BRAC Bank- Annual Report. (2012), BRAC Bank Limited, Dhaka, Bangladesh. Available at https://www.bracbank.com/old/financialstatement/Annual_Report_2012.pdf

- Bunda, I., Hamann, A. J., & Lall, S. (2009). Correlations in emerging market bonds: The role of local and global factors. Emerging Markets Review, 10(2), 67-96.

- Burger, J.D., & Warnock, F.E. (2006). Local currency bond markets. IMF Staff papers, 53(1), 133-146.

- Burger, J.D., & Warnock, F.E. (2007). Foreign participation in local currency bond markets. Review of Financial Economics, 16(3), 291-304.

- Chatziantoniou, I., Duffy, D., & Filis, G. (2013). Stock market response to monetary and fiscal policy shocks: Multi-country evidence. Economic Modelling, 30, 754-769.

- Fidora, M., Fratzscher, M., & Thimann, C. (2007). Home bias in global bond and equity markets: the role of real exchange rate volatility. Journal of international Money and Finance, 26(4), 631-655.

- Hardie, I., & Rethel, L. (2019). Financial structure and the development of domestic bond markets in emerging economies. Business and politics, 21(1), 86-112.

- Hossain, M.A. (2012). Underdeveloped Bond Market in Bangladesh: Reasons and Measures to Improve. Unpublished doctoral dissertation, Asian Institute of Technology, Thailand.

- IBBL. (2010). Annual Report, 2010. Islami Bank Bangladesh Limited, Dhaka, Bangladesh. Retrieved from https://www.islamibankbd.com/annual_report/Annual%20Report%202010.pdf

- IIFM. (2018). A comprehensive study of the global sukuk market. IIFM Sukuk Report. Retrieved from https://islamicbankers.files.wordpress.com/2019/02/iifm-sukuk-report-2018.pdf

- Jahur, M.S., & Quadir, N. (2009). Development of bond market in Bangladesh: issues, status, and policies. CSE Portfolio, 49.

- Jubinski, D., & Lipton, A.F. (2012). Equity volatility, bond yields, and yield spreads. Journal of Futures Markets, 32(5), 480-503.

- Laopodis, N.T. (2009). Fiscal policy and stock market efficiency: Evidence for the United States. The quarterly Review of Economics and finance, 49(2), 633-650.

- Lee, H.H. (2020). Distress risk, product market competition, and corporate bond yield spreads. Review of Quantitative Finance and Accounting, 1-43.

- Livingston, M., Poon, W.P., & Zhou, L. (2018). Are Chinese credit ratings relevant? A study of the Chinese bond market and credit rating industry. Journal of Banking & Finance, 87, 216-232.

- Mihaljek, D., Scatigna, M., & Villar, A. (2002). Recent trends in bond markets. BIS papers, 11, 13-41.

- Misir, M.A., Mohsin, M., & Kamal, A. (2010). Contemporary Issues in Bond Market Development in Bangladesh: Experience and Evidence from Asian Countries. The Perspective Plan and the Roadmap to Vision 2021, 25.

- Mortaza, M., & Shadat, B. (2016). Cost-Benefit Analysis Of Establishing A Secondary Bond Market In Bangladesh. Bangladesh Priorities, Copenhagen Consensus Center, 2016. License: Creative Commons Attribution CC BY, 4.

- Mu, Y., Phelps, P., & Stotsky, J. G. (2013). Bond markets in Africa. Review of Development Finance, 3(3), 121-135.

- Piljak, V. (2013). Bond markets co-movement dynamics and macroeconomic factors: Evidence from emerging and frontier markets. Emerging Markets Review, 17, 29-43.

- Qizam, I., & Fong, M. (2019). Developing financial disclosure quality in sukuk and bond market: Evidence from Indonesia, Malaysia, and Australia. Borsa Istanbul Review, 19(3), 228-248.

- Radzi, R.M. (2018). Evolution in the Sukuk (Islamic Bonds) Structure: How do Market Demands and Shariah (Islamic Law) Solutions Shape Them. Journal of Islamic Banking and Finance, 6(1), 16-28.

- Rahman, M.Z. (2019). Potential of Islamic bond in Bangladesh, The Daily Observer, Bangladesh. Retrieved 23 November 2019 from https://www.observerbd.com/details.php?id=229672

- Sarker, M.A.A., Islam, M.S., Rahman, M.M., Mashrur, M., Khan, M.I., Mobin, M.A. (2019). Liquidity Management Instruments for the Islamic Banks in Bangladesh, Special Research Work Report (SRW-1904), Bangladesh Bank, Head Office, Dhaka. Retrieved from https://www.bb.org.bd/pub/research/sp_research_work/srw1904.pdf

- SEC. (2012). Bangladesh capital market development master plan (2012-2022). Securities and Exchange Commission (SEC), Dhaka, Bangladesh.

- Sharma, K. (2001). The underlying constraints on corporate bond market development in Southeast Asia. World development, 29(8), 1405-1419.

- Smaoui, H., & Khawaja, M. (2017). The determinants of Sukuk market development. Emerging Markets Finance and Trade, 53(7), 1501-1518.

- Standard and Poor's Corporation. (2010). Standard & Poor's Industry Surveys. The Corporation.

- Wang, Z., Yan, Y., & Chen, X. (2016). Multifractal properties of interest rates in bond market. Procedia Computer Science, 91, 432-441.

- Yang, L., & Hamori, S. (2014). Spillover effect of US monetary policy to ASEAN stock markets: Evidence from Indonesia, Singapore, and Thailand. Pacific-Basin Finance Journal, 26, 145-155.

- Yoshitomi, M., & Shirai, S. (2001). Designing a financial marketstructure in post-crisis Asia.