Research Article: 2020 Vol: 19 Issue: 4

Building a Model for Managing the Market Value of an Industrial Enterprise Based on Regulating its Innovation Activity

Andrey Zaytsev, Peter the Great Saint-Petersburg Polytechnic University

Dmitriy Rodionov, Peter the Great Saint-Petersburg Polytechnic University

Nikolay Dmitriev, Peter the Great Saint-Petersburg Polytechnic University

Rinat Faisullin, Izhevsk State Technical University

Abstract

The market value of an enterprise is one of the main performance indicators of any modern enterprise. Consequently, to ensure a continuous increase in the value of the enterprise, it is necessary to implement measures for its management. This study suggests that it is possible to predict and change the market value of an industrial enterprise based on regulating its innovation activity. For confirming the suggested thesis, it is proposed to construct a model of dependence of market value on the innovation activity of an enterprise by means of regression analysis tools. In such a context, it is necessary to consider innovative activity as a value which can be changed and controlled by the enterprise. The solution to the task set has conditioned development of the author's method of calculating the integral indicator of innovative development of an economic agent, taking into consideration its functioning in the industrial sphere. The introduced integral indicator consists of coefficients that characterize the innovative potential of an enterprise, each of which can be adjusted to the current corporate strategy. In order to prevent distortion of data, the proposed method also includes the potential for assessing the impact of the innovation activity on economic value added, as a significant indicator referring to market value formation. Innovation activity of an industrial enterprise characterizes its competitive position in the market in a strategic range, which has a direct impact on the market value of the entity. In case of an insufficient level of the innovative development, the increase of market value is unlikely to be possible. The importance of the proposed model lies in creation of the author's method to consider innovation activity dynamics for modeling processes by market value management. Testing the given model proves expediency of its use from the position of the economic analysis. So, in the course of the model consideration at an industrial enterprise, positive connection between the author's integral indicator and the market value of the enterprise has been identified. In the future, it is planned to adapt the developed model to a specific innovation sector of the economy, taking into account macroeconomic aspects, such as the transition state of the Russian economy.

Keywords

Innovation Activity, Value Management, Market Value, Innovative Development, Innovation Management, EVA, Econometric Model, Regression Analysis.

Introduction

Annually, innovation activity is becoming an increasingly important area of the economic activity, which corresponds to global trends to accelerate introduction of innovations in production processes. However, innovation is characterized by a high risk and uncertainty level, the combination of which poses a number of obstacles to sustainable development of business entities (Galeitzke et al., 2015). Overcoming the difficulties caused by market instability creates new opportunities to ensure growth of the enterprise value. In the business environment, it is the market value that becomes the main indicator of business success because it takes into consideration interests of many stakeholders, but there is still no ideal way to organize its management processes (Demidenko et al., 2018a).

A steady increase in the subject's market value determines its sustainable development, but it is practically impossible to give a full list of internal and external factors affecting the cost parameters of the enterprise. In the post-industrial economy, the determining factor of success is the intellectual potential of an enterprise, which can be formed only if there is a sufficient level of innovation activity. Thus, the strategic position of any economic entity can only be favorable if the available innovation opportunities are competently used (Asaturova & Khvatova, 2019; Mikalauskiene & Atkociuniene, 2019).

The processes of intellectualization are accelerating every year, which significantly increases the importance of introducing innovations in production processes. It is not the first decade that innovative technologies are considered in the scientific community as a tool for overcoming market instability, which is growing under the negative influence of growing international competition, increasing macroeconomic disproportions and other ambiguous manifestations of the economic system ( Zaitsev et al., 2019). Thus, in order to prevent a decline in the market value, it is necessary to take this trend into account and build rational management models capable of taking into consideration the needs for modernization and technological upgrading.

The conditions listed above determine relevance of the research on developing a model for maximizing efficiency of business activity of a business entity by increasing its market value. Within the framework of the work presented, it is proposed to consider innovations as a determinant of achieving sustainable development of an enterprise.

The goal of the study is to develop the author's model to manage the market value of an industrial enterprise based on changes in its innovation activity. Achieving the given goal has stipulated the statement of the following problems: to carry out the review of the existing scientific approaches to the issues of managing the market value and innovation activity; to develop an author's way of determining innovation activity of an industrial enterprise using an integral indicator; to consider the algorithm of the regression analysis between innovation activity and the indicator characterizing the market value; to carry out a testing procedure of the model at a specific enterprise to confirm its practical realization.

Literature Review

There is a considerable amount of research in the scientific literature on the issues of studying the market value and confirming importance of its management. In particular, the fundamental work by Copeland Thomas et al. (1994) considers the main processes of managing the enterprise value characteristics. The authors pay significant attention to innovative ways of value creation for economic entities. Another important work on this issue is the work of authors Kaplan & Norton (2001), in which the researchers focused their attention on market value management through the processes of making rational managerial decisions on investment issues and innovative development. The essence of the economic value added of the enterprise was elaborated in the work of Stern et al. (2001), in particular, the high importance of this indicator in formation of the market value of subjects and the need to create innovative factors to increase it were highlighted.

In more recent works, there is a detailed theoretical study of the problem and empirical research. Within the framework of this study, of particular interest were the works on the market value by such authors as Turilo & Turilo (2014); Boiarko & Paskevicius (2017); Demidenko & Dubolazova (2019). For example, the paper (Turilo & Turilo, 2014) proposed methods to assess results of capitalization of an enterprise to identify the main factors of value formation, and the team of the authors in the study (Demidenko et al., 2018b) analyzed the essential components of the market value and qualitative processes of its creation. In turn, the issues of interrelationship between the value characteristics of an enterprise, as well as innovative factors of value creation were studied in the paper by Boiarko & Paskevicius (2017).

Investment issues were discussed in the works by Ustinov et al. (2016); Nikolova et al. (2019); Demidenko & Dubolazova (2019); Wang (2020). Thus, the team of the authors in the study (Ustinov et al., 2016) considered a practical example of how the market value of an enterprise depends on investment in the intellectual development of an economic entity. The paper (Demidenko & Dubolazova, 2019) analyzed the importance of investment in innovative enterprises from the perspective of creating modern competitive products and identified key provisions to enhance innovation. The processes of developing an investment program of an enterprise in a resource-constrained environment and the issues of optimization of investments depending on their economic performance, including innovative projects, were elaborated in the paper (Nikolova et al., 2019). Wang (2020) assessed the impact of investments in research and development on capitalization of an economic entity and its scientific and technical potential. The paper (Zaitsev et al., 2019) analyzes the possibilities of applying normative and dynamic approach in financial and investment analysis.

Works on management of economic activity of an industrial enterprise in modern social and economic conditions have also been analyzed. For example, in the work (Mednikov et al., 2018a), the processes of formation of the enterprise strategy in the conditions of crisis and insufficient development of organizational, technical, and managerial measures were considered, which confirms the importance of innovative technologies in creating corporate values. Also interesting is the paper (Rodionov et al., 2018), in which the authors determined the directions of ensuring sustainability of industrial enterprise development depending on its technological development and the level of innovation activity. Potential difficulties in calculating the external factors influencing the innovative position of a modern enterprise and the directions of investment policy to solve key innovation problems were discussed in the papers (Krasyuk et al., 2018; Nikolova et al., 2017).

The essence of corporate innovation is analyzed in the works of Greenhalgh & Rogers (2006); Varadarajan (2018); Ikeuchi (2017); Asaturova & Khvatova (2019); Maiti et al. (2020). In particular, the paper Greenhalgh & Rogers (2006) analyzes market valuations of British companies based on their R&D and intellectual activity. In the study by Varadarajan (2018), the author examines various types of corporate innovations that are strategically important for corporate development. Using the example of Japanese firms' innovation activities, Ikeuchi's (2017) study examines the impact of innovation activity results on the market value and performance. The study Mednikov et al. (2018b) covers many issues related to R&D and organization of production and technological activities, which together form the innovative potential of an enterprise. Asaturova & Khvatova (2019) worked on the search for opportunities to optimize innovation processes within enterprises. The interest was also aroused by the collective work (Maiti et al., 2020), in which the resource-oriented model of linear programming for resource optimization of innovative enterprises is presented.

The works of Xia (2010); Ustinova & Ustinov (2014); Galeitzke et al. (2015), Marchese & Privileggi (2018); Tikhomirov & Komshilova (2019); Zhilenkova et al. (2019) considered the processes of intellectualization of production, which are directly related to the innovative development of industry. For example, the work of Xia (2010) emphasizes the importance of intellectual property strategy for industrial enterprises, and the study of Ustinova & Ustinov (2014) revealed the influence of certain components of the intellectual capital structure on the capitalization levels of Russian industrial enterprises. The paper Marchese & Privileggi (2018) analyzed the main models of endogenous growth through the use of intellectual resources generated in the course of innovation activity.

The totality of the analyzed studies allows us to say that innovations allow acquiring additional competitive advantages. It is the introduction of innovative technologies into production processes that makes it possible to achieve tactical and strategic goals by increasing the value of industrial enterprise assets and its intellectual potential (Maiti et al., 2020; Tikhomirov & Komshilova, 2019).

The direct influence of innovation activity on the market value of an economic entity was considered in the works by Sorescu (2012); Dosso & Vezzani (2019) as well as Dmitriev & Zaitsev (2020 a & b). For example, the paper (Sorescu, 2012) analyzes the existing relationship between innovation and market value, which confirms its impact on the strategic success of the enterprise. The empirical study was carried out in the paper (Dosso & Vezzani, 2019), which showed the essence of innovation activity of corporations, as well as identified a positive correlation between intellectual property and the dynamics of the value of a business entity. The works by Dmitriev & Zaitsev (2020 a & b) presented the models of creating an integral indicator of innovative development and the potential for its adaptation to value management at an industrial enterprise.

Analyzing the works (Demidenko et al., 2018b; Dmitriev et al., 2020; Kajander et al., 2012; Yashin & Soldatova, 2013), we can identify the factors that determine the stable position of industrial enterprises, namely technological parameters of production, resource base, intellectual capital, diversification level, and capital structure. All these parameters are directly connected with innovation activity and can be used as a basis for the author's integral indicator.

It is possible to assert that transformation processes in the economic science allow speaking about numerous methods of management of production processes, but none of the researchers can say with certainty that their method is perfect. However, a lot of studies express the possibility of organization of market value management by alternative methods. For construction of management models, it is most rational to use mathematical methods, for example, regression analysis. The use of regression analysis and its adaptation to interdisciplinary research was developed in the works (Carlberg, 2016; Draper & Smith, 1998). Development of mathematical apparatus makes it possible to set numerical parameters of the model and solve managerial problems in an econometric way.

Methods

On the basis of the totality of available studies, it was discovered that innovation processes are a determinant of sustainable development and allow forecasting dynamics of the subject's market value. Individual innovation coefficients are measurable, while overall innovation activity is virtually impossible to calculate. Thus, at the first stage, it is proposed to develop a general integral indicator of the innovative development of an industrial enterprise.

In accordance with the system analysis, any enterprise in modern conditions should interact with its environment and take into consideration the driving social and economic trends. Any investment and financial system cannot exist without innovation activities aimed at increasing utility (Krasyuk et al., 2018; Nikolova et al., 2017). Such an approach determines the possibilities of innovative development assessment based on the indicators that take into consideration the systematic nature of investment and innovation activities of industrial enterprises. It is also possible to analyze innovation processes of a specific enterprise through distributing tangible and intangible resource potential (Marginson, 2019; Matos et al., 2019).

For creating an integral indicator, the main elements of the innovation activity of an enterprise operating in industrial branches have been defined. In the work (Cohen et al., 2013), innovation activity is considered from the position of innovation capital, which includes the costs of research and development, improving the quality of human capital, technological transformation of production systems. The study (Chen & Chen, 2008) considers the innovation capital of an enterprise as a set of certain coefficients: the ratio of R&D expenses to sales revenue; the number of scientific and other innovation employees; sales revenue of innovative products; revenue from modified products in the last few years; the number of patents and so on. Another suggestion for considering innovation capital is to consider the system of coefficients discussed in the paper (Yakubovich, 2005). Thus, it is absolutely true that there is no universal indicator based on which the level of innovation activity of an industrial enterprise can be determined with high precision.

In the framework of the author's research, it is planned to form integral assessment on the basis of the following coefficients: Fixed asset renewal coefficient (K1); investment performance coefficient (K2); intellectual property ownership coefficient (K3); investment activity coefficient (K4); innovative development financing coefficient (K5).

The fixed asset renewal coefficient in the context of assessing innovation activity shows the ability of an enterprise to annually upgrade its production facilities and introduce new ones. The coefficient can be considered as standardized for all industrial enterprises, since the frequent renewal of fixed assets and the introduction of new ones indicates effectiveness of innovation policies and well-developed project activities. The coefficient is calculated by formula 1:

K1= FCs/FCa (1)

Where,

FCs is the cost of fixed assets acquired during the year;

FCa is the average annual cost of fixed assets.

The investment performance coefficient reflects the level of investment activity of an enterprise, i.e. the volume of income received from investment activities in the total income of an economic entity. The coefficient is calculated by formula 2:

K2 = Ri/Rt (2)

Where,

Ri is the revenue from investment activity;

Rt is the total revenue.

The intellectual property ownership coefficient involves using the intellectual potential of an enterprise by maintaining a sufficient amount of intangible assets in the balance sheet structure capable of generating additional income. The coefficient is calculated by formula 3:

K3 = IA / FA (3)

Where,

IA is the cost of intangible assets;

FA is fixed assets.

The investment activity coefficient represents the volume of investment resources allocated for financial and material investments in relation to the level of fixed assets of an enterprise. Implementation of any innovative projects is possible only if sufficient capital investments are attracted, which are often of high-risk nature, but contribute to obtaining additional income through the use of intangible advantages (Krasyuk et al., 2018). The coefficient is calculated by formula 4:

K4 = (CP + Pita + FIlt) / FA (4)

Where,

CP is construction in progress;

Pita is profitable investments in tangible assets;

FIlt is long-term financial investments;

FA is fixed assets.

The innovative development financing coefficient is related to the level of investment in intangible assets relative to the total amount of investments. For the Russian industry, this coefficient is particularly important due to insufficient innovation activity of industrial enterprises (Yashin & Soldatova, 2013). The coefficient is calculated by formula 5:

K5 = VIia/ Ia (5)

Where,

VIia is investments in intangible assets;

Ia is aggregate investments.

Innovation activity and development of intangible assets contribute to creation of intellectual property objects, which can lead to a significant reduction in production costs. Innovations contribute to boosting research and development potential, which provides additional economic benefits in the long term and will significantly increase capitalization of a business entity (Kiseleva et al., 2017).

These coefficients are subject to internal adjustment and, therefore, there is a possibility to optimize the innovation program of an industrial enterprise in order to achieve the highest efficiency of investment resources in boosting innovative development (Nikolova et al., 2017; Yakubovich, 2005).

The combination of these coefficients makes it possible to calculate innovation capital, the development of which at the level of an industrial enterprise allows organizing production capacities for implementation of innovative projects that can not only improve product quality, but also create favorable social effects.

In order to identify the impact of innovation activity on the market value of an enterprise, it is necessary to analyze the coefficients in dynamics and form an integral indicator of innovative development (ΣK). The integral indicator can be created on the basis of the equivalence of each coefficient or it is possible to determine the weight of individual coefficients on the basis of the calculations made. The weight of each indicator can be static or calculated for each period. In the case of inequality of the coefficients, the sum of all their weights is equal to 100% and is calculated by formula 6:

ΣK = Σzij * p (6)

pi is the weighting of indicators;

zij is the value of a given coefficient, where i is the indicator number; j is the time period.

The resulting dynamics of the integral indicator makes it possible to move to the second stage, the essence of which is to build a regression model and identify the impact of innovation activity on the market value of an industrial enterprise. In the case of incorrect values, it is necessary to decompose the market value indicator, since its use as the resulting indicator in the model may lead to incorrect results. Thus, market value is dependent on economic value added, i.e. economic profit that an enterprise derives from its activity: V ∈ [IC, EV], where V is market value; IC is investment capital; EVA is economic value added. As a result, it is possible to create control models expressed by formulae 7 and 8:

Y(V) = aeva * X(ΣK) (7)

Y(EVA) = av * X(ΣK) (8)

Where,

Y (V; EVA) is the resulting indicator (market value or economic value added);

aeva; aV are regression coefficients;

X (ΣK) is an independent variable (integral indicator of innovation activity).

In order to improve the quality of the study, it is proposed to choose the resulting indicator with the highest determination coefficient. In case the coefficients are equal, it is necessary to analyze the influence of each of them on the resulting indicator. Such calculation is considered by formula 9:

Y(V; EVA) = ak1 * X(K1) + ak2 * X(K2) + ak3 * X(K3) + ak4 * X(K4) + ak5 * X(K5) (9)

Where,

a?i are regression coefficients;

X (Ki) is an independent variable (specific indicator of innovation activity), «i» is the coefficient number.

Traditional methods of market value management are not perfect and consideration of innovative processes in the context of creation of value of an economic subject is a new sight at the given problematics. However, there are certain limitations of the proposed approach:

– This method is relevant only for innovatively active enterprises. In the case of absence of innovation activity or its insignificance, the interrelation of indicators will be minimal and will not allow creating management models.

– In the case of uneven value growth or a lack of clear trends, the use of this method will not be feasible. This fact may be especially true in markets with strong volatility and an unstable innovation background.

Results

Within the framework of this research, it is proposed to test the developed approach at the Russian industrial enterprise “X” (the name has been changed for the purpose of keeping commercial secret). The given enterprise is innovatively active, therefore, expediency of calculation of the integral indicator of innovative development is confirmed.

The first step was calculating dynamics of the innovative development coefficients of the enterprise under analysis (Table 1). Calculations were made on the basis of formulas 1-5.

| Table 1 Dynamics of Innovative Development Coefficients of Enterprise "X" | |||||||||

| Indicator | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | |

| Fixed asset renewal coefficient | K1 | 32% | 35% | 15% | 26% | 25% | 36% | 34% | 36% |

| Investment performance coefficient | K2 | 61% | 59% | 44% | 44% | 52% | 58% | 61% | 62% |

| Intellectual property ownership coefficient | K3 | 54% | 51% | 49% | 48% | 51% | 55% | 58% | 56% |

| Investment activity coefficient | K4 | 31% | 34% | 39% | 35% | 36% | 34% | 37% | 36% |

| Innovative development financing coefficient | K5 | 62% | 58% | 44% | 41% | 48% | 55% | 63% | 65% |

The second step is calculating the coefficients of innovative development, taking into consideration their weight, and sums them up to obtain the integral indicator of innovative development. In this study, the coefficients are equal and therefore the weight of each indicator is 0.2. Table 2 contains the calculations and dynamics of the integral indicator of innovative development of enterprise “X”. It is possible to reveal a strong drawdown of the indicator values in 2014-2015, which can be associated with the crisis in the Russian market due to geopolitical conflicts. However, starting from 2016, there is a recovery and growth of innovation activity.

| Table 2 Calculation and Dynamics of the Integral Indicator of Innovative Development of Enterprise “X” | |||||||||

| Indicator | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | |

| Fixed asset renewal coefficient | K1 | 32% | 35% | 6.4% | 7.0% | 3.0% | 5.2% | 5.0% | 7.2% |

| Investment performance coefficient | K2 | 61% | 59% | 12.2% | 11.8% | 8.8% | 8.8% | 10.4% | 11.6% |

| Intellectual property ownership coefficient | K3 | 54% | 51% | 10.8% | 10.2% | 9.8% | 9.6% | 10.2% | 11.0% |

| Investment activity coefficient | K4 | 31% | 34% | 6.2% | 6.8% | 7.8% | 7.0% | 7.2% | 6.8% |

| Innovative development financing coefficient | K5 | 62% | 58% | 12.4% | 11.6% | 8.8% | 8.2% | 9.6% | 11.0% |

| ΣK | 48.0 | 47.4 | 38.2 | 38.8 | 42.4 | 47.6 | 50.6 | 51.0 | |

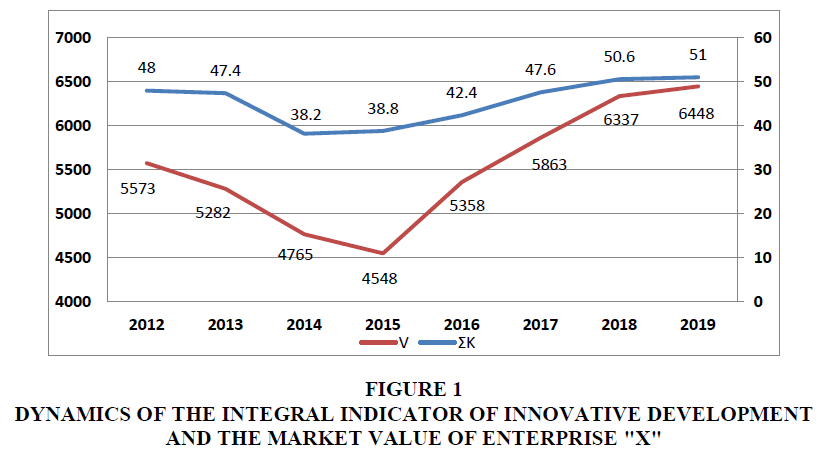

The third step is comparing the values of innovation activity with the market value of enterprise “X”. Table 3 shows dynamics of the innovation activity coefficients (%), the integral indicator of innovative development and the market value (million USD). Graphically, this trend is shown in Figure 1. As it can be seen from the dynamics, enterprise “X” had a significant decline in its market value during the crisis of 2014-2015; at the moment, there is a positive trend of increasing the value of the company.

| Table 3 Comparison of Innovation Activity Indicators and the Market Value of Enterprise “X” | |||||||

| K1 | K2 | K3 | K4 | K5 | ΣK | V | |

| 2012 | 6.4 | 12.2 | 10.8 | 6.2 | 12.4 | 48 | 5573 |

| 2013 | 7 | 11.8 | 10.2 | 6.8 | 11.6 | 47.4 | 5282 |

| 2014 | 3 | 8.8 | 9.8 | 7.8 | 8.8 | 38.2 | 4765 |

| 2015 | 5.2 | 8.8 | 9.6 | 7 | 8.2 | 38.8 | 4548 |

| 2016 | 5 | 10.4 | 10.2 | 7.2 | 9.6 | 42.4 | 5358 |

| 2017 | 7.2 | 11.6 | 11 | 6.8 | 11 | 47.6 | 5863 |

| 2018 | 6.8 | 12.2 | 11.6 | 7.4 | 12.6 | 50.6 | 6337 |

| 2019 | 7.2 | 12.4 | 11.2 | 7.2 | 13 | 51 | 6448 |

Figure 1 Dynamics of the Integral Indicator of Innovative Development and the Market Value of Enterprise "X"

In the fourth step, regression analysis is performed to identify relationship between the indicators. The equation of regression is as follows:

V = –142.122 + 124.481*K

Determination coefficient is above average: R-square = 0.851 (Corrected R-square = 0.8262). The P-value is minimal; therefore the model has high reliability. Thus, it is possible to manage the market value of enterprise “X” by regulating innovative development through optimization and maintaining innovation policy.

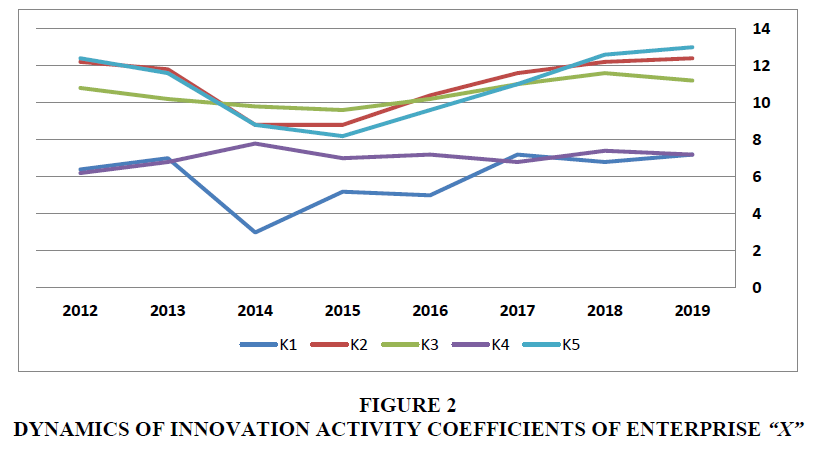

In the fifth step, it is proposed to consider the relationship between the market value and certain innovation activity coefficients of enterprise “X”. The dynamics of the coefficients, considering their weighting value, is considered in Figure 2.

After regression we get the following equation:

Y(V) = –5475.61 + 46.6938*K1 + 221.082*K2 + 585.886*K3 + 362.699* K4 – 41.944*K5

A high determination coefficient is observed: R-square = 0.968 (Corrected R-square = 0.8867). However, the regression coefficient of K5 is negative, and simultaneously it has the largest P-value. This fact may indicate the presence of multicollinearity.

When testing for multicollinearity, the inflation factor method was used (minimum possible value = 1.0; values > 10.0 may indicate multicollinearity). The following values were obtained: K1 = 5.594; K2 = 41.540; K3 = 5.976; K4 = 2.386; K5 = 26.337. Consequently, indicators K2 and K5 are multicollinear.

It is proposed to exclude variable K5 as insignificant. As a result, the regression equation looks as follows:

Y(V) = –5215.32 + 55.288*K1 + 164.78*K2 + 579.965*K3 + 350.0551* K4

There is also a high determination coefficient: R-square = 0.967 (Corrected R-square = 0.923). K3 (intellectual property ownership coefficient) is the most important in the context of enterprise value creation. Thus, by changing regression coefficients, it becomes possible to make forecasts of the market value of an enterprise.

This model is tested at a single enterprise and shows a high impact of intellectual property on its cost indicators. When analyzing a larger number of entities operating in this industry, it is possible to determine the industry dependence and build cost forecasts already at the macro level for the entire sector of the national economy.

Conclusions

If we consider the Russian economic practice, there is a steady increase in the processes of introducing innovative technologies into production processes. In this context, enterprise management should be aimed at achieving maximum efficiency with available factors of production. The result of innovation activity is expansion of production and economic growth with cost reduction. By developing in this way, the enterprise will be able to ensure its competitiveness in the market and create conditions for a significant increase in the value of the subject (Demidenko et al., 2018a).

Achievement of sustainable development at modern enterprises is possible only by implementing measures to ensure increases in their market value. For this purpose, it is necessary to provide qualitative parameters for managing the value characteristics of companies under conditions of innovative development. Thus, maintenance of innovation activity becomes a determinant of maintaining the enterprise value. Innovation activity allows creating opportunities for implementation of strategists to penetrate emerging markets, which contributes to a faster increase in the market value than it is considered in this model (Akhmetshin et al., 2018).

If we focus on industry, many sectors of the national economy have difficulties in forming innovative resources, which hinders potential market growth of industry players. Traditional methods of innovation management cannot be considered sufficient, as they are unable to take into consideration a significant share of factors that have a direct impact on the intellectual development of a firm and thereby on the growth of its value. It is necessary to consider that it is the innovation activity of industrial enterprises that allows forming the economic value added of an enterprise and exceeding its market value over balance sheet.

In the present research, the process of managing the market value of an industrial enterprise by regulating its innovation activity was developed, for which the author's integral indicator of innovative development based on a set of coefficients was introduced. Using such an indicator makes it possible to allocate resources for the most significant innovative development to maximize the value of an economic entity. On the basis of the author's methodology, it is possible to develop recommendations for managing the value of innovatively active enterprises. It is also possible to evaluate the largest players in the industry in order to identify the key innovative components that create their value and form the competitiveness of this sector of the economy.

The conducted testing confirmed significance and viability of the method in the context of the economic analysis. In the future, it is planned to conduct a more complete study of a significant number of enterprises from different industries to identify industry specifics and to form a weighting value of the coefficients. Other promising areas of research are planned to adapt the developed model to a specific innovation sector of the economy, taking into account industry, national and technological aspects of the economy.

Acknowledgement

This research work was supported by the Academic Excellence Project 5-100 proposed by Peter the Great St. Petersburg Polytechnic University.

References

- Akhmetshin, E.M., Ilyasov, R.H., Sverdlikova, E.A., Tagibova, A.A., Tolmachev, A.V., & Yumashev, A.V. (2018). Promotion in emerging markets. European Research Studies, 21, 652-665.

- Asaturova, Y., & Khvatova, T. (2019). How constraints influence company innovation processes. In European Conference on Innovation and Entrepreneurship. Academic Conferences International Limited.

- Boiarko, I., & Paskevicius, A. (2017). Evaluation of the market value of the enterprise with consideration of exogenous factors.

- Carlberg, C. (2016). Regression analysis microsoft excel. Que Publishing.

- Chen, J.K., & Chen, I.S. (2008). Indices for innovation in the r&d manufacturing using fahp. Journal of Global Business & Technology, 4(2), 42-53.

- Cohen, L., Diether, K., & Malloy, C. (2013). Misvaluing innovation. The Review of Financial Studies, 26(3), 635-666.

- Copeland Thomas, E., Koller, T., & Murrin, J. (1994). Valuation: measuring and managing the value of companies. Wiley Frontiers in Finance.

- Demidenko, D.S., & Dubolazova, Y.A. (2019). Drawing up an optimal investment program for innovative development of an enterprise. In European Conference on Innovation and Entrepreneurship. Academic Conferences International Limited.

- Demidenko, D.S., Kulibanova, V.V., & Maruta, V.G. (2018a). Using the methods of the company's capitalization optimal management. In Proceedings of the 32nd International Business Information Management Association Conference, IBIMA 2018-Vision 2020: Sustainable Economic Development and Application of Innovation Management from Regional expansion to Global Growth.

- Demidenko, D.S., Kulibanova, V.V., & Maruta, V.G. (2018b). Using the principles of" digital economy" in assessing the company's capitalization. In Proceedings of the 31st International Business Information Management Association Conference.

- Dmitriev, N., Zaytsev, A., Degtereva, V., & Kichigin, O. (2020). Construction of the methodic assess economic efficiency from the implementation of an investment project of introduce lean production tools. In Proceedings of the 35th International Business Information Management Association Conference, IBIMA.

- Dmitriev, N.D., & Zaitsev, A.A. (2020a). Activation of innovative processes at an industrial enterprise in order to increase its capitalization, Digitalization of Economic Systems: Theory and Practice.

- Dmitriev, N.D., & Zaitsev, A.A. (2020b). Market value Management by regulating innovative activity of an enterprise. In Proceedings of the Digital Economy and Industry 4.0: Foresight Russia.

- Dosso, M., & Vezzani, A. (2019). Firm market valuation and intellectual property assets. Industry and Innovation, 1-25.

- Draper, N.R., & Smith, H. (1998). Applied regression analysis (Vol. 326). John Wiley & Sons.

- Galeitzke, M., Steinhöfel, E., Orth, R., & Kohl, H. (2015). Strategic intellectual capital management as a driver of organisational innovation. International Journal of Knowledge and Learning, 10(2), 164-181.

- Greenhalgh, C., & Rogers, M. (2006). The value of innovation: The interaction of competition, R&D and IP. Research Policy, 35(4), 562-580.

- Ikeuchi, K. (2017). Measuring Innovation in Firms. In Competition, Innovation, and Growth in Japan. Springer, Singapore.

- Kajander, J.K., Sivunen, M., Vimpari, J., Pulkka, L., & Junnila, S. (2012). Market value of sustainability business innovations in the construction sector. Building Research & Information, 40(6), 665-678.

- Kaplan, R.S., & Norton, D.P. (2001). Strategy-focused organization: How balanced scorecard companies thrive in the new business environment/Robert S. Kaplan, David P. Norton.–Boston: Harvard Business School Press.

- Kiseleva, E.M., Artemova, E.I., Litvinenko, I.L., Kirillova, T.V., Tupchienko, V.A., & Bing, W. (2017). Implementation of innovative management in the actions of the business enterprise. International Journal of Applied Business and Economic Research, 15(13), 231-242.

- Krasyuk, I.A., Kobeleva, A.A., Mikhailushkin, P.V., Terskaya, G.A., & Chuvakhina, L.G. (2018). Economic interests focusing as a basis of the formation of investment policy. Espacios, 39(28), 518-531.

- Maiti, M., Krakovich, V., Shams, S.R., & Vukovic, D.B. (2020). Resource-based model for small innovative enterprises. Management Decision.

- Marchese, C., & Privileggi, F. (2018). Endogenous economic growth with disembodied knowledge. Journal of Public Economic Theory, 20(3), 437-449.

- Marginson, S. (2019). Limitations of human capital theory. Studies in Higher Education, 44(2), 287-301.

- Matos, F., Vairinhos, V., Selig, P.M., & Edvinsson, L. (2019). Intellectual Capital Management as a Driver of Sustainability. Springer.

- Mednikov, M.D., Sokolitsyn, A.S., Ivanov, M.V., Sokolitsyna, N.A., & Yuryev, V.N. (2018a). Forming optimal industrial enterprise management strategy. In Proceedings of the 32nd International Business Information Management Association Conference, IBIMA 2018-Vision 2020: Sustainable Economic Development and Application of Innovation Management from Regional expansion to Global Growth (pp. 6589-6599).

- Mednikov, M.D., Sokolitsyn, A.S., Ivanov, M.V., Sokolitsyna, N.A., & Yuryev, V.N. (2018b). Capital structuration as enterprise management strategy elaboration basis. In Proceedings of the 32nd International Business Information Management Association Conference, IBIMA 2018-Vision 2020: Sustainable Economic Development and Application of Innovation Management from Regional expansion to Global Growth.

- Mikalauskiene, A., & Atkociuniene, Z. (2019). Knowledge Management Impact on Sustainable Development. Montenegrin Journal of Economics, 15(4), 149-160.

- Nikolova, L.V., Abramchikova, N.V., & Velikova, M.D. (2019). The investment program of industrial enterprises under conditions of limited resources. In Proceedings of the 33rd International Business Information Management Association Conference, IBIMA 2019: Education Excellence and Innovation Management through Vision 2020.

- Nikolova, L.V., Rodionov, D.G., Malinin, A.M., & Velikova, M.D. (2017). Performance management of innovation program at an industrial enterprise: An optimisation model. In Proceedings of the 30th International Business Information Management Association Conference, IBIMA 2017-Vision 2020: Sustainable Economic development, Innovation Management, and Global Growth.

- Rodionov, D.G., Konnikov, E.A., & Konnikova, O.A. (2018). Approaches to ensuring the sustainability of industrial enterprises of different technological levels. The Journal of Social Sciences Research, 277-282.

- Sorescu, A. (2012). Innovation and the market value of firms. In Handbook of marketing and finance. Edward Elgar Publishing.

- Stern, J.M, Shiely, J.S, & Ross, I. (2002). The EVA challenge: implementing value-added change in an organization . John Wiley & Sons.

- Tikhomirov, A., & Komshilova, S. (2019, March). New approach to analyzing the risk of intellectual capital in the structure of the market price of shares. In IOP Conference Series: Materials Science and Engineering (Vol. 497, No. 1, p. 012052). IOP Publishing.

- Turilo, A.A., & Turilo, A.M. (2014). The system of capitalisation assessment criteria and indicators in the process of innovative development. Actual Problems in Economics, (151), 233-239.

- Ustinov, A.E., Bulnina, I.S., & Arsentyeva, L.I. (2016). Prediction of market capitalization of investment in intellectual capital in companies. Journal of Economics and Economic Education Research, 17, 9.

- Ustinova, L., & Ustinov, A. (2014). Studying the impact of intellectual capital at industrial enterprises on their market capitalization. Asian Social Science, 10(20), 15-20.

- Varadarajan, R. (2018). Innovation, innovation strategy, and strategic innovation. In Innovation and Strategy. Emerald Publishing Limited.

- Wang, H. (2020). The influence of research and development investment expense and capitalization on stock price-based on the empirical research of Chinese telecommunication enterprises. In Recent Trends in Decision Science and Management. Springer, Singapore.

- Xia, H. (2010). Industrial-design-centered intellectual property strategy of the company. In 2010 International Conference on Networking and Digital Society. IEEE.

- Yakubovich, M.A. (2005). Financial indicators of enterprises efficiency. Project controls, (9), 36-39.

- Yashin, S.N., & Soldatova, Y. (2013). An assessment of the innovation development stability of industrial enterprises.

- Zaitsev, A., Kichigin, O., & Korotkova, A. (2019). Standard dynamic financial analysis and control tools of an enterprise in the time of digital economy. In Proceedings of the 2019 International SPBPU Scientific Conference on Innovations in Digital Economy.

- Zhilenkova, E., Budanova, M., Bulkhov, N., & Rodionov, D. (2019). Reproduction of intellectual capital in innovative-digital economy environment. In IOP Conference Series: Materials Science and Engineering. IOP Publishing.