Research Article: 2021 Vol: 20 Issue: 2

Business Diagnostics as a Universal Tool for Study of State and Determination of Corporations Development Directions and Strategies

Igor Kryvovyazyuk, Lutsk National Technical University

Galyna Otlyvanska, O.S. Popov Odesa National Academy of Telecommunications

Liudmyla Shostak, Lesya Ukrainka Volyn National University

Tatiana Sak, Lesya Ukrainka Volyn National University

Larysa Yushchyshyna, Lesya Ukrainka Volyn National University

Iryna Volynets, Lesya Ukrainka Volyn National University

Olha Myshko, Lutsk National Technical University

Iryna Oleksandrenko, Lutsk National Technical University

Viktoriia Dorosh, Lutsk National Technical University

Tetiana Visyna, Lutsk National Technical University

Abstract

The aim of the article is to show how the use of diagnostic methods allows identifying patterns and problems of corporations functioning, providing identification of directions and strategies for further development of their business. Theoretical and methodological basis of the research is a scientific works of scientists in the field of business diagnostics and strategic development, who studied diagnostics in the system of responding to business development problems, identifying areas for improving strategic management, financial statements of corporations of Daimler Group (Germany), Tesla Motors (USA) and Toyota Motor (Japan) and own research results. The methodological basis of the study is a set of general and special methods used to achieve the goal of the research and includes: theoretical generalization and synthesis – in analyzing the content of scientific works on business diagnostics and strategic management; observation – to obtain primary information about the state of business of automotive companies in the world; indicator and integrated assessment – to assess the state of business and the effectiveness of strategic management of automotive corporations; information and logical analysis – when determining the issues and patterns of business development of corporations; problem-target method – to justify the choice of business development strategies; causation-result method – to obtain definitive conclusions. The results of the study of the state of business of the world's leading automotive corporations revealed the dependence of business efficiency on the degree of efficiency of strategic management of their activities, and identified types of strategies that will promote further development of automotive corporations – integrated, concentrated, diversified or globalized growth. The practical significance of the obtained results lies in their usefulness for strategic management for Daimler Group, Tesla Motors, Toyota Motor Corporation.

Keywords

Business Diagnostics, Efficiency of Strategic Management, Problem and Result-Based Approach, ?NC.

Introduction

Long-term business success is determined not only by the efficient distribution of limited economic benefits in the production process and customer needs satisfaction, but also by continuous analysis and lastly planning and forecasting of the economic situation at the macroeconomic level, at the level of forming organizational connections and business structures of entrepreneurship. Diagnostics plays an important role in the process of strategic analysis, which is the basis for further development and selection of strategy. The strategy at business level generally is the same that the corporative strategy of the organization (Fuertes et al., 2020).

The main task of diagnosing a business is to establish a diagnosis, an analytical result regarding its current and future state, its existing and possible problems (Van Aken & Berends, 2018). Equally important is the justification of the feasibility and necessity of applying corrective procedures to bring the basic parameters of business operation to their normative state. In particular, it includes the search for reserves to ensure its further development, forecasting the prospects for change in its quantitative and qualitative indicators. Completion of the task of diagnosing business is provided by a purposeful process that ensures the implementation of changes of different economic nature, direction and intensity through the use of scientific and methodological toolkit and management tools.

Strategic development management of international corporations requires a integrated approach. In addition to diagnostics, modern corporations develop and implement appropriate strategies, the efficiency of which determined by the prospects for their development and sustainability in the external environment. Justification of the choice of development strategies of international corporations should be accompanied not only by the establishment of clear criteria that will be the basis for such a choice, but also taking into account the trajectory of their development management, the degree of transformation of the system of strategic management. Such a transformation is caused not only by the growing uncertainty of market environment trends, destabilization of the world economy, deteriorating of the degree of processes controllability, which requires an appropriate response from the standpoint of management activity for solving modern business problems.

One of the most mobile and dynamically developing sectors today is the automotive sector. Automotive industry in various areas of activity is considered as a driving force of their development, successful and economically sustainable activity of which determines the effectiveness of functioning of the attendant complexes and industries. Therefore, it is important to study the economic condition of corporations, using diagnostics as a universal tool that also allows assessing and determining the prospects for their development.

Therefore, the main objectives of the study in the article should be defined:

– by critical analysis of scientific publications of modern scientists to determine the place of diagnostics in the system of response to problems of business development and its relationship with the definition of directions and strategies for corporations development;

– to conduct diagnostics of the business and effectiveness of strategic management of leading automotive corporations;

– to group the business issues of leading automotive corporations based on the results of diagnostics;

– to specify perspective directions and to offer a scientific approach for choosing strategies of development of business of automobile corporations.

Literature Review

Diagnostics in the System of Response to Issues of Business Development

Diagnostics in relation to business is a multifaceted economic category, around the essence and content of which there is constant debate among scientists. Most often, business diagnostics is defined as one of the effective tools for finding problems that hinder business development (Hutera, 2013; Bronnikova et al., 2020). As a development of the content of this concept, it is also argued that it is a system of methods for identifying the problem by systematic analysis of its preconditions, studying the signs or symptoms and evaluating research results (Gondzarova & Berzakova, 2016), which serves as an information base for senior management to make decisions in order to avoid destructive changes or to stimulate constructive changes in future periods (Smerichevskyi et al., 2021). The definition of the essence of this concept from the standpoint of the time range of the study considers business diagnostics as a retrospective (based on the achieved results), operational (current status) and prospective (development forecast) comprehensive study of the enterprise (Yatskevich, 2015). Thus, business diagnostics, on the one hand, helps to find the issues that hinder business development, on the other hand - is a universal tool of management, which allows identifying timely responses to identified issues and influences the choice of corporate strategy.

Analysis of the scientific literature has shown that the development of modern business is hindered by many factors, among which the most significant are the growth of market concentration, average margin and average profit, reducing the share of labour in income, the relationship between increasing concentration and reducing the share of labour, growing gap in productivity of cross-border and backward companies, reducing the speed of their market penetration, reducing share of young companies on the market, slowing redistribution of jobs, reducing the growth rate of corporations business (Akcigit & Ates, 2018). Business diagnostics is designed to help solve these and many other problems, and it should cover the research of internal and external (business) environment (Fuertes et al., 2020) in accordance with the stages of the life cycle of corporations, their financial capabilities, attitudes to strategic planning processes (Mimick et al., 2015).

Business diagnostics is increasingly becoming a universal tool of management activity. Firstly, its results are the basis for increasing organizational resilience based on the principles of management of quality and supply chain integration (Bastas & Liyanage, 2019). In modern conditions, organizational resilience is given a priority through the formation of the ability of organizations to withstand internal threats and respond flexibly to external threats. Secondly, it acquires the features of global diagnostics, which interacts with the information system, strategic management and innovation processes, providing the definition of reserves to increase functional capabilities of the enterprise (Gondzarova & Berzakova, 2016). The dominance of multinational corporations in the world, where only 147 control up to 40% of the world’s corporate wealth (Reznikova, 2011), requires close attention to their condition, the deterioration of which could instantly provoke a new financial threat to the world community. Thirdly, it is used to determine the ability to strategically improvise in order to survive, adapt and develop in a crisis (Hughes et al., 2020), prevention or overcoming of crisis situations (Skrynkovskyy et al., 2017). It seems to be especially important in the context of increasing the number of problems faced by the business. Fourthly, the concept of diagnostics is widely used in finding ways to improve efficiency of business processes (Kataev et al., 2016; Kryvovyazyuk et al., 2019). The development of diagnostic models in this case plays a key role (Sindi & Roe, 2017; Virakul & Russ-Eft, 2019), after all it allows to overcome global challenges and to increase sustainability of development based on the received results of diagnostic research.

Research of Directions of Improvement of Strategic Management and Justification of the Choice of Corporate Strategies for Solving Business Problems at the Present Stage of Development

In recent years, more and more questions have been raised in the scientific literature that make it possible to create global management mechanisms that could facilitate transitional paths to a fairer and more resilient world, with an emphasis on the corporate sector of the economy (McKeon, 2017). An important role in solving business problems belongs to strategic management, which provides through the achievement of long-term corporate goals an appropriate level of resilience of the organization. It is made possible by the use of adequate management tools and models, which should be applied at different stages of the strategic process to improve the achievement of the strategic goals of the MNC (Gilbert & Behnam, 2009). Some scholars note that the development of MNCs in the conditions of growing global threats requires specialized management of their sustainability based on the choice of appropriate strategy, views of the central government, the availability of resources for its implementation, prospects for development of countries markets and presence competing MNCs. It is equally important to take into account need for consolidation and integration of social, environmental and economic performance (Burritt et al., 2020). It is also important to develop optimization strategies based on a multi-criteria approach (Jarosz et al., 2019). Despite the significant importance of strategic management in solving business problems, it is necessary to take into account the fact that performance and strategies need to be understood in terms of the underlying actions, interactions and characteristics of micro?level entities. It plays important role for the development of global strategies (Contractor et al., 2019). The development of global strategies, in addition to assessing the attractiveness of sales countries, requires detailing the market entry strategy, studying the conditions of creation and impact of global strategic alliances, as well as the globalization of mergers and acquisitions processes (Lasserre, 2017).

Corporate strategy has great practical importance in today’s business environment, and although its scope is mostly aimed at determining the factors of competitive advantage, the importance is in managers’ control the scope of the company activity (Feldman, 2020). If business diagnostics is more focused on identifying problems, then corporate strategy – on solving them by using methods, depending on the type of manager who develops it (Mendes, 2018). For MNCs, corporate strategies are linked to the trade policies pursued by corporations, the use of modern technology, the degree of connections with the market environment, and the effectiveness of actions in the global environment (Rugman & Verbeke, 2017).

It is worth noting that most authors, who disclose the content of global strategies in the context of achieving the strategic goals of the MNC, identify them with corporate strategies, but refines them on the achieved goals or results (Burritt et al., 2020; Contractor et al., 2019; Lasserre, 2017). Thus, the set of problems faced by MNCs, as well as the transformation of the modern system of their strategic management, requires an integrated approach to the development of strategies of merging and acquisition that are integrated in overall corporate strategy, as a tool for innovation and corporate policy restructuring. It helps to ensure the achievement of strategic goals of corporations based on the results of business diagnostics and the level of corporate culture (Feix, 2020). Therefore, such imperatives as resource fluidity, strategic leadership, strategic posture, organizational resilience, innovation proclivity are distinguished as the strategic basis of willingness to improvise in terms of survival, adaptation and development of corporations (Hughes et al., 2020). This approach is a development of the theory of management of strategic opportunity, which has found its development in the works of many scientists, both past and present (Ansoff, 1965; Pearce & Robinson, 1985; Kryvovyazyuk & Strilchuk, 2016a). Alternative areas of strategic management improvement should also be considered, in particular “Integrative Governance”, which examines the interconnectedness of social, economic and environmental components; use of tools for evaluating practical actions; implementation of paradigmatic changes through common practice (Stout & Love, 2018).

Rationale for the choice of global corporate strategies is important for determining the future prospects of business development and is associated with the differentiation of directions of its development and selected criteria for the success of strategic management of corporations. In particular, scientists suggest to select such strategies based on various criteria: based on business efficiency and the impact of the market environment (Rugman & Verbeke, 2017), adaptability of strategic management and the degree of manifestation of the crisis (Kryvovyazyuk & Strilchuk, 2016b), company needs and environment constraints (Mendes, 2018). It is clear that the choice of specific criteria depends on the developed research methodology.

Methodology

The research results are obtained by using a set of general and scientific methods including given below. Observation was used in order to collect the primary information about the state of business of automotive companies used. Indicator and integrated assessment was used for assessing in corporations their state of business and effectiveness of strategic management. Information and logical analysis was used to detect the issues and patterns of business development of researched corporations. Problem-target method was used in justification why specific business development strategy should be chosen. And finally, causation-result method in the research helped to get definitive conclusions.

The statistical sample consists of MNCs, which belong to the largest corporations in the world in the field of automotive production, support high business efficiency, innovate and develop strategies – Toyota Motor ??rporation, Daimler Group, Tesla Inc. Research period is 2014–2019. Information basis of the research is a financial statement of corporations (Daimler Group, 2020; Tesla, 2020; Toyota Motor ??rporation, 2020).

The methodical approach to defining directions and strategies of development of business of automobile corporations is offered to be carried out in 4 stages:

A. Diagnostics of corporations business efficiency.

B. Evaluation of strategic management effeciency.

C. Grouping of business problems of automobile corporations.

D. Clarification of perspective directions and development of business development strategies of automotive corporations.

To calculate the efficiency of MNC business, a system of indicators is proposed that reflect the dynamics of income and expenses, as well as their ratio in the static assessment. Economic efficiency indicator should be defined as the ratio of the growth rate of the corporation’s income to the growth rate of its costs. Business efficiency indicator is recommended to calculate as a ratio of Economic efficiency indicator to Cost expenses dynamics indicator (characterizes the growth rate of costs and expenses).

For diagnostics of management the indicator of return of administrative actions is offered and which will be defined as a ratio of Gross profit to Management costs. Evaluation of the efficient of strategic management should be carried out by the following scale:

? Inefficient management: [-∞; 0]. Characterizes the state of management as unsatisfactory, when the mission is partially achieved, no net profit, financial management is ineffective, the diagnostics is carried out from time to time, the costs on innovation and investment projects or programs significantly exceeds their income, there are unforeseen risks, there is poor relationship with external environment;

? Low efficiency of management: [0,001; 0,500]. Characterizes the state of management as weak, when the mission is partially achieved, net profit is obtained from time to time, financial management has low efficiency, diagnostics is partial, innovation and investment projects or programs involve significant initial costs, there are partially forecasted risks, there is a need to modernize organizational structure;

? Satisfactory efficiency of management: [0,501; 1,000]. Characterizes the state of management as satisfactory, when the mission is formed, net profit is insignificant, financial management is established, but requires improvements, diagnostics of the enterprise state is carried out but is not comprehensive, classic management methods are used, innovation and investment projects or programs are implemented but have average efficiency, there is a sufficient level of management culture, risks are predicted, their negative impact is partially overcome, there is organizational structure of the transformation type, there is close relationship with the external environment;

? Good efficiency of management: [1,001; 2,000]. Characterizes the state of management as sufficient, when the mission is clear and understandable, net profit provides potential reproduction, financial management is effective, diagnostics of the state allows to quickly identify existing problems, modern management methods are used, innovation and investment projects are the basis of organization development, there is high level of management culture, risks are predictable, their negative impact is minimal, the organizational structure is flexible, the motivation system of staff meets their needs and there is a flexible relationship with the external environment;

? High efficiency of management: [2,001; ∞]. Characterizes the state of management as such, when the mission is fulfilled, net profit is high, allows providing innovative development, financial management is highly effective, diagnostics of the enterprise is aimed at preventing problems occurrence, innovative management methods are used, innovation and investment projects are implemented constantly, the level of management culture meets international standards, there are risks, but they are one-time ones, because there is a system of prevention risk management, the organizational structure is adapted to external needs, there is an effective relationship with the external environment.

The efficiency of management of MNC development is a generalization of static and dynamic values of indicators of efficiency of its functioning, development of perspective strategies of their development and formation of competences according to changes of external and internal parameters.

In order to clearly and purposefully identify business issues for automotive corporations, it is suggested to group them and consider individually, identifying 5 main: production, finance, marketing and sales, organizational structure and management, and other issues. This grouping is the basis for determining further directions of business development of the studied corporations.

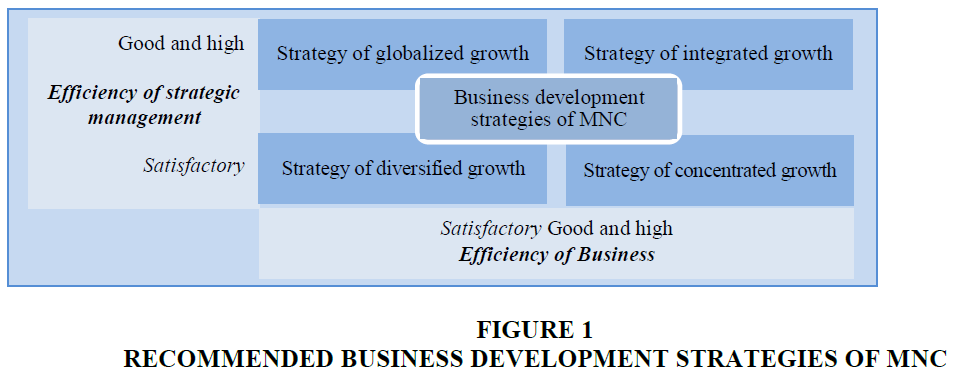

For the effective implementation of the process of strategic management, it is necessary to clarify promising areas and justify business development strategies, which should be based on the available opportunities for integrated, concentrated, diversified or globalized growth.

Results

The automotive industry is the world’s leading industry, which ranks first in terms of gross output, in many developed countries it provides from 5 to 10% of total GDP. Toyota Motor Corporation is the world’s leading carmaker with 10.7 million cars in 2019, Tesla Inc. is the largest manufacturer of electric vehicles (about 0.5 million cars), Daimler Group is characterized by the largest sales of trucks.

In today’s market environment, which reflects the interaction of automotive corporations, dealerships and direct consumers of products, one of the central goals is to diagnose their business in order to identify management problems.

The Results of Diagnostics Business Efficiency Leading Automotive MNCs

The results of calculations of business efficiency indicators of the world’s leading automotive corporations are presented in the Table 1.

| Table 1 Business Efficiency Indicators of Automotive MNCs | ||||||

| Indicators | Research period | |||||

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | |

| Toyota Motor ??rporation | ||||||

| Total revenues, million yens | 27234521 | 28403118 | 27597193 | 29379510 | 30225681 | 29929992 |

| Revenues dynamics indicator | 1.060 | 1.043 | 0.972 | 1.065 | 1.029 | 0.990 |

| Total costs and expenses, million yens | 24483957 | 25549147 | 25602821 | 26979648 | 27758136 | 27487123 |

| Cost expenses dynamics indicator | 1.046 | 1.044 | 1.002 | 1.054 | 1.029 | 0.990 |

| Economic efficiency indicator | 1.013 | 0.999 | 0.970 | 1.010 | 1.000 | 1.000 |

| Business efficiency indicator | 0.969 | 0.957 | 0.968 | 0.958 | 0.972 | 1.010 |

| Daimler | ||||||

| Total revenues, million euros | 129872 | 149467 | 153261 | 164330 | 167362 | 172745 |

| Revenues dynamics indicator | 1.101 | 1.151 | 1.025 | 1.072 | 1.019 | 1.032 |

| Total costs and expenses, million euros | 122958 | 139471 | 144044 | 154565 | 159441 | 172628 |

| Cost expenses dynamics indicator | 1.089 | 1.134 | 1.033 | 1.073 | 1.032 | 1.083 |

| Economic efficiency indicator | 1.011 | 1.015 | 0.992 | 0.999 | 0.987 | 0.953 |

| Business efficiency indicator | 0.928 | 0.895 | 0.960 | 0.931 | 0.956 | 0.880 |

| Tesla, Inc. | ||||||

| Total revenues, million dollars | 3198.4 | 4046.0 | 7000.1 | 11758.8 | 21461.0 | 24578.0 |

| Revenues dynamics indicator | 1.589 | 1.265 | 1.730 | 1.680 | 1.825 | 1.145 |

| Total costs and expenses, million dollars | 3385.1 | 4762.6 | 7667.5 | 13390.8 | 21849 | 24647 |

| Cost expenses dynamics indicator | 1.564 | 1.407 | 1.610 | 1.746 | 1.632 | 1.128 |

| Economic efficiency indicator | 1.016 | 0.899 | 1.075 | 0.962 | 1.118 | 1.015 |

| Business efficiency indicator | 0.650 | 0.639 | 0.668 | 0.551 | 0.685 | 0.900 |

Toyota Motor Corporation, despite the instability of functioning, characterized by the highest efficiency of the business, provided by a high level of values of Economic efficiency indicator. Significant business resilience is shown by a slight arithmetic mean deviation of the Business efficiency indicator from its normative value – 0.0327 or 3.27%. Daimler Group characterizes the steady increase in sales volumes throughout 2014–2019. However, the efficiency of the corporation’s business is cyclical and at the end of the research period decreases significantly, due to the lowest values of the Economic efficiency indicator. At the same time, the arithmetic mean deviation of the Business efficiency indicator from the normative value is 0.0750 or 7.50%, which indicates a much worse resilience of the business compared to Toyota Motor Corporation. Tesla, Inc. characterizes the constant growth of Total revenues, but the rate of increase in total costs and expenses is also significant. In 2019, the corporation provided the highest business efficiency in the period 2014-2019, received the highest values of Economic efficiency indicator. However, the resilience of the business is much worse compared to Toyota Motor Corporation and Daimler Group. Thus, the arithmetic mean deviation of the Business efficiency indicator from its normative is 0.3195 or 31.95%. It indicates a high-risk activity that may lead to excessive profits in the future.

The business problems of the leading automotive MNCs include:

? For Toyota Motor ??rporation – lack of sustainable growth of orders for the corporation’s products, stable growth of Total costs and expenses (except for 2019), reduction of economic efficiency of the activity in the period of 2015–2016;

? For Daimler Group – decline in growth rates of sales in the period 2017–2019, annual growth of Total costs and expenses, exceeding the growth rates of Total costs and expenses over the growth rates of Total revenues in the period 2017–2019, decrease in economic efficiency of activity in the period 2017–2019;

? For Tesla, Inc. – unsustainable growth of Total revenues, stable growth of Total costs and expenses, excess of growth rates of Total costs and expenses over growth rates of Total revenues in 2015 and 2017, decrease in economic efficiency of activity in 2015.

The identified issues allow establishing the following patterns of business development of corporations: ensuring of the growth of sales revenues at a faster rate than the growth of cost expenses forms the basis for increasing the efficiency of the business of automotive corporations; a decline in growth rates of sales or exceeding the growth rate of total costs and expenses over the growth rate of total revenues leads to a decrease in the efficiency of the business of automotive corporations.

The Results of Evaluation of the Efficiency of Strategic Management Leading Automotive MNCs

The results of evaluation of the efficiency of strategic management of the world’s leading automotive corporations are presented in Table 2.

| Table 2 Efficiency of Strategic Management of Automotive MNCs | ||||||

| Indicators | Research period | |||||

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | |

| Toyota Motor ??rporation | ||||||

| Gross profit, million yens | 2750564 | 2853971 | 1994372 | 2399862 | 2467545 | 2442869 |

| Management costs, million yens | 2642281 | 2943682 | 2868485 | 3090495 | 2976351 | 2964759 |

| Management efficiency of Gross profit | 1.041 | 0.970 | 0.695 | 0.777 | 0.829 | 0.824 |

| The level of management efficiency | good | satisfactory | ||||

| Daimler | ||||||

| Gross profit, million euros | 28184 | 31797 | 31963 | 34331 | 33067 | 29165 |

| Management costs, million euros | 3329 | 3710 | 3419 | 3809 | 4036 | 4050 |

| Management efficiency of Gross profit | 8.446 | 8.571 | 9.349 | 9.013 | 8.193 | 7.201 |

| The level of management efficiency | high | |||||

| Tesla, Inc. | ||||||

| Gross profit, million dollars | 882 | 924 | 1599 | 2223 | 4042 | 4069 |

| Management costs, million dollars | 604 | 922 | 1432 | 2477 | 2835 | 2646 |

| Management efficiency of Gross profit | 1.460 | 1.002 | 1.117 | 0.898 | 1.428 | 1.538 |

| The level of management efficiency | good | satisfactory | good | |||

The level of strategic management efficiency of Toyota Motor Corporation in recent years remains at a satisfactory level, due to a significant reduction in gross profit and significant management costs. This can be explained with gradual increase in total costs and expenses, in particular the increase in capital expenditures aimed at increasing production capacity. For Daimler Group in 2014–2019, the level of strategic management efficiency is characterized by a high level, but in recent years there has been a downward trend. It was caused by the reduction in the return of management costs due to significant pressure from competitors, as well as organizational problems. Tesla, Inc. is characterized by a mostly good level of strategic management efficiency, due to successful innovative solutions of the highest level of management.

The identified deviations in the resilience of the business of the researched MNC are the result of insufficiently effective strategic management, the pressure of external factors and the consequences of the impact of economic threats.

Grouping of Business Issues of Automobile Corporations

The development of leading automotive corporations, as well as the entire automotive industry in the world, is accompanied by a range of problems, which are summarized in the following groups: production, finance, marketing and sales, organizational structure and management, and other issues (Table 3).

| Table 3 Issues of Automotive MNCs Bussiness | |||

| Group of issue | Toyota Motor ??rporation | Daimler | Tesla, Inc. |

| Production | Influence of suppliers and increase of prices for raw materials; fuel shortage; dependence on IT efficiency; production shutdown in 2016 due to an earthquake near the island of Kyushu; problems of the transport system | Fluctuations in prices for raw materials, materials and energy; insufficient use of production capacity; increasing technical complexity of production and the need for innovative research | Production delays associated with the release of new car models; lack of production lines and capacities; dependence on IT efficiency |

| Finance | Exchange rate fluctuations; changes in the financial environment in financial markets and increasing competition in financial services field; changes in legislation | Problems of leasing and sales financing, cross-border financing; exchange rate fluctuations | Leasing problems; exchange rate fluctuations |

| Marketing and sales | The slowdown of the development of automotive markets; fierce competition; strengthening of the requirements for car safety, as well as environmental requirements | Unstable demand for products; strong pressure from competitors | Increasing consumer demand for electric vehicles; risks of growth of material costs; substantial regulation in accordance with international, federal, state and local laws |

| Organizational structure and management | Improving the risk management system; changes in the regulation of personnel activities; increase in capital expenditures to increase production capacity | Staff turnover; increase in capital expenditures to increase production capacity | Significant dependence on the top level of management in decision-making; the need for highly qualified personnel |

| Other issues | Cyberattacks that terrorize the corporation; the impact of natural disasters | - | Unauthorized access to IT networks |

The results of the study show that for automotive corporations it is important to work with suppliers, as well as pricing policy of the corporation, creating fuel reserves or transition to alternative energy sources, rapid response to changes in state policy, formation of demand, insurance of currency risk, improving the image, creation of flexible technologies, change in the regulation of personnel activities changes in management, cybersecurity, creating conditions for attracting highly qualified staff and others.

Clarification of Perspective Directions of Development and Strategies of Business Development of Leading Automotive MNCs

As a result of insufficiently effective strategic management of the development of the researched corporations, it is necessary to ensure the development and implementation of such a development mechanism that will prevent the occurrence of negative trends in indicators and ensure the growth of activity as a whole.

Analysis of problems of business allows identifying promising areas of development of the world’s leading automotive corporations (Table 4).

| Table 4 Areas of Development of the World’s Leading Automotive Corporations | |||

| Areas | Toyota Motor ??rporation | Daimler Group | Tesla Motors |

| External | |||

| Work with suppliers | + | + | + |

| Pricing policy of corporation | + | + | + |

| Creating fuel reserves | + | + | |

| Transition to alternative energy sources | + | ||

| Rapid response to changes in state policy | + | + | |

| Formation of demand | + | + | + |

| Insurance of currency risk | + | + | + |

| Improving the image | + | + | |

| Internal | |||

| Creation of flexible technologies | + | + | |

| Change in the regulation of personnel activities | + | + | + |

| Changes in management | + | + | + |

| Cybersecurity | + | + | |

| Creating conditions for attracting highly qualified staff | + | + | + |

| Increase in production capacity | + | ||

| Technical re-equipment | + | + | |

The existing set of tasks for the development of the world’s leading automotive corporations is impossible without justified strategic direction of action of its managers. Knowing the most important areas of development, direction of activities in the future, and aspects that should be considered when developing a corporate strategy can be set.

In order to implement the process of strategic management of automotive MNC, a necessary point is the introduction of such strategies for the development of their business, which will provide solutions to its existing problems, based on the possibilities of integrated, concentrated, diversified or globalized growth. The selection of business development strategy depends on the level of strategic management efficiency and the degree of corporation’s business efficiency (Figure 1).

Concentrated growth strategies are focused on the development of new markets and products, including the formation of proposals for new product groups, brands, conditions of after-sale service, improving pricing and promotion policies. These strategies should provide paying maximum attention to the introduction of all types of advanced and innovative technologies in the fields of management, production, marketing and sales and finance, ensuring a steady increase in efficiency of indicators.

Integrated growth strategies are focused on the development of traditional markets and products, including the reduction of ties with intermediaries, the expansion of retail space, the creation of new outlets etc. These strategies should provide paying maximum attention to the integration of different types of technologies in the fields of management, production, marketing and sales and finance, ensuring increased development efficiency.

Diversified growth strategies are focused on finding and using additional strategic opportunities of the production of new products through the improvement of the existing product range, complementary products and technologies. These strategies should provide paying maximum attention to the diversification of currently used advanced technologies in the fields of management, production, marketing and sales and finance, in order to ensure the transition of the enterprise to a higher level of development due to qualitative changes in management of development.

Globalization growth strategies focus on business expansion based on mergers and acquisitions with potential competitors, ensuring efficiency growth through the effect of production scale, gaining advantages over competitors by integrating staff knowledge, sharing modern technologies, obtaining production synergies.

Using business diagnostics data, the following strategies are recommended for the world’s leading automotive corporations:

• Toyota Motor ??rporation – concentrated growth strategy, taking into account the fact that the efficiency of the business is high, and strategic management is satisfactory and it requires the maximum use of advanced technologies;

• Daimler Group – globalized growth strategy, taking into account the fact that the efficiency of business is satisfactory, and strategic management is high, it is necessary to focus on effective management and further absorption of competitors, as well as on integration of production;

• Tesla, Inc. – concentrated growth strategy, taking into account the fact that it has good efficiency of business and strategic management, it should focus on development of new markets, sales channels and effective management, because the corporation, having a highly innovative product, does not always perform good strategic management.

Within the framework of the adopted strategy, it is recommended to model the development of the corporation, based on a four-dimensional model of development management, which allows combining four key parameters of its development: economic resources; way (process, internal relations, and business processes of the enterprise); goals-results; time line. Using its results allows forming plan of action, the implementation of which will enable the corporation to accelerate its development and take a stronger position in the market. The use of such a business development model of the world’s leading automotive corporations is justified from the standpoint of economic efficiency and feasibility. In conditions of threatening impact of risks, increasing pressure from competitors, corporations set minimum goals (expected results), spending as much time on them as possible, although using the simplest ways to improve the organization of work. For the current stage of business development Toyota Motor Corporation, Daimler Group, Tesla Inc. is characterized by significant costs of economic resources. With the chosen business development strategies automotive MNC will be able to maximize the expected results (business goals are increasing and getting more complicated). Improving existing ways of organizing business, as well as the accumulated experience, more rational organization of business processes will provide reduction of time waste. Optimization of economic resources will be achieved on the basis of maximizing goals and optimizing business processes. Organizing a business on a targeted basis provides an opportunity to solve a number of important tasks for Toyota Motor Corporation, Daimler Group and Tesla Motors - from reducing unproductive costs and the most complete use of resources based on optimal work organization to product range management and product pricing.

In order to improve economic results and further growth, it is suggested: for Toyota Motor ??rporation – to introduce into production a new type of products of a hybrid car with CO2 ZERO, which allows to increase energy efficiency through fuel economy, simultaneously reduce CO2 emissions and save ecology; for Daimler Group, in order to increase business efficiency – to introduce the production of Actross truck with reduced fuel consumption and increased profitability, as well as increased comfort for the driver; for Tesla, Inc. in order to increase profits – to update the electric car Model X, which will feature a powerful 430 hp electric motor and the ability to cover 600 km on a single charge.

Conclusion

Destabilization of economic development and the growing economic threats that accompany the functioning of the MNCs caused the need to transform management approaches in solving business problems. Analysis of scientific publications of modern scientists has established that rapid detection of such problems and timely response to them can be provided by business diagnostics. It is determined that business diagnostics occupies an important place in the activity management system, plays a crucial role in the process of achieving the goals and objectives of management activity. In modern conditions, business diagnostics acts as a universal tool of management, a comprehensive study of the business system, the results of which serve as a further basis for management decisions, improving strategic management and developing business development strategies of modern corporations.

The suggested methodology for determining the directions and strategies of business development involves the use of a set of methods, the choice of which depends on the research area, the direction of their implementation and on the strategic direction. Phased implementation of the methodology (diagnostics of business efficiency, evaluation of strategic management efficiency, analysis of business issues, and clarification of directions and strategies of business development) based on a system of integrated indicators and analytical generalization provides justified and reliable research results.

Business diagnostics of the leading automotive MNCs revealed the lack of sustained growth in orders for Toyota Motor Corporation products, a slowdown in business growth – for Daimler Group, and destabilization of business development for Tesla, Inc. Certain patterns of business development of automotive corporations are determined and indicate that ensuring the growth of sales revenues at a faster rate than the growth of cost expenses helps to increase the efficiency of their business. The decrease in business efficiency is due to a large number of problems, which are grouped as following: production, finance, marketing and sales, organizational structure and management, and other issues. It is established that the highest level of strategic management efficiency is typical for Daimler Group, the lowest – for Toyota Motor Corporation. It is determined that the decrease in the sustainability of the business of leading automotive MNCs is due to insufficient efficiency of strategic management.

In order to overcome the existing problems in the business of the world’s leading automotive corporations, individual directions of their development are recommended, taking into account external and internal strategic priorities. According to the results of the research, the scientific support for the choice of MNC business development strategy based on the use of problem and target-based approach and provides identification and development of actions of corporations, taking into account the possibilities of their integrated, concentrated, diversified or globalized growth. Within each strategy, it is recommended to model the process of managing the development of the corporation by implementing the system of design solutions in order to improve efficiency of management of the development of the researched automotive corporations.

References

- Akcigit, U., & Ates, S. (2018). Declining business dynamism and the diagnostics of its causes through growth theory.

- Ansoff, H.I. (1965). Corporate strategy. New York: McGraw-Hi ll.

- Bastas, A., & Liyanage, K. (2019). Integrated quality and supply chain management business diagnostics for organizational sustainability improvement. Sustainable Production and Consumption, 17, 11-30.

- Bronnikova, V.V., Lyubetskaya, T.R., & Nekrasova, Ya.V. (2020). Business diagnostics and service evaluation. European Journal of Natural History, 3, 130-133.

- Burritt, R.L., Christ, K.L., Rammal, H.G., & Schaltegger, S. (2020). Multinational enterprise strategies for addressing sustainability: The need for consolidation. Journal of Business Ethics, 164(2), 389-410.

- Contractor, F., Foss, N.J., Kundu, S., & Lahiri, S. (2019). Viewing global strategy through a microfoundations lens. Global Strategy Journal, 9(1), 3-18.

- Daimler Group. (2020). Daimler Annualreport, 2014-2019.

- Feix, T. (2020). Embedded M&A strategy. In End-to-End M&A Process Design. Springer Gabler, Wiesbaden.

- Feldman, E.R. (2020). Corporate strategy: Past, present, and future. Strategic Management Review, 1(1), 179-206.

- Fuertes, G., Alfaro, M., Vargas, M., Gutierrez, S., Ternero, R., & Sabattin, J. (2020). Conceptual framework for the strategic management: A literature review-Descriptive. Journal of Engineering, 2020.

- Gilbert, D.U., & Behnam, M. (2009). Strategy process management in multinational companies: status quo, deficits and future perspectives. Problems and Perspectives in Management, 7(1), 59-74.

- Gondzarova, B., & Berzakova, V. (2016). Global Journal of Business, Economics and Management. Management, 6(2), 238-242.

- Hughes, P., Morgan, R.E., Hodgkinson, I.R., Kouropalatis, Y., & Lindgreen, A. (2020). A diagnostic tool to determine a strategic improvisation Readiness Index Score (IRIS) to survive, adapt, and thrive in a crisis. Industrial Marketing Management, 88, 485-499.

- Hutera, M. (2013). Evaluation methodology and its measurements. Economic Review, 3, 397-404.

- Jarosz, P., Kusiak, J., Ma?ecki, S., Morkisz, P., Oprocha, P., Pietrucha, W., & Sztangret, ?. (2019). Multi-criteria optimization strategies for tree-structured production chains. International Journal of Material Forming, 12(2), 185-196.

- Kataev, M., Bulysheva, L., Emelyanenko, A., & Bi, Z. (2016). Enterprise diagnostics for evaluation of enterprise business processes. Journal of Industrial Integration and Management, 1(02), 1650008.

- Kryvovyazyuk, I.V., & Strilchuk, R.M. (2016a). Evaluation of strategic position of engineering enterprises in the context of their opportunities'diagnostics. Actual Problems in Economics, (182), 146-155.

- Kryvovyazyuk, I.V., & Strilchuk, R.M. (2016b). Strategic opportunities management at engineering enterprises. Aktual'ni Problemy Ekonomiky= Actual Problems in Economics, (183), 144-155.

- Kryvovyazyuk, I., Kovalska, L., Savosh, L., Pavliuk, L., Kaminska, I., Okseniuk, K., Baula, O., & Zavadska, O. (2019). Strategic decision and transnational corporation efficiency. Academy of Strategic Management Journal, 18(6), 1-8.

- Lasserre, P. (2017). Global strategic management. Macmillan International Higher Education.

- McKeon, N. (2017). Transforming global governance in the post-2015 era: Towards an equitable and sustainable world. Globalizations, 14(4), 487-503.

- Mendes, M.V.I. (2018). The winding road of corporate strategy. Revista Pensamento Contemporâneo em Administração, 12(1), 33-46.

- Mimick, R.., Thompson, M., & Rachwalski, T. (2015). Business diagnostics. Trafford Publishing.

- Pearce, J.A., & Robinson, R.B. (1985). Formulation, implementation and control of competitive strategy.

- Rugman, A.M., & Verbeke, A. (2017). Global corporate strategy and trade policy. Routledge.

- Sindi, S., & Roe, M. (2017). Strategic Supply Chain Management: The Development of a Diagnostic Model. Springer.

- Skrynkovskyy, R., Pavlenchyk, N., Lesk?v, S., & Pawlowski, G. (2017). The improvements of enterprise anti-crisis management diagnostics in the system of managerial diagnostics. Path of Science, 3(11), 4001-4009.

- Smerichevskyi, S.F., Kryvovyazyuk, I.V., Prokhorova, V.V., Usarek, W., & Ivashchenko, A.I. (2021). Expediency of symptomatic diagnostics application of enterprise export-import activity in the disruption conditions of world economy sustainable development. In IOP Conference Series: Earth and Environmental Science (Vol. 628, No. 1, p. 012040). IOP Publishing.

- Stout, M., & Love, J.M. (2018). Integrative governance: Generating sustainable responses to global crises. Routledge.

- Tesla. (2020). Annualreporton form 10-K for theyearended, 2014-2019.

- Van Aken, J.E., & Berends, H. (2018). Problem solving in organizations. Cambridge university press.

- Virakul, B., & Russ-Eft, D.F. (2019). A model for business responses to global challenges and sustainable development. Social Responsibility Journal, 16 (2), 199-224.

- Yatskevich, I. (2015). Economic diagnostics. Odessa: Bondarenko MO.