Research Article: 2018 Vol: 17 Issue: 2

Business Environment and Company Reputation in Formulating Competitive Strategy of Rural Bank in West Java

Rahajeng Widyasih AV, Padjadjaran University

Sucherly, Padjadjaran University

Umi Kaltum, Padjadjaran University

Rita Komaladewi, Padjadjaran University

Keywords

Business Environment, Reputation, Competitive Strategy, Rural Bank.

Introduction

Research Background

In terms of performance, in the period 2011-2015 there was an increase in banking performance in Indonesia, although unstable. In total, in the last 5 years the profit increased by IDR 30 trillion (39.36%) from IDR 75 trillion in 2011 to IDR 105 trillion in 2015. However, in 2015, there was a reduction in the number of rural banks from the previous year of 1,643 to 1,637 units. This reduction occurred due to the revocation of business license and merger. Meanwhile, the number of office networks increased by 44 offices from the previous year from 3,154 to 3,198 offices. Judging from the form of legal entity of ownership, most of the form of Limited Company with a number of 1,410 rural banks followed by the form of Regional Enterprise as much as 197 units and Cooperatives as many as 30 units (Banking Annual Report, 2015).

Meanwhile, Rural Bank plays a role in lending to micro, small and medium enterprises and can create jobs, as well as equal distribution of income and business opportunities in Indonesia. Rural Bank is established in Indonesia under the Regulation of the Financial Services Authority Number 20/POJK.03/2014 concerning Rural Bank issued in order to encourage national economic growth as well as to support dynamic business development with a strong national banking, including the healthy, strong, productive and competitive rural bank industry to serve the community, especially micro and small businesses.

Although it has a big role to boost the regional economy, the contribution of rural bank today is relatively small. Hadinoto & Retnadi (2007) stated that rural bank has not been widely known by the public and has not been utilized by the government to support the economic development in order to improve the welfare of the people especially in rural areas.

For local governments, rural bank is one of the efforts to increase the regional income. Meanwhile, the growth of asset, savings, deposit and lending rates from rural Banks of West Java and Banten provincial governments tend to increase, but the condition is not balanced by the stable growth of operating profit, which tends to fluctuate, thus indicating un-optimal performance.

The growth of asset, savings, deposit and lending rates from rural Banks of West Java and Banten provincial governments tend to increase, but the condition is not balanced by the stable growth of operating profit, which tends to fluctuate, thus indicating un-optimal performance.

Similarly, private-owned rural banks in general also experience un-optimal performance. The financial performance generally tends to improve, however it is not in line with the growth in the number of rural banks that show a declining trend year-on-year, both nationally and in West Java. This is due to the merger/consolidation and liquidation. From 2006 to 2015, the Deposit Insurance Agency (2016) notes that 69 rural banks were in process or completed liquidated, 24 of which are in West Java, 13 rural banks in West Sumatra and the remaining 32 are scattered in other provinces. In addition, based on Fit and Proper Test existing results that have been completed by December 2015, there are 13 alleged of irregularities consisting of seven Directors and six Executive Officers (Banking Annual Report 2015, OJK, page 107). In terms of numbers, the rural bank offices in West Java Province up to August of 2016 recorded 296 rural banks, of which 109 decreased (26.91%) from 2008. This percentage decline is much larger than the national decline, 136 rural banks (7.68%).

It is related to the population of West Java Province that continuous to increase, should be an opportunity for rural bank in West Java Province to improve its rural bank performance. As data from the Central Bureau of Statistics (2016), West Java Province is the province of Indonesia with the largest population of 43,227,100 inhabitants in 2010 which increased to about 47,379,389 inhabitants in 2016. This condition should provide opportunities for the growth of rural bank performance in West Java Province, considering the market share are residents or MSMEs in their region.

Another phenomenon revealed about the performance of rural banks in West Java is the growth of third party funds collecting gradually growing from 25.70% in 2009 to 8.10% in 2015 and 0.69% in August 2016.

That condition, presumably because of the competitive strategy has not been implemented properly. The three generic competitive strategies according to Porter in Wheelen et al. (2015) aimed to outperform other companies in an industry, that include overall cost leadership, differentiation and focus. Cost leadership is the ability of companies or business units to design produce and market the products more efficiently than its competitors. Differentiation is the company's ability to provide superior and unique value in terms of product quality, special features or after-sales service to buyers. Focus strategy is a company's ability to provide superior and unique value to a particular buyer group, a particular market segment and to a specific geographic market.

Besides have to compete with competitors in and outside of province, rural banks in West Java also have to compete with other public banks that are trying to get into the microcredit market and SMEs. The influx of newcomers as well as large public banks should be anticipated to determine the industry ability of a bank. Rural bank also faces direct competition with Bank Rakyat Indonesia as well as the cooperative who has similar segment that are micro customer, Small and Medium Enterprises (SMEs). While SMEs are potential opportunity because it proved to be able to survive in the past economic crisis than large businesses. In addition, the SME commonly found in the business field in Indonesia. But in general the rural bank does not have additional attributes in their products to enhance the competitiveness of its products. There are no innovative programs to attract customers either savers or borrowers, for example the attractive raffle prizes. In addition, rural bank also has not been optimal in the use and provision of information technology in supporting the customer service.

Another aspect relating to the un-optimized performance of rural bank in West Java is company reputation. Meanwhile, according to Fombrun (2001), to help companies establish a strong reputation that will have positive and profitable impacts, there are several key elements to note: Credibility, reliability, trustworthiness and responsibility. While from the community side, it appears that the credibility of rural bank is still under the national bank. In addition, the level of public confidence is not yet as high as for national private banks. The community assesses the quality of services provided by rural bank is still below the services of commercial banks, especially large banks that have high-level service standards for its customers. National banks more professional in managing the queue of customers either queue to the teller or to customer service. In addition, in terms of technology, commercial banks have better facilities in terms of technology such as ATM that is easily found anywhere, as well as in terms of providing debit card and credit card services that can facilitate customers in making transactions. It can increase the bank’s credibility and customer’s trust.

Another problem related to that phenomenon presumably because the management team has not been able to adapt the business environment in banking industry.

In the current, the rural bank in West Java is still very vulnerable to the conditions and economic situation and politics of regional government, including among others concerning the condition of regional income of local Government in each work area. The management seems to have not been able in adapting the trend of consumers. Where it is seen from the existence of customer complaints against rural bank’s services. Likewise, the banking technology has not been like as commercial bank so rural bank is impressed still lagging behind commercial banks. Meanwhile, Ahmad et al. (2011) argue that many companies seek to maximize their market share and profits through observing the market environment. The external environment includes both a macro environment and a microenvironment. A micro-environment is a stakeholder of a company that has control over suppliers, customers, retailers and competitors. While the macro environment is political, economic, social and technological.

Based on the above research background, the study is presented about the business environment and the company's reputation in influencing competitive strategy.

Based on this background, this study aims to examine the influence of business environment and company reputation on competitive strategy of rural bank in West Java.

Literature Review

Business Environment

Environmental scanning in the strategic management processes in the opinion of Wheelen & Hunger (2015) is the overarching term encompassing the monitoring, evaluation and dissemination of information relevant to the organizational development of strategy. David (2013) proposes external forces divided into five broad categories: (1) Economic forces (2) Social, cultural, demographic and environmental forces; (3) Political power, government and law; (4) Technological power; (5) Competitive power. The results of the Essmui, Berma, Bt Shahadan, Bt Ramlee and Bin Mohd’s study show a strong relationship between sales growth and factors such as corruption, crime, finance, infrastructure, business regulation and human resources.

“Firms are endowed with different business environment characteristics on legal status, taxes, competitions and foreign market presence among others” (Gavrila & Muntean, 2011).

Krapez, Aleš & Miha (2012) explain that the business environment indicates external and internal forces and institutions beyond the control of individuals within the company that can directly or indirectly influence the company's business. According to Ahmad, Khattak, Khan & Khan (2011), many companies are trying to maximize their market share and profitability after launching new products in the era of competition, so the observation of the current market environment is focused on gaining profit through new product development. The external environment includes both macro and microenvironment.

Ahmad, Khattak, Khan & Khan (2011) note an important factor of environmental macro according to Renewal Associates (2003), namely:

Political

1. Ecological/environmental issues

2. Current legislation home market

3. Future legislation

4. Regulatory bodies and processes

5. Government policies

6. Government term and change

7. Trading policies

8. Funding, grants and initiatives

9. Home market lobbying/pressure groups

Economic

1. Home economy situation

2. Home economy trends

3. Overseas economies and trends

4. General taxation issues

5. Taxation specific to product/services

6. Seasonality/weather issues

7. Market and trade cycles

8. Specific industry factors

9. Market routes and distribution trends

10. Customer/end-user drivers

11. Interest and exchange rates

Social

1. Lifestyle trends

2. Demographics

3. Consumer attitudes and opinions

4. Media views

5. Law changes affecting social factors

6. Brand, company, technology image

7. Consumer buying patterns

8. Fashion and role models

9. Major events and influences

10. Buying access and trends

11. Ethnic/religious factors

12. Advertising and publicity

Technological

1. Competing technology development

2. Research funding

3. Associated/dependent technologies

4. Replacement technology/solutions

5. Maturity of technology

6. Manufacturing maturity and capacity

7. Information and communications

8. Consumer buying

9. Mechanisms/technology

10. Technology legislation

11. Innovation potential

12. Technology access, licensing, patents

13. Intellectual property issues

While the micro environment according to Ahmad, Khattak, Khan & Khan (2011) is a stakeholder company that has control over suppliers, customers, retailers and competitors. While the macro environment is political, economic, social and technological.

The business environment according to Peyton, Lewis & Pitts (2003) covers aspects of economic, political, cultural, technological and demographic.

Based on the above description, the business environment in this study covers the dimensions of macro environment and micro environment.

Company Reputation

According to Fombrun (2001), to help companies establish a strong reputation that can have positive and profitable impacts, there are several key elements to note namely credibility, reliability, trustworthiness and responsibility. Fombrun (2001) said that that a good reputation can reduce the cost of the company to obtain capital by increasing its ability to obtain funds from the credit market.

Siano, Kitchen & Confetto (2010) argue that “Applying a resource-based view of the firm, corporate reputation is a rare and valuable intangible asset that competitors find difficult to imitate, substitute or replicate (because of its social complexity). It allows the company to achieve and maintain sustained superior financial performance and contributes significantly to performance differences among organizations”.

Hall & Lee (2014) argue that “Corporate reputation can be defined as the stakeholder’s assessment of a firm’s long-term assessment of an organization’s social and economic potential by its stakeholders (e.g. customers, suppliers, society, etc.)”.

As for this study, the company's reputation is measured by the dimensions of credibility, reliability, trust and responsibility.

Competitive Strategy

There are several strategies to strengthen the position expressed by Hitt, Ireland & Hoskisson (2015) in which the company can choose five business strategies to build and maintain its strategic position against competitors, including namely cost leadership, differentiation, focused cost leadership, focused differentiation and integrated cost leadership/differentiation.

Parnell (2010): “According to Porter’s framework, a business can pursue superior performance by either establishing a cost leadership position (i.e., low costs) or differentiating its offerings from those of its rivals. Either of these approaches may be accompanied by focusing efforts on a given market niche”.

Banker, Raj & Arindam (2014) show that prior literature indicates that a firm following either a differentiation or a cost leadership strategy is in a better position to achieve superior contemporaneous performance.

Kohansal, resource-based view-the company's strategy to create a synergy of resources for value creation are better than their competitors.

In this paper, competitive strategies is measured based on the dimensions of cost leadership strategy, differentiation strategy and focus strategy.

Past research has shown the influence of the business environment and reputation against competitive strategy. Alrawashdeh finds that competitive advantage influenced by supplier bargaining power, substitution threats and local entry threats, while according to Boström & Wilson newcomer strength affects the company's position. Iwu (2014) demonstrated that the cultivation of a strong reputation is related to defeating competition, enhancing market prospects and financial performance as well as sustainable existence. Hall & lee (2014) confirmed a positive correlation between company performance and company reputation and highlighted the importance of company reputation as an important strategic asset that needs to be managed.

Hypothesis

Based on the above description, the following hypotheses are prepared:

H1: The business environment and the company's reputation affect the rural bank’s competitive strategy in West Java.

Research Methodology

This study will examine the Rural Banks in West Java by using quantitative research approach. A quantitative approach emphasizes the numerical assessment of the phenomenon being studied. Quantitative research is more systematic, planned, structured and clear from the beginning until the end of the study. A quantitative approach is used to identify the entire concept of the objectives of the study (Malhotra, 2010).

Research causality tests the truth/facts/principles of a knowledge that already exists in the rural bank in West Java. "Causalities research is used to obtain evidence of the cause and effect (causal) relationship" (Malhotra, 2010).

Time horizon of this study is cross section/one shot, means that any information or data obtained are the result of research conducted at one particular time, namely in 2017.

Sekaran (2010) argues “unit of analysis refers to level aggregation of the data collected during the subsequent data analysis stage”. So that the unit of analysis in this study is the rural bank in West Java, with the observation unit, namely the management of rural bank in West Java Province. Data were taken from a sample of 100 respondents and sampling technique used is simple random sampling with list of BPR in West Java as sampling frame. Analysed using Partial Least Square (PLS), technique of collecting data for the respondents is done through questionnaires, using Likert scale divided into 5 scales with the answer categories divided into very low, low, good enough, good and very good.

Result And Discussion

Analysis of Measurement Model (Inner Model)

Analysis of measurement model (outer model) shows the indicators as with each dimension and latent variables. It is used as validity and reliability test to measure the latent variable and indicator in measuring dimension that is constructing. It is can be explained if the value of Composite reliability and Cronbach’s Alpha of variables >0.70 show that all of variables in the model estimated fulfil the criteria of discriminant validity, if the value of AVE>0.70, then it can be concluded that all of variables has a good reliability.

The Table 1 above shows the result of measurement model for each latent variable and each dimension on indicator. The results of measurement model of latent variables on their dimensions show to what extent the validity of dimensions in measuring latent variables. Following Table 2 shows the result of measurement model for each latent variable on dimensions.

| Table 1: Test Of Outer Model | |||

| AVE | Composite Reliability | Cronbach’s Alpha | |

|---|---|---|---|

| BUSINESS ENV | 0.772 | 0.914 | 0.891 |

| REPUTATION | 0.761 | 0.894 | 0.867 |

| COMPETITIVE STRGY | 0.784 | 0.894 | 0.866 |

| Table 2: Loading Factor Of Laten Variable-Dimension-Indicator | |||||

| Variable-Dimension | Indicator-Dimension | l | SE(l) | t-value | Conclusion |

|---|---|---|---|---|---|

| BUSINESS ENV -> Macro | 0.981 | 0.004 | 249l141 | valid | |

| X11<- Macro | 0.820 | 0.030 | 27.259 | valid | |

| X12<- Macro | 0.580 | 0.087 | 6.700 | valid | |

| X13<- Macro | 0.785 | 0.046 | 17.080 | valid | |

| X14<- Macro | 0.781 | 0.039 | 19.923 | valid | |

| X15<- Macro | 0.879 | 0.018 | 49.951 | valid | |

| BUSINESS ENV ->Micro | 0.954 | 0.009 | 111.438 | valid | |

| X21<- Micro | 0.845 | 0.033 | 25.390 | valid | |

| X22<- Micro | 0.725 | 0.059 | 12.256 | valid | |

| X23<- Micro | 0.792 | 0.034 | 23.478 | valid | |

| REPUTATION ->Credibility | 0.738 | 0.079 | 9.313 | valid | |

| X31<- Credibility | 0.986 | 0.005 | 182.772 | valid | |

| X32<- Credibility | 0.961 | 0.012 | 78.062 | valid | |

| X33<- Credibility | 0.975 | 0.011 | 87.818 | valid | |

| REPUTATION ->Reliability | 0.741 | 0.043 | 17.183 | valid | |

| X41<- Reliability | 0.911 | 0.020 | 44.789 | valid | |

| X42<- Reliability | 0.916 | 0.018 | 51.752 | valid | |

| REPUTATION ->Trust | 0.678 | 0.087 | 7.784 | valid | |

| X51<- Trust | 0.922 | 0.024 | 38.976 | valid | |

| X52<- Trust | 0.669 | 0.081 | 8.238 | valid | |

| X53<- Trust | 0.928 | 0.021 | 43.414 | valid | |

| REPUTATION ->Responsive | 0.784 | 0.056 | 14.106 | valid | |

| X61<- Responsive | 0.974 | 0.011 | 91.086 | valid | |

| X62<- Responsive | 0.974 | 0.011 | 88.532 | valid | |

| COMPETITIVE STRGY ->Cost Leadership Strgy | 0.877 | 0.031 | 28.206 | valid | |

| Y11<- Cost Leadership Strgy | 0.844 | 0.035 | 24.452 | valid | |

| Y12<- Cost Leadership Strgy | 0.789 | 0.048 | 16.598 | valid | |

| Y13<- Cost Leadership Strgy | 0.867 | 0.034 | 25.243 | valid | |

| COMPETITIVE STRGY ->Diff Strgy | 0.922 | 0.016 | 58.957 | valid | |

| Y21<- Diff Strgy | 0.722 | 0.052 | 14.016 | valid | |

| Y22<- Diff Strgy | 0.807 | 0.086 | 9.395 | valid | |

| Y23<- Diff Strgy | 0.800 | 0.087 | 9.213 | valid | |

| Y24<- Diff Strgy | 0.605 | 0.082 | 7.405 | valid | |

| COMPETITIVE STRGY ->Focus Strgy | 0.786 | 0.047 | 16.829 | valid | |

| Y31<- Focus Strgy | 0.900 | 0.021 | 42.667 | valid | |

| Y32<- Focus Strgy | 0.881 | 0.023 | 37.775 | valid | |

The result of measurement model of dimensions by its indicators show that the indicators are valid which the value of t value (<t-table=1.985).

Analysis of Structural Model (Inner Model)

The analysis of inner model shows the relationship between latent variables. Inner model is evaluated by using Goodness of Fit Model (GoF) that shows the difference between the values of the observations result with the values predicted by the model. This test is indicated by the value of R Square on endogenous constructs and Prediction relevance (Q-square) or known as Stone-Geisser's used to know the capability of prediction with blindfolding procedure. If the value obtained 0.02 (minor), 0.15 (medium) and 0.35 (large) and only used for the endogenous construct with reflective indicator. Refer to Chin (1998), the value of R square amounted to 0.67 (strong), 0.33 (medium) and 0.19 (weak).

The data on the Table 3 shows the value of R2 on competitive strategy as endogenous variable is in the strong criteria (>0.6=strong) and the value of Q-Square is in the large criteria (>0.35=large), so that it can be concluded that the research model is fit.

| Table 3 : Test Of Outer And Inner Model | ||

| R Square | Q Square | |

|---|---|---|

| BUSINESS ENV | 0.l567 | |

| REPUTATION | 0.l449 | |

| COMPETITIVE STRGY | 0.l648 | 0.l484 |

Source: SmartPLS 2.0

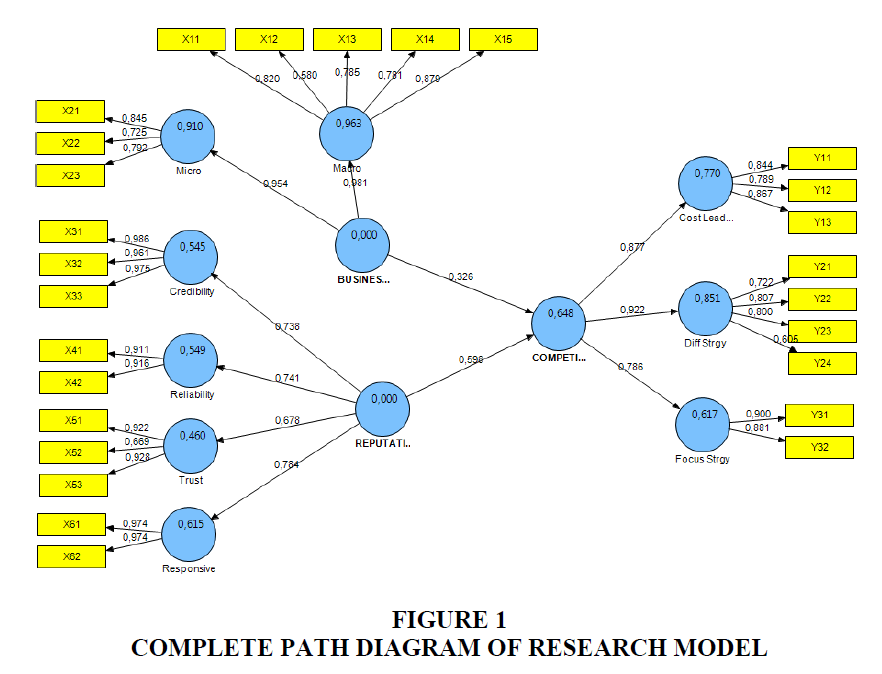

Following Figure 1 show the complete path diagram:

Structural Model

Based on the research framework and then obtained a structural model as follow:

Y=0.326X1+0.598X2+?1

Where:

Y=Competitive Strategy

X1=Business Environment

X2=Reputation

?i=Residual

Hypothesis Testing

The influence of business environment and reputation on competitive strategy. Below is the result of hypothesis testing both simultaneous and partially.

Simultaneous Hypothesis Testing

Below is the result of simultaneous testing of hypothesis:

| Table 4: Simultaneous Testing Of Hypothesis | |||

| Hypothesis | R2 | F | Conclusion |

|---|---|---|---|

| Business Environment and Reputation®Competitive Strategy | 0.648 | 59.493* | Hypothesis accepted |

*Significant at a=0.05 (F table=3.09).

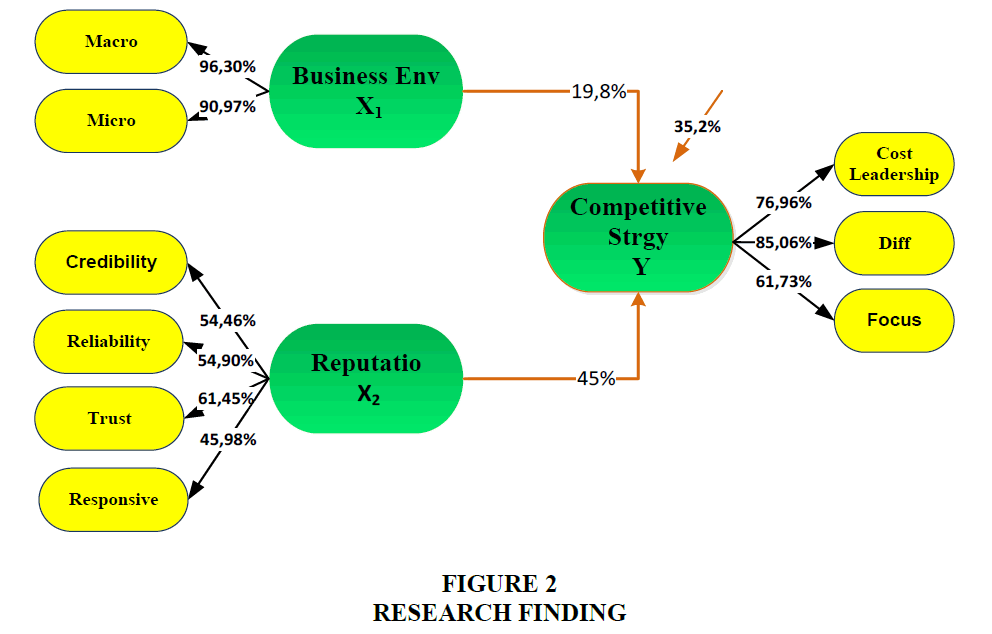

Based on the Table 4, it is known that within the degree of confidence of 95% (?=0.05) simultaneously there is the influence of Business Environment and Reputation to Competitive Strategy amounted to 64.8%, while the rest of 35.2% is affected by other factor did not examined.

Partial Hypothesis Testing

Below is the result of partial testing of hypothesis:

The Table 5 shows that partially, Business Environment and Reputation influential significantly to Competitive Strategy, which is Reputation has a greater influence (45%).

| Table 5: Partial Testing Of Hypothesis | |||||

| Hypothesis | g | SE(g) | t-value | R2 | Conclusion |

|---|---|---|---|---|---|

| BUSINESS ENV ->COMPETITIVE STRGY | 0.326 | 0.106 | 3.072* | 0.198 | Hypothesis accepted |

| REPUTATION ->COMPETITIVE STRGY | 0.598 | 0.116 | 5.168* | 0.450 | Hypothesis accepted |

*Significant at a=0.05 (t-table=1.985)

Research Finding

Based on the results of hypothesis testing obtained model findings as illustrated below: The research finding Figure 2 shows that business environment and company reputation have significant effect on the rural bank competitive strategy. The company reputation has a greater impact than the business environment in determining the right competitive strategy in rural bank in West Java.

The findings of this study indicating the dominant influence of reputation on competitive strategy, supporting the findings of Iwu (2014) who indicate that the cultivation of strong reputation is related to defeating competition, improving market prospects and financial performance and sustainable existence; and Hall & lee (2014) which confirm a positive correlation between company performance and company reputation and highlight the importance of company reputation as an important strategic asset that needs to be managed.

Discussion And Conclusion

Based on the research finding above, can be said that to what extent the rural bank’s reputation against its competitors plays an important role in formulating the most appropriate competitive strategy. In an effort to develop reputation, rural bank’s management should emphasize efforts to increase trusts supported by the development of reliability, credibility and responsibility. Trust from customers, from shareholders and from the public has a dominant role in enhancing the reputation of rural bank which implies the ability to formulate the appropriate competitive strategy. While reliability is manifested in the form of providing services in accordance with the promised and the continuous perfection of business processes. Credibility is demonstrated by the ability of management to provide budgets for appropriate Research & Development activities and in the management capabilities in building corporate responsibility towards customer value and the extent to which management is able to create future prospects. While the responsibility is given either to the customer or to other related parties such as investors.

Based on the result of hypothesis testing, it can be concluded that the business environment and company reputation have an effect on rural bank competitive strategy, where competitive strategy has more dominant influence than the company reputation.

The results of this study have implications for rural bank management that in order to formulate the right competitive strategy, it needs to be supported by the development of company reputation. Reputation determines the company's position in the industry compared to its competitors so that it becomes the foundation in determining the right strategy to do in order to be competitive and lead in its market.

This study can be used as a reference for further research by making it as part of preparing the premise. In the future is expected from academician to be interested in doing research on rural bank from a different perspective in an effort to formulate an appropriate competitive strategy.

References

- Ahmad, C.R., Khattak, J., Khan, M.N. & Khan, N.A. (2011). Pros & cons of macro environment (PEST Factors) on new product development in fast food industry of Pakistan for sustainable competitive advantage interdisciplinary. Journal of Contemporary Research in Business, 3(2), 932-945.

- Banker, R.D., Raj, M. & Arindam, T. (2014). Does a differentiation strategy lead to more sustainable financial performance than a cost leadership strategy? Management Decision, 52(5), 872-896.

- Chin, W.W. (1998). The partial least square approach for structural equation modelling. In G.A. Marcoulides (Eds.), Modern Method for Business Research. Mahwah, NJ: Erlbaum.

- David, F.R. (2013). Strategic management, concepts & cases. Pearson Education Limited, England.

- Fombrun, C. (2001). The reputational landscape. Corporate Reputation Review, 1(1/2).

- Gavrila, P.I. & Muntean, A.C. (2011). Valorizing entrepreneurial potential of the central region-partnership between university and business environment as supporting element of the entrepreneurial culture. Annales Universitatis Apulensis: Series Oeconomica, 13(2), 532-538.

- Hadinoto, S. & Retnadi, D. (2007). Micro credit challenge: Cara efektif mengatasi kemiskinan dan pengangguran di Indonesia. Jakarta: Elex Media Komputindo.

- Hall. & Lee. (2014). Assessing the impact of firm reputation on firm performance: An international point of view. International Business Research, 7(12).

- Hitt, M.A., Ireland, R.D. & Hoskisson, R.E. (2015). Strategic management: Competitiveness & globalization: Concepts and cases (Seventh Edition). Stamford: Cengage Learning.

- Iwa, K. (2015). Strategi bersaing dan kreasi nilai yang didorong oleh kekuatan lingkungan industri dan sumber daya perusahaan berimplikasi pada kinerja BPR (Suatu penelitian pada bank perkreditan rakyat milik pemerintah daerah kabupaten kota provinsi jawa barat dan banten). Disertasi, Universitas Padjadjaran.

- Iwu, E. & Ronald, C. (2014). Corporate reputation & firm performance: Empirical literature evidence. International Journal of Business and Management, 6(4), 197-206.

- Krapez, J., Ale?, G.O. & Miha, ?.A. (2012). Contextual variables of open innovation paradigm in the business environment of Slovenian.

- Malhotra, N.K. (2010). Marketing research: An applied orientation (Sixth Edition). Pearson Education.

- Parnell, J.A. (2011). Strategic capabilities, competitive strategy and performance among retailers in Argentina, Peru and the United States. Management Decision, 49(1), 130-155.

- Peyton, R.M., Lewis, G.L., Kamery, R.H. & Pitts, S.T. (2003). Guideposts concerning the development and implementation of quality childcare/day-care for inner-city families. Journal of Legal, Ethical and Regulatory Issues, 9(1/2), 81-88.

- Sekaran, U. (2010). Research methods for business (Fifth Edition). New York: John Wiley & Sons.

- Siano, A., Kitchen, P.J. & Confetto, M.G. (2010). Financial resources and corporate reputation: Toward common management principles for managing corporate reputation. Corporate Communications, 15(1), 68-82.

- Wheelen, T.L., Hunger, J.D., Hoffman, A.N. & Bamford, C.E. (2015). Strategic management and business policy: Globalization, innovation and sustainability (Fourteenth Edition). Global Edition, Pearson.