Research Article: 2020 Vol: 19 Issue: 5

Can Saving and Bank Claims on the Private Sector Enhance Saudi Economic Growth?

Mohammed A. Aljebrin, Majmaah University

Abstract

Purpose: Developing countries give more importance to financial sector development with a goal of poverty reduction. Saudi Arabia gives more importance to financial sector development with a goal of poverty reduction. The study aims to determine impact of saving and bank claims on the private sector on economic growth to utilize it for raising the economic growth rate in the future. It provides new evidence on the impact of saving and bank claims on the private sector.

Methodology: The study has examined the economic growth of the private sector in Saudi Arabia for bridging the gaps found in theoretical and empirical aspects. The Ordinary Least Squares (OLS) approach and Co integration techniques during the period (1973-2017) were used.

Findings: The results indicated that there exists a positive and significant relationship among the real GDP, all the real domestic saving and the real bank claims on the private sector in both the short and long run. It concludes that if Saudi Arabia desires for economic growth so there should be an increase in the real domestic saving and real bank claims.

Originality: Financial systems need to be properly developed and functioned. Accordingly, the policymakers can formulate monetary policy to get the desired results.

Keywords

Bank Claims, Domestic Saving, Economic Growth, Error Correction Model, Private Sector.

Introduction

Economic growth refers to the rise in the goods and services inflation-adjusted market value generated by an economy over a particular time period. It is traditionally measured as the percentage of rising in the real gross domestic product (GDP). Economic Growth helps in a unifying economic system for attaining a common goal (Popkova et al., 2018). Economic growth is accelerated by the savings which create investment, production, and employment that contributes to the growth of the economy. Economic growth is influenced by an efficient financial system in the following ways: (1) Savings of diverse households are channelized into investment, (2) Allocation of resources, (3) Liquidity provision to individual investors with illiquid and more profitable projects, (4) Risk eradication, (5) Promoting technological innovation, and (6) Facilitation of trade (Khalid & Nadeem, 2017).

Developing countries give more importance to financial sector development with a goal of poverty reduction. With the help of mobilization in savings, facilitating payments, trade of goods and services, and efficient resource allocation, the financial sector facilitates economic growth by broadening access to finance (Johnson et al., 2009). An important role is being played by the banking sector in financing the real economy and small and medium-sized enterprises that are dependent on domestic banks for funding. There should be a state’s intervention for sustaining these financial institutions to keep their economies growing (Grossman & Woll, 2014). The development of the financial sector has a tendency to influence the savings’ allocation which accelerates economic growth (Agbloyor et al., 2014). Researchers of the Bank for International Settlement (BIS) and International Monetary Fund (IMF) suggested that the development in finance is considered beneficial to some extent and after a certain point of time; growth is dragged by the development. This shows that the association between finance and growth is a non-linear one (Law & Singh, 2014).

Economic programs and reforms are undertaken by the Saudi economy that offers evidence about the Saudi Vision 2030. Income sources, at varying levels, were included in this vision that ensures the lowered oil revenues up till 2030. At constant prices in the Saudi economy, a negative growth of 0.86% was reported in 2017, which was a reduction from the preceding year, showing 1.67% GDP in 2016. A deficiency of oil production in Saudi Arabia becomes a major cause, which was resulted due to the agreement of oil producers toward the joint supply reduction, leading to a reduction of 3.09% in the oil sector. On the contrary, a growth of 1.05% was recorded in the non-oil sector in the same year. In the non-oil private sector, the rate of growth was 1.20% was recorded while 0.70% GDP was recorded in the non-oil government sector.

A number of economic production activities had shown an increase at constant prices in 2017 at different prices. For instance, electricity, gas, and water by 1.32%, community, social, and personal services by 1.36%, the activity of government services’ producers by 0.31%, agriculture, fishing, and forestry by 0.5%, manufacturing industries by 1.3%, finance, insurance, real estate and business services by 4.08%, and transport, storage and communications by 2.24%. However, according to the Saudi Arabian Monetary Agency (SAMA, 2019b) report, both construction and building, and mining and quarrying recorded a negative growth rate of 3.25% and 3.5%, respectively.

This study, therefore, aims to determine the influence of bank claims and savings on the private sector on Saudi economic growth. There is a focus on the notion that whether there exists any significant effect of domestic saving and bank claims on the private sector on economic growth for the period 1973-2017 or not. This will be significant for the economic policymakers to formulate future strategies to increase economic growth in Saudi Arabia due to the possible positive link among gross saving, credit market, and economic growth. The challenge of both bank claims and savings has been a subject of interest in many empirical and theoretical studies in the context of the private sector.

Literature Review

According to Schmidt (2003), there is an increase in the investment level at the national level and production in economic growth due to the increase in the savings level. Economic growth is driven by the development of the financial sector. Financial services often work using efficient credit expansion and resource mobilization for increasing efficient capital accumulation and investment levels. In the developed credit markets, there is an obvious relationship between the credit market and economic growth. Thus, economic growth is increased by policies for developing the financial sector. According to Khan & Senhadji (2000), bank credit plays an important role in developing a positive relationship between economic growth and development. The external financing is alleviated by credit institutions intermediate between the deficit and surplus sectors of the economy, resulting in a better credit system and hampering the growth of firms, industries, and credit (Mishkin, 2007). In Saudi Arabia, Samargandi et al. (2014) has examined the influence of development on GDP along with the influences of financial progression on oil and non-oil economic sectors. Using Autoregressive Lag (ARDL) Bounds test technique, it found that financial development was positively related to the growth of the non-oil sector. Similarly, oil-sector growth and total GDP growth were insignificantly related.

Ghosh (2017) examined the globalization of the banking sector on economic growth for 138 nations from 1995 to 2013. By using different econometric models, findings showed that greater openness of the banking sector can reduce economic growth. This result is for both emerging markets and low-income countries. It also applies to nations that possess foreign banks more than 10% but it is not for the countries with advanced economies. Private credit flows in host nations are reduced by foreign banks. Informational bottlenecks are faced by foreign banks that limited their credit lending to potential client-base in host markets (Ghosh, 2017).

Pradhan et al. (2017) have examined the influence of the relationship between the insurance industry and the banking sector on economic development from 1980 to 2014 for the G-2 countries. The results of the vector auto-regression model and the Granger causality test showed that the developing banking sector and insurance industry is significantly related to the economic growth of the G-20 countries in the long run. Whereas, the three factors’ inter-relationship found out to be more difficult, in different stages of development they differ by countries in the short run. Tabash & Dhankar (2014) revealed that the financing of Islamic banks is positively and significantly associated with economic growth in the long run. It highlighted that foreign direct investment is attracted by Islamic banking into the country (APPENDIX Table A).

Material and Methods

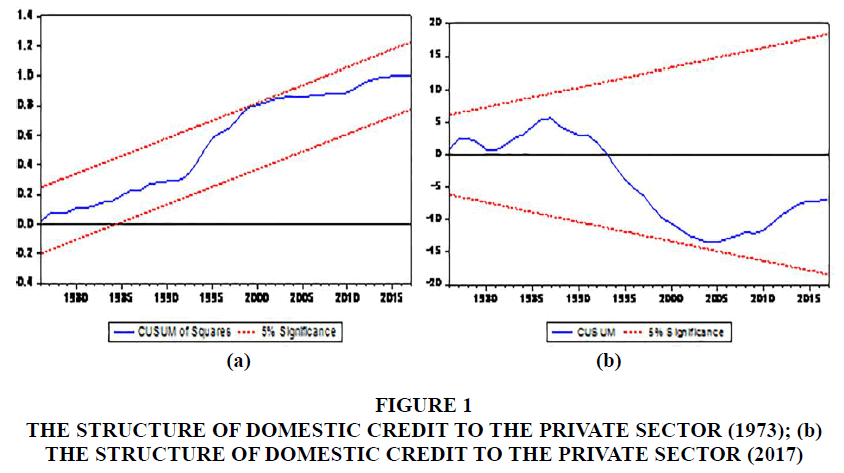

There was a growth of 9.41 percent in the total bank claims in the private and public sectors (loans and advances, bills discounted, investments) during the years 2012-2017. There was an increase of 6.88 percent in total bank claims on the private sector. In addition, a 30% increase has been observed by bank claims on loans to public institutions and investments in government securities (Saudi Arabian Monetary Agency, SAMA, 2019b). Figures 1a and 1b illustrate the changes in the structure of domestic credit to the private sector during the period 1973-2017. The shares of manufacturing, services, and agriculture witnessed an increase; whereas, building and construction witnessed a decrease in the same period. The other sectors did not witness an obvious change.

Figure 1 The Structure of Domestic Credit to the Private Sector (1973); (b) The Structure of Domestic Credit to the Private Sector (2017)

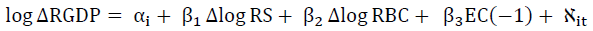

The Ordinary Least Squares (OLS) method is used in the study to assess the impact of saving and bank claims on the private sector economic performance. The estimated function involves the following variables:

(1)

(1)

Where:

RGDP = Real Gross Domestic Product (The value of all goods and services which are produced in a specific country each year. It is represented in base-year prices.

RS = Real Value of Gross Saving (When final consumption expenditure is subtracted by the gross disposable income).

RBC = Real Value of Bank Claims on the Private Sector (Bank claim is basically the claim which arises from a credit agreement, the effect of its real value is checked on the private sector).

EC (-1) = One lag error correction term.

Data has been taken from the Saudi Arabian Monetary Agency (SAMA, 2019a) and World Development Indicators (2019) from 1973 to 2017. The problem of heteroscedasticity was avoided by transforming all variables into a natural logarithm. All variables are equivalently represented in a short-run OLS framework based on the integration of three variables. Engle-Granger technique is one of the most important procedures for testing cointegration. The OLS is used to identify the long-run relationship, while the augmented dickey fuller (ADF) test was applied for examining the cointegration hypothesis. According to Engle & Granger (1987), the presence of an error correction representation is confirmed when a cointegration hypothesis is accepted. The short-run dynamics are represented using the development of the Error Correction Model (ECM).

(2)

(2)

The presence of a short-run relationship is explained from the coefficient of the ECT term. Similarly, the long-run equilibrium is described from the coefficient of speed and convergence. Convergence is represented by its negative value; whereas, divergence is represented by its positive value. A stabilized long-run relationship is confirmed from a significant coefficient of ECT with a negative sign (Banerjee et al., 1998). The tests employed in the study include Parameters stability test, Cointegration based on Trace of the Stochastic Matrix as well as Maximal Eigen value of the Stochastic Matrix.

Results

Augmented Dickey-Fuller (ADF) test is used for individual series to present the evidence that variables are stationary and integrated of the same order or not. Table 1 represents the results of each variable. Akaike Information Criterion (AIC) is selected to reduce residual serial correlation in the ADF test (Akaike, 1998). The summary of acceptance or rejection of null hypotheses for all variables is presented in Table 1.

| Table 1 Unit Root Test | ||

| ADF | ||

| Log (RGDP) | I | -2.034325 |

| I(1) | -6.261118a | |

| Log (RS) | I | -1.356974 |

| I(1) | -5.768738a | |

| Log (RBC) | I | -2.423152 |

| I(1) | -5.963839a | |

“a” indicates significance at the 1% level.

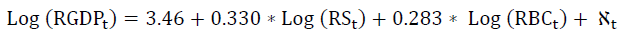

A cointegration is used for achieving long-run relationships among non-stationary variables. According to Engle & Granger (1987), a linear combination among the variables might be stationary if all the variables are integrated at the same order. A cointegrating vector is represented by the vector that associates the variables in the long-run relationship. Following is the estimated OLS model:

(3)

(3)

The ADF test result for residual is illustrated in Table 2, which showed that integration of residual at 5% level. This confirms the presence of the long-run at 1% significance level in the presence of an ECT.

| Table 2 ADF unit Root Test for Residual | |

| Level | |

| ECT | -5.034824a |

The outcomes of the Likelihood Ratio test and the Maximum Eigen value of the stochastic matrix are presented in Table 3 and 4, respectively. The presence of two cointegrating vectors between the variables is confirmed from the trace of stochastic matrix test.

| Table 3 Cointegration Test (Trace) | ||||

| Hypothesized No. of CE(s) | Eigenvalue | Trace Statistic | 0.05 Critical Value | Prob.** |

| Nil * | 0.357130 | 37.49955 | 25.70779 | 0.0053 |

| At level 1 * | 0.313139 | 17.61800 | 13.174749 | 0.0236 |

| At level 2 * | 0.015763 | 0.714968 | 2.466148 | 0.3978 |

* denotes rejection of the hypothesis at the 0.05 level

**MacKinnon et al. (1999) p-values

| Table 4 Cointegration Test (Maximal Eigenvalue) | ||||

| Hypothesized No. of CE(s) | Eigenvalue | Max-Eigen Statistic | 0.05 Critical Value | Prob.** |

| Nil * | 0.357130 | 19.88155 | 25.70779 | 0.0740 |

| At level 1 * | 0.313139 | 16.90303 | 13.174749 | 0.0187 |

| At level 2 * | 0.015763 | 0.714968 | 2.466148 | 0.3978 |

* denotes rejection of the hypothesis at the 0.05 level

**MacKinnon et al. (1999) p-values

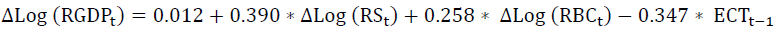

The short-run dynamics are represented in the ECT model based on short-term relationships in an OLS framework.

(4)

(4)

Tables 5-8 represent the robustness of the model based on different diagnostic tests. The aspiration econometric properties are represented from all the tests, which confirms no serial correlation between the model’s residuals and correct functional form, and normally distributed and homoscedastic elements.

| Table 5 BG-LM serial Correlation Test | |||

| F-statistic | 3.001432 | Prob. F(2,38) | 0.0616 |

| Obs*R-squared | 6.002474 | Prob. Chi-Square(2) | 0.0497 |

| Table 6 Arch Heteroskedasticity Test | |||

| F-statistic | 10.22098 | Prob. F(1,41) | 0.0027 |

| Obs*R-squared | 8.580513 | Prob. Chi-Square(1) | 0.0034 |

| Table 7 Normality Test | |

| Jarque-Bera | Prob. |

| 7.130561 | 0. 028289 |

| Table 8 White Heteroskedasticity Test | |||

| F-statistic | 12.32567 | Prob. F(9,34) | 0.0000 |

| Obs*R-squared | 33.67785 | Prob. Chi-Square(9) | 0.0001 |

| Scaled explained SS | 46.06505 | Prob. Chi-Square(9) | 0.0000 |

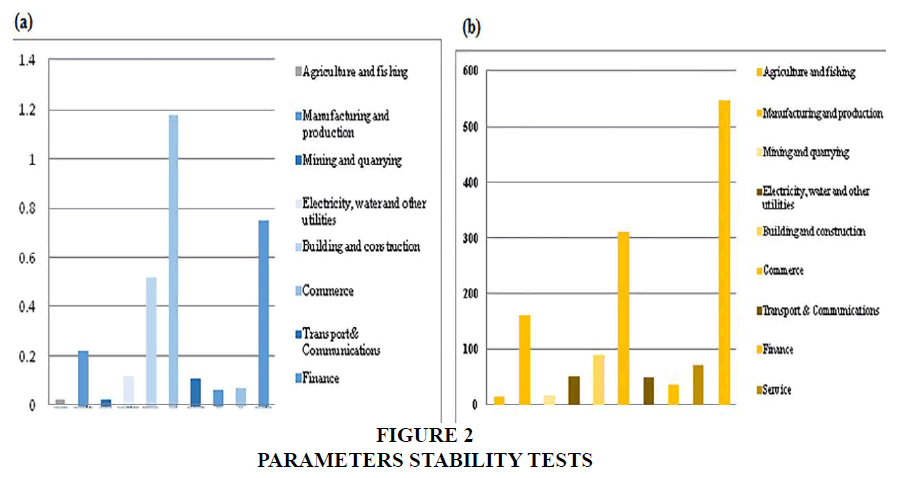

Figure 2 shows the findings of CUSUM and CUSUMSQ, confirming the lack of instability in coefficients considering the 5% confidence interval of parameter stability.

The error correction is proved to be highly significant and negatively signed and has a small magnitude of -0.347 which suggests a slow adjustment process, resulting if real GDP is 1 percent out of equilibrium, 34.7 percent adjustment will take place towards equilibrium within the first year. The estimates of short and long-run OLS are shown in Table 9 where a significant and positive relationship is present among real domestic credit, domestic saving, and real GDP

| Table 9 OLS Estimates (1973-2017) | ||

| Variable | Coefficient | |

| Long Run | Short Run | |

| C | 3.46a | 0.012 |

| Log (RS) | 0.283a | 0.390a |

| Log (RBC) | 0.330a | 0.258a |

| ECT (-1) | - | -0.347b |

Discussion

The study used the OLS model to analyse the impact of bank claims and savings on economic growth in the Saudi private sector. The present study found the positive and significant association of real GDP with real domestic savings and real domestic credit. These findings corroborate with the results of Hassan et al. (2011) who indicated that financial development is positively and significantly related to GDP in developing countries. The findings have indicated that economic growth can be accelerated in either short or long-run if bank claims are used effectively in the private sector. The present results are also verified by the study of Albatel (2003), which showed that developing an effective financial system is positively associated with economic growth.

Law & Singh (2014) stated that the researchers belong to BIS and IMF exclaimed that finance development provides benefits to a certain level after which it yields negative effects on the economy. This study is of the view that if development reaches the saturation level so it will be of no use and the government should consider other sectors for making growth in the economy. The financial system of Saudi Arabia has not reached its full potential as the total number of financial systems is inadequate as compared to other countries. The results also emphasized enhancing the development of the capital market. It is recommended that the government should prioritize the establishment of financial institutions, non-banking financial investment and market of advanced public security as it will help in enhancing the saving rate. If Saudi Arabia intends to maintain the growth in the economy, there is a need for carrying effective monetary policy. Overall, financial and capital markets’ development is essential for economic growth as it helps in mobilizing the savings and improving the productive capacity of the economy. There are certain limitations that the study follows, such as it is limited for the period from 1973 to 2017 due to data availability. Also, the study has been conducted in the context of Saudi Arabia which limits the applicability of the results to other regions. This research directs future researches to estimate their study using models other than OLS.

Conclusion

The influence of savings and domestic credit on economic growth is empirically examined by using OLS and cointegration techniques in Saudi Arabia. The study has investigated the possibility of significant associations among real savings, bank claims, and economic growth in the private sector in the short and long-run. A significant and positive association has been found among the real domestic saving, the real bank claims, and the real GDP on the private sector. It means that if the financial system grows, it will affect the Saudi economy in a positive and significant way. Thus, the Saudi government needs to enhance its capability regarding the financial system and further researches can also help in determining the factors, other than bank claims and real domestic savings, for economic performance.

Acknowledgements

The author is very thankful to all the associated personnel in any reference that contributed in/for the purpose of this research.

Appendix

| Table (A-1) Economic Data (1973-2017) | |||

| Period | Real GDP (2010=100) (Billion Riyal) | Real Gross Domestic Saving (2010=100) (Billion Riyal) | Bank Claims on Private Sector (RBC) (Billion Riyal) (2010=100) |

| 1973 | 194.09 | 36.22 | 3.20 |

| 1974 | 465.08 | 130.04 | 5.40 |

| 1975 | 352.69 | 113.52 | 8.51 |

| 1976 | 368.15 | 149.67 | 8.41 |

| 1977 | 382.52 | 145.03 | 11.22 |

| 1978 | 405.54 | 120.08 | 19.74 |

| 1979 | 552.74 | 176.29 | 29.24 |

| 1980 | 772.60 | 323.31 | 40.25 |

| 1981 | 855.90 | 335.90 | 46.57 |

| 1982 | 714.01 | 196.83 | 49.40 |

| 1983 | 605.41 | 112.21 | 56.00 |

| 1984 | 580.92 | 93.28 | 59.28 |

| 1985 | 534.94 | 56.00 | 58.08 |

| 1986 | 472.91 | 33.41 | 56.14 |

| 1987 | 478.71 | 36.74 | 61.86 |

| 1988 | 488.58 | 52.25 | 70.52 |

| 1989 | 522.43 | 53.97 | 73.28 |

| 1990 | 631.42 | 108.57 | 65.30 |

| 1991 | 676.85 | 108.46 | 73.62 |

| 1992 | 702.30 | 133.92 | 86.04 |

| 1993 | 674.07 | 129.24 | 101.93 |

| 1994 | 681.42 | 143.20 | 113.19 |

| 1995 | 689.05 | 160.62 | 121.15 |

| 1996 | 753.48 | 189.92 | 123.55 |

| 1997 | 787.70 | 198.31 | 133.68 |

| 1998 | 700.16 | 143.80 | 160.66 |

| 1999 | 781.86 | 200.13 | 162.19 |

| 2000 | 926.68 | 269.78 | 172.24 |

| 2001 | 910.60 | 243.96 | 187.06 |

| 2002 | 935.33 | 263.07 | 205.83 |

| 2003 | 1058.10 | 334.80 | 228.49 |

| 2004 | 1262.10 | 453.63 | 313.93 |

| 2005 | 1593.30 | 643.97 | 435.93 |

| 2006 | 1787.76 | 733.05 | 476.02 |

| 2007 | 1895.38 | 802.55 | 577.88 |

| 2008 | 2157.16 | 1080.19 | 734.56 |

| 2009 | 1695.04 | 660.29 | 734.24 |

| 2010 | 1980.78 | 941.19 | 775.76 |

| 2011 | 2378.57 | 1347.32 | 858.37 |

| 2012 | 2535.30 | 1423.32 | 999.13 |

| 2013 | 2484.82 | 1332.67 | 1123.65 |

| 2014 | 2461.91 | 1187.30 | 1256.21 |

| 2015 | 2103.92 | 728.57 | 1371.93 |

| 2016 | 2032.17 | 758.42 | 1405.47 |

| 2017 | 2187.98 | 887.71 | 1393.70 |

References

- Agbloyor, E.K., Abor, J.Y., Adjasi, C.K.D., & Yawson, A. (2014). Private capital flows and economic growth in Africa: The role of domestic financial markets. Journal of International Financial Markets, Institutions and Money, 30, 137-152.

- Akaike, H. (1998). Information theory and an extension of the maximum likelihood principle. In Selected papers of hirotugu akaike (pp. 199-213). Springer, New York, NY.

- Albatel, A.H. (2003). Money, finance and economic growth the case of Saudi Arabia. In Economic Research Fourm (ERF), Annual Conference, Egypt.

- Banerjee, A., Dolado, J., & Mestre, R. (1998). Error?correction mechanism tests for cointegration in a single?equation framework. Journal of time series analysis, 19(3), 267-283.

- Engle, R.F., & Granger, C.W. (1987). Co-integration and error correction: representation, estimation, and testing. Econometrica: journal of the Econometric Society, 251-276.

- Ghosh, A. (2017). How does banking sector globalization affect economic growth?. International Review of Economics & Finance, 48, 83-97.

- Grossman, E., & Woll, C. (2014). Saving the banks: The political economy of bailouts. Comparative Political Studies, 47(4), 574-600.

- Hassan, M.K., Sanchez, B., & Yu, J.S. (2011). Financial development and economic growth: New evidence from panel data. The Quarterly Review of Economics and Finance, 51(1), 88-104.

- Johnson, T., Gunatilake, H.M., Niimi, Y., Khan, M.E., Jiang, Y., Hasan, R., Khor, N., Martin, A.L., Bracey, P., & Huang, B. (2009). Financial sector development, economic growth, and poverty reduction: A literature review. Asian Development Bank Economics Working Paper Series, (173).

- Khalid, A., & Nadeem, T. (2017). Bank Credit to Private Sector: A Critical Review in the Context of Financial Sector Reforms. Stat Bank of Pakistan Staff Note 3, 17.

- Khan, M.M.S., & Semlali, M.A.S. (2000). Financial development and economic growth: An overview (No. 0-209). International Monetary Fund.

- Law, S.H., & Singh, N. (2014). Does too much finance harm economic growth?. Journal of Banking & Finance, 41, 36-44.

- MacKinnon, J.G., Haug, A.A., & Michelis, L. (1999). Numerical distribution functions of likelihood ratio tests for cointegration. Journal of applied Econometrics, 14(5), 563-577.

- Mishkin, F.S. (2007). The economics of money, banking, and financial markets. Pearson education.

- Popkova, E.G., Bogoviz, A.V., Lobova, S.V., & Romanova, T.F. (2018). The essence of the processes of economic growth of socio-economic systems. In Management of Changes in Socio-Economic Systems (pp. 123-130). Springer, Cham.

- Pradhan, R.P., Arvin, M.B., Nair, M., Hall, J.H., & Gupta, A. (2017). Is there a link between economic growth and insurance and banking sector activities in the G-20 countries?. Review of Financial Economics, 33, 12-28.

- Samargandi, N., Fidrmuc, J., & Ghosh, S. (2014). Financial development and economic growth in an oil-rich economy: The case of Saudi Arabia. Economic Modelling, 43, 267-278.

- Saudi Arabian Monetary Agency (SAMA). (2019a), Annual Report, No. 54.

- Saudi Arabian Monetary Agency (SAMA). (2019b), Annual Statistics-English.

- Schmidt, M.B. (2003). Savings and investment in Australia. Applied Economics, 35(1), 99-106.

- Tabash, M.I., & Dhankar, R.S. (2014). Islamic banking and economic growth: An empirical evidence from Qatar. Journal of Applied Economics and Business, 2(1), 51-67.

- World Bank. (2019). Retrieved from: http://data.worldbank.org/indicator/