Research Article: 2021 Vol: 20 Issue: 2

Capital for Sustainable Economic Growth: The Case from Dong Nai Province in Vietnam

Do Thi Lan Dai, Lac Hong University

Hoang Thi Thanh Hang, Banking University of Ho Chi Minh City

Abstract

In recent years, the mobilization and use of investment capital, especially foreign investment capital, have significantly affected the country’s speed and quality of economic growth and each locality. Attracting and effectively using investment capital is always a complex problem for locations that are still weak in infrastructure, financial sophistication, attractive policies, the efficiency of using capital sources, and many inadequacies when implementing investment projects. Therefore, this study aims to identify factors affecting the investment capital attraction for sustainable economic growth in Dong Nai province. The study surveyed 1.000 managers related to enterprises with investment capital in Dong Nai province, but 939 samples processed and answered 39 questions. The data collected from June 2020 to November 2020. The authors tested Cronbach’s Alpha, confirmatory factor analysis (CFA), and structural equation (SEM). Based on the research results, the authors propose policy implications for attracting investment capital for sustainable economic growth in Dong Nai province.

Keywords

Attracting, Investment, Capital, Sustainable, Economic, Growth, BUH, and LHU.

Introduction

Dong Nai has the fifth largest population globally and has the fourth-largest urban population, such as Ho Chi Minh City, Hanoi, and Hai Phong). It is a gateway province to the Southeastern economic region most developed and dynamic economic region in the country. At the same time, Dong Nai is one of Ho Chi Minh City’s three sharp corners and Binh Duong province’s development triangle. Despite socio-economic difficulties, by 2019, the gross domestic product of the province (GRDP) in the first six months of 2019 at constant 2010 prices compared to the same period in 2018 increased by 7.5% (the same period in 2018 increased by 7.26% in 2017), include: industry construction increased by 8.2%; service sector increased by 7.53%; agriculture, forestry, and fishery increased by 3.1%; Product tax (manufacturing, retail, wholesale) increased by 7.03%.

However, some industries are still unsustainable; the livestock industry still has many potential risks; Aquaculture has caused many dead fish in the area due to natural disasters. According to Bah et al. (2014) showed that the disbursement of investment capital for state budget projects was low. Implementing procedures for investment in domestic tasks, PPP projects, and investment socialization face many difficulties regarding the Law’s provisions, the guiding documents between the Investment Law and the Specialized Law. While there is the acceleration of the synchronous construction of infrastructure, economic restructuring towards modernization for sustainable economic development requires much capital (Adams, 2018). Dong Nai needs to effectively implement solutions to mobilize domestic and foreign capital sources and encourage economic sectors to boldly raise capital for themselves and the region and the country.

Literature Review

Sustainable Economic Growth (SEG)

According to Abdikeev et al. (2018) showed that sustainable economic growth means a growth rate that can be maintained without creating other significant financial problems, especially for future generations. There is a trade-off between rapid economic growth today and growth in the future. Today, rapid growth may exhaust resources and create environmental problems for future generations, including the depletion of oil and fish stocks and global warming (Aikaterini Kokkinou & Psycharis, 2005).

Periods of growth are triggered by increases in aggregate demand, such as a rise in consumer spending, but sustained growth must increase output. If the result does not improve, any extra demand will push up the price level (Alvarado et al., 2017). Sustainable economic growth is economic development that attempts to satisfy the needs of humans but in a manner that sustains natural resources and the environment for future generations. The ecosystem provides the production factors that fuel economic growth: land, natural resources, labor, and capital created by labor and natural resources. Sustainable economic growth manages these resources not to be depleted and will remain available for future generations (Helldin, 2017).

Investment Capital Attraction (ICA)

According to Asiamah et al. (2019) showed that investment attraction could be defined as facilitating growth to the local economy by encouraging expanding the existing enterprises and generating new capital flow to the many places from external sources.

According to Alvarado et al. (2017) studied that investment attraction is at the top of the agenda for state organizations, municipalities, and private entities. We will analyze the investment offering during our investment attraction service, identify investor profile and country, introduce your offering to the potential investors, and empower the negotiations by Anwar et al. (2013).

The author will analyze the investment offering, perform feasibility analysis, and develop an investment offering. The author identifies potential investors – industries, size, profile, country. According to (Šlaus & Jacobs, 2010), communicate and introduce your offering to potential investors; Sets up investment meetings between both sides; Organize investor visits to the site and follows up and leads investment communication.

Infrastructure (IN)

According to Managi & Bwalya (2010), infrastructure is a fundamental and essential element for any company’s production and business. These factors include imperative infrastructure factors such as electricity, water, transport, site, and technical infrastructure elements such as communications and banking. Therefore, infrastructure positively impacts investors’ capital attraction (Rose-Ackerman & Tobin, 2005).

When investing in projects, foreign investors focus on production and business activities with good investment infrastructure, and the execution time of projects will be shortened (Michie, 2001). Reduce transportation costs, communication costs for the stages and will increase investment efficiency. A locality with good infrastructure, roads, ports, airports, and good communication will help enterprises invest in inconvenient transportation and modern production systems (Arce, 2019). With those as mentioned above, the researchers have hypothesis following:

H1 Infrastructure has a positive impact on the investment capital attraction in Dong Nai province

Investment Policies (IP)

According to Khorrami Fard & Fakhimi Azar (2017), investment policy regimes are reflected in local governments’ investment incentives policies. The dynamism of government-supported enterprises to invest in administration (Kaliappan et al. 2015).

Besides, legal and tax procedures are clear also. Khorrami Fard & Fakhimi Azar (2017) studied the investment policies that affected enterprises. Therefore, the investment policy regime has a positive impact on investment capital attraction. Public officials cannot take advantage of or harass enterprises.

Tax policy, tax system, attractive incentive regimes for enterprises and individuals to do business in the locality (Lal, 2017). These policies are called the institutional system, the category associated with the procedure. The approach consists of the desired goals, outcomes, and institutions, including norms of the actors’ behavior (Hassan, 2004). Institutions are also a way of organizing ethical practices and codes to achieve the desired policy. For the things mentioned earlier, the researchers have hypothesis following:

H2 Investment policy has a positive impact on the investment capital attraction in Dong Nai province

Working and Living Environment (WLE)

According to Skenderi (2013) showed that the living and working environment are reflected through factors of culture, education, health, quality of the living environment, play, living, harmony, and reasonable cost, representing a quality living environment, and suitable for investor. And employees can operate effectively and to stick with the locality for a long time (Blomström & Kokko, 1999). Therefore, the living and working environment have a positive impact on the capital attraction of investors.

When enterprises investing in investment-attracting localities, foreign investors are very interested in the living and working environment in the host country because FDI is a long-term activity (Coughlin et al., 1991). And investors often have to live and work in this place, even bring the whole family to invest in living (Modarress et al., 2014). Therefore, the host country’s social services and facilities should be carefully considered to ensure that they can meet their living needs (Tocar, 2018). The researchers have hypothesis following:

H3 Working and living environments have a positive impact on the investment capital attraction in Dong Nai province

Public Service Quality (PSQ)

According to Grönroo (1984) showed that investment support activities and investment facilitation services include assistance in market research, finding partners, and investment opportunities. Parasuraman et al. (1988) studied public service quality assisted in project documentation and application for investment permits; assisting in project implementation; support throughout the project’s operation and support when the project does procedures to prepare to terminate the process (Cronin & Taylor, 1992). With the one-stop mechanism, many countries have supported foreign investors in all aspects, from the beginning of looking for investment opportunities to complete investment activities, helping investors save time and money (Parasuraman et al., 1985).

Many countries worldwide consider administrative reform an indispensable requirement, a breakthrough to promote growth, enhance the competitiveness of the economy, promote democracy, and improve the people’s quality of life (Harrington, 2005). In our country, public administration reform has become one of the top priority measures to promote international economic integration, national construction, and development (Chiril?-Donciu, 2014). The mentioned above, the researchers have hypothesis following:

H4 Public service quality has a positive impact on the investment capital attraction in Dong Nai province

Regional Connectivity (RC)

According to Tocar (2018), there are many types of regional linkages, including natural forms of the development process, the most prominent being the pervasive type, which occurs naturally. Objectivity in the development process. This type of association’s main actors are enterprises, non-business units, families, and individuals (Mohammadi, 2018). This factor is a type of link between entities located in different regions (horizontally linked) and highly marketable, including purchase and sale transactions, types of contracts, company shares (Schuh, 2009).

According to Globerman & Shapiro (2002), a decentralized linkage between central and local governments (the vertical connection between large and small regional authorities) often carries bulky administrative orders. There is also horizontal linkage. This factor links local authorities and is also administrative voluntary (Loewendahl & Ertugal-Loewendahl, 2001). The mentioned above thing, the researchers have hypothesis following:

H5 Regional connectivity has a positive impact on the investment capital attraction in Dong Nai province

Human Resources (HR)

In the worldwide trend of entering the Industrial Revolution 4.0, focusing mainly on smart manufacturing, high-quality human resources increasingly play a decisive role in its socio-economic development (Osano & Koine, 2016). Many economists believe that human capital or human capital is the most crucial factor in economic growth. It can be said: human resource is the resource of all resources, the help of all resources (Susic et al., 2017). Whether human resources can promote the growth process depends on two aspects (Yussof & Ismail, 2002).

The number of employed workers: depends on the population growth rate and the economy’s ability to create jobs (Managi & Bwalya, 2010). In emerging countries, the population usually increases rapidly, while in rich countries, the population grows slowly (Barzelaghi et al., 2012). That leads to rich countries lacking labor while developing countries have surplus work and unemployment (Haider et al., 2017). The mentioned above thing, the researchers have hypothesis following:

H6 Human resources have a positive impact on the investment capital attraction in Dong Nai province

Technology (TE)

In recent years, to promote industrialization and the country’s modernization, the Party and State have paid great attention to science and technology development, mainly having spent a large amount of investment capital for growth (Bannò & Redondi, 2014). Science and technology. Modarress et al. (2014) showed that technology is reflected in inventions and production improvements. Scientific and technical progress increases investment capital efficiency, helps exploit natural resources well, and increases labor productivity (Asiamah et al., 2019). Moreover, it also contributes to improving quality and lower production costs. Today, technology development speed, especially information technology, biotechnology, and new material technology, has contributed to increasing production efficiency (Getzner & Moroz, 2020). However, to obtain such results, investment is required in research and development. The mentioned above thing, the researchers have hypothesis following:

H7 Technology has a positive impact on the investment capital attraction in Dong Nai province

Investment Costs (IC)

According to Ngangue (2016) showed that investors have to rent land to build factories to operate. Except for investors who have been previously granted land, they must complete the procedures for transferring land and structures on the ground (Abdikeev et al., 2018). Land rental is a mandatory expense that is recognized in the cost or circulation fee, but the investor always compares it with the land rental in other countries/localities (Ngangue, 2016). Investors need a reasonable and stable price to calculate the total cost and expected return before deciding to invest. Therefore, the country/locality needs to develop an affordable and flexible land rental policy (Mat & Harun, 2012).

According to Obidike & Uma (2013) showed that competitive input costs are a vital factor directly related to an enterprise’s investment efficiency. Enterprises can increase competitiveness or seek higher profit margins when input costs are low (Tocar, 2018). A guaranteed service product quality must always accompany a competitive cost in addition to a reasonable price. Therefore, competitive input costs will have a positive impact on investors’ capital attraction. The mentioned above thing, the researchers have hypothesis following:

H8 Investment costs have a positive impact on the investment capital attraction in Dong Nai province

H9 Investment capital attraction positively impacts sustainable economic growth in Dong Nai province.

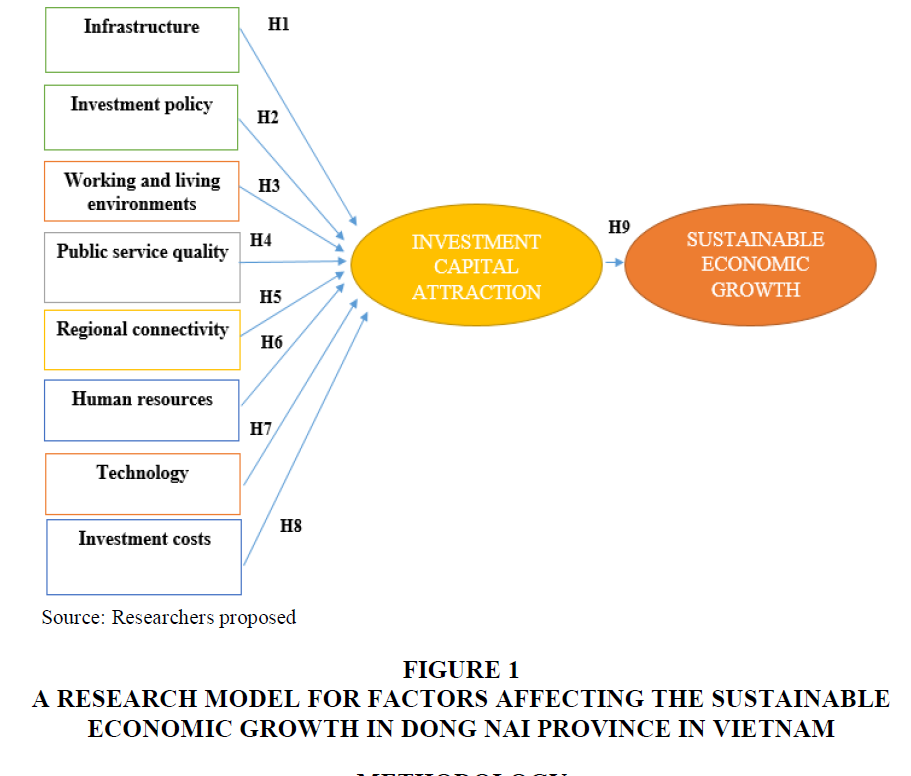

In this study, the author uses qualitative research. It is an approach to seek to describe and analyze the research sample’s characteristics and experts and enterprise leaders’ behavior from the researcher’s perspective (Hair et al., 2010) (Figure 1).

Figure 1 A Research Model for Factors Affecting the Sustainable Economic Growth in Dong NAI Province in Vietnam

Methodology

In qualitative research, the author uses several research questions and information collection methods that are prepared, but this method can be adjusted accordingly as new information appears during the collection process. That is one of the primary differences between qualitative and quantitative methods. The author also uses external sources of data: The author taken from economic organizations, government agencies and researched information from different books, magazines, national magazines, and the internet.

Besides, the authors consulted with 30 experts in the field of investment in Dong Nai province. Thirty experts, including ten experts working at the Department of Planning and Investment, ten economic experts have known about attracting investment outside Dong Nai province. Ten experts are Leaders’ Large enterprises in Dong Nai province. Based on these 30 experts’ opinions, the author has accurately identified the information that needs to be collected from experts’ suggestions and form the questionnaire. The goal is to determine some new aspects of the prepared questions. The steps detailed as follows:

The authors selected the study by the random method and applied the formula calculated according to Slovin (1984) n = N / [1 + N(e)2]. N: the total number of business owners is 12,000 enterprises, n: the number of business owners representing. e: permissible error, in this case, it is 0.05. Thus, the minimum number of samples to be investigated is 400 business owners.

Based on the above calculation results, the author chooses the plan to calculate the sample number of Slovin formula (1984) for exploratory factor analysis is 400 business owners. In this study, the author chose a large enough sample to satisfy all three conditions according to the above criteria. The author decides to select a sample size of 400 business owners and generate 1000 questionnaires corresponding to 1000 business owners.

In this study, the author uses exploratory factor analysis mainly to evaluate convergent values and discriminant values. In the discovery factor analysis, researchers are often interested in some standards: Firstly, the KMO (Kaiser - Meyer - Olkin measure of sampling adequacy) index is an indicator used to consider factor analysis’s appropriateness. The considerable value of KMO (between 0.5 and 1) is sufficient for factor analysis to be appropriate. If the KMO index is less than 0.5, factor analysis is likely not suitable with the data. Second, Bartlett’s (Bartlett’s test of sphericity) is a quantity that looks at the hypothesis of zero correlation among observed variables in the population. If this test is significant (Sig <0.05), the observed variables are correlated in the whole.

Hair et al. (2010) showed that Confirming Factor Analysis (CFA) is appropriate when researchers know the underlying latent variable structure. The researchers implicitly admit the relationship or hypothesis (obtained from theory or experiment) between the experimental and underlying factors before conducting the statistical test. Thus, CFA is the next step of EFA to test whether a pre-existing theoretical model underpins a set of observations. CFA is also a form of SEM. When constructing CFA, observed variables are also indicator variables in the measurement model because they both upload the basic theoretical concept according to Hair et al. (2010).

SEM is used to test theoretical models using scientific methods of hypothesis testing by Hair et al. (2010). It measures the model’s suitability with survey information, and studies often use criteria such as chi-squared, chi-square adjusted for degrees of freedom (CMIN/df). Also used to measure the fit of the model in more detail. Some authors recommend 1 <χ2/df <3 according to Hair et al. (2010), others suggest χ2 as small as possible according to the claim that χ2/df<3: 1 according to Hair et al. (2010). Besides, in some practical studies, people distinguish 2 cases: χ2 / df <5 (with sample N> 200); or <3 (when sample size N <200), the model is considered a good fit according to Hair et al. (2010). GFI: measure the absolute fit (no degree of freedom adjustment) of the structural and measurement models with the survey data set (Hair et al., 2010).

Results

Testing Cronbach’s alpha for factors affecting the sustainable economic growth in Dong Nai province in Vietnam following:

Table 1 showed that Cronbach’s entire Alpha is greater than 0.7. Besides, the scale must have a minimum of 3 measurement variables. In theory, the higher the Cronbach’s Alpha, the better, the more reliable the scale is.

| Table 1 Cronbach’s Alpha for Factors Affecting the Sustainable Economic Growth in Dong NAI Province in Vietnam | |

| Infrastructure (IN), Cronbach’s Alpha: 0.888 | Cronbach’s Alpha |

| In1: You feel secure when investing in Dong Nai because of convenient traffic | 0.880 |

| In2: You choose to invest in Dong Nai because there is a power supply system that meets production and business requirements at peak hours |

0.857 |

| In3: You choose to invest in Dong Nai because there are an adequate water supply and drainage system to meet your business’s requirements |

0.883 |

| In4: You choose to invest in Dong Nai because it has convenient communication systems such as telephone, internet, post office system |

0.839 |

| In5: You choose to invest in Dong Nai because the area has premises and the banking system meets the requirements for production and business |

0.853 |

| Investment policies (IP), Cronbach’s Alpha: 0.859 | Cronbach’s Alpha |

| Ip1: You choose to invest in Dong Nai because of the attractive policy of renting premises for investment | 0.830 |

| Ip2: You choose to invest in Dong Nai because there is a transparent tax system through tax administrators who do not take advantage of it for profit. |

0.792 |

| Ip3: You choose to invest in Dong Nai because the legal documents are implemented transparently and quickly to the business |

0.848 |

| Ip4: You choose to invest in Dong Nai because there are dynamic and creative local leaders in supporting enterprises |

0.806 |

| Working and living environment (WLE), Cronbach’s Alpha: 0.959 | Cronbach’s Alpha |

| Wle1: You choose to invest in Dong Nai because the government resolves conflicts between workers and business owners quickly and satisfactorily. |

0.941 |

| Wle2: You choose to invest in Dong Nai because there is a good education system to meet the needs |

0.959 |

| Wle3: You choose to invest in Dong Nai because there is a quality medical system to meet health care needs. |

0.947 |

| Wle4: You choose to invest in Dong Nai because here the environment is not polluted and the living costs are reasonable |

0.936 |

| Public service quality (PSQ), Cronbach’s Alpha: 0.914 | Cronbach’s Alpha |

| Psq1: You choose to invest in Dong Nai because there are simple, fast, and confidential administrative procedures. |

0.882 |

| Psq2: You choose to invest in Dong Nai because the local government here provides thoughtful support when enterprises meet difficulties |

0.832 |

| Psq3: You choose to invest in Dong Nai because here, the investment and trade promotion centers are always ready to support enterprises |

0.914 |

| Regional connectivity (RC), Cronbach’s Alpha: 0.852 | Cronbach’s Alpha |

| Rc1: You choose to invest in Dong Nai because there are supporting industries located in the region’s provinces/cities. | 0.801 |

| Rc2: You choose to invest in Dong Nai because there is cooperation among provinces/cities in trade promotion and investment. |

0.809 |

| Rc3: You choose to invest in Dong Nai because there is a chain of goods suitable for your business activities |

0.841 |

| Rc4: You choose to invest in Dong Nai because there are activities to coordinate production and business among provinces in the region |

0.794 |

Table 2 showed that all of Cronbach’s Alpha is greater than 0.7. Investment capital attraction (ICA), Cronbach’s Alpha: 0.915, and Sustainable economic growth (SEG), Cronbach’s Alpha: 0.862.

| Table 2 Cronbach’s Alpha for the Investment Capital Attraction and the Sustainable Economic Growth in Dong NAI Province in Vietnam | |

| Human resources (HR), Cronbach’s Alpha: 0.939 | Cronbach’s Alpha |

| Hr1: You choose to invest in Dong Nai because there are quality vocational training schools to meet the needs of enterprises |

0.915 |

| Hr2: You choose to invest in Dong Nai because there is an abundant source of unskilled labor |

0.925 |

| Hr3: You choose to invest in Dong Nai because there are highly disciplined workers and can absorb new technology |

0.923 |

| Hr4: You choose to invest in Dong Nai because it is easy to recruit managers with the right expertise and skills |

0.915 |

| Technology (TE), Cronbach’s Alpha: 0.955 | Cronbach’s Alpha |

| Te1: You choose to invest in Dong Nai because it is always trained to transfer equipment in time |

0.940 |

| Te2: You choose to invest in Dong Nai because there is always work to support specific preferential industries for enterprises |

0.955 |

| Te3: You choose to invest in Dong Nai because it always closely protects copyrights and trademarks. |

0.939 |

|

Te4: You choose to invest in Dong Nai because it always supports funding for research and application of high technology in the production |

0.928 |

| Investment costs (IC), Cronbach’s Alpha: 0.942 | Cronbach’s Alpha |

| Ic1: You choose to invest in Dong Nai because it is here because the land rental is reasonable |

0.915 |

| Ic2: You choose to invest in Dong Nai because of its reasonable labor costs | 0.930 |

| Ic3: You choose to invest in Dong Nai because of the reasonable electricity, water, and freight charges for the business operation |

0.933 |

| Ic4: You choose to invest in Dong Nai because of the competitive cost of communication services and low freight costs |

0.920 |

| Investment capital attraction (ICA), Cronbach’s Alpha: 0.915 | Cronbach’s Alpha |

| Ica1: You choose to invest in Dong Nai because you think the company’s profit will be as desired |

0.888 |

| Ica2: You choose to invest in Dong Nai because you think your business will be useful in the long term |

0.834 |

| Ica3: In general, you are delighted with the capital investment in Dong Nai | 0.909 |

| Sustainable economic growth (SEG), Cronbach’s Alpha: 0.862 | Cronbach’s Alpha |

| Seg1: Attracting investment capital contributes to economic growth (GDP) over each year in Dong Nai province |

0.844 |

| Seg2: Attracting investment capital to contribute to job creation for people in Dong Nai province and neighboring provinces |

0.793 |

| Seg3: The enterprise always strives to contribute responsibly to the economy, community, and society in Dong Nai |

0.851 |

| Seg4: Attracting investment capital contributes to improving the quality of life of people in Dong Nai |

0.804 |

Table 3 showed that column “P” < 0.01 with significance level 0.01. This result indicated eight factors affecting the investment capital attraction and the investment capital attraction affecting Dong Nai province’s sustainable economic growth in Vietnam with a significance level of 0.01with a significance level of 0.01.

| Table 3 Factors Affecting the Investment Capital Attraction and the Sustainable Economic Growth in Dong NAI Province in Vietnam | |||||||

| Relationships | Coe. | Standardized Coefficient | SE. | CR. | P | ||

| ICA | <--- | IP | 0.236 | 0.100 | 0.051 | 4.630 | *** |

| ICA | <--- | IN | 0.149 | 0.089 | 0.049 | 3.059 | 0.002 |

| ICA | <--- | PSQ | 0.158 | 0.115 | 0.033 | 4.712 | *** |

| ICA | <--- | WLE | 0.077 | 0.089 | 0.024 | 3.197 | 0.001 |

| ICA | <--- | RC | 0.178 | 0.175 | 0.031 | 5.810 | *** |

| ICA | <--- | HR | 0.092 | 0.105 | 0.025 | 3.703 | *** |

| ICA | <--- | IC | 0.102 | 0.108 | 0.028 | 3.625 | *** |

| ICA | <--- | TE | 0.475 | 0.531 | 0.027 | 17.624 | *** |

| SEG | <--- | ICA | 0.295 | 0.556 | 0.020 | 14.775 | *** |

Table 4 showed that the column “SE-Bias” < 0.01. This result indicated eight factors affecting the investment capital attraction and the investment capital attraction affecting Dong Nai province's sustainable economic growth in Vietnam with a significance level of 0.01 with testing Bootstrap of 5.000 samples. The results are the same 939 samples authors processed.

| Table 4 Testing Bootstrap of 5.000 Samples for (Mean, Bias) Factors Affecting the Investment Capital Attraction and the Sustainable Economic Growth in Dong NAI Province in Vietnam | |||||||

| Parameter | SE | SE-SE | Mean | Bias | SE-Bias | ||

| ICA | <--- | IP | 0.047 | 0.000 | 0.225 | -0.011 | 0.001 |

| ICA | <--- | IN | 0.049 | 0.000 | 0.150 | 0.001 | 0.001 |

| ICA | <--- | PSQ | 0.047 | 0.000 | 0.142 | -0.016 | 0.001 |

| ICA | <--- | WLE | 0.024 | 0.000 | 0.076 | -0.001 | 0.000 |

| ICA | <--- | RC | 0.050 | 0.001 | 0.161 | -0.017 | 0.001 |

| ICA | <--- | HR | 0.032 | 0.000 | 0.076 | -0.016 | 0.000 |

| ICA | <--- | IC | 0.032 | 0.000 | 0.104 | 0.002 | 0.000 |

| ICA | <--- | TE | 0.038 | 0.000 | 0.472 | -0.002 | 0.001 |

| SEG | <--- | ICA | 0.025 | 0.000 | 0.295 | -0.001 | 0.000 |

Conclusions

In international economic integration, capital plays a critical role in creating a driving force for local economic development. The study surveyed 1.000 managers related to enterprises with investment capital in Dong Nai province, but 939 samples processed and answered 39 questions. The data collected from June 2020 to November 2020. The authors tested Cronbach’s Alpha, confirmatory factor analysis (CFA), and structural equation (SEM). Moreover, eight factors affecting the investment capital attraction and the investment capital attraction affecting the sustainable economic growth of Dong Nai province in Vietnam with a significance level of 0.01. Besides, the investment capital attraction plays an essential role in the local socio-economic development, such as: Adding capital for investment, creating jobs for workers, increasing budget revenues to promote capital attraction. Dong Nai province needs to improve the investment policy mechanism, improve the quality of living and working environment, increase incomplete investment infrastructure. At the same time, to pay attention to developing human resources to improve the quality and quantity of vocational schools and regularly update training programs to meet the requirements of businesses.

Policy implications

Based on the results mentioned above, improving the investment capital attraction and the sustainable economic growth in Dong Nai province in Vietnam.

(1) Policy implication for technology (TE). The province gives priority to investment promotion in the fields related to industry 4.0, such as the Information technology industry, cultural sector exploiting cultural values, high technology, and agriculture with the application of high technology, new materials, biotechnology, and several other related initiatives in line with the province’s development orientation.

(2) Policy implication for regional connectivity (RC). The Dong Nai province gives priority to linking focal regions that link complementary areas of cooperation among localities. That has similarities in geographical location, natural conditions, population distribution, converging most fully development conditions and of decisive significance for the national economy to increase the attraction and at the same time promote the development of localities in the region. The connection method is very diverse. It can be focusing on developing a central nucleus surrounded by satellites, or it can be a finished product through many stages where each locality takes on a role game in the product value chain.

(3) Policy implication for public service quality (PSQ). Implement e-Government (following the United Nations approach). The government has set the goals: Comprehensive reform of all three indicators, including telecommunications infrastructure, human resources, and public services. Coordinate with the implementation units to implement the results of connecting commercial information exchange and businesses operating in the logistics, insurance and other sectors and other related services. Dong Nai province continues to improve the efficiency of the public service quality.

(4) Policy implication for investment costs (IC). Dong Nai province improves unofficial costs that are considered a burden and reduce the competitiveness of businesses in Vietnam. These costs are recorded in the product cost, pushing up the product price and reducing its competitiveness. Unofficial fees are the most costly and challenging issue for businesses. Not only that, but it also raises other costs. For example, to legalize unofficial payments, companies will have to spend more money, leading to fraud in business such as trading invoices, untruthful financial statements, tax.

(5) Policy implication for human resources (HR). Dong Nai province improves the abundant source of unskilled labor with basic vocational training is an essential factor in attracting capital. Meanwhile, most of Dong Nai province’s FDI enterprises have a great demand for work, especially garment projects and assembly. Therefore, Dong Nai province needs to focus on upgrading Universities in Dong Nai province, developing multi-vocational training institutions, and multi-level to ensure the supply of joint labor force through basic vocational training and training high-tech, well-managed, diversified industries for business.

(6) Policy implication for investment policies (IP). This factor is necessary to fully implement the central policies to implement attractive local investment incentives to attract and support enterprises. Based on government policies, to attract potential FDI projects and according to the province’s planning orientation, it must have separate and differentiated attraction policies. In particular, it is necessary to have the policy develop specific planning areas specializing in the cultivation of critical products such as rubber, cashew, pepper and ensure focus on quantity and quality of potential raw materials.

(7) Policy implication for infrastructure (IN). Dong Nai province improves the transport system, bridges, ports, electricity, water, communications, and banking all greatly affect investment decisions because it significantly affects enterprises’ production and business process. Therefore, completing infrastructure and gradually improving the quality of infrastructure, especially districts with difficult socio-economic conditions and weak infrastructure are essential factors that need to be identified by the province. Dong Nai province is interested in improving the investment environment, helping businesses trust and feel more secure in production and trade, thereby quickly introducing Dong Nai province to other potential enterprises.

(8) Policy implication for working and living environment (WLE). Dong Nai province should be a non-polluted living environment with a sound health system that investors are very concerned about the environment. Therefore, to improve the living environment to attract FDI investors, Dong Nai needs to resolutely not license projects with the risk of causing environmental pollution, focusing on improving the system's quality. Health care system, improving the structure of ecological sanitation, urban landscape and ensuring security and order in the investment area in particular and Dong Nai province in general.

References

- Abdikeev, N.M., Bogachev, Y.S., & Melnichuk, M.V. (2018). Identifying the factors that contribute to sustainable development of the national economy. European Research Studies Journal, 11(2), 411-425.

- Adams, A. (2018). Technology and the labour market: the assessment. Oxford review of economic policy, 34(3), 349-361.

- Alvarado, R., Iñiguez, M., & Ponce, P. (2017). Foreign direct investment and economic growth in Latin America. Economic Analysis and Policy, 56, 176-187.

- Anwar, Z., Saeed, R., Khan, M.K., & Ahmad, S.S. (2013). Determinants of foreign direct investment (FDI) in Pakistan’s agricultural sector. Scientific Papers Series Management, Economic Engineering in Agriculture and Rural Development, 13(1), 13-18.

- Arce, J.J.C. (2019). Forests, inclusive and sustainable economic growth and employment. In Forests and sustainable development goals. United Nations Forum on Forests.

- Asiamah, M., Ofori, D., & Afful, J. (2019). Analysis of the determinants of foreign direct investment in Ghana. Journal of Asian Business and Economic Studies, 26(1), 56-75.

- Bah, A.O., Kefan, X., & Izuchukwu, O.O. (2015). Strategies and determinants of foreign direct investment (FDI) attraction. International Journal of Management Science and Business Administration, 1(5), 81-89.

- Bannò, M., & Redondi, R. (2014). Air connectivity and foreign direct investments: economic effects of the introduction of new routes. European Transport Research Review, 6(4), 355-363.

- Barzelaghi, M.T., Dizaji, M., & Laleh, M.M. (2012). The effect of transportation infrastructure on foreign direct investment attraction in Iran. International Journal of Economics And Finance Studies, 4(2), 153-161.

- Blomström, M., & Kokko, A. (1999). Regional integration and foreign direct investment: A conceptual framework and three cases. Journal of International Economics, 7(1), 317-22.

- Chiril?-Donciu, E. (2014). Promoting and attracting foreign direct investment. CES Working Papers, 6(3), 17-28.

- Coughlin, C.C., Terza, J.V., & Arromdee, V. (1991). State characteristics and the location of foreign direct investment within the United States. The Review of economics and Statistics, 675-683.

- Cronin Jr, J.J., & Taylor, S. A. (1992). Measuring service quality: a reexamination and extension. Journal of Marketing, 56(3), 55-68.

- Getzner, M., & Moroz, S. (2020). Regional development and foreign direct investment in transition countries: a case-study for regions in Ukraine. Post-Communist Economies, 32(6), 813-832.

- Globerman, S., & Shapiro, D. (2002). Global foreign direct investment flows: The role of governance infrastructure. World Development, 30(11), 1899-1919.

- Grönroos, C. (1984). A service quality model and its marketing implications. European Journal of Marketing, 18(4), 36-44.

- Haider, M., Gul, S., Afridi, S.A., & Batool, S. (2017). Factors Affecting Foreign Direct Investment in Pakistan. NUML International Journal of Business & Management, 12(2), 136-149.

- Hair, J.F., Anderson, R.E., Babin, B.J., & Black, W.C. (2010). Multivariate data analysis: A global perspective: Pearson Upper Saddle River.

- Harrington, D.R., Khanna, M., & Zilberman, D. (2005). Conservation capital and sustainable economic growth. Oxford Economic Papers, 57(2), 336-359.

- Hassan, M.K. (2004). FDI, information technology and economic growth in the MENA region. In Economic Research Forum 10th Annual Conference.

- Helldin, A. (2007). Regional determinants of foreign direct investment:-A study of eastern China.

- Kaliappan, S.R., Khamis, K.M., & Ismail, N.W. (2015). Determinants of Services FDI Inflows in ASEAN Countries. International Journal of Economics & Management, 9(1), 45-69.

- Khorrami Fard, S., & Fakhimi Azar, S. (2017). The factors affecting the attraction of foreign investors in construction and development of industrial towns in east azerbaijan province. International Journal of Economics and Management Sciences, 6(454), 2.

- Kokkinou, A., & Psycharis, Y. (2005). Foreign direct investment and regional attractiveness in southeastern European countries.

- Lal, A.K. (2017). Foreign direct investment, trade openness and GDP in China, India and Mexico. The Singapore Economic Review, 62(05), 1059-1076.

- Loewendahl, H., & Ertugal-Loewendahl, E. (2001). Turkey’s performance in attracting foreign direct investment: Implications of EU enlargement.

- Managi, S., & Bwalya, S.M. (2010). Foreign direct investment and technology spillovers in sub-Saharan Africa. Applied Economics Letters, 17(6), 605-608.

- Mat, S.H.C., & Harun, M. (2012). The impact of infrastructure on foreign direct investment: The case of Malaysia. Procedia-Social and Behavioral Sciences, 65, 205-211.

- Michie, J. (2001). The impact of foreign direct investment on human capital enhancement in developing countries. Report for the Organization for Economic Co-operation and Development (OECD).

- Modarress, B., Ansari, A., & Thies, E. (2014). The impact of technology transfer through foreign direct investment in developing nations: a case study in the United Arab Emirates. International Journal of Economics and Finance, 6(7), 108-126.

- Mohammadi, F.M. (2018). Assessment of Factors Affecting the Foreign Investment Attraction in Iran. Baltic Journal of Real Estate Economics and Construction Management, 6(1), 193-200.

- Ngangue, N. (2016). Infrastructure factors of foreign direct investment attraction in developing countries. International Journal of Economics, Commerce and Management, 4(12), 98-112.

- Obidike, P., & Uma, K. (2013). Effects of macroeconomic variables on foreign direct investment in a liberalized economy: The case of Nigeria. Journal of Economics and Finance, 1(4), 12-20.

- Osano, H.M., & Koine, P.W. (2016). Role of foreign direct investment on technology transfer and economic growth in Kenya: a case of the energy sector. Journal of Innovation and Entrepreneurship, 5(1), 1-25.

- Parasuraman, A., Zeithaml, V.A., & Berry, L. (1988). SERVQUAL: A multiple-item scale for measuring consumer perceptions of service quality.

- Parasuraman, A., Zeithaml, V.A., & Berry, L.L. (1985). A conceptual model of service quality and its implications for future research. Journal of Marketing, 49(4), 41-50.

- Rose-Ackerman, S., & Tobin, J. (2005). Foreign direct investment and the business environment in developing countries: The impact of bilateral investment treaties. Yale Law & Economics Research Paper, (293).

- Schuh, G.E. (2009). Human capital for sustainable economic development'. Dimensions of sustainable development.

- Oxford: EOLSS Publications, 74-91.

- Skenderi, M. (2013). The impact of technological transfer from foreign direct investment (FDI) on host economies: the case of Albania. Unpublished doctoral dissertation, University of Sheffield.

- Šlaus, I., & Jacobs, G. (2011). Human capital and sustainability. Sustainability, 3(1), 97-154.

- Susic, I., Stojanovic-Trivanovic, M., & Susic, M. (2017). Foreign direct investments and their impact on the economic development of Bosnia and Herzegovina. In IOP Conference Series: Materials Science and Engineering. IOP Publishing.

- Tocar, S. (2018). Determinants of foreign direct investment: A review. Review of Economic and Business Studies, 11(1), 165-196.

- Yussof, I., & Ismail, R. (2002). Human resource competitiveness and inflow of foreign direct investment to the ASEAN region. Asia-Pacific Development Journal, 9(1), 89-107.