Research Article: 2020 Vol: 19 Issue: 1

CEO Characteristics: A Literature Review and Future Directions

Marwan Altarawneh, Tunku Intan Safinaz School of Accountancy, Universiti Utara Malaysia

Rohami Shafie, Tunku Intan Safinaz School of Accountancy, Universiti Utara Malaysia

Rokiah Ishak, Tunku Intan Safinaz School of Accountancy, Universiti Utara Malaysia

Abstract

This paper reviews existing literature related to the different facets of the Chief Executive Officer (CEO) that may add value to firms. The focus of this paper is on CEO characteristics as the CEO position is very crucial in the management hierarchy, CEOs become part of the important factor that enhances the firms’ performances as well as financial reporting quality, and their characteristics are claimed to play essential roles in the firms. Many firms have excelled in business as a result of their CEO’s characteristics. However, prior studies have manifested mixed and inconclusive results as well as several gaps in the literature have also been identified due to the inconsistent results of previous studies. In addition, previous research highlights the individual CEO’s characteristics that impact the firm’s performance and also the quality of financial reporting and provides an impetus for conducting more studies in related areas. This paper provides a better understanding of the roles of CEO characteristics and future directions for research. In addition, this paper recommends to the regulators about the CEOs characteristics that affect firm performance and financial reporting quality. Finally, the paper suggests that firms should focus on these characteristics in enhancing their performances and financial reporting quality.

Keywords

CEO Characteristics, Financial Reporting Quality, Firm Performance.

Introduction

The Chief Executive Officer (CEO) is one of the critical players in the corporate sector. Sitting in the top positions of the management teams in firms, CEOs are able to guide the firms to actively pursue opportunities (Barnard, 1938), and control the structures and strategies of the firms (Woodward, 1965; Lawrence & Lorsch, 1967 and Thompson, 1967). Specifically, CEOs pursue important and strategic decisions that can influence the performances of their firms (Child, 1972). Drucker (1954) claimed that the most important determinant of the survival and success of a firm are based on the performance and quality of the top managers in the firm.

In other words, CEOs have crucial roles to play for the firm’s successes or failures. However, a few years back, financial and accounting statement fraud, scandals and CEO participation had been extensively documented (Troy et al., 2011). The cornerstone of the scandals was, among others, earnings manipulation (i.e., Enron, WorldCom, Tesco Plc‘s, Toshiba and Satyam). Firms’ managers who are driven by different motivations might apply several techniques of earnings manipulation to avoid reporting losses or low earnings, believing that by doing so, they can improve the image of their firms. Such techniques do not only mislead the users of the financial information (Saleh et al., 2005; Malik, 2015), but also affect the investors’ confidence in the financial statements in a negative manner. This has also led to an increase in the public perception of earnings manipulation (Hamid et al., 2013).

Moreover, the involvement and indictment of CEOs in financial statement fraud have run rampant. For example, in the United States, the CEO of Tyco, Kozlowski, manipulated earnings which resulted in the loss of US$100 billion in the firms’ market value (a sum that exceeded Enron’s total loss) (Troy et al., 2011). Another case, which was the Satyam scandal, occurred in India. The CEO of Satyam took the final responsibility for all accounting misappropriations as he fudged the book of accounts so that it seemed to be a bigger enterprise, with a faster growth rate and higher profits than it really had. The debacle of Satyam raised a discussion about the character of a CEO in driving a firm to the altitudes of success (Bhasin, 2015 & 2016).

Evidently, CEO characteristics have been listed among numerous factors that influence firms, as reported by several studies. The CEO's personality is likely to have an important impact on a firm’s success (Kets de Vries & Miller, 1984; Miller & Toulouse, 1985). The focus of the paper is on CEO characteristics as the CEO position is very crucial in the management hierarchy. Therefore, this paper sheds light on the CEOs’ characteristics and their impacts on firms. Thus, it is important that this paper will assist researchers in understanding the roles of CEOs in firms. The first part of this paper provides the literature review of previous studies of the CEO characteristics. The second part offers vital information about the relationships between the characteristics of CEOs and firm performance. The third part discusses the relationships between CEO characteristics and financial reporting quality. The forth part shows the methodology. Finally, discussions and conclusions are presented at the end of this paper.

Literature Review

CEO Characteristics Studies

Hambrick (2007) posits that the best way to understand a particular firm’s performance is to consider its fundamental dispositions and biases of the powerful actors, who are the top executives. These assumptions are based on the upper echelons theory that was proposed by Hambrick & Mason (1984). The theory opines that, the characteristics of managers can be useful in predicting the outcomes of the firm. The theory argues that the cognitive base and values of the executives influence the basis of their personalized interpretations of the strategic situations they face. It shows a person’s knowledge base, skills, values and the ability to process information, which influences the process of making decisions (Hambrick, 2007).

There has been a growth of studies on managerial characteristics topics as seen in the past decade. Shefrin (2001) indicated that managers’ sociological and physiological characteristics may impact various management decisions. Several studies have shown that the characteristics of CEOs influence decision-making. For example, Byrnes et al. (1999) studied the CEOs’ gender and risk-taking attitudes; Brown & Sarma (2007) researched the CEO’s overconfidence and corporate acquisitions; Barros & Da Silveira (2007) studied the CEO founder and the use of leverage; Bamber et al. (2010) investigated the age of CEOs and voluntary choice of financial disclosure; Li et al. (2011) and Serfling (2012) studied the age of CEOs and investment decisions; and Tomak (2013) examined the CEO’s overconfidence and capital structure decisions. In addition, the CEOs have a substantial amount of control on the reported financial results of their firms. Several empirical studies have supported these allegations (Jiang et al., 2010; Bamber et al., 2010 and Demerjian et al., 2013), and those on CEO turnover (Kramarz & Thesmar, 2013) and corporate governance (Brown et al., 2012). Ting et al. (2015) examined the impacts of the personal characteristics of the CEOs on financial leverage.

Many characteristics of the CEOs have been identified in the previous studies, such as gender, education, expertise, tenure, age, career background, experience, shareholding and duality, that impact the CEO’s behavior (Bamber et al., 2010; Jiang et al., 2013). Recently, several studies on CEOs’ characteristics have been carried out, such as on the CEO age and the amount of capital raised (Badru et al., 2017), the CEOs demographic characteristics (e.g., experience, age, education, professional experience and gender) on corporate risk-taking (Farag & Mallin, 2018) and the CEO power on corporate social responsibility disclosures (Muttakin et al., 2018). Taken together, this river of research highlights how individual CEOs impact their firms and provides a motivation for conducting studies in related areas.

CEO Characteristics and Firm Performance

One of the major signals that are used to draw the attention of investors to a firm is firm performance. The performance of the firm is also used to assess the effectiveness of the policies and activities of the management. The information on the performance of the firm is used to make several economic decisions by the stakeholders in the circle of financial reporting (Fauzi et al., 2010). CEOs need to make sure that the performances of the firms are in line with the objectives of the firms due to the high responsibility and commitment by the stakeholders. Hence, an individual needs to have certain qualities and criteria in order to become the CEO of a firm.

Recent decades have witnessed a surge of research interest in the effect of CEOs on firm performance (Burgelman et al., 2018). Researchers in various fields have used different methods to examine the extent to which CEOs account for the heterogeneity of firm performance, such as variance decomposition (Crossland & Hambrick, 2007) and stock market reactions to sudden CEO death announcements (Quigley et al., 2017).

Despite the ongoing debate (Lieberson & O’Connor, 1972; Fitza, 2014) and the constraints that CEOs may face from time to time (Hambrick & Finkelstein, 1987), prior studies have consistently found that CEOs do matter to firm performance. Indeed, the CEO effect has increased substantially over the years (Quigley & Hambrick, 2015; Quigley & Graffin, 2017). In addition, studies have moved beyond the contention that CEOs matter to questions of the channels through which they have impacts on firm performance, with a particular focus on personal characteristics. Drawing on several theoretical perspectives, the researchers have sought to investigate which CEO characteristics translate into relevant firm performance outcomes.

Taking an upper echelons perspective, some ascribe firm performance to the CEO’s background or personality (Hambrick & Mason, 1984; Hambrick, 2007; Zhu & Chen, 2015 and Wang et al., 2016). Leadership researchers have linked behavioral characteristics (e.g., leadership styles) with firm performance (Waldman et al., 2001). Academic interests have tried to relate between executive characteristics and firm outcomes. Basically, they gained momentum from Hambrick & Mason’s (1984) seminal article of the upper echelons theory, which holds that executives act on the basis of their personal interpretations of the strategic situations as a function of their experiences, values and personalities (Hambrick, 2007). From this, the stream of research has evolved the individual CEO characteristics that are related to firm strategy (Chatterjee & Hambrick, 2007; Simsek et al., 2010).

A related research stream has considered that individual CEO characteristics do relate to a firm’s strategic choices. The theory underpinning this approach not only builds on the upper echelons theory to justify the basic relationship but also shifts to the explanatory variables to the individual level of the CEO and, in general, connects this with the major choices and outcomes manifested at the firm level. Previous studies have investigated a variety of different individual characteristics, including the CEO’s background, such as experience (Datta & Rajagopalan, 1998; Barker & Mueller, 2002; Cooper & Uzun, 2012 and Hamori & Koyuncu, 2015), CEOs with multiple directorships (Chiang & He, 2010), education (Ng & Feldman, 2009) and international experience (Khavul et al., 2010), and along with the impact these have on innovation, diversification and strategic change.

Researchers have also considered CEO demographics, such as age (Yim, 2013; Amran et al., 2014) and gender (Khan & Vieito, 2013; Lee & Marvel, 2014 and Chen et al., 2016), as well as personality characteristics, such as core self-evaluation (Hiller & Hambrick, 2005; Simsek et al., 2010), hubris (Hayward & Hambrick, 1997), humility (Ou et al., 2014), narcissism (Chatterjee & Hambrick, 2007) and overconfidence (Chen et al., 2015). This research stream has shed light on the effects of CEOs on firms, but very few of them link the CEO characteristics and firm performance. In summary, this stream of research highlights the individual CEO’s characteristics that impact the firm’s performance and provides an impetus for conducting studies in related areas.

CEO Characteristics and Their Impacts on Financial Reporting Quality

Several studies have verified that CEOs play significant roles in their firms’ effectiveness because they are at the highest level of management; and, are those who are in charge of formulating and implementing strategies towards their firms’ successes (Carmeli & Halevi, 2009; Liu et al., 2018). This paper has turned into a review of the previous studies related to CEO characteristics and their impacts on financial reporting quality attributes.

A number of studies documented that CEO characteristics significantly affect financial reporting quality (Huang et al., 2012). Recently, researchers have become more interested in the effects of managerial characteristics. Studies investigating managerial influence on corporate decisions have been primarily conducted in light of Hambrick & Mason’s (1984) well-known upper echelons theory. The theory professes that managerial responsibilities, background personalities and expertise affect the way managers interact in a business environment and deal with problems, which thus influences the firms’ outcomes (Pham, 2016).

Furthermore, the researchers have examined a diversity of different individual characteristics with different financial reporting quality attributes, such as financial expert (Bamber et al., 2010; Baatwah et al., 2015 and Gounopoulos & Pham, 2018), CEO age (Peterson et al., 2001; Huang et al., 2012 and Belot & Serve, 2018), CEO tenure (Michel & Hambrick, 1992; Zhang & Wiersema, 2009; Ali & Zhang, 2015 and Besar et al., 2017), CEO reputation (Francis et al., 2008), CEO networks (Starr & MacMillan, 1990; Hoang & Antoncic, 2003 and Bhandari et al., 2018), the overconfidence of CEOs (Schrand & Zechman, 2012) and CEO gender (Kotiranta et al., 2007; Adams & Ferreira, 2009; Arun et al., 2015; Na & Hong, 2017 and Belot & Serve, 2018). Previous studies argued that newly-listed firms with financial expert CEOs are less likely to participate in earnings management. Similarly, CEO age positively affectes financial reporting quality. Additionally, previous research revealed that a long-tenured top management was aligned with team familiarity and cohesion of the firm’s internal business (Kor, 2006; Ali & Zhang, 2015).

Essentially, a position held for a long period of time would improve one’s personal experience and knowledge, leading to the efficient and successful completion of tasks. Francis et al. (2008) indicated that CEO tenure was positively associated with the financial reporting quality. Moreover, through a well-established CEO network (for example, with auditors, creditors and underwriters), the CEOs will have a quick access to important information. Information about market conditions, for instance, provides crucial market facts and highlights entrepreneurial opportunities that are beneficial for the firms; as well, CEO networks improve financial reporting quality (Hoang & Antoncic, 2003; Bhandari et al., 2018).

Moreover, with regards to the CEO gender and financial reporting quality, it is argued that the firms run by females are less preoccupied with earnings management than the firms run by males. It has also been shown that female CEOs have distinct characteristics that can positively impact the monitoring of financial reporting processes and the strategic direction of firms (Obanya & Mordi, 2014; Belot & Serve, 2018). Accordingly, based on the previous studies, CEO characteristics have had unique influences on the quality of financial reporting. Such studies have added valuable insights to the current CEO literature, which centres exclusively on CEO internal characteristics. To shed more light on the impact of CEO characteristics on firm outcomes and financial reporting quality, it is critical to investigate the CEO characteristics and different attributes of financial reporting quality, such as real earnings management and earnings forecasts, as well as examine the CEO characteristics with financial statement fraud in developing countries.

Methodology

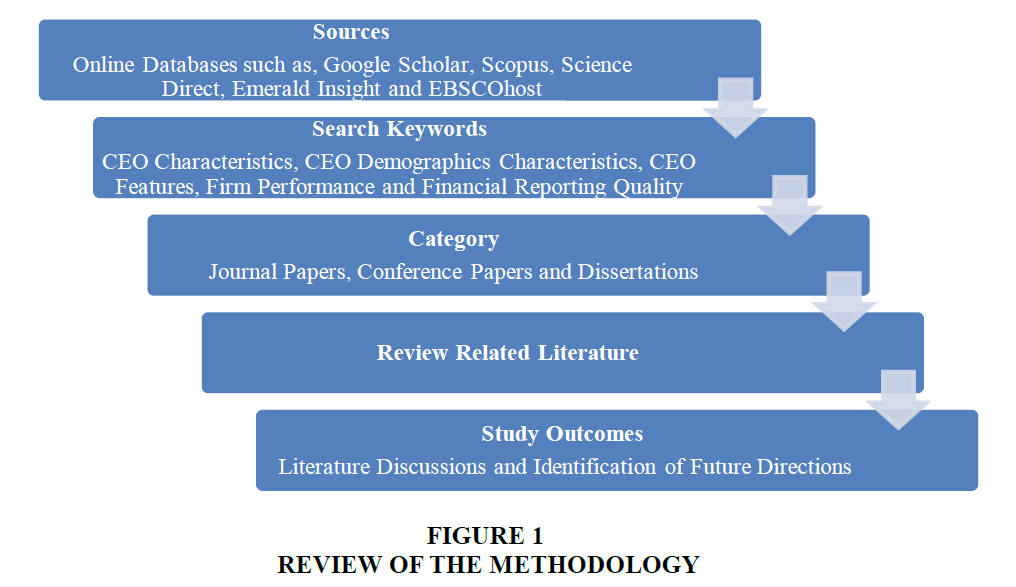

CEO characteristics are a very important topic since the CEO is one of the critical players in the corporate sector as well as sitting in the top positions of the management teams in firms, they are able to guide the firms to actively pursue opportunities, control the structures and strategies of the firms. CEOs pursue important and strategic decisions that can influence the performances of their firms. Therefore, due to the importance of this topic this paper aims to identify as to what extent the CEO characteristics influence both firm performance and financial reporting quality in the firms. In order to limit the scope of this review, this paper focused on the characteristics of the CEO. This paper also formed several criteria for the articles to be reviewed in order to guide the literature search: First, online peer-reviewed, articles or dissertations published in journals or conferences and international venues. Secondly, articles that study any of the CEO characteristics on firm performance or financial reporting quality measurements. Third, articles that clearly describe the methodology used to conduct the study such as quantitative studies. Fourthly, articles that clearly identify the top management team characteristics especially CEO characteristics. In addition, online databases such as Google Scholar, Scopus, Science Direct, Emerald Insight and EBSCOhost explores were searched to get relevant studies for this paper. Keywords used for the literature search were: “CEO characteristics”, “CEO demographics characteristics”, “CEO features”, “firm performance” and “financial reporting quality”. This paper reviewed 86 research papers from leading accounting, finance and business journals and conferences. The articles were searched and ordered based on the characteristics of the CEO in relation to firm performance and financial reporting quality attributes. The review of the methodology for this paper is graphically presented in Figure 1.

Discussion and Conclusions

The primary purpose of this paper has been to provide a review of the empirical research that investigated the relationships between CEO characteristics and both firm performance and financial reporting quality. This paper is, therefore, expected to enhance the understanding of the concerned policymakers and researchers about the roles of CEO characteristics. Overall, the outcomes of the review indicate that the roles of CEO characteristics have impacts on firm performance and financial reporting quality attributes.

Based on the review of the CEO studies, it is evinced that CEO characteristics, such as financial expertise and age, are able to discern firm performance and high quality financial information. It is important to note that such experience may positively enhance firm performance as well as the financial reporting process. As a result, information irregularity between firms and stakeholders can be reduced. In addition, CEO tenure strengthens the experience and capability of the CEOs with regard to the accounting models and areas, besides enhancing the CEOs’ capabilities to note and avert any unusual conducts. Further, this review implies that CEO networks are the determinant of CEO assurance for high quality financial reporting. Likewise, this indicates that unlike male CEOs, female CEOs avoid risks in making financial decisions, and female executives increase performance. However, all of the aforementioned studies reported mixed results which created a research gap, especially in this field. From the review, several gaps in the literature have also been identified due to the inconsistent results of previous studies. Subsequently, to fill the gaps, suggestions for future research are presented as follows. The literature review with respect to the influence of CEO characteristics on firm performance and financial reporting quality has revealed some promising avenues for future research although the findings need to be meticulously interpreted. In addition, the relationships between CEO characteristics and firm performance are not decisive. Future studies may consider the outcomes of the review and investigate further the roles of CEO characteristics based on different measurements of financial reporting quality, such as real earnings management and earnings forecasts. Although some advances have been made in understanding the link between CEO characteristics and firm performance, the area is ripe for future investigation.

In addition, the review of the empirical studies elucidated herewith suggests that there are inconclusive results on the relationships between CEO characteristics and poor financial reporting. While some studies reported a positive association, some other studies failed to document any associations at all. Thus, financial reporting quality and the perception associated it with CEO characteristics remain unclear. Furthermore, additional research is necessary to test whether CEO characteristics have different or even stronger impacts on financial statement fraud or the CEO characteristics affect the sustainability of the firm. This area may be considered as a new topic for future research as there are very limited studies to date even though it is very important to the body of knowledge, regulators and practitioners. Future studies may also consider other characteristics that would affect firm performance and financial reporting quality, such as CEO power, CEO founder, CEO ethnicity, CEO compensation, CEO ownership and CEO religiosity. Hence, this paper provides several research questions that in our opinion deserve further investigation as presented in Table 1.

| Table 1: Recommended Future Directions Of Ceo Characteristics Research | |

| No. | Research Questions |

|---|---|

| CEO Characteristics and Firm Performance | |

| RQ1 | How do CEO characteristics important to firm performance? |

| RQ2 | How do CEO characteristics namely, CEO power, CEO founder, CEO ethnicity, CEO compensation, CEO ownership and CEO religiosity affect firm performance? |

| CEO Characteristics and Financial reporting quality | |

| RQ3 | How do CEO characteristics important to improve the quality of financial reporting? |

| RQ4 | Do CEO characteristics namely, CEO power, CEO founder, CEO ethnicity, CEO compensation, CEO ownership and CEO religiosity affect financial reporting quality? |

| RQ5 | Do CEO characteristics affect Real Earnings Management? |

| CEO Characteristics and Financial Statement Fraud | |

| RQ6 | How do CEO characteristics affect financial statement fraud? |

| RQ7 | How does CEO engage with financial statement fraud? |

| CEO Characteristics and Sustainability of the Firm | |

| RQ8 | How do CEO characteristics affect the sustainability of the firm? |

| RQ9 | What are the important CEO characteristics that may affect the sustainability of the firm? |

References

- Adams, R.B., & Ferreira, D. (2009). Women in the boardroom and their impact on governance and performance.Journal of Financial Economics,94(2), 291-309.

- Ali, A., & Zhang, W. (2015). CEO tenure and earnings management. Journal of Accounting and Economics, 59(1), 60-79.

- Amran, N.A., Yusof, M A.M., Ishak, R., & Aripin, N. (2014). Do characteristics of CEO and Chairman influence Government-Linked Companies performance?.Procedia-Social and Behavioral Sciences,109, 799-803

- Arun, T.G., Almahrog, Y.E., & Aribi, Z.A. (2015). Female directors and earnings management: Evidence from UK companies.International Review of Financial Analysis,39, 137-146.

- Baatwah, S.R., Salleh, Z., & Ahmad, N. (2015). CEO characteristics and audit report timeliness: do CEO tenure and financial expertise matter?.Managerial Auditing Journal,30(8/9), 998-1022.

- Badru, B.O., Ahmad-Zaluki, N.A., & Wan-Hussin, W.N. (2017). CEO characteristics and the amount of capital raised in Malaysian IPOs.International Journal of Management Practice,10(4), 327-360.

- Bamber, L.S., Jiang, J., & Wang, I.Y. (2010). What’s my style? The influence of top managers on voluntary corporate financial disclosure.The Accounting Review,85(4), 1131-1162.

- Barker III, V.L., & Mueller, G.C. (2002). CEO characteristics and firm R&D spending.Management Science,48(6), 782-801.

- Barnard, C. (1938). The functions of the executive. Harvard University Press, Cambridge M, A.

- Barros, L., & Da Silveira, A. (2007). Overconfidence, managerial optimism and the determinants of capital structure. Brazilian Journal of Finance. 6(3), 293-334.

- Belot, F., & Serve, S. (2018). Earnings quality in private SMEs: Do CEO demographics matter?. Journal of Small Business Management, 56, 323-344.

- Besar, S.S.N.T., Ali, M.M., & Ghani, E.K. (2017). Examining upper echelons managers’ characteristics on financial restatements. Journal of International Studies, 10(4), 179-191.

- Bhandari, A., Mammadov, B., Shelton, A., & Thevenot, M. (2018). It is not only what you know, it is also who you know: CEO network connections and financial reporting quality.Auditing: A Journal of Practice & Theory,37(2), 27-50.

- Bhasin, M.L. (2015). Creative accounting practices in the Indian corporate sector: An empirical study. International Journal of Management Sciences and Business Research, 4(10), 1-18

- Bhasin, M.L. (2016). Fraudulent financial reporting practices: Case study of Satyam Computer Limited. The Journal of Economics, Marketing and Management, 4(3), 12-24

- Brown, R., & Sarma, N. (2007). CEO overconfidence, CEO dominance and corporate acquisitions.Journal of Economics and Business,59(5), 358-379.

- Brown, R., Gao, N., Lee, E., & Stathopoulos, K. (2012). What are friends for? CEO networks, pay and corporate governance. InCorporate Governance,Springer, Berlin, Heidelberg, 1, 287-307.

- Burgelman, R.A., Floyd, S.W., Laamanen, T., Mantere, S., Vaara, E., & Whittington, R. (2018). Strategy processes and practices: Dialogues and intersections.Strategic management journal,39(3), 531-558.

- Byrnes, J.P., Miller, D.C., & Schafer, W.D. (1999). Gender differences in risk taking: a meta-analysis.Psychological Bulletin,125(3), 367.

- Carmeli, A., & Halevi, M.Y. (2009). How top management team behavioral integration and behavioral complexity enable organizational ambidexterity: The moderating role of contextual ambidexterity.The Leadership Quarterly,20(2), 207-218.

- Chatterjee, A., & Hambrick, D.C. (2007). It's all about me: Narcissistic chief executive officers and their effects on company strategy and performance.Administrative science quarterly,52(3), 351-386.

- Chen, G., Crossland, C., & Huang, S. (2016). Female board representation and corporate acquisition intensity.Strategic Management Journal,37(2), 303-313.

- Chen, G., Crossland, C., & Luo, S. (2015). Making the same mistake all over again: CEO overconfidence and corporate resistance to corrective feedback.Strategic Management Journal,36(10), 1513-1535.

- Chiang, H.T., & He, L.J. (2010). Board supervision capability and information transparency.Corporate Governance: An International Review,18(1), 18-31.

- Child, J. (1972). Organizational structure, environment and performance: The role of strategic choice.Sociology,6(1), 1-22.

- Cooper, E., & Uzun, H. (2012). Directors with a full plate: the impact of busy directors on bank risk.Managerial Finance,38(6), 571-586.

- Crossland, C., & Hambrick, D.C. (2007). How national systems differ in their constraints on corporate executives: A study of CEO effects in three countries.Strategic Management Journal,28(8), 767-789.

- Datta, D.K., & Rajagopalan, N. (1998). Industry structure and CEO characteristics: An empirical study of succession events.Strategic Management Journal,19(9), 833-852.

- Demerjian, P.R., Lev, B., Lewis, M.F., & McVay, S.E. (2013). Managerial ability and earnings quality.The Accounting Review,88(2), 463-498.

- Drucker, P F. (1954). The Practice of Management. Harper & Row, New York.

- Farag, H., & Mallin, C. (2018). The influence of CEO demographic characteristics on corporate risk-taking: evidence from Chinese IPOs.The European Journal of Finance,24(16), 1528-1551.

- Fauzi, H., Svensson, G., & Rahman, A.A. (2010). “Triple bottom line” as “Sustainable corporate performance”: A proposition for the future.Sustainability,2(5), 1345-1360.

- Fitza, M.A. (2014). The use of variance decomposition in the investigation of CEO effects: How large must the CEO effect be to rule out chance?.Strategic Management Journal,35(12), 1839-1852.

- Francis, J., Huang, A.H., Rajgopal, S., & Zang, A.Y. (2008). CEO reputation and earnings quality.Contemporary Accounting Research,25(1), 109-147.

- Gounopoulos, D., & Pham, H. (2018). Financial expert CEOs and earnings management around initial public offerings.The International Journal of Accounting,53(2), 102-117.

- Hambrick, D. (2007). Upper echelons theory: An update. Academy of Management Review, 32(2), 334-343.

- Hambrick, D.C., & Finkelstein, S. (1987). Managerial discretion: A bridge between polar views of organizational outcomes.Research in Organizational Behavior.

- Hambrick, D.C., & Mason, P.A. (1984). Upper echelons: The organization as a reflection of its top managers.Academy of Management Review,9(2), 193-206.

- Hamid, F.Z.A., Shafie, R., Othman, Z., Wan-Hussin, W.N., & Fadzil, F.H. (2013). Cooking the books: the case of Malaysian listed companies. International Journal of Business and Social Science, 4(13), 179-186.

- Hamori, M., & Koyuncu, B. (2015). Experience matters? The impact of prior CEO experience on firm performance.Human Resource Management,54(1), 23-44.

- Hayward, M.L., & Hambrick, D.C. (1997). Explaining the premiums paid for large acquisitions: Evidence of CEO hubris.Administrative Science Quarterly, 103-127.

- Hiller, N.J., & Hambrick, D.C. (2005). Conceptualizing executive hubris: the role of (hyper?) core self?evaluations in strategic decision?making.Strategic Management Journal,26(4), 297-319.

- Hoang, H., & Antoncic, B. (2003). Network-based research in entrepreneurship: A critical review.Journal of Business Venturing,18(2), 165-187.

- Huang, H.W., Rose-Green, E., & Lee, C.C. (2012). CEO age and financial reporting quality.Accounting Horizons,26(4), 725-740.

- Jiang, F., Zhu, B., & Huang, J. (2013). CEO's financial experience and earnings management.Journal of Multinational Financial Management,23(3), 134-145.

- Jiang, J.X., Petroni, K.R., & Wang, I.Y. (2010). CFOs and CEOs: Who have the most influence on earnings management?.Journal of Financial Economics,96(3), 513-526.

- Kets de Vries, M. & D. Miller. (1984). The neurotic organization. San Francisco: Jossey-Bass.

- Khan, W.A., & Vieito, J.P. (2013). CEO gender and firm performance.Journal of Economics and Business,67, 55-66.

- Khavul, S., Benson, G.S., & Datta, D.K. (2010). Is internationalization associated with investments in HRM? A study of entrepreneurial firms in emerging markets.Human Resource Management,49(4), 693-713.

- Kor, Y.Y. (2006). Direct and interaction effects of top management team and board compositions on R&D investment strategy.Strategic Management Journal,27(11), 1081-1099.

- Kotiranta, A., Kovalainen, A. & Rouvinen, P. (2007). Female leadership and firm profitability. EVA Analysis, 3-5, OECD Publishing.

- Kramarz, F., & Thesmar, D. (2013). Social networks in the boardroom.Journal of the European Economic Association,11(4), 780-807.

- Lawrence, P.R., & Lorsch, J.W. (1967). Organization and environment (Harvard Business School Press, Boston).

- Lee, I.H., & Marvel, M.R. (2014). Revisiting the entrepreneur gender–performance relationship: a firm perspective.Small Business Economics,42(4), 769-786.

- Li, S., Selover, D.D., & Stein, M. (2011). “Keep silent and make money”: Institutional patterns of earnings management in China.Journal of Asian Economics,22(5), 369-382.

- Lieberson, S., & O'Connor, J.F. (1972). Leadership and organizational performance: A study of large corporations.American Sociological Review, 37(2), 117-130.

- Liu, D., Fisher, G., & Chen, G. (2018). CEO attributes and firm performance: A sequential mediation process model.Academy of Management Annals,12(2), 789-816.

- Malik, M. (2015). Corporate governance and real earnings management: The role of the board and institutional investors. Journal of Knowledge Globalization, 8(1), 37–87.

- Michel, J.G., & Hambrick, D.C. (1992). Diversification posture and top management team characteristics.Academy of Management Journal,35(1), 9-37.

- Miller, D., & Toulouse, J.M. (1985). Strategy, structure, CEO personality and performance in small firms.American Journal of Small Business,10(3), 47-62.

- Muttakin, M.B., Khan, A., & Mihret, D.G. (2018). The effect of board capital and CEO power on corporate social responsibility disclosures.Journal of Business Ethics,150(1), 41-56.

- Na, K., & Hong, J. (2017). CEO gender and earnings management.Journal of Applied Business Research,33(2), 297.

- Ng, T.W., & Feldman, D.C. (2009). How broadly does education contribute to job performance?.Personnel Psychology,62(1), 89-134.

- Obanya, S., & Mordi,, C. (2014). Gender diversity on boards of publicly quoted companies in Nigeria. Nigerian Observatory on Corporate Governance, 5(1), 1-26.

- Ou, A.Y., Tsui, A.S., Kinicki, A.J., Waldman, D.A., Xiao, Z., & Song, L.J. (2014). Humble chief executive officers’ connections to top management team integration and middle managers’ responses.Administrative Science Quarterly,59(1), 34-72.

- Peterson, D., Rhoads, A., & Vaught, B.C. (2001). Ethical beliefs of business professionals: A study of gender, age and external factors.Journal of Business Ethics,31(3), 225-232.

- Pham, H.M. (2016).The impact of credit ratings and CEOs’ work experience on earnings management and post-issue performance of US IPOs, Unpublished doctoral dissertation, University of Sussex.

- Quigley, T.J., & Graffin, S.D. (2017). Reaffirming the CEO effect is significant and much larger than chance: A comment on F itza (2014).Strategic Management Journal,38(3), 793-801.

- Quigley, T.J., & Hambrick, D.C. (2015). Has the “CEO effect” increased in recent decades? A new explanation for the great rise in America's attention to corporate leaders.Strategic Management Journal,36(6), 821-830.

- Quigley, T.J., Crossland, C., & Campbell, R.J. (2017). Shareholder perceptions of the changing impact of CEOs: Market reactions to unexpected CEO deaths, 1950-2009.Strategic Management Journal,38(4), 939-949.

- Saleh, N.M., Iskandar, T.M., & Rahmat, M.M. (2005). Earnings management and board characteristics: Evidence from Malaysia. Jurnal Pengurusan, 24(4), 77–103.

- Schrand, C.M., & Zechman, S.L. (2012). Executive overconfidence and the slippery slope to financial misreporting.Journal of Accounting and Economics,53(1-2), 311-329.

- Serfling, M.A. (2012). CEO age, underinvestment, and agency costs.Eller College of Management, University of Arizona.

- Shefrin, H. (2001). Behavioral corporate finance.Journal of Applied Corporate Finance,14(3), 113-126.

- Simsek, Z., Heavey, C., & Veiga, J.J.F. (2010). The impact of CEO core self?evaluation on the firm's entrepreneurial orientation.Strategic Management Journal,31(1), 110-119.

- Starr, J.A., & MacMillan, I.C. (1990). Resource cooptation via social contracting: Resource acquisition strategies for new ventures.Strategic Management Journal, 11(Special Issue), 79-92.

- Thompson, J.D. (1967). Organizations in action. New York: McGraw-Hill.Thompson Organizations in Action1967.

- Ting, I.W.K., Azizan, N.A.B., & Kweh, Q.L. (2015). Upper echelon theory revisited: The relationship between CEO personal characteristics and financial leverage decision.Procedia-Social and Behavioral Sciences,195, 686-694.

- Tomak, S. (2013). The impact of overconfidence on capital structure in Turkey.International Journal of Economics and Financial Issues,3(2), 512-518.

- Troy, C., Smith, K.G., & Domino, M.A. (2011). CEO demographics and accounting fraud: Who is more likely to rationalize illegal acts?.Strategic Organization,9(4), 259-282.

- Waldman, D.A., Ramirez, G.G., House, R.J., & Puranam, P. (2001). Does leadership matter? CEO leadership attributes and profitability under conditions of perceived environmental uncertainty.Academy of Management Journal,44(1), 134-143.

- Wang, G., Holmes Jr, R.M., Oh, I.S., & Zhu, W. (2016). Do CEOs matter to firm strategic actions and firm performance? A meta?analytic investigation based on upper echelons theory.Personnel Psychology,69(4), 775-862.

- Woodward, J. (1965). Industrial organization: Theory and practice. Oxford university press, New York.

- Yim, S. (2013). The acquisitiveness of youth: CEO age and acquisition behavior.Journal of Financial Economics,108(1), 250-273.

- Zhang, Y., & Wiersema, M.F. (2009). Stock market reaction to CEO certification: The signaling role of CEO background.Strategic Management Journal,30(7), 693-710.

- Zhu, D.H., & Chen, G. (2015). CEO narcissism and the impact of prior board experience on corporate strategy.Administrative Science Quarterly,60(1), 31-65.