Research Article: 2018 Vol: 17 Issue: 3

CEO Incentive Compensation and Risk-Taking Behavior: The Moderating Role of CEO Characteristics

Hussam Al Shammari

Indiana University of Pennsylvania Eberly College of Business and Information Technology

Keywords

CEO Incentive Compensation, Risk-Taking Behavior, CEO Characteristics.

Introduction

Over the past two decades, CEO compensation has interested researchers from various disciplines such as economics, finance and strategic management (Deschenes et al., 2014; Hou, Priem & Goranova, 2014). According to Barkema & Gomez-Mejia (1998), a total of more than 300 studies have accumulated examining the relationship between CEO compensation and various organizational outcomes including firm performance, innovation, corporate strategy and more recently CEO risk-taking (Balkin, Markman & Gomez-Mejia, 2000; Finkelstein & Boyd, 1998; Sanders, 2001; Wright et al., 2007). The vast majority of research in this area of study has been grounded on agency theory prescriptions originally developed by Jensen & Meckling (1976). Despite the large number of studies conducted, the results of this stream of research have best been described as mixed and inconsistent (Barkema & Gomez-Mejia, 1998; Gomez-Mejia & Wiseman, 1997; Pass, 2003). To move this stream of research forward, several suggestions have been advanced to examine the effects of various internal and external contextual factors that might interact with these relationships (Barkema & Gomez-Mejia, 1998; Hambrick, 2007).

Similarly, Hambrick & Mason (1984) call for the use of TMT demographic characteristics to study the content and process of firm strategies has led to an impressive body of empirical investigations in the last twenty years. This body of literature can be broadly classified into two distinct streams. One stream focuses on how the characteristics of the CEO and/or the Top Management Team (TMT) relate to various organizational outcomes (Prasad & Junni, 2017; Laufs, Bembom & Schwens, 2016; Nguyem, Rahman & Zhao, 2018; Herri, Handika & Yulihasric, 2017; Meeks, 2015; Henderson, Miller & Hambrick, 2006; Simsek, 2007; Wei & Ling, 2015). The second stream investigates the dynamics of the relationships between CEO/TMT demographics and their behaviors (Ahn, Minshall & Mortara, 2017; Saeed & Ziaulhaq, 2018; Wei, Ouyang & Chen, 2018; Smith et al., 1994; Simons, Pelled & Smith, 1999). The emergence of the second stream, to a great extent, was a response to the criticisms about the “black-box” of organizational demography (Lawrence, 1997). That is, the upper echelons approach has been often faulted for its use of CEO and/or TMT demographics as proxies of executive’s cognitive frames, limiting its accuracy, validity and completeness of appreciation for the real psychological and social dynamics that drive executive behaviors (Hambrick, 2007). Despite this criticism, research using the organizational demography approach has continued to flourish, primarily because of its ability to predict organizational phenomena. As Hambrick points out in his retrospective, there is no sign that interest in upper echelons theory is waning or that the theory has been tapped out.

This study is a response to Hambrick (2007) insightful call for theory and research integrating the combined effects of executive compensation system and CEO characteristics. There has been a growing interest in recent years in CEO risk-taking and/or firm risk-taking (Wright et al., 2007; Simsek, 2007). Our effort is to explain the variance in CEOs’ risk-taking behaviors by simultaneously examining both CEO compensation arrangements and CEO characteristics. For example, what are the effects of an aggressive long-term incentive plan on the behavior of a 45-year-old CEO compared to a 65-year-old CEO?

Similarly, what are the effects of an aggressive long-term incentive plan on the behavior of a CEO in his first year compared to a CEO who has been in the saddle for ten years?

These are the two questions this paper is trying to answer.

In order to accomplish the above objectives, the remainder of the paper is organized as follows: The next section reviews relevant literatures and develops our model and hypotheses. We then outline the methodology, data and sample, operationalization of variables and inference methods. Section four presents the findings from the statistical analysis. We conclude by discussing the findings and their implications.

Theory And Hypotheses

According to agency theory, one important area where the interests of principals and agents diverge is their attitudes and preferences toward risk. While shareholders regard their investment in a firm as a single investment within a well-diversified portfolio, thus diversifying away their risk relatively easily and inexpensively, managers are normally less able to diversify their risks in the forms of employment (Amihud & Lev, 1981), human capital (Wang & Barney, 2006) and ownership stakes in the firm. As a result of this, interests of managers and owners tend to diverge on this issue. While shareholders, who are well-diversified, are in favor of risk-seeking strategies, managers, who are constrained by their firm-specific investments, tend to adopt strategies that reduce risk.

Different mechanisms have been suggested to align the interests of managers and owners and help ensure that managers act on behalf of shareholders, thereby mitigating potential agency problems and costs. These include incentive alignment, monitoring and bonding (Jensen & Meckling, 1976). One important incentive alignment mechanism is executive compensation, which has captured the interest of researchers since the beginning of the past century (Taussig & Barker, 1925). In subsequent decades, a huge body of research has accumulated that examines both the antecedents and outcomes of CEO and/or TMT compensation (Barkema & Gomez-Mejia, 1998). Agency theory holds that the design of executive compensation provides a powerful mechanism to align the traditionally divergent interests of managers and owners, especially since firm outcomes such as performance tend to interact non-uniformly with the various elements of executive compensation (Lewellen, Loderer & Martin, 1987; Murphy, 1985). For example, Lewellen, Loderer & Martin (1987) point out that a component designed to control for one problem (i.e., time horizon) may tend to intensify another problem (i.e., risk exposure).

Agency theorists argue that an appropriately designed executive compensation system should reduce managerial opportunism, promote positive risk-taking attitudes on the part of executives and induce wealth maximizing investment strategies, decisions and behaviors that presumably would enhance firm performance (Jensen & Murphy, 1990). For example, the incentive alignment argument posits that executives who are paid large amounts of long-term incentives such as stock options in their compensation should be reluctant to engage in investments that do not increase shareholders wealth (Amihud & Lev, 1981; Sanders, 2001). However, so far, according to Finkelstein & Hambrick (1996), only limited effort has been made to explore the effects of executive compensation structure on CEO behaviors, especially in regards to strategic decisions and risk-taking behavior (Bloom & Milkovich, 1998; Sanders, 2001; Gilley et al., 2004; Wright et al., 2007). Therefore, according to Bloom & Milkovich (1998), underestimating the important role of risk attitudes and behaviors in this area of research may result in telling only part of the story about whether and when incentive pay leads to positive organizational outcomes.

To what extent can the design of CEO/TMT compensation promote congruence among shareholders and managers and thus induce greater risk-seeking on the part of executives? Despite the agency theory prediction that the introduction of long-term incentives, such as stock options, in CEO compensation can help reduce managerial opportunism and induce shareholder wealth maximizing corporate investment decisions and behaviors (Jensen & Meckling, 1976; Jensen & Murphy, 1990), the actual empirical results seem to be somewhat mixed and more nuanced. For example, DeFusco, Johnson & Zorn (1990) reported a positive relationship between the adoption of stock option plans and managerial risk-taking behavior, measured as variance in both stock price and stock returns. However, later studies provided less consistent evidence. While Hoskisson, Hitt & Hill (1993); Balkin, Markman & Gomez-Mejia (2000) found no significant relationships between executive long-term incentives and managerial risk-taking, a negative relationship was reported by Gray & Cannella (1997).

Sanders (2001) examined the influence of executive incentives on corporate decisions and strategies that entail risk-taking by testing the effects of executive’s stock option pay on firm’s acquisition and divestiture strategy. He reported that executive option pay had positive relationships with both acquisition and divestiture activities. The author’s interpretation that these results lend support to the incentive alignment argument, however, may be problematic in light of prior research on diversification. The general consensus emerging from diversification literature is that agents have the motive to pursue excessive diversification that goes beyond the optimal level for shareholders because diversification is one of the means through which they can reduce their employment risk (Amihud & Lev, 1981). In addition, firm size, according to previous work in this area, is known to be a strong predictor of executive compensation (Hambrick & Finkelstein, 1995; Tosi et al., 2000). From a shareholder’s perspective, diversification and acquisition are not beneficial due to the low cost of portfolio diversification in the external capital market (Amihud & Lev, 1981). Therefore, more acquisition activity associated with stock option pay found in this study is more an indicator of interest misalignment than an evidence of alignment. In a similar vein, Wright et al. (2007) attempted to examine the influences of various components of TMT compensation (i.e. salary and bonus, stock options) on subsequent firm risk-taking. The results of their study indicated that TMT long-term incentives such as stock options are uniformly and positively related to firm’s corporate risk-taking.

One of the approaches to resolving inconsistent findings in the relationship between two variables is to introduce additional variables to identify the specificity of that relationship to the presence of a third set of contextual factors. In this respect, Hambrick (2007) suggestion that CEO characteristics may influence how a particular CEO may respond to a given compensation arrangement is particularly insightful. Over the last two decades, a significant body of research has accumulated examining the extent and the ways top executives influence firm’s strategic choices and outcomes (Westphal & Zajac, 1995; Zajac & Westphal, 1996; O’Reilly, Caldwell & Barnett, 1989; Pfeffer, 1983). With the upper echelons theory (Hambrick & Mason, 1984) as the dominant paradigm, this stream of research has focused on the CEO/TMT demographics such as age, tenure and functional background as predictors of organizational decisions and actions. As Davidson, Nemec & Worrell (2006) state, Demographic features such as age, religion, sex and socioeconomic position influence not only individual behavior, but also the actions of organization.

In this study, we pay particular attention to CEO tenure and age, in line with Hambrick (2007) call to consider the joint effects of compensation arrangements and CEO characteristics.

Ceo Tenure

Several studies have examined the effects of CEO tenure on both CEO behaviors and firm outcomes (Nguyem, Rahman & Zhao, 2018; Wei, Ouyang & Chen, 2018; Saeed & Ziaulhaq, 2018). Based on a review of relevant literatures, Henderson, Miller & Hambrick (2006) argued that senior executives, including CEOs, do not think, behave or even perform uniformly over their tenure.

In line with this argument, Miller (1991) reported that in the first 10 years of CEO tenure, firm-environment alignment was observed leading to better performance. However, after 10 years in office, a different pattern was evident wherein firm-environment alignment became less apparent, resulting in lower firm performance. Similar findings were reported by Miller & Shamsie (2001), who found that CEO tenure had an inverted U-shaped relationship with firm performance. These results suggest that CEOs with different tenures tend to behave differently.

Simsek (2007) theoretically argued and empirically tested the relationship between CEO tenure, risk-taking propensity and firm performance. His results indicated that an increase in CEO tenure introduces more risk-taking propensity, which subsequently improves firm performance. Simsek (2007) argued that changes in risk-taking and willingness to embrace strategic risk are likely to occur over the course of a CEO’s tenure.

That is, the greater a CEO’s past positional experience in dealing with strategic risk, the less uncertainty he or she is likely to perceive regarding the magnitude or the probability of loss associated with strategic risk-taking. This reduction in the level of uncertainty is caused by three factors. First, as CEO past experience increases, it improves the selection process by enabling him or her to identify those risky actions that have the greatest probability of success. Second, increases in tenure and experience allow a CEO to more comprehensively assess and justify taking actions that might otherwise be deemed to be too risky absent such experience. Finally, more CEO experience could result in improvements in the execution of these risky actions. Consistent with the aforementioned arguments and evidence, we suggest that short-tenured CEOs are less likely to engage in risk-seeking behavior until they accumulate deeper firm and environment knowledge, adequate experience and necessary leverage through strong networks with key stakeholders. We then expect long-tenured CEOs to be involved in more strategic risk-taking behavior than short-tenured CEOs. Thus, we hypothesize that:

H1: CEO tenure will moderate the relationship between CEO long-term incentive compensation and CEO risk-taking behavior. This relationship will strengthen as CEO tenure increases.

Ceo Age

Similar to tenure, CEO age has been the focus of considerable research in the area of organizational demography (Davidson, Nemec & Worrell, 2006; Deckop, 1988; Karami, Analoui & Kakabadse, 2006; Nelson, 2005). It is argued that executive age carries with it a portfolio of personal values, experiences and mindsets that shape his or her attitudes and behaviors, which are eventually reflected in organizational actions and outcomes (Davidson, Nemec & Worrell, 2006). For example, Rhodes (1983) argued that there are certain psychological changes that are associated with aging. This includes changes in values, needs, expectations and mindsets. These changes, according to Rhodes, could eventually affect the attitudes and preferences that an individual holds toward various strategic issues and options facing the organization. Consequently, strategic choices and decisions made may then reflect the preferences and interests of the CEO rather than the owners, creating agency problems.

Divergence in risk attitudes and preferences between executives and shareholders is an important area where CEO age becomes a significant factor in either alleviating or mitigating the extent of such divergence. For example, shareholder’s investment time horizon in the firm is infinite. However, executives face a limited time horizon in their employment. This becomes more pronounced, especially when CEOs are older and close to retirement (Harvey & Shrieves, 2001). In line with this perspective, Lewellen, Loderer & Martin (1987) argued that younger CEOs tend to have longer prospective employment with the firm; therefore, they are less likely to be myopic when making strategic investment decisions on behalf of the firm. Furthermore, younger CEOs tend to have more concern about being strongly disciplined by managerial external labor market if they fail to meet shareholder objectives (Gibbons & Murphy, 1992; Lewellen, Loderer & Martin, 1987). Therefore, they are discouraged from engaging in opportunistic behaviors.

On the other hand, since CEO aging is normally associated with psychological effects such as changes in values, needs and experiences (Davidson, Nemec & Worrell, 2006; Rhodes, 1983), one can expect CEO’s risk attitudes and preferences to change as the CEO gets older. For example, as executives age and become older, they tend to place greater weight on financial and career stability and security needs (Rhodes, 1983). In addition, since older CEOs have a limited personal investment horizon as they close in on retirement (Harvey & Shrieves, 2001) they become less inclined to pursue risky and long-term investment strategies. Therefore, we expect older CEOs to avoid personally unjustified exposure to volatile and risky endeavors in the firm’s investment opportunity set. Consistent with this evidence and argument, we expect CEO age to have a moderating effect on the relationship between CEO long-term incentive compensation and strategic risk-taking behavior, weakening the positive relationship predicted by agency theory. Therefore,

H2: CEO age will moderate the relationship between CEO long-term incentive compensation and CEO risk-taking behavior. This relationship will weaken as CEO age increases.

Methods

Sample and Data

The sample for this study consisted of publicly traded U.S. manufacturing firms (NAICS 31-33) listed in the Fortune 1000. The study used data on 160 U.S. manufacturing public companies. CEO compensation information was derived from EXECUCOMP Database. Data for CEO age, tenure, ownership and board size were collected from firm’s proxy statements. Performance, sales, R&D spending and debt data were downloaded from COMPUSTAT Database. Consistent with previous research, a one-year lag between CEO incentive compensation and subsequent risk is introduced to allow time for the CEO’s investment decisions that may result from compensation schemes to affect firm’s risk.

Variables and Measures

Independent Variable

CEO long-term incentive compensation was measured using the weight of stock options in the CEO’s pay mix. Following previous research (Makri, Lane & Gomez-Mejia, 2006; Stroh et al., 1996), CEO incentive compensation was obtained by calculating the proportion of the CEO’s compensation that was comprised of stock options. Stock options were valued using the Black-Scholes options pricing model (Black & Scholes, 1973), which has been extensively used and validated in previous literature.

Dependent Variable

The conceptualization of risk and its measurement in the field of strategic management has been described as “ambiguous” (Sanders & Hambrick, 2007) and “underdeveloped” (Wiseman & Gomez-Mejia, 1998). Much of the confusion on the definition and operationalization of risk is attributed, according to Ruefli, Collins & Lacugna, to strategy research heavily relying on risk measures developed in adjacent disciplines. Surprisingly, researchers in the field of strategic management have not devoted serious attention to the development of measures more pertinent to strategy research. Given that risk is a multidimensional construct and that there is a multitude of risk measures, it is unclear which of these measures is appropriate for strategy research, especially for a study such as this. For example, Jemison argued that “risk is an elusive concept” that has different interpretations and concerns, depending on the perspective from which it is viewed. Further, risk could be either ex ante or ex post risk. Failure to differentiate between these two types of risk can lead to inconsistent finding and erroneous conclusions in strategy research. For example, since one cannot use ex post variation in return as an indicator of the risk that exists ex ante, it is unsound to use ex post measures of risk to explain current or future firm actions and/or outcomes, including current or future risk.

In line with Ruefli, Collins & Lacugna call for more theory development on risk and its measurement in strategy research, Sanders & Hambrick (2007), recently proposed a more comprehensive conceptualization of risk in the context of strategy research. Following Larcker, they argued that the most basic element of risk is the size of the R&D investment outlay. The bigger the R&D investment outlay, the bigger is the firm’s risk exposure. Conversely, smaller R&D spending will result in less exposure and hence yield lower levels of risk. Following Sanders & Hambrick (2007), this study employs R&D investment spending to assess managerial risk-taking behavior. This measure has also been used and validated in prior work (Hoskisson, Hitt & Hill, 1993). Further, the utilization of this measure as an ex ante measure is consistent with the objective of our study. We operationalized R&D investment outlay as R&D intensity, which is the ratio of R&D expenditures to sales.

Moderator Variables

CEO age was operationalized as the age of the CEO in years. CEO tenure was measured as the number of years the CEO has been in the position.

Control Variables

Based on prior CEO compensation and demographics literature, this study employed six control variables. First, firm size is considered to be the most clearly influential factor in determining CEO compensation (Tosi et al., 2000). Therefore, we controlled for firm size, which was measured as the natural log of the firm’s sales. Second, prior research indicated that past performance is an important antecedent of strategic change in organizations, including turnaround and diversification posture, which has subsequent implications for business risk (Hambrick & Schecter, 1983; Tushman & Romanelli, 1985; Tushman, Virany & Romanelli, 1989). Therefore, this study controlled for the effect of this variable by averaging the Return on Equity (ROE) for the three-year period from 2001 to 2003. Third, Sanders (2001) reported that executive ownership plays an important role in executive risk-taking appetite. Drawing on this evidence, this study controlled for the effect of this important variable. Executive ownership was measured as the percentage of shares outstanding held by the CEO in 2003. Fourth, the debt-to-equity ratio was included as a control variable following Sanders (2001). Fifth, we also included board size as a control variable consistent with Pearce & Zahra (1992); Pfeffer (1983). Finally, following Gilley et al. (2004), we controlled for the previous state of the dependent variable by averaging the R&D expenditures for the three-year period from 2001 to 2003.

Analysis And Results

Table 1 presents the means, standard deviations and zero-order correlations among all study variables. The correlation matrix was used to examine bivariate correlations among independent, control and moderator variables. The magnitude of the highest correlation among these variables was 0.44. Thus, multicollinearity is unlikely to be a serious threat to our analyses (Tsui et al., 1995). However, when testing for moderation effects, issues of multicollinearity arising from the interaction terms being highly correlated with their constituent variables called for remedial measures. Following Aiken & West (1991) suggested procedures, the direct terms used to construct interaction terms were centered by subtracting the mean of each variable from observed values. Data centering of the direct terms also allows for an easier interpretation of results (Chin, Marcolin & Newsted, 2003). In addition, the Variance Inflation Factors (VIFs) were computed to assess whether multicollinearity was still a problem. None of the VIFs approached the threshold value of 10 identified by Netter.

| Table 1: Means, Standard Deviations And Correlations Among All Variables |

|||||||||||||

| Variable | Mean | S.D. | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Control | |||||||||||||

| 1 | Firm Size | 8853.12 | 19918.9 | 1.0 | |||||||||

| 2 | Past Performance | 14.80 | 80.64 | -0.012 | 1.0 | ||||||||

| 3 | Past Strategic Risk | 0.066 | 0.10 | -0.066 | -0.090 | 1.0 | |||||||

| 4 | CEO Ownership | 0.015 | 0.03 | -0.096 | 0.001 | -0.076 | 1.0 | ||||||

| 5 | Board Size | 10.25 | 2.28 | 0.294*** | 0.077 | -0.211*** | -0.096 | 1.0 | |||||

| 6 | Firm Leverage | 0.236 | 0.14 | 0.255*** | 0.129** | -0.264*** | -0.103 | 0.205*** | 1.0 | ||||

| Independent | |||||||||||||

| 7 | CEO Option Pay | 0.47 | 0.22 | 0.047 | -0.033 | 0.438*** | 0.086 | -0.053 | -0.247*** | 1.0 | |||

| Moderator | |||||||||||||

| 8 | CEO Age | 55.10 | 7.10 | 0.131 | 0.061 | 0.057 | -0.134 | 0.071 | 0.033 | -0.043 | 1.0 | ||

| 9 | CEO Tenure | 6.53 | 5.50 | -0.075 | 0.047 | 0.017 | 0.288*** | -0.158 | -0.174 | 0.123 | 0.307*** | 1.0 | |

| Dependent Variable | |||||||||||||

| 10 | Strategic Risk (R&D) | 0.063 | 0.07 | -0.053 | -0.032 | 0.848*** | -0.092 | -0.156** | -0.275*** | 0.55*** | 0.037 | 0.086 | 1.0 |

* p<0.10; **p<0.05; ***p<0.0

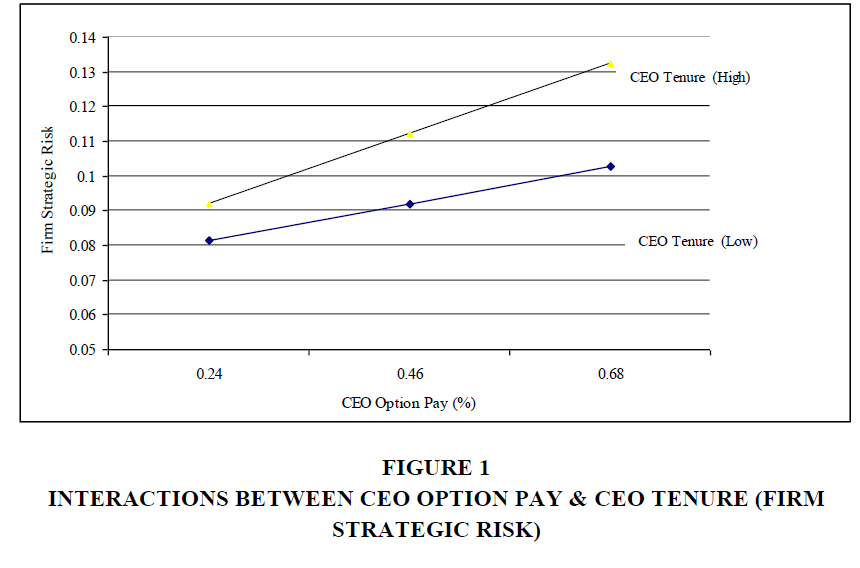

The results of our regression analyses are presented in Table 2. Model 1, which included the control variables, explained nearly 74 percent of the variance in firm strategic risk. In Model 2, we introduced the CEO long-term incentives measure. The results indicated a significant, positive relationship between CEO incentive pay and CEO risk-taking behavior/firm strategic risk (β=0.074, p<0.01; R2=0.78, p<0.01). The introduction of the CEO option pay variable explained an additional 4% of the variance in firm strategic risk (p<0.01). Hierarchical Ordinary Least Squares (OLS) regression analyses were used to test the hypotheses. Control variables, CEO option pay and moderator variables were first entered as main effect predictors of CEO risk-taking behavior/firm’s strategic risk (see Model 3 of Table 2). Next, we created moderator terms by multiplying each of the moderator variables by CEO long-term incentives ratio. When the interaction terms were entered into the regression equation (see Model 4 of Table 2), there was a moderate yet significant increase in model fit for regression equations that predict CEO risk-taking/firm strategic risk (ΔR2=0.01; p<0.05). Hypothesis 1 suggests that CEO tenure will moderate the relationship between CEO long-term incentives and CEO risk-taking/firm strategic risk, with the relationship being stronger in firms where CEOs have long tenures. Results of regression analyses provide support for our hypothesis. As indicated in Model 4 of Table 2, the interaction term comprised of CEO long-term incentives and CEO tenure was significant, suggesting that CEO tenure moderates the relationship between CEO incentive pay and firm strategic risk (β=0.004; p<0.05). The positive effect of CEO long-term incentive pay on firm strategic risk strengthened as CEO tenure increases. Figure 1 graphically illustrates this relationship.

| Table 2: Results Of Hierarchical Regression Analyses: Testing Moderation Effects On firm strategic riska | |||||

| Variable | Model 1 | Model 2 | Model 3 | Model 4 | |

|---|---|---|---|---|---|

| Control | Firm Size | -0.005 | -0.008 | -0.01* | -0.011* |

| (0.008) | (0.007) | (0.007) | (0.007) | ||

| Past Performance | 0.000 | 0.000 | 0.000 | 0.000 | |

| (0.000) | (0.000) | (0.000) | (0.000) | ||

| Past Strategic Risk | 0.620 *** | 0.554*** | 0.555*** | 0.560*** | |

| (0.032) | (0.033) | (0.033) | (0.033) | ||

| CEO Ownership | -0.003 | -0.003 | -0.009* | -0.010** | |

| (0.005) | (0.004) | (0.005) | (0.005) | ||

| Board Size | -0.001 | -0.001 | -0.001 | -0.001 | |

| (0.001) | (0.001) | (0.001) | (0.001) | ||

| Firm Leverage | -0.019 | 0.001 | 0.008 | 0.009 | |

| (0.008) | (0.021) | (0.022) | (0.021) | ||

| Independent | CEO Option Pay | 0.074 *** | 0.070 *** | 0.067*** | |

| (0.014) | (0.014) | (0.014) | |||

| Moderator | CEO Age | -0.0001 | 0.0001 | ||

| (0.0004) | (.0004) | ||||

| CEO Tenure | 0.001** | 0.0008* | |||

| (0.001) | (0.0006) | ||||

| Interaction | CEO Age*CEO Option Pay | -0.003** | |||

| (0.001 | |||||

| CEO Tenure*CEO Option Pay | 0.004** | ||||

| (0.002) | |||||

| Intercept | 0.043* | 0.053** | 0.045** | 0.044** | |

| (0.024) | (0.014) | (0.023) | (0.023) | ||

| R2 | 0.74*** | 0.78*** | 0.79*** | 0.80*** | |

| F | 76.00 | 80.07 | 63.97 | 54.30 | |

| ?R2 | 0.04*** | 0.01* | 0.01** | ||

| F for ?R2 | 27.00 | 2.41 | 3.02 | ||

a:Unstandardized coefficients are reported; The figures in parentheses are standard errors. N=160 for all models. *p<0.10; **p<0.05; ***p<0.01

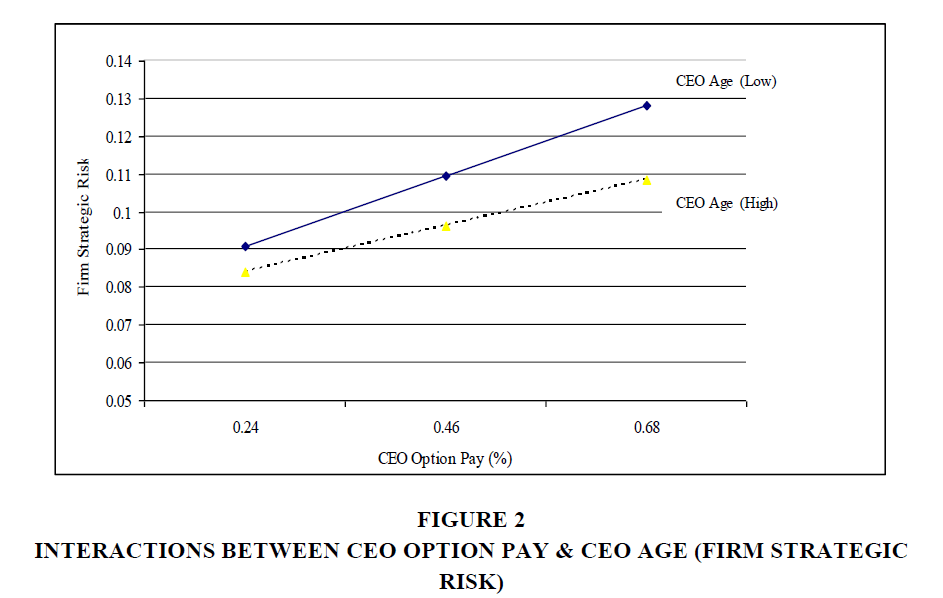

Hypothesis 2 predicts that CEO age will moderate the relationship between CEO long-term incentives and CEO risk-taking/firm strategic risk, with the relationship weakening as CEO age increases. As can be seen in Model 4 of Table 2, the interaction term of CEO long-term incentives and CEO age had a negative and significant coefficient in the regression equation predicting CEO risk-taking/firm strategic risk (β=-0.003, p<0.05). This suggests that CEO age moderates the relationship. The positive effect of CEO long-term incentives on CEO risk-taking/firm strategic risk weakens with CEO age getting older. This supports Hypothesis 2 and is graphically presented in Figure 2.

Discussion, Limitations And Conclusions

Despite being among the most extensively researched subjects in strategy literature, research on executive compensation and upper echelons theory have produced mixed evidence in regards to their individual effects on organizational outcomes. For example, executive compensation research has been described as “meager, misguided and myopic” (Heneman & Judge, 2000) and “remains in the melting pot” (Pass, 2003). Similarly, Hambrick (2007) indicated that “we still have much to learn about the effects-both positive and negative-of top executives on organizations” towards a fine-grained development and understanding of upper echelons theory. While much progress has been made in each of these areas, we believe that implementing Hambrick (2007) call for the joint consideration of executive compensation arrangements and CEO characteristics can lead to more insightful inferences.

The objectives of this study were to highlight the interplay between CEO long-term incentive compensation and CEO demographic attributes and the consequences of such interplay for CEO risk-taking behavior. Our results indicate that CEO long-term incentive pay does have an influence on CEO risk-taking behavior, in line with agency theory’s incentive alignment argument and reaffirms prior research findings in this area of study (DeFusco, Johnson & Zorn, 1990; Sanders, 2001; Wright et al., 2007). In addition, this result extends previous work, especially in regards to the way we operationalized CEO risk-taking behavior. For example, DeFusco, Johnson & Zorn (1990) utilized stock returns risk to capture managerial risk-taking behavior. Wright et al. (2007) employed income stream risk measures to measure firm corporate risk-taking behavior. In this study, we relied on R&D expenditure to proxy CEO strategic risk-taking behavior. By doing so, we provide empirical evidence that the effects of executive compensation on risk-taking behavior hold across the three types of risk traditionally employed in strategy literature identified in Miller & Bromiley (1990).

Although CEO long-term incentive pay exhibited a positive relationship with CEO risk-taking behavior, subsequent hierarchical regression analyses showed that such a relationship was moderated by CEO characteristics. Consistent with Figures 1 & 2, it is clear that the initially positive and significant relationship between CEO long-term incentive compensation and subsequent risk-taking is strengthened as CEO tenure increases and weakened as CEOs become older. These findings are notable for several reasons. First, our study confirms Hambrick (2007), intuition that the influence of CEO compensation arrangements on organizational decisions and actions can be best understood by examining its combined effects with CEO characteristics. Second, these results reaffirm the notion that CEO characteristics such as tenure and age influence both individual behaviors and firm actions (Davidson, Nemec & Worrell, 2006). This would be consistent with the literatures on CEO tenure and age (Harvey & Shrieves, 2001; Henderson, Miller & Hambrick, 2006; Lewellen, Loderer & Martin, 1987; Simsek, 2007). In addition, the results provide support for the contingency relationship perspective that many researchers called for to advance our knowledge of the dynamics of executive compensation relationships to organizational outcomes (Barkema & Gomez-Mejia, 1998).

While interpreting the results of this study, it is important to bear in mind some of its limitations. First, the generalizability of our findings is somewhat limited. Our study is based on large, U.S. based manufacturing firms. Therefore, extending our model to other non-manufacturing, small and medium size represent an area where future research can enhance the generalizability of these findings. Second, we relied on an archival measure to capture CEO strategic risk-taking behavior. While this is the case in most of prior work in strategy literature, there are questions as to whether these measures can adequately capture the underlying attitudes and preferences of CEOs. While it would be ideal for future research to use more fine-grained psychological constructs that may better capture the underlying beliefs and preferences of CEOs, obvious difficulties in access to information on these constructs make such an effort less than feasible at this point. In a similar vein, our reliance on CEO observable demographics such as age and tenure to predict CEO’s actions and underlying attitudes and beliefs has also its own limitations (Simsek, 2007). Yet this limitation does not undermine our findings. For example, Barker & Mueller (2002) argued that “visible CEO demographics may have more practical value than psychological measurements” to predict CEOs’ moves. Third, the cross-sectional design of our study mandates caution in regards to causality inferences and conclusions derived from our findings. We tried to address this issue by: (1) introducing a one-year lag between our independent and moderator variables on one side of the equation and the dependent variable on the other and (2) incorporating control variables including prior state of dependent variable. Despite this, we believe that future research can better address this causality issue by using techniques such as panel data analysis that covers longer time periods. Fourth, the vast majority of empirical executive compensation and upper echelons research, including this study, is based on samples of U.S. firms. Hambrick (2007) argues that national systems in which CEOs operate embed a multitude of contingencies that can either implicitly or explicitly restrict CEOs actions and the strategic alternatives available to them. Consistent with this argument, Crossland & Hambrick (2007) empirically found CEOs tend to matter more in the U.S. than in Germany and Japan when it comes to their impact on firm performance. Replicating our study across different national environments may provide a better understanding of the context specificity of our conclusions. Finally, the ability of our study to capture the dynamics of decision making at corporate levels is confined to the level of measurement in our analysis. Our review of literature on upper echelons theory reveals that prior work has employed two levels of analysis; individual CEOs and TMTs. Our study relied on individual CEOs as a unit of analysis, both in compensation and demographics. Upper echelon’s theorists have long argued that TMT composition, size, integration and characteristics yield strong predictions of strategic behavior (Hambrick, 2007). Yet CEOs’ power and how much say they have are important considerations when it comes to corporate decision-making (Finkelstein, 1992). One interesting observation Hambrick (1994 & 1995) has reported is that TMTs have limited team properties. It was found that TMT members tend to engage in bilateral relations with the CEO and have little to do with each other, creating a tendency to not operate as a team. Drawing on this, TMT “integration” versus “fragmentation” is as just an important consideration in assessing the appropriateness of TMT as a meaningful level of analysis. This issue falls beyond the scope of our current study. However, consistent with Hambrick (2007) call, this represents a future research frontier for upper echelons theorists.

Notwithstanding the above limitations, we believe that our study has contributed to a better appreciation for the need to consider CEO compensation and upper echelons theory together than in isolation. In addition to reaffirming prior research findings in regard to the incentive alignment argument of agency theory, our results also provide evidence on the combined effects of CEO compensation arrangements and demographics on CEO strategic risk-taking behavior. We believe that our results demonstrate that multi-theoretic approaches to the study of organizational phenomena can provide a better understanding than studies restricted to the narrow confines of a single theory. Our study may be seen as a first effort in implementing Hambrick (2007) call for the need for theoretical integration of executive compensation research and upper echelons theory.

References

- Ahn, J.M., Minshall, T. & Mortara, L. (2017). Understanding the human side of openness: The fit between open innovation modes and CEO characteristics. R&D Management, 47(5), 727-740.

- Aiken, L.S. & West, S.G. (1991). Multiple regression: Testing and interpreting interactions. Newbury Park, CA: Sage.

- Amihud, Y. & Lev, B. (1981). Risk reduction as a management motive for conglomerate mergers. Bell Journal of Economics, 12(2), 605-617.

- Balkin, D.B., Markman, G.D. & Gomez-Mejia, L.R. (2000). Is CEO pay in high-technology firms related to innovation? Academy of Management Journal, 43(6), 1118-1129.

- Barkema, H.G. & Gomez-Mejia, L.R. (1998). Managerial compensation and firm performance: A general research framework. Academy of Management Journal, 41(2), 135-145.

- Barker, V.L. & Mueller, G.C. (2002). CEO characteristics and firm R&D spending. Management Science, 48(6), 782-801.

- Black, F. & Scholes, M. (1973). The pricing of options and corporate liabilities. Journal of Political Economy, 81, 637-659.

- Bloom, M. & Milkovich, G.T. (1998). Relationships among risk, incentive pay and organizational performance. Academy of Management Journal, 41(3), 283-297.

- Chin, W.W., Marcolin, B.L. & Newsted, P.R. (2003). A partial least squares latent variable modeling approach for measuring interaction effects: Results from a Monte Carlo simulation study and an electronic-mail emotion/adoption study. Information System Research, 14(2), 189-217.

- Crossland, C. & Hambrick, D.C. (2007). How national systems differ in their constraints on corporate executives: A study of CEO effects in three countries. Strategic Management Journal, 28(8), 767-789.

- Davidson, W.N., Nemec, C. & Worrell, D.L. (2006). Determinants of CEO age at succession. Journal of Management and Governance, 10(1), 35-57.

- Deckop, J.R. (1988). Determinants of chief executive office compensation. Industrial and Labor Relations Review, 41(2), 215-226.

- DeFusco, R.A., Johnson, R.R. & Zorn, T.S. (1990). The effect of executive stock option plans on stockholders and bondholders. The Journal of Finance, 45(2), 617-627.

- Deschenes, S., Bouaziz, M.Z., Morris, T., Rojas, M. & Boubacar, H. (2014). CEO's share of top-management compensation, characteristics of the board of directors and firm-value creation. Academy of Strategic Management Journal, 13(8), 57-73.

- Finkelstein, S. (1992). Power in top management teams: Dimensions, measurement and validation. Academy of Management Journal, 35(3), 505-538.

- Finkelstein, S. & Boyd, B.K. (1998). How much does the CEO matter: The role of managerial discretion in the setting of CEO compensation. Academy of Management Journal, 41(2), 179-199.

- Finkelstein, S. & Hambrick, D.C. (1996). Strategic leadership: Top executives and their effects on organizations. West Publishing: Minneapolis, MN.

- Gibbons, R. & Murphy, K.J. (1992). Optimal incentive contracts in the presence of career concerns: Theory and evidence. Journal of Political Economy, 100(3), 468-505.

- Gilley, K.M., Coombs, J.E., Parayitam, S. & Summers, E.L. (2004). CEO stock options and subsequent stock risk. Presented at the 2004 meeting of the Academy of Management. New Orleans, Louisiana.

- Gomez-Mejia, L. & Wiseman, R.M. (1997). Reframing executive compensation: An assessment and outlook. Journal of Management, 23(3), 291-374.

- Gray, S.R. & Cannella, A.A. (1997). The role of risk in executive compensation. Journal of Management, 23(4), 517-540.

- Hambrick, D.C. (1994). Top management groups: A conceptual integration and reconsideration of the "team" label. Research in Organizational Behavior, 16, 171-224.

- Hambrick, D.C. (2007). Upper echelons theory: An update. Academy of Management Review, 32(2), 334-343.

- Hambrick, D.C. & Finkelstein, S. (1995). The effects of ownership structure on conditions at the top: The case of CEO pay rises. Strategic Management Journal, 16(3), 175-193.

- Hambrick, D.C. & Mason, P.A. (1984). Upper echelons: The organization as a reflection of its top managers. Academy of Management Review, 9(2), 193-207.

- Hambrick, D.C. & Schecter, S.M. (1983). Turnaround strategies for mature industrial-product business units. Academy of Management Journal, 26(2), 231-248.

- Hambrick D.C. (1995). Fragmentation and the other problems CEOs have with their top management teams. California Management Review, 37(3), 110-117.

- Harvey, K.D. & Shrieves, R.E. (2001). Executive compensation structure and corporate governance choices. The Journal of Financial Research, 24(4), 495-512.

- Henderson, A.D., Miller, D. & Hambrick, D.C. (2006). How quickly do CEOs become obsolete? Industry dynamism, CEO tenure and company performance. Strategic Management Journal, 27(5), 447-460.

- Heneman, H.G. & Judge, T.A. (2000). Compensation attitudes. In S.L. Rynes & B. Gerhart (Eds.), Compensation in Organizations: Current Research and Practice (pp. 61-103). San Francisco: Jossey-Bass.

- Herri, J.A., Johan, A.P., Handika, R.F & Yulihasric (2017). CEOs characteristics and the successful of turnaround strategy: Evidence from Indonesia. Academy of Strategic Management Journal, 16(1), 69-80.

- Hoskisson, R.E., Hitt, M.A. & Hill, C.W.L. (1993). Managerial incentives and investment in R&D in large multiproduct firms. Organization Science, 4(2), 325-341.

- Hou, W., Priem, R.L. & Goranova, M. (2014). Does one size fit all? Investigating pay-future performance relationships over the "Seasons" of CEO tenure. Journal of Management, 43(3), 864-891.

- Jensen, M.C. & Murphy, K.J. (1990). Performances pay and top management incentives. Journal of Political Economy, 98(2), 225-264.

- Jensen, M.C. & Meckling, H.W. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3(4), 305-360.

- Karami, A., Analoui, F. & Kakabadse, N.K. (2006). The CEOs’ characteristics and their strategy development in the UK SME sector. Journal of Management Development, 25(4), 316-324.

- Laufs, K., Bembom, M. & Schwens, C. (2016). CEO characteristics and SME foreign market entry mode choice: The moderating effect of firm's geographic experience and host-country political risk. International Marketing Review, 33(2), 246-275.

- Lawrence, B.S. (1997). The black box of organizational demography. Organization Science, 8(1), 1-22.

- Lewellen, W., Loderer, C. & Martin, K. (1987). Executive compensation and executive incentive problems: An empirical analysis. Journal of Accounting and Economics, 9(3), 287-310.

- Makri, M., Lane, P.J. & Gomez-Mejia, L.R. (2006). CEO incentives, innovation and performance in technology-intensive firms: A reconciliation of outcome and behavior-based incentive schemes. Strategic Management Journal, 27(11), 1057-1080.

- Meeks, M.D. (2015). Strategic management and the disparate duties of the CEO. Academy of Strategic Management Journal, 14(2), 93-116.

- Miller, K.D. (1991). Stale in the saddle: CEO tenure and the match between organization and environment. Management Science, 37(1), 34-52.

- Miller, K.D. & Shamsie, J. (2001). Learning across the life cycle: Experimentation and performance among the Hollywood studio heads. Strategic Management Journal, 22(8), 725-745.

- Miller, K.D & Bromiley, P. (1990). Strategic risk and corporate performance: An analysis of alternative risk measures. Academy of Management Journal, 33(4), 756-779.

- Murphy, K. (1985). Corporate performance and managerial remuneration: An empirical analysis. Journal of Accounting and Economics, 7(1-3), 11-42.

- Nelson, J. (2005). Corporate governance practices, CEO characteristics and firm performance. Journal of Corporate Finance, 11(1-2), 197-228.

- Nguyem, P., Rahman, N. & Zhao, R. (2018). CEO characteristics and firm valuation: A quantile regression analysis. Journal of Management and Governance, 22(1), 133-151.

- O’Reilly, C.A., Caldwell, D.F. & Barnett, W.P. (1989). Work group, demography, social integration and turnover. Administrative Science Quarterly, 34(1), 21-37.

- Pass, C. (2003). Long-term incentive schemes, executive remuneration and corporate performance: An empirical study. Corporate Governance, 3, 18-27.

- Pearce, J.A. & Zahra, S.A. (1992). Board compensation from a strategic contingency perspective. Journal of Management Studies, 29(4), 411-438.

- Pfeffer, J. (1983). Organizational demography. In L.L. Cummings & B.M. Staw (Eds.), Research in Organizational Behavior (pp. 299-357). Greenwich CT: JAI press.

- Prasad, B. & Junni, P. (2017). A contingency model of CEO characteristics and firm innovativeness: The moderating role of organizational size. Management Decision, 55(1), 156-177.

- Rhodes, S.R. (1983). Age-related differences in work attitudes and behavior: A review and conceptual analysis. Psychological Bulletin, 93(2), 328-367.

- Saeed, A. & Ziaulhaq, H.M. (2018). The impact of CEO characteristics on the internationalization of SMEs: Evidence from the UK. Canadian Journal of Administrative Sciences.

- Sanders, W.G. (2001). Behavioral responses of CEOs to stock ownership and stock option pay. Academy of Management Journal, 44(3), 477-492.

- Sanders, W.M.G. & Hambrick, D.C. (2007). Swinging for the fences: The effects of CEO stock options on company risk taking and performance. Academy of Management Journal, 50(5), 1055-1078.

- Simons, T., Pelled, L.H. & Smith, K.A. (1999). Making use of difference: Diversity, debate and decision comprehensiveness in top management teams. Academy of Management Journal, 42(6), 662-673.

- Simsek, Z. (2007). CEO tenure and organizational performance: An intervening model. Strategic Management Journal, 28(6), 653-662.

- Smith, K.G., Smith, K.A., Olian, J.D., Sims, H.P., O’Bannon, D.P. & Scully, J.A. (1994). Top management team demography and process: The role of social integration and communication. Administrative Science Quarterly, 39(3), 412-438.

- Stroh, L.K., Brett, J.M., Bauman, J.P. & Reilly, A.H. (1996). Agency theory and variable compensation strategies. Academy of Management Journal, 39(3), 751-767.

- Taussig, F.W. & Braker, W.S. (1925). American corporations and their executives: A statistical inquiry. Quarterly Journal of Economics, 40(1), 1-51.

- Tosi, H.L., Werner, S., Katz, J.P. & Gomez-Mejia, L.R. (2000). How much does performance matter? A meta-analysis of CEO pays studies. Journal of Management, 26(2), 301-339.

- Tsui, A.S., Ashford, S.J., Clair, L.S. & Xin, K.R. (1995). Dealing with discrepant expectations: Response strategies and managerial effectiveness. Academy of Management Journal, 38, 1515-1543.

- Tushman, M. & Romanelli, E. (1985). Organizational evolution: A metamorphosis model of convergence and reorientation. In L.L. Cummings & B.M. Staw (Eds.), Research in Organizational Behavior (pp. 171-222). Greenwich, CT: JAI Press.

- Tushman, M.L., Virany, B. & Romanelli, E. (1989). Effects of CEO and executive team succession on subsequent organization performance. Paper presented at the Academy of Management Meeting, Washington, DC.

- Wang, H.C. & Barney, J.B. (2006). Employee incentives to make firm-specific investments: Implications for resource-based theories of corporate diversification. Academy of Management Review, 31(2), 466-476.

- Wei, J., Ouyang, Z. & Chen, H. (2018). CEO characteristics and corporate philanthropic giving in an emerging market: The case of China. Journal of Business Research, 87, 1-11.

- Wei, L.Q. & Ling, Y. (2015). CEO characteristics and corporate entrepreneurship in transition economies: Evidence from China. Journal of Business Research, 68(6), 1157-1165.

- Westphal, J.D. & Zajac, E.J. (1995). Who shall govern? CEO/board power, demographic similarity and new director selection. Administrative Science Quarterly, 40(1), 60-83.

- Wiseman, R.M. & Gomez-Mejia, L.R. (1998). A behavioral agency model of managerial risk taking. Academy of Management Review, 23(1), 133-153.

- Wright, P., Kroll, M., Krug, J.A. & Pettus, M. (2007). Influences of top management team incentives on firm risk taking. Strategic Management Journal, 28(1), 81-89.

- Zajac, E.J. & Westphal, J.D. (1996). Who shall succeed? How CEO/board preferences and power affect the choice of new CEOs. Academy of Management Journal, 39(1), 27.