Research Article: 2022 Vol: 21 Issue: 1

Characteristics of Impact Variables of Working Capital Management (WCM) Performance in Listed Firms in Amman Stock Exchange 2002-2020

Hamza ALOdat, AL Hussein Bin Talal University

Mohammad Aalaya, AL Hussein Bin Talal University

Ahmad AlKhateeb, AL Hussein Bin Talal University

Citation Information: ALOdat, H., Aalaya, M., & AlKhateeb, A. (2022). Characteristics of impact variables of working capital management (WCM) performance in listed firms in amman stock exchange 2002-2020. Academy of Strategic Management Journal, 21(S1), 1-11.

Abstract

This paper aims to investigate the relationship between Dependent variable as profitability (working capital management) for a sample of 306 Jordanian listed firms listed in Amman stock exchange over the period -2020, so the paper research the working capital financial performance relationship with independent variables, (Tobin's Q ratio) 2 annual sales growth, Tangible fixed assets, current ratio, cash flow, cash cycle, conversation, Used a quantitative approach using different penal data technique (OLS, fixed effect, random effect (General least square and Generalized moment method to detect the efficiency of working capital management, that which variables have a significant influence on profitability (return on equity). The research providing empirical evidence to examine the influence for Jordanian (306) firms listed in ASE particularly foe three sectors, correlation matrix were identified the association between WCM, 6 models were utilized to have the evidence of impact on ROA, negatively influenced as CCC and 1V( number of days inventory, some variables has negative influence (ASG, CC C, and C.F) of financial performance, where (TFA and AG has a positive impact of TFA with RoA, while some influence between RoA and control variables. The findings of this study suggest that policymakers and financial managers of these firms should adopt aggressive working capital management to create shareholders worth enhancing the three sectors' financial performance.

Keywords

Working Capital Management, ASE (Amman Stock Exchange), Econometrics Models, Pooled OLS, Performance.

Introduction

This study as the previous studies aims to study the working capital management and it is effect on listed companies in Amman Stock Exchange as empirical evidence of WCM in addition to that study the control system and working capital management of these financial and industrial companies, when the financial and industrial performance is an important aspect of these organizations, hence, to measure the risk management, organization policies, and their achievement in their operations. Also, it is important to evaluate the success of the organization, where the need for examination of the financial performance and help the administrator to improve and measure their activities. (Abuzayed,2012) Working Capital Management (WCM), is considered to be a crucial element in determining the financial performance of these organizations and their policies evaluation (Odyek, 2017). Dong & Su (2010) who argued that financial performance reflects the financial position of the company; they have analyzed the relationship between capital management components and profitability through the WCM, they have used the penal data analysis during the period (2000-2012), a negative relationship between cash flow cycle and profitability. We considered that the ability of firms to fund the difference between a shared term of financial assets (both the assets and liabilities). WCM is deemed as an index of the debtor's ability to meet this obligation, the main challenge within management performance and accounting and control research is now to study the complicated systems from holistic perspectives. As the consequences of this subject, the model under specification can serve consequences, such as spurious results and wrong empirical interpretations. Many studies' perspective typically looks at working capital components such as inventory, accounts payable. (Moussa, 2019), the package approach can only indicate patterns of the interrelationship between variables in the study and decided that it is not possible to say whether there are significant statistically independent variables in this information data packages (Otley, 2016) studied the effectiveness of WCMPs to check the contribution to financial performance. However, most of the empirical studies that are related to WCM literature are based on Cartesian theory, trying to establish the direct and indirect effects between the dependent variable and independent variables. The importance of WCM that is resulted from the optimal route for business, and it acts as butter of liquidity, (Dul, 2016). Also holder larger inventories are allowing for trade credit to customer's lenders of the firm's profitability Tsuruta (2018) and Staniewski & Awruk (2019), they say that the firms should be taking into account the entrepreneurial success can refer to the more important fact of continuing to run business.

The study conducted as 5 sections,in section 1 include introduction,study problem, objectives,and hypothesis of the study.while section 2 contain the litreture review.third section included the data and methodology,mpdels of study,and the conceptual framework, where section 4 included the empirical results of analysis ,and section 5 contain the conclusionand recommandations.

Problem Statement

WCM provides critical insight into the state of the company they are money shareholders who are lender or investors will examine on the balance sheet of these organization this is consociate the investors’ expectations such as companies have for well-performed their expectations, this may appear in firms’ financial reports of these organization who are listed in Amman stock exchange.

Objectives

This study aims to examine the effect of variables that affected the management performance of the organization; To determine the effect of financial performance, through payable management, and establish the effect of receivable management on the financial performance of those organizations.

Nature of the Study

In this paper we are drawing on post-positivist paradigm demonism .enhance the research has used the quantitative method to allowed deductive testing. The measurements are testing by data analysis of the hypothesized related to the working capital method (WCM). The research is designed to create about this phenomenon which derived from participation (Venkatesh et al., 2013; Faden, 2013).

Hypothesis

The hypothesis of research comes out from the null hypothesis : HN: β=0

H1: HN: β=0.that there is a relationship between Tobin's Q and WCM(represent by ROA)

H2 HN: β=0, That there is a relationship between annual sales growth and WCM

H3 HN: This means there is a relationship between tangible fixed assets and WCM.

H4 HN: β=0, means the HN: β=0, There is a relationship between the current ratio and WCM

H5 HN: β=0, there is a relationship between cash flow and WCM.

H6 HN: β=0, that there is a relationship between cash conversion and WCM

H7 HN: β=0, it means there is a relationship between aggressive financing policy and WCM.

H8 HN: β=0, which means there is a relationship between inventory and WCM.

Literature Review

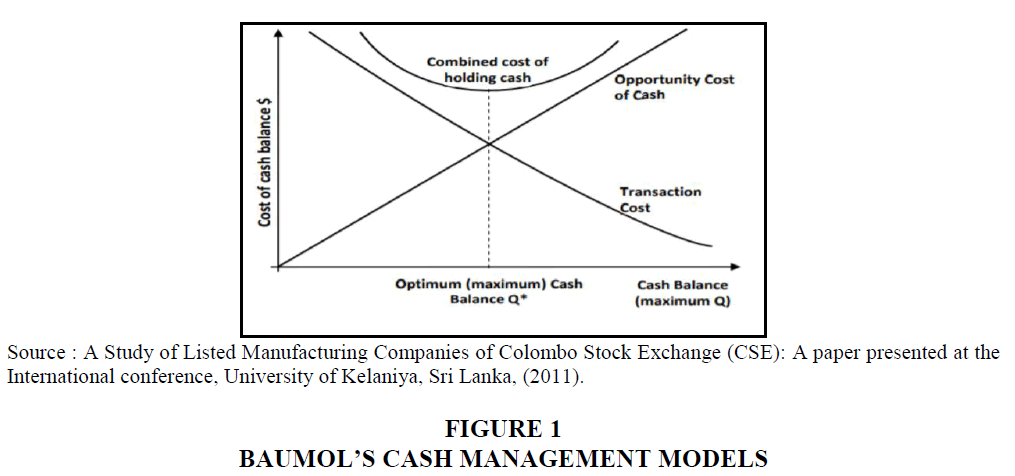

The theoretical framework can help us to interpret the results of the analysis and can provide the context for doing the design conducting of the variables of study in addition to that give precise results and choose the suitable method for data analysis (Turner, 2013). The variables are: CCC shows the relationships among WCM and organization profitability(Baños-Caballero, 2012), the CCC is a dynamic measure of WCM, that can help at the time to convert money of cash flow, it can provide a coherent theoretical explanation of the relationship between research and variables. in this study, we depend on Baumol’s cash management models which are drawn in Figure 1.

Rahman et al., (2021) have used in their paper the financial (DFI), operating DOL and combined leverage as independent variables, while ROA, ROE, and (NPM) as dependent variables.Sample respondent of 5 industrial companies,subjected to 2016-2019 period,results of correlation are not significant for all independent variables,and no significant indecators are detected through analysis as impacted variables with ROA,ROE,NPM.

Data and Definitions of Variables and Methodology

Data & Sources of Data

Data of research consists of daily traded prices of each variable through daily traded prices. The 25 traded days in ASE collected as average then multiplied by 12 months to have the variable yearly traded price, then we have 19 years values of traded prices for each variable, the data observations are ( 306*19): 5418 observations are used in the analysis,

Central bank of Jordan (CBJ) annual reports related to ASE several issues (2002-2020). The central bank of Jordan monthly reports, several issues related to ASE since (2002- 2020).

Association of Jordanian commercial banks reports 2008,2012.2017.2019,2020. Amman Stock Exchange daily prices of traded shares. for the period from 2002 -2020.

Conceptual Frame Work of Study

Measurements of Variables of the Study

The variables of interest in this study appear in the Table 1.

| Table 1 Measurement of Variables Study | ||||

| Variables | Definition | Measurement | Sign | |

| Dependent variables Return on assets |

ROA | Return on total assets of the firm. | Profits before tax and interest/total assets | + |

| (Independent variables) | ||||

| Tobin’s Q | TQ | The ratio between a physical asset's market value and its replacement value. | The market value of the firm/book value of assets | + |

| Annual sales growth rate | Asg | Is a business and investing specific term for the geometric progression ratio. | Percentage changes in sales revenue over the year | + |

| Tangible fixed assets | TFA | Assets, tangible assets or property, plant, and equipment. | Fixed assets of firms as a percentage of total assets | + |

| Current ratio | CR | Current assets / current liabilities | ||

| Cash flow | CF | A measure of the cash generated by a company's regular business operations. | Operating income before depreciation and amortization- interest expense+ income tax / total assets | + |

| Cash conversion cycle | CCC | Measures how long a firm will be deprived of cash. | Total inventories / (cost of sales*365)+ account of receivables / sales *365- accounts payable / purchase *365 | + |

| Aggressive financing policy | AG | The method is to assess strategies based on their degree of aggressiveness. | Total current liabilities /total assets | |

| Inventory | IV | Refers to the goods and materials that a business holds. | Number of days inventories period | |

Models and Methodology

To conduct the OLS regression and FEM to determine the influence of WCM on listed companies through detecting the influence of the three sectors of these listed companies; financial manufacture and service sectors to have individual influence separate for each sector.

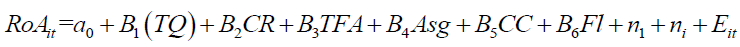

Model 1

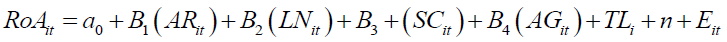

Model 2

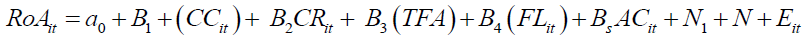

Model 3

While, Model 4+5+6: depends on Model 1 and entered independent varaibles. But Uit

combined from Eit+Vit.

Where:

ROAit: Return on assets of firm I in year t as dependent variables

a0: Intercept lo efficient (CR, FL, TFA, ASg, CC, FL) variables,

I.v: number of days inventory .

Asg: annual sales growth of the firm in year t.

COR: the current ratio of limit at year t, CCC: cash cycle of the firm I in the year it.

CF: cash flow of firm I in year t.

TFA: Tangible fixed asset of the firm I in year t.

TQ: ratio of total assets ( Tobin's Q).

AGit: current liabilities to total assets.

Ni: time dummy.

TLi: unobservable heterogeneity which measuring the particular characteristic of each firm.

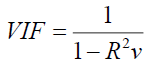

Multicollinearity Problem

The multicollinearity problem should be detected to insure of free model of this problem that appears between two variables more independent variable in a multiple regression model highly correlated. The problem does not reduce the predictive power of the reliability of the estimated model. Glaiber (1967) indicate to the problem when can be measured qs

Heteroscedasticity Problem

In the detection of this problem, we use Whit's test to determine the presence of heteroscedasticity problems.it occurs when the variance of error terms differ across observations to correct and solve this problem, we should use robust standard errors.

Correct Outliers’ Problem

The outliers refer to an observation that is numerically distant from the rest of the data in regression analysis outliers can changes results and p-values of regression lines and coefficients. also, it can mislead the results as a consequence of detecting and corrected the violate the normality assumption. Values of cook's-D that are higher than 4/N

Empirical Results

The data is classified into three categories, commercial banks and financial institutions (56 firms), industrial firms from different categories of industry 150 industrial firms, and service sector firms 100 firms.

Analysis for Each Sector

The Table 2 provides sample characteristics based on a sample of listed organizations and firms that are listed on ASE, over the period 2002-2020.

| Table 2 Descriptive Statics for All Data of All Sectors | |||

| Variables | Mean | ST/error | Sd/dev |

| ROA rate, ROA, | 5.825 | 3.7692 | 8.7976 |

| TQ | 5.3381 | 1.0441 | 1.0093 |

| CR | 5.086 | 1.3765 | 2.087 |

| TFA% | 5.726 | 8.933 | 10.762 |

| ASG% | 5.313 | 24.628 | 21.963 |

| CC | 5.209 | 2.167 | 3.018 |

| FL | 5.816 | 10.967 | 11.523 |

| AG | 6.003 | 11.029 | 13.452 |

Analysis of Financial Sector Data

The financial sector in ASE includes commercial banks (conventional, Islamic banks and foreign banks in Jordan and some financial institutions), it occuped nearly 30% of transaction of dealers. Regarding the FEM regression (1) indicates a negative significant impact on firm ROA, we suggest to decrease in inventory period may help buffer the company profitability as to speed the stock consumption and improve their sales process. And minimize the financial assets of the company can increase the profitability regression (2) and (3) indicate negative significance statically. Asg and C.F and AG where TF Ait is positive significant impact. The negative sign of impact can be discussed similar to inventory and the cash flow receivables.

Table 3 indicated to three regression analyses from FEM show a significant negative influence of cash flow ( account receivable period on company returns on assets) this means that when customers' hands are tied, firms can have more cash-free on their accounts.

| Table 3 WCM Influence on Listed Financial and Commercial Banks Listed in ASE | ||||||

| Independent variables | Fixed model 1 | Fixed model 2 | Fixed model 3 | Pooled model OLS 4 | Pooled model OLS 5 | Pooled model OLS 6 |

| IV | 0.006 | 0.0008 | ||||

| ASg | -00.9* | -0.007 | ||||

| CCC | -0.017 | 0.192*** | ||||

| TFA | 0.306* | 0.019* | 0.023 | 0.234* | 0.276* | 0.195* |

| AGit | -0.427* | -.476* | 0.191* | 0.173** | 0.112* | |

| C.F | -0.053* | -0.078** | -0.064* | -0.185* | -0.109** | -0.173* |

| R2 | 0.832 | |||||

Source: Authors calculation, based on the financial statement of ASE data, results of E-Views.

Service Sector Data Analysis

Through the results of Table 4 the firm can innovate their processes of producing and selling a good or providing services and gain the benefit of economic seal, this is important enhances firms operating profitability where it suggests that companies should not learn too much on short-term financing different (5) OLS, FEM, regression as table result shows a negative effect of account payable period a firm’s profitability. as results of the table also consistently indicates firms' ROA can increase with firm size and decrease with aggressive financing. Results indicate non-significant CCC, but in models 4,5, and 6 is significant at a 10% level. but we can interpret through the chain of negative effects of ASg and lV with it is the positive effect on company profitability. Also, results from FEM regression show a positive effect of TFA, AG financial firm shall reach a higher level of return on assets (ROA)as growth increases and access the bargaining power of benefits. Where C.F is significant level 5%, this means that C.F has a negative sign and impacts the profitability and companies earn more operating profitability thanks to fastening sales process and having more cash to invest elsewhere.

| Table 4 Influence of WCM on Service Sector Listed Firms | ||||||

| Independent variables | Pooled model OLS 1 | Pooled model OLS 2 | Pooled model OLS 3 | Fixed model 4 | Fixed model 5 | Fixed model 6 |

| IV | -0.008* | -0.0001* | ||||

| ASg | -0.001* | -0.006** | ||||

| CCC | -0.008* | -0.006** | ||||

| AGit | -0.093 | -0.025 | -0.053 | 0.016* | 9.018* | 0.015* |

| TF | 0.075* | 0.62** | 0.068** | 0.073* | 0.018* | 0.015* |

| AG | -0.073** | -0.025** | -0.036* | 0.015* | 0.018* | 0.025* |

| TF | -.043* | -0.021* | -0.056** | 0.073** | 0.061* | 0.019** |

| CF | -0.067* | -0.84** | -0.43* | -0.27* | -0.017* | -0.032* |

| CR | -0.075* | -0.034* | -0.068 | |||

| TQ | -0.0045 | -0.0028* | -0.0031 | |||

Source: Authors calculation, based on the financial statement of ASE data, results of E-Views.

Industrial Sector

Influence of working capital management of industrial sector (manufacture firms) that listed in the ASE 2002-2020.

Regarding Table 5 and FEM regression, model (1)indicates a significant impact of lv on a firm ROA, this can imply a decrease in inventory period may help buffer the company’s profitability and encourage these firms to consume their inventory by baying and sailing .also Asg CCC, AG, C.F, T.Q, variables have to respect a negative relation with a firm ROA that could explained that manufacture firm can bring back their operating profit by the decreasing the level of these variables and can operating profit over non-financial assets of the firms. Regression model (2) and (3) indicates to three negative variables sign that impact of AG, C.F, and T.Q the rationale of this impacts can be explained that companies earned more operating their profitability, through having more cash to invest again in operating activities. Besides, the result of FEM, regression of (5) and (6) model depicts results obtained this result indicates significant negative effects of the inventory, C.F, T.Q, CC, Asg and C.R variables, this can be interpreted as firm’s earner more operating profitability, with more care to fastening sales process and having more free cash.

| Table 5 WCM Influence of Industrial Sector that Listed in ASE(2002 -2020) | ||||||

| Independent variables | Pooled model OLS 1 | Pooled model OLS 2 | Pooled model OLS 3 | Fixed model 4 | Fixed model 5 | Fixed model 6 |

| IV | -0.002* | .032* | ||||

| ASg | -0.002* | -0.008** | ||||

| CCC | -0.003* | -0.0016** | ||||

| AGit | -0.0081* | -0.025 | -0.0062** | 0.021* | 0.019** | 0.020* |

| TF | 0.067* | 0.058** | 0.061** | 0.073* | 0.064* | 0.047* |

| AG | -0.043** | -0.039** | -0.096* | 0.042* | 0.056* | 0.078* |

| CF | -0.0421 | -0.039** | -0.062* | -0.027* | -0.048* | -0.026* |

| CR | -0.053* | -0.061* | -0.072 | |||

| TQ | -0.0027 | -0.0091* | -0.0048* | |||

Source: Authors calculation., based on the financial statement of ASE data, results of E-Views.

Several estimation techniques were used, pooled OLS, fixed effects (FEM) model, Random effect model 1 (REM), generalized moment method(GMM), and generalized least squares (GLS) as main for rigorous testing robustness method (Table 6). The panel data estimating on two models (FEM) and (REM), to consider the most appropriate technique between then Hausman test was employed, in general in this paper Hausmann test was employed, in general in this paper Hausmann test indicates that fixed effect is more employed, in general, this more efficient according to the ratio of chi-square (19.78) with p-value (0.008). The result of the analysis indicates that there is a positive association between CCC, T.Q, and TFA and RoA, this means that there were high states and cash conversations and the variation in the inventory turnover can impact significantly profitability. Table 7 testing the different models' results.

| Table 6 Regression Results for Pooled Sample Data (Financial, Services M and) | |||||

| Independent Variables |

Pooled effect |

Fixed Effect |

Random effect |

GMM | GLS |

| LV | 0.561*** | 0.157*** | 0.581** | -0.381* | 0.571* |

| Asg | -0.12 | -0.102 | -0.12 | -0.0036 | -0.007 |

| CAR | -0.0067* -0.0003 |

0.0039 -0.00071 |

-0.0076 -0.0052 |

-0.0052 0.0001 |

0.0014 -0.02 |

| CCC | 0.0187** -0.0062 |

0.013 -0.0057 |

0.0147*** -0.00513 |

0.016 0.0012 |

0.021** -0.006 |

| C.F | -0.0023** -0.00079 |

-0.0019** -0.00023 |

-0.006* -0.004 |

0.103*** -0.0026 |

|

| T.Q | 0.0168** -0.009 |

0.0185** -0.017 |

0.0264** -0.0019 |

-0.0289 0.0026 |

|

| AG | -0.0073* -0.0016 |

-0.00215* -0.0018 |

-0.00672 -0.0003 |

0.0054 -0.0009 |

|

| TFA | 0.168*** -0.06 |

0.234*** -0.001 |

0.321*** -0.006 |

0.0867** -0.0019 |

|

| Asg | -0.438* -0.0017 |

-0.376 -0.027 |

-0.316** -0.025 |

-0.166 -0.008 |

|

Sources: Authors calculation, based on the financial statement of ASE data, results of E-Views.

| Table 7 Diagnostic Check- Roa | |||||

| Pooled | Fixed Effect | Random Effect | GMM | GIS | |

| Wald-test chi2 prob-chi2 |

22.26 0.000 |

7.83 0.0031 |

57.9 0.000 |

28.92 0.002 |

214.25 0.005 |

| Hausman chi2 Prob-chi2 |

18.79 0.0012 |

18.79 0.0012 |

|||

| rho | 0.7953 | 0.000 | |||

| Prob>2 Surgan test | 0.5348 | ||||

The R2 squared shows that 79% of the variation of ROA was driven by the independent variables (regressors) and 43% in the fixed-effect model, wherein overall of pooled result 68%.Where F-statistic 22-26 with prob-value (0.00) this means that pooled method is suitable to depend on its results, but also the fixed-effect model (7.83) with p-value 0.0031 and the random effect model is 57.9 with p-value 0.000 and rho indicates that there are no several correlations in FEM and REM. Finally, the result of the analysis hypothesis is stated in Table 8, which indicates that all variables are impacted and influences the WCM.

| Table 8 Hypothesis Results of Study Through the 6 Models.Dependent: ROA RE | ||||

| Hypothesis | Symbol | Industrial | Financial | Services |

| H1 | TQ | Accept** | Reject | Reject |

| H2 | ASg | Reject | Reject | Reject |

| H3 | TFA | Accept** | Reject | Reject |

| H4 | CR | Reject | Reject | Reject |

| H5 | CF | Reject | Reject | Reject |

| H6 | CCC | Reject | Reject | Reject |

| H7 | AG | Reject | Reject | Reject |

| H8 | IV | Reject | Reject | Reject |

Source: Authors

Conclusions

In this paper, we are addressing the objective of the study to check and detect the influence of control variables and the dependent variable ( return on assets) as a measure for profitability, concerning the main hypothesis of the study, 6 models are utilized to analyze the data of 306firms divided into three sectors financial, manufacture services firms which are listed in Amman stock exchange (ASE) we argued that are finding can agree and support the aggressive working capital management of these firms theory. The influence of variables with the relationship of ROA aggressive working capital strategy has a low investment in working capital is related to a higher return and risk. The influence of the control variable (independent) explains the conservative strategy that deals with working capital management. (Kabuye, 2019). The result of the analysis gives evidence that cash flow conservation and the number of days inventory one negative significant statistically, also the other independent AG, ASg, C.F accompanied with the theory of capital structure, these variables are an important determinant of firm profitability. The most implication and limitation of the study becomes from the endogeneity perspective. Further researches should be extended the study to include more effective control variables controlling for more microeconomic and macroeconomic variables and endogeneity to become more valuable and to have a contribution for the impact of variable and to have a contribution for the impact of variables on ROA. Also, they should include the government legislation on control and organized the ASE and the government-corporate and others such as the compensation incentives in mediating the relationship between these control variables and WCM profitability

References

Dong, H.P., & Su, J.T. (2010). The relationship between working capital management and profitability: A Vietnam case. International Research Journal of Finance and Economics, 49(1), 59-67.

Faden, C. (2013). Optimizing firm performance: Alignment of operational success drivers on the basis of empirical data. Springer Science & Business Media.

Odyek, J. (2017). The main and last branches of nakumatt shut down.

Rahman, A.A.A., Meero, A., Zayed, N.M., Islam, K.M.A., Rabban, M.R., & Bunagan, V.D.R. (2021). Impact of Leverage Ratios on Indicators of Financial Performance: Evidence from Bahrain. Academy of Strategic Management Journal, 20(3), 1-12.

Venkatesh, V., Brown, S.A., & Bala, H. (2013). Bridging the qualitative-quantitative divide: Guidelines for conducting mixed methods research in information systems. MIS Quarterly, 21-54.