Research Article: 2021 Vol: 24 Issue: 1S

Company Profitability is Influenced by Sales and Administration & General Costs: Evidence from Indonesia

Rusdiyanto, Universitas Airlangga

Widi Hidayat, Universitas Airlangga

Chabib Bahari, Universitas Gresik

Susetyorini, STIENU Trate Gresik

Umi Elan, Universitas Wijaya Putra

Mei Indrawati, Universitas Wijaya Putra

Dwi Lesno Panglipursari, Universitas Wijaya Putra

Aminatuzzuhro, Universitas Wijaya Putra

Gazali, Universitas Madura Indonesia

Abstract

This study aims to determine & analyze the Effects of Sales Costs & administration & general costs: Profitability of manufacturing companies listed on the Indonesian Stock Exchange for the period of 2016-2018. The research method used quantitative research methods with multiple linear regression analysis. The population used in this study is the financial statements of the ceramics, porcelain & glass sub-sector manufacturing companies listed on the Indonesian Stock Exchange for the period 2016-2018. This research data is secondary data, data in the form of financial statements of manufacturing companies listed on the Indonesian Stock Exchange from 2016 to 2018. All sources of data were obtained from the Indonesian Stock Exchange website at https://www.idx.co.id.

Keywords

Sales Costs, Administration and General Costs, Profitability

Introduction

The latest issue Indonesian economy of the processing industry contributes the most to the value of national exports. In January-September 2019 the value of manufacturing sector products reached up to USD93.7 billion or accounted for 75.51% of the total national exports which reached USD124.1 billion. The contribution of the manufacturing industry sector is more than 75%, national exports are not fully commodity. The role of the industry is in increasing the added value of competitive products on the global scene. The Central Statistics Agency explained that the cumulative volume of national exports increased by 7.57% from January-September 2018 by 448 million tons to 482.1 million tons in the same period this year. Increased non-oil and gas export volumes by 9.9 percent or 462 million tons as of the third quarter of 2019.

Administration costs are non-production costs incurred for the purposes of the Administration & general costs in the factory. Administration costs include cost of goods sold, taxes related to overall company administration & general operating expenses. While sales costs are costs incurred to finance the sales process starting from products or services ready for sale (Bradley, Jansen & Silverman, 2003; Chullen, Dunford, Angermeier, Boss & Boss, 2010; Li, Chiang, Choi & Man, 2013; McKay, Lemak & Lovett, 2008; Shen, Cochran & Moseley, 2008). Every company requires general administration costs which are costs to coordinate the activities of production & marketing of products. Non-production costs are reported or displayed in the income statement. General administration costs consist of executive salaries & general business costs directly related to the company's general operations. Every company needs a sales fee. Where the sales cost is used to promote the products sold to be known by the public. Sales costs are costs incurred since the finished product is sent to the buyer until the product is received by the buyer (Altendorfer, 2017; Budhiraja & Pradhan, 2017; Farhat et al., 2019; Kim & Chung, 2017; Zhu et al., 2018). Sales costs incurred are required effectively and efficiently in developing strategies such as spending promotion costs, transportation costs in order to obtain large profits in accordance with the targets set by the company. This research provides a number of contributions. The results of the study identify the important issues at present in Indonesian, where sales and administration and general costs have a positive influence on the profitability of companies in Indonesian that focus their attention on the company's operations. Our findings indicate that sales costs & administration & general costs have an influence on the profitability of companies in Indonesian. As such, this research broadens our knowledge of corporate governance practices in Indonesian.

The remainder of the study is organized as follows. The next section outlines relevant research & develops hypotheses. Section 3 details the sample, variables, & empirical model. Section 4 provides analysis & empirical results. Section 5 outlines the conclusions & implications of the study.

Literature Review and Development of Hypotheses

Cost of Sales

Cost is the sacrifice of an economic resource that is measured in units of money that have occurred, are incurred which are likely to occur for a particular purpose. Whereas expenses are a decrease in economic benefits during one accounting period in the form of cash flow or reduced assets or a decrease in equity that does not involve distribution to investment. Costs are reductions in net assets as a result of the use of economic services to create income (Bradley, Jansen & Silverman, 2003; Chullen, Dunford, Angermeier, Boss & Boss2010; Li, Chiang, Choi & Man, 2013; McKay, Lemak & Lovett, 2008; Shen, Cochran & Moseley, 2008). Cost is the sacrifice of resources or the equivalent value of cash that is sacrificed to obtain goods or services that are expected to provide benefits now or in the future”.

Sales are the main income from trading companies, service companies, and industrial companies in the form of proceeds from the sale of goods or services to buyers, customers, tenants and other service users. Sales is the total amount charged to customers for merchandise sold by the company, including cash sales & credit sales (Alalwan, 2020; Shi et al., 2020; Y?ld?r?m, 2020; Yu et al., 2020).. Selling costs include all costs associated with finding & fulfilling customer orders. Accordingly, sales costs include advertising costs, market research costs, salesman salaries, depreciation of cars and office equipment used by the sales department, and the cost of storing & shipping finished goods. Sales costs are all costs incurred in connection with the activities of selling & marketing goods such as promotional activities, sales & transportation of goods sold”. Sales costs are part of marketing costs. Marketing costs are costs incurred to carry out product marketing activities, for example advertising costs, promotion costs, sample costs (Altendorfer, 2017; Budhiraja & Pradhan, 2017; Farhat et al., 2019; Kim & Chung, 2017; Zhu et al., 2018). Marketing costs in the strict sense are limited as sales costs, i.e., costs incurred to sell products to the market. While marketing costs in the broadest sense include all costs incurred since the time the product is finished being produced and stored in a warehouse until the product is converted back in cash.

Based on the above understanding, it can be concluded that sales are a source of corporate profit from goods sold either by cash or credit sales within a certain period of time. One of the company's goals in carrying out activities is achieving the desired level of sales volume by the company in the form of goods or services. Sales Fees are all costs associated with fulfilling customer orders.

Administration and General Costs

Administration & general costs are all costs associated with the general administration function. Furthermore, Administration & General Costs are the costs for coordinating the production & marketing activities of the product, for example the cost of checking an accountant & photocopy costs. Classification of administration & general costs is the costs incurred to coordinate the production & marketing activities of the product while Administration & general costs are the costs for coordinating the production & marketing activities of the product. Examples of salary costs for employees in finance, accounting, personnel, & public relations for accounting fees, photocopy fees (Bradley, Jansen & Silverman, 2003; Chullen, Dunford, Angermeier, Boss & Boss, 2010; Li, Chiang, Choi & Man, 2013; McKay, Lemak & Lovett, 2008; Shen, Cochran & Moseley, 2008). Administration cost and general is the costs incurred in order to direct, run and control the company to produce finished goods.

Profitability

The importance of profitability for the company by stating that the company's business operations can be said to be successful if from time to time it can collect sufficient profits. There are various forms of profitability calculation that are based on the point of view of companies calculating the level of profitability ratios (Ballotta et al., 2020; Kratky & Zamazal, 2020; Martín-Herrán & Sigué, 2020; Ni et al., 2020; Schreinemachers et al., 2020) is a comparison of the number of sales results obtained during the period certain with profit after tax Return on investment is the ability of companies to produce profits that will be used to cover the investment incurred, return on equity which is often called the profitability of own capital, intended to measure the ability of companies to generate profits based on capital certain, earnings per share is a measure of a company's ability to generate profits per shareholder. Profitability is the relationship between revenues and costs generated by using company assets, both current and permanent in production activities (Gazali, Kusuma, Aina, Bustaram, Amar et al., 2020; Juanamasta et al., 2019a; Rusdiyanto et al., 2019; Rusdiyanto, Agustia, Soetedjo & Septiarini, 2020; Rusdiyanto, Agustia, Soetedjo, Narsa et al., 2020; Rusdiyanto, Hidayat, Soetedjo et al., 2020; Rusdiyanto, Hidayat, Tjaraka et al., 2020; Rusdiyanto & Narsa, 2019a, 2020)

Effect of Sales Costs on Profitability

Selling costs include all costs associated with fulfilling customer orders. Accordingly, sales costs include advertising costs, market research costs, salesman salaries, depreciation of cars and office equipment used by the sales department, and the cost of storing and shipping finished goods. Cost of sales of all costs incurred in connection with the activities of selling and marketing goods such as promotional activities, sales and transportation of goods sold. Sales costs are part of marketing costs. Based on research conducted by (Altendorfer, 2017; Budhiraja & Pradhan, 2017; Farhat et al., 2019; Kim & Chung, 2017; Zhu et al., 2018) explained that sales costs have a significant effect on profitability. Based on the arguments above, the hypotheses tested are as follows:

H1: Sales costs affect the profitability of manufacturing companies in Indonesian Stock Exchange in the basic industrial and chemical sectors of the sub-sectors of ceramics, porcelain and glass.

Effect of Administration & General Costs on Profitability

Administration and General costs are all costs associated with the general administration function, costs for coordinating the production and marketing activities of the product, for example accountant audit fees and photocopy costs. Classification of administration and general costs is costs incurred to coordinate the production and marketing activities of the product. Administration and general costs are costs for coordinating the production and marketing activities of the product. Examples of salary costs for employees in the financial are accounting, personnel, and public relations departments of accountant fees, photocopy fees. Administration and general costs are incurred in the context of directing, running, and controlling companies to produce finished goods.

Based on the results of research that have been done (Chullen, Dunford, Angermeier, Boss & Boss, 2010; Li, Chiang, Choi & Man, 2013) which explained the administration & general costs significantly influence profitability. Based on the arguments above, the hypotheses tested are as follows:

H2: Administration cost and general affect the profitability of the manufacturing companies of the Indonesian stock exchange of the basic industrial sector and chemical of the sub sector of ceramics, porcelain and glass.

H3: Sales and Administration & General Costs affect Profitability in the manufacturing companies of Indonesian stock exchange of the basic industrial sector and chemical sub-sectors of ceramics, porcelain and glass.

Research Method

Type of Research Approach

The research approach used in this study is a quantitative approach that emphasizes examiner & deals with numbers. Quantitative research is a research approach that is required to use numbers (Gazali, Kusuma, Aina, Bustaram, Risal et al., 2020; Rusdiyanto, Sawarjuwono & Tjaraka, 2020; Juanamasta et al., 2019b; Rusdiyanto & Narsa, 2019b; Gazali, Kusuma, Aina, Bustaram, Amar et al., 2020; Syafii et al., 2020; Lamtiar et al., 2021; Gazali, Kusuma, Aina, Bustaram, Risal et al., 2020; Rusdiyanto, Sawarjuwono & Tjaraka, 2020; Shabbir et al., 2021; Susanto et al., 2021; Luwihono et al., 2021; Rahayu et al., 2020; Utari et al., 2020; Prabowo et al., 2020; Astanto et al., 2020; Rusdiyanto, Mufarokhah, Al’asqolaini et al., 2020; Rusdiyanto, Sawarjuwono & Tjaraka, 2020; HIDAYAT et al., 2020; Rusdiyanto & Narsa, 2020; Ulum et al., 2020; Hidayat et al., 2020; Rusdiyanto et al., 2019), ranging from data collection, interpretation of the data, as well as the appearance of the results to determine the results of the Effects of Sales Costs and Administration and General Costs of Profitability in manufacturing companies in the basic industrial and chemical sectors of the sub-sector of ceramics, porcelain and glass for the period of 2016-2018.

Definition of Variable Operations

The variables used in this study consist of the dependent variable and the independent variable, which explains the relationship between the effects of operational costs on profitability.

Dependent Variable

Dependent variable in this study is profitability which looks at the ability of company to generate corporate profits. The profit of company is to measure overall management effectiveness, the greater the profitability ratio, the better it is to describe the ability to obtain profit of company. Profitability is stated in profit after tax. Profitability ratios used are Net profit margin which is the ratio between net income after tax and sales. The size of the net profit margin shows that how much profit after tax the company obtained for a certain level of sales

Independent Variable

The independent variable is a variable that is thought to influence the dependent variable. The independent variable in this study is consisted of:

Sales Costs

Cost of sales is a planned budget that is more detailed about the company's sales during the period in the future, in describing the type, quantity, selling price, time and marketing area of the product being sold. Sales costs include all costs associated with searching and fulfilling customer orders, including advertising costs, market research costs, salesman salaries, depreciation of cars and office equipment used by the sales department, storage costs and transportation of finished goods (Farhat et al., 2019;; Zhu et al., 2018).

Administration Costs & General

Administration costs & general are very difficult because the marketing and administration functions do not have standardization. General administration activities include salaries for administration staff, writing and writing costs, depreciation or depreciation of office buildings depreciation or depressed office inventory, telephone costs, and salaries of company leaders and staff. But in this study taking from the overall administration costs and general (Chullen, Dunford, Angermeier, Boss & Boss, 2010; Li, Chiang, Choi & Man, 2013).

Sample Population and Sampling Techniques

The population in this study is the report of Sales Costs, Administration & General Costs & the report on the profitability of manufacturing companies in the basic industry sector & chemical sub-sectors of ceramics, porcelain & glass from 2016 to 2018. The samples in this study are financial statements taken from companies manufacturing of basic industrial sectors and chemical of sub-sectors of ceramics, porcelain & glass for the period 2016-2018. The sampling technique in this study uses non probability sampling with special methods that meet the requirements associated with elements of the indicator variables as a whole.

Discussion of Research Results

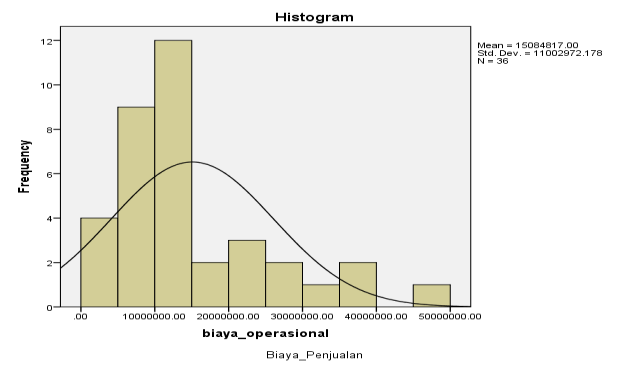

Descriptive Analysis of Sales Costs

The results of the study showed that the average sales volume at manufacturing companies of the basic industrial sector and chemical of the sub-sectors of ceramics, porcelain & glass listed on the Indonesian Stock Exchange in 2016-2018 had a trendline that tended to increase. The company experiences ups & downs so that it can be concluded that the selling costs that increase every year reflect the company's performance. The increased sales costs are caused by the increased production volume produced by the company and the production costs incurred by the company.

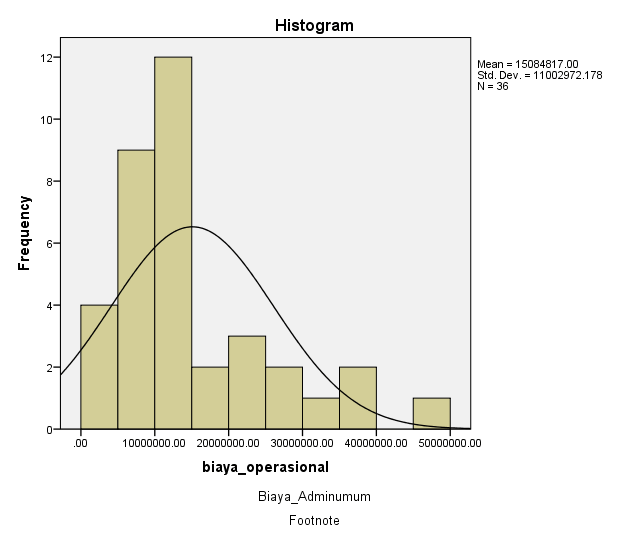

Descriptive Analysis of Administration and General Cost

The results of the study showed that the average promotional costs in manufacturing companies of the basic industrial sector and chemical of the sub-sectors of ceramics, porcelain and glass listed on the Indonesian Stock Exchange in 2016-2018 had a fluctuating trendline. This happens because as long as the company carries out a significant promotion the company is already well-known or has an image to carry out advertisements reminding consumers. The decrease in promotion costs is because the company considers the promotion activities previously carried out to be on target and according to plan.

The results of this study produce that the average net profit in manufacturing companies of the basic industrial sector & chemical sub-sectors of ceramics, porcelain & glass listed on the Indonesian Stock Exchange in (2016-2018) has a trendline that generally increases in the year (2016-2017), but in 2017 & 2018 it has decreased quite dramatically. The company experienced an increase in profitability at the company is healthy & can give a good image to the company. While the decline in profitability that occurs is the excess costs incurred to get the income received. This can occur because in the last two years the demand is declining so that the sales volume has decreased, while the available raw materials are abundant to excess inventory.

Research Result

| Table 1 Result Test Linieritas |

|||||||

|---|---|---|---|---|---|---|---|

| Sum of Squares | df | Mean Square | F | Sig. | |||

| (Combined) | 117.413 | 57 | 37.341 | 4.234 | .004** | ||

| Linearity | 103.846 | 1 | 103.846 | 22.515 | .000** | ||

| NPM* | Between Groups | Deviation | 13.568 | 56 | 19.569 | .588 | .709 |

| BY_Sales | From | ||||||

| Linearity | |||||||

| Within Groups | 115.306 | 2 | 4.612 | ||||

| Total | 232.719 | 59 | |||||

Multiple Linear Regression Analysis

| Table 2 Test Results of Multiple Linear Regression Analysis |

|||||

|---|---|---|---|---|---|

| Coefficientsa | |||||

| Model | Unstandardized Coefficients | Standardized Coefficients | T | Sig. | |

| B | Std. Error | Beta | |||

| (Constant) | 4980.969 | 625.363 | 7.982 | 0.001 | |

| 1 Sales cost | 0.002 | 0.001 | 0.910 | 4.014 | 0.016** |

| Administration & General Cost | -0.005 | 0.002 | 0.785 | -0.3151 | 0.031** |

| a. Dependent Variable: NPM | |||||

Y=4980.969+0.002X?-0.005X?

Hypothesis Test

T-Test (Partial) Analysis of Multiple Linear Regression

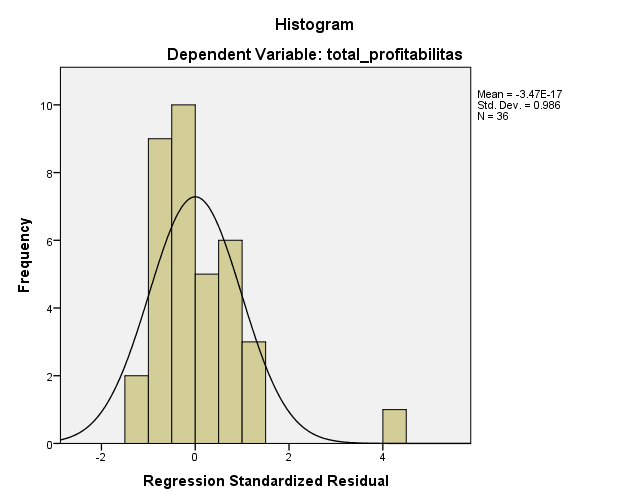

1. Effect of Sales Costs (X1) on Profitability (Y) Based on the table above, that the t-count for Sales Costs is 4,014, on t-tables with dk 4 (n-3=7-3) with a significant level of 0.05 obtained 0.016 because t -calculate <t-table then H0 is rejected and Ha is accepted. Thus the decision taken that the Cost of Sales (X1) partially has a significant effect on profitability (Y). The t-test significance value of 0.016 is smaller than 0.05, so the decision taken with a significant level of Sales Costs (X1) partially influences the Profitability (Y).

2. Effect of Administration and General Costs (X2) on Profitability (Y) Based on the table above, that t-count for Administration and General Costs is -3,151 on t tables with dk 4 (n-3=7-3) and a significant level of 0.05 is obtained 0.031 because t -count> t-table then H0 is rejected and Ha is accepted. Thus the decision taken that Administration and General Costs (X2) partially has a significant effect on profitability (Y). The t-test significance value of 0.031 is smaller than 0.05, so the decision taken with the significance level of Sales Costs (X1) partially has a significant effect on profitability (Y).

| Table 3 CalculationResult of Determinant Coefficient (R Square) |

||||

|---|---|---|---|---|

| Model Summary b | ||||

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate |

| 1 | 0.769a | 0.592 | 0.783 | 6.03552 |

b. Dependent Variable: NPM

The R-Square value is 0.592. R-Square value indicates the coefficient of determination 0.592. That is, Profitability is affected by Sales and Administration & General Costs by 59.2.

| Table 4 Results of F-Test Calculations Effect of X1 and X2 on Y |

|||||

|---|---|---|---|---|---|

| Anova | |||||

| Model | Sum of Squares | Df | Mean Square | F | Sig. |

| Regression | 1402398.078 | 2 | 686199.039 | 9.647 | .020b** |

| 1 Residual | 2076.37 | 57 | 73242.409 | ||

| Total | 1404474.459 | 59 | |||

b. Predictors: (Constant) Administration & General Cost, Sales cost

From the above table 4, it can be seen that the value of F-count is 9,647, while the F-table can be obtained in a F degree table that is free residual 4 and regression 2 with a significant level of 0.05, so an F-table of 0.020 is obtained. F-count> F-table, then H0 is rejected and Ha is accepted. This means that the two variables free of Sales Costs (X1) and Administration & General Costs (X2) simultaneously have a significant effect on profitability (Y). From the ANOVAa table above, it can be seen that the significance value of the f-test is 0.020 smaller than 0.05, so the decision taken with a significant level of Sales Costs (X1) & Administration & General Costs (X?) simultaneously has a significant effect on profitability (Y).

Discussion of Research Results

The specific discussion & grand theory of the effect of sales costs, administration & general costs impact on profitability as described below:

Effect of Sales Costs on Profitability

Based on the results of the analysis, they show that the administration and general costs have a positive influence on profitability in the Indonesian Stock Exchange of the manufacturing company of the ceramic sub-sector. Administration & General Costs get a t-count value of -3.151<2.776 and a significance value of 0.31<0.05, so it can be concluded that Administration & General Costs have a positive effect on profitability. Administration & general costs are costs to coordinate product production & marketing activities, for example employee salary costs in the accounting, personnel & public relations departments, accountant audit fees and photocopy costs. Classifying costs include administration & general costs which are costs incurred to coordinate the production and marketing activities of the product.

So it can be concluded that the higher the administration and general costs will also decrease the level of profitability of the company. Administration & General Costs have an influence on profitability, every company has costs to coordinate the production and marketing activities of its products both goods or services companies, companies must be able to minimize administration and general costs properly in order to maintain the company's survival.

Effect of Sales and Administration and General Costs on Profitability

Based on the results of the analysis, the cost of sales and administration & general costs have a positive effect on profitability in the manufacturing company of the Indonesian Stock Exchange of the sub sector of ceramics. This can be reflected in the results of the F-test which has a significance value of 0.020 <0.05, it can be concluded that the cost of sales, administration & general costs have an influence on profitability. The effect of Sales & Administration & General Costs on Profitability is shown by the calculation results of the R-Square analysis test of 82.9% and the remaining 17.1%, is another variable that also affects the profitability not included in this study including liquidity, solvency, activity, costs operational, operational cash flow, non-operational costs and so forth.

Sales and administration & general costs are costs incurred to carry out product marketing activities, for example advertising costs, promotional costs, & sample cost. Marketing costs in the strict sense are limited as sales costs, i.e., costs incurred to sell products to the market. While marketing costs in a broad sense include all costs incurred since the time the product is finished being produced and stored in a warehouse until the product is converted back into cash. So it can be concluded that the greater the cost of sales and administration and general costs incurred by the company, the lower the profit level of the company.

Conclusion

Partial sales costs have a significant effect on profitability. This means that profitability can be determined by sales costs at manufacturing companies of the basic industrial sector and chemical sub-sectors of ceramics, where Sales costs have a positive effect on profitability, meaning that the higher the cost of sales, the lower the level of profitability. Administration and General Costs partially have a significant effect on profitability. This means that profitability can be determined by Administration and General Costs in manufacturing companies of the basic industrial sector and chemical of sub-sectors of ceramics, Administration and General Costs have a negative correlation to profitability, the higher the administration and general costs, the lower the level of profitability. Sales and Administration and General Costs together have an effect on profitability, meaning that profitability can be determined by Sales and General and Administration Costs in manufacturing companies of the basic industrial sector and chemical sub-sector of ceramics listed.

References

- Altendorfer, K. (2017). Relation between lead time dependent demand and capacity flexibility in a two-stage supply chain with lost sales. International Journal of Production Economics, 194, 13–24.

- Astanto, D., Rusdiyanto, M.F., Khadijah, S.N., Rochman, A.S., & Ilham, R. (2020). Macroeconomic impact on share prices: Evidence from Indonesia. Solid State Technology, 63(6), 646–660.

- Ballotta, L., Fusai, G., Kyriakou, I., Papapostolou, N.C., & Pouliasis, P.K. (2020). Risk management of climate impact for tourism operators: An empirical analysis on ski resorts. Tourism Management, 77.

- Bradley, B., Jansen, P., & Silverman, L. (2003). The Nonprofit Sector’s, 81(5), 94-103+130.

- Budhiraja, S., & Pradhan, B. (2017). Computing optimum design parameters of a progressive type I interval censored life test from a cost model. Applied Stochastic Models in Business and Industry, 33(5), 494–506.

- Chullen, C.L., Dunford, B.B., Angermeier, I., Boss, RW., & Boss, A.D. (2010). Minimizing deviant behavior in healthcare organizations: The effects of supportive leadership and job design. Journal of Healthcare Management, 55(6), 381–397.

- Farhat, M., Akbalik, A., Hadj-Alouane, A.B., & Sauer, N. (2019). Lot sizing problem with batch ordering under periodic buyback contract & lost sales. International Journal of Production Economics, 208, 500–511.

- Gazali, Kusuma, A., Aina, M., Bustaram, I., Amar, S.S., Rusdiyanto, T.H., & Panjilaksana, S.D.D. (2020). The effect of financial performance on stock prices: A case study of Indonesian. Talent Development and Excellence, 12(1), 40074016.

- Gazali, Kusuma, A., Aina, M., Bustaram, I., Risal, Z., Purwanto, R., & Tjaraka, H. (2020). Work ethics of madura communities in salt business : A case study Indonesian. Talent Development and Excellence, 12(1), 3537–3549.

- Hidayat, W., Soetedjo, S., Tjaraka, H., Septiarini, D.F., Herli, M., Ulum, B., Syafii, M., Irawan, H., & Rahayu, D.I. (2020). The effect of macroeconomics on equity prices: an Indonesian case study. Magazine Spaces, 41(17).

- Hidayat, W., Tjaraka, H., Fitrisia, D., Fayanni, Y., Utari, W., Indrawati, M., Susanto, H., Tjahjo, J.D.W., Mufarokhah, N., & Elan, U. (2020). The effect of earning per share, debt to equity ratio and return on assets on stock prices: Case Study Indonesian. Academy of Entrepreneurship Journal, 26(2), 1–10.

- Jang, R. (1988). Medicaid Formularies: A critical review of the literature. Journal of Pharmaceutical Marketing & amp; Management, 2(3), 39–61.

- Juanamasta, I.G., Wati, N.M.N., Hendrawati, E., Wahyuni, W., Pramudianti, M., Wisnujati, N.S., … & Umanailo, M.C.B. (2019a). The role of customer service through Customer Relationship Management (CRM) to increase customer loyalty and good image. International Journal of Scientific and Technology Research, 8(10), 2004–2007.

- Kim, B.S., & Chung, B.D. (2017). Affinely adjustable robust model for multiperiod production planning under uncertainty. IEEE Transactions on Engineering Management, 64(4), 505–514.

- Kratky, L., & Zamazal, P. (2020). Economic feasibility and sensitivity analysis of fish waste processing biorefinery. Journal of Cleaner Production, 243.

- Lamtiar, S., Arnas, Y., Rusdiyanto, A.A., Kalbuana, N., Prasetyo, B., Kurnianto, B., … & Utami, S. (2021). Liquidity effect, profitability leverage to company value: A case study Indonesia. European Journal of Molecular & Clinical Medicine, 7(11), 2800–2822.

- Li, J., Chiang, Y.H., Choi, T.N.Y., & Man, K.F. (2013). Determinants of efficiency of contractors in Hong Kong and China: Panel data model analysis. Journal of Construction Engineering and Management, 139(9), 1211–1223.

- Luwihono, A., Suherman, B., Sembiring, D., Rasyid, S., Kalbuana, N., Saputro, R., … & Asih, P. (2021). Macroeconomic effect on stock price: Evidence from Indonesia. Accounting, 7(5), 1189–1202.

- Martín-Herrán, G., & Sigué, S.P. (2020). Manufacturer defensive & offensive advertising in competing distribution channels. International Transactions in Operational Research, 27(2),

- McKay, N.L., Lemak, C.H., & Lovett, A. (2008). Variations in hospital administrative costs. Journal of Healthcare Management, 53(3), 153–166. 00005

- Ni, D., Li, K.W., & Fang, X. (2020). Two-echelon supply chain operations under dual channels with differentiated productivities. International Transactions in Operational Research, 27(2), 1013–1032.

- Prabowo, B., Rochmatulaili, E., Rusdiyanto, & Sulistyowati, E. (2020). Corporate governance and its impact in company’s stock price: case study [Gobernabilidad corporativa y su impacto en el precio de las acciones de las empresas: Estudio de caso]. Utopia y Praxis Latinoamericana, 25(Extra10), 187–196.

- Rahayu, D.I., Ulum, B., Rusdiyanto, Syafii, M., Pramitasari, D.A., & Tuharea, F.I. (2020). Fundamental impact on share prices: Evidence from indonesia. PalArch’s Journal of Archaeology of Egypt/ Egyptology, 17(6), 9090–9104.

- Rusdiyanto, Agustia, D., Soetedjo, S., Narsa, I.M., & Septiarini, D.F. (2020). Determinants of audit delay in indonesian companies : Empirical Evidence. Espacios, 41(3), 46–55.

- Rusdiyanto, Agustia, D., Soetedjo, S., & Septiarini, D.F. (2020). The effect of cash turnover & receivable turnover on profitability. Opcion, 36(26), 1417–1432.

- Rusdiyanto, H.T., Mufarokhah, N., Al’asqolaini, M.Z., Musthofa, A.J., Aji, S., & Zainab, A.R. (2020). Corporate social responsibility practices in islamic studies in Indonesian. Journal of Talent Development and Excellence, 12(1), 3550–3565.

- Rusdiyanto, Hidayat, W., Soetedjo, S., Tjaraka, H., Septiarini, D.F., Gazali, H.M., Ulum, B., … & Rahayu, D.I. (2020). The effect of macroeconomics on stock prices : Case study Indonesian. Espacios, 14(17), 26.

- Rusdiyanto, Hidayat, W., Tjaraka, H., Septiarini, D.F., Fayanni, Y., Utari, W., … & Imanawati, Z. (2020). The Effect of earnig per share, debt to equity ratio and return on assets on stock prices: Case study Indonesia. Academy of Entrepreneurship Journal, 26(2), 1–10.

- Rusdiyanto, & Narsa, I.M. (2019a). The effects of earnings volatility, net income & comprehensive income on stock prices on banking companies on the Indonesia stock exchange. Internasiotional Review of Manahement and Marketning, 9(6), 18–24.

- Rusdiyanto, & Narsa, I.M. (2020). The effect of company size, Leverage & return on asset on earnings management : Case Study Indonesian. Espacios, 41(17), 25.

- Rusdiyanto, R., Agustia, D., Soetedjo, S., Septiarini, D.F., Susetyorini, S., Elan, U., … & Rahayu, D.I. (2019). Effects of sales, receivables turnover, and cash flow on liquidity.

- Rusdiyanto, R., & Narsa, I.M. (2019b). The effects of earnigs volatility, net income & comprehensive income on stock prices on banking companies on the Indonesia stock exchange. International Review of Management and Marketing, 9(6).

- Rusdiyanto, Sawarjuwono, T., & Tjaraka, H. (2020). Interpret the shari’ ah accounting practice in Indonesian. Talent Development and Excellence, 12(3), 2420–2433.

- Rusdiyanto, Tjaraka, H., Mufarokhah, N., Al’Aslaini, M.Z., Musthofa, A.J., Aji, S., Zainab, & Rohmah, A. (2019). Corporate social responsibility practices in islamic studies in Indonesian. Talent Development and Excellence, 12(1), 121–139.

- Sari, D.W. (2019). Ratio analysis of financial performance of companiesl Q45 index listed. Humanities and Social Sciences Reviews, 7(3), 419–423.

- Schreinemachers, P., Grovermann, C., Praneetvatakul, S., Heng, P., Nguyen, T.T.L., Buntong, B., Le, N.T., & Pinn, T. (2020). How much is too much? Quantifying pesticide overuse in vegetable production in Southeast Asia. Journal of Cleaner Production, 244.

- Shabbir, M.S., Mahmood, A., Setiawan, R., Nasirin, C., Rusdiyanto, R., Gazali, G., … & Batool, F. (2021). Closed-loop supply chain network design with sustainability & resiliency criteria. Environmental science and pollution research.

- Shen, J.J., Cochran, C.R., & Moseley, C.B. (2008). From the emergency department to the general hospital: Hospital ownership and market factors in the admission of the seriously mentally ill. Journal of Healthcare Management, 53(4), 268–279.

- Shi, S., Wang, Y., Chen, X., & Zhang, Q. (2020). Conceptualization of omni channel customer experience and its impact on shopping intention: A mixed-method approach. International Journal of Information Management, 50, 325–336.

- Susanto, H., Prasetyo, I., Indrawati, T., Aliyyah, N., Rusdiyanto, R., Tjaraka, H., … & Zainurrafiqi, Z. (2021). The impacts of earnings volatility, net income and comprehensive income on share Price: Evidence from Indonesia Stock Exchange. Accounting, 7(5), 1009–1016.

- Syafii, M., Ulum, B., Rusdiyanto, Suparman, P., Rahayu, D.I., & Syasindy, N.B. (2020). The effect of financial performance on the company’s share price: A case study Indonesian. European

- Tee, C.M. (2019). Institutional investors’ investment preference and monitoring: Evidence from Malaysia. Managerial Finance, 45(9), 1327–1346.

- Ulum, B., Rusdiyanto, M.S., Rahayu, D.I., & Pramitasarisari, D.A. (2020). Profitability impact on company share prices: A case study Indonesian. Solid State Technology, 63(6), 1672–1683.

- Utari, W., Setiawati, R., Fauzia, N., Hidayat, W., Khadijah, S.N., Pramitasari, D.A., & Irawan, H. (2020). The effect of work discipline on the performance of employees in compensation mediation : A case study Indonesia. 17(9), 1056–1073.

- Y?ld?r?m, M. (2020). Individual, organization and structure: Rethinking social construction of everyday life at workplace in tourism industry. Tourism Management, 76.

- Yu, L., Duan, Y., & Fan, T. (2020). Innovation performance of new products in China’s high-technology industry. International Journal of Production Economics, 219, 204–215.

- Zhu, Q., Li, X., & Zhao, S. (2018). Cost-sharing models for green product production and marketing in a food supply chain. Industrial Management and Data Systems, 118(4), 654–682.