Research Article: 2021 Vol: 20 Issue: 5

Comparative Analysis of Performance of State-Owned Companies

Nikolay Vladimirovich Kuznetsov, Financial University

Stanislav Boisovich Reshetnikov, Financial University

Denis Aleksandrovich Smirnov, Financial University

Natalya Evgenyevna Kotova, Financial University

Citation Information: Kuznetsov, N.V., Reshetnikov, S.B., Smirnov, D.A., & Kotova, N.E. (2021). Comparative analysis of performance of state-owned companies. Academy of Strategic Management Journal, 20(5), 1-8.

Abstract

The specifics of using the mathematical toolkit Data Envelopment Analysis (DEA) to analyze the relative performance of state-owned companies have been discussed in the article. The DEA algorithm has been implemented using the Python programming language. Sixteen largest companies from various sectors of the economy included in the MOEX SCI index have been studied using DEA. The performance of the companies has been assessed, based on the ability to use the available assets and borrowed funds to generate profit, cash flow, and state treasury income. It has been shown that four companies currently have the best performance: Transneft, Inter RAO, NCSP, and UAC. The performance of all other companies is, on average, half as much, which can partly be explained by high infrastructure costs.

Keywords

Data Envelopment Analysis, State-Owned Companies, Relative Performance, Economic Development, Performance.

Introduction

Assessment of the state, prospects, and choice of directions for the development of the modern economy raised the following urgent question: “Which is more efficient for society in the historical perspective: nationalization of the national economy or its corporatization?”. In fact, it is an issue of developing specific organizational, legal, and regulatory mechanisms to achieve the goal of transitioning the economy to a new technological structure of the digital era and sustainable development.

Literature Review

Developing countries, including Russia, are currently some of the largest shareholders owning stakes in the largest companies – flagships of the domestic economy, operating in all key sectors of the national economy (Liu et al., 2020). At the same time, according to Cooper & Seiford (2007) and Dorofeyev et al. (2018), the participation of the state in business is manifested both directly through the Federal Agency for State Property Management (Rosimushchestvo), subordinate to the Government of the Russian Federation, and indirectly through dependent structures, which include the largest state corporations (SC Rostec, SC VEB.RF, etc.), other state institutions (for example, the Central Bank of the Russian Federation), as well as structures under their control.

In this regard, according to Akande et al. (2013) this situation creates dual conditions for the operation of such companies: on the one hand, they are typical “firms” under the concept of a market economy, while on the other hand, they acquire the features of centrally planned economy enterprises, because the state largely determines the policy and strategy of their development as their main investor and beneficiary (Feeney & Hogan, 2017). This largely determines the possibility of implementing the economic policy adopted in the country, and also ensures the controllability and predictability of social development (Shen et al., 2020).

At the same time, the Federal Antimonopoly Service of Russia (FAS RF) notes the preservation of state-monopoly trends in the economy as one of the significant factors of economic threats that contradict the logic of economic rationality and lead to disruption of the market equilibrium and self-regulation. According to Aldieri & Vinci (2018) and Kosov et al. (2017), the participation of the state in market interactions not only as a developer of rules and a guarantor of their implementation, but also as an actor can have a significant distorting effect on competition.

Fully aware of both the positive and negative effects of state participation in the economy, the Government of the Russian Federation sets two tasks for the coming period: in order to increase the pace of economic development, the participation of the state in the activities of commercial companies in competitive markets will be minimized, and the number of organizations with state participation will decrease by 10% annually. At the same time, according to Abuhommous & Mashoka (2018) and Kosov et al. (2016), the management efficiency of state-owned companies will improve through the better corporate governance mechanisms.

However, Federal Law No. 50-FZ “On the acquisition of ordinary shares of the public joint-stock company Sberbank of Russia from the Central Bank of the Russian Federation by the Government of the Russian Federation” was adopted on March 18, 2020, which allowed to increase the state’s share in the share capital of PJSC Sberbank of Russia up to 52.32% (votes to the total number of voting shares of the credit institution). The shareholder agreement was concluded between the Ministry of Finance of the Russian Federation and the Central Bank of the Russian Federation in April 2020, the subject of which was the exercise of certain rights certified by the shares of PJSC Sberbank.

As such, despite the outlined strategic guidelines of the Government of the Russian Federation, the share of the state in the economy continues to grow even in such a seemingly competitive market as banking. In this regard, according to Bradley et al. (2016), it is essential to assess the efficiency of state participation in the economy (Kostova et al., 2008). At the same time, according to the researchers Kosera et al. (2018) and Akhmadeev et al. (2019), while the initial task of state participation in corporations was to consolidate assets, stabilize activities, and create potential for development in the most critical sectors of the economy, today the tasks of creating new value and ensuring the international competitiveness of Russia are gaining importance (Morozova et al., 2020). The authors believe that this, in turn, can generate the need to assess the activities of companies in terms of the ability to efficiently use the resources at their disposal, as well as to comply with the strategic goals and objectives of the state as a key shareholder.

Methods

Among all the variety of state-owned companies, 16 public companies are the most significant, whose stocks are traded on the Moscow Exchange (Table 1) (Abuhommous & Mashoka, 2018).

| Table 1 State-Owned Companies Included in the Moex Sci Index | ||||

| # | Name | Ticker symbol | Share of the state | Sector of economy |

| 1 | PJSC Sberbank of Russia | SBER | 52.3% | Finance and banking |

| 2 | PJSC Bank VTB | VTBR | 70.0% | |

| 3 | PJSC Gazprom | GAZP | 50.0% | Oil and gas |

| 4 | JSC NC Rosneft | ROSN | 50.0% | |

| 5 | JSC Gazpromneft | SIBN | 47.8% | |

| 6 | PJSC Tatneft | TATN | 34.0% | |

| 7 | JSC Transneft | TRNFP | 100.0% | |

| 8 | PJSC Inter RAO | IRAO | 44.3% | Electrical energy |

| 9 | PJSC Rosseti | RSTI | 88.9% | |

| 10 | PJSC FGC UES | FEES | 71.8% | |

| 11 | PJSC RusHydro | HYDR | 75.4% | |

| 12 | PJSC UAC | UNAC | 96.8% | Transport |

| 13 | PJSC Aeroflot | AFLT | 58.2% | |

| 14 | PJSC NCSP | NMTP | 80.6% | |

| 15 | PJSC ALROSA | ALRS | 66.0% | Diamond industry |

| 16 | PJSC Rostelecom | RTKM | 54.9% | Communication |

The above companies cover such key sectors of the economy as finance, mining and processing of minerals, transport, communications, and energy. At the same time, the scope of their activities is so impressive that it creates significant impact on the economic development of the country in general (Akande et al., 2013). For example, according to the estimates of the FAS RF, “only two enterprises (JSC Gazprom and JSC Rosneft) provide a contribution to GDP in the amount of 12 – 14%”. The “health” and the pace of development of the Russian economy largely depend on the “health” and the pace of development of these companies. This situation stipulates close attention to them from analysts working for both state and private institutions (including international ones). Their exceptional importance led to their inclusion in a separate index – “State-owned Companies Index” (MOEX SCI) (Akhmadeev et al., 2019).

It must be noted that the study of the companies revealed a significant difference among them not only by industry and type of activity, but also by financial and property status. In this case, the methods of financial and economic analysis based on standard performance criteria are ineffective. Besides, such a difference among the companies under consideration makes it impossible to compare them in order to identify the most and the least efficient companies using traditional approaches. Obviously, other methods of analysis must be used to solve this problem (Aldieri & Vinci, 2018).

DEA is one of the methods for analyzing the efficiency of the economic systems operation in their comparison, developed in the late 1970s – early 1980s for complex technical systems (Banker et al., 1984) and later used for comparative analysis of socioeconomic systems (Filc et al., 2020). The mathematical toolkit of the DEA method is discussed in detail in (Cooper & Seiford, 2007). However, the authors consider it in the simplest basic setting in this study, described below (Banker et al., 1984).

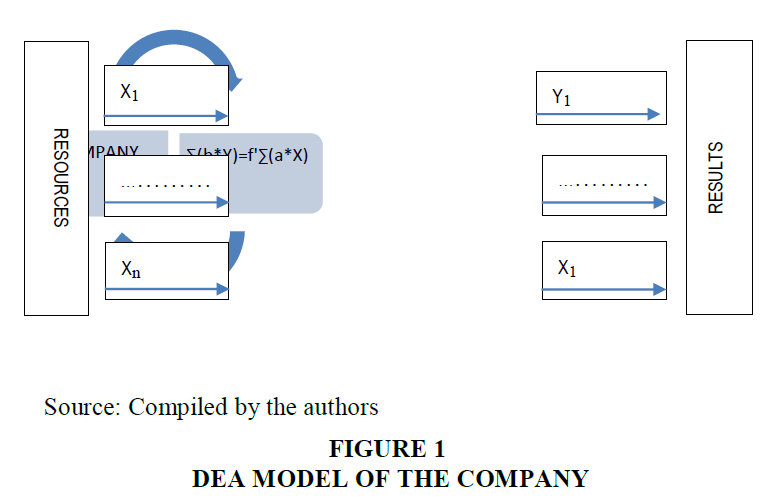

The DEA method is based on the black box concept, where each of the analyzed companies is considered as a system that converts a set of n resources (X1,.....Xn) into m performance results (Y1,.....Ym) in accordance with the principle of interconnection unknown to the authors (f) (Figure 1). In this case, the ratio of the final aggregate result to the consumed aggregate resources will describe the company performance (i.e., in fact, describe the efficiency of converting resources into results) (Bradley et al., 2016).

A production function that reflects the quantitative relationship between the output values and production factors is the simplest economic analogue of this equation (attention must be paid to a significant difference: the DEA model is dimensionless and does not require bringing all indicators to a single unit of measurement) (Cooper & Seiford, 2007).

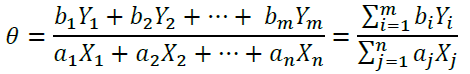

In this case, considering a set of Q companies, their aggregate performance can be formulated as follows:

Where a and b are the weight coefficients for resources and outputs, respectively.

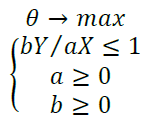

The relative efficiency of each company in the set Q can be determined by solving a linear programming problem from the condition of achieving a general maximum, provided that the efficiency of each object is ≤ 1, and the coefficients a and b cannot be less than zero (Cooper & Seiford, 2007):

As such, the DEA model allows to identify the most efficient company (with rating = 1) and compare with it all the rest by ranking them in the range from 0 to 1.

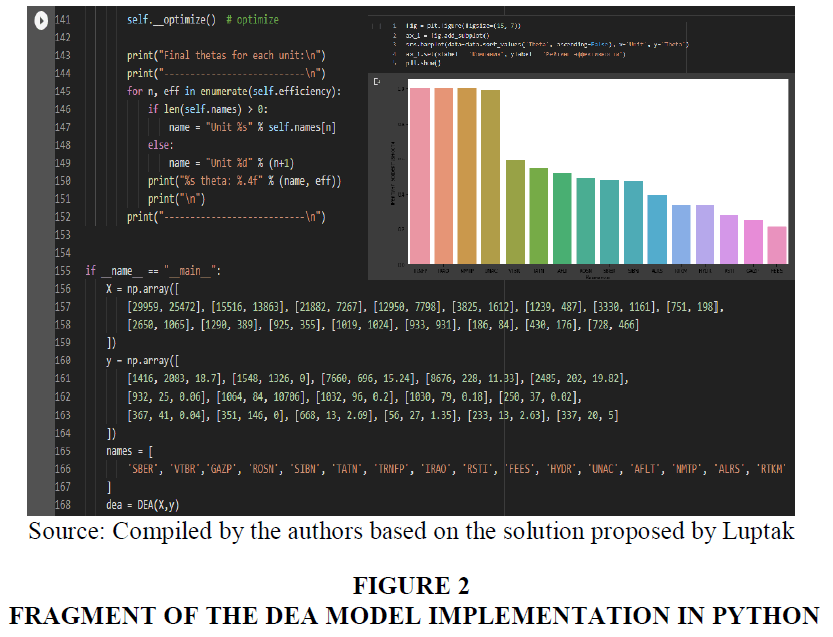

In the course of the study, the DEA model was implemented by the authors in the Python programming language using the NumPy and SciPy libraries for performing scientific and engineering calculations (Figure 2) (Dorofeyev et al., 2018).

Data Analysis and Results

The analysis was made on the basis of the companies' public financial statements for 2019 (Table 2).

| Table 2 Financial Indicators of the State-Owned Companies | |||||

| Company | TA | TL | R | NCF | DI |

| SBER | 29,959 | 25,472 | 1,416 | 2,083 | 18.70 |

| VTBR | 15,516 | 13,863 | 1,548 | 1,326 | - |

| GAZP | 21,882 | 7,267 | 7,660 | 696 | 15.24 |

| ROSN | 12,950 | 7,798 | 8,676 | 228 | 11.33 |

| SIBN | 3,825 | 1,612 | 2,485 | 202 | 19.82 |

| TATN | 1,239 | 487 | 932 | 25 | 0.06 |

| TRNFP | 3,330 | 1,161 | 1,064 | 84 | 10,706.00 |

| IRAO | 751 | 198 | 1,032 | 96 | 0.20 |

| RSTI | 2,650 | 1,065 | 1,030 | 79 | 0.18 |

| FEES | 1,290 | 389 | 250 | 37 | 0.02 |

| HYDR | 925 | 355 | 367 | 41 | 0.04 |

| UNAC | 1,019 | 1,024 | 351 | 146 | - |

| AFLT | 933 | 931 | 668 | 13 | 2.69 |

| NMTP | 186 | 84 | 56 | 27 | 1.35 |

| ALRS | 430 | 176 | 233 | 13 | 2.63 |

| RTKM | 728 | 466 | 337 | 20 | 5.00 |

The values of total assets (TA) and total liabilities (TL) of the companies were considered as input parameters, while revenue (R), net cash flow (CF), as well as the weighted average dividend yield (DI), calculated taking both common and preferred shares into account, were considered as output parameters. As such, the authors assessed the performance of the companies based on the ability to use the available assets and borrowed funds to generate profit, cash flow, and state treasury income. The results of the relative efficiency rating of the companies obtained using the DEA method (Feeney & Hogan, 2017).

The analysis of the rating allows to reveal four leading companies. They are Transneft, Inter RAO, Novorossiysk Commercial Sea Port (NCSP) (their rating = 1), as well as the United Aircraft Corporation (UAC), which is close to them in terms of rating (rating = 0.9921).

A key feature of their operation is that all these companies are actually natural monopolies (Banker et al., 1984) with a significant state participation in capital and management. The relative efficiency of all other companies is significantly lower. For example, the rating of VTB Bank, which is in fifth place, is actually 1.7 times worse than the rating of the leaders. At the same time, the rating assessment of the performance of other companies ranges from 0.59 to 0.21 with an average value of 0.41 and a median of 0.43 (Filc et al., 2020).

In this regard, it can be stated that the average performance of a company from the “lagging” sector is actually twice worse than the performance of the leading companies. At the same time, the relatively low performance of the three companies in the bottom of the rating (FGC UES, Gazprom, Rosseti), in the opinion of the authors, is explained by high infrastructure costs. For power grid companies, these are the costs of developing and maintaining networks, while for PJSC Gazprom, these are the costs associated with the construction of the Nord Stream 2 gas pipeline (Kosera et al., 2018).

Conclusion

State participation in the economy is a modern objective economic law. At the same time, the new version of the Russian Constitution of 2020 states the following: “local self-government bodies and state authorities shall comprise a part of a unified system of public authority in the Russian Federation and shall interact for the most effective problem-solving in the interests of the population living on the corresponding territory” (Article 132) (Shen et al., 2020). This testifies to the new paradigm of concentration of the political system of Russia, which was laid down at the constitutional level and will also necessarily take an economic dimension in the future. It can be stated that the past constitutional changes confirmed the political and legal basis for the further concentration of economic power in the hands of the state. As such, it is likely that state participation in the economy will increase, despite the negative attitude of the investment community to this phenomenon (Morozova et al., 2020).

At the same time, being a shareholder, the state needs to control the performance of companies (Kosetter et al., 2007). This control should be based on assessing the compliance of the actually achieved performance with the state economic policy and strategy and also take into account both the norms of state regulation and corporate self-regulation. The state-owned companies may be less efficient than “purely market” companies. However, their efficiency in solving state problems should be maximized (Kosov et al., 2019a, 2019b). The performance rating analysis, conducted by the authors using the DEA method, allowed to identify the leading and the lagging companies. At the same time, Russian state-owned companies have good potential for their further development. They can become attractive targets for medium and long-term investments, being under the “protection” of the state and providing stable profitability, coupled with their low current value, in the current crisis economic conditions. However, in the existing conditions, the implementation of this potential requires the use of not only economic but also administrative (regulatory) set of incentive measures (Liu et al., 2020).

It must also be noted that the DEA method used by the authors has two significant disadvantages. Firstly, the estimates obtained are relative (comparative). It is impossible to obtain an absolute assessment of the company's performance using this method. The DEA method can demonstrate how well a company is performing in comparison to other companies, but not in comparison with the theoretical maximum. Secondly, when using the DEA, an expert will always face the validity problem with the choice of input and output parameters. In this case, the main mathematical and algorithmic advantage of the method – its tolerance to the indicators under consideration and their dimensions – turns into its disadvantage, requiring the expert to clearly define what exactly is currently understood as “performance”.

Acknowledgements

The reported study was funded by RFBR according to research project No. 19-010-00936.

References

Abuhommous, A.A.A., & Mashoka, T. (2018). A dynamic approach to accounts receivable: The case of Jordanian firms. Eurasian Business Review, 8(2), 171-191.

Akande, J.M., Onifade, M., & Aladejare, A.E. (2013). Determination of airflow distributions in Okaba underground coal mine. Journal of Mining World Express, 2(2), 40-44.

Akhmadeev, R., Morozova, T., Voronkova, O.Y., & Sitnov, A.A. (2019). Targets determination model for vat risks mitigation at B2B marketplaces. Entrepreneurship and Sustainability Issues, 7(2), 1197-1216.

Aldieri, L., & Vinci, C.P. (2018). Innovation effects on employment in high-tech and low-tech industries: Evidence from large international firms within the triad. Eurasian Business Review, 8(2), 229-243.

Banker, R.D., Charnes, A., & Cooper, W.W. (1984). Some models for estimating technical and scale inefficiencies in data envelopment analysis. Management science, 30(9), 1078-1092.

Bradley, D., Pantzalis, C., & Yuan, X. (2016). Policy risk, corporate political strategies, and the cost of debt. Journal of Corporate Finance, 40, 254-275.

Cooper, W.W., Seiford, L.M., & Tone, K. (2007). Data envelopment analysis: a comprehensive text with models, applications, references and DEA-solver software (Vol. 2). New York: Springer.

Dorofeyev, M., K?sov, M., Ponkratov, V., Masterov, A., Karaev, A., & Vasyunina, M. (2018). Trends and prospects for the development of blockchain and cryptocurrencies in the digital economy. European Research Studies Journal, 21(3), 429-445.

Feeney, S., & Hogan, J. (2017). A path dependence approach to understanding educational policy harmonisation: The qualifications framework in the European higher education area. Higher Education Policy, 30(3), 279-298.

Filc, D., Rasooly, A., & Davidovitch, N. (2020). From public vs. private to public/private mix in healthcare: lessons from the Israeli and the Spanish cases. Israel Journal of Health Policy Research, 9(1), 1-14.

Komera, S., Lukose, P.J., & Sasidharan, S. (2018). Does business group affiliation encourage R&D activities? Evidence from India. Asia Pacific Journal of Management, 35(4), 887-917.

Koetter, M., Bos, J.W., Heid, F., Kolari, J.W., Kool, C.J., & Porath, D. (2007). Accounting for distress in bank mergers. Journal of Banking & Finance, 31(10), 3200-3217.

Kosov, M.E., Akhmadeev, R.G., Osipov, V.S., Kharakoz, Y.K., & Smotritskaya, I.I. (2016). Socio-economic planning of the economy. Indian Journal of Science and Technology, 9(36), 102008.

Kosov, M.E., Akhmadeev, R.G., Smirnov, V.M., Popkov, S.Y., & Rycova, I.N. (2017). Hydrocarbon market in countries with developing economy: Development scenario. International Journal of Energy Economics and Policy, 7(6), 128-135.

Kosov, M.E., Sigarev, A.V., Malashenko, G.T., Kharakoz, J.K., & Sekacheva, A.B. (2019). Economic cycles: Influence on the innovation system of Russia. Journal of Advanced Research in Law and Economics, 10(6), 1794-1800.

Kosov, M.E., Solyannikova, S.P., Sigarev, A.V., Karpenko, V.P., & Popkov, S.Y. (2019). Public investment in Russia: Peculiarities of implementation and ways to improve efficiency. Journal of Advanced Research in Law and Economics, 10, 1288-1295.

Kostova, T., Roth, K., & Dacin, M.T. (2008). Institutional theory in the study of multinational corporations: A critique and new directions. Academy of Management Review, 33(4), 994-1006.

Liu, P., Mauck, N., & Price, S.M. (2020). Are government owned investment funds created equal? evidence from sovereign wealth fund real estate acquisitions. The Journal of Real Estate Finance and Economics, 61(4), 698-729.

Morozova, T., Akhmadeev, R., Lehoux, L., Yumashev, A.V., Meshkova, G.V., & Lukiyanova, M. (2020). Crypto asset assessment models in financial reporting content typologies. Entrepreneurship and Sustainability Issues, 7(3), 2196-2212.

Shen, C.H., Chen, Y., Hsu, H.H., & Lin, C.Y. (2019). Banking crises and market timing: Evidence from M&As in the banking sector. Journal of Financial Services Research, 1-33.