Research Article: 2017 Vol: 16 Issue: 2

Comprehensive Method of Analyzing the Investment Potential of Industrial Enterprises

Anna Anatolievna Burdina, Moscow Aviation Institute (State University of Aerospace Technologies)

Marina Nikolaevna Kaloshina, Moscow Aviation Institute (State University of Aerospace Technologies)

Andrey Stanislavovich Chizhik, Moscow Aviation Institute (State University of Aerospace Technologies)

Keywords

Import Substitution, Investment, Investment Potential, Default of Investment Potential, Economic Reliability of Investment Potential.

Introduction

The analysis reveals that development programs for aviation industry are developed at present time. The core message of the programs is to create unified economic conditions for the growth of the investment potential of industrial enterprises in order to implement large strategic projects. Management of the investment potential of aviation industry enterprises has the following objectives: Implementation of large strategic projects, creation of efficient corporations, import substitution, promotion of aviation products on domestic and foreign markets, as well as growing competitiveness of Russian aviation enterprises. However, efficient management of the enterprise potential requires methods for analysing the investment potential, as well as mechanisms for assessing the economic reliability of investment potential.

The purpose of the study is to develop a comprehensive method for analysing the investment potential of aviation industry enterprises based on the concept of economic reliability, taking into account the risks of implementing industrial projects.

Literature Review

The most important theoretical aspects of assessment of investment potential and analysis of economic reliability are revealed in the papers of Russian and foreign authors (Brealey, Damodaran, Egorov, Skrypnik, Troshin, Horne, Ferrer, Kinnunen, Valuing, Mabert, Vincent Watts, Charles, Mileris, Orsag, McClure et al.). Analysis of various studies has shown the development of methodological and methodological issues of analysis, the formation of the investment potential of enterprises. However, the above studies do not address the most important issues for the aviation industry in assessing the probability of an investment default, nor have approaches been developed to determine the integral index of economic reliability of the investment potential of aviation industry enterprises, which justifies the need for this work.

As limitations of this study, it is possible to single out the specifics of production, financing and control of enterprises in the aviation industry. Prospects for the study are the development of a complex of economic and mathematical models for the formation, building and realization of the investment potential of the developing enterprises of the aviation industry in the current and projected socio-economic conditions of the globalization of the economy.

Methods

The methodological foundations of the study are represented by the provisions of investment management, economic theory, investment analysis (current project value (NPV), internal rate of return (IRR), return on investment (PI) and others) (Mileris, 2010; Orsag & McClure, 2013), as well as the papers of the domestic and foreign scientists in the field of assessing the investment potential and economic reliability. A systematic approach and methods of economic analysis were used to solve the tasks of this study. Methods of cash flow discounting, investment analysis, decision-making theory and financial and economic analysis were applied to solve the task of efficiency assessment (indicators of liquidity, profitability, turnover, stability) (Egorov, 1990; Burdina, 1998; Mabert & Watts, 2005).

The method of the study includes:

1. Research of the current state, problems and development trends of industrial enterprises of the aviation industry, justification of the author's interpretation of the concept of investment potential and the default of investment potential.

2. Identification of the main drawbacks in approaches to assessing the investment potential of aviation industry enterprises, based on the study of regulatory and methodological support, generalization and analysis of existing practices in Russia and abroad.

3. Justification of the need to develop a comprehensive method for analysing the investment potential of aviation industry enterprises based on the assessment of economic reliability.

4. Development of a comprehensive method for analysing the investment potential of enterprises based on economic reliability, taking into consideration the specifics of investment projects in the aviation industry.

5. Practical implementation of a comprehensive method for analysing the investment potential of the aviation industry enterprises.

The following approaches to the definition of this concept can be highlighted, based on the studies of the domestic and foreign scientists on the interpretation of the "investment potential" category (Damodaran, 2014; Egorov, 1990; Skrypnik, 2016; Troshin, Burdina, Moskvicheva, Nikulina, Tarasova & Rogulenko, 2016; Kaloshina, 2007):

1. An ordered collection of investment resources;

2. Existing and potential capabilities of the enterprise for simple and extended production;

3. Investment opportunities, which are used with the purpose of achieving the objectives of the enterprise’s investment strategy;

4. A set of the socio-economic interconnected resources, which can be used to achieve the objectives of investment activities under the external and internal factors of the investment environment.

The study analyzes the method of analysing investment potential through the evaluation of investment projects (Khan, 2011; Ferrer, 2012; Kinnunen, 2010). Based on the above approaches to the interpretation of the "investment potential" concept, it can be defined that the investment potential of the developing enterprise is a set of potential investment resources, sources, capabilities and tools that are formed under the influence of certain external and internal factors and begin to interact with each other to solve the tasks set. The investment potential of developing enterprises should be reviewed within the framework of three existing aspects: Ability to implement a development project; ability to raise external investment resources (state contract for R&D, loan, emission, resources of investment funds, etc.); ability to invest from own sources (self-financing) (Bodiako, Ponomareva, Rogulenko, Karp, Kirova, Gorlov & Burdina, 2016; Kaloshina, 2007).

The hypothesis of this study is the following: The default of investment potential is the state of the enterprise, in which the technical and economic indicators describing the investment potential take on the lowest values.

The analysis shows that implementation of measures provided for in the policy documents (Concerning the state regulation of aviation development, 1988; Development of the aviation industry for 2013-2025; Brealey, 2015) is designed to ensure a qualitative leap in the formation, growth and realization of the investment potential of the developing enterprises in the aviation industry in the current and projected socioeconomic conditions and to achieve the projected indicators (Table 1). However, implementation of the measures provided for in the documents is impossible without strengthening the procedures for developing the investment potential of the aviation industry enterprises.

| Table 1: Projected Values Of Market Volumes | ||||||||

| Market segment | Market volume | Share of domestic production | ||||||

|---|---|---|---|---|---|---|---|---|

| Russian market | Global market | Russian market | Global market | |||||

| 2015 | Forecast (target year) | 2015 | Forecast (target year) | 2015 | Forecast (target year) | 2015 | Forecast (target year) | |

| Transport and space systems | ||||||||

| Aviation systems | 83.5 bln rub. | 179.6 bln rub. (2020) |

2.8 bln $ | 57 bln $ (2020) |

19.60% | 58% (2020) |

1.5% | 4.4% (2020) |

| Aircraft engines | 44 bln rub. | 64.6 bln rub. (2025) |

21.9 bln $ | 33 bln $ (2025) |

11.40% | 46.9% (2025) | 0.9% | 6% (2025) |

| Production of spacecrafts and their elements | 5.8 bln rub. | 14 bln rub. (2017) |

9.2 bln $ | 11 bln $ (2017) |

0% | 85% (2017) |

6% | 7% (2017) |

Source: Skrypnik (2016)

The study analysed the method of analysing investment potential using the EVA criterion (Khan, 2011; Kinnunen, 2010; Mabert & Watts; 2005; Mileris, 2010). Analysis of the forecast of the long-term socioeconomic development of the Russian Federation for the period through to 2030, developed by the Ministry of Economic Development of Russia, allowed to identify the problems of formation, growth and realization of the investment potential of the developing enterprises in the Russian aviation industry:

1. The efficiency of "the aviation industry functioning depends on the supply of military products" (Concerning the state regulation of aviation development, 1988; Development of the aviation industry for 2013-2025);

2. "Insufficient technological development of production of aviation equipment, its components and assemblies, lack of the efficient system of the 1st and 2nd levels of supply of components for final integrators. The existing problem results in underperformance of production processes" (Concerning the state regulation of aviation development, 1988; Development of the aviation industry for 2013-2025; Bodiako, Ponomareva, Rogulenko, Karp, Kirova, Gorlov & Burdina, 2016);

3. "High labour intensity and low production volumes, which is reflected in high production costs". As such, restrictions are imposed on the investment activities of organizations (Horne & Wachowicz, 2015);

4. Lack of the required qualified personnel, modern certified production process and quality control systems. This problem significantly reduces the technological competitiveness of the output products (Burdina & Troshin, 2011);

5. "Low level of development of the system of warranty maintenance and after-sales service of aviation equipment". This result in declining attractiveness of Russian products in the domestic and foreign markets is decreasing in the conditions of globalization (Development of the aviation industry for 2013-2025; Burdina, 1998).

Investment projects, which are described by an increased level of risk in the field of aircraft engineering, are a fundamental component of the investment potential of the enterprise. The products of aircraft factories-airplanes, helicopters and aircrafts of various classes and purposes are technically complex systems. Creation of any product is a science-intensive and labour-intensive process that requires the development of innovative technologies and fundamentally new productions. This is why the project and financial risks are growing, along with the need for a more accurate expert assessment of project risks. At the moment, aviation plants are implementing investment projects simultaneously in three areas:

1. Modernization of the aviation component of the Armed Forces and creation of promising products for the world aviation arms markets;

2. Creation of competitive civil products and a system for their promotion at the air markets;

3. Modernization of the research, design and production infrastructure of the aviation industry (Skrypnik, 2016; Burdina & Troshin, 2011; Kaloshina, 2007).

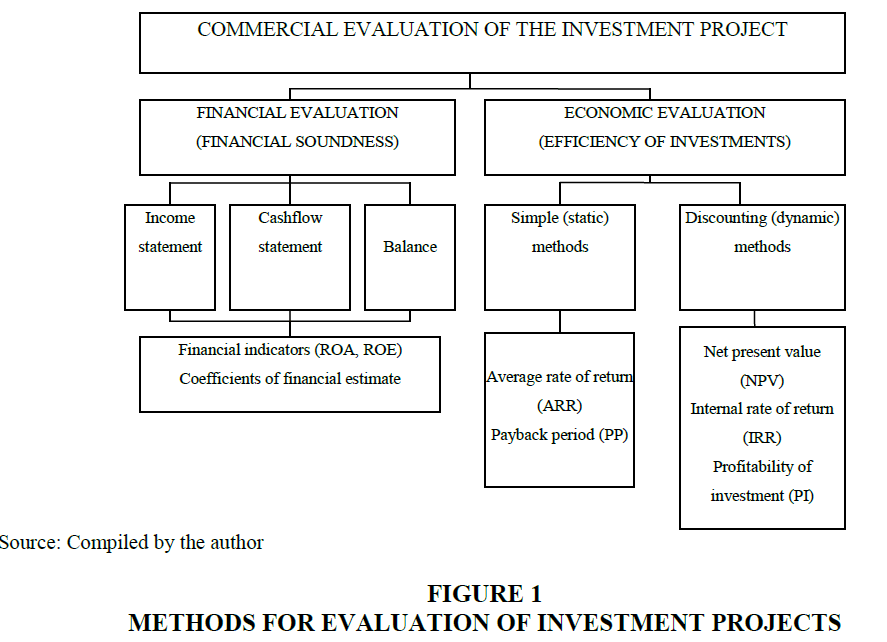

Figure 1 presents the main methods and criteria for evaluation of the commercial efficiency of investment projects (Brealy & Myers, 1995).

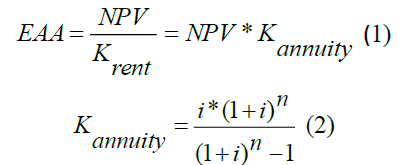

To assess the investment potential of aviation enterprises, it is recommended to use the EAA (Equivalent Annual Annuity) indicator along with the above. The essence of the equivalent annuity method is that the real unequal flow is replaced by an equivalent rent-based flow by the NPV criterion (Burdina, 1998; Kaloshina, 2007).

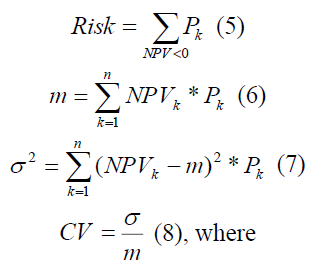

Aside from the commercial attractiveness of investment projects, it is necessary to take into consideration the change in the intercompany results of the production operation when introducing improved technologies and new products, as well as the level of risk, when assessing the investment potential at the aircraft manufacturing enterprises. The risk of the investment project is determined by the fact that the preliminary calculations are based on the projected values of the discount rate and the cash flow indicators, which depend on a range of uncertain parameters: Prices, monthly payments, various types of costs, etc. The project is deemed costeffective if the net present value of the project (NPV) is positive. This condition may fail in case of the above uncertainties. As such, the following natural risk measure can be used to assess the risk of the investment project (Egorov, 1990; Burdina, 1998):

1. Risk is numerical value of the risk measure;

2. ? is probability of occurrence of the event indicated in parentheses.

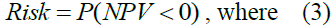

It often turns out that this risk measure can only be assessed indirectly due to the lack of reliable information about probabilistic distributions of uncertainty factors. Therefore, it is customary to use an alternative approach based on the Chebyshev inequality in practice, instead of the value of the Risk measure.

k is a parameter;

m is NPV expectation;

is NPV variance.

is NPV variance.

For k=3, the right hand side of this in equation is of the order of 0.1. Therefore, it is considered that the interval m ± 3σ contains the most probable NPV values (three sigma rule). In the future, this interval is called a confidence interval. The smaller part of the confidence interval is in the negative area, the lower the risk of the project.

The study analyzes the method of analysing investment potential using the scenario approach (Khan, 2011; Ferrer, 2012; Kinnunen, 2010; Mabert & Watts, 2005; Mileris, 2010; Orsag & McClure, 2013). To calculate the value of the project risk measure, it is necessary to identify possible options for its development in the first place. The finite number of such options is usually considered by the years of implementation. After that, the probability is assigned to each option. Preliminary scenario screening requires a qualitative analysis of the situation and, possibly, additional research. This is a key stage in the analysis of scenarios, since the calculation results significantly depend on the assumptions and conclusions made at this stage.

Advantages of the scenario approach:

1. Deep preliminary qualitative analysis of the investment project;

2. Only the options that seem to be important for a decision-maker are analysed, which allows avoiding a mechanical search of all possible combinations of the cash flow parameters.

Risk and confidence interval can be estimated on the basis of the analysis of the NPV indicator values in the course of development of various project implementation scenarios. The overall risk of the investment project is calculated on the basis of addition of probabilities, for which the NPV will be negative.

Pk is probability of occurrence of event k;

NPV is net present value of the project;

m is NPV expectation;

is NPV dispersion;

is NPV dispersion;

CV is coefficient of variation describing the share of risk per unit of income (Nikulina & Tarasova, 2014).

The study analyses the method of analysing investment potential using the method of bankruptcy diagnostics (Kinnunen, 2010; Mabert & Watts, 2005; Mileris, 2010; Orsag & McClure, 2013). Overall, the scenario method allows getting a fairly clear picture for various options of the project implementation, as well as provides information on the project sensitivity to changes in input parameters and on possible deviations in the rates of return, which influences the investment capital.

The following areas of financial analysis are used to analyse the investment potential of the enterprise: Liquidity, turnaround, efficiency, financial soundness.

Besides, statistical models can be used to analyse the level of investment attractiveness of the enterprise and the integration structure in the aviation industry and rapid estimates of the probability of default can be carried out. The models of Altman, Beaver, Tuffler, Savitskaya, Zhdanov, etc. are common in practice. These models provide an evaluation of the investment attractiveness class depending on the level of the risk of debt losses (Skrypnik, 2016; Troshin, Burdina, Moskvicheva, Nikulina, Tarasova & Rogulenko, 2016; Moskvicheva & Melik-Aslanova, 2015).

Statistical and mathematical methods are mainly used in development of quantitative models. These models have various rating scales (discrete, ordinal), which reflect the various states of enterprises. The combined type models include the method of Pyastolov, who says in his study that not only financial and economic indicators are taken into account for the rating evaluation, but also the factors influencing the financial condition, which include the enterprise reputation, image and other qualitative characteristics.

The study analyzes the method of analysing investment potential using the method of rating scales and accounting for non-systematic risks (McClure, 2013). Since qualitative parameters are taken into account in this method, the final rating may be probabilistic in nature. However, these indicators are insufficient for the analysis of the investment potential of the aviation enterprise and the integration structure in the aviation industry. Non-systematic risks, which are considered as specific risks inherent only to a given company, have a significant impact on the investment attractiveness of a particular enterprise. Non-systematic risks can be analysed and assessed taking into account the kinetic approach, i.e., the movement of risks and their static causes can be considered. The kinetic approach assumes the need to differentiate non-systematic risks into the following two main groups:

1. Non-systematic risks caused by financial and economic specifics of implementation of various types of organizational and legal obligations of the company under study;

2. Non-systematic risks caused by structural changes in property and sources of its financing for a potential investment object (Skrypnik, 2016; Nikulina & Tarasova, 2014).

The first group of non-systematic risks ensures their multi-vector movement, which, unlike the correlation regressions, is described by a set of dependencies, providing a predictive functional that is directly or inversely influences the investment attractiveness of a particular economic entity. An Agreement is the object of occurrence of the first group of non-systematic risks.

The second group of non-systematic risks summarizes the static reasons that build the basis for quantitative calculation of the company valuation-for example, in accordance with the legislation on valuation activities-in order to assess the prospect of obtaining a high degree of capitalization of investment in a certain period of time.

The kinetic approach to identification of non-systematic risks for assessing the investment attractiveness allows building a strategic financial and economic plan for potential investment, which is particularly important for agreements that have signs of affiliation, interest, major transactions and influence industry or market volatility, which is typical for industrial enterprises, holdings and corporations (Nikulina & Tarasova, 2014).

The analysis of investment potential assessment methods shows that they do not take into account in the complex: The specifics of the aviation industry, the probability of an investment default, the reliability of the investment potential for the implementation of projects. The analysis of methods for assessing the investment projects and investment potential in the study allowed developing a comprehensive method for analysing the investment potential of developing aviation industry enterprises, as well as integration structures, taking into account the risks of default based on the probabilistic approach, including the Bayesian approach.

At the first stage of a comprehensive method for analysing the enterprise (integration structure) investment potential, a set of indicators describing the financial condition, solvency and investment activity is defined. They can include the company's net asset indicators (market models), macroeconomic indicators of the enterprise financial condition and indicators of investment projects. Information and empirical basis for selecting indicators of investment potential are data from the Professional Market and Company Analysis System (SPARK), data from the ERP information technology and the analysed enterprises in the aviation industry; data of the Federal State Statistics Service and others.

The analysis of academic papers and publications (Troshin, Burdina, Moskvicheva, Nikulina, Tarasova & Rogulenko, 2016; Brealy & Myers, 1995), as well as well-known research by foreign authors (Altman, Tuffler & Beaver) allowed identifying indicators describing the investment component of the enterprise and the integration structure. Quantitative and qualitative indicators were identified and correlated indicators were eliminated (Table 2).

| Table 2: System Of The Analysis Indicators Of The Enterprise Investment Potential In The Aviation Industry |

| Stock market indicators |

|---|

| P/E (ratio of the share market price to earnings per share) (equity value per share/earnings earned by equity) |

| P/BV (share price/book value of equity per share) (equity market value/equity book value) |

| Financial indicators |

| Return on assets |

| Return on sales |

| Current assets coverage ratio |

| Interest coverage ratio |

| Current liquidity ratio |

| Debt-to-equity ratio |

| Receivable turnover ratio |

| Inventory turnover ratio |

| Quantitative indicators |

| Earnings |

| Profit |

| Indicators of project efficiency and qualitative indicators |

| Profitability of investments index (PI) |

| Internal rate of return (IRR) Risk indicators of investment projects |

| Weighted average capital cost |

| Ability to implement large investment projects and regionally significant projects |

| Possibility of guarantees and collateral |

| Ability to implement state programs |

| Tax benefits, investment tax credit |

Source: Compiled by the author

It is recommended to apply the Bayesian model to this group of indicators in the study and determine the degree of the enterprise (integration structure) investment potential.

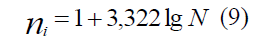

At the second stage of a comprehensive method for analysing the enterprise (integration structure) investment potential, each value of the sample index is ordered in ascending or descending order, depending on the impact on the investment component and is subjected to interval ranking. Each interval corresponds to a specific value of the rating score. The number of score groups is estimated with the help of the Sturgess formula (Skrypnik, 2016; Troshin, Burdina, Moskvicheva, Nikulina, Tarasova & Rogulenko, 2016) based on the sample size:

Where,

is the number of score groups;

is the number of score groups;

N is the number of enterprises analysed in the sample.

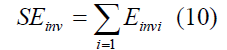

At the third stage, the total ranking score is calculated using the following formula:

Where,

is the total ranking score of the enterprise (integration structure) investment potential;

is the total ranking score of the enterprise (integration structure) investment potential;

is the ranking score corresponding to the value of the ith indicator of the enterprise (integration structure) investment potential.

is the ranking score corresponding to the value of the ith indicator of the enterprise (integration structure) investment potential.

At the fourth stage, a ranking is assigned to each interval in the sample.

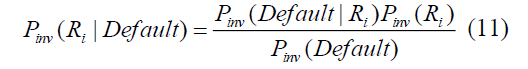

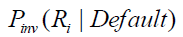

At the fifth stage of the comprehensive method for analysing the enterprise (integration structure) investment potential, the Bayesian classifier is used to estimate the a posteriori probability of the investment default.

The a posteriori probabilities of investment default are estimated based on the information obtained from the classification results. An estimate of this probability can be obtained using the Bayes’ theorem for each ranking value (Horne & Wachowicz, 2015; Skrypnik, 2016; Kaloshina, 2007)

Where,

is the probability that the enterprise (integration structure) with the value of the investment ranking of R iwill enter an investment default;

is the probability that the enterprise (integration structure) with the value of the investment ranking of R iwill enter an investment default;

is the probability that the enterprise (integration structure) that has entered into an investment default will have a ranking equal to R i.

is the probability that the enterprise (integration structure) that has entered into an investment default will have a ranking equal to R i.

is the probability that the enterprise (integration structure) will have a ranking of R i.

is the probability that the enterprise (integration structure) will have a ranking of R i.

Pinv(Default) inv is the probability of investment default.

The probability that the enterprise (integration structure) will enter an investment default:

The probability of investment default is calculated for each value of the investment ranking, using formula (5.2).

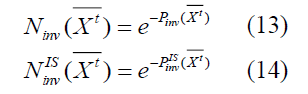

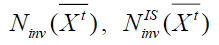

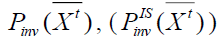

At the sixth stage of the comprehensive method for analysing the formation, growth and implementation of the enterprise (integration structure) investment potential, the economic reliability of the enterprise investment potential and investment integration is assessed using the proposed model (Horne & Wachowicz, 2015; Skrypnik, 2016; Burdina & Troshin, 2011).

Where,  is indicator of economic reliability of the enterprise (investment integration) investment potential;

is indicator of economic reliability of the enterprise (investment integration) investment potential;

is probability of an investment default of the enterprise (integration structure), defined using the Bayesian model;

is probability of an investment default of the enterprise (integration structure), defined using the Bayesian model;

is a vector of parameters that determine the state of the enterprise (integration structure) investment potential at the point of time t.

is a vector of parameters that determine the state of the enterprise (integration structure) investment potential at the point of time t.

Results

The method for analysing the enterprise investment potential was implemented in practice at the enterprises JSC "Ulan-Ude Aviation Plant (U-UAZ)", JSC "Reduktor-PM", JSC "Mil MHP". The quantitative and qualitative indicators of 40 sampling enterprises describing the state of the aviation industry enterprises are calculated. The values of the indicators of the enterprises under assessment are ordered in the ascending or descending order, their maximum and minimum are identified. The indicators are ranked to build the ranking of the investment component (Table 3).

| Table 3: Identification Of The Ranking Interval For The Investment Component | ||||||||

| Ranking | ? | ??? | ?? | ? | ??? | ?? | ? | D |

|---|---|---|---|---|---|---|---|---|

| Ranking interval | (83; 95) | (71; 83) | (59; 71) | (48; 59) | (36; 48) | (24; 36) | (12; 24) | (0; 12) |

Source: Compiled by the author

The a posteriori probability of the investment default is estimated based on the information obtained from the classification results. This probability is estimated using the Bayes’ theorem. The a priori probability of the fact that an enterprise will enter an investment default is defined according to the Bayes’ formula; it will amount to 0.462 for the aviation industry enterprises. The probability of investment default for aviation industry enterprises from the sample was estimated (Table 4).

| Table 4 : Estimation Of The Probability Of Investment Default For Aviation Industry Enterprises | ||||||||

| Ranking | A | BBB | BB | B | CCC | CC | ? | D |

|---|---|---|---|---|---|---|---|---|

| Probability of investment default | 0% | 0% | 0% | 7% | 13% | 19% | 25% | 41% |

Source: Compiled by the author

The investment potential ranking, the probability of investment default, the indicator of economic reliability of the investment potential for each enterprise are determined according to the developed method (Table 5).

| Table 5 : Indicators Of The Investment Potential | |||

| Aviation industry enterprises | JSC "Ulan-Ude Aviation Plant (U-UAZ)" | JSC "Reduktor-PM" | JSC "Mil MHP" |

|---|---|---|---|

| Investment potential ranking | ?? | ??? | ?? |

| Probability of investment default | 19% | 14% | 20% |

| Indicator of economic reliability of the investment potential | 0.79 | 0.83 | 0.85 |

Source: Compiled by the author

The results of the study contain academic and research results on the issues of analysis of the investment potential of aviation industry enterprises. The analysis revealed that along with certain positive changes achieved within the industry over the last decade, a number of unsolved problems persist, which are systemic in nature and need to be taken into consideration in the methods for assessing the investment potential. Such problems include:

1. High degree of depreciation of fixed assets at aviation enterprises;

2. High cost and risk of investment projects;

3. Impossibility to implement large strategic industrial projects without creating integration structures.

Discussion

This paper provides the author's interpretation of the concept "default of investment potential". In addition, the specifics of the interpretation of the economic reliability of the enterprise investment potential in this study include the probability of stability (failure-free operation) of the investment and technological component of the enterprise economic activities for implementation of industrial projects.

The existing theoretical and practical approaches to the analysis of investment potential and its reliability were examined. The analysis of methods revealed that they did not take the risk of defaults in investment potential into consideration, which was proposed to be considered as structural elements of the economic reliability indicator. A comprehensive method for analysing the investment potential was developed in this paper and implemented in practice at specific aviation enterprises. The reliability of results obtained by the authors is determined by the use of data published in official publications of the Russian Federation, official reporting of enterprises and organizations and is confirmed by the application of the significance criteria (mathematical statistics).

Conclusion

The academic novelty of the study is represented by the following core provisions and results:

1. The author's interpretation of the concept "investment potential in the aviation industry" is given based on the examination of regulatory, methodological and methodical support and analysis of existing practices in Russia and abroad. In contrast to known definitions, this interpretation is based on the principle of separation, which takes the risk of investment and technological default into consideration, specifics of which include the targeted focus on the implementation of large industrial projects.

2. A methodical toolkit for analysing the investment potential of industrial enterprises has been developed, taking the risks of the aviation industry into consideration, specifics of which include the ability to take into consideration the nonlinear dependence of investment insolvency (default) on the factors that reflect the specifics of large aviation enterprises operation to the fullest extent, which provides a higher accuracy of assessment against existing models.

3. A comprehensive method for assessing the investment potential has been developed, taking economic reliability into consideration, the novelty of which lies with the definition of the level of investment and technological insolvency (default) of aviation enterprises.

4. The theoretical significance of the research lies with the development of the theory of organization, management of large industrial enterprises and integration structures, as well as the theory of assessing the economic reliability.

Practical significance of the study lies with the possibility of using the developed comprehensive methodology as methodological support and recommendations by specialists at industrial enterprises in the development and adoption of managerial decisions aimed at implementing the strategic industrial projects.

This study has limitations for the further expansion of the scope of application of the methodology, related to the specifics of aviation production, the requirements for the level of investment default indicators and the economic reliability of the investment potential of aviation industry enterprises under state control and globalization.

Acknowledgement

The team of authors expresses gratitude to the staff of the Department of Financial Management of Moscow Aviation Institute for the essential participation in the study and the constructive review of the results.

References

- Bodiako, A.V., Ponomareva, S.V., Rogulenko, T.M., Karp, M., Kirova, E., Gorlov, V. & Burdina, A. (2016). The goal setting of internal control in the system of project financing. International Journal of Economics and Financial Issues, 6(4), 1945-1955.

- Brealey, R. (2015). Printsipy korporativnykh finansov [Principles of corporate finance]/trans. from English by N. Baryshnikova. Moscow: “Olymp-Business” CJSC.

- Brealy, R.A. & Myers, C. (1995). Fundamentals of corporate finance. New York: McGRAW-HILL INC.

- Burdina, A.A. & Troshin A.N. (2011). Formalizatsiya zadachi optimizatsii stoimosti korporativnykh struktur s uchotom faktora regionalnoy nadozhnosti [Formalization of the task of optimizing the value of corporate structures, given the factor of regional reliability]. MAI, 49, 74-83.

- Burdina, A.A. (1998). Sovershenstvovaniye vzaimodeystviya proizvodstvennoy i bankovskoy sistem [Perfection of interaction between industrial and banking systems]. Dissertation of a candidate of economic sciences: Moscow: Moscow Aviation Institute (State University of Aerospace Technologies).

- Damodaran, A. (2014). Investitsionnaya otsenka [Investment valuation]. Trans. from English and edited by V. Ionov. Moscow: Alpina Business Books.

- Egorov, V.N. (1990). Ekonomicheskiye problemy nadezhnosti proizvodstvennykh system [Economic problems of reliability of production systems]. Moscow: Lenpromizdat.

- Horne, J.C. & Wachowicz, J.M. (2015). Osnovy finansovogo menedzhmenta [Fundamentals of financial management]. Moscow: Publ. House "Williams".

- Kaloshina, M.N. (2007). Effektivnost investitsionnoy regeneratsii distribyutorskogo menedzhmenta [Efficiency of investment regeneration of distribution management]. Management in Russia and abroad, 1, 34-45.

- Moskvicheva, N.V. & Melik-Aslanova, N.O. (2015). Analiz osobennostey modernizatsii proizvodstvennykh moshchnostey predpriyatiy aviatsionnoy promyshlennosti [Analysis of specifics of production capacities modernization at the aviation industry enterprises]. Bulletin of the Moscow Aviation Institute, 22(4), 208-213.

- Nikulina, E.N. & Tarasova, E.V. (2014). Tekhnologiya kommercheskoy i investitsionnoy otsenki investitsionnykh proyektov v aviatsionnoy otrasli [Technology of commercial and investment evaluation of investment projects in the aviation industry]. Bulletin of the Rybinsk State Aviation Technological University named after Solovyov, 1(28), 151-157.

- Skrypnik, I.V. (2016). Razrabotka organizatsionno-ekonomichechskogo mekhanizma formirovaniya korporativnogo obrazovaniya [Development of the organizational and economic mechanism for the establishment of corporate education]. Dissertation of a candidate of economic sciences: Moscow.

- The Federal Law "O gosudarstvennom regulirovanii razvitiya aviatsii [Concerning the state regulation of aviation development]" (1988). No. 10-FZ (modified and supplemented on July 13, 2015).

- The state program of the Russian Federation "Razvitiye aviatsionnoy promyshlennosti na 2013-2025 gody [Development of the aviation industry for 2013-2025]" (Approved by the Decree of the Government of the Russian Federation dated April 15, 2014 No. 303). Retrieved August 31, 2017, from http://docs.cntd.ru/document/499091776

- Troshin, A.N., Burdina, A.A., Moskvicheva, N.V., Nikulina, E.N., Tarasova, E.V. & Rogulenko, T.M. (2016). Mechanism to analyse economic reliability of the innovational potential of aircraft enterprises. International Journal of Applied Business and Economic Research, 14, 747-765.

- Khan, A.A. (2011). Mergers and acquisitions in the Indian banking sector in post liberalization regime. International Journal of Contemporary Business Studies, 2(11), 31-45.

- Ferrer, R.C. (2012). An empirical investigation of the effects of merger and acquisition on firms' profitability. Academy of Accounting and Financial Studies Journal, 16(3), 31-55.

- Kinnunen, J., (2010). Valuing M&A synergies as (Fuzzy) real options. Proceedings (CD-ROM) of the 14th Annual International Conference on Real Options, 16-19.

- Mabert, V.A. & Watts, C.A. (2005). Enterprise applications: Building best-of-breed systems. In E. Bendoly & F.R. Jackobs (Eds.), Strategic ERP. Extension and use (pp. 52-70). Stanford: Stanford University Press.

- Mileris, R. (2010). Estimation of loan applicants default probability applying discriminant analysis and simple Bayesian classifier. Economics and management, 15, 1078-1084.

- Orsag, S. & McClure, K. (2013). Modified net present value as a useful tool for synergy valuation in business combinations. UTMS Journal of Economics, 4(2), 71-77.