Original Articles: 2017 Vol: 16 Issue: 1

Conception BSC for Investment Support of Port and Industrial Complexes

Tatyana Vladimirovna ?lesinskaya, South Federal University

Diana Vladimirovna Arutyunova, South Federal University

Vlada Georgievna Orlova, South Federal University

Igor Vasilevich Ilin, Peter the Great Saint Petersburg Polytechnic University

Svetlana Vladimirovna Shirokova, Peter the Great Saint Petersburg Polytechnic University

Keywords

Port and industrial complexes, investment potential, balanced scorecard, strategic map, investment support, strategic planning.

Introduction

In the context of the Russian economic crisis (2014-2015), international sanctions and restrictions on political and economic relations with Turkey (partner in the Azov-Black Sea basin), the state economic policy is focused on the development of its own production and infrastructure, including port one.

In the current conditions the port and industrial complexes (PIC) can become one of the most powerful factors in economic development of Russian regions. PIC allows integrating production, infrastructure, financial and social components, which implements the investment potential of the port area (Orlova, 2014).

The solution of many regional problems is impossible without strategic management of economic systems (Egorshin, 2004). PIC is a subsystem of the region, i.e. it has many links with other subsystems and its elements, and therefore, it also needs strategic management. Strategic management is necessary for PIC investment support in multipolar world.

Along with this, the main problem in socio-economic development of regions is still an imbalance between the individual subsystems of the economy: innovation processes critically lag behind production ones, investment growth - behind the growth of population savings (Kleiner, 2011).

This situation is exacerbated by the lack of a coordinated system of interrelated strategic plans for the development of industries and Russian Federation subjects. This leads to imbalance in the system when developing the concepts of the state, regional and municipal management objects, in particular the PIC.

Besides the problem of external balance of meso - and macrolevel strategies, there is a related task of internal balance of PIC development plans. In this regard, in the present work the formation of a balanced scorecard (BSC) is proposed to define the strategic guidelines for the development of PIC. This allows to assess the current and future (target) state of the PIC investment potential.

Literature Review

World practice shows that an evidence-based approach to the creation of the investment environment allows implementing transit-communication potential of PIC and, ?onsequently, to solve complex socio-economic tasks in the seaside region.

The object of this study is Taganrog PIC, located on the shore of the Azov sea, the subject is the investment potential of PIC. Currently Taganrog PIC is in a stage of decay, the main cause of which was the crisis of 2008 (Orlova, 2014).

Strategic management systems, aimed to build and implement the investment potential, are needed for investment development of the Russian PIC in the context of globalization. An important condition in the process of selection of investment object for investors is practical availability of a mechanism for effective strategic management.

There are many scorecards to assess strategic and operational aspects of the business. The study by Popov D. (2003) proposed a set of criteria, which allows to select the most appropriate tools of strategic management solutions - Quantum Performance Measurement (Quantum measurement of achievements - QPM) and BSC. QPM is designed to optimize the performance of an enterprise by analyzing information about the organizational structure, processes and employees. In addition to these areas BSC evaluates customer (marketing) and financial perspectives, which are a priority for the analysis of the results of investment support. It should be noted that initially BSC as a concept is a model of company's strategy (Kochnev, n.d.) (in the context of this study, port and industrial complexes) and investment management tools, that is business development.

Confirmation of the relevance of the chosen methodology is that the last 15 years of strategic planning is the leader in the list of the world's most popular management tools. At the same time, since 2008, the top ten management tools invariably have been including the Balanced Scorecard (“BAIN & Company”, 2013).

In this context, in this study the development of strategic management concept of Taganrog PIC in order to increase its investment potential is based on the application of BSC methodology.

The concept of Balanced Scorecard (BSC) developed by R. Kaplan and D. Norton (2014) has the greatest practical value (Arutyunova, 2005), it is adaptive from the point of view of the objects of study (Arutyunova & Lankin, 2013). Therefore, in the future, this concept is considered as fundamental.

The balanced scorecard converts the strategy into a system of interrelated indicators. There are a number of unresolved methodological issues of practical application of the BSC tool and its integration into the system of management of organizations.

These include, in particular, filtration of objectives that are not strategic, selection of important aspects of business (perspectives), identification of causal relationships between indicators and their quantitative assessment, formulation and justification of indicators coordination criteria, the decrease of the resistance of grass-roots management (Boukreev, n.d.; Nedosekin, 2015). In addition, from the position of management information concept BSC practical application involves the implementation of all three groups of management system functions. These are functions of information exchange, routine functions of information processing, and functions of information content transformation (decision-making). Therefore, there is an additional managerial and technical task of automation work with BSC. These issues should be resolved on the basis of system analysis methodologies, cybernetics, measurement theory, multiobjective optimization, causal analysis, etc.

Research Methodology

Along with this, it should be noted that, despite the popularity of this tool, there is a problem of having open access to specific techniques of practical construction and usage of BSC. In particular, one of the problematic issues is the method and criteria for assessing the indicators coordination (balance).

In the framework of further study, the following interpretation options of the indicators coordination notion in the BSC are offered:

1) coordination on the basis of mutual arrangement of indicators in the BSC between:

• indicators within each block (vertical coordination, decomposition objectives);

• the performance of different units (horizontal coordination, cause-effect Relationships);

• the BSC indicators and environmental factors, including stakeholders, the Environment constraints (causal relationships);

• Indicators of past, present and future time periods (time coordinate).

2) coordination on the basis of the content of indicators in the BSC:

• coordination of the quantitative values of the indicators;

• Coordination of the characteristics of reachability, risk, uncertainty achievement indicators.

One of last works, devoted to the development of coastal areas, is the work of Valev ?.?. (2009), in which he defined them as coastal production facilities in Europe. He identified four types of complexes: multi-functional, capital, specializing in shipbuilding, iron and steel industry, oil reception and processing, resort territories. The study of Gogoberidze G.G. and Mamayeva M.A. (2011) suggests indicator system for assessing the capacity of the marine coastal and marine port and industrial complexes to determine the characteristics and strategic capabilities of economic development of such areas.

Of particular interest is the work by Fedulova E.A. and Kononova S.A. (2014) dedicated to evaluating the effectiveness of investment regions strategies. In contrast to the concept of Norton D.P. and Kaplan R.S., it offers to use the fifth perspective “Society”, which includes the following objectives:

• economic development of the territory,

• social investment effect,

• Increase in investment activity.

At the same time the general goal of the strategic management of this interpretation is the quality of life, sustainable socio-economic development of the region.

The results of these tasks characterize the implementation of the region investment potential. PIC is one of the subsystems of the regional socio-economic system, for this reason the objectives of perspective “Society” are the general goal of strategic management. There is another question on the BSC methodology, proposed by Fedulova. It is one-sided orientation of the relationship between problems of different perspectives on the strategic map, which strictly follow in the upward direction from one perspective to another: “training and Development” → “internal processes” → “client” → “finance” → “society”. In our opinion, this approach simplifies real interdependence and can’t see the feedback between the tasks of different perspectives, which enhances the multiplier effect of management.

Problem Statement and Research Objective.

Concept of investment potential

The defining aspects of this study are: specific management objects of research - PIC, the subject - investment support and the BSC concept as a tool for strategic management. The goal of this study is to develop tools for modeling of PIC investment support with BSC. Research objectives include:

• to determine the structure of PIC investment potential;

• to distribute the components of investment potential on BSC perspectives;

• to form a tree of BSC objectives and tasks for management of PIC investment Potential;

• to justify the indicators, which measures objectives;

• to determine the causal relationship indicators, tasks and perspectives of the BSC.

In this study, components of investment potential are determined on the basis of major factors of production: labour, land, capital, entrepreneurial talent and information. In coastal areas the factor “land”, including water area corresponds to the production and transit communications potentials. Social capacity reflects the production factor “labour”, financial - capital, innovative capacity – “entrepreneurial skills”.

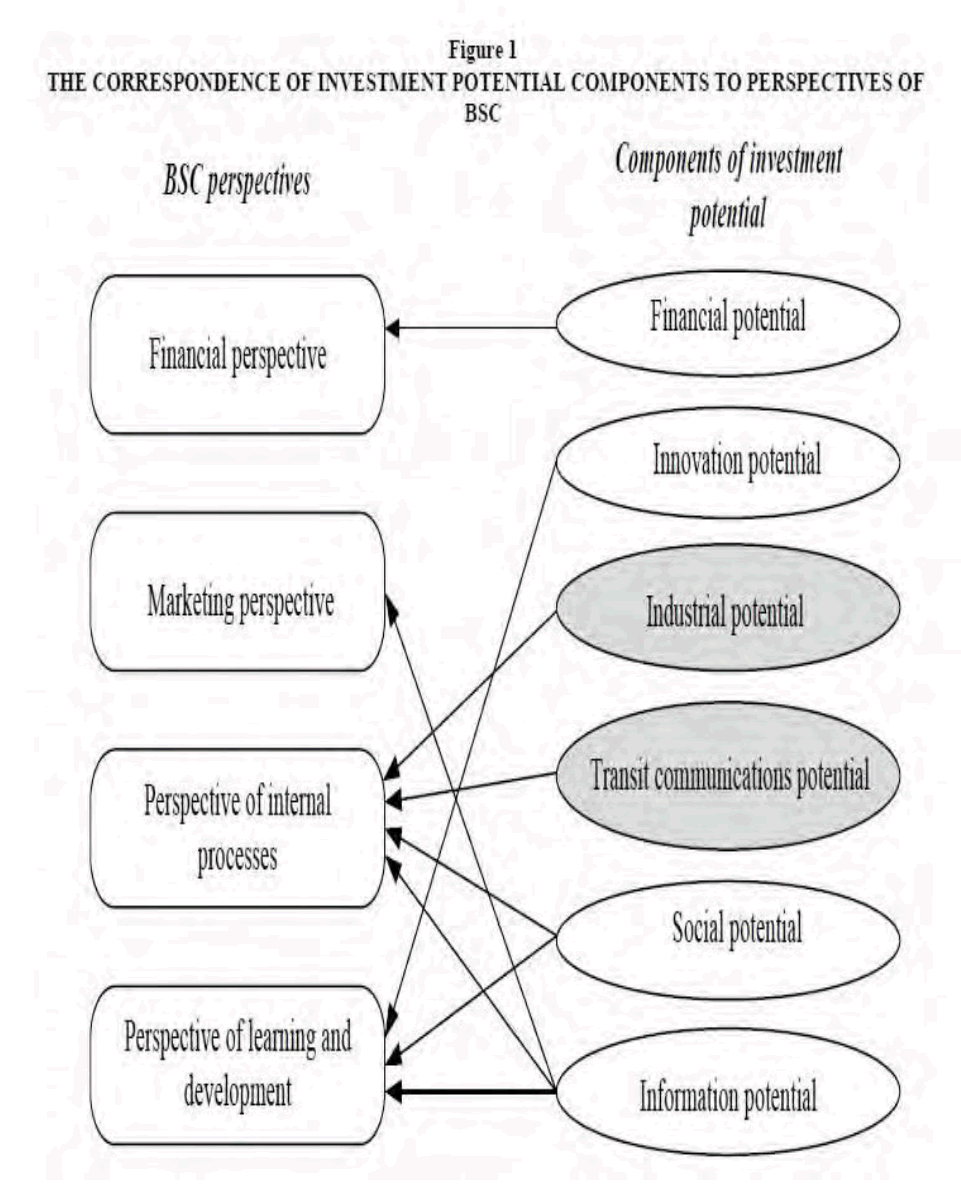

Thus, social (labor), financial, innovation and information potentials provide realization of industrial and transit-communication components of investment potential (Fig.1) (institutional potential is included in all potentials, tourism potential is not considered in this study).

It should be noted that investment potential indicators in the structure of each of the components can be divided into two groups. The first group of indicators characterizes the conditions of the PIC, and the second group is resultant. In this regard, in our view, it is necessary to consider the same infrastructure (industrial potential - production infrastructure, etc.) for the first group within each investment potential component. The main purpose of every kind of infrastructure is to create conditions for effective PIC activities. Resulting indicators, such as industrial potential, should include the volume of production.

Port and industrial complex is a powerful source of development, basis of investment potential of the coastal zone. In the context of globalization, competitive advantages disappear on the basis of production factors; the development degree of all types of infrastructure comes to the foreground as an important factor of investment attractiveness (Kuznetsova, 2010).

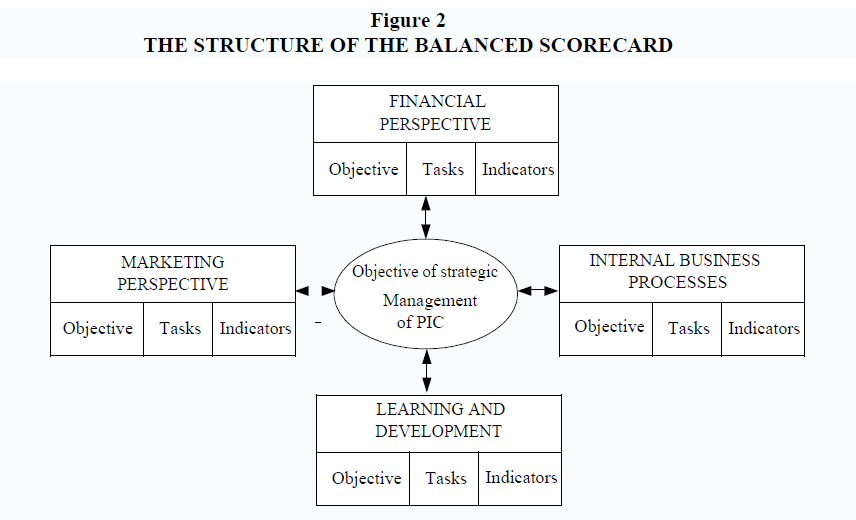

The general goal of PIC strategic management is to increase its investment potential. This goal is decomposed on the objectives and the corresponding to them tasks within each of the BSC perspectives. Implementation of each task is measured by a set of indicators (Fig.2).

The components of investment potential should be distributed according to the classical four BSC perspectives as follows (see Fig.1).

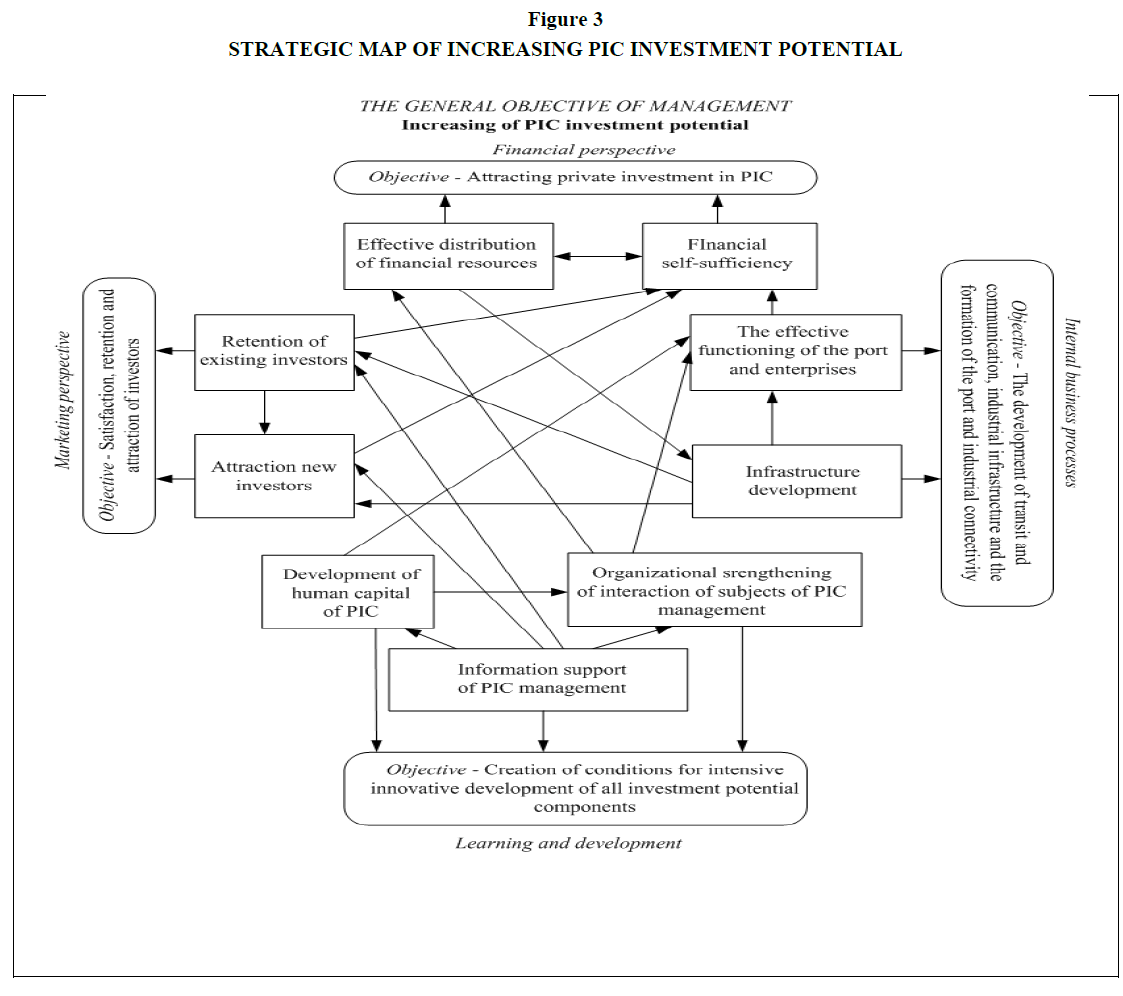

The main focuses of attention for each perspective were used during the formation of the BSC tasks. Figure 3 shows the strategy map of increasing of PIC investment potential. It displays the relationship between the BSC tasks and perspectives.

The perspective of financial performance

The perspective of financial performance is resultant in the BSC and it shows the financial component of investment potential.

The objective of financial perspectives is attracting private investment to PIC, which includes the following two tasks.

• Efficient allocation of financial resources that allows creating all kinds of PIC infrastructure. The result of this problem decision can be determined by the following indicators: structure of financing, total investment in infrastructure component of the investment potential.

• Financial self-sufficiency, implying the presence of financial capacity for the implementation of tasks of PIC infrastructure development. Indicators of solving the problem will be: percentage of profitable enterprises, increase in the number of enterprises, profits of the port, amount of the tax base (“Expert RA”, 2015).

The causal relationship of two tasks of financial and marketing perspectives is the following: effective distribution of financial resources allows creating, maintaining all kinds of infrastructure, which provides necessary conditions for retaining old investors and attracting new ones. It will lead to the development of PIC enterprises, and, therefore, increase their profitability, and consequently, increase the tax base that implements the financial sense of selfsufficiency.

Marketing Perspective

Marketing perspective corresponds to the formation of attractive image of PIC for the outer investment. The objective of marketing perspectives - satisfaction, retention and attraction of PIC investors - is achieved by solving two interrelated tasks.

• Retention of existing investors is measured by the following indicators: the volume of investments per capita, the volume of foreign investments per capita.

• The attraction of new investors includes indicators of the dynamics of investment per capita, the dynamics of foreign investments per capita, territory ranking.

A territory rating is indicator of its competitive ability, which, from marketing perspective, is a condition (factor) of promotion of PIC in the investment market. Dynamic indicators reflect trends of PIC investment development, which allows to predict the perspectives of potential investments.

The causal relationship between two tasks of marketing perspective is as follows. Successful solution of retaining old investor’s task creates a positive image of PIC. It increases the likelihood of attracting new investors. In addition, investors, who are currently working with the PIC, can attract new investors, based on interconnected business. It contributes to the formation of clusters.

Perspective of Internal Processes

Perspective of internal processes of PIC reflects the production, transit and communication, social, informational potentials, because the eponymous types of infrastructure are the basis for the implementation of production and logistics functions.

The objective of the perspective of PIC internal processes is development of transit and communication, industrial infrastructure and the formation of port and industrial connectivity. Tasks are focused on following two directions.

1. Effective functioning of port and businesses is measured by indicators of port workload in tonnage, shipped goods of its own production, the value of fixed assets per capita.

2. Infrastructure development is determined by the number of investment projects implemented in infrastructure field and the investments in infrastructure per capita.

A causal relationship between perspective of internal processes and marketing perspective - internal PIC processes determine the development of transit communication and production component of the investment potential in the first place. It directly increases the attractiveness of the territory for investors (marketing perspective). Attraction of investments in turn promotes another cycle of development of the seaside complex. Marketing perspective keeps old investors, attracts new investors and increases investment support of the internal PIC processes.

The perspective of learning and development

The perspective of learning and development is primarily based on innovation, social and informational potentials. An innovation is essential element of knowledge, technology, and infrastructure update. They are the most important factor economic growth. Well-developed information infrastructure is a necessary condition for operative reception and information processing and, consequently, making effective management decisions. Social capacity also Refers to living conditions of the population, in particular, environmental situation in PIC. This is due to bidirectional use of marine resources: port and recreation.

The objective of the growth and development perspectives is creating conditions for intensive innovative development of all investment potential components, resulting in the following problems.

1. Human capital development of PIC is measured by total income, unemployment rate, number of citizens not involved in labor activity, applying for 1 vacancy, the structure of professional degree of the territory.

2. Information support of PIC management is determined by the index of information transparency, in particular, by the presence of norms of legislation requiring companies to disclose information on investment projects (their own or borrowed funds, Russian or foreign investments, total investment, share of attracted investments), as well as structure of open channels of communications (official sites), newsletters, etc. with information on investment in the territory. So, on the official website of the Administration of Taganrog the register of investment projects (total amount, the ones realized in prior periods, or are under implementation, or are expected to be realized in the future) and grounds are presented, as well as information about the auctions, catalogue of Taganrog producers divided by sector of activity, etc.

3. Organizational strengthening of interaction between the subjects of PIC management (port management, industrial enterprises and the territory administration). In our opinion, “development institutions”, i.e. the rules of the game, have paramount importance for the formation and development of port and industrial zones. They focus not on all participants in economic or political life, but only on some of them, who were selected in a certain way (Guajava & Shogenov, 2009). One of the most effective tools to strengthen such collaboration is a public-private partnership (PPP).

Results

Causal relationship between perspectives of growth and development and other perspectives is that:

• the development of human capital helps to ensure PIC enterprises and PIC management with qualified personnel, which increases internal processes efficiency and contributes to effective PIC management;

• PIC information support creates conditions of open access to business information of PIC management subjects (improvement of internal processes controllability), existing and potential investors (increasing of investment attractiveness and, consequently, increasing marketing perspectives);

• increasing marketing perspective and internal processes leads to the achievement of objectives and tasks of financial perspective (dependencies are described above); institutional strengthening of interaction of subjects of management, based on the creation of “development institutions” provides “targeted” financial, human, informational assistance in the development of the port and industrial area, increases the efficiency of its production and communication activities (from the perspective of internal processes), attracts investors (marketing perspective).

Discussion

The existence of clear institutional environment is important prerequisite for motivating the private sector to participate in PPP (Bazhenova & Pivovarov, 2006). For PIC investment support there are institutional conditions of interaction between the two main leading actors: state and private capital. The institutional component reflects the risks, including investment, which along with investment potential is investment climate component of PIC.

This interaction can be assessed by the following indicators: the presence of vertically integrated companies-investors of PIC, including the industrial structure, the proportion of turnover, serving the needs of local businesses, the availability of the overall development PIC strategy. This strategy should be the result of close interaction of such organizational institutions of Taganrog as the city Administration, the Council on entrepreneurship under the city Administration, the Fund for support of entrepreneurship and competition development of Taganrog, Consulting group “expert Advisor”, Taganrog enterprise development Agency. These institutions form the infrastructure of business support, which provides an integrated approach to the implementation of its requirements. This applies to financial, property, information, consulting and other types of support, and also provides coordination of the PIC subjects.

Conclusions

The study identified a number of methodological and applied problems in the formation of strategic management system for PIC investment support. BSC tool is widely used in different areas of regional administration. But in the scientific literature there are no studies, which explore the problem of PIC investment support and BSC as a tool for evaluation of its investment potential. The following methods have been proposed to resolve the identified problems:

? Study of the investment potential components of the PIC territory and their distribution on the perspectives;

? Interpretation of the concept of indicators coordination in the BSC;

? Justification of objectives, tasks and indicators of each of BSC perspectives;

? Detection and study of cause and effect relationships between BSC objectives, tasks and specific indicators of PIC strategic management;

? Justification of causality BSC indicators and construction of strategic map for increase PIC investment potential.

References

- Anfilatov, V.S., Emelyanov, A.A. & Kukushkin, A.A. (2002). Models of the main functions of organizational and technical management. In A.A. Emelyanov (Eds.), System analysis in management (pp. 209-251). Moscow: Finance and statistics.

- Arutyunova, D.V. & Lankin, V.E. (2013). Structural simulation of the interaction of systems. Proceedings of the Southern Federal University, Technical science, 6(143), 120-126.

- Arutyunova, D.V. (2005). Adaptive economic management arrangements of the University in the marketplace. (Phd dissertation): Taganrog state University of radio engineering,Taganrog,Russian.

- Boukreev, M. (2014). Turning the concept into reality. Internet page of “INTALEV”.

- Retrieved December 20, 2014, from

- Bazhenova, V.S. & Pivovarov N. A. (2006). State regulation of innohttp://www.intalev.ua/library/articles/article.php?ID=24932.vation and technology development in modern conditions. Ulan-Ude: Publishing house of ESSTU.

- Egorshin, A.P. (2004). The concept of strategic management region. In A.P. Egorshin, D.S. Lvov & A.G.

- Granberg (Eds.), Strategic management: region, city, enterprise (pp. 128-179). Moscow: Economy.

- Fedulova, E.A. & Kononova, S.A. (2014). Evaluating the impact of the implementation of regional investment strategies based on the balanced scorecard. Siberian School of Finance, 4(105), 78-84.

- Gogoberidze, G.G. & Mamayeva, M.A. (2011). Strategic opportunities for economic development of the Russian coastal and marine port and industrial complexes of the Baltic Sea. Problems of Modern Economics, 4 (291-294).

- Guajava, A.S. & Shogenov, T.M. (2009). Institutional environment as a factor of economic growth. Bulletin of Adyghe state University. Series 5: The Economy Is Issue1. http://cyberleninka.ru/article/n/institutsionalnye-usloviya-kak-faktor-ekonomicheskogo- rosta#ixzz3T8Na17kD

- Kaplan, R.S. & Norton, D.P. (2014). The balanced system of scorecard. From strategy to action. Moscow: Olympic Busines.

- Kleiner, G.B. (2011). The main problems of the Russian mesoeconomics. In G.B. Kleiner (Ed.), Meso-Economics of development (pp.33-41). Moscow: Nauka.

- Kochnev, A.F. BSC, KPI and other indicators (2015). Retrieved June 15, 2015, from http://iteam.ru/publications/strategy/section_27/article_4114/

- Kuznetsova, A.I. (2010). Infrastructure: Issues of theory, methodology and applied aspects of modern infrastructure development. The geo-economic approach. Moscow: Komkniga.

- Nedosekin, A. (2015). The balanced system of scorecard (Balanced Scorecard): pros, cons, problems of implementation. Retrieved June 15, 2015, from http://balanced-scorecard.ru/node/591/linkintel.

- Orlova, V.G. (2014). Macroeconomic factors of the investment potential of the port and industrial centers.Proceedings of the XIX International conference: "Global economic processes", 156-161.

- Orlova, V.G. (2014). Investment development of the territories of the port and industrial activity in the South of Russia. In A.G. Druzhinin, S. Kolesnikov & V.N. Ovchinnikov (Eds.), South of Russia: Institutions and Strategy of modernization of the economy (pp. 296-302). Moscow: University book.

- Popov, D. (2003). Evolution of indicators of enterprise development strategies. Company Management, 2(69- 80).

- Valev, E.B. (2009). Problems of development and interaction of the coastal areas in Europe. Regional studies, 1(12).

- BAIN & Company (2015). Website of the International Consulting Company BAIN & Company. Retrieved June 15, 2015, from http://www.bain.com/publications/articles/management-tools-and-trends-2013.aspx

- Expert R.A. (2015). Retrieved February 1, 2015, from http://www.raexpert.ru/rankings/#r_1108 (Date of access (1.02.2015)).