Research Article: 2022 Vol: 21 Issue: 2S

Conceptual Paper on Corporate Environmental Performance as Mediating between Innovation and Financial Performance in Jordanian Industrial Sector

Maher Mohammad Ahmad Alnaim, University Malaysia Terengganu

Farizah Sulong, University Malaysia Terengganu

Zalailah Salleh, University Malaysia Terengganu

Ghaith Abdulraheem Ali Alsheikh, Amman Arab University

Keywords

Financial Performance, Environmental Performance, Innovation, Industrial Sector, Jordan

Citation Information

Alnaim, M.M.A., Sulong, F., Salleh, Z., & Ali Alsheikh, G.A. (2022). Conceptual Paper on Corporate Environmental Performance as Mediating between Innovation and Financial Performance in Jordanian Industrial Sector. Academy of Strategic Management Journal, 21(S2), 1-9.

Abstract

Environmentally friendly firms opt for publishing their environmental and financial performance in their annual reports, illustrating the actual performance of the company. Such information is an important fodder for stakeholders. In relation to this, corporate boards and managers need to improve effective informative procedure to manage issues stemming from the management-shareholders connection. In this study, the relationships between innovation, corporate environmental performance, and corporate financial performance. Moreover, the study provided a description of the relationships among the mentioned factors, integrated under NRBV theory. The study also provided an extensive review of current literature, pertaining to the quantitative findings obtained from examining financial performance in the Jordanian Industrial Sector. Based on the findings, a positive relationship exists between innovation, and corporate financial performance, with corporate environmental performance as having a positive mediating role on the relationship between innovation, and corporate financial performance. In sum, innovation and corporate environmental performance are major factors to be considered by industrial sector desirous of maintaining their survival in the current competitive marketplace.

Introduction

In this research, the main focus is directed towards Corporate Environmental Performance (CEP)-a topic that has gained increasing attention in the past few decades (Muhammad, Scrimgeour, Reddy & Abdin, 2016). The topic has primary implications on the structuring of corporate environmental policies and related policies to the company’s financial performance. In regards to this, the companies opting for a switch from clean production to green and environment-friendly productions (Eweje, 2017) have been the focus of research in light of the opinions of their management, stakeholders and shareholders on environmental dependable plans (Darnall, Henriques & Sadorsky, 2010). Findings from scientific studies indicate the presence of hazardous factors that influence the development of the economy and the natural resources. In relation to this, regulatory entities are exerting efforts to review legislations dedicated to the control of corporate environmental breaches (Yang, Wang, Zhou & Jiang, 2018), More recently, there have been waves of criticisms aimed towards the business community (including shareholders) with regards to the formations and awareness of environmental influences. Despite such awareness, the influence remains ambiguous (Joudeh, Almubaideen & Alroud, 2018; OECD, 2018).

According to Baliardi (2013), innovation strategy rivals are distinct from each other in terms of their sizes–in that if the company is augmented, innovation effects on financial performance also changes. Hence, it can be stated that regardless of new technology acceptance, with the increase in the size of the company, the innovation effects on the financial performance will increase. The outcomes have considerable implications to management for the achievement of higher business performance through continuous innovation. Also, the innovation-financial performance relationship holds high interest in the circles of consultant and government affirmative associations.

Past studies evidenced the positive innovation-profitability and competitive advantage relationship (specifically processing and producing innovation) that could culminate in improved financial performance (e.g., Bao, Sheng & Zhao, 2012; Gunday, Ulusoy, Kilic & Alpkan, 2011; Lopez-Mielgo, Montes-Peon & Vazquez-Ordas, 2009).

Innovation and performance relationship has been the topic that was tackled in many prior studies, among them, Atalay, Anafarta & Sarvan (2013); Geroski, Machin & Walters (1997) reported a significant relationship between the two. Innovation primarily achieves stability which considers performance and other responsibilities linked to sustainable development (Andries & Stephan, 2019). Moreover, in other studies, Pisano (2015); Oltra & Saint Jean (2009) contended that incorporating innovation into the firm’s operations can meet the needs of consumers, while Khessina, Goncalo & Krause (2018); Simpson, Simpson, Siguaw & Enz (2006) related that innovation is believed to be expensive and unstable and thus, negatively affects expenses and the pleasure of workers, indicating a negative relationship between innovation and performance.

Several other studies along this line (e.g., Kemp, 1994; Oltra & Saint Jean, 2009) revealed that techniques, processes and products can eradicate or minimize the pollutants emission or the use of raw materials, natural resources and energy. Meanwhile, in the studies by Lee & Min (2015); Oltra & Saint-Jean (2006), the authors found that the innovation influence on environmental performance did not largely depend on R&D but also on technologies as new technology pushes organizations to search for fresh methods for the environment.

Categorized as an emerging economy, Jordan faces issues in terms of industrial solid waste and water contamination control brought on by the operations of the industries and service firms. The first environmental challenge faced by Jordan is the lack of water resources and with the increasing population growth rate and refugees’ influx from Syria, the matter has been compounded. On the basis of the survey study by Hadadin & Tarawneh (2007), the per capita water requirement availability is slowly decreasing, indicating a 50%-60% decrease in water availability per capita. Also, the government has incorporated different control measures when it comes to gas emission and solid waste resulting from by-product, wherein firms were found to be in need to adopt innovation in their processes and products for market competitiveness. Hence, this stresses on the need to examine the relationship between innovation and financial performance of Jordanian firms, while keeping a close eye on their environmental issues. Studies in the field include that of Anwar’s (2018) study that revealed business innovation model to significantly influence the firm’s competitive edge and performance.

Corporate Financial Performance

This is a term that has a recurring trend in the business domain, in different industries and services. The achievement of a firm used to be evaluated based on its financial performance, disregarding all other factors that could promote the dominance of the firm in the market (Albatayneh, 2014). Corporate performance refers to the measure of the change of the firm’s financial situation, or the results of the financial aspects of the firm that have been brought about by the decisions of management and their execution by the workers (Carton & Hofer, 2006).

The primary objective behind financial management is profitability, which is to increase the owners’ interest, where performance refers to the firm’s ability towards acquiring and managing resources, using several methods, for the achievement of competitive advantage (Iswatia & Anshoria, 2007). Corporate performance is important to the strategic management domain of a firm and this includes its, innovation it employ and the like as this is what for-profit entities are concentrated on. In other words, for-profit entities, are by nature, fulfilling the demands of the public and as such, its financial performance is of major consideration (Naranjo-Valencia, Jimenez-Jimenez & Sanz-Valle, 2016; Ngunyu, 2013).

Corporate Environmental Performance

Throughout the past years, government sectors, policy makers, non-governmental entities, and the global firms has focused increasingly on the state of the environment (Berg & Lidskog, 2018; Rootes, 2014; Rosenbaum, 1977). The prevention of environmental challenges occurrence, has in fact, influenced the strategy and practice of firms in their efforts to prevent the delay of expensive projects. Along this line, innovative firms have begun to acknowledge environmental concerns as part of their business concerns that should have a place in corporate strategy, policies and practices (Muhammad, 2014).

According to Chang (2015), higher level of environmental performance and inclination towards it can support the management of the environment and prevent environmental accidents/disasters from occurring. This, in turn, mitigates the level of risks against the political, market and environmental situation of the country. Activists generally urge administrators of corporations to create environmental practices/policies to enhance environmental performance and thus, stakeholders do consider the environmental tendency and performance of the firms they invest in (Vasi & King, 2012). The firm’s inclination towards environmental performance may place the greater emphasis of the operations and activities on both environmental and financial performance (Earnhart, 2018).

The concept of corporate environmental performance has been the focus of consideration of scholars in the past three decades but to date, no consensus has been reached among researchers and regulators as to its measurement. In addition, developing the concept’s definition is challenging owing to the difficulty in its measurement (Dragomir, 2018).

Different corporate environmental performance definitions were reviewed in Poser, Guenther & Orlitzky’s (2012) study, and they provided a summary of such definitions in both theoretical and empirical studies). They considered the use of energy and waters, greenhouse gases emissions and released toxics as well as spillage under the Environmental Performance (EP) category. They also listed EP definitions found and these included Rowe & Enticott’s (1998) definition that described EP as the level of implementing set(s) of environmental initiatives and supporting management systems by the firms to mitigate the impact on their activities in the environment. Moreover, the authors also mentioned Gollagher, Sarkis, Clemens & Bakstran’s (2010) definition, which states that EP is a multidimensional construct, having factors, which include environmental effects on the biosphere, customers, employees, local community as well as other stakeholders.

Innovation

Corporations partially adopt innovations to accomplish optimum performance (Wadho & Chaudhry, 2018). Despite the fact that innovation is indubitably linked to firm efforts, it has become a key tool in the development of the social welfare of countries and the financial growth of firms (Chen, 2017) and as such, majority of countries attempt at obtaining competitive advantage all over the globe through innovation (Atkinson, 2013). Advanced as well as emerging economies are leveraging innovations for the growth and competitive advantage acceleration (Acs, Aduretsch, Lehmann & Licht, 2017; Chen, Yin & Mei, 2018).

More importantly, innovation refers to the successful commercial exploitation of new ideas and the interactive process of gaining knowledge from multiple sources (internal/external or both) (Hazwan, 2015). Schumpeter’s (1989) work is the pioneering one that coined the concept the first time as the gales of creative destruction (Felekoglu & Moutrie, 2014). Schumpeter (1980) claimed that innovation is represented by new outputs that are unique from others and for the meeting of the needs of customers, innovative firms can thrive as they are capable of generating and using technologies, products and processes expediently compared to their rivals.

Innovation Types

Innovations adopted by corporations come in different types to enhance competence and performance and they are generally categorized into product, process, organizational and market innovations.

• Product Innovation–a new advanced product judging from its features or use, and this covers enhancements in technology supplies, components of the product, integrated software and customer-friendly features, along with other additional features that are newly incorporated (Edwards-Schachter, 2018).

• Process Innovation–the adoption of enhanced manufacturing technology to assist in satisfying the demand of the clients and to sustain competitiveness in the market. Process innovation also assists firms in attaining performance indicators consisting of, but not confined to, operational expenses, enhanced qualities of products and consumer demand satisfaction (Edwards-Schachter, 2018).

• Marketing Innovation–this is the acceptance of new methods and approaches to marketing that are directed towards the maintenance of consumer relationship, using price strategy and promotions of products (Edwards-Schachter, 2018).

• Organizational Innovation–this covers the corporation’s handling of work processes, for instance, internal/external customer relationship that boosts competitive advantage. This type of innovation also helps companies to create worker involvement levels that results in enhanced productivity and mitigated influence (Edwards-Schachter, 2018).

The unprecedented economic growth around the globe has mostly led to unsustainable improvement and significant boost in pollutant emissions (Zhang, 2012), and owing to this unfortunate outcome, the world is faced with environmental issues that threaten the existence of humanity in the form of climate change and environmental pollution brought on by growth in the population, industrialized and urbanization developments and the rising demand of energy (Choi & Han, 2018). Such issues and threats to the environment challenge the environmental sustainability that is the core to the human (present and future) existence.

As a consequence, for the continuation of human living in a sustainable manner, it is a must to develop resource and energy efficiencies to support sustainable economies (Welford, 2016b). In doing so, the associations between consumption of resources and economic growth will be strengthened and sustainable growth ensures current environmental sustainability and economic growth. In fact, such sustainability is significant to growth, and its increasing significance has led to the environmental technological innovation (environmental innovations) as an alternative to achieving environmental sustainability. Environmental innovation refers to an environmental driven innovation that is directed towards mitigating adverse environmental externality (Tidd & Bessant, 2018).

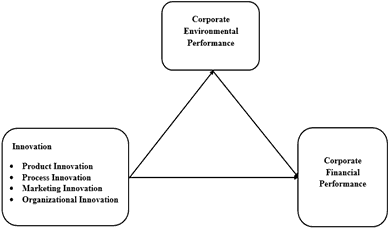

Theoretical Framework

This study primarily aims to conduct a determination of the influence of the innovation on the financial performance with environmental performance as the mediating variable. Developed and developing countries establishing policies to protect the natural environment, with the sectors adopting various policies and activities to achieve this aim and ultimately enhance their financial performance. The justification of such examination can be presented through the conceptual framework. A conceptual framework clarifies the hypothetical relationship among the examined dependent, independent and mediating variables (Bryman & Bell, 2018).

Theoretical Foundation

A suitable theory for the research is the Natural Resource Based View (NRBV), which is an extension of the Resource Based View (RBV), and such extension can be attributed to the efforts made by Hart (1995). The original RBV theory argues that the firm’s growth is dependent on the use of strategic management and accessible resources but Hart (1995) proposed the NRBV theory as a conceptual framework, with the influence of natural environment on competitive advantage and the performance outcomes of firms incorporated. The NRBV primarily posits that there are three main eco-strategies and they are; preventing pollution through the decrease of solid wastes and effluents, product stewardship by mitigating the product lifecycle cost, and sustainable development by mitigating the environmental burden brought on by the growth of business. Based on the theory, all the above mentioned factors are significant in the development of the firm’s competitive edge over critical resources with a distinct environmental driving force (Alalade & Oguntodu, 2015).

Additionally, NRBV has a product stewardship element that addresses the prevention of pollution in the lifecycle of products and as such, the stakeholder is the one who often convinces the internal management to integrate such product designs that can lead towards adoption of environmental prevention measures, and eventually benefit the performance of the company (Konadu, 2018). Thus, NRBV focuses on the adoption of environmental strategies as an enhancer of the performance of firms.

Environmentally friendly firms opt for publishing their environmental and social performance in their annual reports, illustrating the actual performance of the company. Such information is an important to attract stakeholders. In relation to this, corporate boards and managers need to improve effective informative procedure to manage issues stemming from the management-shareholders connection. Based on the above discussion, the NRBV and RBV is used in the research to evaluate influence of corporate environmental performance on the financial.

NRBV has a significant implication to this research as the objective is to empirically examine the influence of innovation strategy on corporate financial performance, with environmental performance as the mediating factor.

Conclusion

Past studies evidenced the positive innovation-profitability and competitive advantage relationship (specifically processing and producing innovation) that could culminate in improved financial performance (e.g., Bao, Sheng & Zhao, 2012; Gunday, Ulusoy, Kilic & Alpkan, 2011; Lopez-Mielgo, Montes-Peon & Vazquez-Ordas, 2009).

According to Baliardi (2013), innovation strategy rivals are distinct from each other in terms of their sizes–in that if the company is augmented, innovation effects on financial performance also changes. Hence, it can be stated that regardless of new technology acceptance, with the increase in the size of the company, the innovation effects on the financial performance will increase. The outcomes have considerable implications to management for the achievement of higher business performance through continuous innovation. Also, the innovation-financial performance relationship holds high interest in the circles of consultant and government affirmative associations, these are starting point for future studies to explore the relationship between innovation strategy and sustainability.

References

Acs, Z.J., Audretsch, D.B., Lehmann, E.E., & Licht, G. (2017). National systems of innovation.The Journal of Technology Transfer, 42(5), 997-1008.

Alalade, S., & Oguntodu, J. (2015). Motivation and employees performance in the Nigerian banking industry.International Journal of Economics, Commerce, and Management, 3(4).

Albatayneh, R.M.S. (2014). The effect of corporate sustainability performance on the relationship between corporate efficiency strategy and corporate financial performance. Universiti Utara Malaysia.

Albertini, E. (2013). Does environmental management improve financial performance? A meta-analytical review.Organization & Environment, 26(4), 431-457.

Andries, P., & Stephan, U. (2019). Environmental innovation and firm performance: How firm size and motives matter.Sustainability, 11(13), 3585.

Anwar, M. (2018). Business model innovation and SMEs performance—does competitive advantage mediate?International Journal of Innovation Management, 22(07), 1850057.

Atalay, M., Anafarta, N., & Sarvan, F. (2013). The relationship between innovation and firm performance: An empirical evidence from Turkish automotive supplier industry.Procedia-Social and Behavioral Sciences, 75, 226-235.

Atkinson, R. (2013). Innovation economics: The race for global advantage practicing sustainability. 123-126, Springer.

Bao, Y., Sheng, S., & Zhou, K.Z. (2012). Network-based market knowledge and product innovativeness.Marketing Letters, 23(1), 309-324.

Berg, M., & Lidskog, R. (2018). Deliberative democracy meets democratised science: A deliberative systems approach to global environmental governance.Environmental Politics, 27(1), 1-20.

Bigliardi, B. (2013). The effect of innovation on financial performance: A research study involving SMEs.Innovation, 15(2), 245-255.

Bryman, A., & Bell, E. (2018). Business research methods. Oxford University Press.

Carton, R.B., & Hofer, C.W. (2006). Measuring the organizational performance. Metrics for entrepreneurship and Strategic management research.

Chang, K. (2015). The impacts of environmental performance and propensity disclosure on financial performance: Empirical evidence from unbalanced panel data of heavy-pollution industries in China.Journal of Industrial Engineering and Management (JIEM), 8(1), 21-36.

Chen, J. (2017). Towards new and multiple perspectives on innovation.International Journal of Innovation Studies, 1(1), 1-4.

Chen, J., Yin, X., & Mei, L. (2018). Holistic innovation: An emerging innovation paradigm.International Journal of Innovation Studies, 2(1), 1-13.

Choi, J., & Han, D. (2018). The links between environmental innovation and environmental performance: Evidence for high-and middle-income countries.Sustainability, 10(7), 2157.

Darnall, N., Henriques, I., & Sadorsky, P. (2010). Adopting proactive environmental strategy: The influence of stakeholders and firm size.Journal of Management Studies, 47(2), 56-72.

Dixon-Fowler, H.R., Slater, D.J., Johnson, J.L., Ellstrand, A.E., & Romi, A.M. (2013). Beyond does it pay to be green? A meta-analysis of moderators of the CEP–CFP relationship.Journal of business ethics, 112(2), 353-366.

Dragomir, V.D. (2018). How do we measure corporate environmental performance? A critical review.Journal of cleaner production, 196, 1124-1157.

Earnhart, D. (2018). The effect of corporate environmental performance on corporate financial performance.Annual Review of Resource Economics, 10, 425-444.

Edwards-Schachter, M. (2018). The nature and variety of innovation.International Journal of Innovation Studies, 2(2), 65-79.

Eweje, G. (2017). A shift in corporate practice? Facilitating sustainability strategy in companies.Corporate social responsibility and Environment Management, 18(3), 126-136.

Felekoglu, B., & Moultrie, J. (2014). Top management involvement in new product development: A review and synthesis.Journal of Product Innovation Management, 31(1), 159-175.

Geroski, P.A., Machin, S.J., & Walters, C.F. (1997). Corporate growth and profitability.The Journal of Industrial Economics, 45(2), 171-189.

Gilley, K.M., Worrell, D.L., Davidson III, W.N., & El–Jelly, A. (2000). Corporate environmental initiatives and anticipated firm performance: The differential effects of process-driven versus product-driven greening initiatives.Journal of management, 26(6), 1199-1216.

Gollagher, M., Sarkis, J., Clemens, B., & Bakstran, L. (2010). A framework of theoretical lenses and strategic purposes to describe relationships among firm environmental strategy, financial performance, and environmental performance.Management Research Review.

Gunday, G., Ulusoy, G., Kilic, K., & Alpkan, L. (2011). Effects of innovation types on firm performance.International Journal of Production Economics, 133(2), 662-676.

Hadadin, N., & Tarawneh, Z. (2007). Environmental issues in Jordan, solutions and recommendations.American Journal of Environmental Sciences, 3(1), 30-36.

Hart, S.L. (1995). A natural-resource-based view of the firm. Academy of Management Review, 20(4), 986-1014.

Iswatia, S., & Anshoria, M. (2007). The influence of intellectual capital to financial performance at insurance companies in Jakarta Stock Exchange (JSE).Paper presented at the Proceedings of the 13th Asia Pacific Management Conference, Melbourne, Australia.

Joudeh, A.H.M., Almubaideen, H.I., & Alroud, S.F. (2018). Environmental disclosure in the annual reports of the jordanian mining and extraction companies.Journal of Economics Finance and Accounting, 5(1), 100-107.

Kemp, R. (1994). Technology and the transition to environmental sustainability: The problem of technological regime shifts.Futures, 26(10), 1023-1046.

Khessina, O.M., Goncalo, J.A., & Krause, V. (2018). It’s time to sober up: The direct costs, side effects and long-term consequences of creativity and innovation. Research in Organizational Behavior.

Konadu, R. (2018). Corporate environmental performance and corporate financial performance: Empirical evidence from the United Kingdom. Bournemouth University.

Lee, K.H., & Min, B. (2015). Green R&D for eco-innovation and its impact on carbon emissions and firm performance.Journal of cleaner production, 108, 534-542.

López-Mielgo, N., Montes-Peón, J.M., & Vázquez-Ordás, C.J. (2009). Are quality and innovation management conflicting activities?Technovation, 29(8), 537-545.

Muhamad Hazwan, H. (2015). Exploring the relationship of innovation and features towards new product development. Universiti Utara Malaysia.GoogleScholar

Muhammad, N. (2014). Corporate environmental performance and its impact on financial performance and financial risk: Evidence from Australia. University of Waikato.

Muhammad, N., Scrimgeour, F., Reddy, K., & Abdin, S. (2016). Emission indices for hazardous substances: An alternative measure of corporate environmental performance.Corporate Social Responsibility andEnvironmental Management, 23(1), 15-26.

Naranjo-Valencia, J.C., Jiménez-Jiménez, D., & Sanz-Valle, R. (2016). Studying the links between organizational culture, innovation, and performance in Spanish companies.Latin American Journal of Psychology, 48(1), 30-41.

Nishitani, K., Kaneko, S., Fujii, H., & Komatsu, S. (2011). Effects of the reduction of pollution emissions on the economic performance of firms: an empirical analysis focusing on demand and productivity.Journal of cleaner production, 19(17-18), 1956-1964.

Oltra, V., & Saint Jean, M. (2009). Sectoral systems of environmental innovation: an application to the French automotive industry.Technological Forecasting and Social Change, 76(4), 567-583.

Oltra, V., & Saint-Jean, M. (2006). Variety of technological trajectories in low emission vehicles (LEVs): A patent data analysis. Cahier, 20.

Orlitzky, M., & Benjamin, J.D. (2001). Corporate social performance and firm risk: A meta-analytic review.Business & Society, 40(4), 369-396.

Pisano, G.P. (2015). You need an innovation strategy.Harvard Business Review, 93(6), 44-54.

Poser, C., Guenther, E., & Orlitzky, M. (2012). Shades of green: Using computer-aided qualitative data analysis to explore different aspects of corporate environmental performance.Journal of Management Control, 22(4), 413-450.

Rootes, C. (2014). Environmental movements: local, national and global. Routledge.

Rosenbaum, W.A. (1977). The politics of environmental concern. Praeger New York.

Rowe, J., & Enticott, R. (1998). The role of local authorities in improving the environmental management of SMEs: some observations from partnership programmes in the west of England. Eco-Management and Auditing, 5(2), 75-87.

Sarkis, B. (2017). A fluid-structure solver to study the relaxation of microcapsules in confined environments.23rd French Congress of Mechanics CFM2017.

Schumpeter, J.A. (1989). Essays on entrepreneurs, innovations, business cycles, and the evolution of capitalism. New Brunswick, NJ, USA: Transaction Publishers.

Simpson, P.M., Siguaw, J.A., & Enz, C.A. (2006). Innovation orientation outcomes: The good and the bad.Journal of business research, 59(10-11), 1133-1141.

Stefan, A., & Paul, L. (2008). Does it pay to be green? A systematic overview.Academy of management perspectives, 22(4), 45-62.

Tidd, J., & Bessant, J.R. (2018). Managing innovation: Integrating technological, market and organizational change. John Wiley & Sons.

Vasi, I.B., & King, B.G. (2012). Social movements, risk perceptions, and economic outcomes: The effect of primary and secondary stakeholder activism on firms’ perceived environmental risk and financial performance. American Sociological Review, 77(4), 573-596.

Wadho, W., & Chaudhry, A. (2018). Innovation and firm performance in developing countries: The case of Pakistani textile and apparel manufacturers. Research Policy, 47(7), 1283-1294.

Wagner, M., Van Phu, N., Azomahou, T., & Wehrmeyer, W. (2002). The relationship between the environmental and economic performance of firms: an empirical analysis of the European paper industry. Corporate Social Responsibility and Environmental Management, 9(3), 133-146.

Welford, R. (2016b). Corporate environmental management: Towards sustainable development. Routledge.

Yang, D., Wang, A.Z., Zhou, K.Z., & Jiang, W. (2018). Environmental strategy, institutional forces, and innovation capability: A management cognition perspective. Journal of Business Ethics, 21(3), 1-15.

Zhang, J. (2012). Delivering environmentally sustainable economic growth: The case of China. Asia Society Report, 2-25.

Received: 20-Nov-2021, Manuscript No. asmj-21-8123; Editor assigned: 23-Nov-2021, PreQC No. asmj-21-8123 (PQ); Reviewed: 06- Dec-2021, QC No. asmj-21-8123; Revised: 27-Dec-2022, Manuscript No. asmj-21-8123 (R); Published: 07-Jan-2022