Research Article: 2019 Vol: 18 Issue: 2

Corporate Diversification: A Fundamental Exploration of General Business Environments, Industry Environments and Firm Characteristics

Jolly Sahni, Prince Sultan University

Ariff Syah Juhari, Prince Sultan University

Abstract

Diversification has been central in the area of strategic management. Businesses in many countries have used diversification as the means to advance its economic progress. For Saudi Arabia to reach their vision by 2030, corporate diversification will be central to achieve a ‘short-cut’, if you will, in fulfilling its ambition. Researches in various disciplines are growing to propose creative solutions and approaches to achieve specific areas of the vision. However, the challenge should begin at solidifying corporate relationships that will soon connect various industries towards the common goals that have been presented before all stakeholders. Therefore, the purpose of this paper is to develop a framework for corporate diversification, based on general business, industry environments and the firm’s characteristics, and its effects on performance, to prepare firms to better understand its environments and characteristics in the context of developing countries in general and Saudi Arabia in particular. Data was collected from 62 managers representing their respective firms in Saudi Arabia’s petrochemical, construction, banking and financial sectors, retail sectors, telecommunications and ICT, and the transportation sector. A combination of parametric and non-parametric tests was carried out using SPSS 22.0. The findings of this study suggest that the most used expansion strategy by far is internal capacity expansion. Additionally, businesses in Saudi Arabia mostly diversify by adding new products to their product line. Based on ResourceBased View (RBV), Skilled and competent technical staff, highly trained operatives, ability to access and retain highly qualified subcontractors and specialist labor factors were managed in most of the surveyed corporations. Further, almost all the surveyed corporations identified their strengths to be the skill and competency of their technical staff. Interestingly, however, communications and information technology were identified as the main weaknesses of these corporations. In the current state of things, a positive note is the indication that there have been improvements in the utilization of resources by these corporations, amongst some other benefits. However, the main barriers revealed the biggest concern being that there have been too many activities unrelated to the main business. This framework has never been tested on businesses in Saudi Arabia.

Keywords

Corporate Diversification, Strategic Management, Saudi Arabia, Vision 2030.

JEL Classification

L10, M10.

Introduction

The central issue addressed in the study of strategic management is how and why some firms outperform others in the market place. With an amplifying change in competition, globalization and economic-political environment, organizations are bound to think of strategies that can help them in achieving growth. In order to attain and sustain the competitive advantage, firms follow different strategic directions, for which one of the proven and highly praised methods is diversification. Diversification has long been a strategic decision that is often made to increase the corporation’s presence on the market either through internal growth methods or external means like acquisition of other companies in order to diversify the type and quality of products to cover a maximum part of the market and increase their reach to a wide range of customers.

The literature suggests that there have been plenty of work done on corporate diversification in the context of developed economies (Chen & Ho, 2000; Selcuk, 2015). However, less number and variety of diversification studies have been conducted in emerging economies (Wright et al., 2005; Hann et al., 2013). Moreover, the effect of diversification on firm value has been extensively researched in the US (Chen & Ho, 2000). Lins & Servaes (2002) investigated the issue of corporate diversification in emerging markets with a sample of over 1000 firms from seven emerging markets, concluded that the cost of diversification is high in emerging markets and less profitable then single segment firms. On the contrary, Khanna & Palepu (1997:2000) argue that diversification can be valuable in emerging markets because diversified firms can learn or imitate the beneficial functions of other institutions from the developed markets. They discussed many factors associated with this in emerging markets related to imperfections in capital markets, product markets, labour markets and businessgovernment relations.

Therefore, to bridge the research gap, the present research analyses the effect of diversification in emerging countries like Saudi Arabia. In this study the focus is on Saudi corporations and their diversification strategies based on the perceptions of key observers and personnel of companies in question and their comments on the most recurrent choices, strategies and modes of diversification.

The significance of the study stems from the fact that it applies the scope of the study to Saudi Arabia in accordance with the provisions of Vision 2030 in an overall atmosphere of lack of studies in this particular area in Saudi Arabia and with specific focus on the ways corporate diversification principles are understood and enacted by major listed corporations in the country. This obviously puts forward the alignment of corporate diversification with the aims and goals of Vision 2030 of Saudi Arabia that has set high targets and raised the bar for national and international companies alike.

The outcome of the present research is built on rational and empirical findings in a way that provides realistic and generalizable conclusions based on the statistical analysis of the data. This can be a great basis for managers and stakeholders in the companies in question as well as other companies offering them more insight into the core of the matter and offering them a better overview of all the possible strategies to undertake and the different diversification modes to maximize their competitive advantage in the market. The present research would also reflect upon the options and modes that should be avoided or disregarded in order to reach a much higher advantage level.

The use of the RBV principles (Resource Based Value) can also impact the decisionmaking tendencies in certain cases and offer a much more comprehensive understanding of the diversification mechanisms especially within an emerging economy. And this would serve as a logical and rational basis for decision makers in the Saudi government especially within the main market controlling ministries and agencies.

Literature Review

Businesses succeed when they possess some advantage relative to their competitors (Porter, 1996). Diversification is one of those strategic directions which companies takes, to expand via related or unrelated industries. Diversification is defined as the entry of the firm or business unit into new lines of activity, either by process of internal business development or acquisition. Diversified corporations have a significant role in economic development of the nation.

However, corporate diversification is a critical and challenging decision as it comes with both benefits and costs. Benefits from diversification can be through the creation of internal capital markets, and it can involve high cost in terms of value loss (Servaes, 1996) and agency cost (Goetz et al., 2013). According to the literature, the cost related to agency theory, states that managers undertake diversification for their own benefit, at the expense of shareholders. The challenging essence of diversification is even more visible through the study of the Indian market by Bathia & Thakur (2017), who have conducted a comparative study between the domestic companies and the multinationals operating in India from different angles including the nature, the extent and the patterns of diversification of each of the 536 sampled corporations using the Jacquemin-Berry entropy-index over three time points. Their results reflected that the domestic corporations have a much larger scope of diversification than the multinationals. And this shows the challenges that multinational corporations face in foreign markets. Yet when it comes to diversification itself, the researchers found that both domestic and multinational corporations prefer related diversification as for the pattern of diversification, it “follows both forward and backward movement while corporations with purely domestic operations have shown a greater trend towards forward pattern” (Bathia & Thakur, 2017).

Studies in the past have examined the effect of diversification on firm’s performance (Purkayastha et al., 2012) and firm’s value (Chen & Ho, 2000). Bullon & Bueno (2011) studied the joint effect of product and international diversification strategies on the performance of small and medium enterprises in Spain. They found that there is no association of product and international diversification with higher performance. The findings of their study suggest independent effects of profitability and interactive effects on risk-adjusted returns and growth. Another study investigates the effect of product and geographic diversification on performance with a moderating role of family involvement. Delbufalo et al. (2016) argued that the relationship between product diversification and performance is linear whereas relationship between geographic diversification and firm performance is inverted U shape. Similarly, Kim et al. (2017) studied how firms can find new business opportunities based on their technological capabilities. They found out that corporations can use different sourcing tools in order to understand the trend and direction in which their business sector is moving. According to them, information mining is a great and very helpful tool to decide on what kind of product or sector the corporation should bet. Aguiar & Reddy (2017) studied the motives that push the Fast Moving Consumer Goods corporations (FMCG’s) to diversify and measured the effect of diversification strategies on the financial ability of such firms. Their results show that diversification allowed corporations to enjoy a much stronger financial performance. Smith & Coy (2018) have also found similar results in various areas of business. They concluded that diversification models may vary but overall, they help firms improve their financial performance and stance in the market.

However, there is a lack of consensus on the relationship between diversification and firm performance among researchers. Some studies advocate a positive relationship between both (Chatterjee, 1986; Chang & Hong, 2000) whereas the others found a negative relationship between diversification and firm performance (Selcuk, 2015).

Ye et al. (2017) affirm that various diversification patterns and concepts are recurrently used by contractors and business owners on the global market as a proven strategy for “either growth, or risk management, or both in this competitive environment”. A great example of such diversification strategies comes from Pelaez & Mizukawa (2017), the focus of their study was on the diversification strategies used by the giant six pesticides corporations in the world (Monsanto, Syngenta, Bayer, Dow, DuPont, BASF). According to them, “the six largest agrochemical corporations went through a process of diversification through acquisitions and agreements starting in the mid-1990s, focused on R&D and production of Genetically Modified (GM) seeds by adding to their assets corporations with useful genetic engineering skills”.

Past studies suggest that the driving forces for firm to diversify can be synergy, resource sharing, risk reduction and/or market power. It is clear that diversification offers a growth strategy, which can promote regional and global spread to the company's market share. In studying corporate diversification, researchers have focused on the direction of diversification; studied product and international diversification (Delios et al., 2008; Kumar, 2009). Sukumaran et al. (2015) examined international diversification and the benefits of diversifying into new markets for Australian investors in comparison to US investors. Diversification is a viable growth strategy (Andersen & Kheam, 1998; Lo & Hsu, 2016) as it bestows synergy to the corporations adopting diversification. A firm may undertake different type of diversification to achieve synergies, the degree to which the combined use of firm resources produces results greater than is possible by individual components. Another study by Rijamampianina et al. (2003) focused on examining how firms can attain sustainable competitive advantage through diversification and proposed conceptual model for improved business performance. It recommends that concentric diversification must leverage off the existing firms competitive advantage in expanding into adjacencies.

Garrido-Prada et al. (2018) have explored the impact of product and geographical diversification on the performance of Spanish non-financial listed corporations. Their results reflect that the corporations combined product and geographic diversification which improved their performance. Vogl (2018) explored in his study how corporations use the right and most accurate product diversification strategies to guarantee the sustainability of their products and operations. He actually identified four different themes that can help a corporation remain sustainable for more than five years. He relates the success of product diversification to the accurate analysis of the business environment, the overall assets and capabilities of the corporation and above all the target market or customer base before choosing their diversification strategies. Other studies have been undertaken for various sectors of business and yielded similar appreciations of diversification strategies. Redpath et al. (2017) investigated Lufthansa Group (German) and Emirates Group (UAE) in the global airline sector to assess and understand their diversification strategies. According to Fellows & Purkayastha (2012), diversification is popular growth options for firms in both, developed and emerging countries. In developing economies, large conglomerates often controlled by family groups, are seen as prominent (Montgomery, 1994). Selcuk (2015) found that diversified firms in emerging markets are valued more compared to focused or single-segment firms operating in similar industries. The diversified business groups are significant players in many emerging economies (Kim et al., 2004). Unlike developed economies, emerging economies have challenges due to weak institutional infrastructure and uncertainties arising from political and economies instabilities (Hoskisson et al., 2000). In addition, lack of market based management skills pose another challenge for strategy decision. According to Wright et al. (2005), firms might face resource scarcity; therefore, a central challenge is the need to understand the barriers to the acquisition of the resources and capabilities. Another barrier to mobilizing the financial and human resources for launching new ventures in emerging economies is the weak market institution. Captivating the economy on the growth path requires government support in the way of incentives. In his book North (1990), uses U.S. economic history as an example of institutional changes that have occurred over time and have, for the most part, persistently reinforced the incentives for organizations to engage in productive activity. Therefore, a change to occur in emerging economies through corporate diversification indeed, needs the government support and incentives.

To sum up, the past studies on diversification have focused on these concerns: i) motives and challenges for diversification, ii) the value addition through diversification to the firm’s performance iii) the “extent” of diversification (less or more), iv) the “directions” of diversification (related or unrelated) and v) the “mode” of diversification (choice of acquisition, merger and internal expansion strategies). All the studies from extant literature are from developed economies. Therefore, looking at the studies from emerging economies in the GCC, we find there is a huge gap in the empirical or conceptual research in this area. A study by Epps & Demangeot (2012) on the challenges and opportunities of diversification in United Arab Emirates found that strategic thrust to diversify its economy is to insulate it from the dependence on oil price fluctuations which is the same contextual approach to our study on Kingdom of Saudi Arabia.

Theoretical Bases

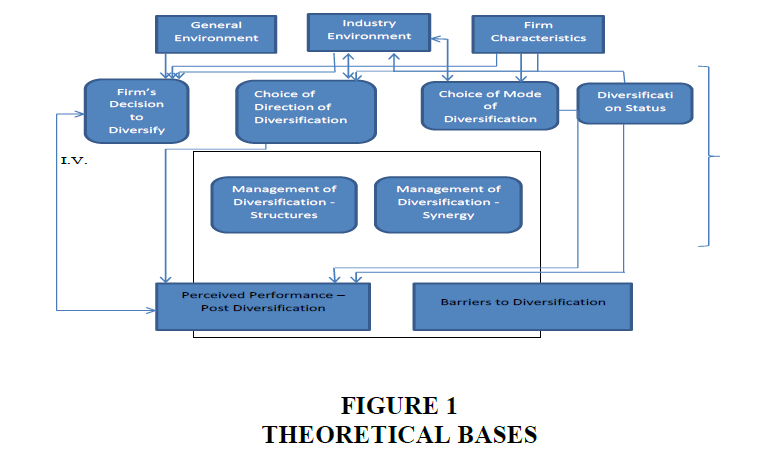

The above Figure 1 is proposed to categorize fundamental aspects of strategic management that is deemed important. This was developed to be used as a provisional framework for achieving the research goals and in the development of the research instrument. The above figure is made up of 11 elements identified through a literature study that represent strategic management and corporate diversification theories to inform the research study. The top three “squares”-the general environment, industry environment, and firm characteristicsrepresent the most fundamental strategic management conceptual themes. For this reason, these will not be discussed in this section. Only the rest of the “squares” below those at the top are of the theories of diversification are discussed.

It has been suggested that a list of factors may influences a firm to diversify. As the decision to diversify is made, the following activity to inform the research is that of the direction for firms to diversify. A firm undergoing diversification is basically evaluating and finding ways to make proper changes to its business to improve the firm’s abilities and achieve its objectives. Studies investigating the patterns of diversification find that firms tend to diversify into industries that are similar to their primary industry in terms of advertising intensity, R&D intensity, and/or buyer/seller relationships (Zahavi & Levie, 2013). Booz, Allen & Hamilton uses the following dimensions to describe the direction of diversification: technologies, product and services, geographic markets, customer segments, and distribution channels. Such diversification is commonly described in strategic management literature as related diversification. Sometimes, however, diversification is undertaken by way of vertical integration (i.e. integrating backward or forward) or by way of exploiting capital market imperfections. Such diversification usually represents entry into unrelated businesses.

The next theme to inform the research is the mode of diversification. What researchers meant refers to the degree to which the firm relies on internal business development rather than acquisitions as a means of entering new lines of activity. Here, the extremes are “internal growth” versus “acquisition-based growth”; however, a mixing of the modes is also possible (Chakrabarti & Mitchell, 2004). It is to note that the rising cost of internal development with the shortening of product life cycle has rendered acquisition-based diversification increasingly attractive to firms. A part of this section in informing the research, therefore, focuses on acquisitions and mergers as a strategy of growth.

Over a course of time, a firm has pursued various diversification initiatives and projects, by whichever approach it chooses for growth, it attains a certain status, if you will. Diversification status in the form of vertically integrated, related-diversified, or unrelateddiversified is identified.

As the firm’s scope of diversification increases, the challenges of managing diversification strategies increase dramatically. The two sections shown in the figure represent the growing challenges on the implementation and management aspects of diversification. Finally, differences in the way diversified firms seek, obtain, and exploit synergies are often traced to their functional or departmental policies (R&D, Marketing, Finance, etc.); therefore, the foci to the sources and synergy are justified in this study.

Methodology

The chosen methodology for this study was an exploratory and descriptive research approach since the area of study is relatively new in Saudi Arabia. The quantitative data collection technique was used since it allows for deductive inferences-which also reduce the expense of surveying an entire population. It also allows the researcher to establish measurements and identify relationships between variables. Therefore, objectives of the present study are; to assess the corporate diversification strategies of holding or diversified corporations in Saudi Arabia, and to ascertain the major challenges of corporate diversification experience (verified from the primary data).

As a result of distinct sample sizes from the target population (public listed corporations listed under Petrochemical, Construction, Banking/Finance, Telecommunication/ICT, and the Transportation sectors) extracted from the Saudi stock exchange (Tadawul), a selective sampling method is adopted. Resource Based View (RBV) of the firm defines Resources as stocks of available factors that are owned or controlled by the firm, as well as the Capabilities of the firm to use these resources to provide enhance productivity, this study will use this perspective to look at the different nature of resources and the varying levels of capabilities of the Saudi firms in their corporate diversification strategies. These capabilities and resources may serve as a source of competitive advantage.

The data collected was analyzed using software Statistical Package for Social Sciences (SPSS) 22.0. Relationship between diversification strategies and financial performance and growth was explored. A combination of parametric and non-parametric tests was carried out, based on the nature of the data collected. Analysis of variables was presented through descriptive statistics which included: mean and standard deviation statistics; ranking statistics; frequency tables, histograms, bar charts, cross tabulations and significance tests.

In addition to minimizing errors, researchers tested the validity of the research according to validity. Validity measuring described by Messick (1987) is the following: content validity, predictive and concurrent criterion-related validity, and construct validity. For the purpose of this study we applied his descriptions of predictive and concurrent criterion under the category of criterion-related. Validity was tested through face validity in which the questionnaire was developed in relation to the study’s objectives.

Research Instruments and Sample

The main research instrument was a questionnaire with four subsections; first section of solicits information on the background, experience and position of the personnel completing the questionnaire; the second section seeks information on the profile of the firm while third section solicits information on the firm’s strengths and weaknesses. The fourth section collects information on the challenges and threats to the growth of the firm and last section solicits information on diversification in the firm. The population for this study consists of managementlevel stakeholders from the firms which are registered in the Saudi Stock Exchange (Tadawul), as at November 2017. As public listed corporations, they are considered to have the organizational structure, human capital, strategic assets and the financial resources to be able to initiate corporate diversification.

Results

This section presents the results of data analysis. Table 1 shows that the most preferred mode of expansion by 77% of the participated corporations was “Internal capacity expansion”, followed by “Acquisition” and “Joint Ventures” (37% and 34%, respectively), while only 11% of participated corporations stated “Mergers” as their strategy of expansion. In addition, data shows that 48% of the corporations that participated in the study were operating outside Saudi Arabia, and around a quarter of them were operating in 1-5 countries, another quarter were operating in 6-10 countries, while one fifth of the corporations were operating in 11-20 countries around the world, and another one fifth of the participated corporations were operating and working in more than 100 countries around the world.

| Table 1: Companies Background Characteristics (Profile) | ||

| Frequency | Percent | |

|---|---|---|

| Major areas of specialization | ||

| Banking/Financial institutions | 11 | 17.70% |

| Retail | 6 | 9.70% |

| Telecommunications and ICT | 18 | 29.00% |

| Others | 27 | 43.50% |

| Total | 62 | 100.00% |

| Corporation’s strategy of expansion | ||

| Internal expansion | 48 | 77.42% |

| Mergers | 7 | 11.29% |

| Acquisition | 23 | 37.10% |

| Joint Ventures | 21 | 33.87% |

| Total | 62 | 100.00% |

| Operating outside KSA | ||

| Yes | 30 | 48.40% |

| No | 32 | 51.60% |

| Total | 62 | 100.00% |

| Number of countries in which business is done | ||

| 1-5 | 8 | 26.70% |

| 6-10 | 8 | 26.70% |

| 11-20 | 6 | 20.00% |

| 21-50 | 1 | 3.30% |

| 50-100 | 1 | 3.30% |

| 100+ | 6 | 20.00% |

| Total | 30 | 100.00% |

In order to determine the factors within and outside the corporation that influences their growth and successes, some information was collected about the corporation’s current status about the factors shown in Table 2. It is clear that almost all respondents stated that all the 19 factors are present in the companies, where skilled and competent technical staff, highly trained operatives, ability to access and retain highly qualified subcontractors and specialist labor factors were strongly focused in 50% of the participated corporations. In addition, financial base and ability to support client financially, access to credit/finance, professionalism and reputation, creativity/innovation in delivery process, ability to build long term relationships with customers, goodwill and brand name of the enterprise, high quality of products and services factors which were very strongly present in more than 40% of the corporations. Which indicated that almost all factors that influences company’s growth and successes were concentrated in their organization (statistically significant at p-value=0.05).

| Table 2: Company’s Current Status About The Following Factors | |||

| Factors | Current status (in percentage) | ||

|---|---|---|---|

| Weak1 | Moderate | Strong2 | |

| Skilled and competent management staff. | 2 | 11 | 87 |

| Highly trained operatives. | 3 | 26 | 71 |

| Adequate plane and equipment. | 7 | 29 | 65 |

| Financial base and ability to support client financially. | 5 | 26 | 69 |

| Flexibility in operation and organization structure. | 8 | 42 | 50 |

| High overhead costs. | 8 | 45 | 47 |

| Sound financial management practices. | 3 | 23 | 74 |

| Access to credit/finance. | 3 | 21 | 76 |

| Ability to access and retain highly qualified subcontractors and specialist labor. | 5 | 19 | 76 |

| High quality of products and services. | 7 | 27 | 66 |

| Age of corporation and experience. | 3 | 21 | 76 |

| Goodwill and brand name of the enterprise. | 3 | 16 | 81 |

| Ability to build long term relationships with customers. | 3 | 16 | 81 |

| Creativity/Innovation in delivery process. | 7 | 26 | 68 |

| Professionalism and reputation. | 6 | 11 | 82 |

| Use information and communication technologies (ICT). | 3 | 50 | 47 |

| 1. It is a combination of very weak and weak. | |||

| 2. It is a combination of very strong and strong. | |||

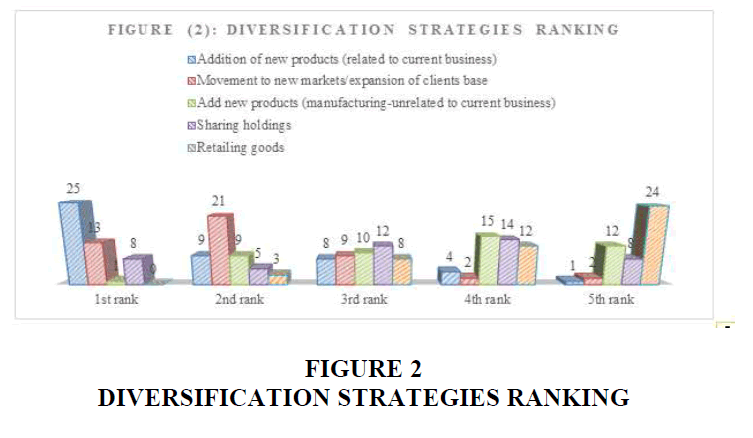

The results indicate strong correlation between presence of the factors and the level of its influence on the organization’s growth which implies increase in sales volume/turnover, fixed assets, employee size, profit and shareholders’ funds. So it was clear for any factor, the higher the presence of factors in the corporation the greater its influence on the corporation growth and success (statistically significant at p-value=0.05). Figure 2 depicts diversification directions and strategies opted by corporations in Saudi Arabia, data shows that “Addition of new products” is the most preferred diversification strategy by around 58% of the corporations participated in the study, followed by “Movement to new markets/expansion of client’s base” which was chosen by around 52% while “Retailing goods” is the least option for corporations as a diversification strategy.

On the other hand, data collected and analyzed showed insignificant relation between management structure of the company before and after diversification, where 33% of corporation’s management structure was same “Functional” before and after diversification. While only 7% of the company’s management structure was formerly “Functional” and after diversification became “Regional administration” (Statistically insignificant at p-value=0.05).

Table 3 shows the results of correlation matrix between main factors in the data. It is clear that there is a highly significant relationship between current status of some factors in the corporation and growth factors. In addition, to the presence of significant relationship between growth of a company with motivation factors and challenges facing them.

| Table 3: Inter-Factors Correlation Matrix | ||||||

| Status of some factors | Growth factors | Challenges/ Threats | Motivation | Growth of Corporation | ||

|---|---|---|---|---|---|---|

| Presence of some factors in the corporation | Correlation Coefficient | 0.911 | ||||

| Growth factors | Correlation Coefficient | .788* | 0.936 | |||

| Challenges/Threats | Correlation Coefficient | -0.15** | -0.177* | 0.843 | ||

| Motivation | Correlation Coefficient | .668* | 0.439* | -.266** | 0.754 | |

| Growth of Corporation | Correlation Coefficient | .455** | 0.432* | .403** | .517** | 0.838 |

Reliabilities are presented on the diagonal; *p<0.01; **p<0.05.

Discussion

The first objective was to assess different corporate diversification strategies that businesses in Saudi Arabia undertake. The answers were not homogeneous but eventually revealed that the most popular strategy of expansion which was preferred by over majority of the sampled companies was “Internal capacity expansion”, depicting that companies usually opt for the most secure and low-risk options that guarantee a smooth and practical diversification process. The internal capacity expansion which is generally a horizontal related diversification scheme seems to be popular since the company is not venturing into unknown areas of business where experience and tact are highly important. However, the fact that most of the surveyed companies had business operations in a number of countries indicates that these companies are not only into internal capacity expansion but they have successfully ventured into international markets where they can acquire cheaper resources.

According to the RBV, the acquisition of rare and valuable tangible and intangible resources is vital to the growth and prosperity of the companies. The acquisitions and mergers as well as joint ventures might be the best option to reach out for a much more vibrant market than the domestic one with varying factors of pricing, resources availability, cheap labor and land in most cases. Yet to drive such diversification efforts the companies needs to enjoy a strong basis of intangible asset especially the unique and valuable skill of top management and technical employees involved in the process. As mentioned earlier, it seems that one of the most important factors that intervene in the success or failure of the diversification strategy is whether or not the company is tactically and strategically ready for the change. Readiness for future plans obviously stems from the adequacy of the current assets that the corporation possesses. The highest and most valuable assets for the corporation as shown in the results of the survey are the skilled and competent management teams and technical staff as well as highly trained operatives. In addition to that, the high overhead costs are also considered as a moderate weakness that the companies still have to deal with.

The challenges for diversification were identified as; the high entry barriers, the use of the lowest bid competitive tendering, globalization and the lack of technical skills for certain projects. The obstacles and challenges found in the present research also coincide with the findings of Hoskisson et al. (2000) who report that emerging economies have challenges due to weak institutional infrastructure and uncertainties arising from political and economies instabilities in addition to the lack of market based management skills that pose another challenge for strategy decision. The findings discussed above also state that some of the most important obstacles are related to the lack of a clear market assessment and the lack of appropriate technical knowledge and transferable knowledge needed for certain projects along with the constantly fluctuating regulatory frameworks in Saudi Arabia.

The results of the present study support the findings of Bathia & Thakur (2017) who found that corporations prefer related diversification. In fact, most of the corporations preferred related internal lateral diversification to other modes and strategies of diversifications. In line with what Garrido-Prada et al. (2018) and Vogl (2018) have expressed in their studies, the present research revealed that the diversifications of related products as well as the annexation of other diversification strategies have indeed proven their effectiveness in raising a corporation’s profitability and performance levels. This research also concludes that a careful analysis of the market and a good analysis of the customer base are vital to the success of the diversification process.

Conclusion

The findings of this research come in concordance with most of the literature studied at the beginning of this paper especially when it comes to the fact that businesses succeed when they possess some advantage relative to their competitors. On the benefits that diversification brought to the corporations in question, most of the respondents testified that the corporations experienced a great improvement in the utilization of resources. Moreover, some of the participants reported that their company’s asset turnover increased, the overall sale volume increased, and the corporate image has improved. From the resources based view of the firm, it seems that the Saudi companies are indeed aware of the importance of acquiring highly skilled and competent management and technical staff before venturing into diversification endeavors. On another level, the study has established that diversification offers a growth strategy and it has been statistically proven that diversification offered Saudi companies several competitive advantages especially that many among them operate in numerous countries globally.

The study is particularly significant for emerging economies. It will contribute to this body of knowledge and research through evidence for diversification across a large sample of firms from emerging market. Moreover, it is important for managerial and public policy concern. The limitation that this research work faced was mainly in the access to the respondents because of the wide base of respondents and the varied sectors in which the respondent companies are working.

Acknowledgement

This work was supported by the research project corporate diversification in an emerging economy; Prince Sultan University; Saudi Arabia grant number IBRP-CBA-2016-11-30. Authors acknowledge the contribution provided by the participants and faculty members including Dr. Allwiya Allui in this research.

References

- Aguiar, E., & Reddy, Y.V. (2017). Corporate diversification on firm's financial performance: An empirical analysis of select FMCG corporations in India. Management Today, 7(4), 194-205

- Andersen, O., & Kheam, L.S. (1998). Resource-based theory and international growth strategies: An exploratory study.International Business Review,7(2), 163-184.

- Bhatia, A., & Thakur, A. (2017). Choice of diversification strategies in an emerging market environment: An empirical evaluation.International Journal of Business and Globalization,19(1), 52-78.

- Chakrabarti, A., & Mitchell, W. (2004). A corporate level perspective on acquisitions and integration. InAdvances in Mergers and Acquisitions(pp. 1-21). Emerald Group Publishing Limited.

- Chatterjee, S. (1986). Types of synergy and economic value: The impact of acquisitions on merging and rival firms.Strategic Management Journal,7(2), 119-139.

- Chen, S.S., & Ho, K.W. (2000). Corporate diversification, ownership structure, and firm value: The Singapore evidence.International Review of Financial Analysis,9(3), 315-326.

- Delbufalo, E., Poggesi, S., & Borra, S. (2016). Diversification, family involvement and firm performance: Empirical evidence from Italian manufacturing firms.Journal of Management Development,35(5), 663-680.

- Epps, A., & Demangeot, C. (2013). The rainbow of diversity versus the rain of fragmentation: The futures of multicultural marketing in the UAE.Foresight. The Journal of Future Studies, Strategic Thinking and Policy,15(4), 307-320.

- Garrido-Prada, P., Delgado-Rodriguez, M.J., & Romero-Jordán, D. (2018). Effect of product and geographic diversification on corporation performance: Evidence during an economic crisis.European Management Journal.

- Goetz, M.R., Laeven, L., & Levine, R. (2013). Identifying the valuation effects and agency costs of corporate diversification: Evidence from the geographic diversification of US banks.The Review of Financial Studies,26(7), 1787-1823.

- Hann, R.N., Ogneva, M., &Ozbas, O. (2013). Corporate diversification and the cost of capital.The Journal of Finance,68(5), 1961-1999.

- Hoskisson, R.E., Eden, L., Lau, C.M., & Wright, M. (2000). Strategy in emerging economies.Academy of Management Journal,43(3), 249-267.

- Khanna, T., & Palepu, K. (1997). Why focused strategies may be wrong for emerging markets.Harvard Business Review, 77, 3-10.

- Khanna, T., & Palepu, K. (2000). The future of business groups in emerging markets: Long-run evidence from Chile.Academy of Management Journal,43(3), 268-285.

- Kim, H., Hong, S., Kwon, O., & Lee, C. (2017). Concentric diversification based on technological capabilities: Link analysis of products and technologies.Technological Forecasting and Social Change,118, 246-257.

- Kim, H., Hoskisson, R.E., Tihanyi, L., & Hong, J. (2004). The evolution and restructuring of diversified business groups in emerging markets: The lessons from Chaebols in Korea.Asia Pacific Journal of Management,21(1-2), 25-48.

- Kumar, M.V. (2009). The relationship between product and international diversification: The effects of short?run constraints and endogeneity.Strategic Management Journal,30(1), 99-116.

- Lins, K.V., & Servaes, H. (2002). Is corporate diversification beneficial in emerging markets?Financial Management, 31, 5-31.

- Lo, F.Y., & Hsu, M.K. (2016). Business group's diversification strategy and sustainability.International Journal of Business and Economics,15(1), 35-49.

- Messick, S. (1987). Validity. In: Lirm, R.L. (ed.), Educational Measurement. New York.

- Montgomery, C.A. (1994). Corporate diversification.The Journal of Economic Perspectives,8(3), 163-178.

- Pelaez, V., & Mizukawa, G. (2017). Diversification strategies in the pesticide industry: From seeds to biopesticides.Ciência Rural,47(2).

- Porter, M.E. (1996). What is strategy? Harvard Business Review, 74(6), 61-78.

- Purkayastha, S., Manolova, T.S., & Edelman, L.F. (2012). Diversification and performance in developed and emerging market contexts: A review of the literature.International Journal of Management Reviews,14(1), 18-38.

- Redpath, N., O'Connell, J.F., & Warnock-Smith, D. (2017). The strategic impact of airline group diversification: The cases of emirates and lufthansa.Journal of Air Transport Management,64, 121-138.

- Rijamampianina, R., Abratt, R., & February, Y. (2003). A framework for concentric diversification through sustainable competitive advantage.Management Decision,41(4), 362-371.

- Servaes, H. (1996). The value of diversification during the conglomerate merger wave.The Journal of Finance,51(4), 1201-1225.

- Smith, G.C., & Coy, J.M. (2018). Corporate diversification: Can the observed diversification discount shed light on management’s choice to diversify or re-focus?Review of Accounting and Finance,17(3), 405-424.

- Sukumaran, A., Gupta, R., & Jithendranathan, T. (2015). Looking at new markets for international diversification: frontier markets.International Journal of Managerial Finance,11(1), 97-116.

- Vogl, J.D. (2018). Implementing product diversification strategies for small and medium retail businesses' sustainability. Walden Dissertations and Doctoral Studies.

- Wright, M., Filatotchev, I., Hoskisson, R.E., & Peng, M.W. (2005). Strategy research in emerging economies: Challenging the conventional wisdom.Journal of Management Studies,42(1), 1-33.

- Ye, M., Lu, W., Ye, K., & Flanagan, R. (2017). How do top construction corporations diversify in the international construction market? InProceedings of the 20th International Symposium on Advancement of Construction Management and Real Estate(pp. 101-110). Springer, Singapore.

- Zahavi, T., & Lavie, D. (2013). Intra?industry diversification and firm performance. Strategic Management Journal, 34(8), 978-998.