Research Article: 2023 Vol: 27 Issue: 2S

Corporate Social Responsibility and Debt Level : empirical study in the tunisian context

Abir Zouaghi, University of Monastir

Mohamed Ali Azouzi, University of Sfax

Citation Information: Zouaghi, A., & Azouzi, M.A. (2023). Corporate Social Responsibility and Debt level : Empirical Study in the Tunisian Context. Journal of Organizational Culture Communications and Conflict, 27(S2), 1-10.

Abstract

The objective of this study is to investigate the relationship between corporate social responsibility and debt financing acces. After discussing the theoretical link between these types of activities and debt financing, we perform binary logistic regression on the data of 100 Tunisian firms in order to empirically show the effect of CSR on access to debt. Our result indicate a significant and positive relationship between CSR and debt, which means that socially responsible firms access to debt more than other financing modes because CSR improves the reputation of the firm and facilitates their access to debt and therefore improves its ability to acces to debt.

Keywords

Corporate Social Responsibility, Debt Financing, Financial Theory, Binary Logistic Regression

Introduction

Since the end of the 20th century, the notion of sustainable development has come an interesting axis for everyone because of the dangerous results of destructive events similar as wars, atomic bombs and natural disasters. Also, the phenomenon of sustainable development appears in order to find results to reduce or indeed avoid these results.

In this context, companies play an essential role in the implementation of the foundations of sustainable development, which is reflected in the birth of corporate social responsibility (CSR), defined by the World Bank at 2003 as : the commitment of companies to contribute to sustainable economic development by working with employees, their families, the local community and society as a whole to improve the quality of life in a way that is both good for business and good for development.

Moreover, during the past years, Corporate Social Responsibility is a privileged research object in management sciences, some researchers have focused considerable attention to study its financial impacts. Indeed, a large literature reveals the impact of CSR on the financial performance of the firm. Similarly, previous literature has recorded an increasing focus on the strategic effects of CSR performance on firm value and reputation. Similarly, previous literature has recorded an increasing focus on the strategic effects of CSR performance on firm value and reputation. In addition, other research has shown that social responsibility also influences capital structure of firms.

So the decision to access to the debt is well explained theoretically, Modigliani & Miller (1959) were the first to conduct a real theoretical reflection on firm financial structure, they have shown that debt is less preferred than other financing choices because of the absence of leveraging effect. Then in 1963, they adjusted their reasoning for his first model by rejecting the no-taxes hypothesis, they confirmed the existence of an optimal capital structure where the use of debt is maximized and consequently the maximization of the firm's value. Miller (1977) adjusted the Modigliani & Miller (1963) model, he added the concept of individual taxation to show the impact of personal taxation on access to debt, he found that individual taxation rejected the preference for debt over other forms of financing. Then, major theories emerged over the years following the hypothesis of market perfection on which the model of Modigliani & Miller (1959) is based, they explained the capital structure based on the hypotheses of market imperfections, such as the positive agency theory, the theory of transaction of cost economics, the signal theory, the Static Trade theory, and the Pecking Order Theory.

Thus, although capital structure is well explained theoretically, few previous studies have investigated the relationship between CSR and debt financing. Moreover, the empirical results of these studies are mixed, some studies show that firms with social activities have easy access to debt Latapí Agudelo et al. (2019) as they build close relationships with stakeholders to support their activities in times of crisis. While other studies show a negative relationship between CSR and access to debt.

Than, to achieve our aims, we obtain a sample of 100 Tunisian companies. The choice of the Tunisian context is motivated by the growing interest in encouraging companies to introduce CSR in their daily financial management. Indeed, different actors encourage companies to invest in this type of activities. Recently in December 2021, the Tunisian Stock Exchange published a Guide to ESG reporting (Environmental, Social and Governance), destined in particular to companies to better explain the basics of CSR and to encourage them to invest in this type of activities.

To determine the nature of the direct relationship between CSR and each financing method, we compose three econometric models and perform the binary logistic regression test on each model.

Literature Review

Corporate Social Responsibility

It is difficult to find a common definition of CSR that is universally accepted. Indeed, a long and varied history is associated with the evolution of the definition of this notion, which is characterized by the existence of several contributions all searching to clarifying the same phenomenon.

Thus, the first conceptualization of CSR was developed in 1953 by the economist Howard R. Bowen, who is qualified as the father of modern responsibility, he defined it as « CSR refers to the obligations of businessmen to pursue those policies, make those decisions or follow those courses of action that are desirable in terms of the objectives and values of our society.

So Joseph W. McGuire is another major contributor to the definition of social responsability. In 1963, he stated in his book Business and Society that : The idea of Social responsibility assumes that the company not only has economic and legal obligations, but also some responsibilities to society that will beyond these obligations.

Furthermore, added that socially responsible companies have obligations to different stakeholders in society, he identified CSR as : the idea that companies, beyond legal or contractual requirements, have an obligation to societal obligation to societal actors.

In this same sense, Donna J. Wood in 1991 explained the concept of CSR differently from her predecessors and placed it in a larger context than a simple definition. She tried to show the performance and application results of CSR, she postulated that the concept of CSR represent the result from the reaction between its principles with its different levels : the meaning of social responsibility can only be understood through the interaction of three principles: legitimacy, public responsibility and managerial discretion. These principles result from the distinction of three levels of analysis : institutional, organizational and individual.

In addition, we should mention the definitions developed by international institutions such as the one published by the World Business Council for Sustainable Development development in 1999 : the continuing commitment of companies to act ethically and to contribute to economic development, while improving the quality of life of its employees and their families, the local community and society as a whole society

Hypotheses

Corporate social responsibility and debt acces: The CSR-debt relationship has attracted the interest of many scholars who have worked to better understand these concepts and their interactions. First, previous studies reveals theoretically that CSR activities designate both of a surveillance and a signal tool to mitigate information asymmetry and reduce agency costs among stakeholders including creditors. Since firms with a solid CSR are more likely to disclosure information about their extensive social activities in order to protect their reputation to the market.

In the same line, these CSR disclosures can provide relevant and complementary nonfinancial information to the financial statements that reflect a picture on the sustainability of the company and subsequently they help convince credit providers.

In addition, other studies have also shown that the adoption of CSR strategies and the availability of credible CSR data reduce information asymmetry and agency conflicts and reduce capital constraints and support better relationships with their key stakeholders hence a better relationship with lenders and banks (La rosa et al., 2018).

On the other side, have shown empirically that socially responsible investment reduces the credit risk of the company. This result has also been validated by several other researches such as the studies of Indeed, because the effect of CSR on improving transparency of information and reducing the risk of financial distress for companies, banks and credit rating agencies are more likely to provide positive assessments of the future performance of companies that implement and report on CSR strategies than those that do not.

Moreover, that investors including banking institutions, acquire good impressions as a result of CSR practices adopted by the company, analysts give better credit ratings. Banking institutions do not have a social agenda to promote, but only care about the borrower's solvency and ability to repay its loan obligations so they concluded that the effect of CSR is economically low.

In addition, the social firms face lower debt costs than other non-social firms. Similarly, that firms with good environmental performance face higher bond yields but also have higher leverage. They interpret this as responsible firms having easier access to debt financing.

In this context, other recent studies have empirically validated that socially responsible companies are more likely to use debt, such as :

Yang et al. (2018) study the effects of CSR on information asymmetry between firms and their lenders. Their empirical results show that firms that employ CSR strategies have higher leverage than others without CSR. Their empirical results show that firms that employ CSR strategies have higher leverage than others companies.

They find that CSR reports provide long-term predictions to credit issuers allowing the firms that issue these reports maintain higher long-term leverage compared to firms that not integrate CSR into their operations. The authors conclude that CSR can significantly reduce the information asymmetry between firms and credit suppliers. These results are consistent with those found by Xu et al. (2020) who showed that obligatory CSR disclosures by Chinese firms also give firms with CSR investments better access to bank loans.

For example, the relationship between CSR success and the ability to receive bank loans in China during 2010-2015. The results showed that firms with better CSR performance have a positive correlation with the firm's ability to access bank loans more.

Thus, using a panel dataset of French companies listed on the Paris Euronext stock exchange between 2010 and 2015, Hamrouni et al, (2019) find a positive correlation between social activities and debt ratio.

Recently, on a sample including 52 Tunisian listed and unlisted firms during 2017, Azouzi (2022) showed a positive and significant relationship between social responsibility and debt ratio. This result can be interpreted through that social activities designate a positive signal and then they favor the access to debt.

Summarizing, the above theoretical and empirical studies reveal the reasons why ethical firms choose to access debt to finance themselves. Indeed, it explained by the role of CSR in reducing credit constraints or inability to borrow such as information asymmetry and financial risk and cost of debt, and as a consequence banks grant more attractive credit conditions for socially responsible firms. As a result, these firms increase their level of debt in order to benefit from the gains of CSR. This leads to the following hypothesis:

H1 : social activities increase companies access to debt

Research Methods

Data

As part of our research, we chose to use a survey as a method of data collection because of lack of indices and social relationships in the Tunisian context. The questionnaire was administered face-to-face with respondents. We opted for this method in order to be close to the respondent in case of misunderstanding of certain terms and for traduction or explication needs. Moreover, this method offers more flexibility compared to other methods by phone or email.

In addition, some data are extracted directly from individual financial statements published on the Tunisian securities exchange, annual reports published on the scientific market board, and corporate websites.

To note, the empirical tests are based on 100 non financial tunisian firms during the 2021 fiscal year (41 are listed companies and 59 are non listed companies). All financial enterprises (including banks, insurance companies) were excluded from the selection of the sample since companies in this sector have a fundamentally different financial structure.

Variables’ Measurement

The objective of this section is to determine the variables measurement :

Dependant Variable : Debt level

There is a variety of previous studies that have attempted to measure the level of debt use in the capital structure by the debt ratio. Other studies have measured the medium and long-term debt ratio, while measured the short-term debt ratio.

Thus, as part of our analysis, we propose to use the debt ratio as a measure of this variable, This ratio is calculated by:

Leverage Ratio (LR)=Total Debt / Total Assets

This measure is commonly used in previous studies, it is also used by (Samet et al., 2018; Xu et al, 2020; Samet et al., 2018; Azouzi, 2022; Hamrouni et al, 2019). A positive change indicates the use of debt.

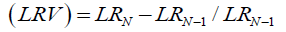

Then to show that the company has accessed on debt, the change in the variation ratio is calculated by :

Leverage ratios variation

Independent Variable: Corporate Social Responsibility

In this study, we measure societal responsibility as a binary variable by referring to previous studies by Foukal & Radi (2020). According to a binary variable is "a qualitative variable that can only take two modalities often coded as 1 or 0". Indeed, for unlisted companies, CSR is measured by a score composed of the sum of the answers to the 10 items of a questionnaire. The method of measuring CSR following a survey has also been used by several previous studies such as (Olfa & Ezzeddine, 20007 ; Dkhili & Ansi, 2012 ; Chtourou & Triki ,2017 ; Suto & Takehara, 2017).

Then, based on the scores obtained from the perceptual measurement by questionnaire CSR takes the value 1 if the company having a high CSR score, it was considered socially responsible and 0 if it has a low CSR score, it was indicated as not socially responsible (Azouzi, 2022).

Profitability : The most profitable companies have more internal financial resources to finance its new investments. If their managers follow a hierarchical order in their access to financing, they will be less inclined to obtain external financing. Then, the debt ratios of these firms will be lower. In the static trade theory, this relationship is reversed, as more profitable firms are less exposed to the risks of failure. As a result, their expected risks of failure are reduced and they can make greater use of the tax benefits provided by debt, thus they choosing a higher debt position. This variable is measured by the “Ratio On Assets” asset profitability ratio, which is considered an indicator of the company’s profitability, is defined as the ratio of profits before taxes and interest to the book value of all assets in the preceding year (Azouzi, 2019)

ROA= earnings before interest and taxes/total assets, lagged one year.

Profitability: The most profitable companies have more internal financial resources to finance its new investments. If their managers follow a hierarchical order in their access to financing, they will be less inclined to obtain external financing. Then, the debt ratios of these firms will be lower. In the static trade theory, this relationship is reversed, as more profitable firms are less exposed to the risks of failure. As a result, their expected risks of failure are reduced and they can make greater use of the tax benefits provided by debt, thus they choosing a higher debt position. This variable is measured by the “Ratio On Assets” asset profitability ratio, which is considered an indicator of the company’s profitability, is defined as the ratio of profits before taxes and interest to the book value of all assets in the preceding year (Azouzi, 2019) ROA= earnings before interest and taxes/total assets, lagged one year

Firm size: The size of the company is considered as an important variable impacting the capital structure of the company. Previous studies suggest that the probability of failure is lower in large firms and therefore their debt capacity is higher than that of small firms. On the other side, fixed transaction costs may make new equity issues unattractive for small firms, which encourages them to issue debt.

This variable has been used by the majority of studies as a control variable but it has been approached differently: either by the number of employees, or by the turnover, and it can also be measured by the logarithm of total assets.

In this study we chose to measure firm size by the logarithm of total assets.

Size=ln (total assets).

Firm age:The age of the enterprise is considered as an indicator that affects funding decisions. The logic in this context is that older and more established companies have a greater ability to borrow more debt.

In our study, we approached the "age" variable as a dummy variable where a young firm refers to a firm that has been operating for less than five years takes the value 0 and a mature firm is more than five years which takes the value 1 (Azouzi 2019).

Gender diversity: Some previous studies have shown that the gender of the company's CEO has an effect on funding decision making. First the studies by Hernandez et al. (2015) argue that women are more risk averse than their male CEO. In other words, women make low-risk decisions, while men make high-risk decisions. For example, male borrowers have a higher risk of excessive debt than their female homologues. This result can be explained by women's risk aversion doctrine to avoid the probability of firm's financial distress risk, meaning that women have less use of debt compared to other financing methods that are less risky. The gender diversity variable is approached as a dichotomous variable that takes 1 if the CEO of the company is a woman, and 0 if the CEO is a man (Hernandez et al., 2015).

Board size: Board size is also a factor that can influence capital structure decisions, according to that a company with a large board of directors uses more debt. Indeed, the large board of directors allows to reduce the asymmetry of information due to the rigorous surveillance of the board members, they are able to ensure the good functioning of their company in order to maximize their value, on the other part, the creditors will perceive that the companies with a large board of directors have the capacity to maintain their reputation and their value. From this perspective, the cost of debt will be lower for larger boards, and thus they catalyze firms' access to debt financing. Board size is calculated by the total number of board members (Zaid et al., 2020).

For simplification purposes, the summary of each variable extent range in the model, its name as well as its expected impact on the firm assets specificity choice are depicted in Table 1.

| Table1 Operational Definitions Of Variables |

||||

|---|---|---|---|---|

| Class | Phenomena | Measure | Variables | Predictions |

| Endogenous variables | ||||

| Debt level | Debt access | Leverage ratios (LEV)= (total debt / total assets) Leverage ratios variation=LEVN- LEVN-1 / LEVN-1 1: if there is a positive variation, 0 if not | LEV | |

| Exogenous variables | ||||

| Corporate Social Responsibility |

Expresses corporate commitment to socially responsible activities | The score obtained by the questionnaire 1 : if the company has a high CSR score 0 : if not | CSR | + |

| Profitability | Indicates the ability of companies to meet their commitments | ROA=earnings before interest and taxes/total assets, lagged one year | ROA | + |

| Firm size | Expresses the performance of companies | Size=ln (total assets) | FSIZE | + |

| Firm age | Expresses the reputation of companies | 1 : if the company is more than five years old 0 : if not | FAGE | + |

| Gender diversity | Represents the CEO's financial decision | 1 : if the CEO is a woman 0 : if not | GD | - |

| Board size | Influences financing decisions | Total number of members of board of directors | BSIZE | + |

Empirical Model

We chose to use binary logistic regression on the different variables : It is a question of explaining access to debt by using the different variables selected.

Empirical Results

Validation of the Items Concerning corporate social responsability: Questions on CSR activities have a Cronbach's alpha value of (α=0.899) is higher than the heavily used reference value of 0.7. Generally, according to the majority of authors if the value of Cronbach’s alpha is greater than 0.7 it indicates that the questionnaire items measure the same characteristic, so we can conclude that our items are consistent.

Once the internal consistency between the items is checked, it is necessary to ensure the reliability of these items. Indeed, we will carry out a principal component analysis (PCA). We started our analysis with the Bartlett and the (KMO) tests. The (KMO) test showed a higher value of 0.5 (KMO = 0.892), with respect to the Bartlett sphericity test has a high Khi-two recorded at a satisfactory value. In addition, Bartlett's significance=0.000 < 0.05, we reject H0 and accept H1. Therefore, Bartlett's test and the (KMO) test confirmed the feasibility of the factor analysis. Next, we performed a principal component analysis (PCA) on all the items, which revealed that they have a strong factorial contribution and good discriminating power. This (PCA) suggests a single factor structure representing 60.763% of the total variance. For the purpose of simplification we see to present the factorial solution in the following Table 2.

| Table 2 Items Used In The Firm Social Responsibility Scale (10 Items) |

|

|---|---|

| les 10 items | Composante 1: principe de la RSE 60.763% de la variance totale |

| 1/ Do you have any knowledge about the notion of CSR (Corporate Social Responsibility)? | 0.753 |

| 2/what do you think about CSR? | 0.779 |

| 3/Does your company adopt CSR approaches? | 0.828 |

| 4/Does your company publish a communication on progress or a extra financial performance statement? | 0.854 |

| 5/Does your company have an international certification standard? | 0.751 |

| 6/Do you think CSR should be involved in the company's management mechanism? | 0.774 |

| 7/On which theme(s) has your company taken action? | 0.723 |

| 8/How often is your company participating in CSR activities? | 0.734 |

| 9/Does the committee responsible for social activities organize training sessions to increase knowledge of CSR? | 0.744 |

| 10/Does your company have an official business ethics policy? | 0.843 |

Empirical Validation of Research Hypotheses

Once the reliability and validity of our questionnaire has been verified, it is appropriate to test the empirical validity of our hypotheses.

According to the Table 3 of descriptive statistics, we notice that the mean of social responsibility (CSR) is equal to 0.80, this indicates that Tunisian companies are considered as socially responsible companies, so the standard deviation of this variable is equal to 0.402. And the debt ratio has an average of 0.67, a standard deviation of 0.473.

| Table 3 The Descriptive Statistics |

|||||||||

|---|---|---|---|---|---|---|---|---|---|

| N | Min | Max | Mean | Std deviation | Skewness | Kurtosis | |||

| Statistic | Statistic | Statistic | Statistic | Statistic | Statistic | Std Error | Statistic | Std Error | |

| LEV | 100 | 0 | 1 | 0.67 | 0.473 | -0.734 | 0.241 | -1.491 | 0.478 |

| CSR | 100 | 0 | 1 | 0.80 | 0.402 | -1.523 | 0.241 | 0.325 | 0.478 |

| OA | 100 | -0.078 | 1.783 | 0.129 | 0.208 | 5.143 | 0.241 | 39.323 | 0.478 |

| FSIZE | 100 | 10.230 | 20.509 | 18.115 | 1.611 | -1.132 | 0.241 | 2.430 | 0.478 |

| FAGE | 100 | 0 | 1 | 0.71 | 0.456 | -0.940 | 0.241 | -1.140 | 0.478 |

| GD | 100 | 0 | 1 | 0.28 | 0.451 | 0.995 | 0.241 | -1.031 | 0.478 |

| BSIZE | 100 | 5 | 12 | 9.01 | 1.931 | -0.659 | 0.241 | -0.671 | 0.478 |

For the normality test, we notice that the Skewness value, which measures the degree of skewness of the distribution, is negative for the majority of the variables. This means that the tail of the distribution is skewed to the left. Then we reject the null hypothesis of normality of the data, which means that the distribution does not follow the normal distribution.

In addition, what concerns the coefficient "Kurtosis" is a coefficient that measures the degree of flattening of the distribution. However, in our case we note that the majority of the coefficients of flattening of the variables are lower than 3, that explains that the distribution is more flattened than the normal law. This confirms the rejection of the null hypothesis of normality.

Binary Logistic Regression Results

This model is used to test our hypothesis and has a satisfactory quality of adjustment (R2=0.514). Overall, the selected variables explain 51.4% of the choice of debt. The model has a significance value of 0.000 which is lower than the P-value of 0.01 at the 99% level, thus indicating that the regression model is globally significant at this confidence level Table 4.

| Table 4 Binary Logistic Regression Results |

||||

|---|---|---|---|---|

| Variables | Coefficient | Signification | Resultat prevu | Resultat trouve |

| Constante | -16.272 | 0.005*** | ||

| CSR | 2.796 | 0.005*** | + | + |

| ROA | -4.677 | 0.053* | + | - |

| FSIZE | 0.71 | 0.023** | + | + |

| FAGE | -0.309 | 0.723 | - | - |

| GD | -1.677 | 0.037** | - | - |

| BSIZE | 0.458 | 0.023** | + | - |

| R2 de Cox et Snell | 0.514 | |||

| X2 for adjustment | 72.141, P=0,000*** | |||

*, **, *** respectively significance at 10%, 5% and 1%.

CSR helps explain access to debt since it is positive and significant at the 1% level (β=2.796; P-value=0.005) means that CSR activities make debt issuance more attractive, and therefore increase the likelihood of using this financing method.

This result confirms the literature of previous studies defended in particular and which support that socially responsible activities facilitate access to debt financing and therefore increase the use of firms to acquire debt. Indeed, this result confirms our theoretical hypothesis that socially responsible companies have more access to debt than other financing methods.

Regarding the control variables, there is a negative and significant relationship between profitability (ROA) and access to debt at the 10% level (β=- 4.677; P-value=0.053). This result can be interpreted as follows, profitable firms use less debt, this result is consistent with the pecking order model, which suggests that firms with high profitability must use internal sources of financing and are therefore less dependent on debt. Moreover, It is coherent with the empirical results of the studies of (Foukal & Radi, 2020; Hamrouni et al., 2019).

Firm size (TAI) also has an impact on debt choice, which is significant at the 5% level with a positive coefficient (β=0.710; P-value=0.023), indeed, the risk of the probability of default is low in large firms, which make their debt capacities higher. This result is consistent with the result of (Yang et al., 2018).

Another significant relationship with negative sign at the 5% level was found between gender diversity and debt choice (β=-1.677.; P-value=0.037), This result shows that female CEOs are averse to taking on debt. Furthermore, this result is consistent with that of (Hernandez et al., 2015).

The board size is also among the variables that can influence the use of debt, the Bsize is positive and significant at the 10% level (β=0.458; P-value=0.023), this relationship shows that firms with large board sizes access more to debt since they have high creditor confidence. This result is consistent with the previous study by (Zaid et al, 2020).

For the Firm age variable is negative and not statistically significant (β=-0.309; Pvalue= 0.723).

Conclusion

This study uncovered the impact of the social responsibility of Tunisian companies on their debt financing access. Indeed, empirical analysis of the relationship between the corporate social responsability with debt shows a positive and significant impact of social Tunisian companies on access to debt, this result confirms our theorical analysis.

Our research is only an attempt to focus the spotlight on the effects of social responsibility of Tunisian companies on access to debt. Therefore, it is recommended toTunisian companies to :

Managers of companies: looking to have sources of financing, these managers should have a better understanding and be more conscious of the effects of social activities on access to financing, this study explains the role of social acts on access to debt.

Companies not engaged in social activities: this study aims to invite companies to engage in social activities by presenting the different benefits of CSR on the company.

References

Azouzi, M.A. (2019). Managerial optimism level, board of directors efficiency and debt decision in Tunisian companies.Economy,6(2), 82-91.

Azouzi, M.A. (2022). Do CEO Political Connections and Firm Social Responsibility Affect Debt Level?. InResearch Anthology on Developing Socially Responsible Businesses, 1755-1775.

Chtourou, H., & Triki, M. (2017). Commitment in corporate social responsibility and financial performance: a study in the Tunisian context.Social Responsibility Journal,13(2), 370-389.

Indexed at, Google Scholar, Cross Ref

Dkhili, H., & Ansi, H. (2012). The link between corporate social responsibility and financial performance: the case of the Tunisian companies.Journal of Organizational Knowledge Management,2012, 1.

Foukal, S., & Bouchra, R.A.D.I. (2020). Impact of the social performance of companies on indebtedness: Case of Moroccan companies listed on the stock exchange. Economic Managerial Alternatives, 2(4), 448-467.

Hamrouni, A., Boussaada, R., & Toumi, N.B.F. (2019). Corporate social responsibility disclosure and debt financing.Journal of Applied Accounting Research,20(4), 394-415.

Indexed at, Google Scholar, Cross Ref

Hernandez-Nicolas, C.M., Martín-Ugedo, J.F., & Mínguez-Vera, A. (2015). The influence of gender on financial decisions: Evidence from small start-up firms in Spain.Economics and Management.

Indexed at, Google Scholar, Cross Ref

La Rosa, F., Liberatore, G., Mazzi, F., & Terzani, S. (2018). The impact of corporate social performance on the cost of debt and access to debt financing for listed European non-financial firms.European Management Journal,36(4), 519-529.

Indexed at, Google Scholar, Cross Ref

Latapí Agudelo, M. A., Jóhannsdóttir, L., & Davídsdóttir, B. (2019). A literature review of the history and evolution of corporate social responsibility.International Journal of Corporate Social Responsibility,4(1), 1-23.

Indexed at, Google Scholar, Cross Ref

Miller, M.H. (1977). Debt and taxes.The Journal of Finance,32(2), 261-275.

Modigliani, F., & Miller, M.H. (1959). The cost of capital, corporation finance, and the theory of investment: Reply.The American Economic Review,49(4), 655-669.

Modigliani, F., & Miller, M.H. (1963). Corporate income taxes and the cost of capital: a correction.The American Economic Review,53(3), 433-443.

Olfa, Z.B., & Ezzeddine, B. (2007). Corporate social responsibility and financial performance: the case of listed Tunisian companies. In XVIth International Conference of Strategic Management. 16.

Samet, M., Mouakhar, K., & Jarboui, A. (2018). Exploring the relationship between CSR performance and financial constraints: empirical evidence from European firms.Review of Social Economy,76(4), 480-508.

Indexed at, Google Scholar, Cross Ref

Suto, M., & Takehara, H. (2017). CSR and cost of capital: evidence from Japan.Social Responsibility Journal,13(4), 798-816.

Indexed at, Google Scholar, Cross Ref

Xu, H., Wu, J., & Dao, M. (2020). Corporate social responsibility and trade credit.Review of Quantitative Finance and Accounting,54, 1389-1416.

Indexed at, Google Scholar, Cross Ref

Yang, S., He, F., Zhu, Q., & Li, S. (2018). How does corporate social responsibility change capital structure?.Asia-Pacific Journal of Accounting & Economics,25(3-4), 352-387.

Zaid, M., Wang, M., Abuhijleh, S., Issa, A., Saleh, M., & Ali, F. (2020). Corporate governance practices and capital structure decisions: the moderating effect of gender diversity.Corporate Governance: The International Journal of Business in Society,20(5), 939-964.

Received: 01-Apr-2023, Manuscript No. JOCCC-23-13521; Editor assigned: 03-Apr-2023, Pre QC No. JOCCC-23-13521(PQ); Reviewed: 17-Apr -2023, QC No. JOCCC-23-13521; Published: 24-Apr-2023