Review Article: 2021 Vol: 24 Issue: 1S

Corporate Social Responsibility and Dividend Policy in Jordan: Advent of Firm Size as a Moderator

Yousef Abu Siam, Applied Science Private University

Abu Reza Islam, Al-Ain University

Mahmoud Nassar, Al-Ain University

Mohammad Jebreel, Applied Science Private University

Hamed ALMahadin, Applied Science Private University

Abstract

This study examined to what extent corporate social responsibility (CSR) affected dividend policy and the role firm size played as a moderator for firms in an emerging market. It used a sample of 265 industrial firms that were listed on Amman Stock Exchange during the period 2010–2016. Regression results indicate that greater is the number of CSR activities & engagements, lesser becomes the propensity to pay dividends by firms on average. The study found that firm size played an important role affecting the relationship between CSR activities and dividend policy. However, the relationship between CSR and dividend policy in this study (in an emerging market) is found to be different from those of the developed markets. This study points out that the trade-off between firms’ CSR activities and dividend policy must address the concerns of the investors, minority shareholders and policy makers for policy reform initiatives to strengthen the protection of other stakeholders’ interests.

Keywords

Corporate Social Responsibility, Dividend Policy, Firm Size, Amman Stock Exchange.

Introduction

A dividend is a portion of a company's profits that is dispersed to its shareholders in accordance with the company's dividend policy, which specifies the amount and frequency with which dividends are paid out (Sheikh et al., 2021) policy is one of the most significant factors that management must consider while operating the firm, as a key component of the company's financial decisions (Brigham & Houston, 2021). Every company therefore, should develop a dividend policy, which specifies the percentage of income to be distributed as dividends as well as the percentage of retained earnings that is reinvested. Investors and corporate executives, in particular, benefit from the decision dividend of conflict between stakeholders.

For investors, deciding on a dividend policy is critical to their long-term success as the dividend itself is their return on investment. The dividend is a financial outflow from the firm that reduces the company's cash to pay interest or even pay off the loan principal, as well as the potential to invest with funds distributed as dividends is to be lowered.

CSR has become increasingly important in recent years (Bassen & Schlange, 2006) due to the dramatic increase in the number of institutions, mutual funds, online resources, and publications that specialize in encouraging companies to improve their practices in accordance with various criteria of responsibility. According to stakeholder theory, companies are guided by to make social disclosures. Companies also perform social disclosures as a kind of obligation to their stakeholders, one of whom is the investor, according to stakeholder theory.

Rakotomavo (2012) conducts the first research investigating the relationship between CSR investment and unexpected dividends. He concludes that investment by firms on CSR activities does not reduce payouts. But, the findings of Cheung (2016) show a somewhat different picture. For US-listed companies, Cheung, et al., (2018) find that CSR activities have no significant impact on the tendency to pay out dividends, but it does bring a beneficial impact on the dividend payout ratio. They find that higher is the company's CSR activities, higher becomes the dividend payout, and vice versa.

Earlier studies argue that larger companies are able to pay dividends (Barros et al., 2020; Rasyid et al., 2020). According to Machfoedz (1999), a company's size can be classified into three categories: large, medium, and small. The total asset of a company is commonly used to determine the size of a firm since the total asset might indicate a company's ability to operate their business. In comparison to larger firms, medium or smaller firms have fewer shareholders because smaller firms typically use their profits to fund their operations or expand their business, whereas larger firms tend to earn the trust of their shareholders by sharing the profits of the business through dividends. Ranti (2013); Cristea & Cristea (2017) find a positive relationship between firm size and dividend payout of Nigerian companies listed on the stock exchange. The findings of research also indicate that firm size is also a strong determinant of firms’ dividend payout decision due to larger companies often has easier and better access to market financing, so they may raise funds more quickly.

Not necessarily dividend payout happens to be mandatory; it may follow somewhat a standard principle and order. Despite the fact that paying dividends is not mandatory in Indonesia, there is a standard policy or method controlling dividend payments, which is still largely dependent on the General Meeting of Shareholders. As a result, companies in Indonesia are free to decide when and how much and what frequency to pay the dividends for a given fiscal year. When it comes to a company's value, it indicates whether any company has the potential to make profits from its stock performances, which are eventually used for the benefit of shareholders. It states further that when a company's stock price rises, it increases the value of the company maximizing the shareholder’s wealth. The company market value is directly proportional to fluctuations of stock prices.

Any change in dividend payout policy, according to Tumiwa & Mamuaya (2019), will have two conflicting effects. If the dividend is paid in full, the backup's interests will be ignored; in contrast, if all earnings are halted, the interests of stockholders for cash are likewise ignored. Financial managers must therefore, choose the best dividend strategy to protect both parties' interests. This suggests that dividend policy decisions can be fascinating to research because they are based on a variety of phenomena.

Given the above discussions related to dividend payout, CSR activities and company size, the goal of our study is to focus on factors influencing the dividend payout ratio; the factors that are based on criteria considered by management and investor decisions. They relate to i) Corporate Social Responsibility and ii) Market Capitalization Value.

There are two ways this study contributes to the existing literature. It adds value to the literature particularly when not much work was conducted earlier to find the relationship between CSR and dividend policy. First, our study investigates the impact of firm size directly on the relationship between CSR and dividend policy. Second, it introduces the firm size as an interaction term with CSR variable, a multiplicative term, to find the combined impact on dividend payouts. Therefore, our research adds new evidence on the relationship between CSR and dividend policy by moderating the firm size with CSR variable unlike previous studies. Therefore, we contend that the academic debate could benefit from investigating these potential moderating factors.

Previous Literature

The Corporate Social Responsibility and Dividend Policy

The first study in the literature is Rakotomavo (2012). He investigates the relationship between CSR investment and unexpected dividends and concludes that CSR investment does not reduce payouts. Samet & Jarboui (2017) test the positive relationship between CSR and dividend payment for European companies; they use the total payout and find the CSR scores having no bearings on dividends payout, while they do have an impact on the dividend payment ratio. For US-listed companies Cheung, et al., (2018) find no significant impact of CSR on dividends payout (whether or not to pay dividends), but it does demonstrate beneficial effect on the dividend payout ratio (what dividends to pay). Recently, Benlemlih (2019) finds that high CSR firms pay more dividends than their counterparts in the US. Further, he shows that dividends are more stable in high CSR firms. Using a sample of 1,480 observations from Pakistan for the period 2010–2016, Sheikh, et al., (2021) investigate whether dividend policy is affected by CSR activities (dividends pay out, the tendency or/frequency simultaneously, the dividend payout ratio). The study results show that greater is the number of CSR activities, larger becomes the tendency to pay out dividends, while reducing the dividend payout by dividend-paying firms.

In theory, two main justifications guide the link between CSR and dividend policy. As per agency theory, dividend payout reduces the amount of cash available to managers, potentially lowering the tendency of inefficient resource usage. According to the CSR perspective, managers may overinvest in CSR efforts in order to get utility from being labeled as socially responsible. Directors and management may be able to be viewed as socially responsible as a result of the donations, even if it comes at the expense of shareholders' interests (Brown et al., 2006). Consequently, CSR activities may be considered as a cost to the agency (Barnea & Rubin, 2010). Shareholders, according to Ye & Zhang (2011), will not support excessive CSR spending that result in a negative net present value for the company. According to Jensen (1986), payout policy aids in the resolution of such agency problems by restricting the cash flow accessible to the self-interested managers. Thus, to avoid overinvestment in CSR activities, an efficient dividend policy may relate CSR investments to dividend payouts.

Signaling theory suggests that an increase in dividends reflects a firm's good prospects. A manager with good investment prospects is more inclined to inform outside investors about the company's future prospects. Dividend payments can signal the market in two ways from a CSR standpoint. First, businesses are encouraged to generate wealth in an ethical and long-term manner that aligns the interests of both financial and non-financial stakeholders. The reputation of a company as caring for its’ shareholders (financial stakeholders) can be enhanced by a high payout strategy (Benlemlih, 2019). Second, existing research suggests that firms may be deprived of cash and suffer a short-term loss of competitive advantage, as a result of CSR initiatives. A different observation is found with Benlemlih (2019). He argues that a firm following a high dividend payout strategy may signal the market that their expenditures on CSR activities are far from over (in cash), leading to adequate/required allocation of company’s resources and satisfaction to shareholders.

Here, dividend policy while playing a monitoring role and preventing management from overinvesting in CSR initiatives by limiting the amount of cash accessible to them, it may also indicate that a corporation caring about its financial stakeholders, is willing to pay them (shareholders). Considering these two views, we formulate our first set of hypotheses as follows:

H1: Firms with higher CSR scores have a higher propensity to pay dividends.

Impact of Firm Size on the Relationship between CSR and Dividend Policy

The company's size is frequently considered as a factor affecting the company's financial performance as evaluated by stock market indices (Demsetz & Villalonga, 2001; Rasyid et al., 2020; Sheikh et al., 2021). The level of commitment to CSR activities is therefore, influenced by the size of the company. Several studies find the link between firm size and CSR disclosure (Reverte, 2009; Arora & Dharwadkar, 2011). As per the legitimacy theory, larger the corporations are, more pressures they put on themselves to have more disclosures, enlisting and describing, varieties of social practices to respond to the claims of various stakeholders, thereby, legitimizing their on-going operations. Therefore, larger firms are more likely to have relatively more CSR disclosures than otherwise (li et al., 2013; Bonsón & Bednárová, 2015).

Earlier, Graves & Waddock (1994) point out that large company are more willing to project a positive image because of their many stakeholders, and they are relatively more sensitive to the media. A huge company can serve as a proxy for the importance of financial resources in executing a responsible management strategy. Redding (1997) demonstrated that the company is substantial and liquid, which means that dividends are more likely to be paid. These findings were both statistically and economically significant. Their findings also suggest, albeit not conclusively, that large companies prefer to pay dividends in bulk. It demonstrates that the model-size companies currently contribute the most to explaining the choice to pay or not pay a dividend. Therefore, firm size is used as a moderate variable to test its effect on the relationship between CSR and dividend policy. This suggests the second hypothesis of our study as follows.

H2: The relationship between CSR and dividend policy might be strengthened by the size of the company.

Research Methodology

Sample Selection

Our sample includes all industrial enterprises on the Amman Stock Exchange (ASE) The ASE had 63 companies listed as of December 31, 2019. Data are collected for all 63 companies throughout a five-year period, from 2015 to 2019. The ASE website (www.ase.com.jo) provides financial and non-financial information that contains annual reports of industrial listed companies. Data are not available for annual reports for 4 firms as some of these firms were listed after 2015 and 6 other firms get de-listed during the 2015 -2019 time period. The final sample contains 265 observations from 53 firms for the period 2015 to 2019.

Regression Model

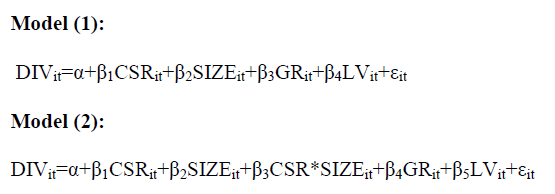

To test the hypotheses, the current study employs two regression models: First, the model 1 evaluates the relationship between CSR and DIV. Second, by including an interaction term between CSR and SIZE in model 2, the impact of SIZE on the association between CSR and DIV is measured.

Measurement of Key Variables

Corporate Social Responsibility

The CSR variable is determined systematically by allocating social responsibility expenses and using the formula: current social responsibility costs divided by preceding year's profit/loss and multiplied by 100%. The study follows the studies of Tsoutsoura (2004); Rasyid, et al., (2020).

Firm Size

Firm size is calculated by using market capitalization information. Market capitalization is a measure of a firm's size that reflects the value of its current total assets, where market value can be calculated by multiplying stock market prices by the number of shares issued (Redding, 1997). Market Capitalization is the term used to describe this market value. The worth of a firm's current wealth is reflected in its market capitalization (Barros et al., 2020).

Dividend Policy

The dividend policy will be proxy by the dividend per share, which compares the amount of all cash dividends paid to shareholders to the number of, shares outstanding (Rasyid et al., 2020).

Control Variables

Growth Opportunity (GR) is considered to be the first control variable. We estimate it as the logarithm of sales growth over the previous year (Burghleh & Al-Okdeh, 2020). The second control variable is Leverage (LEV), calculated as the book value of total liabilities scaled by the book value of total assets (Al-Natsheh & Al-Okdeh, 2020).

Results and Discussion

Descriptive Statistics

| Table 1 Descriptive Statistics |

||||

|---|---|---|---|---|

| Variable | Mean | Standard Deviation | Median | Obs. |

| DIV | 0.028 | 0.037 | 0.017 | 265 |

| CSR | 0.319 | 0.082 | 0.268 | 265 |

| SIZE | 6.872 | 0.546 | 5.936 | 265 |

| LEV | 0.384 | 0.267 | 0.351 | 265 |

| GR | 0.025 | 0.284 | 0.02 | 265 |

Note: DIV (Dividend Policy)=proxy by the dividend per share. CSR (Corporate Social Responsipility)=The current social responsibility costs divided by preceding year's profit/loss and multiplied by 100%. Size (Firm Size)=market capitalization. LEV (Leverage)=The book value of total liabilities scaled by the book value of total assets. GR (Growth)=The logarithm of sales growth over the previous year.

Table 1 explains the results of descriptive statistics where the mean value of DIV is 0.028 and standard deviation is 0.037, CSR has mean value as 0.319 and standard deviation value is 0.082, SIZE mean value is 6.872 and standard deviation value is 0.546, LEV mean value is 0.384 and standard deviation value 0.267, GR has mean value as 0.025 and standard deviation value is 0.284.

Main Empirical Results

Table 2 demonstrates regression estimates for testing the relationship between CSR and dividend policy; also, it shows the moderating impact of firm size on this relationship. Given the first hypothesis H1 postulated in this study, it is expected that firms with higher CSR scores will have a higher tendency to make dividends payout. Table 2 however, reports a negative relationship between the CSR and dividends payout. This result is found to be consistent with those by Rasyid, et al., 2020; Sheikh, et al., 2021; they find that firms with greater number of CSR activities decrease the tendency to make dividends payout. This suggests that hypothesis H1 (as postulated) that firms with higher CSR scores will have a higher tendency to make dividends payout is rejected. Earlier, Cheung, et al., (2018) examine the impact of CSR on the tendency to make dividends payout as well as the amount of dividends paid; their findings indicate that there is no impact for CSR, on the propensity to pay dividends. The finding of our research is also inconsistent with the previous studies (e.g., Rakotomavo, 2012; Samet & Jarboui, 2017; Benlemlih, 2019) all concluding that CSR investment does not reduce payouts.

| Table 2 Regression Analysis of Corporate Social Responsibility, Dividend Policy and Firm Size |

||||

|---|---|---|---|---|

| Model (1) | Model (2) | |||

| Cofe. | t-stat | Cofe. | t-stat | |

| Intercept | -1.541*** | -3.61 | -1.762*** | -4.1 |

| CSR | -3.382*** | -5.73 | -1.621*** | -3.73 |

| SIZE | -2.015*** | -3.45 | -2.056*** | -3.85 |

| CSR*SIZE | -2.032*** | -3.26 | ||

| LEV | 0.248 | 1.75 | 0.214 | 1.68 |

| GR | 0.071 | 0.169 | 0.058 | 1.325 |

| Adj.R2 | 0.311 | 0.369 | ||

| Obs | 265 | 265 | ||

| F-stat | 7.486 | 8.754 | ||

The above finding can be attributed to the Jordanian capital market's unique feature of high levels of ownership concentration in companies which may lead to a concentration in control (Al?Malkawi, 2007). Therefore, ownership concentration could be one explanation for the decrease in dividend payments in high-CSR. Jordanian companies may be utilizing CSR activities for their private benefits, while ignoring the interests of minority shareholders, which will not be able to exert much influence on dividend policy (Al?Malkawi, 2007). The other potential reason is that instead of paying dividends, ownership concentration may engage in CSR activities to reduce the cost of equity and hoard cash for future investments (Sheikh et al., 2021).

With the second model, our research employed Aguinis’s (2004) moderate Multiple Regression model by creating a new variable (an interaction term: a product between the two predictors). The effect of the interaction variable (CSR*SIZE) is found to be negative on dividend policy. This result suggests that firm size (market capitalization) weakens the impact of CSR on dividend policy (having a negative moderating effect on dividends payout). This result contradicts to the second hypothesis H2, suggesting the relationship between CSR and dividend policy to be strengthened by the company size.

This points out that while practicing CSR activities under weak institutional environment, companies do not make use of dividend policy to reduce asymmetric information and increase transparent flow of information, allowing the shareholders to closely monitor managers, to diminish the utility of dividend, as a monitoring mechanism (Achour & Boukattaya, 2021). Further, a larger company size does not necessarily mean the implementation of CSR to be high; therefore, the interaction effects involving firm size with CSR will influence the CSR activities to pay lower dividends (D'Amato & Falivena, 2020). This interpretation reflects the presence of agency problems by powerful principals, Jensen (1986): powerful insiders prefer to low dividends pay out to increase cash flow at their disposal (Al-Najjar et al., 2016; Koo et al., 2017). The results of our study are consistent with those of Rasyid, et al., (2020) who find the role of firm size on the relationship between CSR and dividend policy.

Conclusion

This research is motivated by the need to provide empirical evidence to investigate the impact of CSR on dividend policy in the context of emerging markets. Previous literature was based mostly in the context of developed financial markets; this necessitates extending the existing research beyond that of developed countries by focusing on the emerging financial markets & economies. The study results depict that CSR has a negative effect on dividend policy in industrial Jordanian firms. This finding is inconsistent with the existing studies (e.g., Cheung et al., 2018; Benlemlih, 2019). It is noteworthy that the existing studies use data from the US and European countries. Therefore, it appears that the implications of CSR activities are quite different in Jordan, one of the emerging economies. One potential reason for the cut in dividend payments in high CSR firms is due to ownership concentration and weak legal enforcement. Although the regulatory bodies encourage firms to invest in CSR activities, but the potential opportunistic behavior of ownership concentration warrant the need for policy reform initiatives to strengthen the protection of other stakeholders’ interests. Further, the research finding of an inverse relationship between CSR and dividend policy is weak when firm size is considered as a moderate variable in Jordanian context. To generalize these findings, the framework of the relationship between CSR and dividend policy should be extended by considering other emerging markets with different and or similar institutional settings.

References

- Achour, Z., & Boukattaya, S. (2021). The moderating effect of firm visibility on the Corporate Social Responsibility-firm financial performance relationship: Evidence from France. In Corporate Social Responsibility. IntechOpen.

- Aguinis, H. (2004). Regression analysis for categorical moderators. Guilford Press

- Amman Stock Exchange (2020). Retrieved from: http://www.ase.com.jo/en/about-ase.

- Al-Malkawi, H.A.N. (2007). Determinants of corporate dividend policy in Jordan: An application of the Tobit model. Journal of Economic and Administrative Sciences.

- Al-Najjar, B., & Kilincarslan, E. (2016). The effect of ownership structure on dividend policy: Evidence from Turkey. Corporate Governance: The international journal of business in society.

- Al-Natsheh, N., & Al-Okdeh, S. (2020). The impact of creative accounting methods on earnings per share. Management Science Letters, 10(4), 831-840.

- Arora, P., & Dharwadkar, R. (2011). Corporate Governance and Corporate Social Responsibility (CSR): The moderating roles of attainment discrepancy and organization slack. Corporate governance: An international review, 19(2), 136-152.

- Barnea, A., & Rubin, A. (2010). Corporate social responsibility as a conflict between shareholders. Journal of Business Ethics,. 97(1), 71-86.

- Barros, V., Matos, P.V., & Sarmento, J.M. (2020). What firm’s characteristics drive the dividend policy? A mixed-method study on the Euronext stock exchange. Journal of Business Research, 115, 365-377.

- Bassen, A., Meyer, K., & Schlange, J. (2006). The influence of corporate responsibility on the cost of capital. Available at SSRN 984406.

- Benlemlih, M. (2019). Corporate Social Responsibility and dividend policy. Research in International Business and Finance, 47, 114-38.

- Bonsón, E., & Bednárová, M. (2015). CSR reporting practices of Eurozone companies. Revista de Contabilidad, 18(2), 182-193.

- Brigham, E.F., & Houston, J.F. (2021). Fundamentals of financial management. Cengage Learning.

- Brown, W.O., Helland, E., & Smith, J.K. (2006). Corporate philanthropic practices. Journal of Corporate Finance, 12(5), 855-77.

- Burghleh, M., & Al-Okdeh, S. (2020). The impact of family ownership concentration on the relationship between the characteristics of board of directors and earnings management. Management Science Letters, 10(5), 969-978.

- Cheung, A. (2016). Corporate social responsibility and corporate cash holdings. Journal of Corporate Finance.

- Cheung, A., Hu, M., & Schwiebert, J. (2018). Corporate social responsibility and dividend policy. Accounting & Finance, 58(3), 787-816.

- Cristea, C., & Cristea, M. (2017). Determinants of corporate dividend policy: Evidence from romanian listed companies. In MATEC Web of Conferences, 126, 04009. EDP Sciences.

- D'Amato, A., & Falivena, C. (2020). Corporate social responsibility and firm value: Do firm size and age matter? Empirical evidence from European listed companies. Corporate Social Responsibility and Environmental Management, 27(2), 909-924.

- Demsetz, H., & Villalonga, B. (2001). Ownership structure and corporate performance. Journal of corporate finance, 7(3), 209-233.

- Graves, S.B., & Waddock, S.A. (1994). Institutional owners and corporate social performance. Academy of Management journal, 37(4), 1034-1046.

- Jensen, M.C. (1986). Agency costs of free cash flow, corporate finance, and takeovers. The American economic review, 76(2), 323-329.

- Koo, D.S., Ramalingegowda, S., & Yu, Y. (2017). The effect of financial reporting quality on corporate dividend policy. Review of Accounting Studies, 22(2), 753-790.

- li, Q., Luo, W., Wang, Y., & Wu, L. (2013). Firm performance, corporate ownership, and corporate social responsibility disclosure in China, Business Ethics. A European Review, 22(2), 159-173.

- Machfoedz, M. (1997). Financial ratio analysis and the prediction of earnings changes in Indonesia. Kelola, 7(3), 114-137.

- Rakotomavo, M.T. (2012). Corporate investment in social responsibility versus dividends? Social Responsibility Journal, 8(2), 199-207.

- Ranti, U.O. (2013). Determinants of dividend policy: A study of selected listed Firms in Nigeria. Manager, 17, 107-119.

- Rasyid, H.F., Sudarto, S., & Najmudin, N. (2020). Can company size moderate corporate social responsibility to dividend policy? ICORE, 5(1).

- Redding, L.S. (1997). Firm size and dividend payouts. Journal of financial intermediation, 6(3), 224-248.

- Reverte, C. (2009). Determinants of corporate social responsibility disclosure ratings by Spanish listed firms. Journal of business ethics, 88(2), 351-366.

- Samet, M., & Jarboui, A. (2017). Corporate social responsibility and payout decisions. Managerial Finance, 43( 9), 982-98.

- Sheikh, M.F., Bhutta, A.I., Rehman, B., Bazil, M., & Hassan, A. (2021). Corporate social responsibility and dividend policy: A strategic choice in family firms. Journal of Family Business Management.

- Tsoutsoura, M. (2004). Corporate social responsibility and financial performance. UC Berkeley: Center for Responsible Business.

- Tumiwa, R.A.F., & Mamuaya, N.C. (2019). The determinants of dividend policy and their implications for stock prices on manufacturing companies listed on the indonesia stock exchange. KnE Social Sciences, 778-793.