Research Article: 2021 Vol: 20 Issue: 2

Corporate Social Responsibility Disclosure Earning Management and Corporate Performance

Bambang Jatmiko, Universitas Muhammadiyah Yogyakarta

Titi Laras, Universitas Janabadra Yogyakarta

Jati Kurnia Sandy, Universitas Pembangunan Nasional "Veteran" Yogyakarta

Abstract

The purpose of this study is to examine the effect of corporate social responsibility disclosure (CSRDis) on corporate performance (CP) as moderated by earnings management (EarnM). The population of this study is all companies listed on the Indonesian stock exchange. In order to obtain a representative sample, this study used a purposive sampling method. Partial Least Square (WarpPLS) version 7.0 was used as an analytical tool in this study. This research concludes that CSRDis and EarnM directly have a significant effect on CP; however, EarnM does not moderate the effect of CSRDis on CP. The implication of this research is the importance of CSRDis to improve company performance.

Keywords

Corporate Social Responsibility Disclosure, Earning Management, Corporate Performance.

JEL Classifications

G32, M14, M41

Introduction

Corporate performance (CP) is the company's ability to allocate and utilize the company's resources. Not only that, the achievements of the company in one period can be recognized by examining CP. One measure of CP is corporate financial performance (CFP). The Covid-19 pandemic had a negative impact on economic growth in Indonesia. In addition, this has a profound impact on companies listed on the Indonesian stock exchange as their income has decreased significantly. The sectors that are very depressed due to the Covid-19 pandemic include hospitality and tourism, transportation, and manufacturing industries. The Covid-19 pandemic will cause a decrease in CP from several companies listed on the Indonesian stock exchange, as seen from a decrease in the amount of profit presented in the financial statements.

Though the financial statements reflect a company's CP, financial reports are commonly used by investors and observers who want to identify the financial condition of a company so that they can analyze the financial performance reported to the public. In addition, financial reports can also assess a manager's performance as one of the company managers in a certain period. Therefore, all companies always try to show good CP for stakeholders. If the CP is good, it will increase the company's value, which can invite investors to invest in the company. A good CP will also motivate manager incentives because managers are seen as successful in managing the company to get incentives from the company under the agreed contract. Therefore, managers will use opportunistic measures by tricking stakeholders regarding the company's economic performance by implementing earning management (EarnM) (Healy & Wahlen, 1999). CP is considered very important both for companies and individuals such as managers.

One way to show a good CP is by carrying out CSRD is (Gray, 2005). CSRD is can be used to attract investors as a signal for companies to demonstrate the quality of company management that can recognize the company's social and environmental risks (Gray, 2005). In line with this, Sun et al. (2010) also stated that CSRD is actions carried out by a company will have an impact on company value both in the money market and the debt market. In other words, this statement can mean that profit is not the only goal that the company wants to achieve. However, the company also aims to improve the community's welfare and preserve the planet (triple bottom line).

The research related to this topic has been carried out several times. Research from Machmuddah et al. (2020), Cho et al. (2019), Sial et al. (2018), Lin et al. (2015), Bedi et al. (2009) proves that CSRD is has a significant effect on CP. However, the research findings Angelia & Suryaningsih (2015) prove that CSRD is does not affect Dao & Ngo (2020), Utomo et al. (2019), Safi et al. (2015), Gill et al. (2013) proved that EarnM has a significant effect on CP. However Nuryana & Surjandari (2019) prove that EarnM does not affect CP.

Prior et al. (2008) explained that out of 593 sample companies in 26 countries worldwide, CSR disclosure activities are one thing that companies can do to provide a positive value to increase CFP. On the other hand, when companies take earnings management actions, including moral hazard, they will lose CP. Therefore, it will weaken the effect of the relationship between CSR disclosure and CFP. Research conducted by Prior et al. (2008) who gets the results that CSR activities moderated by EarnM affect CFP. This result is in line with research Sial et al. (2018) and Tandry et al. (2014) finding that EarnM moderates CSRD is and CP's relationship. However, some studies are not in line, including research Dianita (2011) which states that EarnM does not moderate the effect of CSRD is on CP.

With mixed research findings and inconsistent arguments, research on this topic is still interesting to be reviewed. Therefore, this study's research question is:

1. Whether CSRDis and EarnM affect CP? and

2. Does EarnM moderate the effect of CSRD is on CP?

Literature Review

The theory used in this research is stakeholder theory and signal theory. Stakeholder theory explains that a company is responsible for providing benefits to all its stakeholders, concerned with internal needs and external interests. Stakeholder theory describes the relationship between stakeholders and the company's information. Companies must be endeavored properly using a genuine method to improve and maintain the relationship between companies and stakeholders. Without stakeholders' existence, the company as a social and environmental element of the company cannot operate properly.

For stakeholders' interests in the capital market, companies provide information that stakeholders can access; this information is known as a signal. The information conveyed aims to reduce information asymmetry. In line with this, Gray (2005) stated that CSRD could be used as a company signal to attract investors because the motive of CSRD is to provide a signal about the quality of company management that can control corporate social and environmental risks. Likewise, (Sun et al., 2010) explained that if a company is active in CSR activities, the company value will be good to get a good reputation from the money market and debt market.

Hypotheses Development

The effect of CSRD is on CP

The company's CSR activities will significantly impact in increasing the company's branding in society, the signals that the company sends to its stakeholders. The signal that the company sends to its stakeholders is delivered in the form of CSRD is. By carrying out CSRD is, the company has shown stakeholders its social responsibility to stakeholders. Suppose the company carries out its activities well, especially in disclosing social responsibility. In that case, when investors see information about the company's performance, they will see that the company is a company that cares for the community. Company activities that emphasize social responsibility will have a good effect in the future and increase the company's value in the capital market because the company can increase its investment for the better. These activities can increase the company's good name in the capital market and debt market. The company has more power in negotiating contracts between stakeholders and the government; therefore, the impact of CSRD is for the company is an increase in company performance.

This argument is in line with the research findings by Machmuddah et al. (2020), Cho et al. (2019), Sial et al. (2018), Lin et al. (2015), Bedi et al. (2009) which explain that CSRDis has a significant effect on CP. Based on the explanation and results of existing research, the research hypothesis is:

H1 CSRDis has a significant effect on CP.

The effect of EarnM on CP

The company's financial performance can be seen from the company's financial statements published to stakeholders. So that the financial report is a signal that the company gives to its stakeholders. However, company managers will take opportunistic actions so that the company's performance looks good in stakeholders' eyes. Through EarnM, managers' opportunistic actions are carried out by establishing policies in determining the methods used when preparing financial reports. Thus, when managers do EarnM, it will affect CP.

Research findings by Dao & Ngo (2020), Utomo et al. (2019), Safi et al. (2015), Gill et al. (2013) which explain that EarnM has a significant effect on CP. Then the research hypothesis is:

H2 EarnM has a significant effect on CP.

The effect of EarnM as a moderating variable on CSRDis with CP

Stakeholder theory says that when the relationship between the company and stakeholders supported by management is good, it will increase CP. CSRDis activities can be used as a benchmark for this theory. CSRDis is used by companies that can be a tool to efficiently run company resources to positively impact CP, intangible assets in the form of strategies regarding management related to the relationship between companies and stakeholders. Therefore, they can create an image of a company that can improve financial performance by utilizing existing resources. However, when companies carry out EarnM activities, it will affect the relationship between CSRDis and CP because the existence of EarnM activities will lead the company to excess investment in carrying out activities that are considered to be related to CSRDis. The company will provide much disclosure as a step to protect from stakeholder pressure.

On the other hand, doing much disclosure will create high company expenses or costs to impact CP. In addition to impacting the company's increasing costs, EarnM activities will also reduce the company's flexibility in operating because managers will always involve stakeholders as entrenchments to validate their actions. Therefore, EarnM action can affect the relationship between CSRDis and CP.

This argument is in line with the findings of research by Sial et al. (2018) and Tandry et al. (2014) which states that EarnM can influence the relationship between CSRDis and CP. Based on the explanation and results of the previous research, the researcher proposed the following hypothesis:

H3 EarnM can moderate the relationship between CSRDis with CP.

Research Methodology

The population in this study uses all companies listed on the Indonesian stock exchange. The purposive sampling method is used to obtain representative data to fit as expected. The sample used has criteria, namely companies that disclose CSRDis proven through a sustainability report with the GRI Standard Content Index and Regulation of Financial Service Authority for the 2017-2019 period and have complete data related to the variables used.

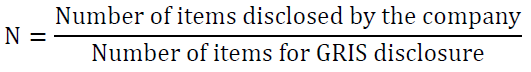

CSRDis describes the form of information disclosed by companies related to corporate social responsibility to stakeholders. The company's CSR activities can be seen in CSRDis in the annual sustainability report that the company discloses. GRI Standard Content Index and Regulation of Financial Service Authority was chosen as a tool to measure CSRDis disclosure. CSRDis disclosure can be seen in the sustainability reports that the company discloses in each period in more detail. CSRDis is calculated using the following formula:

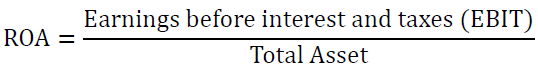

CP is proxied by return on assets (ROA) because it can describe the company's ability to earn profit by utilizing the company's resources. ROA is calculated using the following formula:

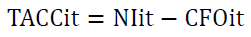

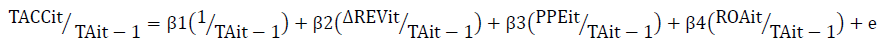

EarnM is proxied by discretionary accrual (DACC). DACC can be calculated using a model developed. The DACC formula is as follows:

Where:

TACCit: Total accrual of company I in year t

Niit : Net income cash from operating activities of company I in period t

CFOit : Cash flow from operating activities of company I in period t

Where:

TAit-1 : Total assets of company I at the end of year t-1

REVit : Change in profit of company I in year t

RECit : Change in net receivable of company I in year t

PPEit : Property, plant, and equipment of company I in year t

ROAit : Return on asset of company I in year t

Where:

NDACCit: Nondiscretionary accrual of company I in year t

e : Error

DACCit : Discretionary accrual of company I in year t

The research method in this study was using the WarpPLS 7.0 software. Partial Least Square is a variant-based structural equation analysis (SEM) that can simultaneously perform measurement model testing and structural model testing. The measurement model is used to test the validity and reliability, while the structural model is used to test the causality (hypothesis testing with predictive models). The advantages of PLS are that it can model many dependent variables and independent variables (complex models), can be used in reflective and formative constructs, can be used on data with different types of scales, namely: nominal, ordinal, and continuous.

Results and Discussion

The objects of this research are companies that disclose sustainability reports with the 2017-2019 period. From the data obtained from www.idx.co.id and www.globalreporting.org, it is known that of the 58 companies that disclosed sustainability reports, 35 companies have sustainability reports with GRI Standard during the 2017-2019 period. Therefore, the number of observations in this study used as many as 105 companies' data.

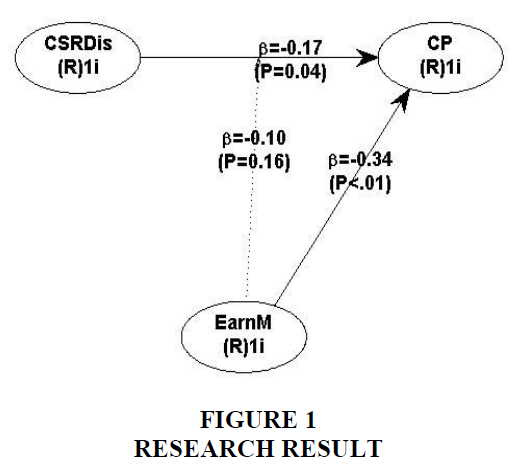

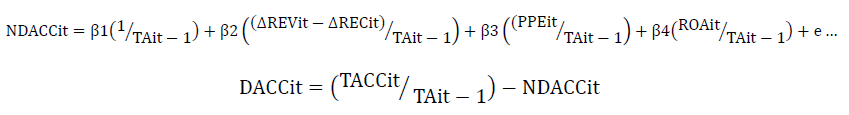

Test Result of the Effect of CSRDis on CP

Based on Table 1, the test on the relationship between CSRDis and CP shows a p-value of 0.035 and a beta value of -0.170; this result means that H1 is accepted, which means that CSRDis has a significant effect on CP. The results are following the development hypothesis, which states that CSRDis can affect CP. In this case, companies that carry out CSR activities proven through CSRDis have the primary objective to provide a positive image to stakeholders. Through CSRDis, the stakeholders will assess that the company carefully and is socially responsible to stakeholders. These activities will increase the company's value in the eyes of stakeholders and, in the end, will increase the CP. The increase in company value can occur in the money market and the debt market.

| Table 1 Research Results | |||||

| Path | Direct Effect | Indirect Effect | Remark | ||

| Coefficient | p-value | Coefficient | p-value | ||

| CSRDisà CP | -0.17 | <0.035** | - | - | H1 is accepted |

| EarnMàCP | -0.345 | <0.001*** | - | - | H2 is accepted |

| CSRDis*EarnMàCP | - | -0.096 | <0.159 | H3 is rejectted | |

| Model Fit Indicators | |||||

| Average Path Coefficient (APC) | 0.204 | 0.007 | - | - | - |

| Average R-square (ARS) | -0.082 | 0.098* | - | - | - |

| Average Variance Inflation Factor (AVIF) | 1.075 | - | - | - | - |

Note: *, **, and *** indicate significance (one-tailed) at the 0,10; 0,05; and 0,01 levels, respectively.

The study findings are in line with Machmuddah et al. (2020), Cho et al. (2019), Sial et al. (2018), Lin et al. (2015), Bedi et al. (2009) which explains a significant change in CP after the implementation of CSRDis. However, this is not following the research findings by Angelia & Suryaningsih (2015) which states that CSRDis does not affect CP proxied using ROA.

Test Result of the Effect of EarnM on CP

Based on Table 1, the test results of EarnM on CP show a p-value of <0.001 and a beta value of -0.345; this result means that H2 is accepted, which means that EarnM has a significant effect on CP. The results are following the development hypothesis, which states that EarnM can affect CP. Through policy determination, managers with opportunistic actions by choosing methods in preparing financial statements have the motivation to have good performance to receive incentives under predetermined contracts. This action will affect CP.

The results are the same as Dao & Ngo (2020), Utomo et al. (2019), Safi et al. (2015), Gill et al. (2013) which explains the significant changes in CP after the application of EarnM proxied by DACC. However, this is not following research by Nuryana & Surjandari (2019) which states that EarnM does not affect CP (Figure 1).

Test Result of the Effect of CSRDis on CP with EarnM as a Moderating Variable

Based on Table 1, the test results on the moderation relationship between CSRDis and EarnM on CP show a p-value of 0.159 and a beta value of -0.096, which means that H3 is rejected. The conclusion is that EarnM is not able to moderate the effect of CSRDis on CP. These results illustrate that when a company carries out EarnM activities, it will not affect CSRDis and CP's relationship because CSR activities carried out by companies are an act of corporate social responsibility to its stakeholders. So this is a concrete manifestation of the company's awareness of its social responsibility to stakeholders.

The study findings are in line with research by Dianita (2011) which states that EarnM does not moderate the relationship between CSRDis and CP. However, this result is different from Sial et al. (2018) and Tandry et al. (2014) which reveals that EarnM moderates the relationship between CSRDis and CP.

Conclusion

This study concludes that CSRDis and EarnM directly affect CP. However, EarnM was unable to moderate the relationship between CSRDis and CP. The limitation of this study's findings is that the adjusted R square value is deficient, only 5.8%. Therefore, future research aims to modify the research model that has been done or add other variables such as corporate governance, firm value, tax avoidance, et cetera. The implication of this study's findings is the importance of CSRDis being carried out by companies to provide a positive image from stakeholders so that they can increase CP.

References

- Angelia, D., & Suryaningsih, R. (2015). The effect of environmental performance and corporate social responsibility disclosure towards financial performance (Case study to manufacture, infrastructure, and service companies that listed at Indonesia stock exchange). Procedia-Social and Behavioral Sciences, 211, 348-355.

- Bedi, H.S. (2009). Financial performance and social responsibility: Indian scenario.

- Cho, S.J., Chung, C.Y., & Young, J. (2019). Study on the relationship between CSR and Financial Performance. Sustainability, 11(2), 343.

- Dao, B.T.T., & Ngo, H.A. (2020). Impact of corporate governance on firm performance and earnings management a study on vietnamese non-financial companies. Asian Economic and Financial Review, 10(5), 480.

- Dianita, P.S. (2011). Analysis of the effect of corporate social responsibility on financial performance with earnings management as a moderating variable. Journal of Modern Accounting and Auditing, 7(10), 1034.

- Gill, A., Biger, N., Mand H.S., & Mathur, N.A. (2013). Earning mangement, firm performance and the value of Indian manufacturing firm. Internasioanal Research Journal of Finance and Economics, 116, 121-132.

- Gray, R. (2005). Taking a long view on what we now know about social and environmental accountability and reporting. Electronic Journal of Radical Organisation Theory, 9(1), 6-36.

- Healy, P.M., & Wahlen, J.M. (1999). A review of the earnings management literature and its implications for standard setting. Accounting Horizons, 13(4), 365-383.

- Lin, C.S., Chang, R.Y., & Dang, V.T. (2015). An integrated model to explain how corporate social responsibility affects corporate financial performance. Sustainability, 7(7), 8292-8311.

- Machmuddah, Z., Sari, D.W., Utomo, S.D. (2020). Corporate social responsibility, profitability and firm value: Evidence from Indonesia. The Journal of Asian Finance, Economics, and Business, 7(9), 631-638.

- Nuryana, Y., & Surjandari, D.A. (2019). The effect of good corporate governance mechanism, and earning management on company financial performance. Global Journal of Management and Business Research, 19(1), 26-39.

- Prior, D., Surroca, J., & Tribó, J.A. (2008). Are socially responsible managers really ethical? Exploring the relationship between earnings management and corporate social responsibility. Corporate governance: An international review, 16(3), 160-177.

- Safi, I., & Shehzadi, A. (2015). Earnings management and firm performance: A case of Karachi Stock Exchange listed firms in Pakistan. International Journal of Economics and Empirical Research (IJEER), 3(6), 278-285.

- Sial, M.S., Chunmei, Z., Khan, T., & Nguyen, V.K. (2018). Corporate social responsibility, firm performance and the moderating effect of earnings management in Chinese firms. Asia-Pacific Journal of Business Administration, 10, 184-199.

- Sun, N., Salama, A., Hussainey, K., & Habbash, M. (2010). Corporate environmental disclosure, corporate governance and earnings management. Managerial Auditing Journal, 25, 679-700.

- Tandry, A.Y., Setiawati, L., & Setiawan, E. (2014). The effect of CSR disclosure to firm value with earning management as moderating variable: case study of non-financing firms listed at Indonesia Stock Exchange. International Journal of Trade and Global Markets, 7(3), 190-204.

- Utomo, S.D., Machmuddah, Z., Oktafiyani, M. (2019). The associations between earnings management, corporate environmental disclosure, corporate financial performance and corporate governance mechanisms. WSEAS Transactions on Business and Economics, 16, 345-354.