Research Article: 2019 Vol: 18 Issue: 2

Corporate Social Responsibility Disclosures and Corporate Performence: Evidence from the Listed Companies in Bangladesh

Mofijul Hoq Masum, United International University

Md. Mohan Uddin, United International University

Hasnan Ahmed, United International University

Md. Helal Uddin, United International University

Abstract

Corporate Social Responsibility (CSR) research becomes a burning issue to the academics in the last three decades both in developed and developing countries. This study aims at examining the possible effect of Corporate Social Responsibility Disclosures (CSRD) on corporate performances based on five key dimensions of CSR, among the public listed companies in Bangladesh. We have considered the Return on Equity (ROE) and leverage ratio as the proxy of dependent variable-corporate performance. Five dimensions of the CSR practices namely, environment, employee, social and community services, product and customer are considered as the proxy of independent variable - CSRD. To determine the CSRD practices of the listed company a three scale content analysis having fifty seven items has been used. To conduct the study, a sample of 196 Dhaka Stock Exchange (DSE) listed companies from seventeen industries has been scrutinized. In our study, we have found significant relationship between the proxy variables of corporate performances and key dimensions of the CSR practices. We have found that the listed companies disclose more information concerning to the employee related CSRD and less information on environment related CSRD. Out of five proxy variables of CSRD, the employee related CSRD and the environment related CSRD has positive impact on corporate performance while the social and community service related CSRD, product related CSRD and customer related CSRD has no significant relationship on corporate performance. The findings of the study show that CSR practices are value relevant in developing countries like Bangladesh. The findings of the study contribute to the literature of CSR in the way that more CSR disclosing companies are performing well in recent days. These findings will encourage the corporate people to involve in more CSR activities as it ensures the sustainability of corporate performances.

Keywords

Corporate Performances, CSR Practices, Listed Companies, Disclosures.

Introduction

Nowadays, the accountability of the business people exceeds the boundaries of their core activities rather the corporations are operated assuming a holistic approach (Karim et al., 2018). The stakeholders of the organizations are not only interested about the economic performances the company but also interested about the social and environmental performances of the (Ahmad et al., 2017; Farooque & Ahulu, 2017; Majumder et al., 2017; Welbeck, 2017; Janggu et al., 2014). This overwhelming accountability of the organization results huge corporate social responsibility research in the last three decades (Chen et al., 2018; Deegan, 2013; Al-Tuwaijri et al., 2004; Klassen & McLaughlin, 1996; Belkaoui & Karpik, 1989). The literature of Corporate Social Responsibility (CSR) disclosures provides divergent findings (Rashid, 2018; Karim et al., 2018; Isnalita & Narsa, 2012; Jamali, 2008). Some of the researchers have found positive association between CSR practices and corporate performances (Dianita, 2011; Setiawan & Darmawan, 2011; Balabanis et al., 1998; Margolis et al., 2009; Fauzi & Idris, 2009; Belkaoui & Karpik, 1989; Klassen & McLaughlin, 1996; Preston & O’Bannon, 1997; Russo & Fouts, 1997; Karpoff et al., 2005) and some of the researchers have found negative association between CSR practices and corporate performances (Wright & Ferris, 1997) even some of the researcher do not find any significant association between CSR and corporate performances (Mahoney & Roberts, 2007; Aras et al., 2010). These big-bang approaches of CSR literature spread over among the developed, developing and even under developed countries as well (Hossain et al., 2017).

The history of corporate social responsibility disclosures practices started in Bangladesh from 1990 and from then the academic researches on CSR become overwhelmingly expanded over the decades (Hossain et al., 2017). The CSR practices do not achieve a remarkable achievement in Bangladesh (Hossain et al., 2006; Belal, 2001; Azmat & Ha, 2013). Belal (2001) conducted a study to measure the CSR practices of the listed companies of Bangladesh although it has scope limitations due to the sample size as it only considers 30 listed banks. His study concluded that Bangladeshi companies are disclosing social, ethical and environmental information on a limited scale. Hossain et al. (2006) further examine the association between social and environmental disclosures and several corporate attributes in Bangladesh, for a sample of 150 listed companies during the year 2002-2003. They developed a single scale disclosure index having 60 contents.They found very few companies in Bangladesh disclosing the CSR activities on their annual reports although most of the CSR activities included the qualitative information. The study also reveals that out of a maximum possible score of 60, the highest CSRD score is only 19 and about 56 percent of the sample companies have a score of less than five and about 36 percent of the sample companies have a score between 5-10.

While most of the previous research has utilized secondary data, a relatively new dimensions of study conducted by Belal & Owen (2007) utilized interviews to document the views of a sample of Bangladeshi managers on the current state of, and future prospects for, social reporting in the country. They conducted a series of interviews with senior managers from 23 Bangladeshi companies representing the multinational, domestic private and domestic public sectors. The results of their study revealed that managers’ major motivation for social reporting practices lies in a desire on the part of corporate management to manage powerful stakeholder groups such as multinational companies. Hossain et al. (2017) has also conducted a case study on listed companies of Bangladesh where he used mixed method-interviews with 20 managers of 100 top listed companies of the country and scrutinized annual report of 2010-2011 of that particular company. He has found that the listed companies are disclosed some information on community or social service related CSR although they found very little information concerning employee related CSR. Further, Rashid (2018) conducted a study over 115 listed companies in Bangladesh and applies a simultaneous equation approach. He has found that CSR information significantly influence the firm performances although the firm’s performance does not significantly influence the CSR performances of the selected samples.

This study is different from the other studies as it examines the impact of five broad dimensions (modified from Saleh et al., 2010) of CSRD on corporate performances and explore which of the five dimensions of CSR significantly influence the corporate performance. This study is different from Rashid (2018) as he used a content analysis of 28 items and had no subdivision of CSR activities. Moreover, like Hossain et al. (2017), he also used annual reports of listed companies from 2001-2010. Whereas in our study, we have used a three scale content analysis having five broad dimensions of CSRD that includes a total fifty seven items. In addition, after the scandal of Rana Plaza in 2013, the companies become more aware on their CSR activities due to both local and international pressure. Thus, we have selected the annual reports of the listed companies during the year 2014-2015 as it represents the changes in corporate disclosures after the scandal of Rana Plaza.

The second section of the study explains the relevant literature of assuming the hypothesis tested in the study. The third section of the paper explains the details about the construction of CSRD index and the dependent and independent variables and model used in the study. The fourth section of the study entails analysis and discussion of the findings and the last section concludes on offering new research opportunities on CSR.

Literature Review And Hypothesis Development

In the era of globalization, the business organizations are not only accountable for their core business activities but also their social, environmental and ancillary activities (Karim et al., 2018). This holistic approach of the business is most valuable to the stakeholders (Ahmad et al., 2017; Farooque & Ahulu, 2017; Janggu et al., 2014). Corporate Social Responsibilities (CSR) are the actions of the organizations which not only results the financial returns of the organizations but also ensures social welfare returns (Javeed & Lefen, 2019). In the literature of recent CSR research, not only the determination of the quality of CSR activities is emphasized but also the association between the quality of CSR disclosures and the performance of the firm becomes a cornerstone to researchers (Rashid, 2018; Ameer & Othman, 2017; Plumlee et al., 2015; Clarkson et al., 2013; Harjoto & Jo, 2011; Dhaliwal et al., 2011; Margolis et al., 2009). Margolis et al. (2009) has conducted a meta-analysis over 250 studies and found three types of relationships, namely, positive relationship, negative relationship and non-significant relationship between CSR disclosures and the performance of the organization. About 28 percentage of the sample studied by Margolis had positive association between CSR disclosures and about 2 percent of the sample studied by him had negative association while his team found that about 29 percent of the sample studied had no significant association between the CSR disclosures and the performance of the concerned company. Rashid (2018) also conducted a study over 115 listed companies in Bangladesh and applies a simultaneous equation approach to investigate the relationship between firms performances and CSR practices. He has found that CSR information significantly influence the firm performances although the firm’s performances do not significantly influence the CSR performances of the selected samples. Meng et al. (2014) has conducted a study on Chinese listed companies where they used a content analysis over a sample size of 533 listed companies and concluded that companies having poor performances and good performances tends to disclose more environment related information rather than the average performers. Javeed & Lefen (2019) also conducted a comprehensive study based on Pakistani listed companies over the period of 2008 to 2017 where they have found that the CSR has a significant positive association with the corporate performances even the interaction of CEO power, interaction of managerial ownership and ownership concentration with CSR do not bring any significant change on such relationship between CSR and the corporate performances.

CSRD and Corporate Performance

CSRD and firm performance has a long and inconclusive history in the literature of CSR (Gallardo-Vázquez et al., 2019; Rashid, 2018; Karim et al., 2018; Patten, 2002). Previous studies have found significant positive association between CSRD and corporate performance (Dianita, 2011; Setiawan & Darmawan, 2011), some of the studies have found negative associations between them (Wright & Ferris, 1997); even some of the studies have explored no significant relationship (Mahoney & Roberts, 2007; Aras et al., 2010) between corporate social responsibility disclosures and corporate performance. Such diversified findings of the prior literatures construct a new research gap and raise questions about the findings of the previous studies (Gallardo-Vázquez et al., 2019). These dubious disputes of the prior literatures pave the substance of newer study on CSRD and corporate performance. Artiach et al. (2010) finds that listed companies having strong financial performance tends to disclose more information than the non-listed companies do, even the strong performer listed companies disclose more social activities on the face of the annual report than the less performing companies. Usually, the high performer company tends to disclose more information as it will reduce the risks associated with corporate performance (Artiach et al., 2010). Because of having diversified prior findings (Gallardo-Vázquez et al., 2019; Rashid, 2018; Karim et al., 2018; Isnalita & Narsa, 2012; Jamali, 2008), in this study, we further investigate the impact of CSRD on corporate performance. To measure the corporate performance, ROE has been used as it is one of the key indicators to measure the financial performance of the company (Bhuiyan & Masum, 2010). In the literature of CSRD and ROE it has motley results as well. For an instance, Lungu et al. (2011) and Jennifer & Taylor (2007) found a significant negative relationship between CSR practices and ROE, although Branco et al. (2014) and Xiang (2009) found a positive relationship between ROE and CSRD. Some other researchers (Rahman & Widyasari, 2008; Ho & Wong, 2001) have found no significant relationship between CSRD and ROE. Because of these diversified views in CSR literature we have re-examined the relationship between CSRD and ROE. Thus, we have assumed our first hypothesis followed by five sub-hypothesis as:

H1: There is a significant positive relationship between CSRD and Return on Equity (ROE).

H1.1: There is a significant positive relationship between environment related CSRD and ROE.

H1.2: There is a significant positive relationship between employee related CSRD and ROE.

H1.3: There is a significant positive relationship between social and community related CSRD and ROE.

H1.4: There is a significant positive relationship between product related CSRD and ROE.

H1.5: There is a significant positive relationship between customer related CSRD and ROE.

CSRD and Leverage

The literature of Corporate Social Responsibility (CSR) disclosures provides inconclusive findings (Gallardo-Vázquez et al., 2019; Rashid, 2018; Karim et al., 2018; Isnalita & Narsa, 2012; Jamali, 2008). Numerous researchers (Omar & Simon 2011; Ameer & Othman, 2017; Yusoff et al., 2016; Uyar & K?l?ç, 2012; Aksu & Kosedag, 2006; Chau & Gray, 2010) have used the leverage ratios as the proxy of corporate performances. Some of the previous studies (Ameer & Othman, 2017; Artiach et al., 2010) have found a significant negative relationship between CSR practices and leverage ratio. Some of the researchers (Al-Shubiri et al., 2012; Patton & Zelenka, 1997) have found a positive relationship between CSRD and leverage. On the other hand Xiang (2009) found no significant relationship between CSRD and leverage of the company. Because of these diversified views in CSR literature, we have also re-examined the relationship between CSRD and leverage ratio. Regardless of the diversified thoughts on the degree of association between CSRD and corporate leverage, there are various reasons for having a significant positive association between CSRD and leverage ratios of the companies. Alves et al. (2012) argue that high level of leverage increase the agency costs which induces the managers to provide large volume of information to reduce the agency costs. Jensen & Meckling (1976) opine that organizations having high leverage ratios have higher monitory costs and disclosed more information compared to the organization having low leverage ratios. Firms having high leverage ratios are also tried to persuade the lenders by disclosing more information and can extend their credit period (Elfeky, 2017). Thus we have assumed our second hypothesis followed by five sub-hypothesis as:

H2: There is a significant positive relationship between CSRD and Leverage.

H2.1: There is a significant positive relationship between environment related CSRD and Leverage.

H2.2: There is a significant positive relationship between employee related CSRD and Leverage.

H2.3: There is a significant positive relationship between social and community related CSRD and Leverage.

H2.4: There is a significant positive relationship between product related CSRD and Leverage.

H2.5: There is a significant positive relationship between customer related CSRD and Leverage.

Methodology Of The Study

Sample Design

To conduct the study, we have taken seventeen industries from the DSE as the formation of some of the industries are a bit different, even some of the companies have customized law regarding their financial reporting. Out of a population size of 245, we have selected 196 samples as some of the companies do not publish their annual reports regularly and some of the companies have no CSR information on their annual reports. Although some of the companies published stand-alone CSR report but the information of the CSR reports are duplicated on annual report (Anas et al., 2015). Moreover annual reports are more reliable as it is attested by third independent party (Gray et al., 2001). Thus, to conduct the study, we have selected the annual reports of the companies. And as per the time frame we have selected the year 2014-2015 followed by the collapse of Rana Plaza.

Variables Design

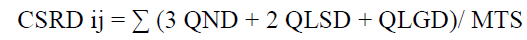

This part of the research depicts the relevance and determination of the variables used in the study. Dependent variables of the study include Return on Equity (ROE) and leverage ratio by which we measure the extent of performance of the concerned company. ROE is determined by dividing the net profit by the capital employed at the beginning of the year while the leverage ratio is determined by scaling the total debt by the total assets.We have used CSRD as the independent variable which is further divided into five broad dimensions, namely, environmental responsibility, employee information, social and community involvement, products responsibility, and customer disclosures. There are various way of quantifying the CSR activities: using number of wards (Zeghal & Ahmed, 1990; Deegan & Gordon, 1996; Deegan & Rankin, 1996; Satoshi, 2018), using number of sentences (Hackston & Milne, 1996), using number of pages (Guthrie & Parker, 1990), using content analysis (Al-Tuwaijri et al., 2004; Aras et al., 2010; Islam & Deegan 2010; Saleh et al., 2010; Hossain et al., 2006; Haniffa & Cooke 2002: 2005). Since all of these techniques has pros and cons (Saleh et al., 2010), we have developed a content analysis having 57 contents to determine the score for CSRD. To measure the quality of each content, we have used a three scale disclosure index: Quantitative disclosures in terms of quantity or amount having a weight of three, Qualitative Specific disclosures having a single value of two and Qualitative general disclosures have a score of one. Sample companies which do not have any disclosure for any particular content will get a score of zero for the concerned content. The CSR activities that are disclosed on the face of the audited financial statements of the listed companies are considered in this regard. We have computed the overall score of the CSRD for each company for each dimension by using the following formula:

Where,

CSRD ij =Corporate Social Responsibility Disclosure for ith company for jth dimension.

QND=Quantitative disclosures (Quantity or Amount).

QLSD=Qualitative Specific Disclosures.

QLGD=Qualitative General Disclosures.

MTS=Maximum Total Score for a particular company.

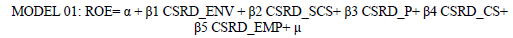

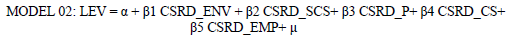

Models

Where,

CSRD_ENV=CSR disclosures Score on Environment Disclosures.

CSRD_SCS=CSR disclosures Score on Social and Community Disclosures.

CSRD_P=CSR disclosures Score on Product Disclosures.

CSRD_CS=CSR disclosures Score on Customer Disclosures.

CSRD_EMP=CSR disclosures Score on Employee Disclosures.

ROE=Return on Equity.

LEV=Leverage ratio.

μ=Error term.

Findings And Data Analysis

Descriptive Statistics

Table one represent the summaries of the descriptive statistics for the independent and dependent variables used in this study. The results represent the CSRD practices of Bangladeshi companies in terms of the five broad dimensions of the CSRD. Here, we can see that out of five dimensions of CSR practices, four of the dimensions have a minimum value of “0” which represents no disclosures of CSR activities on those four dimensions by some of the sample companies. On the other hand, the maximum value of CSR practices by the sample companies are 43.33 % on product related disclosures although the standard deviation (9.97) of CSRD_P also represents the significant differences of the CSR disclosures by the Bangladeshi listed companies. Moreover, the maximum CSR Scores of each of the five dimensions are far away from the mean value of each CSR dimensions. This phenomenon indicates that some of the companies performing their CSR activities in all dimensions while the others are performing very little on this regards. Like the other study (Belal 2001; Hossain et al., 2006), the results reveals that the overall CSR reporting practices in Bangladesh is not satisfactory but it is improving as the result shows the mean CSRD in all dimensions exceed 10% of the maximum possible scores except the environmental related CSR.

The results demonstrate that the highest mean scores on the five CSR dimensions is 22.19 with a standard deviation of 6.16 concerning to the employee dimensions of the CSR. One of the possible reasons may be, recently, the Bangladeshi companies have faced various tragic issues concerning to the employees’ related matters especially the collapse of Rana Plaza. And it is also mandatory for the Bangladeshi company to follow the Bangladesh Labor Act 2014 (amended). Thus, we have found highest mean score for CSRD_EMP among the five dimensions of CSR activities. The standard deviation of CSRD_EMP is 6.16 which indicate that most of the Bangladeshi companies are very much concerned about their employee related CSR activities in recent days and disclose more information on this dimension. The results also represent that the Bangladeshi companies pays less attentions on environmental issues as it has the lowest mean scores of 5.95 and have minimum scores of 0. In addition the standard deviation is 5.49 which are almost equal to the mean value that represents that most of the companies in Bangladesh are not too much cognizant about their environment related issues. The descriptive statistics of the dependent variables especially, LEV represents that the information of the samples are homogeneous in nature as their standard deviation is very low compared to their mean values. The ROE of the companies are fluctuated in a noticeable amount as its standard deviation is 18.92 which are close to the mean value of 19.14 (Table 1).

| Table 1: Descriptive Statistics | |||||

| N | Minimum | Maximum | Mean | Std. Deviation | |

|---|---|---|---|---|---|

| LEV | 196 | 0.01 | 0.39 | 0.17 | 0.08 |

| ROE | 196 | -1.29 | 98.21 | 19.14 | 18.92 |

| CSRD_ENV | 196 | 0.00 | 23.53 | 5.95 | 5.49 |

| CSRD_EMP | 196 | 3.64 | 32.73 | 22.19 | 6.16 |

| CSRD_SCS | 196 | 0.00 | 40.00 | 11.49 | 8.46 |

| CSRD_P | 196 | 0.00 | 43.33 | 12.97 | 9.97 |

| CSRD_CS | 196 | 0.00 | 26.67 | 11.52 | 8.60 |

Collinearity Statistics

We have used both the tolerance value and VIF value to check the collinearity of the variables. In case of tolerance value, Tabachnick & Fidell (2001) suggested that tolerance value should be more than 0.10 while the others, like Menard (2000) suggested that the minimum tolerance value should be 0.20. In our study, we have found that all the variables have more than 0.10 tolerance value. Thus on the basis of tolerance value, our variables has no multi-collinearity problems. In addition, we have also checked the VIF values of our variables. There are divergent views of using the VIF values. Neter et al. (1989) suggested that the maximum value for VIF value should be 10 while Rogerson (2001) suggested that it should be 5. In our study, we have found that the VIF values for the variables are less than 2 that indicate that our variables have no multi-collinearity problems in terms of VIF value as well.

Regression Analysis

Table 2 represents the results of the regressions which are run through SPSS (version 25) software. We have found that all the models are significant at 1% level of significance. This indicates that the corporate performances namely, ROE and Leverage of the Bangladeshi listed companies are significantly associated with the five dimensions of CSR activities of the concerned companies. The adjusted R square values for the two models are 0.588 and 0.289 at p<0.01; which indicates that all corporate performance variables are significantly influenced by the variation in CSR dimensions which is also similar to the findings of Javeed & Lefen (2019). The results entails that on the first model, the ROE is significantly positively associated with environment related CSR (p<0.05) and employee related CSR (p<0.01) although the co-efficient of environment related CSR is very small (0.046). Our findings concerning to the environment related CSRD also supported by the findings of Meng et al. (2014) which is conducted on the basis of Chinese listed companies and he concluded that companies having poor performances may disclose more environment related information. From table two, we have found that the employee related CSR has most significant association on corporate performance as it has the highest co-efficient (2.723, p<0.01) among all other CSRD variables. This represents that the corporate performance of the listed companies in Bangladesh has been significantly influenced by the employee related CSRD. The more the company spend on employee related CSR the greater the performance the company has achieved.

| Table 2: Regression Analysis | |||||||

| Model | CSRD_ENV Beta, (t statistics) |

CSRD_EMP Beta, (t statistics) |

CSRD_SCS Beta, (t statistics) |

CSRD_P Beta, (t statistics) |

CSRD_CS Beta, (t statistics) |

Adjusted R Square |

Constant |

|---|---|---|---|---|---|---|---|

| ROE (t-Stat) |

0.046** (0.434) |

2.723* (15.690) |

0.118 (1.082) |

-0.084 (-0.941) |

0.345 (2.247) |

0.588* | 9.682** |

| LEV (t-Stat) |

0.001*** (1.165) |

0.059* (4.409) |

0.000 (0.268) |

-2.719 (-0.055) |

-0.024 (-2.061) |

0.289* | 0.090* |

Note: * 1 % level of significance, ** 5% level of significance, *** 10% level of significance.

With regards to the second model, it is found that the employee related CSRD and environment related CSRD has significant positive association with the leverage ratio of the sample companies at p<0.01 and p<0.10 respectively. In the second model we have found that the highest beta co-efficient lies on product related CSRD (-2.719) although it has negative and insignificant impact on leverage of the company. The beta co-efficient of the employee related CSRD and environment related CSRD are 0.001 and 0.059 respectively although these indicates very low influence on leverage ratio but they have significant influence on leverage ratio of the sample companies. Therefore, we have found that the decisions of the lenders are significantly influenced by the employee related CSRD and environment related CSRD.

Hypothesis Analysis

The results of the study entail that from the first model, hypothesis H1.1 which assumes significant positive relationship between ROE and environment related CSRD and H1.2 that assumes significant positive relationship between return on equity and Employee related CSRD are accepted at p<5% and p<1% respectively. These hypotheses are also accepted by Branco et al. (2014) and Xiang (2009). The rest three hypotheses (H1.3, H1.4 and H1.5) concerning ROE and CSRD are rejected. This result suggests that companies having higher ROE invest more on Environment related CSRD and Employee related CSRD. In our second model where it is assumed that the leverage ratios of the companies has significant positive associations with the dimensions of CSRD. But we have found that the leverage ratio has only significant positive associations with environment related CSRD and employee related CSRD which is statistically significant at p<10% and p<1% respectively (Table 3). These hypotheses are also accepted by Al-Shubiri et al. (2012) and Xiang (2009). These implies that the firms having high leverage spent more on environment related CSRD and employee related CSRD due to the pressure of the lenders. Other three hypotheses (H2.3, H2.4 and H2.5) concerning to the leverage has been rejected as they are statistically insignificant.

| Table 3: Summary Of The Key Findings | |||

| Models | Adjusted R Square | Significance of the Independent Variables (IV) | Degree of Association |

|---|---|---|---|

| Model 01 ROE as the dependent variable | 58.8%* | Significant IV: CSRD_ENV** CSRD_EMP*** Insignificant IV: CSRD_SCS,CSRD_P,CSRD_CS |

Negative Association: CSRD_P, Positive Association: CSRD_ENV,CSRD_SCS,CSRD_CS, CSRD_EMP |

| Model 02 LEV as the dependent variable | 28.9%* | Significant IV: CSRD_ENV**, CSRD_EMP* Insignificant IV: CSRD_SCS,CSRD_P,CSRD_CS |

Negative Association: CSRD_P ,CSRD_CS Positive Association: CSRD_ENV, CSRD_EMP, CSRD_SCS |

Note: * 1 % level of significance, ** 5% level of significance, *** 10% level of significance.

Discussion

The results of the study epitomize that the Bangladeshi listed companies pay more attention on their employee related dimensions of CSR activities and surprisingly on environment related dimensions of CSR activities. Since the employees of a company play vital role to enhance corporate performance (Masum et al., 2017), it is logical that the company should spend more on them. In addition, the amended Bangladesh labor act 2014 has some compliance issues that compel the listed companies to perform certain activities which ultimately increase their employee related CSRD. The scandals of Tajreen Garments, Spectrum Garments, Rana Plaza, etc. bring a rapid change regarding the corporate social responsibility practices in Bangladesh. Moreover Bangladesh is the ninth-most polluted country in the world according to the statistics of the global Environmental Performance Index in 2014. These local and international issues directly and indirectly compel the Bangladeshi companies to involve more on CSR activities especially on environmental issues, for an instance, introduction of green tax, tax rebate on environmental issues, ISO 14001 certification etc. Thus we have found that both ROE and Leverage ratio of the firm is significantly associated with environment related CSRD.

Conclusion And Recommendation

Although the CSR practices of the listed companies are not up-to the mark as we have found some of the companies disclose no information concerning to the CSR on their annual reports but still it is far better than earlier. It is also a matter of hope that the listed companies consider the CSR spending as an investment rather than expenditure. The findings of the study will stimulate the companies to spend more on CSR, as more spending on CSR will increase both the long run (in terms of solvency) and the short run performances (profitability) of the organization. The overall findings of the study will induce the corporate people to think the CSR expenditures as the investment rather than expenses. The study has some limitations; firstly, it only considers the cross sectional data a longitudinal study can be conducted to draw a more accurate conclusion, secondly our study only considers the listed companies, and CSR practices of unlisted companies can also be relevant on this regards, thirdly, all the companies of the selected sample has been taken from Bangladesh thus the findings can hardly be generalised for other countries except the South Asian region. And last of all we have used only the annual reports to measure the quality of CSRD for the listed companies some other sources like websites, stand-alone CSR report can be used to measure the extent of the CSRD as well. Several broad areas of studies can be carried on future research, for an instance:

1. To explore Quality of CSR disclosures for both sensitive and non-sensitive industries so that the sensitive industries can come up with sufficient investment on these issues.

2. To examine the impact on managerial decisions to disclose potential CSR information.

3. To explore the relationship between CSR disclosures with corporate performances for both sensitive and non-sensitive industries.

4. To measure the extent of CSR disclosures between the awardee companies with the non-awardee companies and the variability of their performances.

Appendix

Appendix 1: List of Items based on Five Broad Dimensions of CSRD [Fifty Seven Items]

| A. Environment related CSRD (seventeen items) |

|---|

| 1. Environmental policies or company concern for the environment. |

| 2.Statements indicating that the company’s operations are non-polluting |

| 3.There are in compliance with pollution laws and regulations. |

| 4.Pollution Control and Reduction |

| 5.Conservation of natural resources e.g. Busing recycling material, recycling glass, metals, oil water, paper etc. |

| 6.Environment Restoration Program |

| 7.Support for public/private action designed to protect the environment. |

| 8.Disclosing air emission information. |

| 9.Disclosing water discharge information. |

| 10.Disclosing solid waste deposal information |

| 11.Contributions to beautify the Environment |

| 12.Wildlife conservation |

| 13.Restoring historical buildings or structures |

| 14.Training employee on environmental issues |

| 15.R & D for the environment |

| 16.Internal environmental audit |

| 17.Award for environmental protection e.g. ISO 14001, Carbon label. |

| B. Employee related CSRD (twenty two items) |

|---|

| 1.Complying with health and safety standards and regulations. |

| 2.Information on education/training of employees on health and safety. |

| 3.Information on accident statistics. |

| 4.Receiving a safety award e.g. OSHAS 18000, ISO 18001, Zero accident, TLS: 8001 |

| 5.Providing low cost health care to employees |

| 6.Employees training/Giving financial assistance to employees in educational institutions or continuing education courses |

| 7.Providing recreational activities/facilities. |

| 8.Providing staff accommodation/staff home ownership schemes, food, fuel, other benefits. |

| 9.Information about support for day care, maternity and paternity level, holidays and vacations |

| 10.Disclosing policy for company’s remuneration package/schemes. |

| 11.Information of employees share purchase schemes. Or profit sharing issues |

| 12.Providing number of employees in the company/branch/subsidiary or employee profile |

| 13.Providing information on qualifications and experience of employees recruited. |

| 14.Providing information on the stability of the worker job and company’s future. |

| 15.Reporting on company’s relationship with trade unions/workers. |

| 16.Information on recruitment/employment of minorities/women/special interest groups. |

| 17.Statistics of employee turnover |

| 18.Establishment of training center |

| 19.Conducting research to improve work safety |

| 20.Reducing or eliminating pollutants or hazards in the work environment |

| 21.Child labour related issues |

| 22.Effective auditing system for compliance of employee related issues |

| C. Social and community service related CSRD (eight items) |

|---|

| 1.Donations of cash, products or employee services to support community activities, events, arts sports etc. |

| 2.Summer or part-time employment of students |

| 3.Sponsoring public health projects and distributing health-related information to public |

| 4. Funding scholarship programs or activities |

| 5. Aiding disaster victims (donation cash, product etc.) |

| 6. Supporting National Pride or Govt. sponsored campaigns |

| 7. Recognizing local and indigenous communities or public project |

| 8. Charity donation |

| D. Product related CSRD (six items) |

|---|

| 1. Disclosing that products meet applicable safety standards |

| 2. Providing information on the safety of the firm’s product |

| 3.Information on developments related to the company’s products, including its packaging |

| 4. Product research and development by the company to improve its products in terms of quality and safety |

| 5. Information on the quality of the firm’s products as reflected in prizes/awards received e.g. ISO 9002, 22000, ISO/IEC 17025, GMP/HACCP/HALAL, BRC |

| 6. Discussions of major products |

| E. Customer related CSRD (four items) |

|---|

| 1.Types of consumer |

| 2. Nature of service provided to the customer |

| 3. Customer rating |

| 4. Customer loyalty service |

| Appendix 2: Overview Of Samples | |||

| Name of the Industry | Population ( N) | Sample (n) | |

|---|---|---|---|

| 1 | Bank | 30 | 30 |

| 2 | Cement | 7 | 6 |

| 3 | Ceramics Sector | 5 | 4 |

| 4 | Engineering | 36 | 31 |

| 5 | Financial Institutions | 23 | 17 |

| 6 | Food & Allied | 18 | 16 |

| 7 | Fuel & Power | 18 | 14 |

| 8 | IT Sector | 8 | 8 |

| 9 | Jute | 3 | 2 |

| 10 | Paper & Printing | 2 | 1 |

| 12 | Pharmaceutical &Chemical | 29 | 24 |

| 13 | Services & Real Estate | 4 | 4 |

| 14 | Tannery Industries | 6 | 5 |

| 15 | Telecommunication | 2 | 2 |

| 16 | Textile | 50 | 29 |

| 17 | Travel & Leisure | 4 | 3 |

| Total | 245 | 196 | |

References

- Ahmad, N.B.J., Rashid, A., & Gow, J. (2017). Board independence and corporate social responsibility (CSR) reporting in Malaysia. Australasian Accounting, Business and Finance Journal, 11(2), 61-85.

- Aksu, M., & Kosedag, A. (2006). Transparency and disclosure scores and their determinants in the Istanbul stock exchange. Corporate Governance: An International Review, 14(4), 277-296.

- Al-Farooque, O., & Ahulu, H. (2017). Determinants of social and economic reportings: Evidence from Australia, the UK and South African multinational enterprises. International Journal of Accounting & Information Management, 25(2), 177-200.

- Al-Shubiri, F.N., Al-Abedallat, A.Z., & Orabi, M.M.A. (2012). Financial and non-financial determinants of corporate social responsibility. Asian Economic and Financial Review, 2(8), 1001-1012.

- Al-Tuwaijri, S.A., Christensen, T.E., & Hughes Ii, K.E. (2004). The relations among environmental disclosure, environmental performance, and economic performance: A simultaneous equations approach. Accounting, organizations and society, 29(5-6), 447-471.

- Alves, H.R.A.M., Rodrigues, A.M., & Canadas, N. (2012). Factors influencing the different categories of voluntary disclosure in annual reports: An analysis for Iberian Peninsula listed companies. Tekhne, 10(1), 15-26.

- Ameer, R., & Othman, R. (2017). Corporate social responsibility performance communication and portfolio management. Managerial Finance, 43(5), 595-613.

- Anas, A., Abdul Rashid, H.M., & Annuar, H.A. (2015). The effect of award on CSR disclosures in annual reports of Malaysian PLCs. Social Responsibility Journal, 11(4), 831-852.

- Aras, G., Aybars, A., & Kutlu, O. (2010). Managing corporate performance: Investigating the relationship between corporate social responsibility and financial performance in emerging markets. International Journal of Productivity and Performance management, 59(3), 229-254.

- Artiach, T., Lee, D., Nelson, D., & Walker, J. (2010). The determinants of corporate sustainability performance. Accounting & Finance, 50(1), 31-51.

- Azmat, F., & Ha, H. (2013). Corporate social responsibility, customer trust, and loyalty-perspectives from a developing country. Thunderbird International Business Review, 55(3), 253-270.

- Balabanis, G., Phillips, H.C., & Lyall, J. (1998). Corporate social responsibility and economic performance in the top British companies: Are they linked? European Business Review, 98(1), 25-44.

- Belkaoui, A., & Karpik, P.G. (1989). Determinants of the corporate decision to disclose social information. Accounting, Auditing & Accountability Journal, 2(1).

- Bhuiyan, M.N.U., & Masum, M.H. (2010). Balanced scorecard: A multi-stream performance measurement tool for public sector corporations in Bangladesh. The Cost and Management, 38(5), 19-25.

- Castelo Branco, M., Delgado, C., Sá, M., & Sousa, C. (2014). Comparing CSR communication on corporate web sites in Sweden and Spain. Baltic Journal of Management, 9(2), 231-250.

- Chau, G., & Gray, S.J. (2010). Family ownership, board independence and voluntary disclosure: Evidence from Hong Kong. Journal of International Accounting, Auditing and Taxation, 19(2), 93-109.

- Chen, Y.C., Hung, M., & Wang, Y. (2018). The effect of mandatory CSR disclosure on firm profitability and social externalities: Evidence from China. Journal of Accounting and Economics, 65(1), 169-190.

- Clarkson, P.M., Fang, X., Li, Y., & Richardson, G. (2013). The relevance of environmental disclosures: Are such disclosures incrementally informative? Journal of Accounting and Public Policy, 32(5), 410-431.

- Clarkson, P.M., Overell, M.B., & Chapple, L. (2011). Environmental reporting and its relation to corporate environmental performance. Abacus, 47(1), 27-60.

- Deegan, C. (2013). The accountant will have a central role in saving the planet? really? A reflection on green accounting and green eyeshades twenty years later. Critical Perspectives on Accounting, 24(6), 448-458.

- Deegan, C., & Gordon, B. (1996). A study of the environmental disclosure practices of Australian corporations. Accounting and Business Research, 26(3), 187-199.

- Deegan, C., & Rankin, M. (1996). Do Australian companies report environmental news objectively? An analysis of environmental disclosures by firms prosecuted successfully by the Environmental Protection Authority. Accounting, Auditing & Accountability Journal, 9(2), 50-67.

- Dhaliwal, D.S., Li, O.Z., Tsang, A., & Yang, Y.G. (2011). Voluntary nonfinancial disclosure and the cost of equity capital: The initiation of corporate social responsibility reporting. The Accounting Review, 86(1), 59-100.

- Dianita, P.S. (2011). Analysis of the effect of corporate social responsibility on financial performance with earnings management as a moderating variable. Journal of Modern Accounting and Auditing, 7(10), 1034-1045.

- Elfeky, M.I. (2017). The extent of voluntary disclosure and its determinants in emerging markets: Evidence from Egypt. The Journal of Finance and Data Science, 3(1-4), 45-59.

- Fauzi, H., & Idris, K. (2009). The relationship of CSR and financial performance: New evidence from Indonesian companies. Issues in Social and Environmental Accounting, 3(1).

- Gallardo-Vázquez, D., Barroso-Méndez, M.J., Pajuelo-Moreno, M.L., & Sánchez-Meca, J. (2019). Corporate social responsibility disclosure and performance: A meta-analytic approach. Sustainability, 11(4), 1115.

- Gray, R., Javad, M., Power, D.M., & Sinclair, C.D. (2001). Social and environmental disclosure and corporate characteristics: A research note and extension. Journal of Business Finance & Accounting, 28(3-4), 327-356.

- Gray, R., Kouhy, R., & Lavers, S. (1995). Corporate social and environmental reporting: A review of the literature and a longitudinal study of UK disclosure. Accounting, Auditing & Accountability Journal, 8(2), 47-77.

- Guthrie, J., & Parker, L.D. (1990). Corporate social disclosure practice: a comparative international analysis. Advances in Public Interest Accounting, 3, 159-175.

- Hackston, D., & Milne, M.J. (1996). Some determinants of social and environmental disclosures in New Zealand companies. Accounting, Auditing & Accountability Journal, 9(1), 77-108.

- Hair, J.F., Anderson, R.E., Tatham, R.L., & William, C. (1986). Black (1995), multivariate data analysis: An empirical typology of mature industrial-product environments. Academy of Management Journal, 26(2), 213-230.

- Haniffa, R.M., & Cooke, T.E. (2002). Culture, corporate governance and disclosure in Malaysian corporations. Abacus, 38(3), 317-349.

- Haniffa, R.M., & Cooke, T.E. (2005). The impact of culture and governance on corporate social reporting. Journal of Accounting and Public Policy, 24(5), 391-430.

- Ho, S.S., & Wong, K.S. (2001). A study of the relationship between corporate governance structures and the extent of voluntary disclosure. Journal of International Accounting, Auditing and Taxation, 10(2), 139-156.

- Hossain, M., Islam, K., & Andrew, J. (2006). Corporate social and environmental disclosure in developing countries: Evidence from Bangladesh.

- Hossain, M.M., Momin, M.A., Rowe, A.L., & Quaddus, M. (2017). Corporate social and environmental reporting practices: A case of listed companies in Bangladesh. Sustainability Accounting, Management and Policy Journal, 8(2), 138-165.

- Islam, M.A., & Deegan, C. (2010). Media pressures and corporate disclosure of social responsibility performance information: A study of two global clothing and sports retail companies. Accounting and Business Research, 40(2), 131-148.

- Isnalita, & Narsa, I.M. (2012). CSR disclosure, customer loyalty, and firm values (study at mining company listed in indonesia stock exchange). Asian Journal of Accounting Research, 2(2), 8-14.

- Jamali, D. (2008). A stakeholder approach to corporate social responsibility: A fresh perspective into theory and practice. Journal of Business Ethics, 82(1), 213-231.

- Janggu, T., Darus, F., Zain, M.M., & Sawani, Y. (2014). Does good corporate governance lead to better sustainability reporting? An analysis using structural equation modeling. Procedia-Social and Behavioral Sciences, 145, 138-145.

- Javeed, S., & Lefen, L. (2019). An analysis of corporate social responsibility and firm performance with moderating effects of CEO power and ownership structure: A case study of the manufacturing sector of Pakistan. Sustainability, 11(1), 248.

- Jennifer Ho, L.C., & Taylor, M.E. (2007). An empirical analysis of triple bottom-line reporting and its determinants: Evidence from the United States and Japan. Journal of International Financial Management & Accounting, 18(2), 123-150.

- Jensen, M.C., & Meckling, W.H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3(4), 305-360.

- Jo, H., & Harjoto, M.A. (2011). Corporate governance and firm value: The impact of corporate social responsibility. Journal of Business Ethics, 103(3), 351-383.

- Karim, K., Lee, E., & Suh, S. (2018). Corporate social responsibility and CEO compensation structure. Advances in Accounting, 40, 27-41.

- Karpoff, J.M., Lott, Jr, J.R., & Wehrly, E.W. (2005). The reputational penalties for environmental violations: Empirical evidence. The Journal of Law and Economics, 48(2), 653-675.

- Klassen, R.D., & McLaughlin, C.P. (1996). The impact of environmental management on firm performance. Management Science, 42(8), 1199-1214.

- Lungu, C.I., Caraiani, C., Dascalu, C., & Guse, R.G. (2011). Exploratory study on social and environmental reporting of European companies in crises period. Accounting and Management Information Systems, 10(4).

- Mahoney, L., & Roberts, R.W. (2007). Corporate social performance, financial performance and institutional ownership in Canadian firms. In Accounting Forum, 31(3), 233-253.

- Majumder, M.T.H., Akter, A., & Li, X. (2017). Corporate governance and corporate social disclosures: A meta-analytical review. International Journal of Accounting & Information Management, 25(4), 434-458.

- Margolis, J.D., Elfenbein, H.A., & Walsh, J.P. (2009). Does it pay to be good... and does it matter? A meta-analysis of the relationship between corporate social and financial performance. And does it matter.

- Masum, M.H., Fakir, A.A., & Hossain, M.K. (2017). Industries: A comprehensive study from Bangladesh. Research Journal of Finance and Accounting, 8(10).

- Menard, S. (2000). Coefficients of determination for multiple logistic regression analysis. The American Statistician, 54(1), 17-24.

- Meng, X.H., Zeng, S.X., Shi, J.J., Qi, G.Y., & Zhang, Z.B. (2014). The relationship between corporate environmental performance and environmental disclosure: An empirical study in China. Journal of Environmental Management, 145, 357-367.

- Neter, J., Wasserman, W., & Kutner, M.H. (1989). Applied linear regression models.

- Omar, B., & Simon, J. (2011). Corporate aggregate disclosure practices in Jordan. Advances in Accounting, 27(1), 166-186.

- Orlitzky, M., Schmidt, F.L., & Rynes, S.L. (2003). Corporate social and financial performance: A meta-analysis. Organization Studies, 24(3), 403-441.

- Patten, D.M. (2002). The relation between environmental performance and environmental disclosure: A research note. Accounting, Organizations and Society, 27(8), 763-773.

- Patton, J., & Zelenka, I. (1997). An empirical analysis of the determinants of the extent of disclosure in annual reports of joint stock companies in the Czech Republic. European Accounting Review, 6(4), 605-626.

- Plumlee, M., Brown, D., Hayes, R.M., & Marshall, R.S. (2015). Voluntary environmental disclosure quality and firm value: Further evidence. Journal of Accounting and Public Policy, 34(4), 336-361.

- Preston, L.E., & O'bannon, D.P. (1997). The corporate social-financial performance relationship: A typology and analysis. Business & Society, 36(4), 419-429.

- Rahman Belal, A. (2001). A study of corporate social disclosures in Bangladesh. Managerial Auditing Journal, 16(5), 274-289

- Rahman Belal, A., & Owen, D.L. (2007). The views of corporate managers on the current state of, and future prospects for, social reporting in Bangladesh: An engagement-based study. Accounting, Auditing & Accountability Journal, 20(3), 472-494.

- Rahman, A., & Widyasari, K.N. (2008). The analysis of company characteristic influence toward CSR disclosure: empirical evidence of manufacturing companies listed in JSX. Journal of Accounting and Indonesian Auditing, 12(1).

- Rashid, A. (2018). The influence of corporate governance practices on corporate social responsibility reporting. Social Responsibility Journal, 14(1), 20-39.

- Rogerson, P. (2001). Statistical methods for geography. Sage

- Russo, M.V., & Fouts, P.A. (1997). A resource-based perspective on corporate environmental performance and profitability. Academy of Management Journal, 40(3), 534-559.

- Saleh, M., Zulkifli, N., & Muhamad, R. (2010). Corporate social responsibility disclosure and its relation on institutional ownership: Evidence from public listed companies in Malaysia. Managerial Auditing Journal, 25(6), 591-613.

- Satoshi, S. (2018). Motivation to adopt game-based learning (GBL) for employee training and development: A case study. Journal of Entrepreneurship Education, 21(4).

- Setiawan, M., & Darmawan. (2011). The relationship between corporate social responsibility and firm financial performance: Evidence from the firms listed in LQ45 of the Indonesian stock exchange market. European Journal of Social Sciences, 23(2), 288-293.

- Sweeney, L., & Coughlan, J. (2008). Do different industries report corporate social responsibility differently? An investigation through the lens of stakeholder theory. Journal of Marketing Communications, 14(2), 113-124.

- Tabachnick, B.G., & Fidell, L.S. (2001). Using multivariate analysis.

- Uyar, A., & Kiliç, M. (2012). Value relevance of voluntary disclosure: Evidence from Turkish firms. Journal of Intellectual Capital, 13(3), 363-376.

- Welbeck, E.E. (2017). The influence of institutional environment on corporate responsibility disclosures in Ghana. Meditari Accountancy Research, 25(2), 216-240.

- Wright, P., & Ferris, S.P. (1997). Agency conflict and corporate strategy: The effect of divestment on corporate value. Strategic Management Journal, 18(1), 77-83.

- Xiang, X.I.A.O. (2009). Effects of corporate governance structure and company characteristics on social responsibility information disclosure. Proceeding of 2009 International Conference on Management Science and Engineering, Beijing Jiaotong University.

- Yusoff, H., Jamal, A.D.A., & Darus, F. (2016). Corporate governance and corporate social responsibility disclosures: An emphasis on the CSR key dimensions. Journal of Accounting and Auditing: Research and Practice.

- Zeghal, D., & Ahmed, S.A. (1990). Comparison of social responsibility information disclosure media used by Canadian firms. Accounting, Auditing & Accountability Journal, 3(1).