Research Article: 2021 Vol: 20 Issue: 2S

Customer Satisfaction measurement of E- Banking Service Quality in Riyadh, Saudi Arabia

Nihayah Mahrakani, Al-Ahliyya Amman University

Marwan M. Shammot, King Saud University

Nawras M. Nusairat, Applied Science Private University

Ahmad M. A. Zamil, Prince Sattam bin Abdulaziz University

Ahmad Yousef Areiqat, Al-Ahliyya Amman University

Abstract

Advances in the capabilities of data technologies and the desire for accelerated business advancements are inspiring services firms, such as banks, to re-engineer their current business processes and cycles and develop newer business models. The execution of self-service through a web-based portal is one of the critical business models being actualized by banks. These portals are expected to encourage upgrades in the quality of customer services. Yet, there is a need to develop research models to inspect what features of portals or web sites and how they could enhance customer perceptions of quality and satisfaction. This paper draws upon hypotheses and ideas from information systems and services marketing literatures to develop a rich model and suggestion connecting the features of web portals/websites and customer satisfaction with internet banking services. Exact exploration results show that while internet banking customer satisfaction in Riyadh can be enhanced by closing service connection gap and service information gap, the overall service quality can be improved by closing the service connection gap and service guidelines gap.

Keywords

Customer Satisfaction, Design of Theoretical Framework, Online Banking Service Quality, Portal Based E-Banking, Self-Service E-Banking

Paper Type

Development of Theoretical Framework and Description part of a Research in Internet Banking Service Quality.

Introduction

In this day and age of intense competition, one of the keys to competitive advantage lies in delivering top notch services and enhancing customer satisfaction (Sureshchandar, Chandrasekharan & Anantharaman, 2002). Service quality has been identified as the ultimate objective of service providers (Abby, Simon & Matthew, 1994). Service quality and customer satisfaction are inarguably two core concepts at the core of the marketing theory and practice (Chu, Po-Young, Lee, Gin-Yuan, Chao & Yu, 2012). Today, numerous monetary services associations are racing to become more customers focused (Thornton & White, 2001).

Technological developments especially in the area of telecommunications and data technology are revolutionizing the banking business. Aided by technological advances and developments, banks have responded to the challenge of competition from several companies that have entered into financial and banking industry by embracing online banking strategy that focuses on attempting to construct customer satisfaction (Joseph, McClure & Joseph, 1999) through giving better items and services and at the same time to reduce operating costs (Adel, 2001). The Internet has expanded skylines for businesses worldwide, especially e-services (Divya & Padhmanabhan, 2008). Retailer's websites are a significant interface between retailers (banks) and their customers. The discoveries on different features and elements that banks include their websites assume a critical role in attracting customers and ensuring their satisfaction with online services (Dobdinga, 2013). During the most recent couple of years, these discoveries have led to the development of simple banking web sites into comprehensive e-banking portals offering a great variety of services notwithstanding conventional bank items and thereby enabling customers to acquire financial advice from merely one source (Mahdi, 2019).

One of the critical manners by which Internet technologies provide opportunities for enhancing customer service is through the appropriation and implementation of self-service web portals. Web portals assume an increasingly specialized role in the online world (Brian, 2000). Portals are gateways enabling viewers to access authoritative services by means of Internet. Portals integrate a variety of services giving them to viewers in a single window (Mari & Minna, 2004). These portals provide uphold for the direct of banking exchanges through the Internet. Examples of the exchanges are balance request, exchange history, account transfers, on-line bill payments, and on-line loan applications (Ziqi & Michael, 2002). Bank web sites that offer just data on their pages without probability to do any exchanges online are not qualified as self-service portals (Joseph, McClure, & Joseph, 1999). One advantage with portals banking is that no proprietary software must be installed for accessing the banking service over the Internet. Banking services can be acquired through the public network of the Internet or through private virtual network. Hence, a customer can access to his/her financial balance through the Internetor Extranet (Kristina, 2007).

The Internet is expected to have a significant and positive effect on customer perceptions of service quality in the banking sector (Wang et al., 2003). Despite the importance of Internet banking in numerous financial foundations, fewer studies have focused on customer reception and customer satisfaction (Mols, 1998) especially in Middle Easterner world and especially in Saudi Arabia (Al-Ghatani, Hubona & Wang, 2007; Joseph, McClure & Joseph, 1999; Divya & Padhmanabhan, 2008; Mari & Minna, 2004) especially utilizing portal based electronic banking services.

Objective

Given the salience of these portals, the objective of our research is to examine how the features of these portals could affect customer's perceptions of the quality of banking services. By proposing a new framework for portal implementation, our point is to address the existing research hole by proposing a new framework for portal implementation. We draw upon theories and research from data management systems and services marketing to develop a set of suggestions that answer the accompanying question:

How do features of the web-based portals influence banking customers’ perceptions of service quality and satisfaction?

The next section of this paper presents our conceptual model. This model presents a nomological network of effects through which the features of the portal affect customer perceptions of online service quality and customer satisfaction. This model is worked through the integration of related literature in information systems and services marketing. The subsequent section discusses the ramifications of this model and recommendations for future research and practice.

Conceptual Model

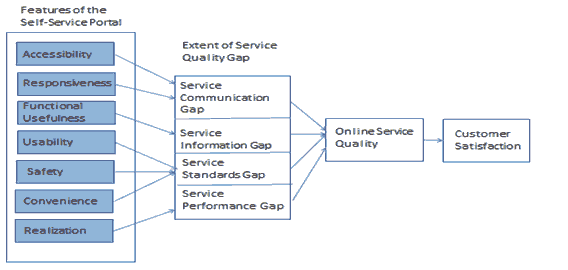

Figure 1 presents our conceptual model. As per (Oserwalder et al., 2005) any business model definition ought to follow three level representations. In the present paper a mix of level-2 and level-3 are used to describe the research while the level-1 was presented as a strategy for service quality model representation (in AlSudairi, 2012). We argue that features of the self-service web portal will affect customers' perceptions about the hole between their expectations about service and the real levels of service delivered to them. Thus, this hole will affect their perceptions about online service quality and their levels of customer satisfaction. Each one of these elements of the model is described below.

Features of the Web-based portal

As defined earlier, web-based portals include mechanisms for giving data, encouraging exchanges, and offering support for correspondence with the banks. We attract after existing literature to identify seven huge features of web-based portals.

Accessibility

Refers to the capacity to communicate with the service provider (Irvine & Theresa (2003) through place, time and technology facilities (Suganthi, Balachandher & Balachandran, 2001). Accessibility includes not just the real network accessibility to different web resources, for example, web pages, databases, and other tangible resources, yet additionally the presence of intangible resources that help the customer in reaching and interacting necessary resource persons and processes to meet their expectations operationally and practically. The convenience of utilizing a portal can't be achieved without accessibility; accessibility includes the accessibility of web-based services constantly (7 x 12) with the capabilities of speedy sign in, access, search, and web downloads (Balachandran, 2001). Pilioura, et al., (2003); infer that anytime access to information or service can be possible by having the correspondence capacity of utilizing web services. Therefore, online communication channels, for example, chat rooms and bulletin sheets facilitate sharing of knowledge and experience (Divya & Padhmanabhan, 2008).

Responsiveness

Refers to the speed and effectiveness with which the portal provides the necessary data or exchange backing to the customers. One of the components of responsiveness is the speed with which the content is made available to users (Rens, 2006). Response time is the time it takes for the Web page to stack in a user's browser and furthermore the time required completing subsequent exchanges (Rupa, 2003; Zeithaml et al., 2002) found a brisk response, assurance, and follow-up of services are the key elements for the web site success with consumers. In the context of web-site response to web page stacking speed continues to vex users; even as broadband reception continues to increase (Rens, 2006). Some studies concluded that web server performance in terms of response time ought to be allowed to become not more than 2 seconds while other studies alert on page stacking delays time for 12 seconds or more. Research studies show that consumers holding up times affect their retrospective evaluation of Internet web sites (Rens, 2006). These studies showed the result that holding up can, yet not in every case negatively affects evaluations of web sites. Results likewise show that potential negative effects can be neutralized by overseeing holding up experiences (by giving progressive bars, intermediate useful visuals etc.).

In an examination of 100 U. S. retailers, accessibility and responsiveness of the web site were found to be key markers of the service quality (Nitsure, 2003; Parasuraman & Malhotra, 2002).

Functional Usefulness

User’s belief that a system would enhance job performance (Scheepers, 2006; Joseph, McClure & Joseph, 1999; Ariely, 2000) argued that in the portal-based web environment, customers ought to have control on the data in terms of clarity, understanding, and management of the data and its stream. Further, et al., (2002) proposed that semi-automated and automated features such as search functions, download speed are some of the overall design elements of web usability. Customer-perceived usefulness is only practical usefulness (Birch & Young, 1997; Gant & Gant, 2002) proposed that customization is one of the key aspects of web portal functionality. All web portals provide generic content and give users the capacity to practically customize the generic content meeting the personal needs of the user. Yang, et al., (2005) found that up-to-date data and value-added tips on items and services contribute to capacity to practically useful.

Usability as against Ease of Use

One of the key aspects of portal functionality is the convenience (Jeffrey & Constance, 2015). The definition of Ease of Use has been considered as Usability and is given as a piece of ISO 9241 norm (Edwin, David, Andy & Yeung, 2006) where Perceived Ease of Use is the degree of the user believes that the system would be free of effort (Scheepers, 2006; Joseph, McClure & Joseph, 1999). The Technology Acceptance Model (TAM) sets that perceived ease of use and perceived usefulness is the essential determinants of system usage (Scheepers, 2006). Ease of Use has been often considered as an equivalent to Usability however the meaning of convenience is beyond the ease of use (Edwin, David & Andy, 2006). Consequently, when the definition of convenience is given as "The extent to which a item can be used by specified users to achieve specified objectives with effectiveness, efficiency, and satisfaction in a specified context of use", Author has considered Usability as a service quality attribute to replace Perceived Ease of use. Usability refers to the ease with which users can access data and navigate the web portal (Loonam & O’Loughlin, 2008). To measure the usability of the state web portals, the features of have increased the ease of use of the portal is to be recorded, making it easy to navigate and discover necessary data as shown in Table 1.

| Table 1 Technology Acceptance Factor for Service Quality Determinants |

|

|---|---|

| TAM determinants | Service Quality Context meanings |

| Perceived Ease of Use | Usability |

Convenience is a non-utilitarian requirement. It could be considered as an operational requirement that enhances the practical requirement capacity. Likewise, with other non-utilitarian requirements, usability cannot be directly measured however should be quantified by means of indirect measures or attributes such as, for example, the number of reported problems with ease-of-use of a system (Wiki-Usability, 2011). In the context of web portals, ease of use is related to search facilities, accessibility of customized search capacities and ease of navigation (Balachandran, 2001). One possible explanation is that Windows environment is inherently easy to use. Windows GUI, as an ease of use factor contributed to eventual profitability (Mohd Shoki et al., 2013). The web interface provides a simple, menu-driven access to information and tools for examination (Ramayah, Muhamad Jantan, Mohd Nasser Mohd Noor & Koay Pei Ling, 2003). Portal environment composed of Grid computing, Java RMI, Strut Framework technologies provide easy to use features (Minjoon & Shaohan, 2001). Well-designed portals have pleasant, consistent interfaces that are easy to use (Loonam & O’Loughlin, 2008). The richness of VRML is due to its interaction and navigation capabilities and also to the fact that VRML objects can be hyperlinked to multimedia (image, text, video, audio) or HTML files, as well as to other VRML objects (Milind, 1999).

Safety

American Heritage Dictionary meaning of safety mentions that it is the state of being safe; freedom from danger, risk or injury. In the context of Internet banking, it refers to security and reliability of exchanges (Frimpong, 2012). In the context of Internet Banking safety refers to security technology and customer’s trust of the service (Damien & Matthew, 2003). Internet security services include access control, authentication, confidentiality, integrity and security measure include computerized signatures, digital certificates, security socket layers, secure electronic exchanges, firewall access control and virtual private networks (Hole, Moen & Tjostheim, 2006). As per (Hull, Benedikt, Christophides & Su, 2003), a standard practice in distributed processing is to generate skeletons of implementations from signature. Safety or Security has been considered as a norm in web services-based implementations. The consortium of IBM, Microsoft and W3C norms of utilization of the superior Deterministic Finite-State Automation (DFA) based SOAP/XML message parser for WS-Security is a standard means of giving safety and can be considered as an implied standard when implementing Finite State Automata (FSA) based web services, since the WS-Security standard provides transport-level authentication, encryption and computerized signatures. WS-Security is based on the XML signature standard and XML encryption standard. Moreover, FSA permits the catching of a large class of e-services and officially verifies the significant properties of e-services such as correctness, safety at each point in the execution of an e-service (Raisch, 2001). Absence of safety on public networks is definitely a hindrance (White & Nteli, 2004). Open Internet Standards environment is an open-architecture system for the arrangement of e-services to home residents for giving safety and security services (Koskosas & Koskosa, 2011). Identity checking is one of the essential features of confidential access to subscribed web resources (Kasemsan, & Hunngam, 2011). Confidential access to subscribed web resources can be provided by furnishing the customers with a smart card because a smart card is a means of enciphering the text and data utilizing the session key and it is written from the issuer’s computer to the customer smart card (Andersen, 2006). Collaborative environments use PKI for subscriber authentication for accessing web resources. Digital certificates express the attribution of a subscriber. As per digital certificates, subscriber should have to get specific rights to a resource usage, who is trusted to create use-condition statements and who can attest to a subscriber’s attributes. Resource Gatekeeper or Policy Enforcement Point (PEP) verifies the subscriber access rights to the resource usage with a trusted party or a Policy Decision Point (PDP). The stake holders express access constraints in the form of digital certificates on the resources usage to protect against their misuse by subscribers (Salisbury, Pearson, Pearson & Miller, 2001). Tsai & Chang (2006) proposed the feasibility of authenticating the subscribers on WLAN, based on GPR/GSM based membership mechanism utilizing SIM cards. Guests can also access web resources that are inside their organization's intranet from their host’s wireless network via a secured web tunnel that encrypts traffic and authenticate users all over HTTP links with SIM cards. Online safety includes protected access in terms of assault against viruses, unwanted disclosures and unwanted interruption on the private cyberspace during the e-service delivery process (Buys, 2003). In online exchanges, favorable outcomes and customer satisfaction are initial markers of Trust (Buys & Brown, 2004). Giving non-repudiation service, guarantees safety which can make customers trust Internet banking (Al-sabbagh & Molla, 2004).

Convenience

Theoretically, convenience is defined as a value or attitude of consumers in saving time and effort (Victor, 1997). It is additionally defined as an attribute with item or service. Convenience is defined by expectations, influences of how quick issues can be resolved and is key in building a successful business; convenience is a need and massively affects the quality of life (Kaushik, 2013) thus author proposes to have it as feature of service quality. Convenience refers to having the self-service ability (Shubham, 2013). “E-Service Aggregation is a service standard that gathers relevant e-services from multiple sources to provide convenience and add value by investigating the aggregated services composability for accomplishing specific goals using Web Technologies” (Minjeong , Jung‐Hwan Kim & Sharron, 2006). This technique is quite useful and assume a huge part in acting as service intermediations. It involves collection, categorization and re-grouping of different services from multiple sources. Convenience saves time and effort (Kuo et al., 2005). Operational Citizen Service Management underpins citizen interaction with greater convenience through a variety of channels (Tommi, Maria & Teemu, 2018). The research work by Vassilis, Konstantinos, Manos, Efstratios & Papadoupoulos (2004) proposed the Open Internet Standards between home users and service providers through an intermediate entity called service aggregator. Concurring, et al., (2004) “the modular architecture of the Service Aggregator provides the capability of integrating and supporting a great number of heterogeneous e-services from many service providers. The end-to-end communication can be achieved entirely based on the prevailing and emerging Internet standards, ensuring platform, vendor and language independence”. The web technologies such as HTTP, XML, SOAP and WSDL guarantee that the system is really open and future proof.

The feature of Information Aggregation can facilitate convenience. “To implement convenience and to build information aggregators, service model relies on service-oriented architecture with which it is possible to integrate readymade however storehouses of uses into an inter-connected set of services, each accessible through standard interfaces and messaging protocols such as XML, SOAP, WSDL and UDDI” (Qingqing Bi, 2019). When ‘convenience’ is understood as the hole between ‘facilitate’ and ‘drive’, this hole fulfillment can be obtained by employing and dealing with the ability of one-to-one, one-to-many and lastly many-to-many service relationship outside the boundaries of electronic market places to fulfill the globalization needs. Therefore, in the contemporary electronic market place the center has been shifted towards giving ‘complete service’ solutions. The ability to aggregate multiple services in order to coordinate a specific service request ought to be provided as an internal service from electronic market places (Bismark, Bismark, Eric & Isaac, 2015).

Information aggregation is a service that gathers relevant information from multiple sources to provide convenience and add value by examining the aggregated information for specific objectives utilizing Internet technologies. Web portals are information aggregators since they all collect information from multiple sources and disseminate it for convenient consumption at different levels of granularity for specific goals (Ryan, Monica, Dave, Jeffrey & Constance, 2015).

“While service aggregation may offer direct benefits to the requester, it is a type of service brokering that offers convenience work – all the required services are grouped “under one roof”. Service requester could retain the right to select an application service provider based on those that can be discovered from a registry service such as the UDDI. SOA technologies such as UDDI, security and privacy standards such as SAML and WS-Trust introduce another role which addresses these issues called a service broker. Service brokers are trusted parties that force service providers to adhere to data practices that conform to privacy laws and regulations. In this manner broker-sanctioned service providers are guaranteed to offer services that are in compliance with local regulations and create a more trusted relationship with customers and partners (Qingqing Bi, 2019; Hamed, 2018). Access to multiple channels and their integration can increase convenience leading to customer satisfaction which emphatically effects on customer obtaining, extension and retention (Aarma & Vensel, 2001). The convenience of ‘accessing to government data through multiple access channels by customers’ (citizens and businesses) can be implemented by receiving GOVML (Government Markup Language) and ebXML (Loonam & O’Loughlin, 2008). The effect of multiple channel strategies on market-level responses has received significantly less attention by researchers (Yang, Zhilin & Jun, 2002). Customer’s complex needs are more likely to be satisfied with the synergistic blend of service output and applying multiple channel strategies (Hans, Maik & Tomas, 2005). Responding to customer through multiple channels consistently and meeting their service level expectations while lowering contact center expenses is the key to keep up customer satisfaction (Markus, 2016; Rao, 1999) mentioned how automated search facilitates convenience as follows: “Consumers are getting smarter in utilizing e-taliers and online search engines and search agents for convenience. Automated Search capabilities within e-tail stores replace physical browsing through endless aisles at a customary retailing especially if the item is elusive or unavailable”.

In the context of ascribing customization and personalization (Xun, Charles & Shuo Zeng, 2017) as a piece of convenience, Gant & Gant (2002) mentioned that advanced web portals give users the capacity to create customized views that provide personalized content organized in a way that meets the direct needs of the user. It means the portal definition itself says that it offers customized data and exchange function to the user through web browser. The terms customization and personalization are often used interchangeably in both academic and non-academic literature. Different authors are given their understandings on these terms. The subtle difference is given by Nielsen’s (Mayer, 1990) is that customization is under the direct control of the user; the user explicitly selects between certain options. Personalization is driven by computers that attempt to serve individualized pages to users based on some sort of model of their individual needs. Coener (2003) mentioned that in Customization, web site users can actively dictate the data on the site, match of categorized content to profiled users. In personalization, the content is filtered for users by assuming a more passive part. Author understanding of personalization is the activity of performing the setting of values based on personal choices; once set it becomes verifiable, whereas Customization is understood as the ability of facilitating personalization by performing explicitly. An empirical investigation of an Internet portal was tied in with extant theories about service quality, customer satisfaction and loyalty. Data collected in an on-line survey by Van Riel, Liljander & Jurriëns (2001) educates that a solid positive effect regarding overall satisfaction is the intention to use and continue utilizing the portal was found. Szymanski & Hise, (2000) conducted an investigation on assessing customer e-satisfaction against the customer perception of having online convenience alongside other elements. It is discovered that convenience is one of the predominant elements in consumer assessment of e-satisfaction. As per Schaupp & Belanger (2005) customizability is one of the significant considerations in e-satisfaction. According to Smith (2006), “If e-personalization efforts are successful, companies can increase sales and customers can have more fulfilling e-commerce experiences”. These new channels like Internet offer huge increase in the flexibility for delivering personalized access (Jessica, 2003). E-service provide greater convenience by eliminating travel costs and enabling 24 x 7 purchases irrespective of geographic area. E-Services are benefiting stakeholders of PPP model in the form of giving 24 x 7 conveniences so that citizens can make payments over the net through the participating bankers (Salehi, Mahdi, Zhila & Azary, 2008). As per Piccinelli & Mokrushin (2001), the electronic market places ought to, in any event, enable specific service providers as an alternate to support aggregation-oriented business effectively. Conveniences provide better customer satisfaction via enabling alternate strategy in the form of providing alternate e-services based on Self-service technologies (Kent & Daniel, 2007); e-services as alternate service distribution channel (Åke, Mathias & Andreas, 2007) electronic marketplaces as alternative markets (Francisco et al., 2013).

Realization

The service realization involves looking over an increasing diversity of different options for services which might be mixed in different blends (Qingqing Bi, 2019). The realization of full e-commerce-based services (Jiun-Sheng ChrisLin & Pei-Ling Hsieh, 2011) can be achieved through outsider plug-in. Because outside plug-in is a value-added service for information security on order to improve enterprise management online service for avoiding security threat from hacker and virus’s harassment. Self-adaptive component-based architectures facilitate the structure of systems that are capable of progressively adjusting to differing execution context (Mauricio, Anthony, Miyazaki, David & Sprott, 2010). The service realization is achieved through the means of adapters and façade to provide web or e-service interfaces exposing the required usefulness (Heston, Sid & Jiju, 2003); A semantic web service can extend the ability of a web service by associating semantic concepts to the web service in order to enable better search, discovery, selection, structure and integration (McIlraith et al., 2001). Specification of semantic web services facilitates develops of planning between the semantic descriptions to concrete service realizations (McIlraith et al., 2001).

Effects of Portals features on Service Quality Gap

Customarily, researchers have offered different meanings of service. Ramaswamy (1996) described service as “the business transactions that take place between service provider and service receiver to produce an outcome that satisfies the customer. Zeithaml & Bitner (1996) characterized services as “deeds, processes and performances”. Gronroos (1990) defined services as an activity or series of activities of more or less intangible nature that normally, but necessarily, take place in interactions between the customer and service employees and/or systems of the service provider, which are provided as solutions to customer issues. So the system-oriented definition of service definition given by Lakhe & Mohanty (1995) is: “service is a production system where various inputs are processed, transformed and value added to produce some outputs which have utility to the service seekers not merely in an economic sense but from supporting the life of human system in general, even it may be for the sake of pleasure”. Yong (2000) reviewed service as a performance that happens between consumers and service providers. According to Parasuraman, Zeithaml & Berry (1985) as well as Zeitham & Bitner (1996) service can be recognized from merchandise by distinguishing the service as an intangible, heterogeneous, synchronous, and simultaneous in production and consumption and perishable.

In spite of numerous examinations on service quality, there is no agreement about how to conceptualize service quality (Sanjeev & Haim, 1990; Reeves & Bednar, 1994) noticed that there is no universal, economical or comprehensive definition or model of quality. Service Quality is characterized by the client's impression of the service provided to them. It is the degree and direction discrepancy between client’s service perception and expectations (Berry, Parasuraman & Zeithaml, 1988; Parasuraman, Zeithaml & Berry, 1985). Service Quality is the consumer’s general impression of the relative inferiority/superiority of the association and its services (Abby, Simon & Matthew, 1994). Many service companies have research programs intended to quantify service quality as well as consumer satisfaction. Such projects are designed to oversee service provision and relationship-building activities of service quality with customer satisfaction. Kotler & Armstrong (1996) characterized customer satisfaction as the level of an individual's felt state resulting from comparing an item’s perceived performance or outcome in infringement to his/her expectations. So, it is defined as “the levels of service quality performance that meets client assumptions” (Joseph, Steven & Taylor 1992; Oliveira, Roth & Gilland (2002) recommend that companies can accomplish capacities by offering great e-services to clients. Service quality emphatically affects consumer satisfaction and on the performance of companies. Improving e-service quality to fulfill and retain clients is turning into a difficult issue. Earlier examinations have contended that data quality decidedly effects on perceived ease of use and perceived usefulness (Amanda, Nick, Leonard & Coote 2007). Consequently, perception of ease of use and usefulness in the context of online retailing has a positive influence on data quality (Tony, Seewon & Ingoo Han, 2007). The operational meaning of e-satisfaction is the degree to which the web site has surpassed client's expectations and prerequisites, in terms of satisfaction with functional performance of the site as well as with the perceived satisfaction with overall quality of experience e.g., in terms of transacting business on the site. Estimating client satisfaction is regularly utilized as a pointer of achievement (Damien & Matthew, 2003).

The perceived quality of the service relies upon the client's prior experience with the service, the temperament and the stress level, the particular idea of the communication between the service provider and the client (Saif, 2012). So, efforts of service design must include the heterogeneity of the service encounter and the overall service features.

Client expectations are fractional convictions or presumptions about products or services that serve as standards or reference focuses against which a product’s/services performance is judged (Gronroos, 1988). These client expectations are shaped based on past experience, and ideas of what organization ought to provide (Parasuraman, Zeithaml & Berry, 1988; Parasuraman, Zeithaml & Berry, 1991; Xin Ding, Rohit & Zafar, 2007). Zeithaml, Parasuraman & Berry, (1993) pointed that three levels of expectations can be characterized against which quality is assessed: the desired service, which reflects what clients need; the adequate service defined as the standard the clients are willing to accept; and the predicted service- the level of services clients believe is likely to occur.

Spreng & Mackoy (1996) gave a perceived quality and satisfaction model (Zhen Zhu, Cheryl, Sivakumar & Dhruv, 2007). This model is an adjusted version of Oliver’s model (1993), and it highlights the impacts of expectations, perceived performance, desires, desired congruency and expectations disconfirmation on overall service quality and consumer satisfaction. Thus, our examination has been performed based on the guidelines taken from Spreng & Mackoy (1996).

The gap model of (Parasuraman, 2002; Parasuraman et al., 1985; Zeithaml et al., 1990) gives a coordinated structure to overseeing service quality and customer-driven service innovation that can possibly empower online customer satisfaction. It has been utilized across enterprises to assist organizations with planning techniques for delivering quality service, integrate customer focus across functional areas, and give a solid establishment for service excellence (Bitner et al., 2010). Service gap analysis distinguishes five areas of gaps for analysis:

Gap5=Gap1+Gap2+Gap3+Gap4

Where Gap5=Customer Side Service Quality Gap

Gap1=Customer-Oriented Market related Information Gap

Gap2=Service Performance Gap

Gap3=Service Standards Gap and

Gap4=Service Communication Gap

The Parasuraman et al., gap model of service quality positions key ideas in services marketing that start with the consumer and constructs organization’s tasks around necessities to close the gap between customer and the organization. The focal point of this model is the customer side gap. Organizations need to close this gap in order to upgrade customer satisfaction (Juga, Juntunen & Grant, 2010).

Closing Service Communication Gap

This is the gap between what is communicated to consumers and what is really delivered (Katia, Massimo, Anupriya & Naveen, 2003). Tuning in to clients multiplely, building relationship with clients by comprehension and addressing client needs over time can help in closing the service communication gap. Internet can be considered as a medium for giving accessibility and responsiveness for the purpose of closing service communication gap (Sahar & Mohammadbagher, 2012).

In the context of minimum service guarantee responsiveness, Pandey, Barnes & Olsson (1998) created two perspectives of the quality of service: client-based and server-based. In the client-based view, “the HTTP server ensures explicit services to its clients”. Instances of such quality of service are a server’s guarantees on lower limits on its throughput (for example, number of bytes/second) or upper limits on response times for specific requests. In the server-based view, “the quality of service relates to actualizing a site’s view of how it ought to offer particular types of service. This remembers setting priorities among different demands and limits on server resource usages by various demands”. Minimal service guarantee of launching online banking services require minimal demand on the banks existing foundation and assets (Bebko, 2000; Birch & Young, 1997).

H1: Closing the Internet Banking Service Communication Gap will upgrade the customer satisfaction.

Closing Service Information Gap

The significance of electronic service quality (e-sq) is featured by Zeithaml, Parasuraman & Malhotra (2002) who guarantee that the end of electronic service quality gap will prompt consumer satisfaction, Zeithaml, et al., (2002) identified Information Gap is one of the e-SQ gaps. Information gap addresses the contrast between customer’s website prerequisites and managements’ beliefs about those requirements (Bebko, 2000). Data gaps are an investable consequence of continuous advancement of business sectors and establishments. These gaps are featured when an absence of ideal, precise data upsets the capacity of managers, policy creators and market members to develop effective responses (IMF & FSB, 2009). Customer oriented relationship advertising projects can upgrade the progression of information between the bank and clients, and clients can build their good sentiments towards their bank (Ricardo, 2006). This is because the value and beliefs of customer-oriented market information lie in: (1) continuous cross-functional learning about customer’s expressions and their idle useful needs. (2) Web site capability to empower cross functional facilitated activities to make and adventure the learning (Yuan & Min, 2010). So functional usefulness is considered for proposing it as an online service quality factor as it can possibly close the information gap.

H2: Closing the Internet Banking Service Communication Gap will upgrade the customer satisfaction.

Closing Service Standards Gap

Service Standards Gap is the difference between management’s perceptions of consumer’s expectations and service quality specifications, i.e., ill-advised service quality norms (Sandra, 1990). This gap centers on making expectations into actual service designs and creating norms to quantify service operations against customer expectations (Carmel & Scott, 2009). Usability, Safety and Convenience is proposed as e-service quality variables and its corresponding items are proposed as a piece of online service quality standards.

H3: Closing the Internet Banking Service Communication Gap will upgrade the customer satisfaction.

Closing Service Performance Gap

Performance gap is the distinction between service quality details and service actually delivered (Lesley & Robert, 2003). Closing Service Performance gap includes coordinating technology successfully and efficiently to aid service performance. Online Interactivity such as online chat, self-service technology-based web services (Carmel & Scott, 2009) can advance web sites in realizing service performance. Kotov (2001) portrays e-services as the realization of federated and dynamic e-business parts in the Internet environment. Web services are software application and are equivalent to e-services (Haiyan Sun, Xiaodong Wang, Bin Zhou & Peng Zou, 2003).

H4: Closing the Internet Banking Service Communication Gap will upgrade the customer satisfaction.

Relation between Gap Closing and Online Service Quality Perceptions

In service marketing, services are about guarantees. Vital methodology in keeping the guarantee lies in adjusting the services towards gaps model of the service quality. Four difficulties are caught by the service quality gap-based system that makeup the expectations/perception or client gap. An organization is probably going to have an expectations/perceptions gap if they’re failing at any of the four gaps viz. Service Information Gap, Service Standards Gap, Service Performance Gap and Service Communication Gap. Organizations can keep their promises to clients only when the gaps are closed. When building up another service such as portal based service, the gaps model can also help you to deciding whether you are really prepared to launch (Sahar & Mohammadbagher, 2012). All in all, gap model gives a superior perceivability on deciding whether the organization is aligned around what has been guaranteed to the customer based on how best it is filling the customer gap in terms of service gap fulfillment. As indicated by essential service economy principle, service requestor or customer gap can be equal to service provider or supplier gap. The effect of information technology on systems related to closing the service provider gap has been referenced by Bitner, et al., (2010); AlSudairi, (2012). Further AlSudairi, (2012) inferred that the procedure of his reasonable model can possibly close online service quality gap in the context of online banking.

H5: Closing the service quality gap from customer perspective will considerably upgrade the overall service quality.

Relation between Overall Online Service Quality Perceptions and Overall Online Customer Satisfaction

Service quality was not identified to customer satisfaction in specific circumstances according to the arguments of some researchers (Jun, Yang & Kim, 2004). For example, Parasuraman et al., (1985) found a few examples where despite the fact that some consumers were satisfied with a specific service, they did not imagine that it was a result of high service quality. It could be because of offering some alluring product/service features such as interest rates on loans and other value contributions (Mengi & Pooja, 2009). Anyway, different analysts recommended that service quality would prompt either customer satisfaction or dissatisfaction (Harry, Roger, Andi & Paul, 2007). Customer satisfaction can be seen as a total assessment and an outcome of perceived service quality (Amudha & Vijayabanu, 2012). Subsequently, it is fundamental, in the context of online retailing (remembering banking sector as well), it is imperative to investigate whether or not the client perceived quality is essentially identified with their overall satisfaction. In this way the accompanying theories are built.

Analysts have given a lot of consideration to the close relationship between service quality and customer satisfaction (Achim & Hans, 2000). Service quality is a more specific judgment that can prompt an expansive evaluation of customer satisfaction (Jyotsna, 2012). Regarding the particular service quality measurements that impact the formation of customer satisfaction, Johnston (1995, 1997) has found that the reasons of dissatisfaction and satisfaction are not really the equivalent. Some service quality attributes may not be critical for consumer satisfaction but can essentially prompt dissatisfaction when they are performed ineffectively. The same author has additionally classified all measurements into upgrading (satisfiers), hygiene (dissatisfiers) and dual factors. Upgrading factors are those which will lead to customer satisfaction if they are delivered appropriately but will not really cause dissatisfaction if absent. Interestingly, hygiene elements will lead to client dissatisfaction if they fail to deliver yet won’t result in satisfaction if they are available. Dual factors are those that will affect both satisfaction and dissatisfaction. Johnston (1995) distinguished attentiveness, responsiveness, care and friendliness as the principal wellsprings of satisfactions (satisfiers) in banking services, and trustworthiness, reliability, availability and usefulness as the fundamental sources of dissatisfaction (dis-satisfiers). In the examination Khan, Mahapatra & Sreekumar (2009) suggests that bigger banks or banks with a more youthful age, private ownership and lower branch power have a high likelihood of adoption of this new innovation. Banks with lower market share likewise see i-banking technology as a way to build the market share by pulling in more and more clients through this new channel of delivery. Self-service technologies i.e., services created totally by the client with no immediate association or connection with the firm’s representatives has also changed the way organizations think about closing quality gaps. These technologies have proliferated as organizations see the possible expense of investment funds, potential sales growth, efficiency accomplishment, expanded consumer satisfaction and competitive advantage (Bodo & Mark, 2003). Nonetheless, the service quality in i-banking from clients’ needs thorough examination to discover the determinants for progress and growth of new channel of delivery so that useful guidelines for bankers can be given.

H6: Closing the overall service quality gap from customer perspective will considerably upgrade the customer satisfaction.

Research Methodology and Design Towards Hypothesis Testing

The goal of this segment is to explain the connection between the service quality, which can be accomplished through portal features as service quality measurements and thus with consumer satisfaction. A multi-item proclamation to gauge consumer satisfaction with i-banking services in Riyadh in Saudi Arabia has been proposed for estimating internet Banking Service Quality towards consumer satisfaction.

The exploration can be arranged as a descriptive examination. The examination was planned as an overview prospective questionnaire. The poll incorporates explanations to assess the interaction investigation of client reactions, the value of which is reviewed utilizing 5-point Likert Scale range of ordinal data. The focuses to ordinal data are appointed as most elevated for example 5 to 'Strongly Agree' towards most minimal for example 1 to 'Strongly Disagree' reactions for the motivations behind statistical calculations and inductions.

The data gathered is needed to be considered as that utilizing a cross sectional strategy made to get the data applicable to portal features as service quality dimensions and demographic data for pivoting. In view of the literature survey (as described in the paper) and exploration plan (through designing a research system), a poll was set up with 30 (thirty) proposed items initially. As 2 (two) items each having a place with safety and convenience dimensions respectively are not upheld, they have been erased. At that point the substantial number of complete items have been decreased to 28 (twenty-eight).

The statement responses gathered are subjected to the processing for data analysis utilizing SPSS v15 for Windows statistical software package. Estimations of reliability and ANOVA are led for getting the outcomes. The accompanying section gives details on these two figurings.

Internal Consistency and Reliability

Reliability is critical when deciphering study impacts and test outcomes (Lloyd & Mark, 2004). In like manner this segment centers around the most usually utilized gauge of reliability, internal consistency coefficients, with accentuation on coefficient alpha. Internal legitimacy alludes to how much a specialist is advocated in reasoning that noticed (cause and effect) relationship is casual. It implies the substantial connection between dependent variables and independent variables (Riadh, 2010). A valuable coefficient for assessing internal consistency of dependent variable (as an element of independent variables) is Cronbach’s Alpha (Christmann & Van Aelst, 2006).

The proposed online banking service quality exploration instrument was tested for internal consistency utilizing Cronbach’s coefficient of alpha gauge. When the Cronbach’s Alpha value surpasses a base indicated value of 0.6, the proportions of develops are considered reliable (James Tobin, 1958).

The Cronbach’s Alpha values at dimension level are: 0.728, 0.737, 0.812, 0.735, 0.720, 0.834 and 0.812 (running between 0.720 to 0.834) and hence the (post-deleted) item structure of Internet banking service quality regarding its dimensions is consistent.

The Cronbach’s Alpha values at gap level are: 0.843, 0.812, 0.902 and 0.812 (running between 0.812 to 0.902) and henceforth the dimension structure of internet banking service quality regarding its gap are consistent. The general service quality structure is likewise supposed to be consistent with an indicated Cronbach’s Alpha value of 0.942. A consistent relationship is observed among the customer satisfaction (with its one item, multi-perceptions data) and generally speaking service quality with a Cronbach’s Alpha value of 0.812.

Results of Hypothesis Testing

H0=There is no gap between Perceived Values and Desired Values with the proposed structural elements of the overall service quality (i.e., pmean –dmean=0).

HA=There is gap between Perceived Values and Desired Values of the proposed structural elements of the overall service quality.

t-value and p-value for 30 WePoServQual items are calculated based on N, Mean, Standard Deviation and Standard Error of Values gathered from the clients, for making an inference on whether there exists a service quality gap, if so, what items are contributing to service quality gap and what are satisfying the service quality.

| Table 2 Items Having Gap |

||

|---|---|---|

| Description | Total Items | Item No’s Contributing to Gap(See Appendix-A) |

| Items have service quality gap @95% Confidence Level | 12 | 1,3,4,5,6, 10, 12, 16,18, 19, 20, 27 |

| Items not having service Quality gap @95% Confidence Level | 18 | 2,7,8,9,11,13,14,15,17,21-26,29-30 |

The gap scores and its weighting elements are also measured and given in the table 2(see Appendix-A)

Goal Hypothesis

HG (Goal Hypothesis): There is a direct connection between Internet banking client’s satisfaction and perceived service quality that can close the gap of the Internet Banking Service Quality proposed in terms of Service Communication Gap, Service Information Gap, Service Standards Gap and Service Performance Gap respectively.

HG=ß1=ß2=ß3=ß4=0

HA (Alternate Hypothesis): There is no direct connection between Internet banking client satisfaction and perceived service quality that can close the gap of the Internet Banking Service Quality proposed in terms of Service Communication Gap, Service Information Gap, Service Standards Gap and Service Performance Gap respectively.

HA=At least one ß is not equal to zero.

Results of Correlation Analysis

The speculation was tested by (binary) logistic relapse investigation, a multivariate strategy used to foresee the presence or absence of a characteristic or outcome based on values of a bunch of predictor variables. This procedure is similar to linear regression model yet is reasonable for models where dependent variable is dichotomous (binary). Independent variables can be absolute (i.e., ordinal). To choose predictor variables, the forward stepwise relapse technique was utilized. Forward stepwise method begins with a model that contains only the constant. Variables are analyzed based on entry and evacuation measures (Christmann & Van Aelst, 2006).

Upon the perceptional data values in Riyadh population during June-July 2013, a regression test is performed on SPSS v15 and attempted to construct the regression model.

| Table 3 Correlation Analysis |

||||||

|---|---|---|---|---|---|---|

| Unstandardized Coefficients | Standardized Coefficients | @ (95%) | Row of values to be considered for modeling | |||

| Model | Coefficient (B) | Std. Error (E) | Beta ( | |||