Research Article: 2021 Vol: 24 Issue: 1S

Decomposition of Banks Return on Equity Using DuPont Model: Evidence from the Nigerian Banking Industry

Emeka Nwuba, College of Management and Social Sciences, Covenant University

Alexander Ehimare Omankhanlen, College of Management and Social Sciences, Covenant University

Godswill Osagie Osuma, College of Management and Social Sciences, Covenant University, Ota

Keywords

DuPont, ROE, Equity Multiple, Asset Turnover, Net Profit Margin and Tax Burden

Abstract

This study applied the DuPont model to analyse the profitability of deposit money banks in Nigeria. A sample of ten banks was taken from the quoted banks in Nigeria for a period of ten years (2009 – 2018). The adjusted DuPont model was used to decompose the Return on Equity (ROE) of banks in Nigeria into four components; net profit margin (NPM), Equity Multiple (EM), Asset Turnover (AT) and Tax Burden (TB). Results show that net profit margin is the only component out of the four that have significantly impacted on the ROE of the selected banks in the past ten years. Results further showed that banks with weak profitability have very high ratio of operating expenses to net operating income which consequently dragged down the NPM and by extension, the ROE. The paper recommends that banks in Nigeria should continue to improve their net interest margin by maintaining efficient balance sheet made up of low cost deposit liabilities and well-priced loan assets. In addition, less profitable banks can improve their returns by embarking on higher income diversification and prudent management of operating expenses

Introduction

Among the financial metrics used in measuring firm profitability are; gross profit margin, net profit margin, net interest margin, return on assets, return on equity, return on capital employed, earnings per share and dividend per share. The most popular measures of these named metrics used in the literature are Return on Assets (ROA) and Return on Equity (ROE). The two measures relate a firm’s absolute net income to the underlying investments. While ROA computes net income as a ratio of total assets deployed in making the income, ROE on the other hand computes net income as a ratio of investment by the owners of the business called the equity shareholders. The choice between ROA and ROE in profitability analysis is not an easy pick. For instance, one of the challenges with ROE is that an increase in ROE may not be a full indication of increase in profitability but could be a sign of dwindling equity capital. On this consideration, ROA seems to be a preferred measure (Doorasamy, 2016; Rahman & Mia, 2018). However, the European Central Bank, (2010) stated that ROE is by far the most popular measure of performance for the reasons that (a) it proposes a direct assessment of the financial return of a shareholder’s investment, and (b) allows for comparison between different companies or different sectors of the economy. In this wise, the DuPont model is mostly advocated as a tool for in-depth analysis of this profitability measure (Rahman & Mia, 2018). Accordingly, Mahamuni & Poman (2019); Kusi, Ansah-Adu & Sai (2015), describes DuPont model as a tool for assessing the profitability or otherwise of a business venture. Coined around early 19th century, DuPont model has been a widely used profitability tool in most organizations globally. Indeed, there are different versions to its use based on user purpose (Rahman & Mia, 2018). On the basis of this, the study applies the model in decomposing and analyzing ROE for better decision making. According to Omankhanlen Senibi & Senibi (2016) the growth of an economy is crucial in terms of earnings expectations of corporate entities. Structurally, the study is divided into four sections; the Introduction. Immediately after this is the literature review. Methodology is next to this, followed by Result and Analysis while, Conclusion and Recommendation complete the study.

Objective of the Study

The objective of the study is to use the DuPont model to decompose the return on equity of the Nigerian deposit money banks with the aim of ascertaining how each component of the model has contributed to the growth of ROE over time. The outcome of the analysis will enable us recommend areas of improvement that will help profitable banks to further boost their ROE and also help loss making banks to return to the part of profitability in the years ahead.

Literature Review

What is DuPont Model

DuPont is a model that was first developed around 1918 by an electrical engineer at DuPont, Donaldson Brown in the United States of America who was seconded to review the finances of General Motors which DuPont was in the process of acquiring. (Mahamuni & Poman, 2019; Kusi, Adu & Sai, 2015). Initially and as at the time, the focus of business performance review was on its Return on Assets (ROA) which is the ratio of net profit divided by the total assets. The engineer however observed that the return on assets could be broken down into two components as shown below;

ROA=Net Income/ Total Assets=(Net Income/Sales) x (Sales/Total Assets) (1)

Where (Net Income/Sales) represents profit margin while (Sales/Total Assets) represents total assets turnover or operating efficiency. Thus, by breaking ROA into these two components, firms can easily see the impact of their input-output pricing decisions (profit margin) and the sales activities (operating efficiency) on their assets returns. In the 1970s, a change in the firms’ objectives moved toward maximizing the value of shareholders’ wealth. This change in firms’ objectives resulted to the modification of the DuPont model to what was known as the ‘three-step’ DuPont model used for calculating ROE (Kusi, Ansah-Adu & Sai, 2015). It was recognized that companies can boost their returns to the equity holders by taking in more debts. The impact of debt is known as equity multiple (the reciprocal of leverage). The three-step DuPont model was therefore used to calculate ROE in the following way:

ROE=(Net Income/Sales) x (Sales/Assets) x (Asset/Equity) (2)

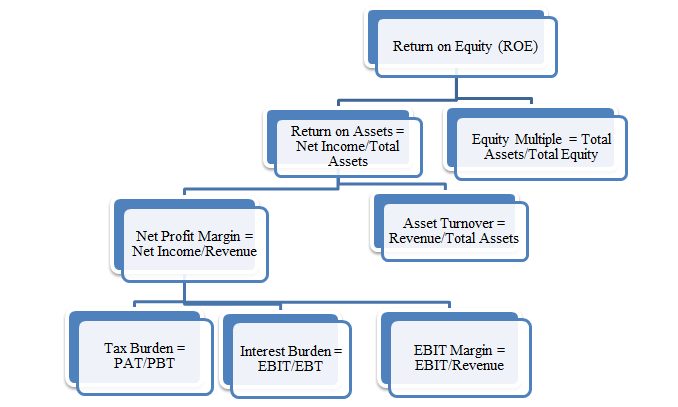

The above equation means that return on equity can be broken down into net profit margin, asset turnover (operating efficiency) and equity multiple. This equation is so useful in analyzing the profitability of firms in order to precisely identify the area of impact on the equity returns of a company or a group of companies in a given year or over a period of time. Over time, further modifications were made on the DuPont model to better reflect the business decisions that impact on the profit margin of a company in a given period. This led to the formulation of the ‘five-step’ DuPont model which incorporated two additional variables; interest burden and tax burden in addition to the three listed in equation (2) above, (Georgios et al., 2013; Rooplata, 2016). The importance of interest burden stems from our knowledge of firms’ capital structure, that companies can boost returns to the equity holders by adding more leverage up to the point where the cost of leverage (interest burden) is greater than or equal to the incremental returns arising from using leverage. Beyond this level, the use of leverage becomes counter-productive as the interest cost weighs in more on the profitability and so depresses returns to the equity holders (Rahman & Mai, 2018; Rooplata, 2016). The five-step model brings out this scenario more clearly as well as the impact of effective tax management on the overall returns to the equity holders since this category of investors are only entitled to the residual profit after all statutory taxes are paid. The expanded five-step DuPont model can therefore be shown below;

ROE=(Net Income/Earning before tax) x (Earnings Before Tax/Earnings Before Interest & Tax) x (Earnings Before Interest & Tax/Sales) x (Revenue/ Assets) x (Assets/Equity)

The above equation simply depicts return on equity as a product of tax burden, interest burden, operating profit margin, operating efficiency and equity multiple (Figure 1)

Adopted from CFA, Level-1, Financial Reporting & Analysis, 2018).

Thus, from the perspective of a business organization, the activities of the various business units all combine to create value for the owners. The activities of those involved in input purchase and output pricing affect the operating profit margin (EBIT/Sales). The effectiveness or otherwise of the sales force, capital expenditure decisions and working capital management all combine to influence the asset turnover or operating efficiency (Rao & Ibrahim, 2017; Rooplata, 2016). According to Rahman & Mai (2018), capital structure decisions also affect both the operating leverage and interest burden while the tax management unit works to bring down the tax burden. Looking at ROE from these five different components will help an organization to know the segment of the business that is not pulling its weight based on pre-set targets and then take corrective actions where significant gaps are established (Rahman & Mia, 2018; Ramesh, 2015).

DuPont Application in Banking

The DuPont model was created with the mindset of a typical merchandizing business whose income statement easily conforms to the defined variables. The business of banking is however different (Rao & Ibrahim, 2017). First, while non-banking businesses use leverage only to augment their capital, the business of banking is a leveraged business and a greater portion of the employed capital of the bank comes from the depositors’ funds (Almazari, 2016). Consequently, the interest expense is a major item in the income statement of a bank and it is treated as above the line item (before arriving at net operating income) in the income statement instead of below the line (after net operating income) in the normal merchandizing entity. It is treated in the similar way as cost of sales in a merchandizing firm. Furthermore, there is nothing like sales or revenue as in the normal merchandizing company. In the income statement of a bank, gross income is rather used, which is derived by summing up gross interest income and other non-interest income such as trading gains, net income on fees and commission and other operating income. Also, the total asset of a bank is made up of both on-balance sheet and off-balance sheet (contingents) items. The analyst has to choose whether to use only the on-balance sheet items or combine both. The analyst has to modify the income statement of the bank in order to arrive at variables that are as close as possible to the components of a DuPont ratio (Kusi, Ansah-Adu & Sai, 2015; Daniel & Kamalodin, 2015; Jumono, Adhikara & Mala, 2016)

Some Empirical Studies

The study of DuPont model in the analysis of banks’ profitability is still at a developing stage. Few authors have attempted to use the model for empirical analysis of corporate profitability. Many of them applied it more as a ranking tool in terms of firm profitability by ROE standard, Hereiu & Ogrean (2011) sought to rank the topmost profitable companies in the world using DuPont model came up with the conclusion that absolute net income ranking does not give the same conclusion as when the profits are expressed as a ratio of investors’ stake represented by shareholders’ equity. A similar corporate ranking was done using DuPont model by Rahman & Mia (2018) in their study of commercial banks in Bangladesh. They ranked the banks by size of their ROE showing Dhaka Bank as the best and AB Bank as the least performing. They concluded that a company can have high ROE if it has high operating margin, lower interest expense, lower income tax, efficient use of assets and high leverage in the capital structure.

Ramesh (2015) applied DuPont model to compare the ROE of the selected bank (Axis Bank) with peer group banks in the Indian banking industry. The decomposed ratios show some peer group banks with low profit margin such as SBI Bank. The study showed that some banks whose net profit margins were found to be low, had their ROE significantly boosted with equity multiplier. Almazari (2016) applied the DuPont model to compare the ROE of Samba Bank and Jordanian Arab Bank. Using financial data drawn from the period 2010 to 2015, the results showed that Samba Bank had a relative stability in net profit margin while significant fluctuation was witnessed for Arab Bank during the period. The results equally show the relative performance of both banks in terms of equity multiplier and asset turnover.

A good attempt was made by Kusi, Ansah-Adu & Sai (2015) in the use of an econometric technique to test the significance of each of the components of the DuPont ratio on the ROE of banks in Ghana. Twenty five (25) banks were sampled for the period 2006 to 2012 and panel regression was used in the data estimation technique. Their findings show that all the five elements of the five step DuPont model have a positive and significant relationship with ROE including tax burden and interest burden. However, minor observations were noticed in the study. First was the wholesale application of DuPont model (developed with a merchandizing firm in mind) to banking institutions without adjusting for the uniqueness of the income statement of banks. Thus, there was repeated use of the term ‘sales’ does not apply to banking. Secondly, some variables such as interest burden and tax burden were not correctly depicted thus leading to wrong interpretation of outcome suggesting that a rising interest burden is a plus to return on equity

Rooplata (2016) studied the ROE of nineteen (19) nationalized banks in India using the DuPont model. Their thorough analysis of the various profitability ratios and the components of ROE led them to the conclusion that the performance of a bank cannot be judged by the size of their profit alone and that banks that made high absolute profits are not necessarily efficient.

The study adds to literature by bringing adjusted DuPont model that suits the uniqueness of banking business.

Methodology

This section documents the methodology employed in this study including, the research design, study population and sampling, sampling techniques, method of analysis, etc.

The research adopted descriptive statistics (static and trend analysis) to decompose and analyse the ROE using the DuPont model (see Mohamuni & Poman 2019; Almazari, 2016; Ramesh, 2015; Rahman & Mia, 2018). Descriptive statistics was employed to clearly show the trend of the various components of the DuPont model among the banks over time, the variables that have witnessed significant growth, those that have stalled and those that have possibly witnessed reduction.

There are fourteen deposit money banks in Nigeria that have consistently published their financial statement within the ten-year period of the study. These form the population of the study, Convenience sampling method was used to select ten banks among these banks drawing from both the most profitable banks by the absolute size of profit before tax and least profitable banks by the same standard. The objective is to carry out a two-stage analysis to compare the behavior of the variables among the two groups which may necessitate the same or different managerial approaches among the two groups to boost ROE.

The sample period covered is ten (10) years spanning from 2009 to 2018. The data used are secondary data drawn from the annual reports of the banks which were downloaded from their respective websites. The variables were computed after adjusting the financial statements for the uniqueness of banking business to bring them to harmony with the principles of the DuPont model

Description of Variables

The variables are derived from the five-step DuPont model which states that return on equity is a function of operating profit margin, interest burden, tax burden, operating efficiency and equity multiple. However, we make some modifications to accommodate the unique nature of the banking business.

Return on Equity (ROE)

Our dependent variable is return on equity. This is computed by dividing net profit after tax by the closing shareholders’ Fund. The shareholders’ funds include the paid up share capital, share premium, retained earnings and all categories of reserves.

Net Profit Margin (NPM)

We modified the income statement of the selected banks to streamline them with the typical income statement of a merchandizing firm. First we determine gross income (where this is not expressly stated on the income statement) by adding gross interest income, fees and commission income, and all other operating income together. As noted earlier, interest expense is treated like cost of sales and therefore deducted before arriving at net operating income. Consequently, instead of having operating profit margin and interest burden as two separate variables, we use net profit margin and discard interest burden (since interest is already factored in before arriving at operating income). This is computed as net profit before tax divided by the gross income

Tax Burden (TB)

This variable weighs the impact of the tax paid or provided for relative to the profit before tax. It is computed by dividing the after-tax profit for the year by the profit before tax. The higher the tax expense, the lower the figure obtained and so the lower the return on equity. This means that higher taxes increase the tax burden and reduces the ROE. Typically, this variable is always below 1 in a normal situation. However, significant tax refund in a year where the operating profit is low could throw up figures above 1.

Assets Turnover (AT)

This variable shows the number of times the gross income of the banks covers the total assets of the company. We refine the total assets to include only on-balance sheet assets (fixed assets, loans and advances, investment securities, etc.) and exclude off-balance-sheet assets considered to be significantly different in nature from the on-balance sheet items. We divide the gross income by the value of the on-balance sheet assets to obtain the level of operating efficiency. Higher efficiency is expected to have a positive impact on ROE

Equity Multiple (EM)

This tells the story of the leverage position of the company. It compares the equity position with the portion of the total assets that are financed with debts (deposit and other liabilities) and express this relationship as a multiple of equity. It is computed by dividing closing total on-balance sheet assets with closing shareholders; funds. The higher the multiple, the higher the ROE

Data Presentation

The study employed the analytical tool of DuPont ratio to study the performance of deposit money banks in Nigeria over the years and use trend analysis to establish the relative importance of each of the components of the five-step DuPont ratio (four steps in the case of banking) in order to understand the behavior of banks’ return on equity over time. Descriptive statistics was adopted as the analytical tool both in figures and in graph. A sample of ten deposit money banks was selected at random for a period of ten years from 2009 to 2018. Figures were extracted from the audited accounts of the selected banks in order to establish the trend of ROE and its components. We also break the data into two; the most profitable five banks and the least profitable five banks with the objective of identifying the key success factors in these two groups and comparing the results with the combined figures. The summary statistics and the accompanying Table 1 are shown below:

| Table 1 Summary Statistics |

||||||

|---|---|---|---|---|---|---|

| PARAMETER | CLUSTER | ROE | NPM | EM | AT | TB |

| MAX | All Banks | 1.11 | 0.60 | 192.26 | 0.17 | 16.06 |

| Most Profitable | 0.33 | 0.50 | 11.81 | 0.16 | 1.10 | |

| Least Profitable | 1.11 | 0.60 | 192.26 | 0.17 | 16.06 | |

| MIN | All Banks | (1.09) | (1.52) | (8.64) | 0.08 | 4.55 |

| Most Profitable | 0.02 | ( 0.05) | 4.12 | 0.09 | 0.19 | |

| Least Profitable | (1.09) | (1.52) | (8.64) | 0.08 | (4.55) | |

| MEAN | All Banks | 0.13 | 0.16 | 7.27 | 0.02 | 0.92 |

| Most Profitable | 0.16 | 0.22 | 7.27 | 0.12 | 0.81 | |

| Least Profitable | 0.06 | 0.01 | 7.44 | 0.12 | 0.90 | |

| SD | All Banks | 0.23 | 0.23 | 19.09 | 0.02 | 1.63 |

| Most Profitable | 0.09 | 0.13 | 1.79 | 0.02 | 0.19 | |

| Least Profitable | 0.30 | 0.28 | 26.89 | 0.02 | 2.30 | |

Discussion of Results

For the combined data, the maximum and minimum figures for ROE were 1.11 and (1.09) respectively. The minimum values of the combined sample reflect the data in the least profitable bank group. This is not surprising as the least results are likely to come from the least profitable bank group. Surprisingly however, the maximum return on equity for the entire banks came from the least profitable group. This was a one-off figure largely from a bank with a very weak capital base thus throwing up a seemingly high ROE even with relatively small absolute net profit figure. The maximum and minimum values for net profit margin also reflect same pattern as that of ROE. The maximum and minimum figures for Equity multiple are 192 and (8.64). This shows the degree to which the banks use depositors funds to create value for the shareholders.

The mean figures provide more insight on the performance of Nigerian banks in the 10-year period under review. The average ROE (computed as weighted average) are 0.13, 0.16 and 0.06 for all banks, most profitable banks and least profitable banks respectively. This means that the banks in these groups have given a return of 13% 16% and 6% respectively to their shareholders on average in the last ten years. A closer look shows that the combined average is tilted more toward the ROE of most profitable banks than that of the least profitable. The implication of this is that the absolute profits of these large banks are so large that they effectively mitigated the downward pressure of the losses and weak profits of the least profitable banks, such that the overall industry returns still looks very good relative to the returns posted by the non-banking sector. Net profit margin for the three groups average 16%, 22% and 1% respectively. Again, the same pattern is seen as in ROE where the industry average reflects more of the margin for the most profitable banks than that of the least profitable. However, the average figures for equity multiple, asset turnover and tax burden are almost the same for the three groups. This is so because, there is a limit to how much leverage a bank can create.

The regulatory prescription of capital adequacy ratio puts a cap on the limit to which a bank’s operations are funded by depositors’ funds. Banks must maintain a prescribed minimum ratio between equity capital and total assets. Furthermore, the tax burden is a function of the tax laws in any country. No matter how skilled a bank’s tax managers are, its tax management activities must be done within the ambit of the law. This leaves little room for tax manager in their efforts to improve the returns to shareholders through tax management activities. The average figures for asset turnover reflect the nature of banking business (large assets relative to gross earnings) as opposed to most merchandizing firms where asset turnover of less than one (1) is viewed as operating inefficiency and possibly over investment in working capital.

Finally, the standard deviation of ROE and net profit margin shows relative stability among the top profitable banks compared to the least profitable. The standard deviation of returns for all the banks tilts towards that of the least profitable group with wider variation in returns since the standard deviation varies with numbers.

Trend Analysis

So far, the analyses above are more of static position and does not help us to show which of the components of the ROE is more critical in analyzing the growth or otherwise of the ROE of the deposit money banks in Nigeria. Tables (2-4) and the accompanying graphs in figures 2-6 in the Appendix section give a trend of these components over the ten-year period. The ROE of the industry has moved from (3%) in 2009 to 19% in 2018. The most profitable banks have moved from 4% in 2009 to 21% in 2018 while the range for least profitable banks moved from (22%) in 2009 to 9% in 2018. The industry’s negative return in 2009 is understandable in the aftermath of the global financial crisis and the resultant huge provisions for non-performing loans in almost all the banks. A critical look at the trend figures and graphs shows that apart from a few exceptions, the trend for equity multiple, asset turnover and tax burden has remained within the same narrow range for the past ten years. However, the graph for ROE and NIM move in the same direction. The years where the least profitable banks had negative returns to shareholders, the net profit margin equally had significant deep on the negative region. The ROE of the most profitable banks have been consistently higher than that of the other two groups for the ten-year period. The same thing applies to the NIM trend for the same period.

| Table 2 Trend Summary for All Banks |

|||||||||

|---|---|---|---|---|---|---|---|---|---|

| YEAR | ROE | NPM | EM | AT | TB | NII/GINC | IINC/LOAN | INT/DE | OPEX/NOI |

| 2009 | (0.027) | (0.011) | 6.375 | 0.118 | 3.208 | 0.289 | 0.188 | 0.057 | 1.016 |

| 2010 | 0.169 | 0.141 | 6.867 | 0.115 | 1.159 | 0.369 | 0.169 | 0.047 | 0.814 |

| 2011 | 0.000 | (0.002) | 7.279 | 0.101 | 0.019 | 0.376 | 0.161 | 0.048 | 1.002 |

| 2012 | 0.192 | 0.246 | 7.323 | 0.117 | 0.908 | 0.337 | 0.200 | 0.048 | 0.651 |

| 2013 | 0.165 | 0.229 | 7.761 | 0.111 | 0.838 | 0.331 | 0.178 | 0.060 | 0.663 |

| 2014 | 0.112 | 0.230 | 7.413 | 0.115 | 0.866 | 0.345 | 0.163 | 0.052 | 0.658 |

| 2015 | 0.048 | 0.176 | 6.842 | 0.121 | 0.838 | 0.314 | 0.162 | 0.055 | 0.697 |

| 2016 | 0.050 | 0.183 | 7.271 | 0.125 | 0.820 | 0.388 | 0.153 | 0.050 | 0.674 |

| 2017 | 0.030 | 0.197 | 6.896 | 0.123 | 0.841 | 0.322 | 0.190 | 0.060 | 0.662 |

| 2018 | 0.092 | 0.228 | 8.629 | 0.112 | 0.821 | 0.334 | 0.202 | 0.065 | 0.648 |

| Table 3 Trend Summary for Most Profitable Banks |

|||||||||

|---|---|---|---|---|---|---|---|---|---|

| YEAR | ROE | NPM | EM | AT | TB | NII/GINC | IINC/LOAN | INT/DE | OPEX/NOI |

| 2009 | 0.037 | 0.082 | 5.981 | 0.124 | 0.609 | 0.255 | 0.197 | 0.047 | 0.886 |

| 2010 | 0.096 | 0.187 | 6.137 | 0.110 | 0.760 | 0.300 | 0.170 | 0.035 | 0.758 |

| 2011 | 0.096 | 0.161 | 7.730 | 0.099 | 0.775 | 0.298 | 0.171 | 0.037 | 0.769 |

| 2012 | 0.228 | 0.300 | 7.294 | 0.113 | 0.919 | 0.242 | 0.214 | 0.041 | 0.599 |

| 2013 | 0.196 | 0.278 | 7.929 | 0.107 | 0.827 | 0.240 | 0.190 | 0.035 | 0.614 |

| 2014 | 0.194 | 0.263 | 7.571 | 0.114 | 0.852 | 0.259 | 0.177 | 0.044 | 0.621 |

| 2015 | 0.151 | 0.216 | 6.946 | 0.121 | 0.834 | 0.245 | 0.169 | 0,046 | 0.635 |

| 2016 | 0.168 | 0.217 | 7.443 | 0.128 | 0.813 | 0.347 | 0.167 | 0.040 | 0.612 |

| 2017 | 0.178 | 0.241 | 7.201 | 0.121 | 0.843 | 0.281 | 0.205 | 0.051 | 0.605 |

| 2018 | 0.210 | 0.267 | 8.479 | 0.110 | 0.846 | 0.294 | 0.220 | 0.058 | 0.604 |

| Table 4 Trend Summary for Least Profitable Banks |

|||||||||

|---|---|---|---|---|---|---|---|---|---|

| YEAR | ROE | NPM | EM | AT | TB | NII/GINC | IINC/LOAN | INT EXP/DEP | OPEX/NOI |

| 2009 | (0.223) | (0.281) | 7.592 | 0.104 | 1.009 | 0.235 | 0.202 | 0.055 | 1.419 |

| 2010 | 0.501 | 0.034 | 10.19 | 0.128 | 11.41 | 0.316 | 0.241 | 0.052 | 0.954 |

| 2011 | (0.228) | (0.441) | 6.202 | 0.109 | 0.765 | 0.219 | 0.219 | 0.042 | 1.929 |

| 2012 | 0.095 | 0.119 | 7.404 | 0.128 | 0.843 | 0.251 | 0.251 | 0.048 | 0.801 |

| 2013 | 0.089 | 0.111 | 7.336 | 0.121 | 0.903 | 0.233 | 0.233 | 0.114 | 0.810 |

| 2014 | 0.112 | 0.147 | 7.033 | 0.118 | 0.925 | 0.205 | 0.205 | 0.051 | 0.763 |

| 2015 | 0.048 | 0.068 | 6.570 | 0.122 | 0.874 | 0.213 | 0.213 | 0.063 | 0.876 |

| 2016 | 0.050 | 0.071 | 6.802 | 0.117 | 0.887 | 0.174 | 0.174 | 0.058 | 0.874 |

| 2017 | 0.030 | 0.048 | 5.986 | 0.128 | 0.822 | 0.207 | 0.207 | 0.076 | 0.902 |

| 2018 | 0.092 | 0.091 | 9.261 | 0.120 | 0.910 | 0.212 | 0.212 | 0.070 | 0.840 |

The implication of the above is that banks that have delivered good returns to their shareholders are those who have maintained very good net profit margin regardless of the figures for equity multiple, asset turnover and tax burden. It is also apparent from the graphs that banks with weak ROE have been struggling with their net margin over the study period. The most important component of ROE therefore is the profit margin. Asset turnover, equity multiple and tax burden play a less critical role in the growth of ROE of deposit money banks in Nigeria.

Tables 2 to 4 (last four columns) and figures 7 to 10 were used to investigate further the reasons for the weak profit margin of the banks in the low profitability group. The trend shows that banks with strong returns have diversified into other non-interest income thus maintaining a higher ratio of non-interest income to gross income compared to their counterpart in the low profitability group. Figure-9 also shows the ratio of operating expenses (OPEX) to operating income among the three groups. Profitable banks have maintained a low and declining ratio which is an indication of efficiency. In 2009 and 2011, the ratio of OPEX to net operating income for the low profitability group was far in excess of 1 which resulted to heavy losses for this group of banks. Although this ratio witnessed a decline among in subsequent years, it has nevertheless tilted toward 1 which explains the low profitability of these banks as their income was barely big enough to cover their operating income.

Conclusion and Recommendation

This study applied the modified five-step DuPont model to decompose the return on equity of deposit money banks in Nigeria for a period of ten years covering 2009 to 2018. The four components that make up the ROE of banks, net profit margin, equity multiple, asset turnover and tax burden were reviewed using descriptive statistics (static and trend analysis). On the whole, Nigerian banks have significantly improved their returns to shareholders in the last ten years, starting from an average return of (3%) in 2009 to 19% in 2018. The results show that although equity multiple is a significant component of ROE of banks (being a leveraged business), its impact on the growth of ROE of Nigerian deposit money banks over the years is negligible. Also, asset turnover and tax burden does not have much importance in the growth or otherwise of the ROE of banks in Nigeria. The trend analysis however shows that the banks that have consistently posted impressive ROE are those that maintained very good net profit margin. The net profit margin of least profitable banks is shown to be weak within the study period. Further analysis shows that income diversification has assisted top banks in Nigeria in growing their margins as they have higher proportion of non-interest income to total gross income in their income statement compared to their least profitable counterpart. Furthermore, the net margin of least profitable banks is found to be dragged down by higher proportion of operating expenses to operating profits.

In the light of the findings above, we recommend that banks in Nigeria should continue to improve their net margin by maintaining an efficient balance sheet made up of low-cost deposit liabilities and well-priced loan assets. In addition, banks should expand the depth of their financial intermediation function in order to further boost their gross income relative to their total assets (asset turnover). The average asset turnover of 0.112 can be improved upon for better ROE. Finally, we recommend that less profitable banks can improve their returns by embarking on higher income diversification and efficient management of operating expenses.

Acknowledgement

The authors sincerely appreciate Covenant University Centre for Research Innovation and Discovery (CUCRID) for sponsoring this research article.

References

- Almazari, A.A. (2016). A comparison of the financial performance between Saudi Samba Bank and Jordanian Arab Bank using dupont model. International Journal of Economics, Commerce and Management, 4(12), 689-705.

- Beyond ROE. (2010). How to measure bank performance. Appendix to the report on EU banking structures. European Central Bank.

- CFA Program Curriculum. (2018). Level 1. Financial Reporting & Analysis, 3.

- Daniels, T., & Kamalodin, S. (2016). The return of equity of large Dutch banks. De Nederlandsche Bank N.V, 14(5).

- Doorasamy, D. (2016). Using DuPont analysis to assess the financial performance of the top 3 JSE listed companies in the food industry. Investment Management and Financial Innovations, 13(2), 29-44.

- European Central Bank, Eurosystem. (2010). Beyond ROE – How to measure bank performance.

- Hereiu, M., & Ogrean, C. (2011). DuPont analysis of 20 most profitable companies in the world. 2010 International Conference on Business and Economic Research, 1, 45-48.

- Jumono, S., Adhikara, M.A., & Mala, C.M. (2015). Profit structure of Indonesian banking industry - an empirical study based on DuPont model. Journal of Emerging Issues in Economics, Finance and Banking, 5(2), 1947-1968.

- Kusi, B.A., Ansah-Adu, K., & Sai, P. (2015). Evaluating bank profitability in Ghana: A five-step dupont model approach. International Journal of Finance and Banking Studies, 4(3), 69-82.

- Mohamuni, P.A., & Poman, A.A. (2019) Evaluating profitability performance of Bajaj Auto Ltd and Hero Motocorp by using dupont model. International Journal of Management, IT and Engineering, 9(6), 338-351.

- Omankhanlen, A.E., Senibi, E.J., & Senibi, E.J. (2016). Macro-economic indicators and stock price movement nexus: a study of the Nigerian stock market. The Social Sciences, 11(13), 3294-3306.

- Rahman, Z., & Mia, R. (2018). Deconstruction of ROE: An implementation of DuPont model on the selected Bangladesh commercial banks. International Journal of Economics & Financial Research, 4(6), 165-170.

- Ramesh, M.P. (2015). DuPont analysis of Axis Bank. Asian Journal of Management Research, 5(4), 566-569.

- Rao, K.P., & Ibrahim F. (2017), Financial performance analysis of banks: A study of IDBI Bank. International Journal of Research in IT and Management (IJRIM), 7(1), 64-72.

- Rooplata, P. (2016). DuPont analysis of nationalized banks in India. International Journal of Management, IT and Engineering, 6(12), 211-223.