Research Article: 2021 Vol: 24 Issue: 1S

Degree of Trustiness and Awareness of Cryptocurrency: Factors Affecting the Future Currency in the Gulf Cooperation Council (GCC)

Abdelrhman Meero, Kingdom University of Bahrain

Saad Darwish, Kingdom University of Bahrain

Abdul Aziz Abdul Rahman, Kingdom University of Bahrain

Keywords

Cryptocurrency, Stability, Trustiness, Awareness of Cryptocurrency, GCC Economy

Abstract

This research focuses on the future of cryptocurrency in GCC countries. Using an organized survey, this paper tries to discover the GCC population awareness of cryptocurrency and their degree of trustiness in this currency. The Likert scale questionnaire had a section related to the willingness of the GCC people to use cryptocurrency in their daily life and investment. Another section in the survey has been oriented to evaluate the importance of the fluctuation of cryptocurrency from the respondents' point of view. The analysis of the 212 responses has demonstrated that the awareness of cryptocurrency in the GCC region is at an average level, and the people have some doubts about the stability of cryptocurrency. They also have a low level of trustiness in this innovation. Regarding the willingness to use cryptocurrency, the results revealed an inconclusive decision towards the willingness to use cryptocurrency as the highest percentage of answers were concentrated in the midpoint answer (3) and on the close sides of the average answer (2 and 4).

Introduction

More attention has been given in recent years to Bitcoin and other cryptocurrencies. The world is divided between supporters and opponents to cryptocurrency. Some countries like Japan, the United States, Canada, Germany, and France started limiting the transaction in cash and legalized the use of cryptocurrency. On the other hand, some countries consider trading and the use of cryptocurrency as illegal such as Algeria, Bolivia, Ecuador, Bangladesh, Nepal, and Macedonia.

Meanwhile, in the GCC region, most countries have bought into the underlying technology of cryptocurrencies, which is blockchain. The United Arab Emirates and Saudi Arabia are considering dealing with cryptocurrency as legal. However, the future of the use of digital currencies as a formal method of exchange or investment remains ambiguous, with few configured legislations. The increased use and the rapid spread of digital currency has raised a question concerning the future of this currency: Can digital currency become the international currency?

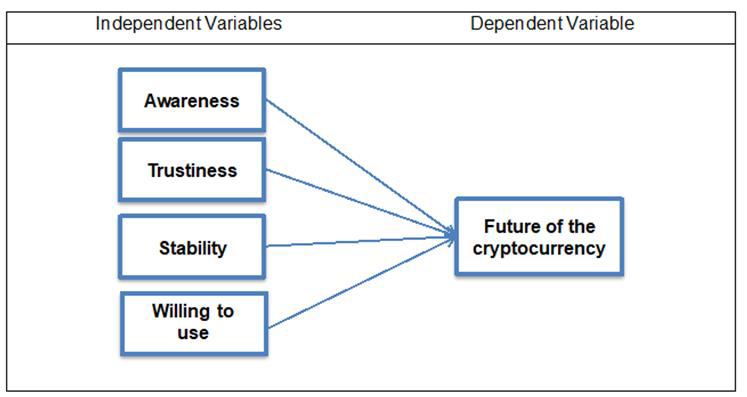

This paper focuses on the future of cryptocurrency in the GCC countries. To clarify the factors affecting cryptocurrency in this region, the current research designed an organized questionnaire based on the factors affecting the popular acceptance of cryptocurrency as a circulated currency in the GCC countries or global level. The first factor in the research model is the awareness of this new currency. The second factor is the trustiness of cryptocurrency. The third factor is the stability of cryptocurrency, and the last factor is the willingness of the GCC population to use cryptocurrency.

Research Background and Literature Review

The origin of cryptocurrency and more specifically Bitcoin started from 1982-1997. This was when David Chaum, a research scientist, provided the conceptual framework of developing e-Cash. Chaum in his valuable paper, reported in detail an innovative formulation of writing codes that allows customers for automated payment in which different parties cannot utilize information on the e-payment. Chaum has also thrown ideas on the creation of untraceable payments for its constructive usage in 1990 through the development of DigiCash. An electronic digital cash company creates a safe and secure online digital currency.

At the end of 1998, Wei Dai introduced a summarized outline detailing view for BTCs money. This is a cryptocurrency where the exchange rate is the same as the network of blockchains of Bitcoin (Vuji?i? et al., 2018). His effective efforts for building up the system have enabled the digital currency with the solution of a computational source through which the digital money is launched to the network areas.

During the year 2009, the first blockchain technologies of Bitcoins were introduced as “Genesis Block”. This progress has been followed by the publishing of the first BTC exchanges which has been considered as the origin of initial cryptocurrency. On March 17, 2010, the first bitcoin transaction started on BitcoinMarket.com which was the first Bitcoin exchange market (Gerard, 2017). Figure 1 shows the stability of the exchange rate of Bitcoin against the US dollar till 2017 when the great fluctuation of Bitcoin prices started (Aalborg et al., 2019).

Legal Dimension

The instability of Bitcoin or other cryptocurrencies is an important feature of these digital currencies. In the current study, this factor is integrated under the independent variable stability, which also covers the regulatory aspect of cryptocurrency. Deng, et al., (2018) discussed the importance of the legal framework to ensure the Initial Coin Offering process and give less fluctuation to the prices of cryptocurrency. The regulatory system controlling the system of cryptocurrencies is still ambiguous and is unable to satisfy the needs and the development of the economic and social system (Zhu & Yan, 2019). The evidences needed to prove any legal dispute is far from being achieved. Disputes for victimized people will experience difficulty to provide the legal evidence (Sapovadia, 2015). The innovative idea of cryptocurrency is still a spectacle for central banks. Although they can adopt and improve the current situation, they feel there is a challenge to replace existing currencies by digital ones. Furthermore, new legislations may boost the acceptance of new financial infrastructure and will be a leap forward in the economic effectiveness (Liebkind, 2019). The Sharia Islamic Law as expressed by Al Azhar (Dostor Newspaper, 2018) is seen as the main source of Ifta’a. They clearly stated that dealing with Bitcoin “...is prohibited by Islamic law”, and its circulation contradicts the general purpose of Islamic law, which is the principle of "no harm or harm", and that "Bitcoin" contains many dangers that threaten the country and the people, which must be prohibited.” There are other resolutions from other Islamic countries that follow the rules. This may raise some ethical issues as considering it as a form of gambling (Darwish et al., 2019).

Economic Dimension

The Bitcoin phenomenon might be a standout amongst the most interesting signs of the digital economy. Bitcoin rises up out of the spearheading period of advanced monetary standards with the signs of undeniable money. It is perceived globally as a unit of measure, mechanism of trade, and store of significant worth. Components of Bitcoin configuration are probably going to impact advancements in global monetary framework as they face the difficulties of a computerized economy (Eun, 2003). For business people and business pioneers, understanding the effect of virtual monetary forms on their clients and their business sectors is crucial. This is because it creates systems that amplify potential interest that could lead their enterprises into the virtual money period.

The author of a recent article suggests that the countering of the volatility concern is an impediment to the widespread acceptance of Bitcoin. He is of the opinion that Bitcoin volatility is not the relevant predictor of its success as a currency system. A change in the very structure of international banking is very much influenced by the emerging Bitcoin system (Lee, 2013). Tax compliance and other regulatory measures threaten to complicate the process.

The rise of Bitcoin and similar cryptocurrencies may pose a serious threat to USD as this is seen as an alternative to existing World currencies including USD due to its features. Bitcoin is often described as the first decentralized digital currency (Nakamoto, 2008).

For a large share of recent two centuries, the world's ground-breaking monetary forms were convertible into fixed measures of gold or different valuable metals. Also, for a huge number of years before that, numerous monetary standards were printed specifically from gold or silver species. Bitcoin as an alternative can beat the difficulties of both gold measures and fiat monetary forms.

The current circumstances suggest that there are uncertainties in the digital process of cryptographic money of which Bitcoin is vital. The process requires the emergent usage in a manner that real digital currency is perceived and acknowledged (Josiah, 2013; Magnuson, 2020).

Public Awareness

The awareness about cryptocurrency is considered as a key factor of using cryptocurrency. Sathye (1999) defines innovation awareness as understanding whether or not a customer is aware of the service itself and its benefits. It also explains that the low level of awareness is a determining factor in a customer’s aversion and the reluctance of using financial services over the Internet. According to Reid and De Brentani (2004), innovation is adopted or rejected when the consumer becomes aware of the product. Sidek (2015) found that e-payment adoption by businesses was strongly influenced by the degree of awareness. The lack of awareness is an impediment to the adoption of banking financial services using the Internet in developing countries (Yu & Ibtasam, 2018). Filona & Misdiyono (2019) found that the low level of awareness and public trust about cryptocurrency decreases their willingness to use this currency, and it also affects the widespread of these digital currencies. Srivastava (2019) found that a lack of awareness could decrease the use of digital financial services.

Trusting cryptocurrency can be explained similarly to the trustiness in other currencies. Thus, why do people trust any currency? The answer is so simple because they are confident that they can use this currency in exchange for goods, services, and investment (Pichler et al., 2018). As a result of this, trustiness in cryptocurrency is a key factor affecting the adoption of these currencies as an international currency. Suh & Han (2002) examined the influence of customer trust on the adoption of internet banking. The research result confirmed the high importance of trust in such type of activities. Ha & Stoel (2009) concluded that trust has an important role to play in customer adoption of e-shopping. Kuo, et al., (2009) found that trust is a determinant factor in the money mobile services. Shin (2009) examined the effect of trust and security on the customer's decision to use the mobile wallet. He found that these two factors are the main determinants of the customer's intention to accept the use of the mobile wallet. According to Miliani & Indriani (2013), the risk considerations, as well as safety, do not reduce or affect the consumer’s intention to use electronic financial services. Molchanov (2014) found that the growing confidence in cryptocurrencies is a good sign of the rapid development of cryptocurrency. “Trust is the fundamental tenet that underpins credible currencies, and this trust has to be earned and supported” (Carstens, 2018). Filona & Misdiyono (2019) stated that the low level of awareness and trust in innovation services such as e-money is negatively affecting the adoption of these services. Yuneline (2019) found that Bitcoin is accepted as money when it is trusted and accepted as payment.

The intention of use or the willingness to use cryptocurrency is an important factor which could affect the future of cryptocurrency. The willingness to use technology is also the most significant determinant of the actual use of technology (Davis, 1989; Legris et al., 2003). The intention of using the new financial technology is affected by many factors such as the ease of use, the adherent risk, the advantages of use, and the motivations of this new technology (Filona & Misdiyono, 2019; Darwish, 2015). According to Danuarta & Darma (2019), the increased willingness to use the financial innovation tools would have a positive impact on the growth and the development of these instruments.

Research Objectives

Through the previous literature review, the following variables were adopted to research the future of cryptocurrency in the GCC countries such as the stability of cryptocurrency, the GCC population awareness of cryptocurrency, the GCC population trustiness in cryptocurrency, and the GCC population intention to use cryptocurrency. Their awareness of cryptocurrency will be explored and their willingness to use cryptocurrency will also be surveyed in order to discover the factors affecting the future of cryptocurrency trading in GCC countries.

Importance of the Research

This research will explain and assess the opinions of the public to figure out the legitimate idea of computerized monetary systems and how public awareness, trustiness, and legal aspects will give grounds for future development.

Research Methodology

This research used Google Forms online to collect the data through an organized questionnaire. The questionnaire is composed of six sections. The first section is related to the personal data of the respondents (gender, nationality, and age). The second section is related to the awareness of the GCC population of cryptocurrency. The third section concentrated on the trustiness of the GCC population in cryptocurrency. The fourth section was related to the willingness of the GCC population to use cryptocurrency. The fifth section concentrated on the stability of cryptocurrency. The last section is related to the future of cryptocurrency.

A total of 20 items were employed in the survey to explore the future of cryptocurrency in the GCC countries. Three items were related to the demographic statistics of the respondents. Three items were used to discover the awareness of the GCC population by cryptocurrency and its usage. Three items were employed to know the trustiness of the GCC population in cryptocurrency. Three items were used to get information about the willingness of the population to use cryptocurrency as an international currency. Three items were also designed to collect information about the stability of cryptocurrency. All the other items were designed to measure the expectations of the GCC population for cryptocurrency as a future currency. Furthermore, in order to get adequate information, researchers personally approached the respondents and collected their opinion in this regard shown in Figure 2.

Research Hypotheses

According to the previous discussion, the focus of the current research is to check the validity of the following hypothesis:

H1 There is no relationship between the awareness degree of cryptocurrency and the future of cryptocurrency in the GCC countries.

H2 There is no relationship between the trustiness degree in cryptocurrency and the future of cryptocurrency in the GCC countries.

H3 There is no relationship between the Stability of cryptocurrency and the future of cryptocurrency in the GCC countries.

H4 There is no relationship between the willingness to use cryptocurrency and the future of cryptocurrency in the GCC countries.

Research Model

Research Results

The research tested the internal consistency of the survey questions using Cronbach Alpha. The awareness variable with five items has shown an alpha equal to 0.79, and the trustiness of the GCC population in cryptocurrency with four items has shown an alpha equal to 0.82. The willingness of the population to use cryptocurrency has shown alpha equals to 0.81. The three items related to the stability of cryptocurrency scored alpha equals to 0.78. The five items of cryptocurrency as future currency showed an alpha equal to 0.76. The consistency test is acceptable as all the values shown are higher than 0.7 (Robinson et al., 1991). These results indicate that the scale used is reliable. In the next step, the research hypotheses were tested and an assessment to determine which variable has more effect on the future of cryptocurrency was also carried out. Furthermore, the paper identified some limitations and the discussion of the results as well as its implication will provide a chance for further research (Table 1).

| Table 1 | |||||

|---|---|---|---|---|---|

| DEMOGRAPHIC ANALYSIS OF THE RESPONDENTS N=212 | |||||

| Variables | Frequency | Percentage | Variable | Frequency | Percentage |

| Gender | Age | ||||

| Female | 84 | 39.62% | 18-25 | 69 | 32.55% |

| Male | 128 | 60.38% | 26-35 | 43 | 20.28% |

| Female | 84 | 36-45 | 55 | 25.94% | |

| 45-55 | 31 | 14.62% | |||

| Country | 55-65 | 11 | 5.19% | ||

| Bahrain | 72 | 33.96% | Above 66 | 3 | 1.42% |

| KSA | 57 | 26.89% | |||

| Kuwait | 23 | 10.85% | |||

| Oman | 24 | 11.32% | |||

| UAE | 36 | 16.98% | |||

Source: Research Survey Data analyzed by IBM SPSS Statistics 22

The frequency analysis shows that the percentage of females that responded to the questionnaire is about 40% while the male percentage is about 60%. The responses to this questionnaire have been collected from Bahrain 34%, Saudia Arabia 27%, the United Arab Emirates 17%, Kuwait 11%, and Oman 11%. Most of the respondents were under 45 years of age (around 79% of the respondents).

Variable Analysis

The analysis of the variables has been done in two methods. In the first method, the mean and the standard deviation for each variable was calculated. In the second method, a normalized frequency analysis was done for each variable to examine closely the tendency of the responses as per the Likert scale. Table 2 shows the mean and standard deviation of the variables.

| Table 2 | |||

|---|---|---|---|

| Descriptive statistics of the variables N=212 | |||

| N | Mean | Std. Deviation | |

| Awareness | 212 | 3.2042 | 0.774 |

| Trustiness | 212 | 2.7969 | 0.80619 |

| Willingness_to_use | 212 | 2.9575 | 0.8245 |

| Stability | 212 | 2.5976 | 0.88904 |

| Future Currency | 212 | 2.9311 | 0.63602 |

| Valid N (listwise) | 212 | ||

Source: Research Survey Data analyzed by IBM SPSS Statistics 22

The Independent Variables Analysis

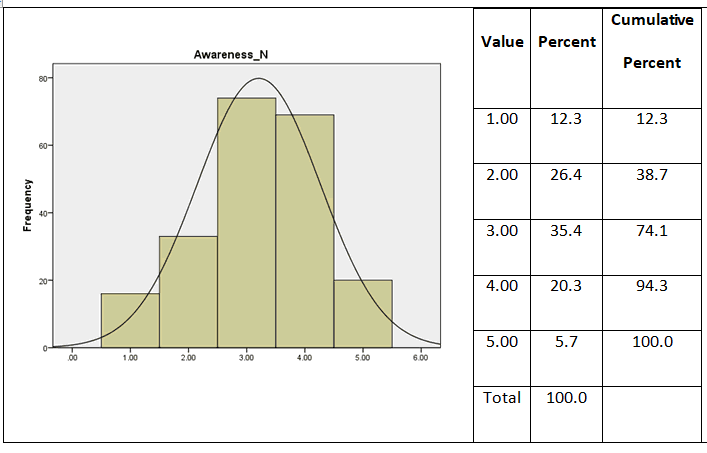

The Awareness of Cryptocurrency

Table 2 shows a mean of 3.20 for the awareness variable which is higher than the midpoint of the Likert scale. The frequency analysis of the respondents (Figure 3) to the awareness shows that majority of the responses are in the agreed part of the Likert scale (3, 4, and 5). Specifically, 42% of the responses made their choice (4, 5) which is almost the area of good awareness. The chart shows slight skewness to the left where the value of one and two are less frequently used by the respondents to the set of questions related to this variable.

Figure 3: The Frequency of the Answers on The Awareness Set of Questions

Source: Research Survey Data analyzed by IBM SPSS Statistics 22

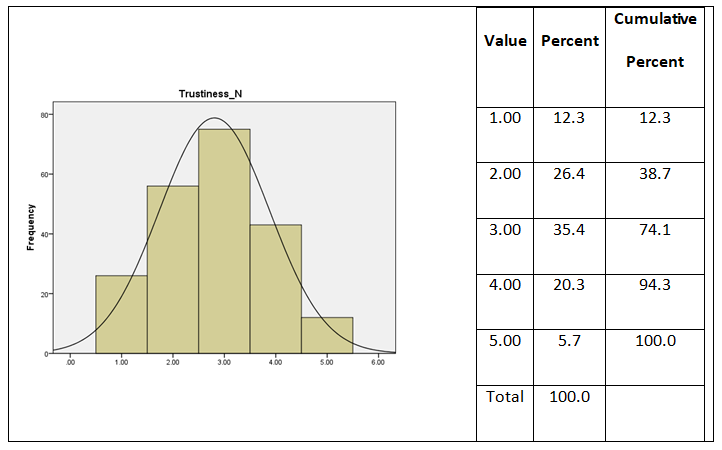

The Trustiness in Cryptocurrency

The frequency analysis of the respondents to the trustiness in cryptocurrency shows that majority of the responses are in the lower part of the Likert scale (1, 2, and 3) with the mean of 2.80 which is below the neutral answer (3). This result indicates that the respondents have some doubts about the functionality of the cryptocurrency system. Figure 4 shows minor skewness to the right where the respondents to this set of questions use less of the value of four and five.

Figure 4: The Frequency of the Answers on the Trustiness Set of Questions

Source: Research Survey Data analyzed by IBM SPSS Statistics 22

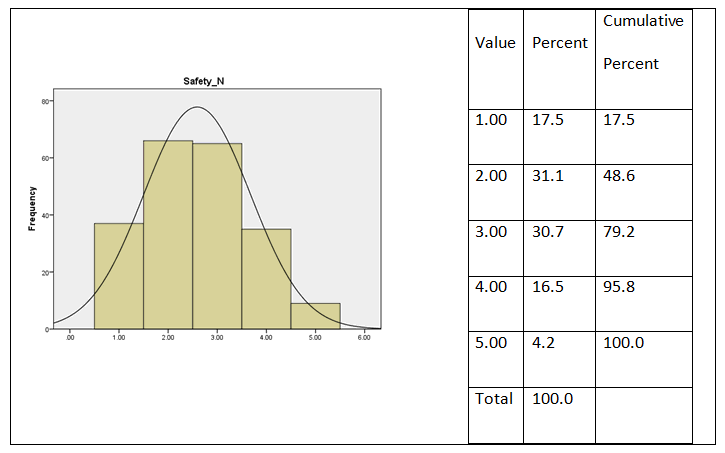

The Stability of Cryptocurrency

The frequency analysis of the respondents to the stability and protection during the use of cryptocurrency shows that about 80% of the responses are in the lower part of the Likert scale (1, 2, and 3) with a mean of 2.60 which is below the midpoint of the scale (3).

This result indicates that the respondents think that they are in a low level of protection if they are using or if they think to use cryptocurrency. Figure 5 shows the concentration of the responses on the choices (2 and 3), and only a few respondents have adopted the strongly agree choice (5) as a response to the stability of cryptocurrency.

Figure 5: The Frequency of the Answers on the stability Set of Questions

Source: Research Survey Data analyzed by IBM SPSS statistics 22

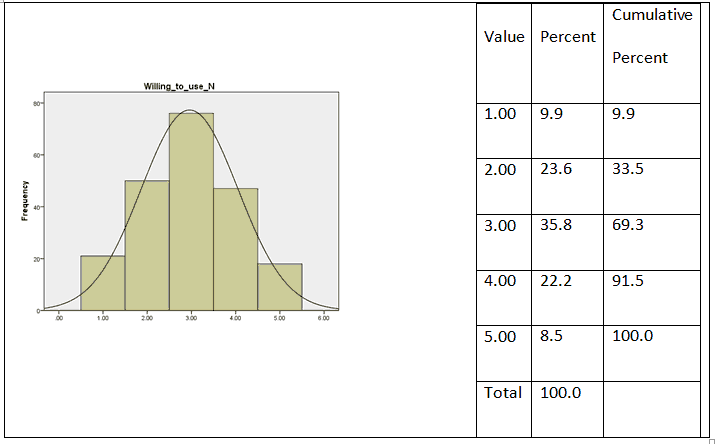

The Willingness to Use Cryptocurrency

Figure 6 presents the frequency analysis of the respondents to the willingness to use cryptocurrency set of questions, which shows a mean of 3.03 and a balanced distribution of the answers around the neutral value. Around 36 % of the responses were in midpoint response (3). This means that the respondents do not have a clear decision to use or not to use cryptocurrency. The responses on the right and on the left of the midpoint are almost equal (34% and 31%). However, there is some confusion around the use of cryptocurrency. This is perhaps caused by different factors such as the non-stability of cryptocurrency or the low level of trustiness on cryptocurrency which has been noticed by the result of the analysis in the previous section.

Figure 6: The Frequency of the Answers of Willingness to Use Cryptocurrency Set of Questions

Source: Research Survey Data analyzed by IBM SPSS Statistics 22

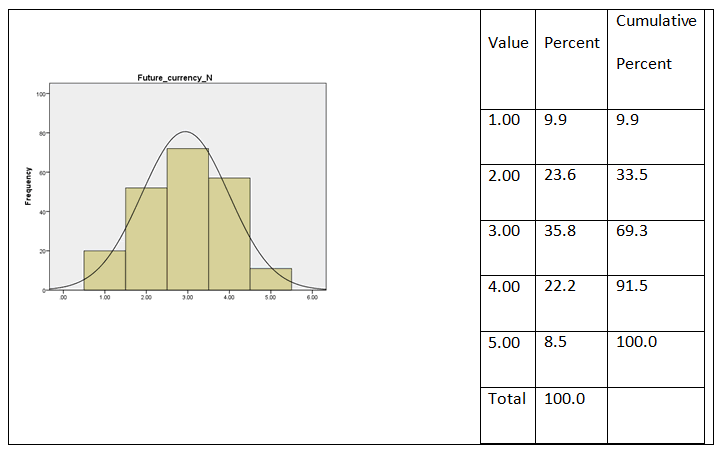

The Dependent Variable Analysis

The Future of Cryptocurrency

The frequency analysis of the respondents to the set of questions related to the future of cryptocurrency as a future global currency shows a result similar to the analysis which has been seen with the variable (willingness to use). The mean of 2.93 and around 36% responded to the midpoint response (3). Around 31% of the responses agree or strongly agree with the cryptocurrency as global future currency. On the other hand, around 32% of the responses are in the lower part of the Likert scale (1 and 2). This means that they disagree or strongly disagree with the future of cryptocurrency as a global currency (Figure 7).

Figure 7: The Frequency of the Future of Cryptocurrency As A Future Currency N-212

Source:Research Survey Data analyzed by IBM SPSS Statistics 22

Findings, Discussion, And Hypothesis Test

This research adopts the regression analysis to test the hypothesis of the study. The results of the regression analysis are presented in Table 3 below.

| Table 3 | |||

|---|---|---|---|

| SUMMARY OF THE REGRESSION ANALYSIS RESULT N-212 | |||

| Model | R2 | F | Significance |

| 0.593 | 75.267 | 0 | |

| Independent Variables | |||

| Beta | t | Significance | |

| Constant | 8.989 | 0 | |

| Awareness | -0.223 | -2.075 | 0.039 |

| Trustiness | 0.346 | 2.543 | 0.012 |

| willingness_to_use | 0.594 | 8.563 | 0 |

| Stability | 0.093 | 1.108 | 0.269 |

Dependent Variable is the future of cryptocurrency

Source: Research Survey Data analyzed by IBM SPSS Statistics 22

The results of Table 3 present the values of standardized regression analysis where the significance equals 0.000. This shows the significance of the model and the existence of a relationship between the independent variables and the dependent variable. The value of R2 equals 0.593 which indicates that 59.3% of the changes in the dependent variable could be explained by the independent variables. The model characteristics explain that the relationship between the independent variable (Stability) and the dependent variable is not statistically significant. This requires the acceptance of the null hypothesis (H03) which states that: There is no relationship between the stability of cryptocurrency and the future of cryptocurrency in the GCC countries. The coefficients of the model indicate a significant and positive relationship between the dependent variable (Trustiness) and the independent variables. This result implies the rejection of the null hypothesis (H02) which states that: There is no relationship between the trustiness degree in cryptocurrency and the future of cryptocurrency in the GCC countries, and acceptance of the alternative hypothesis which confirms the relationship between the trustiness and the future of cryptocurrency in the GCC countries.

The coefficient Beta of the dependent variable (willingness to use) equals 8.563 which is the highest coefficient. Thus, this indicates that this independent variable is the most influential factor in the positive side of the relationship. This result leads to the rejection of the null hypothesis (H03) which states that: There is no relationship between the willingness to use cryptocurrencies and the future of cryptocurrency in the GCC countries, and acceptance of the alternative hypothesis which states the existence of a relationship between the willingness to use cryptocurrencies and the future of cryptocurrency in GCC countries.

The coefficient of the dependent variable (Awareness) is negative and the significance value is less than 0.05 which indicates the existence of a negative relationship between the variable (awareness) and the future of cryptocurrency. This led to the rejection of the null hypothesis (H01) which states that: There is no relationship between the awareness degree of cryptocurrency and the future of cryptocurrency in the GCC countries, and acceptance of the alternative hypothesis which requires the existence of a relationship between the awareness degree and the future of cryptocurrency in the GCC countries.

Limitations and Future Perspectives of the Study

The empirical results reported herein should be considered in the light of some limitations mainly to avoid the randomness of the sample. Although the researchers did not have much choice, the results could have been more representative if the data collected was based on a standard selection of a sample from the targeted population. The previous research regarding this topic is minimal, and this encouraged the researchers to take the challenge and create an investigative case for further research. This limitation does not prevent other researchers from using the results of this paper for similar attempts to help decision-makers in formulating strategies and policies for future cryptocurrency trading.

Conclusion

The aim of the research is to identify the future of cryptocurrency in GCC countries. The focus of this study was on the awareness of cryptocurrency, trustiness & legality of cryptocurrency, the stability of cryptocurrency, and the willingness to use cryptocurrency. The analysis results show that the GCC population has an average and moderate degree of awareness about the usage and the nature of cryptocurrency. This average level of awareness is accompanied by a slightly low level of trustiness on cryptocurrency, as per the result of the survey analysis. The GCC population has doubts about the stability of using cryptocurrency. Furthermore, the sample of the research has some confusion about the future of cryptocurrency as a global currency. A portion of them is in the favorable opinion of cryptocurrency as an international currency which sheds some suspicions. However, one group within the sample is against it. The last group has chosen the neutral choice. Therefore, it is evident that the sample of this research is influenced by the Sharia law which does not give permission to deal with such coins. Furthermore, trading in this currency needs a high degree of knowledge in the mechanisms of using it. It is concluded from the previous analogy that stability is not a certain outcome for this currency. Therefore, the future may become a spectacle due to various economic and legal reasons. If the GCC would like to go for these trading in cryptocurrency, it must seriously think of establishing the required legal system and financial base that can protect the upper interests of these countries. As for the results of this research, the future is mysterious unless decision-makers draw a strategic plan to cope with this new trend. Thus, more research for this is required to help create a secure currency trading.

Acknowledgement

The authors would like to acknowledge the support rendered by the Research Unit of Kingdom University and University Management for their constant assistance with the research. This work was written by Abdelrhman Meero (Email: ar.meero@ku.edu.bh), Saad Darwish (Email: saad.darwish@ku.edu.bh)& Abdul Aziz Abdul Rahman (Email: a.abdulrahman@ku.edu.bh), Kingdom University, Bahrain.

References

- Aalborg, H.A., Molnár, P., & de Vries, J.E. (2019). What can explain the price, volatility and trading volume of Bitcoin? Finance Research Letters, 29, 255-265.

- Carstens, A. (2018). Money in the digital age: What role for central banks? Lecture at the House of Finance, Goethe University, Frankfurt, 6 February.

- Danuarta, G.L.N., & Darma, G.S. (2019). Determinants of using go-pay and its impact on net benefits. International Journal of Innovative Science and Research Technology, 4(11), 173-182.

- Darwish, S. (2015). Risk and knowledge in the context of organizational risk management. European Journal for Business & management, 7(15).

- Darwish, S., & Abdeldayem, M. (2019). Risk management and business ethics: Relations and impacts in the GCC. International Journal of Civil Engineering and Technology, 10(10), 489-504.

- Davis, F.D. (1989). Perceived usefulness, perceived ease of use, and user acceptance of information technology. MIS quarterly, 13(3), 319-340.

- Deng, H., Huang, R.H., & Wu, Q. (2018). The regulation of initial coin offerings in China: Problems, prognoses and prospects. European Business Organization Law Review, 19(3), 465-502.

- Eun, C.S., & Sabherwal, S. (2003). Cross-Border listings and price discovery: Evidence from U.S. Listed Canadian stocks. The Journal of Finance, 58(2).

- Filona, F., & Misdiyono, M. (2019). Factors affecting the adoption of electronic money using technology acceptance model and theory of planned behavior. Scientific Journal of Business Economics, 24(1), 108-120.

- Gerard, D. (2017). Attack of the 50 foot blockchain: Bitcoin, blockchain, Ethereum & smart contracts. David Gerard.

- Ha, S., & Stoel, L. (2009). Consumer e-shopping acceptance: Antecedents in a technology acceptance model. Journal of business research, 62(5), 565-571.

- Kuo, Y.F., Wu, C.M., & Deng, W.J. (2009). The relationships among service quality, perceived value, customer satisfaction, and post-purchase intention in mobile value-added services. Computers in human behavior, 25(4), 887-896.

- Lee, T. (2013). Bitcoin's volatility is a disadvantage, but not a fatal one.

- Legris, P., Ingham, J., & Collerette, P. (2003). Why do people use information technology? A critical review of the technology acceptance model. Information & management, 40(3), 191-204.

- Liebkind, J. (2020). Bitcoin government regulations around the world.

- Magnuson, W. (2020). Block chain democracy: Technology, law and the rule of the crowd. Cambridge University Press, UK.

- Miliani, L., & Indriani, M.T.D. (2013). Adoption behavior of e-money usage. Information Management and Business Review, 5(7), 369-378.

- Nakamoto, S. (2008). Bitcoin: A peer-to-peer electronic cash system.

- Pichler, P., Schierlinger-Brandmayr, A., & Summer, M. (2018). Digital money. Monetary policy & the economy, (Q3/18), 23-35.

- Reid, S.E., & De Brentani, U. (2004). The fuzzy front end of new product development for discontinuous innovations: A theoretical model. Journal of product innovation management, 21(3), 170-184.

- Robinson, J.P., Shaver, P.R., & Wrightsman, L.S. (2013). Measures of personality and social psychological attitudes: Measures of social psychological attitudes. Academic Press.

- Sapovadia, V.K. (2015). Legal issues in cryptocurrency. Chapter in the book by Chuen, D.L. Handbook of digital currency: bitcoin, innovation, financial instruments, and big data. Saint Louis: Elsevier Science.

- Sathye, M. (1999). Adoption of internet banking by Australian consumers: An empirical investigation. International Journal of bank marketing, 17(7), 324-334.

- Shin, D.H. (2009). Towards an understanding of the consumer acceptance of mobile wallet. Computers in Human Behavior, 25(6), 1343-1354.

- Sidek, N. (2015). Determinants of electronic payment adoption in Malaysia: The stakeholders' perspectives. PhD thesis, The University of Queensland, School of Agriculture and Food Sciences.

- Srivastava, N. (2019). Digital financial services: Challenges and prospects for liberalized and globalized Indian Economy. In Proceedings of 10th International Conference on Digital Strategies for Organizational Success.

- Suh, B., & Han, I. (2002). Effect of trust on customer acceptance of Internet banking. Electronic Commerce research and applications, 1(3-4), 247-263.

- Vuji?i?, D., Jagodi?, D., & Ran?i?, S. (2018). Blockchain technology, bitcoin, and Ethereum: A brief overview. In 2018 17th international symposium infoteh-jahorina (infoteh) (pp. 1-6). IEEE.

- Yu, S., & Ibtasam, S. (2018). A qualitative exploration of mobile money in Ghana. In Proceedings of the 1st ACM SIGCAS Conference on Computing and Sustainable Societies (pp. 1-10).

- Yuneline, M.H. (2019). Analysis of cryptocurrency’s characteristics in four perspectives. Journal of Asian Business and Economic Studies, 26(2).

- Zhu, N., & Yan, M. (2019). Feasibility analysis of digital currency market-Taking bitcoin as an example. In 1st International Conference on Business, Economics, Management Science (BEMS 2019). Atlantis Press.