Research Article: 2022 Vol: 21 Issue: 2

Demystifying Performance within the Context of Resource Fluidity in Nigeria

Idia Sandra Efeomo, Covenant University

Salau Odunayo Paul, Covenant

Kaitell Temiloluwa Moyosore, Covenant University

Bolodeoku Bolanle Paul, Covenant University

Citation Information: Efeomo, I.S., Paul, S.O., Moyosore, K.T., & Paul, B.B. (2022). Demystifying performance within the context of resource fluidity in Nigeria. Academy of Strategic Management Journal, 21(2), 1-9.

Abstract

High organizational performance become even more challenging and dynamic in the last few decades due to globalization and its ability to intensify competition and changes in consumer preference, shorten the lifespan of product and service. This study evaluates resources fluidity and its effect on performance in the Nigerian manufacturing industry. The study adopted a mono method with a descriptive survey design. A total of 196 questionnaires were dispersed to the employees of some selected firms in Nigeria. 161 was filled and return. The data was for the study was analysed and presented using SEM-PLS (structural equation method). The Study result showed that resource fluidity has a positive and significant effect on firm’s performance in the manufacturing industry of Nigeria. The study recommended that manufacturing organization in Nigeria adopt strategies that develops resources fluidity for improved agility to improve their firm’s performance.

Keywords

Resource Fluidity, Firm’s Performance, Dynamic Capability Theory.

Introduction

The need for an organization to adapt to the constant changes in the environment and technology is ultimately geared towards achieving the organization's primary goal, which is to achieve high performance and be able to maintain it in the long run. However, achieving a high organizational performance may have become even more challenging and dynamic in the last few decades due to globalization and its ability to intensify competition and changes in consumer preference, shorten the lifespan of product and service (Mihalache & Mihalache, 2016). The ambiguity and need for sustainable performance in the organizations have led numerous scholars to try to develop strategies to improve the performance of firms to achieve more tremendous success (Kouaib et al., 2020).

The manufacturing industry is one sector that has always been considered the engine for the economy's growth and development, especially in a developing country like Nigeria. It is a pillar for sustainability locally and globally (Okuwa, 2019). The manufacturing industry is a valued requirement for any country's economic development. In as much as the vitality of manufacturing firms is well known, they need to continually perform tremendously in their internal and external environment. In that, the capability of the manufacturing industry to succeed or fail depends solely on its performance. A firm's performance depends on various variables such as its profitability, share of the market, its ability to satisfy its customers and compete in the ever-ongoing industry rivalry (Almatrooshi et al., 2016).

Manufacturing contributes highly to various economies such as china, japan, the United States, and many other developed and developing countries, despite the constant changes and turbulence seen in the environment. However, this is not the case for Africa or Nigeria in particular. Nigeria's economy is one of the largest in Africa and is distinguished by a diverse range of organizations. Manufacturing is a significant and flood-prone business in Nigeria. The manufacturing sector is categorised by economic resources used to produce basic needs for the country's citizens (Khoshnood & Nematizadeh, 2017).

As globalization advances, the performance of firms in the industrial sector is steadily increasing and falling, which has to do with firms' environmental turbulence and dynamism in terms of improving technology and inventions, constantly changing consumer choice, increased rivalry. However, despite the shadowing effects the environment has on them, these manufacturers must succeed. For firms to continually achieve improved and sustained performance, different measures have been denoted and researched to understand its effect on increased firm performance (Rodriguez et al., 2014). Of which these strategies have been discovered to have only a short-run effect on a firm's performance.

The key to improved and sustainable performance is to shift from business process to value-added development in terms of fluid resource movement and environmental sensitive applications is essential to achieve enhanced performance and production. There is a need for these organizations to develop agility in other to respond effectively to the changes of which studies have shown resource fluidity is a key strategy to developing agility and perform better. However, the relevant literature on improving firms' performance introduced the role of resource fluidity in improving and managing the sustainability of a firm's performance in developed countries.

Furthermore, the manufacturing sector has been found to be in great need of agility infused into its operations, in light of the turbulence of the environment. For organizational success, flexibility in its operations with quick responsiveness and adaptability is likely to lead to a greater performance for the firm. Resource fluidity encompasses the internal competency of a firm to be able to reconfigure its systems, restructure and dispatch its resources rapidly, sustain its businesses procedures for resource allocation, along with collaborative mechanisms that create business models and system incentives.

Hence, this study is focused on strengthening the impact of resources fluidity on performance of the selected manufacturing firms. The specific objectives are to:

1. Examine the effect of resource fluidity on market share.

2. Investigate the influence of resource fluidity on employee satisfaction

3. Asses the role of resource fluidity on product quality

4. Determine the impact of resource fluidity on customer satisfaction.

Literature Review

Concept of Resource Fluidity

The Internal capability to quickly reorganize business processes and redeploy resources endorsed systems and methods for operations and resource allocation, people management strategies, structures, and benefits for collaboration that make business model and activity system transformation faster and easier are all the embodiment of resource fluidity (Sharifi & Zhang, 1999; Rotich & Okelio, 2019). Resource fluidity relates to the capacity of an organization to flexibly reallocate and restructure available resources within an organization's subsystems and units as needed resources such as man, money, materials, machine, and information.

As a result of fluidizing resources, a firm may be able to consider more possibilities. Obviously, not all resources are fluid in the same way. The ability to assign and reallocate resources is critical to a company's efforts to produce new products and services (Oyedipo, 2012; Red-well et al., 2021). The fluidity of resources can be cultivated in the following ways: as a method of job rotation, as an open job market for identifying skills, as a bringing individual career growth potential and opportunity to light.

The study of Doz & Kosonen (2010) cited in Red-well et al. (2021) explains that given that resources such as financial resources, personnel, and other basic competencies are highly mobile within the firm, business models become less rigid and open to modifications and reinvention as resource fluidity increases. As a result, the firm gains greater flexibility in reorganizing or redeploying its resources to support its new strategic agenda or to respond to changing market demands, such as new product/service offerings, new customer/market segmentation, and/or new ways to contact customers (Redwell & Hamilton, 2020).

When imprisoned resources characterize a firm, business system rigidity, managerial gaps, and competency traps tend to have a negative impact on the ability of a firm to be agile (Rotich & Okelio, 2019). Mobility and reallocation of persons, on the other hand, boosts agile practices. Agile firms tend to restructure and even realign their resources to invest in current and maybe transient market opportunities to acquire a comparative advantage.

Concept of Firm’s Performance

Firms operate in a competitive atmosphere, and if they want to stay afloat in today's market condition, they must overcome several obstacles that degrade their performance. Poor planning, cultural difficulties, monetary concerns, incentives and compensation issues, administrative issues, corporate strategy issues, environmental uncertainty issues, and leadership issues are some of the obstacles that firms confront. Performance is a key determinant of whether a company will succeed or fail. For instance, firms with high performance are successful in the market, whereas those with poor performance are considered failures in the market.

The concept of firm performance is founded on the premise that a firm is a voluntary alliance of productive assets, such as human, physical, and financial resources, with the goal of attaining a common goal. It is imperative to note that the creation of value is the core of performance (Otley, 1999; Waggoner, 1999; Nikpour, 2017). The assets will continue to be made accessible to the firm and the firm will continue to exist as long as the value generated by the utilization of the donated assets is equal to or higher than the value expected by those providing the assets. Conversely, value creation defined by the resource provider, is the indispensable overall performance benchmarks for any firm. The majority of management empirical research focuses on how value is produced.

There are a number of challenges that come up while evaluating an organization's value generation. To begin with, value creation is situational, as various kinds of firms have varied ideas about what constitutes a desirable output. Second, firms perform on several dimensions in terms of growth, profitability, and credibility, and they frequently trade positive outcomes in one for negative consequences in another. Third, performance is influenced in part being that it is consistently based on what the observer considers "valuable." Finally, timing is important in the creation of value because opportunities generated now that will be realized later are valued now based on individual expectations about future actions and situations (Rehman et al., 2019).

Theoretical Justification

This paper underscores the assumption of the dynamic capability theory (Teece, 2007). The dynamic capability theory arose as a response to the resource-based view's (RBV) incapacity to comprehend the generation and regeneration of resources and capabilities in response to constantly changing conditions. DCT are those processes that help a firm to rethink or reconfigure its strategy and resources in order to create long-term competitive advantages and greater performance in rapidly changing contexts as explained in Figure 1 (Bleady et al., 2018). The DCT explains the ability of the organization to incorporate, create, and restructure internal and external competencies in response to quickly changing circumstances (Teece et al., 2016 a& b), Dynamic Capabilities and Organizational Agility: Risk, Uncertainty and Entrepreneurial Management in the Innovation Economy, 2016). For resource fluidity, dynamic capacity theory explains how the firm integrates, reassemble and restructure its current resources and capabilities in order to enhance the competitive levels of organizations in the field of study (Redwell & Hamilton, 2020). The conceptual framework that shows the relationship between of variables is demonstrated in Figure 1.

The study used a descriptive technique to collect feedback. A mono-method strategy, particularly the quantitative technique, was employed to generate the main data utilizing a structured questionnaire. The data from this approach have been organized and structured in a single frame and information in distinct categories of lines and sections (Saunders et al., 2009). The population of this study was 161 from selected manufacturing firms in Nigeria. There are various techniques for determining the sample size, but the researcher opted for a census approach to this investigation. In this investigation, the researcher carried out a purposive sample that was used to choose the organizations that participated in the study. The statistical tool used included the Structural Equation Modelling (SMART-PLS). Firm’s performance was measured with 12 items under four categories (market share, employees’ satisfaction, product quality, and customer satisfaction), while resource fluidity was measured with 3 items as presented in Table 1.

| Table 1 STRUCTURAL EQUATION MODELLING DATA | ||||

| S/N | Constructs | Variables | No of item | Source |

| 1 | Resource fluidity | • Flexibility of budget • Reallocation and utilization of resources • Adaptable firm size to changes |

9 | Kitur & Kinyua (2020); Redwell & Hamilton (2020); Rotich & Okelio (2019). |

| 2 | Firms performance | • Market share, • employee satisfaction, • product quality and • Customer satisfaction. |

12 | Almatrooshi et al. (2016); Nikpour (2017); Waggoner et al. (1999). |

Analysis and Interpretation of Measurement Model

Demographics of respondents

Demographics of respondents illustrates that 90 (55.9%) of the respondents were males, while 71 (44.1%) were females. The table also reveals 51 (31.7%) of the respondents were single, 98 (60.9%) were married, 12 (7.5%) were others. 11(6.8%) of the respondent has WAEC/O LEVEL, 23(14.3%) of the respondent has an OND/NCE, 89 (55.3%) of the respondent has a BSC/HND, 34(21.1%) of the respondent has a MSC/MBA, and 4(2.5%) of the respondent has a PHD. 12 (7.5%) respondents were 18 – 25 years, 52 (32.3%) were 26 - 33 years, 61 (37.9%) were 34– 41 years, while 36 (22.4%) were between 42 years and above. 40(24.8%) of the respondents were lower level, 82(50.9%) of the respondents were middle level, 39(24.2%) of the respondents were top level. 36(22.4%) of the respondent work experiences of 0-4 years, 67(41.6%) of the respondent work experiences of 5-8 years, 29(18.0%) of the respondent work experiences of 9-12 years, 29(18.0%) of the respondent work experiences of 13 years and above.

Interpretation of Measurement Model

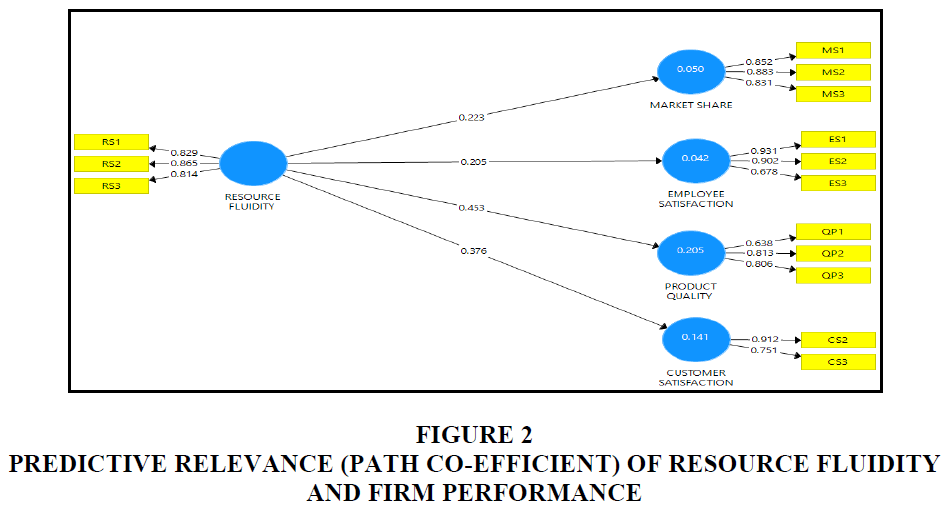

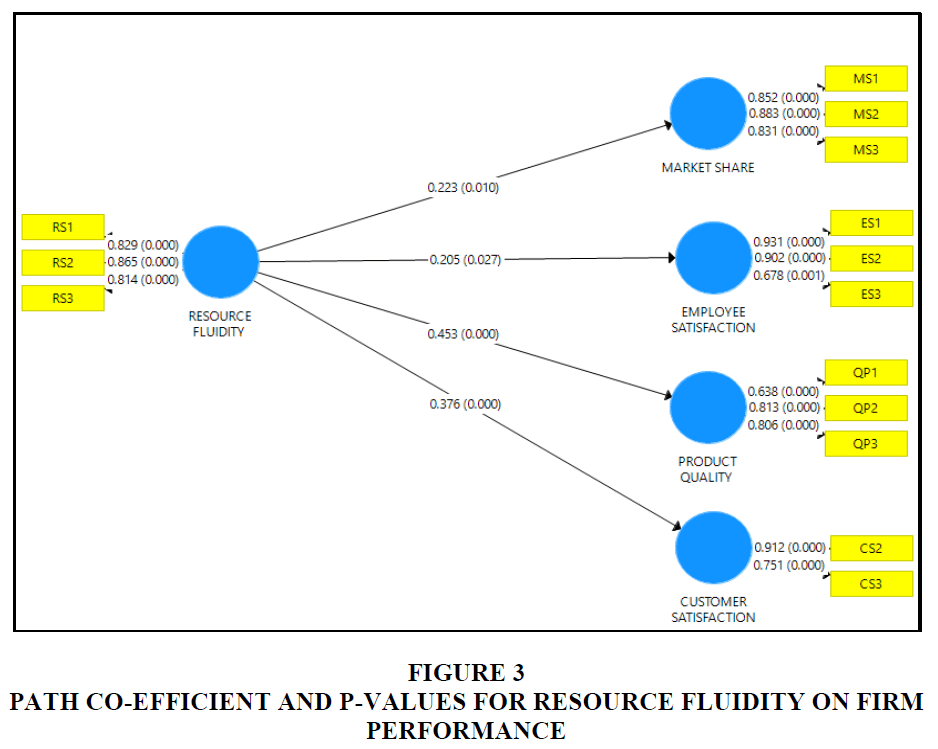

The structural and measurement models are presented in Table 2 and Figures 2 and 3 respectively.

The threshold for all scales and measuring items should be above 0.60 to be reliable. The factor loading must be greater than the 0.70 minimum threshold number. Second, the composite dependability must be 0.80 or above. Thirdly, the construct average variance extracted estimate (AVE) must be more than 0.50. Finally, the Cronbach Alpha is adjudged to be reliable when the value is equal or above 0.70.

From the Table 1, it can be depicted that all the construct of resource fluidity and firms performance have values higher than 0.80 and 0.70, which means that they have composite internal consistency and cronbach alpha reliability respectively. The factor loadings for the specific measures of construct ranged between 0.638 and 0.931. Hence, the instrument is adjudged reliable and valid since the fundsmental requirement for the degree of fitness was satisfactory met. The result of the inner structural model is presented in Figures 2 and 3 respectively.

| Table 2 Factor Loading for Resource Fluidity and Firm Performance (Market Share, Employee Satisfaction, Product Quality, Customer Satisfaction) | |||||

| Factor Loading | Error Variance | Composite Reliability | AVE | Cronbach’s Alpha | |

| Indicators | >0.5 | <0.5 | ≥ 0.8 | ≥ 0.5 | ≥ 0.7 |

| Resource Fluidity (RS) | 0.875 | 0.699 | 0.785 | ||

| RS1 | 0.829 | 0.171 | |||

| RS2 | 0.865 | 0.135 | |||

| RS3 | 0.814 | 0.186 | |||

| Market Share (MS) | 0.891 | 0.732 | 0.819 | ||

| MS1 | 0.852 | 0.148 | |||

| MS2 | 0.883 | 0.117 | |||

| MS3 | 0.831 | 0.169 | |||

| Employees’ Satisfaction (ES) | 0.880 | 0.713 | 0.826 | ||

| ES1 | 0.931 | 0.069 | |||

| ES2 | 0.902 | 0.098 | |||

| ES3 | 0.678 | 0.322 | |||

| Product Quality (QP) | 0.899 | 0.573 | 0.731 | ||

| QP1 | 0.638 | 0.362 | |||

| QP2 | 0.813 | 0.187 | |||

| QP3 | 0.806 | 0.194 | |||

| Customer Satisfaction (CS) | 0.821 | 0.698 | 0.785 | ||

| CS2 | 0.912 | 0.088 | |||

| CS3 | 0.751 | 0.249 | |||

Figure 2 depicts that 5% variance of market share is explained by resource fluidity; 4.2% variance of employees’ satisfaction is explained by resource fluidity; 20.5% variance of product quality is explained by resource fluidity; and 14.1% variance of customers’ satisfaction is explained by resource fluidity. This suggests that resource fluidity contribute more to product quality and customers’ satisfaction; while employees’ satisfaction had the least predictive power.

Figure 2 also indicated the predictive power of the relationship between the variables. The results established that a unit change in resource fluidity will lead to increase in market share by 22.3%, employees’ satisfaction by 20.5%; product quality by 45.3% and customers’ satisfaction by 37.6%. This implies that managers of the selected organisation need to intensify effort in using resource fluidity to facilitate product differentiation and quality. To determine the significance level, a bootstrapping was conducted and demonstrated in Figure 3.

The Path Coefficients (β) and t- Statistics Estimation

Figure 3 provides standardized analysis of bootstrapping for resource fluidity and firm performance. The Path Coefficients (β) and T- statistics Estimation were determined in the Partial Least Square (PLS). The significance of the hypothesis was tested through the β value. The higher the β value, the greater the substantial effect on the endogenous latent constructs. Figure 3 depicted that all the Pvalues of performance proxies are less than 0.05. This suggests that resource fluidity have significant effect on the indicators of firm’s performance except for employees’ satisfaction. The relationship between and among the variables are presented in Table 3.

| Table 3 Path Coefficients for Resource Fluidity on Firm Performance | ||||||

| Variables and Cross Leading | Path co-efficient (O) |

Std. Dev (STDEV) |

T-statistics (O/STDEV) |

P-values | ||

| resource fluidity | → | Customer satisfaction | 0.376 | 0.076 | 4.923 | 0.000 |

| resource fluidity | → | employee satisfaction | 0.205 | 0.088 | 2.329 | 0.020 |

| resource fluidity | → | market share | 0.223 | 0.081 | 2.758 | 0.006 |

| resource fluidity | → | Product quality | 0.453 | 0.075 | 6.065 | 0.000 |

| R-Square (R2) | R-Square (R2) Adjusted | |||||

| resource fluidity | → | Customer satisfaction | 0.141 | 0.136 | ||

| resource fluidity | → | employee satisfaction | 0.042 | 0.036 | ||

| resource fluidity | → | market share | 0.050 | 0.044 | ||

| resources fluidity | → | Product quality | 0.205 | 0.200 | ||

The path coefficient indicates that resource fluidity on firm performance in the analysis at <0.5. to break it down, it is observed that there is a direct significant impact of resource fluidity on customer satisfaction(i.e., b=0.376, f2=0.076, p<0.05), resource fluidity on employee satisfaction (i.e., b=0.205, f2=0.088, p < 0.05), resource fluidity on market share(i.e., b=0.223, f2=0.081, p <0.05), resource fluidity on product (i.e., b=0.453, f2=0.075, p < 0.05).

Overall, the relationship between resource fluidity on firm performance (market share, employee satisfaction, product quality, customer satisfaction) is confirmed to be directly significant with the reference to the beta value of constructs above, which also depicts a strong degree of association especially on product quality. All the path coefficients were of practical importance since the significance level is below .05. The result suggested that since the significant level of the model is less than 0.05, the null hypothesis should be rejected. This implies that resource fluidity is a predictor of product quality, customer satisfaction market share and employee satisfaction.

Discussion of Findings, Recommendation and Conclusion

In line with the stated objectives, the results of the study showed that the stated hypothesis where in line with the expected findings. The result showed that resource fluidity has a positive and significant effect on the performance of selected firms in Nigeria. This result is consistent with the findings of prior studies. The resource fluidity as a strategic tool has a significant impact on the performance of firms. Furthermore, the study recommends that manufacturing firms in Nigeria adopt strategies that develop resources fluidity for improved organizational agility to improve their firm’s performance. Contemporary manufacturing firms should establish and enhance their resource fluidity especially in terms of their adaptive ability to multiple resources trends so that they can notice changes and respond (proactively or reactively) efficiently and effectively in both the internal and external environments in a timely and cost-effective way. The study concludes that resource fluidity has a positive and significant effect on firm’s performance in the manufacturing industry of Nigeria.

Acknowledgements

Great appreciation goes to Covenant University Centre for Research, Innovation and Development (CUCRID) for funding this conference publication.

References

Bleady, A., Ali, A.H., & Ibrahim, S.B. (2018). Dynamic capabilities theory: pinning down a shifting concept. Academy of Accounting and Financial Studies Journal, 22(2), 1-16.

Doz, Y.L., & Kosonen, M. (2010). Embedding strategic agility: A leadership agenda for accelerating business model renewal. Long Range Planning, 43(2-3), 370-382.

Kitur, T., & Kinyua, G.M. (2020). An Empirical Analysis of the Relationship between Resource Fluidity and Firm Performance: A Perspective of Tours and Travel Companies in Kenya. International Journal of Innovative Research and Advanced Studies, 7(11), 13-21.

Nikpour, A. (2017). The impact of organizational culture on organizational performance: The mediating role of employee’s organizational commitment. International Journal of Organizational Leadership, 6, 65-72.

Okuwa, J.A. (2019). Dynamic capabilities and o manufacturing firms in p.

Otley, D. (1999). Performance management: a framework for management control systems research. Management Accounting Research, 10(4), 363-382.

Oyedipo, A. (2012). Strategic agility and competitive performance in the Nigerian telecommunication industry: An empirical investigation. American International Journal of Contemporary Research, 2(3), 227-237.

Redwell, E.E., & Hamilton, D.I. (2020). Strategic sensitivity and competitiveness of Aluminium Manufacturing Firms’ in Rivers State, Nigeria. West Africa Journal of Business, 14(2), 25-45.

Red-Well, E.E., Hamilton, D.I., & Bayo, P.L. (2021). Resource fluidity and competitiveness of Aluminium manufacturing firms in Nigeria. Resource, 2(3).

Rodriguez, I., Williams, A.M., & Hall, C.M. (2014). Tourism innovation policy: Implementation and outcomes. Annals of Tourism Research, 49, 76-93.

Rotich, J., & Okello, B. (2019). The effect of resource fluidity on strategic agility among universities in Kenya: Case of Masinde Muliro University of Science and Technolog. The Strategic Journal of Business & Change Management, 6(2), 2176-2190.

Saunders, M., Lewis, P., & Thornhill, A. (2009). Research methods for business students. Pearson education.

Teece, D., peteraf, M.A., & Heaton, S. (2016b). Entrepreneurial management in the innovation economy dynamic capabilities and organizational agility: risk, uncertainty. california mana, 58, 13-35.

Teece, D.J. (2007). Explicating Dynamic Capabilities: The nature and micro foundations of (sustainable) enterprise performance. Strategic Management Journal, 28, 13-19.

Waggoner, D.B., Neely, A.D., & Kennerley, M.P. (1999). The forces that shape organisational performance measurement systems: An interdisciplinary review. International Journal of Production Economics, 60, 53-60.