Research Article: 2022 Vol: 25 Issue: 6S

Determinants of Dividend Policy: A Review of Selected Nigerian Quoted Companies

Omankhanlen Alexander Ehimare, Covenant University Ota

Nwuba Emeka, Covenant University Ota

Ehikioya Benjamin, Covenant University Ota

Chimezie Onyedikachi Peace, Covenant University Ota

Citation Information: Omankhanlen, A.E., Nwuba, E., Ehikioya, B., & Chimezie, O. P. (2022). Determinants of dividend policy: A review of selected Nigerian quoted companies. Journal of Legal, Ethical and Regulatory Issues, 25(S6), 1-13.

JEL Classification Codes: B40, B41, F65, G21, G23, G40

Abstract

This article focused on the study of firm-specific factors that influence dividend decisions among selected firms listed on the Nigerian Stock Exchange. Samples were drawn from twenty companies for a period of ten (10) years (2008 to 2017). Econometric multiple regression models were used to analyze the data and establish the relationship. Various proxies have been used in the literature to represent company dividend policy including dividend per share (DPS), dividend yield and dividend payout ratio. This study adopted DPS as the closest proxy for dividend policy because of its stable nature and relative freedom from the impact of other exogenous variables since the denominator (no of shares) is stable over time leaving the impact of growth in absolute dividend to be noticed over time. Seven firm-specific variables were identified and used in the study. These include earnings per share (EPS), return on equity (ROE), return on assets (ROA), free cash flow per share (FCF/S), Leverage (LEV), net profit margin (NPM) and price-earnings-ratio (PER). The results show that out of the seven variables tested; only EPS has a positive and significant impact on the dividend policy of the firms. EPS, FCF/S, PER have positive but insignificant relationship with dividend policy while Leverage, ROA and NPM have negative but insignificant relationship with the dividend policy of companies quoted on the Nigerian Stock Exchange. We therefore recommend that income-seeking investors should pay more attention to companies that have demonstrated consistent and growing EPS over time. They should also be critical of heavily geared companies whose dividend paying ability might be impaired due to huge cash outflow from loan repayments.

Keywords

Dividend Per Share, Earnings Per Share, Net Profit Margin, Leverage, Free Cash Flow Per Share, Returns On Assets, Return On Equity, Price Earnings Ratio

Introduction

The concept of dividend dates back to the period after the 15th century when the commanders of marine boats in Holland and Britain started selling the economic rights of having a share in the income made in the marine journey. At the end the journey, the income is distributed among the right holders based on their rights (Multaza, Igbal, Ullah, Rasheed & Basit, 2018).

One of the main objectives of financial management is the maximization of shareholders’ value. In trying to achieve this, finance and business managers are constantly faced with three key decisions; investment decision, financing decision and dividend decision. Investment decision involves choosing from alternative investment options for a project with the maximum risk-adjusted net present value. Financing decision involves choosing from the various sources of financing in order to achieve an optimal capital structure which minimizes the cost of capital and maximizes the value of the firm. Finally, dividend decision involves a decision on what portion of the added value of the company (incremental profits) should be distributed to the shareholders and what portion should be retained in the business to take advantage of future business opportunities.

Gordon (1959) defined dividend as the form of fragmented payments that investors expect to receive, and suggested that profit is the most likely cause for the distribution of dividends. This places profit on the core of dividend policy decisions, after all, dividend policy is a decision on what proportion of the firm’s profit to distribute and what proportion to retain. However, it is not only profitability that is relevant here. Cash flow is equally important. A company might make huge profits without available cash flow to pay dividend and any move to borrow in order to pay dividend will likely alter the company’s cost of capital and capital structure, at least in the short term. So dividend policy decision affects a whole lot of the company’s activities. Dividend policy is seen as part of the core of financial decisions because it triggers changes in corporate economic and financial indicators, having a direct impact on funding policy and investment. By the company distributing dividends, it causes a decrease in the liquidity of their assets, which is reflected in a decrease of free cash flow, directly influencing the form of compensation of investors in the form of dividends or capital gains. (Almelda, Pereira & Taveres, 2015). A firm’s value depends not only on its having an optimal business strategy but also on its ability to communicate its optimizing attitude through dividend payment (Cezary, 1993).

The issue surrounding dividend payments in corporate organizations has been a subject of debate of several decades. While the likes of Modigliani and Miller maintain in their Dividend Irrelevance theory (1961) that whether a company pays dividend or not does not affect the value of the company, authors such as Lintner used the Bird-In-Hand argument (1956) to show that decisions about dividend payment are very much important to shareholders who would rather prefer to have dividend today (a bird in hand) to an uncertain capital gain expected in future from the ploughing back of retained earnings into future business opportunities.

Dividend policyis a standard that guides a company on how much to pay to shareholders as dividends so as to continuously maximize their wealth (Uwuigbe, 2013). It guides firms in determining the size and pattern of cash distribution to shareholders over time (Baker, Singleton & Veit, 2011). For the agency theorists, payment of dividend reduces agency costs by the distribution of free cash flow that otherwise would have been spent by corporate managers on unprofitable projects. Core, Holthausen & Larcker (1999) suggest that corporations with stronger dividend payout policy have lesser principal–agent problems since they pay more to shareholders, thus reducing the extent of friction. In addition, the firms with lesser agency conflicts are more likely to perform efficiently. Dividend policy has continued to retain the interest of management, creditors and academics and the importance attached to this corporate decision arises from its interconnection with other corporate decisions, such as investing and financing, and its impact on shareholders‟ wealth, and on the whole economy (Jabbouri, 2016).

Several debates on dividend abound in literature and attempts to resolve the divergent issues often seems to create more divergence. This probably was the reason why Black (1976) in his Dividend Puzzle stated that “The more we look at dividends, the more it looks like a puzzle, where the pieces just do not fit”. Several factors affect decisions on dividend. Different dividend payout policies are used by companies due to varying regulations, tax policies and nature of the capital markets in various countries (Zameer, Rasool, Iqbal & Arshad 2013).The various unresolved questions include; does dividend decision affect the value of the firm and the company’s overall cost of capital? What are the factors that determine the dividend policy of a company and their relative weights and importance? Do companies pay dividends on an ad hoc decision basis or is dividend policy just a piece among the integrated network of financial decisions that affect the company as a whole and over time? This study examined the factors that affect the dividend policy of a company with special focus on the listed companies in the Nigerian Stock Exchange.

Statement of Problem

Numerous empirical studies in both developing and developed economies have tried to resolve the controversy of dividend payment, but it has remained unresolved (Azhagaiah & Priya, 2008; Eriki & Okafor, 2002). In Nigeria there exists limited studies on the determinants of a firm’s dividend policy. Most of the studies have concentrated on the dividend policy and firm value or performance only.Limited studies have been conducted on the determinants of dividend policy in Nigeria such as Odesa & Ezekie, (2015). This study sought toexpand the frontiers of knowledge by examining the firm specific factors that affect dividend policy in Nigeria.

Objectives of the Study

The general objective of the study is to examine the determinants of dividend policy in Nigeria. More specifically, we examine the relationship between dividend policy and the following explanatory variables: earnings per share, free cash flow per share, leverage, return on equity, return on assets, net profit margin and price earnings ratio. The outcome of the study will guide investors in knowing what indicators to watch out for before selecting stocks that are expected to maintain high dividend payout ratio over time. Furthermore, managers will see how their dividend policies are related to other activities of the company and they ultimately affect the company.

Hypothesis of the Study

The hypothesis of the study are stated in Null Form

H01: There is no significant relationship betweenearnings per share and dividend policy of firms

H02: There is no significant relationship betweenfree cash flow and dividend policy of firms

H03: There is no significant relationship betweenleverage and dividend policy of firms

H04: There is no significant relationship betweenreturn on equity and dividend policy of firms

H05: There is no significant relationship betweenreturn on assets and dividend policy of firms

H06: There is no significant relationship betweennet profit margin and dividend policy of firms

H07: There is no significant relationship betweenprice earnings ratio and dividend policy of firms

Literature Review

Theoretical Review

As noted in the introductory section, there has been several theories that focus on dividend policy of a firm. These date back to the 1950s with the work of authors such as Lintner (1956); Gordon (1959). But the Dividend Irrelevance theory of Modigliani and Miller in 1961 was what spurred serious academic interests on the subject. Since then, there have been several theories that seek to explain the dividend decisions from different perspectives. Due to the large number and ever increasing nature of the debate on dividend policy, it will be practically impossible to give a full review of all the debates on the subject (Lease et al., 2000). According to Al-Malkawi, Rafferty & Pillai (2010), three main contradictory theories of dividends can be identified. Some argue that increasing dividend payments increases a firm’s value. Another view claims that high dividend payouts have the opposite effect on a firm’s value; that is, it reduces firm value. The third theoretical approach asserts that dividends should be irrelevant and all effort spent on the dividend decision is wasted. Some of these theories are explained below.

The Relevance Theory of Dividend

This theory can be traced to the work of two separate authors; Gordon (1959); Lintner (1956). Lintnerconducted series of twenty eight interviews involving managers of American companies regarding dividend distributions and established that decisions on dividend policy were based mainly on payout. The author also concluded that, in a scarce environment, the preferred companies use borrowed funds rather than decreasing the distribution of dividends by checking certain stability in the dividend policy over the various economic exercises. (Almeida, Pereira & Tavares 2015).

A Bird-In-hand Argument

The foundation for this theory was laid by the works of Gordon (1959); Walter (1963). They presented a model of stock evaluation which assumed that dividend grows at a constant rate under a premise of a direct relationship between the dividend policy and the market value of a company. They were of the view that investors behave rationally and generally risk averse. Consequently, in a world full of uncertainty and unavailability of information, investors would prefer to have cash dividend now which is more certain than an expectation of future capital gain arising from the reinvestment of retained earnings. Therefore, companies that pay dividend have a lower cost of equity than those that do not pay dividend.

Dividend Irrelevance Theory – Modigliani and Miller

Franco Modigliani and Milton Miller (1961) came up with their ground breaking Dividend Irrelevance theory. According to M&M, if we assume perfect capital market (no taxes, no transaction costs and information is available to all the investors at the same time), then dividend policy does not matter and will have no impact on the cost of capital and the value of the firm. They supported their arguments with the following points:

• Dividend decision is independent of investment and financing decisions of the company

• Investors can generate home-made dividends. If investors want income, they can sell shares to create dividends

• Dividend can be used to purchase shares if investors do not need income

According to M&M, investors are unconcerned about dividend because the value of the firm is affected by revenues produced by investment policy of the organization and not by how these revenues are disbursed to the stakeholders. (Murtaza, Igbal, Rasheed & Basit, 2018). However, the M&M Dividend Irrelevance hypothesis has nearly as many critics as it has supporters. Part of the issues raised by the critics are the unrealistic assumptions on which the theory was based such as world of no taxes and perfect market situation.

The Residual Theory of Dividend

This is based on the belief that the distribution of dividend will proceed only after an optimal investment decision by the company. The proponents of this theory believe that managers will first commit available cash flow to investment opportunities with positive net present value. As long as such opportunities exist, there will be no dividend payment. It is only after such opportunities are exhausted that investors get dividend from the residual cash flow. In some instances where the company’s cash flow is insufficient to meet all available investment opportunities, the investors will not get any dividend. Dividend payment is seen as a waste and dividend policy is seen as a residual. The return is influenced by the investment policy and not by the dividend policy

Signaling Theory of Dividend

The theory is based on information asymmetry which is characterized by one of the party’s privileged access to information, i.e. managers are holders of more information on the future of the company than the market (Miller & Rock, 1985). Since managers are assumed to have superior information about the company, investors see payment of dividend (or otherwise) as a signal of the state of things in the company. Increase in dividend payout is seen as an indication of future profitability growth even if current profit is not as attractive. Similarly, a drop in dividend payout is taken to be a signal of a bleak future irrespective of the size of profit published this year. For this reason, many companies aim to be consistent with dividend payout over time, increasing dividend payout only when they are certain that the new dividend level will be sustained over time since the impact of a drop in dividend could spell danger for the share price of the company due to possible negative signal such a drop might convey to the shareholders.

Agency Theory of Dividend

This theory was developed by Jensen & Meckling (1976). It considers the company as a set of contracts where the shareholders are entitled to the company’s assets and cash flow. Shareholders and managers try to act in defense of their own interests where each try to maximize self-interests. These maximizations undertaken under different perspectives create differences and conflicts between the two parties. These conflicts tend to be eliminated and the process of elimination generates costs known as agency costs. Consequently, the payment of dividend has a positive effect on the market value of a firm. According to De Angelo & Skinner (2004), managers pay dividend to reduce agency cost.

Empirical Reviews

Uwuigbe, Jafaru & Ajayi (2012) conducted a study to find the impact of financial performance on dividend policy in Nigeria. They checked the relationship between ownership structure, dividend policy and size of the firms. Regression analysis was used to find out the results of this study. There were fifty companies taken to the study for the period 2006 to 2010. They established a positive significant relationship between performance of the firms and dividend policy.

Alam & Hossain (2012) examined the dividend policy of UK companies listed in London Stock Exchange. The study reveals that leverage, profitability and market capitalization influence the dividend rate positively, whereas liquidity and growth have negative impact on dividend payout ratio. With respect to Bangladeshi companies, liquidity, leverage, profitability and market capitalization influence the dividend rate negatively, while growth affects it positively.

Kumar & Waheed (2015) examine the determinants of dividend policy in the United Arab Emirate. The sample covered 120 companies for the 3-year period, 2011-2013. Using partial least squares structural equation modeling to test the hypothesis, results reveal support for residual theory and pecking order argument of dividends. Specifically, growth and liquidity are important determinants of dividend policy of the sample firms during the period of study.

Almelda, Perelra & Taveres (2015) who established that lagged DPS (along with other variables) had a positive and significant influence on the dividend policy of quoted companies in Portugal.

King’wara, (2015) carried out a study on determinants of dividend payout ratios in Kenya. He examined the effect of six factors including earnings of the firm, ratio of retained earnings to total assets, firm size, growth opportunities, leverage and market value, shown to influence dividend policies in companies operating in developed countries on companies operating in Kenya, a developing economy using a Tobin Regression model. It was observed that dividend payout ratio is impacted negatively by the growth rate, debt ratios and firm size and positively by earnings, market-to-book ratio and retained earnings to total assets ratio.

Akani & Yellowe (2016) conducted a study whose objective was to examine the impact of dividend policy on the profitability of selected quoted manufacturing firms in Nigeria from 1981 to 2014. Returns on Investment and net profit margin were the proxies for profitability, while dividend payout ratio, Retention Ratio (RR), Dividend Yield (DY) and EPS were proxies for dividend policy and the outcome of their findings revealed that all the proxies for profitability are positively related to dividend policy except dividend yield.

Peter & Lyndon (2016) investigated the relationship between dividend payout policy and firm performance in Nigeria, using a sample of some listed firms in the NSE for the period 2002–2012. The result showed a positive and significant relationship between dividend payout policy and Profit After Tax (PAT) while EPS had a negative influence on dividend payout policy of firms in Nigeria for the period.

Hakeem & Bamidele (2016) studied the effect of liquidity on firm performance and dividend payout of 50 listed manufacturing companies in Nigeria. Performance was measured by return on asset, return on equity, economic value added, and Tobin’s Q while dividend policy was represented with dividend payout. The study concluded that firm performance has a significant impact on the dividend payout of listed firms in Nigeria. That is, an increase in the financial wellbeing of a firm tends to positively affect the dividend payout level of firms.

In their study of 30 companies listed in the stock exchange of Mauritius, Soondier, Maunick & Sewark (2016) confirmed a negative relationship between dividend payout and retained earnings. However, they could not establish any relationship between dividend payout and cash and debt-to-equity ratio.

Gwaya & Mwasa (2016) in their study sought to examine how dividend policies of selected public limited companies in Kenya affect financial performance during the period 2002–2011. They took a sample of 29 companies listed on Nairobi Stock exchange. The findings of their research established that dividend policy of firms has an effect on its subsequent financial performance.

An assessment of dividend policy of companies listed in the Indian capital market was done by Brahmaiah, Srinivasan & Sangeeth (2018). They sampled 95 quoted companies for the period 2012/3 to 2017/8. Using the Arellano & Bond dynamic panel data model, they established that profitability, liquidity, leverage, risk, firm size and inflation are major determinates of a firm’s dividend policy. Among the variables that influence dividend significantly, profitability, liquidity, firm size and inflation show negative correlation. No significant relationship was established between dividend payout and lagged dividend, investment opportunity, taxation and yield curve. The findings on the influence of lagged dividend seems to be inconsistent with that of Anthonio, Jaara, Alashhab & Jaara (2018) studied non-financial companies in Jordan covering a period between 2005 and 2016. Results show that company size has a significant positive relationship with dividend policy. This implies that large and mature companies were paying more and consistent dividend in view of possibly less growth opportunities where retained earnings could be ploughed into. They equally established that lagged dividend has a significant positive relationship with dividend payout; an indication that firms seek to achieve consistency in dividend payment and not merely a reflection of the level of this year’s profit. Expectedly, they confirmed a negative correlation between risk and dividend.

Salman (2019) used larger sample size of 80 listed companies to study the determinants of dividend policy in Pakistan. The focus was on the impact of shareholder influence and dividend signaling. Using Person correlation and multiple regression analysis, they showed that shareholder preferences and dividend signaling have a significant positive correlation with dividend policy of companies listed in Pakistan.

A greater proportion of the empirical work on determinants of dividend policy seem to be establishing positive and significant relationship between dividend payout and company fundamentals such as EPS, lagged dividend, return variables etc. This is an indication that in most of the studies reviewed, dividend policy decisions are seen more as part of an integrated financial management framework than a mere ad hoc decision based only on shareholder’s expectations. This is consistent with the findings of Bostanci, Kadioglu&Sayilgan (2018) that studied dividend policy in the Turkish capital market. Using dynamic panel data regression analysis, they found a statistically positive correlation between dividend payout and lagged dividend, ROE, market-to-book value ratio, liquidity and firm size. It is worthy of note that their proxy for dividend policy include combined cash and share dividend which is not a common feature of the rest of the studies analyzed.

Methodology

This study adopted a longitudinal research design since data were collected over a period of ten years, with focus on twenty (20) quoted manufacturing firms in Nigeria. The study covered the period from 2008 to 2017. Convenience sampling technique was adopted since data was collected from only manufacturing firms (Industry and consumer goods sector) that have consistently published their annual reports with focus on dividend paying companies.

| Table 1 Explanation of Key Variables |

|||

|---|---|---|---|

| S/N | Variables | Measure | Apriori Expectation |

| 1 | Dividend Per Share (DPS) | This is our chosen proxy for dividend policy and measured as total gross dividend paid divided by the number of shares fully paid up | Dependent Variable |

| 2 | Earnings Per Share (EPS) | Net income after tax divided by the number of issued and paid up share capital of the company | Positive (since higher income is expected to give rise to higher dividend |

| 3 | Return on Assets (ROA) | This relates the net income of the company to the total assets invested (profit after tax divided by the total net assets of the company stated in %) | Positive |

| 4 | Return on Equity (ROE) | This measures the ratio between net income after tax and preference dividend and the total equity capital (inclusive of retained earnings) stated in % | Positive |

| 5 | Leverage (LEV) | This shows the proportion of total assets that are financed with debts and calculated as total debts divided by total net assets | Negative (the higher the leverage, the more fixed payment commitment and the less cash available for dividend |

| 6 | Net Profit Margin (NPM) | This was calculated as net income divided by gross sales revenue | Positive |

| 7 | Price/Earnings (PER) ratio | This is calculated as price per share divided by earnings per share | Positive. |

| 8 | Free Cash flow per share (FCF/S) | This was calculated as free cash flow divided by the total number of issued and fully paid share capital | Positive. The higher the free cash available to the company, the more convenient it will be for them to pay cash dividend. |

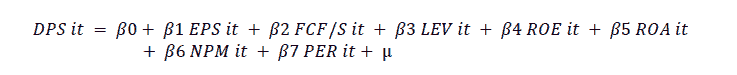

The functional model of this study is therefore stated below;

DPS = F (EPS, FCF/S, LEV, ROE, ROA, NPM ,PER,)

Where;

EPS: Earnings Per Share firm i at time t,

FCF/S: Free Cash flow per share for firm i at time t,

LEV: Leverage firm i at time t,

ROE: Return on Equity firm i at time t

ROA: Return on assets firm i at time t,

NPM: Net Profit Marginfirm i at time t

PER: Price Earnings Ratio firm i at time t,

Econometrics Model

Where β0, is the intercept and β1, β2, β3, β4, β5, β6 and β7 = Slope of the regression measuring the amount of the change in stock returns with a unit change in the independentvariable andμ =Error term.

Method of Analysis

This study made use of panel regression techniques. The panel regression deals with two-dimensional (cross sectional /time series) for the period covering 2008-2017. The panel regression also considered the heterogeneity in the manufacturing firms hence reduced the problem of inadequacy of data observation. The study made use of the fixed effect and random effect method of estimating panel regression model while the Hausman test was used to select between the two methods.

Presentation and Discussion of Result

| Table 2 Descriptive Statistics |

||||||||

|---|---|---|---|---|---|---|---|---|

| DPS | EPS | FCF/S | NPM | PER | ROA | ROE | LEV | |

| Mean | 1.47 | 2.36 | 0.07 | 0.06 | 20.86 | 0.07 | 2.96 | 0.60 |

| Median | 0.40 | 0.96 | 0.09 | 0.06 | 11.97 | 0.06 | 0.16 | 0.59 |

| Max | 32.9 | 42.55 | 0.94 | 0.28 | 612.67 | 0.53 | 697.01 | 1.13 |

| Min | 0.00 | -16.82 | -0.88 | -0.52 | -73.00 | -0.70 | -9.89 | 0.12 |

| Std. Dev. | 3.70 | 5.27 | 0.20 | 0.10 | 53.34 | 0.11 | 43.25 | 0.17 |

| Skewness | 5.09 | 3.80 | -1.01 | -1.41 | 6.72 | -0.48 | 15.97 | 0.58 |

| Kurtosis | 33.9 | 24.18 | 7.65 | 7.77 | 65.47 | 11.43 | 256.85 | 3.43 |

The descriptive statistics shows that there is a wide range of variation in the DPS of the sampled companies with maximum value of 32.9 and minimum value of 0. The mean value of DPS is 1.47. The standard deviation of 3.7 confirms the variability. The same wide volatility is noticed in EPS with max and min values of 42.55 and -16.82 respectively. The widest volatility is seen in P/E ratio with max and min values of 612.67 and -73 respectively. From the observed distribution, it shows that almost all the variables were positively skewed whereas return on assets and net profit margin are negatively skewed. The coefficient of kurtosis for all variables wasgreater than 3, showing a peaked-curve (leptokurtic) distribution which is positive kurtosis that is greater than 3. This indicate a normal distribution among the variable.

| Table 3 Fixed Effect Or Lsdv Model |

||||

|---|---|---|---|---|

| Variable | Coefficient | Standard Errors | T-statistics | Prob |

| EPS | 0.14561 | 0.04487 | 3.24518 | 0.0014 |

| FCF/S | 0.99578 | 0.64634 | 1.54065 | 0.1248 |

| LEV | -0.5339 | 1.11149 | -0.4804 | 0.6314 |

| ROE | 0.00085 | 0.00284 | 0.29794 | 0.766 |

| ROA | -2.0323 | 3.26454 | -0.6225 | 0.5342 |

| NPM | -0.3846 | 3.53268 | -0.1089 | 0.9134 |

| PER | 0.00265 | 0.00228 | 1.16406 | 0.2456 |

| R-squares | 0.80279 | |||

| Adj R-square | 0.77299 | |||

| Durbin Watson | 1.56156 | |||

| F-statistics | 26.9392 | |||

| Table 4 Random Effect Model |

||||

|---|---|---|---|---|

| Variable | Coefficient | Standard Errors | T-statistics | Prob |

| EPS | 0.545881 | 0.024098 | 22.65250 | 0.0000 |

| FCF/S | 0.712524 | 0.590887 | 1.205856 | 0.2290 |

| LEV | 1.646463 | 0.763032 | 2.157790 | 0.0319 |

| ROE | -0.001118 | 0.002708 | -0.412947 | 0.6800 |

| ROA | 5.839364 | 2.309734 | 2.528154 | 0.0121 |

| NPM | -6.978424 | 2.711497 | -2.573642 | 0.0106 |

| PER | 0.002933 | 0.002161 | 1.357423 | 0.1759 |

| R-squares | 0.627716 | |||

| Adj R-square | 0.617375 | |||

| Durbin Watson | 1.844099 | |||

| F-statistics | 60.70033 | |||

| Table 5 Hausman Test |

|||

|---|---|---|---|

| Correlated Random Effects - Hausman Test | |||

| Equation: Untitled | |||

| Test cross-section random effects | |||

| Chi-Sq. Statistic | Chi-Sq. d.f. | Prob. | |

| Test Summary | |||

| Cross-section random | 137.111151 | 7 | 0.0000 |

A correlated random effect-hausman test was done to choose which of the estimated models should be accepted under a null hypothesis, and an alternative hypothesis. The null hypothesis specifies that Random Effect model is suitable, alternative hypothesis specifies that fixed effect model is suitable. In this case the fixed effect model is suitable because the value of the probability is less than 5% showing that the errors are not correlated

| Table 6 Correlation Matrix |

|||||||

|---|---|---|---|---|---|---|---|

| EPS | FCF/S | NPM | PER | ROA | ROE | LEV | |

| EPS | 1 | 0.1640 | 0.3742 | 0.0285 | 0.3789 | -0.0356 | -0.0285 |

| FCF/S | 0.1640 | 1 | 0.2585 | -0.2213 | 0.2936 | -0.2285 | -0.0830 |

| NPM | 0.3742 | 0.2585 | 1 | 0.0478 | 0.7041 | -0.2302 | -0.4797 |

| PER | 0.0285 | -0.2213 | 0.0478 | 1 | 0.0130 | -0.0204 | 0.0756 |

| ROA | 0.3789 | 0.2936 | 0.7041 | 0.0130 | 1 | -0.1557 | -0.3900 |

| _ROE | -0.0356 | -0.2285 | -0.2302 | -0.0204 | -0.1557 | 1 | 0.1464 |

| LEV | -0.0285 | -0.0830 | -0.4797 | 0.0756 | -0.3900 | 0.1464 | 1 |

The correlation matrix as shown and presented in Table 4 depicts the relationship that exists between the variables that were selected for this study. The most used correlation coefficient is Pearson’s correlation coefficient, which was employed in this study to examine the presence or absence of multicollinearity among the variables. It makes comparison of two ratio variables, and most of the time, the major diagonal of the correlation matrix table is a set of ones, because the correlation between a variable and itself is usually 1. This implies that there is no evidence of multicollinearity among the independent variables in the regression model.

Hypothesis Testing

| Table 7 Results of Hypothesis Testing |

||||

|---|---|---|---|---|

| Variable | Coefficient | Probability | Decision | Interpretation |

| EPS | 0.145613 | 0.0014 | Reject null hypothesis | Positive, Significant |

| FCF/S | 0.995776 | 0.1248 | Retain null hypothesis | Positive, Insignificant |

| LEV | -0.533945 | 0.6314 | Retain null hypothesis | Negative, Insignificant |

| ROE | 0.000845 | 0.7660 | Retain null hypothesis | Positive, Insignificant |

| ROA | -2.032275 | 0.5342 | Retain null hypothesis | Negative, Insignificant |

| NPM | --0.38460 | 0.9134 | Retain null hypothesis | Negative, Insignificant |

| PER | 0.002653 | 0.2456 | Retain null hypothesis | Positive, Insignificant |

Conclusion

This article focused on the study of firm-specific factors that influence dividend decisions companies quoted on the Nigerian Stock Exchange. Twenty companies were sampled for a period of ten (10) years from 2008 to 2017. Econometrics multiple regression method of analysis was used to analyze the data and establish the relationship.

From the results, out of a total of seven independent variables which include, EPS, FCF/S, Leverage, ROA, ROE, Net Profit Margin and P/E ratio, only EPS was found to have a positive and significant impact on dividend policy of the analyzed firms. This result conforms with the outcome of most empirical findings such as King’wara, (2015); Brahmaiah, Srinivasan & Sangeeth (2018), It also shows that earnings per share is a better proxy for purpose of dividend analysis as it shows the impact of incremental absolute net income expressed as a percentage of a more stable denominator (unit of shares) as opposed to other measures of profitability and return measures such as net profit margin, return on assets, etc.

The above analysis reflected in the number of insignificant relationship which included all other profitability and return measures. The direction of relationship of the variables are in line with literature and apriori expectations except for ROA and net profit margin. It is expected that return on assets as well as higher net profit margin should exert positive impact on the dividend payout of a company. However, the results show a negative relationship for these variables. This may have been as a result of other exogenous factors not connected with the firm-specific factors.

The negative relationship between leverage and dividend policy is expected. The more heavily geared a company is, the more, its fixed payment obligations. The heavy cash drain for debt services takes a tool on the free cash available for payment of dividends. However the findings did not indicate any significant relationship between this variable and dividend policy in Nigeria.

Recommendations

In line with the results of this research, we hereby make the following recommendations:

1. Earnings per share has been established to be a major determinant of dividend policy in Nigeria. Investors who which to enjoy stable income through stable and consistently growing dividend should focus on companies with sound historical EPS as well as those with predictable growth in earnings per share.

2. Companies should be conscious of how various forms of share dilution will have a dilutive impact on earnings per share and consequently on dividend per share. A heavily diluted EPS may have an indirect impact on the market price of the shares due to shareholders’ expectations.

3. Dividend-focused investors should be mindful of companies that are heavily geared. Such high level of indebtedness especially when the exposure is on regular periodic repayment of fixed sums is likely to impair the company’s ability to pay good dividend either now or in the near future.

4. Investors should equally pay attention to the cash flow position of their potential investment targets as this is likely to affect their future dividend paying ability

Acknowledgement

The Authors appreciate Covenant University Centre for Research and Innovation (CUCRID) for sponsoring the publication of this paper.

References

Akani, H., &Yellowe, S. (2016). Dividend policy and the profitability of selected quoted manufacturing firms in Nigeria. Journal of Finance and Accounting, 4(4), 212-224.

Crossref, GoogleScholar, Indexed at

Almeida, L., Perelra, E., & Taveres, F. (2015). Determinants of dividend policy: Evidence from Portugal. RevistaBrasileira de Gestão e Negócios, 17(54), 701-719.

Crossref, GoogleScholar, Indexed at

Alam, M & Hossain, M. (2012). Dividend policy: a comparative study of UK and Bangladesh based companies. IOSR Journal of Business and Management, 1(1), 57- 67.

Al-Malkawi, H., Rafferty, M., & Pillai, R. (2010). Dividend policy: A review of theories and empirical evidence. International Bulletin of Business Administration: 9, 171-200.

Azhagaiah, R., & Priya, S. (2008). The impact of dividend policy on shareholders’ wealth. International Research Journal of Finance and Economics, 20, 180-187

Baker, H., Singleton, J., &Veit, E. (2011). Survey Research in Corporate Finance. Oxford University Press.

Black, F. (1976). The Dividend Puzzle. The Journal of Portfolio Management, 2, 5–8.

Crossref, GoogleScholar, Indexed at

Bostanci, F., Kadioglu, E., & Sayilgan, G. (2018). Determinants of dividend payout decisions: a dynamic panel data analysis of the Turkish stock market. International Journal of Financial Studies, 6(93), 1-16.

Crossref, GoogleScholar, Indexed at

Brahmaiah, B.,Srinivasan P &Sangeetha, R. (2018). Determinants of corporate dividend policy in India: a dynamic panel data analysis. Academy of Accounting and Financial Journal: 22(2), 1-13.

Cezary, M. (1993). The determinants of dividend policy: Research paper No 259. University of Nevarra.

Core, J., Holthausen, R., & Larcker, D. (1999). Corporate governance, chief executive officer compensation, and firm performance.Journal of Financial Economics, 51, 371-406.

DeAngelo, H., DeAngelo, L., & Skinner, D. (2004). Are dividends disappearing? Dividend concentration and the consolidation of earnings. Journal of Financial Economics, 72(3), 425-456.

Eriki, O., & Okafor, C. (2002), Dividend and stock prices on the Nairobi stock exchange: The Nairobi perspective. European Journal of Finance, 12(9), 448-497.

Gordon, M. (1959). Dividends, Earnings, and Stock Prices. The Review of Economics and Statistics, 41, 99–105.

Crossref, GoogleScholar, Indexed at

Gwaya, D., & Mwasa, D. (2016). Effect of dividend payout on financial performance among public limited companies in Kenya. International Journal of Social Sciences and Information Technology, 2, 642-651.

Hakeem, S., &Bambale, A. (2016). Mediating effect of liquidity on firm performance and dividend payout of listed manufacturing companies in Nigeria. Journal of Economic Development,

Jabbouri, I. (2016). Determinants of corporate dividend policy in emerging markets: Evidence from MENA Stock Markets. Research in International Business and Finance, 37(2016), 283 - 289.

Crossref, GoogleScholar, Indexed at

Jensen, M., & Meckling, W. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure.Journal of financial economics, 3(4), 305-360.

Crossref, GoogleScholar, Indexed at

Jaara, B., Alashhab, H., & Jaara, O. (2018). The determinants of dividend policy for non-financial companies in Jordan. International Journal of Economics and Financial Issues; 8(2), 198-209.

King'wara, R. (2015). Determinants of dividend payout ratios in Kenya. Research Journal of Finance and Accounting, 6(1), 6.

Kumar, B., & Waheed, K. (2015). Determinants of dividend policy: evidence from GCC market. Accounting and Finance Research, 4(1), 17 – 29

. Crossref, GoogleScholar, Indexed at

Kumar, B.&Waheed, K.(2015). Determinants of dividend policy: evidence from GCC market.Accounting and Finance Research, 4(1), 17 – 29.

Crossref, GoogleScholar, Indexed at

Lease, R., Kose, J., Avner, K., Uri, L., & Oded H. (2000). Dividend Policy: Its Impact on Firm Value. (Harvard Business School Press, Boston,Massachusttes).

Lintner, J. (1956). Distribution of Incomes of Corporations among Dividends, Retained Earnings and Taxes. American Economic Review, 46, 97–113.,

Miller, M. & Modigliani, F. (1961). Dividend policy, growth, and the valuation of shares. Journal of Business 34, 411–433.

Crossref, GoogleScholar, Indexed at

Miller, M. & Rock, K. (1985). Dividend policy under asymmetric information. The Journal of the American Finance Association. XL(4), 1031-1051.

Crossref, GoogleScholar, Indexed at

Murtaza, M., Igbal, M., Ullah, Z., Rasheed, H., 7 Basit, A. (2018). An empirical review of dividend policy theories. Journal of Advanced Research in Business and Management Studies, 11(1), 62-76.

Odesa, J., & Ekezie, A. (2015). Determinants of dividend policy in quoted companies in Nigeria. Communication Panorama - African and Global Perspectives,1(1), Sept – Oct.

Peter, E., & Lyndon, M. (2016). Dividend pay-out policy and firm performance: Evidence from Nigeria. Social Science Learning Education Journal, 1(1), 6-9.

Salman, A. (2019). Determinants of dividend policy: Investment Management and Financial Innovations, 16(1), 167-177.

Soondur, S., Maunick, D., & Sewak, S. (2016). Determinants of the dividend policy of companies listed on the stock exchange of Mauritius. Proceedings of the Fifth Asia-Pacific Conference on Global Business, Economics, Finance and Social Sciences (AP16Mauritius Conference) ISBN - 978-1-943579-38-9 Ebene-Mauritius, 21-23 January, 2016. Paper ID: M619.

Uwuigbe, O. (2013). Determinants of dividend policy: A Study of Selected Listed Firms in Nigeria. Manager, 17, 107 – 119.

Uwuigbe, U., Jafaru, J., & Ajayi, A. (2012). Dividend policy and firm performance: A study of listed firms in Nigeria. Accounting and Management Information Systems, 11(3), 442-454.

Walter, J. (1963). Dividend Policy: It’s Influence on the value of the enterprise. The Journal of Finance, 18, 280–91.

Zameer, H., Rasool, S., Iqbal, S., &Arshad, U. (2013). Determinants of dividend policy: A case of banking sector in Pakistan. Journal of Scientific Research, 18(3), 410-424.

Received: 22-Apr-2022, Manuscript No. JLERI-21-3504; Editor assigned: 25- Apr -2022, PreQC No. JLERI-21-3504 (PQ); Reviewed: 09- May - 2022, QC No. JLERI-21-3504; Revised: 14-May-2022, Manuscript No. JLERI-21-3504 (R); Published: 23-May-2022.