Research Article: 2021 Vol: 24 Issue: 1S

Determinants of Non-Compliance with Property Tax Payment in the District of San Miguel, Province of San Roman - Peru, 2020

Quispe Mamani, J.C, Universidad Nacional del Altiplano

Roque Guizada, C. E, Universidad Nacional Amazónica de Madre de Dios

Barra Quispe, D.E, Universidad Nacional del Altiplano

Mamani Flores, A, Universidad Nacional del Altiplan

Barra Quispe, T.L, Universidad Nacional del Altiplano

Velázquez Giersch, L, Universidad Nacional Amazónica de Madre de Dios

Coacalla Vargas, E. Universidad Nacional del Altiplano

Keywords

Taxes, Collection, Factors, Property Tax, Culture, Awareness

Abstract

The objective of the research was to determine the factors that determine the non-payment of the property tax in the district of San Miguel, for which the descriptive and correlational methodology was applied, through the LOGIT- PROBIT type models, applying a sample of 375 respondents. It was possible to determine that the variables of gender, occupation, payment with amnesty, the means of information, knowledge of the sanctions, considering knowledge of the rights and obligations and with the condition that the municipality reports positively determined the payment of property tax at 4.33%, 4.75%, 23.91%, 4.53%, 10.01%, 4.08% and 12.15% respectively; while age, marital status, level of education, income, decrease in taxes, service to the municipality, system improvements and knowledge about taxes negatively determine the payment of property tax in 3.97 %, 4.75%, 1.61%, 0.81%, 0.74%, 2.28%, 0.82% and 2.09%.

Introduction

The property tax as part of the tax revenue components of a local government plays a very important role in the contribution to local development, since its contribution is earmarked towards the efficient allocation of resources in activities and actions programmed by the local municipality in the corresponding fiscal year (Bagus et al., 2011; Hassan, 1998). However, this contribution in reality is contingent on the behavior of the population, according to its typological characteristics of the family and its members. It is widely known that the property tax (real estate tax) is considered as a tax that is paid by homeowners and private property (Allen & Dare, 2002; Awasthi et al., 2020; Bandara & Hettiaratchi, 2010; De et al., 2019; Unda & Moreno, 2015).

At present globally there is the problem of poor or low collection of these taxes, and it is most evident in local governments in Latin America; where it is found to be a phenomenon that affects the normal development mainly of small local municipalities (Allen & Dare, 2002; Cantú, 2016; Galgalo & Shibia, 2015; Unda & Moreno, 2015).

Perhaps this is due to social and economic factors involving the population living in the local territorial area, such as their economic income from families, the number of members therein, the characteristics of the dwelling, the type of activity to which it is engaged, the level of education, deficiencies in the conditions for payment in the area of tax collection of local governments. among others (Bustamante Quintana, 2001; Eom, 2008; Lagunas Puls, 2014; Lieberman, 2001; Pico et al., 2011; Ramírez et al., 2017).

In addition, according to existing information from the different research carried out at the world level, they emphasize that localities and local governments that are part of regional or provincial areas are part of the areas that show greater inequality, mainly in Latin America, but despite the existence of this limitation, they have been able to face their limitations and thus contribute to the reduction of the existing poverty and poverty gap and consequently improve their family economies (Henriques, 2013; Lustig, 2015; Lustig et al., 2012; Ramírez et al., 2017). That is why today the different types of tax collection system administered by local governments in Latin America are regressive, since they do not guarantee an efficiency in their collection, let alone allow for a transformation towards reducing existing inequalities (Arias, 2019; Hassan, 1998; Ramos et al., 2005).

In the specific case of municipalities in Peru, they have a responsibility to administer and collect taxes, however, district growth has a very serious problem, as it is common in the different municipalities of the country to collect the property tax (Morones, 2010). In addition, in the municipalities there is still the problem of non-compliance with the payment of municipal taxes, since in recent years municipalities worked to reduce the delinquency rates, the establishment of which led the competent authorities to find a way to be able to demand the payment of these taxes from debtor taxpayers; but because of the lack of information, the lack of tax culture and the level of monthly income of each taxpayer are factors that affect the non-payment of the property tax (Castro, 2020; Durán, 2015; Lustig et al., 2012; Reátegui, 2016). In addition, in accordance with the provisions of Peru's Political Constitution, in article 43, Peru is defined as a country with a type of unitary, representative and decentralized government, where considering a territorial extension of 1,285,215.60 km2 and with a population that is above 33 million people (Flores, 2019).

In addition, these taxes apply to the total value of the taxpayer's premises, which are located in each district jurisdiction. Therefore, for the purpose of determining the total value of the premises, tariff values are applied to property and unit values the period it gives taxpayers to pay their taxes is one fiscal year; hence it can be established that the collection of property tax is fundamental to the construction of public works for the benefit of its inhabitants and its breach of tax duty does not allow municipalities to work efficiently so a fiscal deficit occurs, as it is not enough to properly meet the needs (Carhuamaca, 2009; Durán, 2015; Flores, 2019; Mamani et al., 2019).

In accordance with Legislative Decree 776, it is established that the collection and control of municipal taxes is the responsibility of the local municipalities, and they are responsible for collecting and considering them as part of the revenue of the same. The functions of municipalities are to collect through their dependence on rents and collections; its efficient compliance and sustainability of its collection will ensure efficient administration, control and control of taxes, since being a directly collected resource, will allow this municipality to seek administrative and management autonomy, since these will help to finance all public services demanded by families and for attention in actions as part of investments or projects for the collective benefit of its population (Huaman, 2018; Matteucci, 1995; Rojas, 2019; Trejos, 2016).

Analyzing this behavior in the local governments of the Puno Region, it can be clearly evidenced that they are facing critical problems regarding the collection of property tax, given that non-compliance with timely payment by taxpayers is very notorious, in the Municipality Provincial of San Román and specifically in the District Municipality of San Miguel is more complicated, since tax responsibilities are not being assumed by the taxpaying population, and this is given by the low level of tax culture, low tax awareness, Existence of the lack of information on the procedure for the fulfillment of the payments that on average in 2019 in the Provincial Municipality of San Román amounting to 80% of non-compliance and in San Miguel it is below 70%. In this sense, what is stated in the previous points affects the necessary and timely collection of taxes, and needs to be intervened for its improvement as a tax management system, since this directly affects the institutional budget of said municipality (Mamani et al., 2020; Reátegui, 2015).

Therefore the questions to be answered with this investigation were: What are the factors that determine non-payment of property tax in the district of San Miguel?, What is the main factor of the default of property tax in the district of San Miguel? and how is the behavior of the tax culture of the population about the payment of the property taxes of the district of San Miguel.com Therefore, the objective of the investigation was to determine the factors that determine non-payment of the property tax in the district of San Miguel.

Methodology

Methodological Analysis

This research corresponds to non-experimental design, since variables are studied in their real context as without being subject to some modifications (Hernández et al., 2010). The proper use of the maximum likelihood model, specifically by applying a binary model for the estimates of the relationship between the variables that explain the non-compliance with the property tax will ensure that the objective set is achieved. It should be noted that in intermediary cases, the municipal tax administration does not have a well-established catastrophe, in cases of the tax control of property tax is the set of activities carried out by the municipal tax administration aimed at verifying compliance with the obligations related to this tax. Therefore, Logit-Probit models were used to explain phenomena in which the relevance variable is dichotomical or binary, which means that it can only take two values (Mendoza, 2014).

Methodoogical Strategies

In order to demonstrate efficient evidence of non-payment of the property tax of the District Municipality of San Miguel, the following procedures were carried out:

• Bibliographic review of theoretical research by different authors in both the internal and extreme environments.

• Searching for data collection with primary sources by applying study surveys obtained in the district of San Miguel.

• The data obtained has been processed according to the application of the instrument manually using the Excel program, using an array table of the two variables. Stata statistical software was used for analysis and on the measurement scales of both variables.

• Data sheet, through bibliographic data sheets, summary, etc. from documentary sources for both the theoretical framework and for specialized information on non-compliance with property tax payments.

• An analysis was carried out to the Survey, through the application of a questionnaire for the collection of information on the non-compliance with property taxes, according to the conventional sample used.

Population and Sample

Population: The universe or population is made up of the 10,000 heads of family that counts in district.

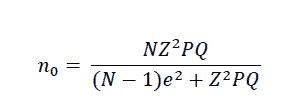

Sample: The optimal sample for this study was found by the simple random sampling method using the sample size for estimating the population or qualitative variable ratio. If we assume the same percentage and use a 95% confidence level, with a sample margin of error of 5%, performing the use of the statistic we can get the following results:

Where

Z(1-α/2)= Normal distribution value according to the desired confidence level.

P= Favorable ratio.

Q= P-1= Unfavorable proportion

e= Sampling margin of error

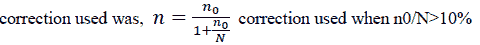

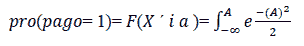

When the n0 /N fraction is more than 10% we use the correction otherwise the optimal sample size was n0. The

Replacing the data in the formula we have:

Then: n0/N= 375.00/10000= 0.0375= 3.75% as n0 is less than 10% we do not use the corrector. Of which, the optimal sample size is 375 heads of household.

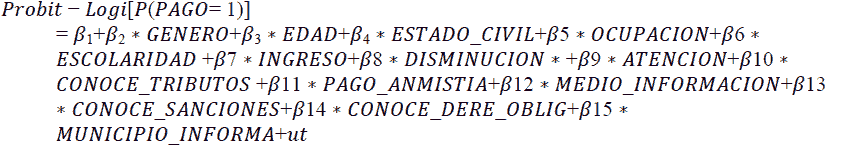

Econometric model analysis

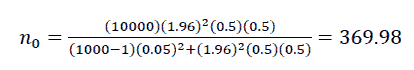

Model Logit, where its representation of the model is as follows (Aldrich & Nelson, 1984; Iglesias, 2012):

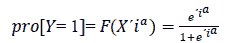

In the case of the Probit Model, its representation is as follows:

Results

Descriptive Analysis of the Determinants of the Property Tax

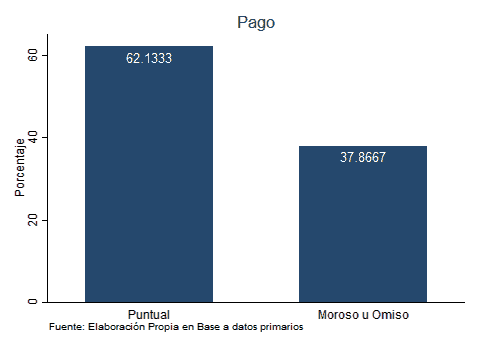

In analyzing the variable payment of property tax, it can be clearly shown that of the total respondents, 62.13% of respondents indicated that they are timely in their payments against property taxes; however, the behavior of delinquency is 37.86% (142 people), in which it is clear that taxpayers are mostly punctual with the compliance of the veneres with the State (Figure 1).

The variables that determine non-payment of property taxes are diverse and one of them is the gender of the taxpayer, where it is observed that of the total number of respondents, 50.1% (188 people) are Women, the same ones who identified themselves as owners of the premises in which they are located and 49% (187 people) of the contributing population are male.

Similarly, the age of the taxpayer is a factor that greatly influences the payments of property taxes, in this sense, of the total number of respondents, 7.2% of the population has between the ages of 25-30 years, (27 people); 21.3% are between the ages of 30-35 (80 people); 17.36% are part of the group between the ages of 35-40 years (64 people); 18.67% are aged between 40-45 years (70 people) and 35.7% of respondents are over 45 years of age (134 people). It is essential to know the civilian status of the taxpayer, to demonstrate the responsibilities that they assume in the development process as a person; so, of the total respondents, 44.2% (167 people) are single, which could contribute to the payment of the tax; 50.5% (151 people) of respondents are married and financially dependent on a source of work for their livelihood and income generation; 4.8% (18 people) of taxpayers are divorced; 5.8% (22 people) are widowers. It can therefore be shown that the responsibilities they assume in starting a family are decisive for the contribution and others; since the formation of families new demands economic expenditures on them.

The population's behaviour with respect to occupation is also important, in this sense, according to the study is characterized by the occupation as being of commercial development and services, of which 16.8% (63 people) of the taxpayers indicated that they are a student; 45.8% (172 people) are traders; 27.2% (102 people) are professionals, 4.5% (17 people) are housewives and only 5.6% (21 people) are from other trades.

In the case of the evolution of the professional characteristics of the population of the District of San Miguel, 7.7% (28 people) of the people surveyed have studies up to full primary school; 28.2% (106 people) of taxpayers have full secondary education; 27.7% (104 people) have incomplete technical higher education; 29.8% (113 people) have incomplete university studies; 6.4% (24 people) have postgraduate studies; why we show the kind of activity they carry out in their daily lives for the generation of economic income.

Analyzing the income from the economic activities of taxpayers in the district of San Miguel shows progress in economic actions to which the population of the study outline explained in the previous paragraph is offered,

one that results in the procreation of economic income that in many cases is formidable. So when analyzing respondent income, 16.53% of the population surveyed indicated that they have incomes less than 500-999 soles, which is the living minimum wage, 28.27% of property owners have an income between 1000 and 1499 soles; 22.13% of owners have an income between 1500 and 1999 soles, 12.53% of owners have an income between 2000 and 2499 soles; 6.4% of homeowners have an income between 2500 and 2999 soles and 14.13% have other owners. In this sense, when considering the reduction of property taxes that in some cases the beneficiaries require, it can be shown that of the total of 375 respondents 92.3% (346 people) of the population agrees with the tax reduction and the other total is with a negative of 7.7% (29 people) (Figure 2).

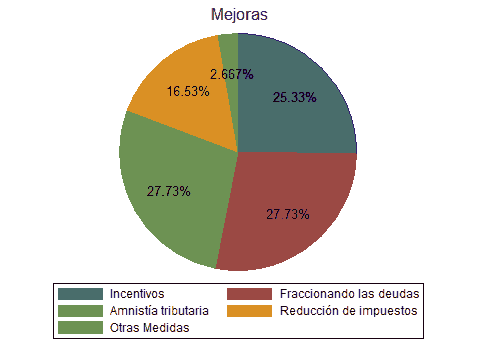

The above is very important and its relationship is linked to the attention provided by the Municipality of San Miguel to taxpayers; so, of the population surveyed, 2.6% (10 people) tell us that the attention is very good; 25.8 (97 people) indicate that the care is good; 53.5% (212 people) indicate that care is regular; 12.2% (46 people) indicate that care is poor and finally 2.67% (10 people) rate care as very bad. Complementing the previous paragraph, it is clear that in the last two years an improvement in one-off payments of property taxes, the same as evidenced through the population surveyed, where of the total number of respondents, 25.33% (95 people) prefer incentives; 27.73% (104 people) prefer to split their debts; 27.73% (104 people) prefer to wait for tax amnesty; 16.53% (62 people) prefer tax cuts; 2.66% (10 people) prefer other people to opt for other measures (Figure 3).

In addition, this behaviour relates to their knowledge of the payment of these taxes, and when consulting on this, 48% of taxpayers are aware of the fulfilment of these obligations and 23.2% of taxpayers are aware of and 28.8% of taxpayers are aware of this; which motivates us to continue to strengthen this important aspect.

Therefore, after knowing the preferences of each taxpayer regarding the tax amnesty, 89.86% (337 people) agree to pay their property taxes when there is a tax amnesty and 10.13% (38 people) do not they agree to pay their taxes in the existence of the tax amnesty. Awareness and dissemination about the payment of property tax is necessary and for that it is possible to use the different means of information, where 33.6% of those surveyed indicate that it can be done through TV, 30.66% indicate that it can be done Through social networks, 21.1% indicated that it can be done through radio transmission, 8.3% indicate that it would be better through posters (Figure 4).

The other very important aspect is the penalties that the taxpayer may receive in breach of the payment of the property tax, so 58.93% of respondents are considered to be aware of such penalties and 41.06% are not aware of the sanctions, which shows that greater dissemination of the sanction is required.

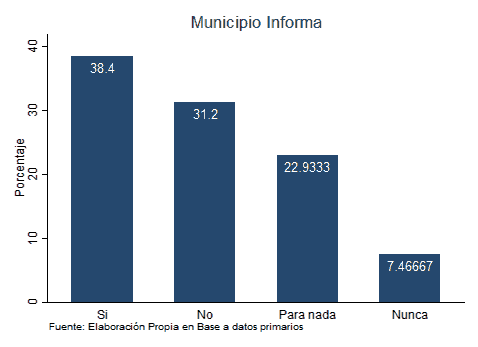

Finally, the importance of the level of information provided by the District Municipality of San Miguel to taxpayers is considered, where 38.4% of those surveyed indicated that they do receive information from the municipality; 31.2% of taxpayers indicated that they do not receive information from the municipality; 22.9% of those surveyed indicated that they have no knowledge and only 7.4% of taxpayers indicated that they never acquired information from the municipality (Figure 5).

Econometric Analysis of Determinants of Default on Property Tax

In this section, estimates were made to analyze the influence of the factors involved in compliance with property tax payment; estimates will be based on analysis of two regression models: the Probit model and the Logit model.

Both models are based on the following general equation:

Model results are based on regression, under 95% confidence level parameters (accepted parameter for social studies) and an allowed alpha error margin of 5%. The result summaries for both models are presented in the following table, where we quickly observe that both the Probit and Logit model have significance values: Prob>chi2 x 0.000, whose value is less than our alpha error margin of 0.05; which is why both models are statistically significant. On the other hand, according to the value of the LR it tells us that in the Probit model, the sets of all factors explain 50.19% of all the behavior of the Payment variable; and in the Logit model it is 50.08%.

| Table 1 Probit and Logit Regressions With All Variables |

||||

|---|---|---|---|---|

| Probit model | Logit model | |||

| Number of observations= 375 | Number of observations= 375 | |||

| LR chi2(15)= 50.19 | LR chi2(15)= 50.08 | |||

| Prob>chi2= 0.0000 Log likelihood= -223.68428 | Prob>chi2= 0.0000 Log likelihood= -223.74035 | |||

| Pseudo R2= 0.1009 | Pseudo R2= 0.1006 | |||

| Variable | Coefficient | Prob | Coefficient | Prob |

| Constant | -1.106436 | 0.0971 | -1.8304 | 0.0992 |

| Gender | 0.114873 | 0.4196 | 0.20773 | 0.3769 |

| Age | -0.10519 | 0.0565 | -0.1765 | 0.0555 |

| Civil status | -0.125969 | 0.0661 | -0.2131 | 0.0555 |

| Occupation | 0.106933 | 0.1329 | 0.1773 | 0.1355 |

| Scholarship | -0.042665 | 0.5318 | -0.072 | 0.5251 |

| Entry | -0.021486 | 0.6257 | -0.0347 | 0.6341 |

| Decrease | -0.019644 | 0.9434 | -0.0418 | 0.9263 |

| Attention | -0.060595 | 0.5275 | -0.0899 | 0.5688 |

| Gets better | -0.021648 | 0.7252 | -0.036 | 0.7279 |

| Know taxes | -0.055466 | 0.5576 | -0.0784 | 0.6134 |

| Amnesty payment | 0.61121 | 0.0105 | 1.00259 | 0.0109 |

| Information media | 0.120376 | 0.0557 | 0.19524 | 0.0619 |

| Know sanctions | 0.263932 | 0.075 | 0.43291 | 0.0755 |

| Know rights and | 0.108084 | 0.3062 | 0.16998 | 0.3278 |

| Obligations | ||||

| Municipality reports | 0.322144 | 0 | 0.52333 | 0 |

| Akaike info criterion | 1.278316 | 1.27862 | ||

| Achwars criterion | 1.445865 | 1.44616 | ||

The value of R2 can be shown in the table above, where of both models they have virtually similar values; therefore, to make a choice of the most suitable model, we look at the information criteria of Akeike and Schwarz, where we must look for the model that has the minimum value in such indicators; so the Probit model shows to have minimum values of Akaike and Schwarz relative to the values of the Logit model.

In Table 1, we can also analyze the significance of each factor (Prob), where the only factors within the margin of error, i.e. less than or equal to our alpha of 0.05, are: "Amnesty Payment", "Municipality Reports"; so these two factors are the significant ones of the whole model. In this sense, given that the model with the best benefits is the Probit model, the following table presents the analysis of marginal effects, which includes all factors.

| Table 2 Marginal Effects With All Variables (Probit Model) |

|||||||

|---|---|---|---|---|---|---|---|

| Marginal effects by Probit model Y= Pr (payment ) (predect)= 0.63154653 | |||||||

| Variable | dy/dx | Standard error | Z | P>|Z| | [ 95% C. I, ] | X | |

| Gender | 0.043313 | 0.05376 | 0.81 | 0.42 | -0.0618 | 0.1485 | 1.4986 |

| Age | -0.03966 | 0.02079 | -1.91 | 0.056 | -0.0804 | 0.001 | 3.544 |

| Civil status | -0.04749 | 0.02587 | -1.84 | 0.066 | -0.0981 | 0.0032 | 1.8586 |

| Occupation | 0.040319 | 0.02682 | 1.5 | 0.133 | -0.0122 | 0.0928 | 2.3626 |

| Scholarship | -0.01608 | 0.02573 | -0.63 | 0.532 | -0.0665 | 0.0343 | 2.9893 |

| Entry | -0.0081 | 0.01661 | -0.49 | 0.626 | -0.0406 | 0.0244 | 3.064 |

| Decrease | -0.00738 | 0.10369 | -0.07 | 0.943 | -0.2106 | 0.1958 | 0.9226 |

| Attention | -0.02284 | 0.03616 | -0.63 | 0.527 | -0.0937 | 0.048 | 3.136 |

| Gets better | -0.00816 | 0.02322 | -0.35 | 0.725 | -0.0536 | 0.0373 | 2.434 |

| Know taxes | -0.02091 | 0.03564 | -0.59 | 0.557 | -0.9077 | 0.0489 | 2.248 |

| Amnesty payment | 0.23919 | 0.09263 | 2.58 | 0.01 | 0.05756 | 0.4206 | 0.8986 |

| Information media | 0.45388 | 0.0237 | 1.91 | 0.056 | -0.001 | 0.0918 | 2.2613 |

| Know sanctions | 0.10001 | 0.0562 | 1.78 | 0.075 | -0.0101 | 0.2102 | 0.58933 |

| Know rights and | 0.04075 | 0.0398 | 1.02 | 0.306 | -0.0372 | 0.1187 | 2.3893 |

| Obligations | |||||||

| Municipality reports | 0.12146 | 0.0291 | 4.16 | 0 | 0.0642 | 0.1786 | 3.0053 |

| (*) dy/dx is the discrete representation of the dummy variable for 0 to 1 | |||||||

As stated by marginal effects; we have that the "Genero", "Occupation", "Amnesty Payment", "Means of Information", "Know Sanctions", "Know Rights and Obligations" and "Municipality Reports" have a positive effect on the payment of the property tax; i.e. an additional increase in these factors improves the likelihood of payment of the property tax by 4.33%, 4.75%, 23.91%, 4.53%, 10.01%, 4.08% and 12.15% respectively; and inversely influence factors such as "Age", "Civil Status", "School", "Income", "Decrease of Taxes", "Attention of the Municipality", "Improvements",. "Know Tributes"; i.e. by an increase in its values, the likelihood of paying the property tax decreases by 3.97%, 4.75%, 1.61%, 0.81%,0.74%,2.28%,0.82% and 2.09% respectively.

To estimate a better, tighter model, the analysis of a small model has been developed where only significant factors are included (Table 3). The estimate also considered both regression models: Probit and Logit. It can be seen that both models are significant with Prob>chi2 x 0.0000, lower than our margin of error of 0.05; and the two Probit and Logit models account for 31.10% and 31.18% of the behavior of the predial tax payment variable respectively.

| Table 3 Probit and Logit Regressions With Significant Variables |

||||

|---|---|---|---|---|

| Probit model | Logit model | |||

| Number of observations= 375 | Number of observations= 375 | |||

| LR chi2(15)= 31.10 | LR chi2(15)= 31.18 | |||

| Prob>chi2= 0.0000 Log likelihood= -233.22697 | Prob>chi2= 0.0000 Log likelihood= -233.18771 | |||

| Pseudo R2= 0.0625 | Pseudo R2= 0.0627 | |||

| Variable | Coefficient | Prob | Coefficient | Prob |

| Constant | -1.172083 | 0 | -1.91002 | 0.0001 |

| Amnesty Payment | 0.604708 | 0.0075 | 0.97902 | 0.0078 |

| Municipality Reports | 0.316375 | 0 | 0.517297 | 0 |

| Akaike info criterion | 1.259877 | 1.259668 | ||

| Achwars criterion | 1.291293 | 1.291083 | ||

Since the value of R2 is almost similar, we see that according to the values of the Akaike and Schwarz information criteria in the table above, where the values are searched to be minimal; the regression model with the most optimal results is now the logistics model. Finally it is also important to evaluate the marginal effects of significant variables on the independent variable, the results of such evaluation are done this time with the Logit model, the results of which can be seen in the following table:

| Table 4 Marginal Effects With Significant Variables (Logit Model) |

|||||||

|---|---|---|---|---|---|---|---|

| Marginal effects by Probit model Y= Pr (Payment) ( predict) =0.62818617 | |||||||

| Variable | dy/dx | Standard error | Z | P>|Z| | [ 95% C. I, ] | X | |

| Amnesty payment | 0.23896 | 0.0885 | 2.7 | 0.01 | 0.0654 | 0.4125 | 0.8986 |

| Municipality | 0.12082 | 0.0274 | 4.4 | 0 | 0.067 | 0.1746 | 3.005 |

| Reports | |||||||

| (*) dy/dx is the discrete representation of the dummy variable for 0 to 1 | |||||||

Unsurprisingly, in marginal effect results, the two factors have statistical significance, i.e. they have a "P" <= 0.05 and their effect is positive; an increase or improvement in one of the factors in "Amnesty Payment", and " Municipality Informs" implies that there is an increase in the likelihood of compliance with property tax payment by 23.90%, 12.08%, respectively.

The results presented can conclude that compliance with property tax payment can be improved by implementing amnesty programs; as well as it is also evident that there is significant influence when the municipality provides adequate information in the payment of taxes; in addition, there are other factors that have a positive impact on the fulfillment of property tax such as the taxpayer's gender being male and that sanctions information exists; as well as knowledge of citizens' rights and obligations; these factors have a positive impact; however, the level of influence could not be significantly corroborated.

Discussion

In obtaining the results of this investigation, it could be shown that the gender, occupation, payment with amnesty, the means of information, on knowledge of sanctions, considering knowledge of rights and obligations and on the condition that the municipality reports showed a positive effect on the payment of the property tax at 4.33%, 4.75%, 23.91%, 4.53%. 10.01%, 4.08% and 12.15% respectively; on the contrary, age, marital status, level of schooling, economic income, declining taxes, the attention of the municipality, improvements in the system and knowledge about taxes showed a negative effect on the payment of property tax by 3.97%, 4.75%, 1.61%, 0.81%,0.74%,2.28%,0.82% and 2.09%. These results are consistent with what was obtained by Quispe & Quispe (2017), where they established that the lack of tax culture, having a culture of payment, the establishment of tax incentives, the lack of knowledge about the fate of taxes collected and the lack of efficiency of the authorities categorically influence the payment of tax collection.

Moreover, it is not consistent and consistent with what is obtained by Alata (2016) and Deller & Rudnicki (1992), in determining that economic income, the level of schooling is inversely related to our research, but it was positively what the authors mentioned with respect to the payment of tax collection. However, according to Mamani, et al., (2019), the determinants of non-payment of property tax of the population living in the Bellavista neighborhood of Puno are the family income, the level of education, the activity in which the contributor is developed, and the characteristics of the house, so it is equally consistent with the variables determined in this research, as with the authors Alata (2016); Carhuamaca (2009); Flores (2019); Guerrero & Noriega (2015); Huaman (2017); Rojas (2019).

Our results also match what is determined by Chávez & López (2019), where it was able to determine that the collection of property tax is subject to the type of federal transfer policy established; In addition to the fact that the determinants that explain the same proposal of diversification of the tax collection points that the local municipality implements as a strategy, the establishment of current regulations and in accordance with what is required by the population also plays an important role and this also occurs in the District Municipality of San Miguel.

According to Sandoval, et al., (2020), the determining factors that affect a low collection of real estate tax are the absence of tax policies implemented by that municipality, and the low civic awareness of taxpayers, and the same is true in the District Municipality of San Miguel and this coincides with the determination that taxpayers at their greatest proportion if they have knowledge of the fulfillment of their obligations to the State and at the same time know about the payment of taxes. either at the local level or at the national level, but that there is not yet sufficient tax awareness on the part of the general population.

Conclusion

It could be determined that gender, occupation, payment with amnesty, the means of information, on the knowledge of sanctions, considering knowledge of rights and obligations and on the condition that the municipality reports positively determine the payment of the property tax at 4.33%, 4.75%, 23.91%, 4.53%, 10.01%, 4.08% and 12.15% respectively; while age, marital status, level of schooling, economic income, declining taxes, municipality care, system improvements and tax knowledge negatively determine the payment of property tax by 3.97%, 4.75%, 1.61%, 0.81%, 0.74%, 2.28%, 0.82% and 2.09%.

In addition, it can be determined that the property tax in the district of San Miguel is in charge of the Office of Tax Administration and it has an important role in the income of one-off payments. While it is true that municipal taxes are taxes, the compliance of which does not result in a direct consideration of the Municipality to the taxpayer.

Finally, it was possible to determine that most taxpayers receive information from the Municipality of San Miguel against the property taxes, so it is recommended to work in different aspects to improve the collection as it could train the staff to make the customer service pleasant so that it makes the taxpayer satisfied with the service. On the taxpayer side through incentives or by splitting debts, tax amnesty, among other means. In addition, training staff to make customer service as minimal as possible by making the taxpayer satisfied with the service.

References

- Alata, T.D.V. (2016). Factors that influence the collection of property tax in the provincial Municipality of Puno - period 2012. In Universidad Nacional del Altiplano. National University of the Altiplano.

- Aldrich, J.H., & Nelson, F.D. (1984). Linear probability, logit, and probit models.

- Allen, M., & Dare, W. (2002). Identifying determinants of horizontal property tax inequity: Evidence from Florida. Journal of Real Estate Research, 24(2), 153–164.

- Benavides, G.D.A. (2019). Determinantes of the collection of property and industry tax. In Autonomous University of Manizales. Autonomous University of Manizales.

- Awasthi, R., Le, T.M., & You, C. (2020). Determinants of property tax revenue : Lessons from empirical analysis. In determinants of property tax revenue : Lessons from empirical analysis. World Bank, Washington, DC.

- Bagus, P., Block, W., Eabrasu, M., Howden, D., & Rostan, J. (2011). The ethics of tax evasion. Business and Society Review, 116(3), 375–401.

- Bandara, N.J.G.J., & Hettiaratchi, J.P.A. (2010). Environmental impacts with waste disposal practices in a suburban municipality in Sri Lanka. International Journal of Environment and Waste Management, 6(1–2), 107–116.

- Quintana, N.B. (2001). Property tax in Hermosillo, Sonora. Demographic and Urban Studies, 16(2), 415.

- Suárez, N.E.C. (2016). Determinants in the collection of property tax: Nuevo León, Mexico.

- Mendoza, R.R.C. (2009). Determining factors of the collection of property tax in the provincial municipality of Chupaca, period 2009-2018. In National University of the Center of Peru.National University of the Center of Peru.

- Castro, E.B.G. (2020). Incidence of the allocation of transfers in tax collection in the municipalities of Peru. Magazines.Unap.Edu.Pe, 9(2), 1503–1517.

- Maza, L.A.C., & Toache, V.L. (2019). Determinants of real estate tax collection: A statistical approach for Mexico. Ibero-American Journal of Municipal Studies, 19, 89–119.

- De, P., Municipalidad, L.A., & De Viru, P. (2019). Property tax delinquency and its effects on the budget of the Provincial Municipality of Virú. In Inca Garcilaso de la Vega University. Inca Garcilaso de la Vega University.

- Deller, S.C., & Rudnicki, E. (1992). Managerial efficiency in local government: Implications on jurisdictional consolidation. Public Choice, 74(2), 221–231.

- Acosta, L.D.R.M.M. (2015). The property tax regime in the public finances of local governments. In Accounting and Business. 19 (10).

- Eom, T.H. (2008). A comprehensive model of determinants of property tax assessment quality: Evidence in New York State. Public Budgeting and Finance, 28(1), 58–81.

- Quiñones, N.L.F. (2019). Determining factors of the collection of property tax in the Provincial Municipality of Huancayo. In the National University of the Center of Peru. National University of the Center of Peru.

- Barako, D.G., & Shibia, A.G. (2015). Fiscal decentralization and determinants of property tax performance in kenya: cross-county analysis. In Research Journal of Finance and Accounting, 6(14).

- Díaz, R.J.G., & Quintana, H.F.N. (2015). Property tax: Factors that affect its collection. In ECONOMIC CUC. University of the Coast Corporation.

- Hassan, F.M.A. (1998). Revenue-productive income tax structures and tax reforms in emerging market economies: Evidence from Bulgaria. The World Bank.

- Henriques, J.M. (2013). On becoming healthier communities: Poverty, territorial development and planning. Elsevier.

- Sampieri, R.H., Collado, C.F., & Lucio, P.B. (2010). Investigation methodology 1.

- Jaqquehua, E.V.H. (2018). Factores determinantes in the collection of the property tax of the Provincial Municipality of Tambopata period. Universidad Andina Del Cusco.

- Huaman, J.E.V. (2017). Factores determinantes in the collection of the property tax of the Provincial Municipality of Tambopata period.

- Ibarra, S.J., & Cervantes, L.S. (n.d.). Determinantes de the collection of property tax in Tamaulipas: Institutions and the Northern Border Area. Determinants of Property Tax Revenues in Tamaulipas: Institutions and the Northern Border Area.

- Iglesias, T. (2012). Goodness of fit methods in logistic regression. 84.

- Puls, S.L. (2014). The lodging tax collection in the state of Quintana Roo, Mexico: Descriptive statistics and fractal trend pattern. Economics Notebooks (Spain), 37(103), 45–51.

- Lieberman, E.S. (2001). National political community and the politics of income taxation in Brazil and South Africa in the twentieth century. Politics and Society, 29(4), 515–555.

- Lustig, N. (2015). Inequality and fiscal redistribution in middle income countries: Brazil, Chile, Colombia, Indonesia, Mexico, Peru and South Africa. SSRN Electronic Journal.

- Lustig, N.C., Gray-Molina, G., Higgins, S., Jaramillo, M., Jimenez, W., Paz, V.C., … & Yanez, E. (2012). The impact of taxes and social spending on in equality and poverty in Argentina, Bolivia, Brazil, Mexico and Peru: A Synthesis of Results. SSRN Electronic Journal.

- Mamani, J.C.Q., Guevara, M.M., Ccoa, D.M.C., & Rramírez, Y.A.T. (2019). Determinants of non-compliance with the property tax payment of the inhabitants of the Bellavista neighborhood of the city of Puno, Peru-2018. Key People, 3(2), 65–88.

- Mamani, J.C.Q., Mamani, M.G., Guizada, C.E.R., Maquera, H.R.M., & Maquera, V.R.M. (2020). Factors that influence compliance with the payment of the property value tax in the city of Puno-Peru. Latin Science Multi-disciplinary Scientific Journal, 4(2), 268–285.

- Matteucci, M.A. (1995). The definition of tax awareness and the mechanisms to create it. Tax Analysis, 8(90), 37–38.

- Bellido, W.M. (2014). How do economists research? Guide to prepare and develop a research project.

- Hernández, H.M. (2010). Proposed actions to increase the collection of property tax. Tax authorities Municipal, 108, 80–90.

- Pico, A.A., Mesa, R.E.A., & Navas, R.E.M. (2011). Determinantes of property taxes and industry and commerce in Cartagena. Work documents.

- Romero, Z.R.Q., & Ramos, A.B.Q. (2017). The property tax and the tax collection of the taxpayers of the District Municipality of Acoria-Huancavelica, 2014.

- Ramírez, J.M., Díaz, Y., & Bedoya, J.G. (2017). Property tax revenues and multidimensional poverty reduction in colombia: A spatial approach. World Development, 94, 406–421.

- Ramos, J.F., María Iregui, A.B., & Melo, L.B. (2005). The property tax in Colombia: Explanatory factors of the collection. Economy Magazine Del Rosario, 8(1), 25–58.

- Reátegui, M. (2016). Importance of the tax culture in Peru. In Journal of Accounting Research Accounting power for business, 1(1).

- Reátegui, M.A. (2015). Importance of the tax culture in Peru. Accounting Power for Business Magazine, 73–90.

- Rojas, G.D. (2019). Determinants of the collection of the property tax in the district municipality of veintiséis de Octubre for the period 2019. National University of Piura

- Sandoval, P.M.V., Madriz, Y.M.M., & Ballestero, E.J.Z. (2020). Determining factors that affect the low collection of the real estate tax (IBI) of the Municipal Mayor of Quezalguaque in the department of León.

- Trejos, J.L.O. (2016). Changes in the distribution of family income in Costa Rica during the first decade of the 21 century. Economic Sciences.

- Gutiérrez, M.U., & Jaimes, C.M. (2015). Property tax collection in Mexico: An analysis of its economic determinants in the Period 1969-2010. Mexican Journal of Political and Social Sciences, 60(225), 45–77.