Research Article: 2019 Vol: 22 Issue: 5

Developing a Model for the Governance of Arab Family Companies and their Legislation

Tamara Yacoub Nasereddin, Middle East University

Yacoub Adel Nasereddin, Middle East University

Abstract

The current research aimed to developing a model for the governance of Arab family companies and their legislation, which contributes to the interconnection between the vision and the structures of supervision and control, and reduces the conflict and duplication of decision and performance. This is an attempt to address the Problem faced by Arab family companies, namely the ambiguity of roles overlapping tasks, lack of discipline and reflection of family problems on the performance and growth of the company due to the absence of a structure for the governance of these companies. The research used survey methods, and literature review and then the development of indications and opinions and make comparisons and simulations, in order to extract indicators and evidence from them. The research concluded with the development of a model of corporate governance that seeks to unify the components of the various models and their indicators within a single model to avoid defects in these models and gain their advantages and make all practices understandable, easy to implement and review. The research presented a set of recommendation as follows: Testing the model developed in this research and to show its strengths against its weaknesses in preparation for its adoption in the governance of Arab family companies. The need for intensive education on the importance of corporate governance and its necessities. This can be achieved through workshops and seminars. The legal legislator has expanded on the issue of corporate governance and mechanisms for following up on its implementation, and for the urgent need for expansion and clarification. Increasing the financial, moral, and technical support of family companies to ensure their survival continuity and success in supporting the national economy on the one hand and encouraging the establishment of more of these companies on the other. Proposing a course to in universities for the bachelor's and graduate studies entitled "Management of family companies and their governance". Adding an explicit statement on the characteristics of the senior administration and its traits that senior administration has the ability to translate the strategic direction of the company to the actual actions and tangible results, and to mention a text in the Jordanian companies’ law on leadership and creativity.

Keywords

Family Companies, A Model for the Governance of Arab Family Companies, Legislation.

Introduction

Family companies are distinctive feature of companies that contribute to the development of many economies. These companies are managed from several generations mostly belonging to the same family (AL-Dobil, 2013). The last decades of the twentieth century witnessed a remarkable growth in the fields of knowledge related to family companies. Attention has been given to studying their various aspects in the 1960 by specialized institutes and institutions in western societies. In the 1980 and 1990s, interest in studying in Japan and china increased. In the Arab region, there was interest and education in the companies mentioned in 2001 through the Arab organization for Administrative Development (Zidane, 2011).

Despite the Jordanian legislation toke and organized Family company in two different kinds of companies in Companies law. But these provisions still not enough to handle all issues related this kind of companies (El-Haija, 2019). This shortage refers to the private nature of this kind of companies which constitutes from relatives belonging to one family.

And for the importance of Arab family companies and their role in developing economies, analytical, developmental and organizational studies are still very limited and there is a clear need to do more. For these main reasons this study has come.

Research Problem

Monitoring of studies and research enabled the researchers to identify the current research problem with the following phrase:

“Family companies suffer from ambiguity of roles, overlap of tasks, lack of Discipline and reflection of family problems on the performance and growth of the company due to the absence of a structure for the governance of these companies.”

The Davis & Dyer (2003) study has shown:

“One of the most important weaknesses of family companies is the ambiguity of the role and the overlap of the problems of the family with the problems of the company.”

The (Dyer, 2006) study found that:

“The family companies suffer from one person in the management of the tasks of the system of the family and the system of the company which generates a lot of duplication and conflict in decisions. The international finance corporation’s guide to family corporate governance indicated that the most prominent weaknesses in the family companies are lack of discipline and insufficient attention to strategic areas and succession planning plans.”

The Zidane study (2011) concluded that:

“The Arab family companies’ need a governance structure inters relates vision, supervision structures and oversight.”

The Main Purpose of the Research and its Objectives

The main purpose of the research is to develop a model for the structure of Arab family corporate governance contributes to the correlation between vision and structures of supervision and control, reduces the conflict and duplication of decisions and performance by achieving the following objectives:

1. Understand the concept of family companies their characteristics, and generations.

2. Understand the concept of corporate governance acne, and family corporate governance and its legislations.

3. Define the features and components of the model of Arab family corporate governance.

The Nature and Style of Research

The research is of an office and theoretical nature. The method of analysis deduction was adopted according to the following steps:

1. Identifications of literature and related studies.

2. Analysis of the contents of these literature and studies according to their relevance to the subject of research and the Arab environment.

3. Drawing idea and indicators suitable for developing the model.

4. Developing the structure of the model by determining its features and components.

Conceptual Framework

The Concept of Family Companies

1. Entity controlled by a single family on voting power, and focuses on the importance of the strategic decision of this entity and those who take, such as: appointment of new executive, general directions of the company and the role of the family (Poza, 2004).

2. The company in which the votes are in the hands of the controlling owner, including the founder who intends to transfer the company to the generations (International Finance Corporation, 2011).

3. The company that controls the ownership of the share capital in a manner that enables it to control the board of directors and appoint the chief executive officer (CEO) of the company from the family members (Colli, 2003).

Through the previous concepts can be drawn the most important indicators of the concept of family companies and characteristics as follows:

Indicators of the Concept of Family Companies

1. A company owned by a single family.

2. The majority of votes are in the hands of the family.

3. The control of the family on share capital.

4. The control of the family on the board of directors.

5. The power of appoint an executive chairman and be a member of the family.

Characteristics of Family Companies

Family companies have the following characteristics: (International Finance Corporation, 2011; Cabrera-Suarez, 2005).

1. A high degree of dedication due to the great Commitment of the individuals of the family to achieve growth and maintain the company’s reputation.

2. The accumulation of knowledge and experience resulting from the transfer of knowledge and sharing across generations.

3. High quality products resulting from credibility, and the need to maintain reputation and then proud of them.

4. High confidence due to the cooperative family atmosphere.

5. Agree and consistency in decisions due to family orientation and the speed of persuasion.

6. Flexibility in work and performance.

7. A high degree of loyalty and sacrifice results from the value system agreement.

Stages of Family Companies

Table 1 represents the stages of the family companies, their transmission and the development of their sizes some activities:

| Table 1 Stages of the Family Companies | |

| Stage | Stage Practices |

| First: Founder | • Leadership transitions. • Transfer of power. • Planning of disposition of property. |

| Second: Brotherhood partnership | • Maintain team spirit and harmony between brothers. • Maintain ownership of the family. • Transfer of power. |

| Third: Union of cousins | • Capital allocation of the company. • Profits distribution. • Liquidation of shares. • Dispute of family disputes. • Share the role of family. • Vision and mission of family. • The relation of the family to the works of the company. |

Generations of Family Companies

There is almost agreement between researchers and scholars that the generation of family companies is in three generations: (Al-Dobil, 2013; Franks et al., 2011; Van-Buren, 2007).

First Generation

The Characteristics of this generation are the following:

1. The Company stars as an individual Project.

2. The central model of management and decision making is prevailing.

3. Achieving survival is the first task and then thinking about growth.

4. No conflicts within the company.

Second Generation

The characteristics of this generation are as follows:

1. Beginning with the death of the founder of the company, or inability to work and having to give up administrative powers.

2. To delegate the work and decision to a second person from the family, nominated by the founder or agreed upon by the family.

3. The emergence of signs of overlap between the relations of the family, the owner and the director, which may cause the delay of decisions.

4. The likelihood of conflicting roles and their duplication is very frequent.

5. Reducing the Power of the central model and the gradual trend towards the decentralized model.

6. Attention to the exercise of delegation of powers and empowerment.

7. Attention to growth strategies and adoption of creativity.

Third Generation

This generation is characterized by the following:

1. Beginning with an increase in the number of family members who share the decision- making and directing authorities.

2. The emergence of conflicts and disputes over the company’s and management of the company.

3. Lack of unity of thought and direction in the management of the company.

4. Concern about low growth rates due to conflicts.

5. The tendency to return to the central model of action to control and end conflicts.

6. Trying to reconsider the company’s vision and mission.

An examination of the characteristics of the three generations indicates the existence of organization, administrative and technical problems that cause concern and may lead to the end of the company and its activates. This conclusion comes in line with what was raised in the current research problem, and stresses the need for a model of the structure Arab family corporate governance to solve these Problems and the one hand and to encourage the establishment of family companies in the future.

The Conceptual Frame Work of Family Corporate Governance Conceptual and Theoretical Review of Governance

The concept of modern governance was popular in the early 1970 in business administration in both the United States and Britain, but initial ideas about it were mentioned long before. In 1920, for example, the American Association of university professors published a special declaration on the relevance of governance principles to institutions of higher education (Nasser, 2015).

The evaluation of the use of this concept came from the World Bank study on Africa, which defined governance as an exercise of political power to manage state affairs.

Later on, the World Bank looked at governance as the way Power is exercised in managing a country’s economic and social resources for development. But this concept from the researcher’s point of the view derived from their multiple studies in this field is a concept of dynamic, not stable and not suitable for stability. It calls for renewal, change modernization and adaptation constantly.

This confirms the ability to limit ten intellectual orientations to use this concept as shown in Table 2:

| Table 2 Intellectual Orientation to use the Concept of Governance | ||

| # | Concept Orientation | Concept Usage |

| 1 | The exercise of power in the government and the political sphere. | Promote democracy and human rights, promote economic prosperity and social cohesion, reduce poverty and deepen confidence in government and public administrations. |

| 2 | Reduction of government intervention | Pressure of expenditure and increased freedom of market mechanisms and competition in the economy. |

| 3 | Attentions to stakeholders | Organizing the relationship between the owners the board of directors and the executive directors, in the management of private companies to reduce the risk of investment increase capital attraction, improve performance, transparency and integrity. |

| 4 | Reinventing the government | The government is changing and its duties are evolving, and that government, such as- private sector management is capable of adapting to the. |

| 5 | Concepts orient | Spirit of the times and redeveloping itself from time to keep pace with the information age. |

| 6 | System of immunity protection and activation | Protecting behaviors and ensuring their integrity from deviation to corruption in its various forms. |

| 7 | Self-denial system | Giving preference to the public interest over narrow personal and self-interests. |

| 8 | Comprehensive State administration. | Appling the principles of transparency, accountability and participation. |

| 9 | Structure of responsibilities and rights. | Determining mechanisms for distributing rights and duties and measuring the safety of performance. |

| 10 | Methodology for drawing the future. | Determining the vision, mission, values of the organization and develop guidelines for ethical compliance. |

| 11 | A systematic mechanism to measure the effectiveness of governance. | • How to choose who are in power, watch them and replace them. • The ability of the government to formulate sound policies, implement them effectively and provide public services. • Respect for citizens and state of institutions that govern economic and social interactions among them. |

| Source: (Nasser, 2012; Nasser, 2018) | ||

There are many definitions of governance. It has been defined as: a set of mechanisms that include the structures, responsibilities, practices and tradition adopted by the state or institution to ensure that its mission is achieved (Yacoub, 2013).

It was also defined as a set of rules and regulations for performance control, and the organization of relations between the various parties according to a structure that includes the distribution of rights and duties, and to ensure the quality of the results (Nasser, 2012).

Based on the above governance is defined as a dynamic multi-purpose and levels concept. The levels correspond to the macro level (state and government) and partial level (ministries, institutions, companies and individuals).

The general purpose is to provide services, benefits, while the special purpose to achieve profits and sustainability, that reflect the governance mechanism in building of goad governance structure, the information of amoral value system and the drawing up correct work practices, in order to eradicate corruption practices in various forms, achieve optimal investment in resources and increase effectiveness of organization through (Nasser, 2018).

1. Good selection of power crews.

2. Develop their performance indicators and replace them.

3. Promote democratic practice in worked life.

4. Ensure justice and equality.

5. Achieve economic growth.

6. Reduce investment risk.

7. Attract capital.

8. Setting mechanisms for selecting board members.

9. Activating accountability and participation.

10. Increase the level of transparency and disclosure.

The Concept of Family Corporate Governance and its Objectives

Family corporate governance refers a set of principles governing the establishment of a parallel family system for the legal systems that govern companies in general, such as the establishment of the council of the families, the drafting of its constitution and the control of actions that have a direct effect on the company (Al-Zamea, 2016).

In light of the above definition, family corporate governance is represented

1. Principles governing the management of family companies.

2. It regulates relations between the company’s management and other stakeholders.

3. The family company directs towards the right way to formulate the company’s vision, mission and objectives.

Family Corporate Governance is aimed at (International Finance Corporations, 2011):

1. To inform the values of the family, its vision and its mission to all members of the family.

2. Knowledge of the individuals of the family, the performance of the company in detail.

3. Reporting rules and decisions that can affect the employment of family individuals.

4. Open official channels of communications that allow the members of the family to share their ideas, express their hopes and present issues that concern them.

5. Allow family members to meet and make any necessary decision.

Table 3 represents the family corporate governance models:

| Table 3 Family Corporate Governance Models | |

| Market Model | Management Model |

| • High level of financial disclosure. • Focus on a short-term strategy independent board members. • Shareholders consider the company as asset. • Separation of ownership from administration. |

• Full confidentiality on financial issues. • Focus on a long-term strategy • Shareholders have more links with the company than financial ties. • Board members are familiar with everything. • The administration and ownership are clearly overlapped. |

| Source: (Al-Dobil, 2013). | |

Arab Family Company’s Legislation

In light of the family development of governance in the current era, it was necessary to legislate these concepts and put them in a legislative frame- work of its own, because of this company of widespread and particularly important in the Arab countries.

Legislation is defined as the enactment of regulations and laws with binding texts for applications, together with a punishment applied to those who deviate from it (Nasser, 2019).

It is also defined by jurisprudence as a set of general rules of public behavior that are binding, Which regulates the social ties in society and is accompanied by a financial penalty, and the state report people to follow them if by force when needed (Al-Daoudi, 2012).

It is worth mentioning that the Jordanian legislator omits the organization of family companies from several sources:

1. The family companies were not regulated and their establishment and management subject to corporate governance by the type of company its wishes to establish.

2. The Jordanian law defined the terms of membership in the board of directors in terms of good communications skills, high analytical skills, courage and self-confidence-Article 147 of the Jordanian companies law stipulated that the conditions of membership in the board of directors.

A person who nominates himself for membership of the board of directors of any public shareholding company shall be required:

1. Must be at least twenty-one years old.

2. He shall not be an employee of the government or of any public official institution. The fore, what is stated in the Jordanian company’s law lacks the required qualities in the membership of the board of directors, so that the company achieves its objectives for which it was found.

3. The Jordanian companies law mentioned the duties, and powers enjoyed by the members of the supervisory board in the text of article (85) where it was stated: The supervisory board of a company shall recommend the following shares, tasks powers:

1. Monitor the progress of the company and ensure the correctness of procedures of its establishment and request the director of the company or its managers to provide a comprehensive report on these actions and procedures.

2. See the company’s restriction, records, contracts, inventory of funds and assets.

3. To express opinion in the question that he considers to be of interest to the company or in matters Presented by its director or managers.

4. Approve the conduct of acts and which the company’s system stipulates that its implementation or performance requires its approval.

5. Invitation of the general assembly to on extra-ordinary meeting if it becomes clear to him that irregularities have been committed in the management of the company and must be presented to the general assembly.

However, he neglected to mention the tasks related to the contribution of the board of directors in setting the strategic direction of the company in light of the features of the strategic plan specialized in the company’s constitution, and made the board of directors an executive authority to implement the plans and decisions implemented by the general assembly of the company as the legislative authority.

Components of Family Corporate Governance Structure

International Finance Corporation (2011) determined the structure as follows:

1. Family governance.

2. Board of directors.

3. Senior management.

4. IPO stock.

The Lebanese Transparency Association has identified the components of the application of good governance rules in the Lebanese family companies as follows:

1. Structure of family council: formation and performance.

2. Characteristics of the board of directors and its tasks.

3. Risk management and control.

4. Internal and external audit.

5. Conflicts of interest and transaction of the parties concerned.

6. Evaluation of senior management and succession.

7. Shareholder’s equity and duties.

The Zidane (2011) study determined the components of Egyptian family corporate governance as Follows:

1. The nature of the relationship between the company, the family and ownership.

2. The nature of the board of director’s formation.

3. Professional management specifications.

4. Growth and change of ownership form.

5. The nature of dependence on the family assists

6. Reliance of relatives at work.

The Saudi ministry of trade and investment has set the guiding principles for family companies in terms of family corporate governance components as follows:

1. The values and objectives of the family.

2. Shareholders associations.

3. Family council.

4. Board of directors and chief executive officer.

5. Business policy in the company.

6. Disposition of shares and exit.

Al-Dobil (2013) study identified the components of the family corporate governance in Jordan as follows:

1. Help sheet

2. Why corporate governance.

3. Perspective of the evolution of performance.

4. Structure of the board of directors.

5. Independence of the board of director’s member.

6. Corporate governance improvement programs.

7. Supervisory review list.

Al-Zamea (2016) study determined the components of family corporate governance in Kuwait as follows:

1. The constitution of the family.

2. General assembly of the family.

3. The company board of directors.

4. Council of the family.

5. Executive manager.

6. Senior management.

7. Strategic planning committee.

8. Family charity work.

9. Investment committee.

Developing a Model for the Governance of Arab Family Companies

Justifications of Model Development

The variation of model components and the overlap of their concepts and the overlap of their concepts and practices may cause noncompliance with any of these models. This is what was revealed by the Al-Zamea (2016) study and had shown that only (27%) of the family companies in gulf cooperation council have rules of governance and the dominant ratio does not have to be, due to the lack of comprehensive model rules.

Ensure the continuity and length of the re-construction of Arab family companies, because of the death, disappearance or sale of these companies in the early reconstruction of the establishment. A World Bank study showed that:

“Two-thirds to three-quarters of family businesses collapse or are sold by the founder during his lifetime and that (95%) of these companies do not exceed the third generation (IFC, 2011).”

Another study found that (80%) of the family companies disappear before reaching the third generation1.

Objective of Developing the Model

The current research aims at unifying the various models and their indicators within a single model to avoid defects in these models and gain their advantages and make all practices understandable easy to implement and review.

Components of Model Development

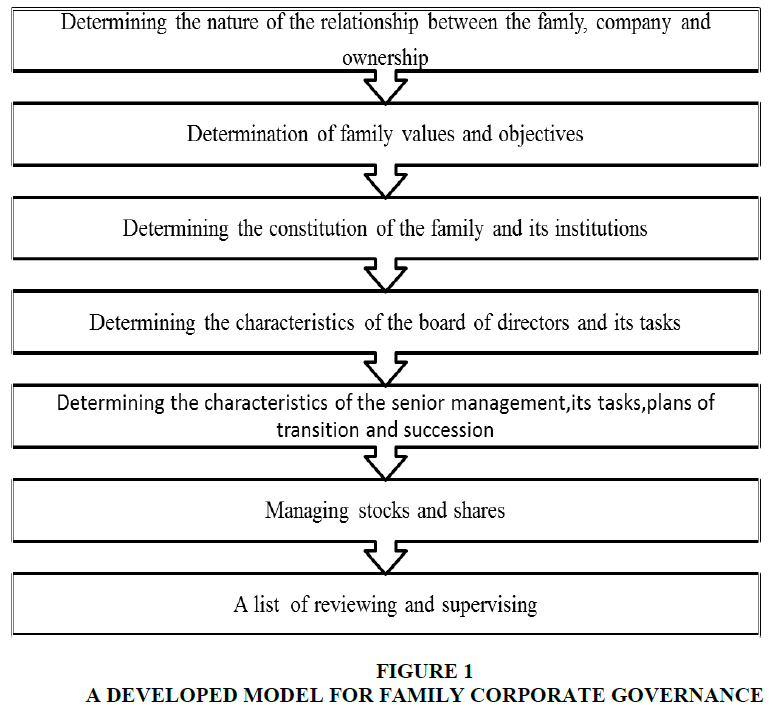

The following Figure 1 shows the development model of family corporate governance.

Determining the Nature of the Relationship between the Family, Company and Ownership

This component is concerned with determining the nature of the relationship between individuals who share ownership and do not perform administrative tasks within the company and between individuals who share ownership and exercise administrative tasks, in order to distinguish the ownership system from the management system (Zidane, 2011).

Determination of Family Values and Objectives

This component focuses on defining ethical and professional principles and rules in leading the company’s activities and actions, and how they can work together to make the company a professional entity with sustainable and balance growth contribute as well as providing a regular and rewarding income for the members of the family-to provide employment opportunities for members of the society (Saudi ministry of trade investment; Nasser, 2018).

Determining the Constitution of the Family and its Institutions

The constitution of the family is a live document and a practical translation of the nature of the relationship between the company, the management and the owner. It represents the company’s labor law. This component determines (International Finance Corporation, 2011):

1. The family establishments: they include the family gathering, the family council, the education committee, and the family office.

2. Determining the parameters of the company’s strategic plan.

3. Employment policies of family members.

4. Ownership policies for stockholders and shares.

Determining the Characteristics of the Board of Directors and its Tasks

This component identifies two tasks:

1. Characteristics of board members: they include: (integrity, ability to work with others, good communication skills, high analysis skills, courage and self-confidence) (International Finance Corporation, 2011)

2. Determining the tasks of the board of directors: they include: directing the company’s affairs and setting the strategic direction of the company in light of the strategic plan parameters specified in the company’s constitution, and performance monitoring and evaluation, making strategic decisions, and repudiating the strategic direction, including vision, mission and objectives (Wheelen et al., 2018).

Determining the Characteristics of the Senior Management: Its Tasks, Plans of Transition and Succession

This component focuses on two tasks:

1. Characteristics of senior management: They include experience, specialized knowledge, ability to make decisions the ability to translate the company’s strategic direction into concrete actions and tangible results, leadership and creativity, high communication skills, and ability on leadership and influence (Jones & Hill, 2013).

2. Senior Management Tasks: They include:

1. Transformational leadership which represents an approach through which the leader seeks to reach the underlying motives and apparent motives of subordinates, and then works to satisfy their needs and invest their energies in order to achieve a deliberate change, so that the subordinates feel trust, admiration, loyalty and respect for the leader, which increases their motivation to do more than usually do (Essa, 2018). On the basis of these results, the company is becoming better.

2. Strategic Planning Administration: The translation of strategic plans in to activities and actions in a manner that enables the company offices to integrate with each other and with the strategic plan of the company (Wheelen et al., 2019).

3. Transition Plans, Sequencing and Succession: They include the provision, preparation and qualifying of alternative leaders to fill vacancies in the future, through a set of stages are: Initiate an early selection process, develop systems to develop the career path and clarify the transition of positions (International Finance Corporation, 2011).

Managing Stocks and Share

This component is critical to the future of the company and requires study of all aspects related to the advantages of offering and subscription and its disadvantages, as well as determining its justifications.

A List of Reviewing and Supervising

These components focuses on attention to feedback, monitoring deviations, advising on innovation and review the objectives, as well as know the mechanisms to deal with international financial institutions, companies and institutions that implement programs to improve family corporate governance (Al-Dobil, 2013).

Recommendations

The Researchers Recommended the Following

1. Testing the model developed in this research, and to show its strengths against its weaknesses in preparation for its adoption in the governance of Arab Family companies.

2. The need for intensive education about the importance of family corporate governance and its necessities through workshops and seminars.

3. The legal legislator should expand on the issue of family corporate governance and mechanisms to Followup on its implementation.

4. Increasing the financial, moral and technical support of the family companies to ensure their survival, continuity and success in supporting the national economy on the one hand and encouraging the establishment of more of these companies on the other.

5. Proposal of a course in universities in the stages of bachelors and graduate studies entitled "management of family companies and their governance" due to the importance of this subject.

6. Adding an explicit statement on the characteristics of the senior management and its traits, that the senior management has the ability to translate the strategic direction of the company into realistic actions and tangible results, and to mention a text in the Jordanian company’s law on leadership and creativity.

Acknowledgement

The author(s) is/are grateful to the Middle East University, Amman, Jordan for the financial support granted to cover the publication fee of this research article.

End Notes

1. www.ammonnews.net/article/21/02/2019

References

- Al-Daoudi, G.A. (2012). Introduction to the science of law. Amman: Dar Al-thakafa.

- Al-Dobil, R. (2013). Evaluation of family companies. Amman: Dar Al- Yazori for Puplishing and Distribution.

- Al-Zamea, F.A. (2016). Family companies: The challenge of survival and the role of governance in its sustainability. Kuwait International Law School Journal, 4(15), 301-333.

- Cabrera-Suarez, K. (2005). Leadership transfer and the successor’s development in the family. The Leadership Quarterly, 16(1), 71-96.

- Colli, A. (2003). The history of family business. Cambridge University Press, Cambridge, UK.

- Davis, H., & Dyer, W. (2003). Consulting to family business. San Francisco: Jossey_Bass.

- Dyer, W. (2006). Examining the family effect on firm performance. Family Business Review, 19(4), 253-273.

- El-Haija, M.I.A., Kara, S.M.S., & Nasereddin, T.Y. (2019). E-Government legislative Constraints. International Journal of Civil Engineering and Technology, 10(6), 240-244.

- Essa, M.B. (2018). Examining the relationship between strategic leadership, leadership styles and knowledge sharing in the electric power sector in Jordan (Doctoral dissertation). Alliant International University.

- Franks, J., Mayer, C., Volpin, P., & Wagner, H. (2011). The life cycle of family ownership: International evidence. Review of Financial Studies, 25(6), 1675-1712.

- International Finance Corporation (IFC). (2011). Family business governance handbook. World Bank Group.

- Jones, G., & Hill, C. (2013). Strategic management: An integrated approach. Boston Houghton Mifflin Company.

- Nasser, E.D.Y. (2018). Governance a mechanism for good governance in policymaking and decision-making. A lecture delivered at the Royal police Academy-directorate of public security.

- Nasser, E.D.Y. (2018). Governance and its relation security within the framework of reducing university violence, a research paper presented to the National forum for university security. Held at the University of Mo’tah, entitled the role of security institutions in providing a safe university environment.

- Nasser, E.D.Y. (2019). Governance of training. The Middle East university publications, Amman , Jordan.

- Nasser, E.Y. (2015). Guide of Arab universities governance. A research Presented to the 48th session of the general conference of the union of the Arab universities. Saint Joseph University, Beirut, the Middle East University Publication, Amman, Jordan.

- Nasser, ED.Y. (2012). Governance and strategic thinking. Amman, the Hashemite Kingdom of Jordan.

- Poza, E.J. (2004). Family business. Mason, Ohio: South-Western Cengage Learning.

- Van-Buren, B. (2007). The life and times of a family business: A case study. In International Council for Small Business Conference, Turku, Finland.

- Wheelen, T., Hunger, D., Hoffman, A., & Bamford, C. (2018). Strategic management and business policy: Globalization, innovation and sustainability. Pearson, New York.

- Yacoub, N.Y. (2013). Governorship and community reform a future outlook. British Journal of Humanities and Social, 9(2), 23-38.

- Zidane, A.A. (2011). Egyptian family companies: A field study for distinctive features and strategic indications. Arab Journal of Administrative sciences, 18(3), 1-11.