Research Article: 2019 Vol: 18 Issue: 1

Development of Adaptive Organizational and Economic Mechanism of Strategic Management of Corporation Resistance to Risk

Andrii Antokhov, Chernivtsi National University named after Yuriy Fedkovych

Yryi Tytynnik, Poltava State Agrarian Academy

Alexander Krivenko, National Defence University of Ukraine named after Ivan Cherniakhovskyi

Volodymyir Pashynskyi, National Defence University of Ukraine named after Ivan Cherniakhovskyi

Svitlana Cherkasova, Odessa National Polytechnic University

Abstract

The article identifies the need to create and implement an adaptive organizational and economic mechanism of strategic management of corporation resistance to risk. The main features of the basic and new methodological approaches of strategic corporation risk management are substantiated and detailed. The universal organizational and economic mechanism of strategic management of corporation resistance to risk is proposed. The methodological research platform is determined by the tendencies of crisis management practices focused on the use of organizational and economic potential and application of mechanisms of response to risk situations. Development of a risk card, which is a visual overview of the most important characteristics of risks and threats, is necessary to check and justify the current strategy of the corporation and its capabilities to generate additional profitability. Strategic risk management in corporate activities is defined as a system of purposeful influence on all manifestations, types of risk making it possible to avoid, reduce or minimize the negative consequences of the subjective nature of the market environment. Considering that the effectiveness of the mechanism of strategic management of economic risks of corporations depends on these components, the necessity of introduction of specific approaches in the process of their functioning is proved.

Keywords

Strategic Management, Corporation, Resistance to Risk, Risk Profile, Monitoring, Control, Management Decisions.

JEL Classifications

M21

Introduction

In the periods of unstable conditions of corporate sector functioning there is a growing understanding that, despite all the recessions in the development of basic industries of the world economy, stable functioning of corporations depends first and foremost on the strategic management system. All of this should be aimed at sustainable development, enhancing the ability to withstand the effects of negative factors and developing mechanisms of resistance to risk for doing business. One of the ways of addressing this problem is based on the application of organizational and economic mechanism of strategic management of corporation resistance to risk (Malakhovskyi et al., 2019).

Literature Review

The main aspects of the mechanism of strategic management of company resistance to risk taking into account the stage of transformational changes in the market environment are in the process of continuous development. This issue is being studied at the high scientific level by (Dess et al., 2005; Johnson et al., 2011). We may note the study of the practice of risk in the works of such scholars as (Hofmann, 2010; Manuj & Mentzer, 2008; Zsidisin et al., 2004). A wide range of problematic issues remain open in this area including the steps taken to develop and use a strategic mechanism of management of corporation resistance to risk.

Methodology

The methodological research platform is determined by the tendencies of crisis management practices focused on the use of organizational and economic potential and application of mechanisms of response to risk situations. Systematic research is formed from the point of view of the fact that corporations are constantly influenced by complex, unstable and changing factors of the environment of its functioning, which periodically creates significant obstacles to improving its competitiveness and requires constant improvement of forms and methods of business.

Findings and Discussions

The purpose of the study is to substantiate the process of development and functioning of a strategic mechanism of management of corporation resistance to risk in the conditions of dynamic changes in the environment and market transformation. The risk category in the modern theory of strategic decision-making is considered as one of the possible characteristics of a complex economic situation, which impedes the decision-making process, accompanies all aspects of the corporation activity, including all management subsystems and processes. Corporations, as standalone business entities, must make daily decisions about survival in challenging conditions to achieve their global and local goals with minimal resources available to increase the efficiency and effectiveness of their operations (French, 2009).

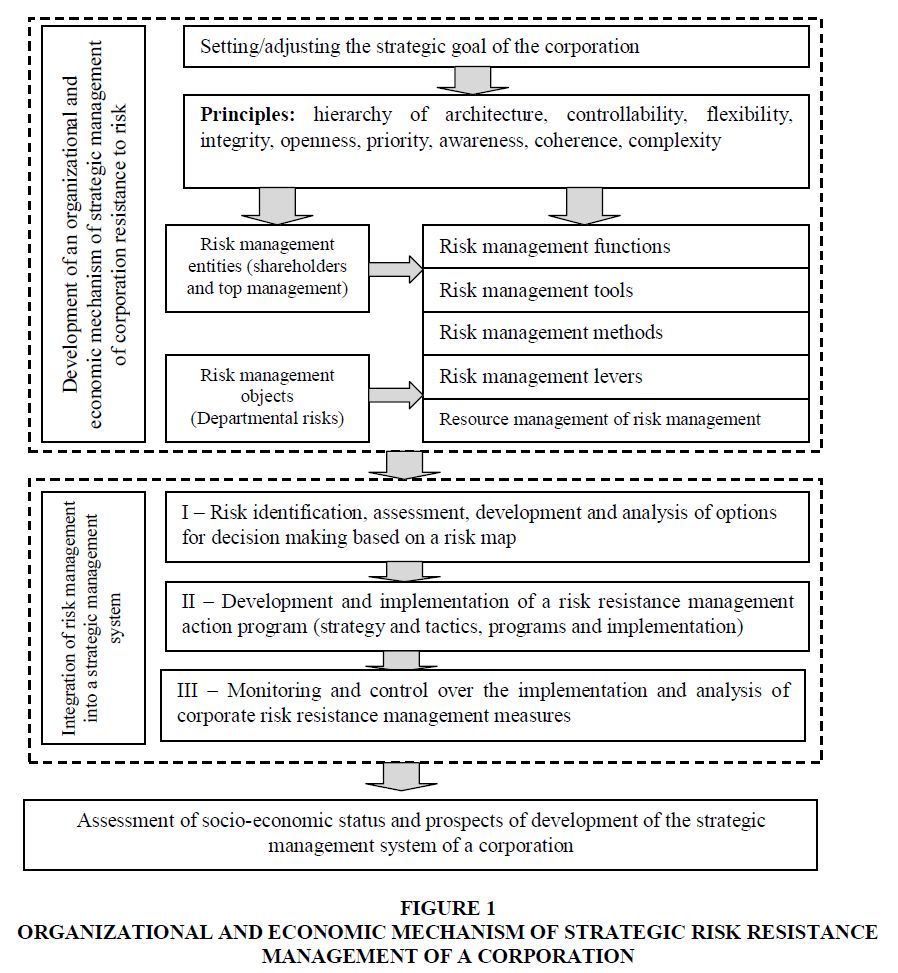

Organizational and economic mechanism of strategic risk management of a corporation is an integral part of a risk identification system for a corporation with a reasonable set of structural elements, methods, levers, instruments of influence on an object of management with an appropriate resource provision. To ensure the effective management of economic risks in the activities of the corporation, the features of the basic and new methodological approaches of corporation risk management is substantiated (Table 1).

| Table 1 Main Features of the Basic and new Methodological Approaches of Strategic Corporation Risk Management | |

| Basic Approach | Basic Approach |

| 1. Fragmented risk management: each department manages risks independently (according to its functions). First of all, this applies to the financial block. 2. Incidental risk management: risk management is carried out when managers deem it necessary. 3. Limited risk management: primarily applies to insurance and financial risks. |

1. Integrated, combined risk management: risk management is coordinated by senior management; every employee considers risk management as part of their job. 2. Continuous risk management: risk management process is continuous. 3. Extended risk management: all risks and opportunities of their organization are considered. |

If an element is ineffective in this system, the imperfections of this element will be felt by the whole control system and, accordingly, it will be less effective (Jüttner et al., 2003). Therefore, it is very important to periodically check the compliance of elements of the strategic management system with one another and, if necessary, make adjustments (Figure 1).

Figure 1 Organizational and Economic Mechanism of Strategic Risk Resistance Management of a Corporation

The choice of a particular method of risk resistance by the management and shareholders of a corporation depends on their individual perception of the real external environment in which the corporation operates (Tetiana et al., 2018). The solution to the problem of corporate risk resistance is carried out in three directions-financial, investment and operational activities, which provides a synergistic effect in the functioning of a socio-economic system. With regard to the risk resistance of the financial sector-it is a question of financial stability of a corporation, which provides for profitability and self-financing of activity, financial independence of a corporation from external sources of financing (David et al., 2008). At the same time, such indicators may be criteria for corporate risk resistance: financial stability, profitability, availability and structure of own working capital, characteristic of a management system to have a tendency to risk, etc.

Risk management of investment activities, which have the highest degree of riskiness, is aimed at increasing the attractiveness of investments and reducing losses from risky operations or avoiding them at all. Risk resistance of a corporation operating activities is related to the main activity of a corporation, the key elements of which are sales of products, works (services) and carrying out of the marketing strategy of the corporation (Makedon et al., 2019).

We suggest that the initial information for a corporate risk resistance diagnostics should include the following: definition of the specified goal and trajectory of movement of the corporation (profitability, cash flows, value); identification and definition of the characteristics and outlines of internal and external risks and threats; definition of the probable states of the corporation in the event of risks and a matrix of transition probabilities (Drobyazko et al., 2019).

The authors consider the development of a risk card and definition of its risk profile an important step in the development of an organizational and economic mechanism of strategic corporation risk resistance management. Development of a risk card, which is a visual overview of the most important characteristics of risks and threats, is necessary to check and justify the current strategy of the corporation and its capabilities to generate additional profitability.

In the risk management process corporations also need to constantly collaborate with functional employees, security engineers, IT support experts, insurance experts, financial services and top management.

To sum up the above it should be noted that the nature of functioning of any corporation requires the introduction of a formalized risk management scheme in its every day life, with the initiative to create, implement and ensure the functioning of an effective risk management system necessarily coming from the top management of the corporation.

Recommendations

The basis of risk management should be a purposeful search and organization of work to reduce risk, obtain and increase the return in an uncertain economic situation, and the degree of risk resistance is the probability of achieving the goals and objectives. Prospects and recommendations for further scientific studies are finding ways to mitigate risks based on their industry attribute.

Conclusion

Strategic risk management in corporate activities is defined as a system of purposeful influence on all manifestations, types of risk making it possible to avoid, reduce or minimize the negative consequences of the subjective nature of the market environment. Considering that the effectiveness of the mechanism of strategic management of economic risks of corporations depends on these components, the necessity of introduction of specific approaches in the process of their functioning is proved.

References

- David, L., Olson, & Desheng, D. Wu. (2008). Financial Engineering and Risk Management – Enterprise Risk Management, World Scientific Publishing Co. Pte. Ltd.

- Dess. G., Lumpkin. G., & Taylor, M. (2005). Strategic Management., McGraw-Hill Irwin Ed., New York

- Drobyazko, S., Barwi?ska-Ma?ajowicz, A., ?lusarczyk, B., Zavidna, L., & Danylovych-Kropyvnytska, M. (2019). Innovative entrepreneurship models in the management system of enterprise competitiveness. Journal of Entrepreneurship Education.

- French, S. (2009). Critiquing the language of strategic management. Journal of Management Development, 28(1), 6-17.

- Hofmann, E. (2010). Linking corporate strategy and supply chain management. International Journal of Physical Distribution & Logistics Management, 40(4), 256-276.

- Johnson, G., Whittington, R., & Scholes, K. (2011). Exporing Strategy: Text & Cases.

- Jüttner, U., Peck, H., & Christopher, M. (2003). Supply chain risk management: outlining an agenda for future research. International Journal of Logistics: Research and Applications, 6(4), 197-210.

- Makedon, V., Drobyazko, S., Shevtsova, H., Maslosh, O., & Kasatkina, M. (2019). Providing security for the development of high-technology organizations. Journal of Security & Sustainability Issues, 8(4).

- Malakhovskyi, Y., Gamaliy, V., Zhovnovach, R., Kulazhenko, V., & Cherednichenko, M. (2019). Assessment of the risks of entrepreneurship as a prerequisite for the implementation of innovation projects. Journal of Entrepreneurship Education, 22, 1-6.

- Manuj, I., & Mentzer, J. T. (2008). Global supply chain risk management. Journal of Business Logistics, 29(1), 133-155.

- Tetiana, H., Karpenko, L. M., Olesia, F. V., Yu, S. I., & Svetlana, D. (2018). Innovative Methods of Performance Evaluation of Energy Efficiency Projects. Academy of Strategic Management Journal.

- Zsidisin, G. A., Ellram, L. M., Carter, J. R., & Cavinato, J. L. (2004). An analysis of supply risk assessment techniques. International Journal of Physical Distribution & Logistics Management, 34(5), 397-413.