Research Article: 2018 Vol: 17 Issue: 5

Development of the Cost Management Mechanism for Metal Products Manufacturing Based on Budgeting Method

Olga Aleksandrovna Nikitina, Nosov Magnitogorsk State Technical University

Yulia Vladimirovna Litovskaya, Nosov Magnitogorsk State Technical University

Olga Stanislavovna Ponomareva, Nosov Magnitogorsk State Technical University

Abstract

The article is dealing with the cost management mechanism, which is based on the budget planning and control method. Quantitative indicators of resources and goals allow the corporate leader to see, compare and combine different elements that are used in the operation of the organization. Budgetary method can be applied not only in the management of the enterprise in general, but in cost management as well. Budgeting is an effective quantitative method of linking planning and control. The application of the budgeting method will allow reducing the time span between planning and control, since control is carried out continuously. To form the general expenditure budget of the enterprise, which will be an integral part of the enterprise’s consolidated budget, the developed mechanism involves the creation of end-to-end system of budgets of all structural units of the enterprise that fully covers all corporate costs. Practical implementation of the developed mechanism is carried out in terms of PJSC “Interregional Metallurgical Company”, the budget of which is expressed in terms of value reflecting plans for receipt and expenditure of financial, material and energy resources of the enterprise, the planned major economic indicators and projected outcomes of the enterprise, prepared and adopted in the prescribed manner for the planning period.

Keywords

Enterprise, Management, Profit, Budget, Budgeting, Cost, Resources, Control, Production, Planning, Competition.

Introduction

The management of the enterprise is an activity, which is directed on the regulation of manufacturing processes in accordance with the intended purpose. The purpose of enterprise’s, company’s or organization’s activity consists in its progressive development. The means to achieve this purpose consists in the maximization of profits, in particular, through cost management system. Thus, in the current economic conditions, the success of an enterprise largely depends on the efficiency of the cost management system (Litovskaya, 2002; Nikitina, 2005). The relevance of the chosen topic is connected with the fact that budget planning and control play an important role in the development of a company and in making more profit. Managing a company is impossible without financial planning of its work, as well as monitoring the implementation of the developed financial plans. Therefore, budget planning and monitoring of the results of a company’s operation become impossible without the formation of a budget as the main tool for flexible management.

Literature Review

In the work of Rasskazova-Nikolaeva (2014), the essence of the cost-accounting method of direct-costing is that permanent overhead costs are not included in the cost of production, but are directly attributed to the profit and loss account in the period when they occurred (Rasskazova-Nikolaeva, 2014). The advantages of this method are that the necessary information can be obtained from regular financial reports without creating additional accounting procedures. The profit of the period does not depend on the constant overhead costs when the reserve balances change. The laboriousness of distribution of overhead costs is reduced; it becomes possible to determine the contribution of each type of product to the formation of the profit of the enterprise. Disadvantages of this method are connected with the fact that many types of costs cannot be unambiguously assigned to the category of variables or constants, with lack of attention to constant costs and distortion of the financial result due to understating or overstating the value of previously produced products. The method creates an illusion of profitability of technologically complex projects that require significant investment. Kostina et al. (2017) outline such methods of cost accounting as standard costing and cost benchmarking (Kostina et al., 2017). Advantages of standard-costing are in the formation of the necessary information base for analysis and control of costs, visibility in reflecting deviations from the plan in the process of formation of costs, minimization of accounting work associated with the calculation of cost, timely provision of managers with information on expected costs of production. But the method is only applicable for periodically repeating costs. The success of its application depends on the composition and quality of the regulatory framework. It is impossible to set norms for individual types of costs. The essence of benchmarking is the ability to comprehensively assess the management of costs in an enterprise in comparison with a reference enterprise, which is a serious prerequisite for the gradual improvement of cost management based on the experience and technologies of other enterprises, but in the event of an incorrect choice of a benchmarking enterprise, the effectiveness of the method is reduced. All considered methods of cost accounting do not allow to track daily costs in the production process, are characterized by high labor intensity and do not have mechanisms for making managerial decisions while the use of the budgeting method makes it possible for the process of making managerial decisions in the conditions of limited financial resources to become flexible. In addition, it allows evaluating not only past costs but also the present and future ones.

Methods

The market conditions and tough competition increase the need for new cost management mechanisms based on budget planning and control methods. In our view, the use of the budgeting method for running costs is stipulated due to the following requirements (Nikitina 2005):

1. The process of responding to the changing production conditions requires daily cost tracking of the enterprise, its divisions, and particular operations, and is characterized by a high work labor input while there are no tools of managerial decision-making. Not so much the management information creation process becomes important, as the development of rapid response mechanisms.

2. Increasing the flexibility of many industries towards upgrading the range of products; limited financial resources require a stronger link between plans of the enterprise and monitoring the implementation of these plans.

3. Unlike traditional costing systems for cost management, today it is necessary to evaluate not only past costs but also current and the future costs.

The Russian practice gained over the market economy period has significantly lagged behind the western practice in implementing modern cost management methods. Until recently, Russian companies have used the conventional (cost-accounting) cost management method. Despite the serious theoretical investigations and practical developments, this cost management method does not meet the requirements of market economy mechanisms (Nikitina et al., 2016; Nikitina et al., 2017). Budgeting method in combination with the cost-accounting method is the most promising method of cost management in the context of Russian enterprises.

The concept of “budget” (Mescon, 2016) is a method of allocating resources to achieve the objectives outlined in the quantitative form. Quantitative indicators of resources and goals allow the corporate leader to see, compare and combine different elements, which are used in the organization’s operation.

The budgetary method can be used not only in enterprise management in general but in cost management as well (Rakhlis et al., 2016). Budgeting is an effective quantitative method of linking planning and monitoring. Application of the budgeting method will allow reducing the time span between planning and monitoring since monitoring is carried out continuously.

The expenditure budget represents, in our opinion, planned consumption of resources of the enterprise to fulfill the set goals expressed in quantitative (usually monetary) form for a certain period of time (day, decade, month, and year) (Litovskaya, 2002; Nikitina et al., 2016). The budgetary cost management method includes the traditional management functions, such as planning, accounting, control, analysis, and regulation. However, this method allows solving two main tasks (Nikitina, 2005); target rationale for the consumption of the resources available at the enterprise, and operational control of performance goals. Exactly these traits define the essence of the budgetary cost management method. The first step in budgeting is determining the purpose, based on the overall strategy of the enterprise. The purpose of the enterprise’s performance may be focused on increasing production volume, changing product mix, improving product quality, social transformation (improving the environment, enhancing labor and rest conditions for employees at the enterprise), etc. All the objectives of the enterprise are reflected in the budget, and maybe primarily, in the expenditure budget. To improve the efficiency of costs controlling as well as their variances, it is recommended directing accounting and cost control reports to three management levels: administrative (highest) level, divisions’ (medium) level, and production (lower) level. Each level needs the data to identify and solve problems arising in the course of enterprise performance. These data can be differently aggregated. It should also be noted that the total expenditure budget consists of costs budgets of divisions, which in turn are formed from the budgets of production cost centers and responsibility centers. This budget breakdown is needed to identify the root causes in case of deviation from the planned budget. Budget cost management and control mechanism should be built based on variable costs: first, they constitute the major part of steel products cost, and second, there is more opportunity to manage them, because variable costs refer to managed and swiftly managed costs (Burtsev, 2009). Semi-fixed costs practically do not depend on changes in production volume indicators. Therefore the main objective when analyzing them is reduced to control for deviations of actual values against planned ones, followed by further identifying the causes and factors that caused the changes, and making managerial decisions. This does not require enhanced rapidness in such management.

The main advantages of implementing the budget planning system in PJSC “Interregional Metallurgical Company” are:

1. The possibility of forming a cash flow budget, which is formed from requests for payment, resulting from time management, requirements for materials, mechanisms, etc., and the entry of an income plan. This budget allows seeing possible cash gaps and implementing preventive measures. Possible delays in the payment of receivables will become more predictable, which will improve the management of financial flows. There will be an opportunity to use credit resources to replenish working capital (overdraft, revolving credit line). As a result, the financial position in terms of current assets will become more stable.

2. The possibility of carrying out the activities of the units on the principle of “economic calculation”. Deriving an accurate financial result will allow to set up an effective system of motivation for each employee.

3. Effective motivation of all specialists also carries controlling functions. The emerging self-regulating control mechanism with accurate informative mapping will allow abolishing the organizational structures, the main functions of which were control over the economic efficiency of the units.

Results

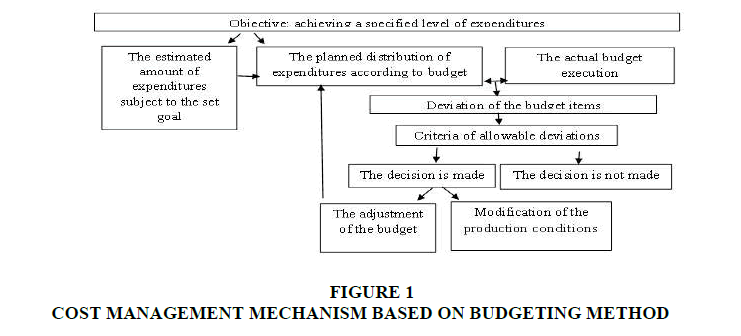

Schematic representation of the proposed cost management mechanism, based on budgeting method is presented in Figure 1.

Proceeding from the set goal that defines a given level of cost, the enterprise generates budget items, i.e. creates a planned budget of variable costs. Accounting information captures the actual consumption of production resources. Control of budget execution is available through the assessment of deviations of the actual budget items against the planned ones (Litovskaya, 2002; Rakhlis et al., 2016). The establishment of maximum allowable variations of the budget items against the predetermined level will provide a management system of criteria, which are required to make managerial decisions. In the event of a deviation below the allowable level, the decision is not made, while in case of deviation above the allowable level, two measures can be undertaken, namely adjustment of the budget, or modification of the production conditions.

In order to avoid double counting of expenditures using process product-costing system in metallurgical production, the developed budgeting mechanism involves consideration of material, fuel, energy, and labor costs in the each redistribution that is carried out separately from the semi-finished products, the costs of which already include past costs of a similar kind. When using the proposed mechanism, control and management will be made only over the variable cost of the given redistribution. The production costs of semi-finished products are not taken into account, because they have been considered at the previous redistributions.

To establish the general expenditure budget of the enterprise, which will be an integral part of the consolidated budget of the enterprise, the developed mechanism involves the creation of end-to-end budgets system of the enterprise, i.e., budgets of all structural units that fully cover all costs of the enterprise. The essence of the general expenditure budget of the enterprise lies in the fact that every budget of the lower level serves as the detailed budget of a higher level, that is, the budgets of the production units are “nested” into the production budget, while production budget substantiates consolidated (comprehensive) budget (European Council, 2010; Ezdakova, 2013; Ivanova & Soldatova, 2012). Total expenditure budget, generated monthly on the basis of the expenditure budgets of the subdivisions, is presented in the following form (Table 1).

| Table 1 The Total Expenditure Budget |

|||||

| Name of subdivision | Budgets | Total general expenditure budget of the structural unit | |||

| Payroll budget. | Raw material cost. | Fuel and energy consumption. | Miscellaneous costs. | ||

Thus, the expenditure budget should become an integral part of the consolidated budget of the enterprise that will ensure the integrity and interconnectedness of enterprise’s activity aspects in fulfilling a single goal (Vitkalova & Miller, 2011).

Discussion

In the article we proposed methodology of assessing the sensitivity of the expenditure budget elements (items) against changes of key parameters. The proposed methodology is necessary to assess the quality of budgeting and forecasting possible situations. The algorithm of sensitivity analysis of budget items against deviations of governing parameters includes the following 5 steps:

1. Selecting the most significant (assessable) budget item.

2. Defining the correlation between the selected budget item and governing variables. These variables can be defined as production parameters selected for analysis. The number of such parameters should not be too large, otherwise it will be difficult to interpret or use the analysis result. In the end, the estimated indicator is defined as the function of just a limited number of key variables of the model. Other variables in the model are treated as constants.

3. Determining probable or anticipated valid ranges of key variables.

4. Calculating the expenditure budget for the adopted ranges of key variables, and using them to plot graphs showing the dependence of the expenditure budget on changes in production parameters.

5. Comparing the obtained charts with each other to determine the parameters which have the greatest effects on the assessed indicator.

The developed mechanism was practically implemented in the context of PJSC “Interregional Metallurgical Company”. The budget of this company represents planned receipts and expenditures of financial, material and energy resources of the enterprise, expressed in terms of value, as well as the planned major economic indicators and projected outcomes of the enterprise, prepared and adopted in the prescribed manner for a certain planning period.

Conclusion

Budget execution planning and control is expected to be carried out at the department of economic analysis and budget planning of the Department for the Economy. The information required for budget planning comes from other departments and offices. After being generated, the budget is distributed between production units. Control over budget execution is exercised at two levels. At the first level, control is carried out in the production units, while at the second level it is carried out at the department of economic analysis and budget planning based on information collected from the production units. The department of economic analysis and budget planning examines the degree of deviations of the actual budget against the planned budget. In the event of deviation below the allowable variation criterion, no measures are undertaken. In case of deviation greater than the allowable variation criterion, it is necessary to carry out the analysis of causes of deviations. Then the information is submitted to the corporate management, which takes decision either to adjust the budget, or to change production conditions.

It should be noted that the generation of budget items should be based on reasonable norms of consumption of material, labor, and financial resources. This requires the use of management mechanisms and maintenance of the required quality of regulatory economy of the enterprise. The use of scientifically grounded models to manage normative economy will not only allow establishing quality standards, but also supporting quality regulatory economy practices (Mescon, 2016).

Assessing the effect of production parameters on the budget items and implementing budgetary cost management mechanism requires calculation of allowable variations of the actual variable costs against their budget level (Nikolaev, 1996).

Proceeding from the allowable variation of the budget adopted at PJSC “Interregional Metallurgical Company” within 5%, we defined allowable variations for each element of variable costs, such as raw materials, fuel and energy resources, and the cost of labor. These variations are local, that is, determining individual variations of each element without considering other elements. More accurate determination of allowable variations requires consideration of comprehensive variations of all budget elements. The obtained results allowed ranking elements according to the importance of their variation and the desired rate of response. Among noted the most significant elements we have selected iron ore, pellets, and technological coals. Even slight variations of these elements cause a fairly strong effect and require an immediate response (Mescon, 2016).

Selected budget elements were studied in terms of their sensitivity with regard to changes in the governing parameters. The main among such parameters were the production volume, the price of material resources, the rate of consumption per unit of production (per ton of production), and production structure.

Based on calculated allowable variation of the budget element, we have set the limit values of the governing parameters, such as the production volume, the price of material resources, and consumption norms. These values are calculated at the local effects that are based on determination of individual variations of each parameter without taking into account other parameters. More exact determination of allowable values requires consideration of integrated effect of parameters on the concerned budget item. The obtained results allowed determining the maximum allowable variation of governing parameters. The higher values of the governing parameters require an immediate response: either change of the production conditions, or budget adjustments.

Monitoring and control of variations of the actual production parameters against those used when generating the budget, and their comparison with allowable variations will increase efficiency in identifying and responding to changing production situations, as well as will allow carrying out strategic cost management.

References

- Burtsev, V.V. (2009). Managerial accounting and production budgeting. Modern Accounting, 7, 30-32.

- European Council. (2010). EUCO7/10. Retrieved from http://register.consilium.europa.eu/doc/srv?l=EN&f=ST%207%202010%20INIT

- Ezdakova, E. (2013). Peculiarities of the construction activities in the development and implementation of the in-line controlling system at the enterprise. Proceedings of the IX All-Russian Scientific-Practical Conference with International Participation Contemporary Problems of Regional Economy Management.

- Ivanova, O.E., & Soldatova, L.I. (2012). Organizational and managerial approaches to construction of organization budgeting system. Economic Analysis: Theory and Practice, 10, 46-52.

- Kostina, N.N., Ivlev, A.V., Skvortsova, N.V., Rakhlis, T.P., Balynskaya, N.R., & Abilova, M.G. (2017). Formation and development of professional competence of bachelors in engineering in the process of economic education. Man in India, 97(5), 53-74.

- Litovskaya, Y.V. (2002). Cost management strategy in steel product manufacturing. Ph.D. Thesis, UGTU, Yekaterinburg.

- Mescon, M. (2016). Fundamentals of management. Transl. from Engl. Moscow: Williams.

- Nikitina, O.A. (2005). Development of design methodology for stamping of aluminum panels with single-sided fins using the vertical hydraulic presses. Ph.D.Thesis, Moscow State University of Steel and Alloys, Moscow.

- Nikitina, O.A., Litovskaya, Y.V., Savinkova, T.A., Zinovyeva E.G., & Ponomareva, O.S. (2017). The use of the budget planning mechanism in construction companies: Evidence from LLC Stroytekhnologiya. Revista ESPACIOS, 38 (33), 17.

- Nikitina, O.A., Slobodyanik, T.M., & Melikhova, Yu.M. (2016). Development of the action plan on restructuring of accounts payable in repair business. Guide to Entrepreneur, 31, 114-120.

- Nikolaev, S. (1996). Managerial accounting and accounting system in Russia. Economics and Life, 44, 29.

- Rakhlis, T.P., Skvortsova, N.V., Koptyakova, S.V., & Balynskaya, N.R. (2016). Development of microelectronics in the circumstances of the innovative and technological growth of the Russian economy. International Business Management, 10(4), 401-407.

- Rasskazova-Nikolaeva, S.P. (2014). Direct-costing. True cost price. Moscow: Knizhniy mir.

- Vitkalova, A.P. & Miller, D.P. (2011). Budgeting and cost control in the organization.