Research Article: 2021 Vol: 20 Issue: 2S

Development of the Kazakhstan Digital Retail Chains within the EAEU E-commerce Market

Sergey Yevgenievich Barykin, Peter the Great St. Petersburg Polytechnic University

Elena Smirnova, St. Petersburg State University of Economics

Petr Sharapaev, Mazhilis of the Parliament of the Republic of Kazakhstan

Angela Mottaeva, Moscow State University of Civil Engineering

Keywords

Digital Retail Chains, Eurasian Economic Union, Republic of Kazakhstan, Digital Trading Platforms, E-commerce

Abstract

The article covers the theoretical and practical experience which could be implemented for the designing of Kazakhstan digital retail chains. The lack of the studies in the field of the operation of digital retail chains in Kazakhstan's e-commerce market within the EAEU could be defined as a research gap. The authors consider the research task as studying the features of the digital retail chains of the Republic of Kazakhstan and the potential of its development in the e-commerce market within the EAEU. The article aims in investigating the advantages and disadvantages of the infrastructure for the development of the digital retail chains and in general e-commerce in Kazakhstan. The authors explore the product distribution system in the sphere of trade, promoting growth in the country’s retail chains, particularly, in the field of online commerce. The research methods include both the system analysis and PEST method, as well as the comparative analysis and synthesis, allowing to trace the main trends in the development of the Kazakhstan's digital retail chains in the e-commerce market. As we have established, the main findings include the specific drivers of the development of Kazakhstan’s digital retail chains. The most significant advantage of the infrastructure for the digital retail chains could be observed from the active introduction of digital technologies, influencing the development of e-commerce and leading to a shift in emphasis when configuring the network structure of physical retail chains, as well as the development of new models of interaction between counterparties. The topics of further research on Kazahkstan's e-commerce market could be developing recommendations for building an integrated digital platform that will allow to perform trade and logistics operations quickly, safely and with minimal costs.

Introduction

The Research Question and the Purpose of the Study

The retail chains of the Republic of Kazakhstan are affected by various factors, both positively and negatively affecting their development. In recent years, the active implementation of digital technologies has influenced the development of e-commerce and led to a shift in configuring the network structure of retail chains, as well as the designing of new models of interaction between counterparties on the basis of the digital technologies. The research question could regard the advantage of the marketplaces which mostly depend on trading platforms providing information about third-party products or services that can be purchased through digital platform (Genkin & Mikheev, 2020). The e-commerce marketplace could be considered as a reseller providing services to promote products from the seller to the consumer through e-commerce tools.

The question that we have formulated for the purposes of our analysis is what current factors influence the trading networks operating in Kazakhstan's e-commerce market within the EAEU, and the factors that can affect the situation in the future. Considering the peculiarities in the evolution of Kazakhstan’s trading networks, we set the goal to identify the drivers that either contribute to successful development of e-commerce in Kazakhstan or hinder it. The existing theoretical and practical problems are rather poorly understood in terms of the principles and methods for integration of trade processes, their analysis and justifications for their effectiveness in the digital economy. The operation of the digital retail chains and in general e-commerce in Kazakhstan.is a complex and multifaceted problem, making research in this direction all the more important.

The article aims in investigating the advantages and disadvantages of the infrastructure for the development of the digital retail chains and in general e-commerce in Kazakhstan. The authors attempt to explore the marketplaces, as platforms for searching for necessary products, are beginning to outpace search engines and social networks. In Kazakhstan, the share of direct traffic on Satu.kz is 10%, Lamoda.kz 37%, OLX 40%, Aliexpress 64% (Chung, 2019; Lund & Manyika, 2016; Nakip & Gökmen, 2017). This trend could be explained by the fact that customers tend to make purchases quickly, conveniently and safely. Fast delivery and the level of logistics service are also important criteria. According to Euromonitor, the volume of the e-commerce market of the Republic of Kazakhstan in 2018 amounted to 287 billion tenge, which is 23.2% more than in 2017.

The researchers could prove that the experts have accumulated considerable theoretical and practical experience on the problem of trading networks, but the specific issues related to the functioning of trading networks in Kazakhstan's e-commerce market within the EAEU have been the focus of considerably less attention in analytical studies.

Methodological Aspects

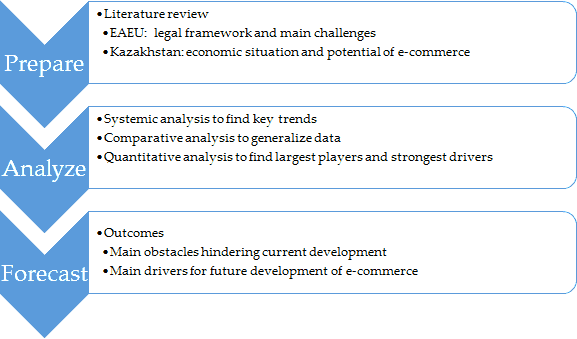

The methods used in the study consisted in applying the provisions of system analysis, comparative analysis and synthesis, allowing to trace the main trends in the development of of the digital retail chains and in general e-commerce of the Republic of Kazakhstan within the EAEU. The general structure of the methodology that we followed in the course of this study is shown in Figure 1.

Elements of systematization, generalization of statistical data, quantitative analysis, and the method of analytical groupings were used to plot the graphs and compile the tables. PEST analysis has been used for identifying both the advantages and disadvantages of the infrastructure for the development of the digital retail chains in the Republic of Kazakhstan.

PEST analysis is a long-established methodology for examining the external macro- environment of the organization (Ross S, 2008). PEST analysis categorizes the factors affecting the organization under four headings (https://pestleanalysis.com/what-is-pest- analysis/), namely:

1. Political

2. Economic

3. Social

4. Technological

The authors have chosen the PEST analysis because of being a simple and widely used tool for analyzing the Political, Economic, Socio-Cultural, and Technological changes in the business environment (https://www.mindtools.com/pages/article/newTMC_09.htm). This type of analysis could be used in different fields (Atkinson, 2003; Cox, 2020) and allows to describe the “big picture” forces of change that the object of the research is exposed to, and, from this, take advantage of the opportunities that they present.

Literature Review

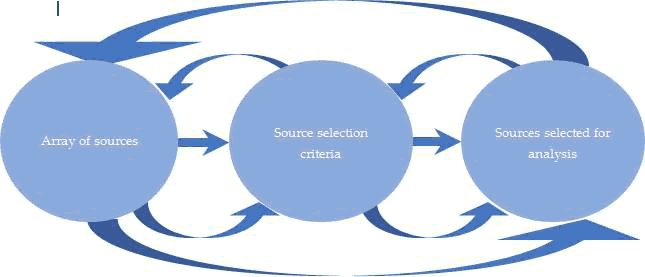

Analysis of the sources was carried out in accordance with the logic proposed for the scientific search, taking into account the interdependence between the sources (shown as arrows in Figure 2). The stages of the search were repeated in the process of consolidating the data. This procedure made it possible to analyze the accumulated sources based on the relationship between the scientific data selected and the actual publications.

The creation of the Eurasian Economic Union (EAEU), which includes the Republic of Armenia, the Republic of Belarus, the Republic of Kazakhstan, the Kyrgyz Republic and the Russian Federation was the result of integration processes taking place in the post-Soviet space. The EAEU is a form of international economic integration of countries' economies in order to strengthen their competitive positions in world markets. The Union's member states have created more than 1,150 different objects of industrial and innovative infrastructure in the field of industry and innovation, including 50 free economic zones, 100 industrial parks, 100 different clusters and development zones, 200 technoparks, 300 business incubators, and 400 centers for the development of science and innovation (Petrovich et al., 2020). The implementation of the integration potential of all the EAEU countries allowed achieving a synergistic effect in the field of Eurasian economic integration, which led to both an increase in mutual trade between the EAEU countries and an increase in trade with third countries, as evidenced by analytical studies (for example, (Bayadyan & Baghdasaryan, 2017; Kasyanov & Kriger, 2020; Krasnov et al., 2019; Malle, Cooper & Connolly, 2020; Maslova et al., 2019; Pak & Iwata, 2020). The legal framework of the EAEU regulates the main directions of the Union's development (Alimkhanova, 2020; Diyachenko & Entin, 2017; Karliuk, 2017). The main tasks facing the EAEU can be divided into several blocks:

1. Activities in the field of customs-tariff and non-tariff policy (Zaurbekova, 2020):

• Harmonization of customs rates with the rates of the common customs tariff of the EAEU;

• Reallocation of customs duties;

• Creating an export support system;

• Creating a system for filing a customs declaration and releasing goods automatically;

• Modernization of the institute of authorized economic operators;

• Development of unified measures of tariff and non-tariff regulation.

2. Activities in the area of trade policy (Kasyanov, 2019):

• Formation of a single market for goods and services;

• Development of digital trade in the EAEU;

• Development of trade regimes for countries outside the EAEU;

• The management of trade statistics;

• Development of rules for regulating markets for goods and services;

• Protection of intellectual property results;

• Creation and development of internal market protection measures;

• Development of mutual trade between the EAEU member States.

3. Activities in the area of industrial policy (Gagarina et al., 2019):

• Implementation of a coordinated industrial policy;

• Development of industrial cooperation;

• Creation of a system of cross-border antimonopoly regulation;

4. Activities aimed at the development of logistics and information infrastructure (RAIMBEKOV et al., 2019; Tsurkan, Irina & Pilipchuk, 2020):

• Formation of a single transport space;

• Development of transport corridors;

• Organization of cross-border transport;

• Creation of a unified system for the transit of goods through the customs territory of the EAEU;

• Formation of a common innovation infrastructure;

• Implementation and recognition of electronic accompanying documents;

• Creation of a system for identifying participants in foreign economic activity;

• Creation of a unified system of normative reference information;

• Implementation of a coordinated policy in the field of ICT;

• Formation of digital platforms for the provision of electronic interstate services;

• Creation of an integrated information search system;

• Unification of the ‘single window’ mechanism in all EAEU member States.

At the same time, it is important to note the need to implement the integration potential of all the EAEU countries, since this approach will allow achieving a synergistic effect in the field of Eurasian economic integration, which will lead to an increase in mutual trade between the EAEU countries.

The administrative territory of the Republic of Kazakhstan consists of 14 regions and 3 cities that have the status of national significance: the capital of the Republic of Kazakhstan is Astana, as well as Almaty and Chimkent. The total territory of the country is 2,724.9 thousand square kilometers (the ninth largest area in the world). The Republic of Kazakhstan shares land borders with Russia, China, Kyrgyzstan, Uzbekistan and Turkmenistan. Kazakhstan does not have direct access to the world ocean, but has access to the Caspian and Aral seas. The transport and transit potential of Kazakhstan is aimed at implementing the New Silk Road project, which will restore the country's historical role as the largest transport and logistics hub in the region. In 2014, the Nurly Zhol program was adopted and implemented (Zhekenov, Darkenbaev & Zhunisov, 2020), aimed at developing the country's logistics, industrial and social infrastructure. Digitalization is already transforming all the segments of transport and logistics, and according to forecasts, this will be the strongest trend in the coming years, which will radically change all the logistics activities. The Industry 4.0 is the major driver of majority digitalization operations, which include Logistics 4.0, as well.

The main purpose of logistics 4.0 is digitalization of related logistics operations to increase effectiveness, profitability, productivity and optimization of costs and time. Based on the growth rate, the digitalization of logistics is one of the main factors and driving forces of Kazakhstan’s economic growth (Kong, 2020). Kazakhstan's main trading partners are Russia, China, Europe and the CIS. The country has a positive foreign trade balance: the volume of exports exceeds the volume of imports. The most important export products are mineral raw materials, copper, iron ore, inorganic chemical products, cereals, etc. The most important imported goods are machinery and equipment, including electrical machines, vehicles, iron products, plastics, pharmaceuticals, etc. Over the past decades, the trade sector of the Republic of Kazakhstan has undergone a reorganization of the commodity distribution system, which has led to the growth of retail chains in the country, as evidenced by analytical studies (for example, (Bukharbayeva et al., 2020; Mekhdiev et al., 2019; Nakip and Gökmen, 2017; Rotaru, 2018)). This trend is typical for the entire global retail market. For example, according to Deloitte, the retail market in 2017 was characterized by the following indicators (Deloitte, 2017):

1. The share of the world's 250 largest retail chains in total turnover was 4.53 trillion USD (18.1 trillion USD on average per company);

2. The largest number of retail chains, 87 companies, or 34.8%, is registered in Europe, their share in the total turnover is 33.8%;

3. The largest number of retail chains organizes international supply chains with sales in different countries, on average in 13 countries per retail chain;

4. The most attractive are retail chains that specialize in the sale of daily demand goods (FMCG)-138 out of 250 retail chains operating in this segment, that is 55.2%; their total revenue is 66.2%.

E-commerce has become particularly relevant in recent years. Some researchers have identified four characteristics of e-commerce: global, direct, convenient, and equal. Thanks to these properties, e-commerce has a huge impact on the economy, culture and daily life of modern society (Li, 2020).

Thus, according to the research company E-Marketer (eMarketer, 2019), the volume of the global e-commerce market in 2021 will reach USD 5 trillion. The top ten countries by the size of the e-commerce market include countries such as China, USA, UK, Japan, Germany, France, South Korea, Canada, Russia, Brazil.

World ranking presented in the study by Akhmetova et al. (Akhmetova et al., 2020) is based on 4 indicators: by the size of the online market, the leading places are taken by the countries: USA, China, Great Britain, UK, South Korea and Germany according to consumer behavior ratings; by the indicator - the growth potential of the e-commerce market in Russia, Germany, Australia; infrastructure is developed in Japan, USA and South Korea. In the Republic of Kazakhstan, trade is most actively developing in Nur-Sultan and Almaty (the largest markets in terms of population and income level). In particular, by 2018, the level of high-quality retail real estate in Nur-Sultan and Almaty amounted to 40% of the total fund of high-quality retail real estate in Kazakhstan (Yemelina, Omarova & Anara, 2018).

Results

Conducting an analysis on different aspects characterizing the evolution of of the digital retail chains and in general e-commerce market of the Republic of Kazakhstan within the EAEU, we found several contributing factors that were either beneficial or detrimental to the development of e-commerce.

The total volume of the vacant e-commerce market of the Republic of Kazakhstan for foreign investors by 2020 is estimated (Akhmetova et al., 2020) at USD 200 million, with a total market volume of USD 420 million. The attractiveness of the e-commerce market for foreign investors is determined by the following factors that contribute to the realization of the potential of e-commerce:

• High level of distribution of devices with Internet accesses overall the country;

• High level of distribution of online commerce in all segments of the population;

• Availability of logistics infrastructure allowing delivery of goods to consumers.

In addition, the level and speed of e-commerce development in the Republic of Kazakhstan is determined by such trends as the active use of social networks and mobile applications as a payment form for making purchases.

According to statistical information provided by the Ministry of national economy of the Republic of Kazakhstan, the share of the e-commerce market in monetary terms was 2.9% of the total retail market. At the same time, according to a survey by AST Kazakhstan, which was conducted in 2019 among residents of Almaty, 39% of respondents did not make purchases via the Internet during the year. These are mostly men and women over the age of The most significant factors when making a purchase through e-commerce are the following (Abdunurova & Surapbergenova, 2019):

• Ability to deliver goods;

• Security of payment;

• Availability of positive reviews;

• cost of goods or services;

• Convenient payment method;

• Possibility of fitting before purchase;

• brand (products of famous brands);

• The ability to quickly return the product and money;

• Easy to use website.

The top 20 largest Kazakhstan online trading platforms are presented in Table 1.

| Table 1 Top 20 Largest Online (Digital) Trading Platforms in Kazakhstan (compiled based on [16]) |

|||||||||

|---|---|---|---|---|---|---|---|---|---|

| # | The digital retail chains | Category | Sector | Geography of presence | Head office, year of launch | Revenue, USD million | Average check, USD | Average monthly attendance | Average monthly online orders placed to completed online orders |

| 1 | Kaspi.kz | Marketplace | Trading platforms | all of Kazakhstan | Almaty, 2014 | 338 | 284.3 | 2 760 000 | 155 500 / |

| 99 000 | |||||||||

| 2 | Airastana.com | Passenger transport | Online store | Whole world | Almaty, 2001 | 110 | 363.6 | 747 000 | 25 150 / |

| 25 150 | |||||||||

| 3 | Chocotravel.com | Ticket sale | Online store | all of Kazakhstan | Almaty, 2013 | 74 | 168.6 | 262 375 | no data/ |

| 438 703 | |||||||||

| 4 | Aviata.kz | Ticket sale | Online store | all of Kazakhstan | Almaty, 2013 | 73.4 | 69 | 345 792 | no data/ |

| 1 064 758 | |||||||||

| 5 | Wildberries.kz | Clothing sales | Online store | all of Kazakhstan | Almaty, 2004 | 37.9 | 53.6 | 1 833 000 | no data/ |

| 163 058 | |||||||||

| 6 | Tickets.kz | Ticket sale | Online store | More than 30 countries | Vienna, 2009 | 37.6 | 46.8 | 388 000 | 84 000 / |

| 67 000 | |||||||||

| 7 | Lamoda.kz | Clothing sales | Online store | all of Kazakhstan | Moscow, 2011 | 32.94 | 116.4 | 726 958 | no data |

| 8 | Sulpak.kz | Electronics | Online store | Kazakhstan, Kyrgyzstan | Almaty, 2009 | 26.9 | 229 | 675 385 | no data/ |

| 9 821 | |||||||||

| 9 | Technodom.kz | Electronics | Online store | Kazakhstan, Kyrgyzstan | Almaty, 2002 | 21.7 | no data | 1 342 083 | no data |

| 10 | Epay.railways.kz, bilet.railways.kz | Passenger transport | Online store | CIS and Baltic States | Nur-Sultan, 2000 | 21.4 | 16.4 | 752 708 | no data |

| 11 | Santufei.com | Ticket sale | Online store | all of Kazakhstan | Almaty, 2014 | 19.7 | 227.9 | 167 000 | 14 094 / |

| 7 476 | |||||||||

| 12 | Scat.kz | Passenger transport | Online store | Whole world | Shymkent, 1997 | 18.45 | 139.5 | 150 015 | 17 921 / |

| 11 018 | |||||||||

| 13 | Kolesa.kz | Classifieds | Trading platforms | Kazakhstan, Uzbekistan | Almaty, 2016 | 18.3 | no data | 5 582 259 | no data |

| 14 | My.avon.kz | Niche stores | Online store | all of Kazakhstan | London, 1886 | 12.7 | 45.4 | 103 100 | no data |

| 15 | Shop.kz | Electronics | Online store | all of Kazakhstan | Karaganda, 2000 | 10.25 | 165 | 948 833 | no data |

| 16 | Ticketon.kz | Ticket sale | Online store | Kazakhstan, Uzbekistan, Tajikistan, Kyrgyzstan | Almaty, 2012 | 10.15 | 18.7 | 825 00 | 292 462 / |

| 59 480 | |||||||||

| 17 | Chocolife.me | Coupon code | Online store | all of Kazakhstan | Almaty, 2011 | 7.8 | 8.6 | 261 208 | no data / |

| 913 172 | |||||||||

| 18 | Mechta.kz | Electronics | Online store | all of Kazakhstan | Nur-Sultan, 2007 | 7.5 | 162 | 377 208 | no data |

| 19 | Kz.oriflame.com | Niche stores | Online store | 60 countries | Stockholm, 1967 | 5.83 | no data | no data | no data |

| 20 | Bonprix.kz | Clothing sales | Online store | Europe, North and South America, Asia | Hanover, 1949 | 5.1 | 50 | 267 292 | no data |

Let us consider the data presented in Table 1 by the method of analytical grouping to explore the characteristics of the largest digital trading platforms in Kazakhstan by category. The results obtained are given in column 3 of Table 2.

| Table 2 Largest Digital Platforms in Kazakhstan Grouped By Category [Compiled By The Authors] |

|||

|---|---|---|---|

| No. | Category | Sector | Revenue, USD million |

| 1 | Marketplace | Trading platform | 338 |

| 2 | Ticket sales | Online store | 214.85 |

| 3 | Passenger transport | Online store | 149.85 |

| 4 | Clothing sales | Online store | 75.94 |

| 5 | Electronics | Online store | 66.35 |

| 6 | Niche stores | Trading platform | 18.53 |

| 7 | Classified | Online store | 18.3 |

| 8 | Coupon sales | Online store | 7.8 |

The study revealed that the categories of the most profitable online platforms involve platforms of digital retail chains offering e-ticket services, passenger transportation, as well as the following groups of goods: clothing, electronics, and niche stores such as Avon and Oriflame. The largest digital trading platform in Kazakhstan is the marketplace Kaspi.kz with revenue of USD 338 million per year. Kaspi.kz could be defined as a digital ecosystem that includes various services for individuals and legal entities in such areas as: Finance, including money transfers, online loans for the purchase of cars, purchase of goods and services, etc. Currently Kaspi.kz offers payment for orders Kaspi Gold, Kaspi Red and Kaspi Bonus.

Special attention should be paid to such specific online stores as, for example, Chocolife.me, specializing in the sale of discount coupons. This service offers a search for discount coupons for various products, services, or jobs with the coupons being sold.

The authors suggest considering such an informal type of digital platform for making person- to-person transactions as “Classified Ads”. Person-to-person transactions typically fall into an ‘informal” category, because there is no record of the transaction, no tax assessed, and no official ‘status’ of the parties involved. A platform that facilitates person-to-person transactions is very different from a commercial digital ecommerce platform. This type of digital platforms could be considered as a service that hosts applications from individuals and legal entities with offers for the sale of goods, works or services. These ads are grouped into various categories that make it easier to find the right product. At the same time, classifieds are a digital platform that offers information and technical solutions required to ensure interaction between buyers and sellers. The largest classified in Kazakhstan is Kolesa.kz, which specializes in placing ads for the sale, purchase or lease of cars and trucks, motorcycles, buses, special equipment, etc., as well as spares parts for them and services of car service centers. The authors use PEST analysis for identifying both the advantages and disadvantages of the infrastructure for the development of the digital retail chains in the Republic of Kazakhstan (Table 3-6).

| Table 3 Pest Analysis of Digital Retail Chains of The Republic of Kazakhstan (Political Factors) |

||||

|---|---|---|---|---|

| Political factor | Factor weight | Influence coefficient | Weighted influence of a factor | Influence on retail chains |

| Government support | 0.3 | 4 | 1.2 | Providing preferences within special economic zones and government support for retail and Internet trade at the level of government programs contributes to the development of retail chains |

| International integration | 0.4 | -3 | -1,2 | Decrease in the price of final goods by reducing the cost of export and import operations in the EAEU countries and increased competition due to the entry of new Kazakhstan trade networks of the EAEU countries on the one hand, contributes to the development of trade in the country. On the other hand, there is a threat of ousting less competitive national retail chains from the domestic market |

| Legal regulation | 0.3 | 3 | 0,9 | The Law of the Republic of Kazakhstan dated 02.04.2019 No. 241-V? ??? “On Amendments and Additions to Certain Legislative Acts of the Republic of Kazakhstan on the Development of the Business Environment and Regulation of Trade Activities” introduces the concept “E-commerce” creates conditions for the organization of fulfillment centers that provide a full range of services for the delivery, storage, packaging, payment of goods, which has a positive effect on the development of retail chains |

| Total for political factors | 0.9 | Conclusion: Currently, political factors have a weak positive impact on the development of retail chains through the provision of state support and the development of regulatory and legal regulation | ||

| Table 4 Pest Analysis of Digital Retail Chains of The Republic of Kazakhstan (Economic Factors) |

||||

|---|---|---|---|---|

| Economic factor | Factor weight | Influence coefficient | Weighted influence of a factor | Influence on retail chains |

| The share of trade in GDP | 0.2 | -2 | -0,4 | The share of trade in GDP is about 17%, the number of employed is about 1.3 million people (15% of the total employed population), which is not enough according to forecasts, the volume of GDP will grow by 2025 1.1% due to the development of e-commerce |

| The share of industry in GDP | 0.2 | -3 | -0.6 | The share of industry in GDP is about 34.1%, the number of employees is about 20.4%. At the same time, the country does not have a sufficient number of producers capable of producing products in sufficient volumes to fill retail chains. This slows down the pace of development of retail chains |

| National currency exchange rate | 0.1 | 2 | 0.2 | The stable exchange rate of the Kazakhstani tenge allows planning the activities of retail chains both in the short and long term |

| No restrictions on foreign direct | 0.2 | 3 | 0.6 | No restrictions on foreign direct investment contributes to the development of trade networks. |

| investment | For reference: Forbes Kazakhstan estimates the total volume of the vacant food trade market of the Republic of Kazakhstan for foreign investors by 2020 at 1,263 billion tenge (about 3.3 billion US dollars), with a total market volume of 660 billion tenge (about 1.7 billion USD). | |||

| By 2020, Forbes Kazakhstan estimates the total volume of the vacant market for trade in non-food products in the Republic of Kazakhstan for foreign investors at 4,500 billion tenge (about 11.7 billion US dollars), with a total market volume of 1,400 billion tenge (about 3.6 billion US dollars). |

||||

| Growth of the e- commerce market | 0.3 | 3 | 0.9 | The growth of the e-commerce market is driving the development of retail chains. |

| For reference: The volume of the e-commerce market of the Republic of Kazakhstan amounted to 287 billion tenge in 2018, which is 23.2% more compared to the same indicator in 2017 | ||||

| Total by economic factors | 0.7 | Conclusion: | ||

| currently, economic factors have a positive impact on the development of retail chains due to the growth of foreign direct investment in trade and the development of e-commerce | ||||

| Table 5 Pest Analysis of Digital Retail Chains of The Republic of Kazakhstan (Social Factors) |

||||

|---|---|---|---|---|

| Social factor | Factor weight | Influence coefficient | Weighted influence of a factor | Influence on retail chains |

| Population | 0.3 | -3 | -1.5 | The population of the Republic of Kazakhstan is 18,265,000 people as of 01.01.2019. Small population slows down the pace of development of retail chains |

| Population density | 0.3 | -3 | -1.5 | The Republic of Kazakhstan has a very low population density, about 6.5 people per 1 km2. The population is unevenly distributed: in the north, east and south, the population density is higher, all major cities of the country are located there. There are several large cities in the west. The center of the country has a very low density. this area is of little use for life. Low population density and uneven distribution across the country slows down the pace of development of retail chains |

| Average salary | 0.4 | -5 | -2 | Average salary in the Republic of Kazakhstan in 2018 amounted to about 40,000 tenge (7,440 rubles or 123.5 USD) shows low purchasing power of the population, which slows down the pace of development of trade networks |

| Total for social factors: | -5 | Conclusion: currently, social factors have a significant negative impact on the development of retail chains due to the low purchasing power of the population | ||

| Table 6 Pest Analysis of Digital Retail Chains of the Republic of Kazakhstan (Technological Factors) |

||||

|---|---|---|---|---|

| Technological factor | Factor weight | Influence coefficient | Weighted influence of a factor | Influence on retail chains |

| Uneven development of logistics infrastructure | 0.4 | -1 | -0.4 | Developed logistics infrastructure in areas with high population density allows efficient delivery of goods to consumers and contributes to the development of retail chains, especially in the field of e-commerce, by accelerating and simplifying the movement of material flow. Reverse situation in areas with low population density |

| Development of digital and electronic technologies in the field of sales | 0.3 | 4 | 1.2 | The development of digital and electronic technologies in the field of sales contributes to the growth of online sales by accelerating and simplifying the movement of information flow |

| Development of an electronic payment system | 0.3 | 4 | 1.2 | Development of an electronic payment system contributes to the growth of online sales by accelerating and simplifying the movement of financial flow |

| Total for technological factors: | 2 | Conclusion: at present, technological factors have a positive impact on the development of retail chains by improving digital and electronic technologies in the field of sales and the development of an electronic payment system. The limiting factor is the uneven development of the logistics infrastructure | ||

The results of the PEST analysis show that the most of the identified factors generally have a positive impact on the development of digital retail chains in the Republic of Kazakhstan and their competitiveness. At the same time, the most significant advantages stem from the technological factors, the action of which is aimed at the development of electronic network trade. Political and economic factors also have a positive impact on the development of retail chains.

The most significant disadvantages of the infrastructure for the development of digital retail chains in the Republic of Kazakhstan and their competitiveness stem from social factors: the low number and, as a consequence, the low and uneven population density and low wages, cause low paying capacity of the population (especially in rural areas). The authors could prove that the mentioned factors negatively influence on the development of retail networks.

Discussion

Digital Retail Chains and Open Innovation

Digital Retail Chains and the Potential of E-Commerce

The total revenue of the top 20 largest online digital trading platforms in Kazakhstan in 2018 amounted to USD 889.62 million. The situation with the coronavirus pandemic in 2020 further contributed to the development of online commerce and increased sales. The attractiveness of the e-commerce market for foreign investors is determined by the factors that contribute to the realization of the potential of e-commerce. The analysis of the functioning of the retail chains of the Republic of Kazakhstan in the e-commerce market within the EAEU made it possible to obtain the following results, which have theoretical significance:

1. The factors of the development of the e-commerce market in the Republic of Kazakhstan have been identified and substantively disclosed, among which the most significant influence is exerted by the level of distribution of mobile devices with Internet access, as well as the availability of a logistics infrastructure that allows efficient delivery of goods to consumers. These two factors increase the efficiency of information and material management, which leads to increased reliability of supply in e- commerce by reducing errors and improving the quality of logistics services.

2. Using the method of analytical grouping, the largest Internet sites in Kazakhstan were identified in the following categories: marketplace, ticket sales, passenger transportation, clothing sales, electronics, niche stores, classified.

The Development of the Digital Retail Chains and the Open Innovation Concept

In this regard the consideration of open innovation impact on digital retail chains’ development should be considered as a very important issue. Different approaches to assessing digital projects are considered in various works showing the specific features of digital economy (Bril, Kalinina & Levina, 2018; Bril, Kalinina & Valebnikova, 2016; Ilin, Kalinina & Barykin, 2018; Schislyaeva et al., 2019; Vilken et al., 2019). In general, building models for open innovation that allow to explore the existing innovation chains can be useful to motivate engineering research promoting the growth of open innovation and development of open business models (Yun, Kim & Yan, 2020).

The authors suggest a discussion on the issue of the connection between the open innovation concept and the developing of the digital retail chains. The term open innovation was first introduced in 2003, and over the next nearly twenty years, open innovation has explored a wide range of issues ranging from individual firms to platforms and ecosystems for government and social issues in general. The growing interest in both the concept of open innovation in general and interest in certain key trends such as digital transformation is obvious (Bogers et al., 2019; West et al., 2014).

The work (Torkkeli, Kock & Salmi, 2009) studies the boundary conditions that determine whether open or closed types of innovation management will actually lead to the highest value for a given firm. The mentioned determinants could be considered as various internal and external constraints (situational factors) from a point of view a contingency perspective. Undoubtedly, it is important to analyze what open innovations’ properties can compensate for the possible negative effect appearing from sharing knowledge with other firms because of going to reduce the potential rarity of the eventual inventions. In this regard the researchers should pay attention to the business model innovation aiming to succeed a competitive advantage on the basis of the sufficiently differentiated business model being hard to replicate for incumbents and new entrants alike (Teece, 2010). We could agree that Business concept innovation is a central pillar in business model innovation (Souto, 2015).

Open Innovation in Value Networks Could be Studied by Analyzing Three Main Issues (Chesbrough, Vanhaverbeke, and West, 2006):

a) How central firms choose between different governance modes when they establish relations with partners;

b) Studying value constellations being a nexus for the integration of different theoretical perspectives since they are a nexus where value creation, non-arm's- length transactions, external resource sourcing and inter organizational networking are welded together;

c) Analyzing Open Innovation at different levels and that interorganizational networks.

The work (Gay, 2014) explores the network perspective for value creation and firm networking activities for different firms, small entrepreneurial firms, and large companies.

More generally, open innovation is built on the ability to create an ecosystem in which people, organizations and sectors can contribute to development It involves business models—the logic of creating and capturing value—that dynamically transcend organizational boundaries within that innovation ecosystem (Bogers, Chesbrough & Moedas, 2018).

There is no single way for managing open innovation. The specific modes that companies use to manage open innovation are determined by the state of the innovation system in question, the stage of maturity of the technology and the choice of value proposition (Christensen, Olesen & Kjær, 2005).

Clayton M. Christensen introduced the concept of disruptive innovation and thus reflected the complexity and contrary of innovation in general (Christensen et al., 2018).

An innovative approach to the development of entrepreneurial ecosystems forms the following bases:

• A coordinative and cooperative network of the focal organization and partners;

• Relationships based on collaborative vertical and horizontal linkages among network partners, with a specific focus on the intra-network flow of knowledge;

• Value-capture in partnerships;

• External linkages of the ecosystem network to other networks and firms. In summary, strong interdependence can be noted between the ICT infrastructure, open innovation, and economic growth (Pradhan et al., 2019; Pustovrh, Rangus & Drnovšek, 2020).

Conclusion

The authors suggest the approach to analytical assessment of the peculiarities of the digital retail chains and Kazakhstan's e-commerce market within the EAEU with both advantages and disadvantages of the infrastructure being defined. The most popular among consumers are online digital trading platforms that offer services for the sale of electronic tickets, passenger transportation, as well as the following product groups: clothing, electronics, and niche stores. In addition, services for searching for discount coupons are actively developing

– coupons, as well as classifieds – services where ads from individuals and legal entities with offers for the sale of goods, works or services are placed with the coupons being sold.

Another important area of development of e-commerce could be observed in the provision of various financial and banking services, including money transfers, online loans for the purchase of cars, purchase of goods and services, etc.

Having conducted a study of the features of the functioning of retail networks of the Republic of Kazakhstan in the e-commerce market within the EAEU, the following conclusions can be made. The most intensive retail chains are developing in the field of e-commerce.

The development of the digital retail chains in the Republic of Kazakhstan is influenced by different factors. When assessing the potential of the digital retail chains in the Republic of Kazakhstan, the following advantages and disadvantages of the infrastructure can be identified.

The Disadvantages of the Infrastructure for the Development of the Digital Retail Chains Could be defined as Follows

1. The uneven development of the transport and logistics infrastructure is due to the fact that most of the country's land is unsuitable for life. In this regard, the question arises about the transport accessibility of certain regions.

2. Undeveloped production. For mutually beneficial interaction between retail chains and suppliers, it is necessary that the latter can supply manufactured goods in quantities sufficient to meet the needs of retail chains.

The Authors Suggest Considering Separately the Challenges For The Development of Digital Retail Chains in Kazakhstan

1. Small market capacity could be treated as a barrier for the development of physical retail chains. This is due to the fact that the Republic of Kazakhstan has a large territory (2,724,900 square kilometers) with a population of 18,265 thousand people. So, the population density is only about 6.5 people per 1 km2, i.e. the population density is low and uneven in relation to the entire territory of the country. Retail chains are developing mainly in large cities, but there is no full coverage of the country's territory. However, the effects of small market capacity (low population density, urban vs. rural distribution) could be considered as an opportunity for the development of digital retail chains. The point is that consumers could order online and have the items shipped to them, rather than having to drive to the city. So, the study proves that E-commerce could be a possible solution for this challenge.

2. Different levels of purchasing power in urban and rural populations do not allow the same effective development of different formats of retail chains. We could discuss if it is a barrier or opportunity. The mentioned issue, how purchasing power of diverse consumer populations affects the development of different formats of retail chains could be treated as a barrier for physical and, on the contrary, an opportunity for the digital retail chains.

Thus, the digital retail chains in the Republic of Kazakhstan have a potential for their development.

Advantages of the Infrastructure for the Development of Digital Retail Chains Include the Following

1. Preferential policy implemented by the state and provision of state support for retail and Internet trade at the level of state programs.

2. Integration of the Republic of Kazakhstan into the EAEU leads to lower prices for final goods by reducing the costs of export and import operations in the EAEU countries.

3. The absence of restrictions on foreign direct investment contributes to the development of trading networks.

4. Market development of e-commerce.

The authors believe that further directions for exploring the operation trading networks in the e-commerce market of the Republic of Kazakhstan within the EAEU lie in developing theoretical and methodological provisions for trade integration in international supply chains based on the key principles of the theory of commerce and logistics. The research shows that the potential of digital technologies can be combined with the fundamentals of the theory and methodology of digital logistics to form the digital retail chains increasing the competitiveness of the economy of Kazakhstan within the EAEU.

Author Contributions

All authors have contributed substantially to the entire work reported. All authors have read and approved the final manuscript. Conceptualization, S.B. and E.S.; methodology, P.S. and A.M.; writing—drafting, S.B. and P.S.; writing—inputs, all authors; writing—reviewing and editing, all authors.

Funding

The study was supported by the Academic Excellence Project 5-100 proposed by Peter the Great St. Petersburg Polytechnic University.

Conflicts Of Interest

The authors declare no conflict of interest.

References

- Abdunurova, A., & Surapbergenova, Z. (2019). Digital consumer behavior in tourism: A cross-national analysis in Asian countries. Conference Proceedings, 201–224.

- Akhmetova, Z., Baimukhanbetova, E., Belgozhakyzy, M., Alikbaeva, A., & Tulebaeva N. (2020). The development of e-commerce infrastructure in modern conditions. E3S Web of Conferences, Ziyadin S, Shaikh A, Dinis de Sousa R, Borodin A, Mottaeva A (eds) 159: 04028.

- Alimkhanova, S.K. (2020). Legal aspects of harmonization of labor legislation of kazakhstan and the eurasian economic union countries (EAEU). Journal of Advanced Research in Law and Economics, 11(4), 1080– 1086.

- Atkinson, J. (2003). Managing change and embedding innovation in academic libraries and information services. New Review of Academic Librarianship. Routledge, 9(1): 25–41.

- Bayadyan, A., & Baghdasaryan, A. (2017). Problems of development and integration of the securities market in the countries of the eaeu. International Organisations Research Journal, 12(4), 91–108.

- Bogers, M., Chesbrough, H., Heaton, S., & Teece, D.J. 2019. Strategic management of open innovation: A dynamic capabilities perspective. California Management Review, 62(1), 77–94.

- Bogers, M., Chesbrough, H., & Moedas C. (2018). Open innovation: Research, practices, and policies California Management Review, 60(2), 5–16.

- Bril, A., Kalinina, O., & Levina, A. (2018). Two-stage commercial evaluation of engineering systems production projects for high-rise buildings. E3S Web of Conferences, Safarik D, Tabunschikov Y, Murgul V (eds) 33, 3004.

- Bril, A., Kalinina, O., & Valebnikova, O. (2016). Innovation venture financing projects in information technology. in internet of things, smart spaces, and Next generation networks and Systems, Galinina O, Balandin S, Koucheryavy Y (eds). Springer International Publishing: Cham, 9870, 766–775.

- Bukharbayeva, A.Z., Nauryzbayev, A.Z., Jrauova, K.S., Oralbayeva, K., & Aimagambetova, A.D. (2020). Formation of the transport and logistics system as the basis for rice production development in the Kazakhstan Aral Sea region in the context of the EAEU economic integration. Academy of Strategic Management Journal, 19(3), 1–7.

- Chesbrough, H., Vanhaverbeke, W., & West, J. (2006). Chapter 13 Open innovation in value networks. In Open Innovation: Researching a New Paradigm, Chesbrough H, Vanhaverbeke W, West J (eds). Oxford University Press.

- Christensen, C.M., McDonald, R., Altman, E.J., Palmer, J.E. (2018). Disruptive innovation: An intellectual history and directions for future research. Journal of Management Studies, 55(7): 1043–1078.

- Christensen, J.F., Olesen, M.H., Kjær, J.S. (2005). The industrial dynamics of Open Innovation - Evidence from the transformation of consumer electronics. Research Policy, 34(10), 1533–1549.

- Chung, K.C. (2019). Mobile (shopping) commerce intention in central Asia: The impact of culture, innovation characteristics and concerns about order fulfilment. Asia-Pacific Journal of Business Administration, 11(3), 251–266.

- Cox, J. (2020). The higher education environment driving academic library strategy: A political, economic, social and technological (PEST) analysis. Journal of Academic Librarianship. Elsevier, 47(1).

- Deloitte. (2017). Global powers of retailing: The art and science of customers. Deloitte.

- Diyachenko, E., & Entin, K. (2017). The court of the eurasian economic union: Challenges and perspectives. Russian Law Journal, 5(2), 53–74.

- eMarketer. (2019). Global Ecommerce 2019. eMarketer.

- Gagarina, G.Y., Sorokina, N.Y., Chainikova, L.N., Sizova, D.A., & Nadyrov, S.M. (2019). Tools to ensure the economic security of the old industrial regions. Entrepreneurship and Sustainability Issues, 7(1), 747– 762.

- Gay, B. (2014). Open innovation, networking, and business model dynamics: The two sides. Journal of Innovation and Entrepreneurship, 3(1).

- Genkin, A.S., Mikheev, A.A. (2020). Influence of coronavirus crisis on food industry economy. Foods and Raw Materials, 8(2), 204–215.

- Ilin, I., Kalinina, O., Barykin, S. (2018). Financial logistics innovations in IT Project Management. MATEC Web of Conferences, Mottaeva A, Melovi? B (eds) 193: 5062.

- Karliuk, M. (2017). Russian legal order and the legal order of the eurasian economic union: An Uneasy Relationship. Russian Law Journal 5(2): 33–52.

- Kasyanov, R., & Kriger, A. (2020). Towards single market in financial services: Highlights of the EU and the eaeu financial markets regulation. Russian Law Journal 8(1), 111–137.

- Kasyanov, R.A. (2019). The EU experience as a model for the development of a single financial market regulation in the Eurasian Economic Union (EAEU). European Company and Financial Law Review 16(5), 592–621.

- Kong, H. 2020. Kazakhstan’S transit potential development through transformation of logistics processes, 4205: 56–62.

- Krasnov, A., Beknazarov, B., Jarikbayeva, D., Yeshpanova, D., & Karshalova, A. (2019). Security of the eurasian economic union member states: Socioeconomic and financial aspects. Journal of Security and Sustainability Issues, 637–648.

- Li, B. (2020). Analysis of the impact of e-commerce on industrial manufacturing based on big data. Journal of Physics: Conference Series, 1648, 042106.

- Lund, S., & Manyika, J. (2016). How digital trade is transforming globalisation. E15Initiative. Geneva: International Centre for Trade and Sustainable Development (ICTSD) and World Economic Forum (January).

- Malle, S., Cooper, J., & Connolly, R. (2020). Greater Eurasia: more than a vision? Post-communist Economies, 32(5), 561–590.

- Maslova, V., Zaruk, N., Fuchs, C., & Avdeev, M. (2019). Competitiveness of agricultural products in the eurasian economic union. Agriculture, 9(3), 61.

- Mekhdiev, E. (2019). Conjugation of the belt and road initiative and Eurasian economic union: Problems and Development Prospects. Economies, 7(4), 118.

- Nakip, M., & Gökmen, A. (2017). An empirical survey of consumer ethnocentrism in Kazakhstan and the preference of consumers on imported products. Bilig, 82, 65–90.

- Pak, O., & Iwata, K. (2020). A path to financial integration: Steps for the Eurasian Economic Union. Asia Europe Journal 18(1), 99–115.

- Petrovich, G.A. (2020). The eurasian economic union in the context of digital transformation: Main directions in the development of industrial cooperation. Webology, 17(1), 333–340.

- Pradhan, R.P., Arvin, M.B., Nair, M., Bennett, S.E., & Bahmani, S. (2019). Short-term and long-term dynamics of venture capital and economic growth in a digital economy: A study of European countries. Technology in Society. Elsevier Ltd 57,125–134.

- Pustovrh, A., Rangus, K., & Drnovšek, M. (2020). The role of open innovation in developing an entrepreneurial support ecosystem. Technological forecasting and social change, 152.

- Raimbekov, Z., Syzdykbayeva, B., Rakhmetulina, Z., & Zhenskhan, D. (2019). The effectiveness of logistics development and its impact on the economies of the countries along the silk road passing through kazakhstan. Transport problems, 13(4), 127–142.

- Ross Sr, L.F. (2008). So you want to be a strategic leader: Here are the essentials to get you started. Xlibris Corporation.

- Rotaru, V. (2018). The Eurasian economic union–a sustainable alternative for the former soviet space? Journal of Contemporary European Studies, 26(4), 425–442.

- Schislyaeva, E., Saychenko, O., Barykin, S., & Kapustina, I. (2019). International energy strategies projects of magnetic levitation transport. In advances in intelligent systems and computing, 983: 313–320.

- Souto, J.E. (2015). Business model innovation and business concept innovation as the context of incremental innovation and radical innovation. Tourism management. Elsevier Ltd, 51, 142–155.

- Teece, D.J. (2010). Business models, business strategy and innovation. Long Range Planning. Elsevier Ltd, 43(2–3), 172–194.

- Torkkeli, M.T., Kock, C.J., Salmi, P.A.S. (2009). The “open innovation” paradigm: A contingency perspective. Journal of Industrial Engineering and Management, 2(1), 176–207.

- Tsurkan, M., Irina, D., & Pilipchuk, N. (2020). Cross-boundary projects e-governance as a method of EAEU economic policy integration, 165–178.

- Vilken, V., Kalinina, O., Barykin, S., & Zotova, E. (2019). Logistic methodology of development of the regional digital economy. IOP Conference Series: Materials Science and Engineering, 497, 12037.

- West, J., Salter, A., Vanhaverbeke, W., & Chesbrough, H. (2014). Open innovation: The next decade. Research Policy. Elsevier B.V. 43(5), 805–811.

- Yemelina, N., Omarova, A., & Anara, K. (2018). Analysis and forecast of prices of the housing market. Journal of Applied Economic Sciences, 13(3), 843–851.

- Yun, J.J., Kim, D., & Yan, MR. (2020). Open innovation engineering—preliminary study on new entrance of technology to market. Electronics (Switzerland), 9(5), 1–10.

- Zaurbekova, Z. 2020. Role of global supply chain strategy in control of transfer pricing in the EAEU countries. International Journal of Supply Chain Management 9(4), 1046–1054.

- Zhekenov, D., Darkenbaev, A., & Zhunisov, Z. 2020. The ‘Nurly Zhol’ and the ‘One Belt, One Road’ projects: Juxtaposition of an idea. The challenge of change for the legal and political systems of Eurasia: The impact of the new silk road, 131–140.