Research Article: 2020 Vol: 19 Issue: 3

Dichotomy and Interdependence in Strategic Management Concerning Innovative and Investing Activities of Organizations

Halyna Humenyuk, Vasyl Stefanyk Precarpathian National

UniversityVictor Yemtsev, National University of Food

TechnologiesKostiantyn Salyga, Classic Private University

Tetiana Pavliuk, Zaporizhzhia National University

Halyna Pavlova, Dnipro State University of Agriculture and Economics

Abstract

The article raises questions about obtaining potential and effective ability of the organization to symbiotic innovation and investment development. Controlling provision of innovation and investment activity from the position of organizational and economic mechanism of economic activity is considered. It is proposed to introduce the Balanced ScoreCard (BSC) tool into the strategic management of innovation-investment activity and to form the evaluation indicators of the quality management of innovation-investment organizations activity.

Keywords

Strategic Management, Innovation and Investment Activities of Organizations, Controlling Support, Balanced ScoreCard (BSC), Capacity Formation, Management Model.

JEL Classifications

M5, Q2

Introduction

In the context of current market transformations, globalization processes and international integration, increasing attention is being paid to implemention of an innovation strategy, both within an individual organization and transnationally. The intensification of innovation and investment activity in organizations and the innovative type of economic development is increasingly becoming the foundation that determines the economic strength of the country, its competitiveness and prospects in the world market. Considering how widely and thoroughly the problem of innovation and investment activity and the conditions of its realization are considered today, it is possible to make conclusions about the expediency and relevance of this topic.

Literature Review

Nowadays, a large number of scientists are exploring the issues of innovation and investment activities (Arnold, 2010; Drobyazko et al., 2019; Skrypnyk et al., 2019). However, gradually the vector of scientific research in this field is shifting towards considering together the innovation and investment activities of organizations and aspects of its formation, which is reflected in the works of the following scientists (Grinold & Kahn, 2000; Maringer et al., 2016; Tidd & Bessant, 2014). But despite the considerable accumulation of theoretical developments in this field, the constant and rapid change of the external environment, and accordingly its requirements for the modern organization, needs constant elaboration of theoretical and practical aspects of strategies formation in the field of innovation and investment activity.

Methodology

The symbiotic approach of this research is formed in the aspect of an organization's ability to innovate and is determined by its innovative potential, in particular, its ability to realize innovations within the chosen strategic direction of development. The capacity-building method means the ability to innovate, it is determined by the potential capacity of the organization to innovate and by the set of conditions that contribute to, or conversely, impede innovation. The method of systemic competitiveness determines that the most important source of creation and maintenance of competitive advantages of the organization is the identification and usage of new scientific and technical products in the implementation of innovative activity, which is the result of intellectual, scientific and engineering creativity.

Findings and Discussion

Innovations can not exist without investments. The economic success of every innovation project is the ratio of the level of financial return to the initial investment, and almost every innovation project can be considered as an investment, the main goal of which is to make a profit.. The investment mechanism includes a system that ensures the usage of a wide range of economic as well as administrative levers and instruments to influence the investment process, including the licensing and promotion of various investment goods supplies.

There is an inextricable link between the concepts of “innovation” and “innovation process”. The innovation process is related to the creation, development and distribution of innovations. Therefore, the effect of individual innovation could be only analyzed by considering the local reproductive innovation subsystem. Evaluation of innovation processes occurring in individual organizations in the field of production and science (integrated capacity assessment) showed that in most cases, the development of innovation does not require the usage of current scientific knowledge, as investment support is much more important (Vaccaro et al., 2012; Drobyazko et al., 2020).

The main components of the strategic management mechanism in the sphere of innovation-investment activity are the relations, methods, tools and indicators that characterize the essence of strategic innovation management in the framework of the implementation of the selected strategies in order to achieve the set goals. They should ensure, within the mechanism and system of strategic management, such action on innovation and investment activities, which would enhance the positive and eliminate the negative impact of these factors on the business processes of the organization itself. In our opinion, it is advisable to consider the innovation potential as a qualitative integral characteristic of its ability to ensure the implementation of the innovation process and the achievement of organization's strategic goals. (Metelenko et al., 2019; Stoyanova et al., 2019). In this interpretation, innovation potential includes such types of potential as: technological, intellectual, informational, capacity of innovation market, etc.

Controlling Support of Innovation-Investment Activity

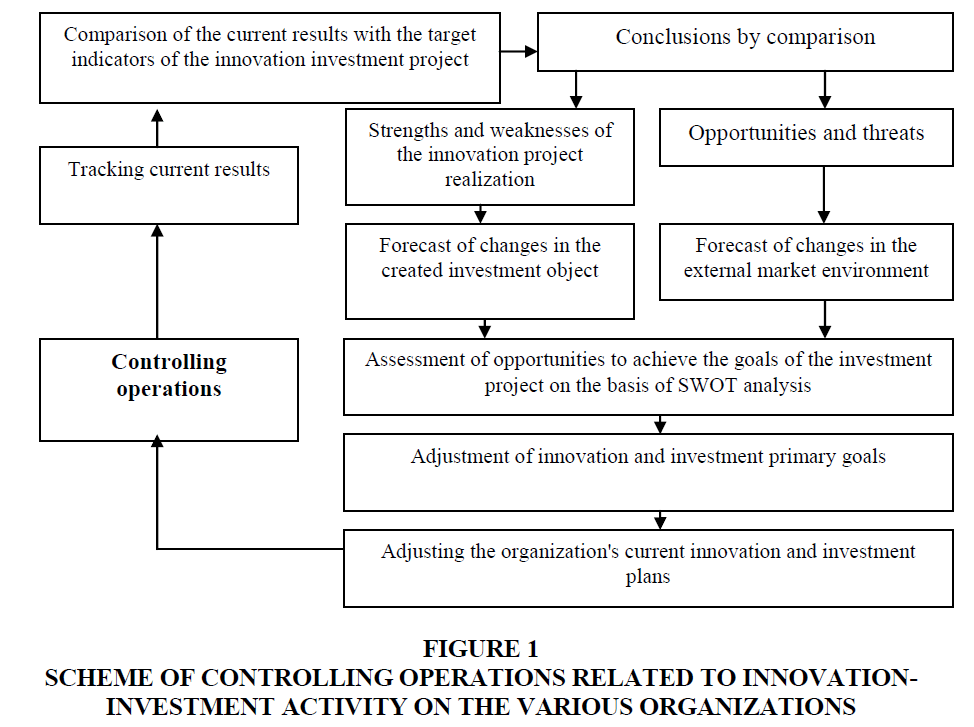

Forms of organizational and economic mechanism of investment are mostly determined by the state and level of the investment market development. Within the organizational and economic mechanism, the processes of investment, planning and forecasting should be aimed at determining the levels of investment objects profitability, identifying opportunities for reducing investment risks and managing them, developing managerial decisions and organizational forms of investment realization.. Controlling, as an element of organizational and economic mechanism of investment, for different organizations includes various forms and methods of planning the movement of investment flows, as well as provides control over their flows (Bakan, 2004). Scheme of investment activity controlling operations for different existence types of organizations is presented in Figure 1.

Figure 1 Scheme of Controlling Operations Related to Innovation-Investment Activity on the Various Organizations

We emphasize, that control is one of the essential processes of innovation and investment activity that precedes its analysis. Controlling performs the following functions: raising capital at the stage of investment resources development; connector between investors; coordination of investments into the investment objects. In the investment process, goals and objectives need to be adjusted depending on the investment market situation. Based on strategic controlling, operational controlling of the organizational and economic mechanism ensures the detection of changes from the set parameters of all investment mechanism components.

Controlling is understood as a functionally segregated area of economic activity in an organization, related to management accounting, control, analysis, operational adjustment of plans, refinement of operational goals, as well as the justification of tactical management decisions.

Balanced ScoreCard (BSC) in Strategic Management of Innovation and Investment Activity

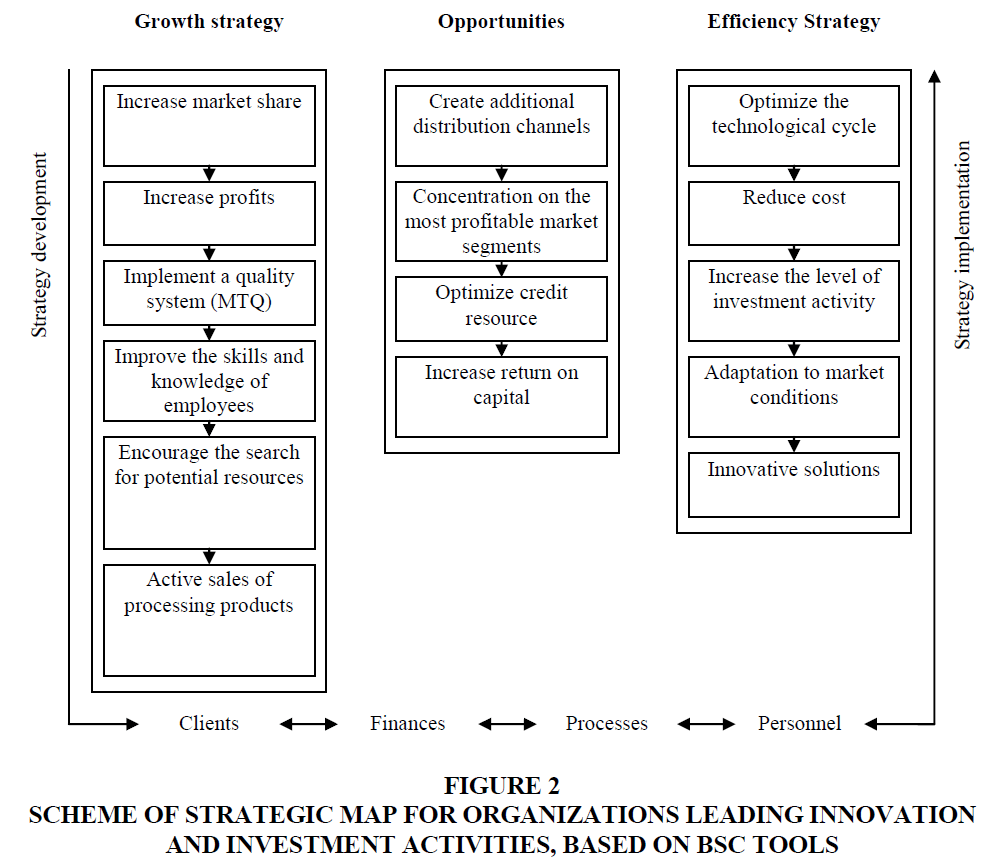

Many believe that the content of strategy plays a key role, and the form of its presentation is secondary. Gradually, managers refuse this point of view because they understand that strategies can be successfully implemented only in case when employees understand them. By describing the strategy in a less orderly form, we increase the likelihood of its successful implementation. One of the tools for presenting the strategy implementation process is a balanced scorecard (Balanced ScoreCard, BSC). The result of the BSC principles implementation is the creation of a strategic map model (Figure 2), which shows perspective development directions of the investment and innovation process of the studied object (Lendel & Varmus, 2014).

Figure 2 Scheme of Strategic Map for Organizations Leading Innovation and Investment Activities, Based on BSC Tools

At the top of the map is the financial component of innovation and investment activity, which shows how the complex is intended to benefit its founders, particularly, to increase market value. Under the financial component the client component is based. It characterizes the competitive offer based on the results of innovation and investment activity, due to the production of innovative products that are in strong demand. This component determines the choice of market position and key customers. The processes are mostly determined by the development level of the client component. At the bottom of the map is a personnel component (Garvey et al., 2016).

The specific feature of this model is the usage of an innovative component, which characterizes the management of innovation and investment activity from the standpoint of resource development processes and the ability to use marketing development strategies. The role of the innovation component is to increase resource efficiency in the field of innovation development and implementation of innovations.

Thus, BSC, as a subsystem of strategic management of innovation and investment activity, ensures the coherence of actions within the investigated object, eliminates functional disconnection, and, at the same time, maintains the balance between different participants interests in the innovation process. This approach made it possible to clarify the list of balanced indicators that characterize the innovative component of management, also, to determine their thresholds and connections (Pedersen, 2018). The list of balanced indicators is presented in Table 1, specifying their weight categories in the summary balanced indicators.

| Table 1 Balanced Indicators Characterizing the Management of Innovation and Investment Activities of Organizations | ||

| Component | Summary indicator | Weight |

| Financial | Expanding the structure of innovation and investment activity | 0.25 |

| Revenue growth | 0.30 | |

| Cost reduction and efficiency growth | 0.29 | |

| Improving asset usage in innovation development and implementation activities | 0.16 | |

| The summary indicator of financial component | 1.00 | |

| Client | Characteristics of products (goods, works or services) | 0.50 |

| Image | 0.25 | |

| Relationships | 0.25 | |

| The summary indicator of the client component | 1.00 | |

| Process | Strategic processes | 0.45 |

| Operating processes | 0.30 | |

| Customer management processes | 0.15 | |

| Legislative and environmental processes | 0.10 | |

| The summary indicator of the process component | 1.00 | |

| Personnel | Competencies | 0.50 |

| Strategic technologies | 0.25 | |

| Corporate activity | 0.25 | |

| The summary indicator of the personnel component | 1.00 | |

| Innovative | Industrial innovation | 0.20 |

| Service innovation | 0.15 | |

| Transport innovation | 0.15 | |

| Infrastructure innovation | 0.15 | |

| Organizational innovation | 0.15 | |

| Administrative innovation | 0.20 | |

| The summary indicator of the innovative component | 1.00 | |

Summaries are calculated taking into account the coefficients of balanced indicators that are part of them, and their values are determined on a scale from “+1” to “-1”:

• From “-1.0” to “-0.5” - critical level of indicator, low sustainability, reengineering of innovative processes is needed;

• From «-0.5» to «0.0» - low level of the indicator, insufficient resources provision, lack of interaction coordination between the participants of innovation processes, low efficiency of the usage of assets;

• From “0.0” to “+0.5” - normal level of the indicator, the necessary resource security, sufficient timeliness and stability of participants interaction, stable outturn from the usage of assets;

• From “+0.5” to “+1.0” - high level of indicator, sustainability of innovative processes, increased resource efficiency at low resource capacity, presence of resource saving capabilities (Jones, 2011).

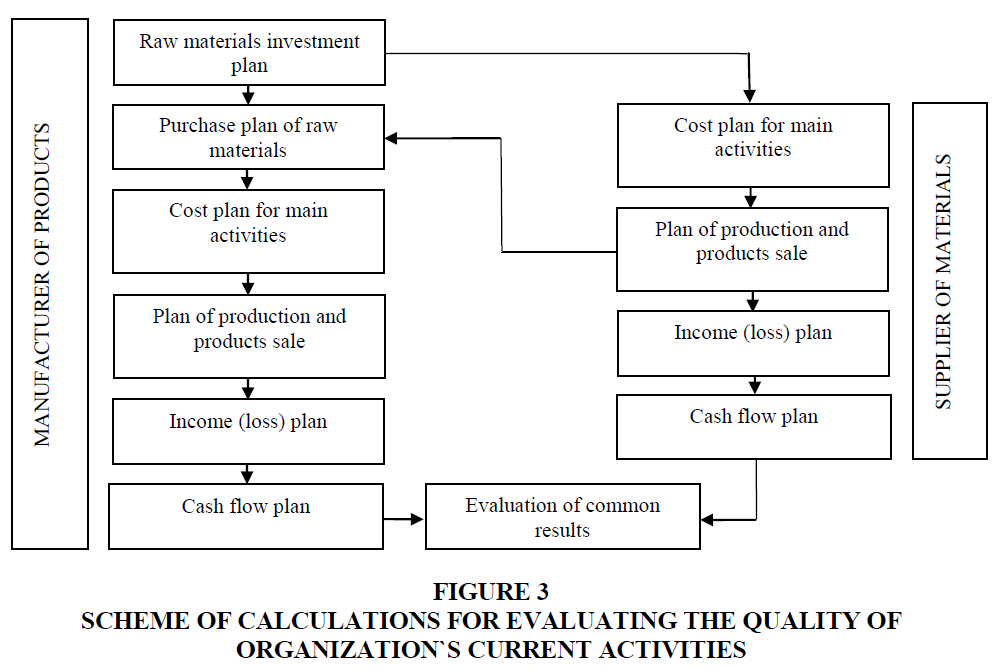

Thus, an investment strategy is a single, highly integrated system consisting of various aspects that are inextricably linked with each other, in order to achieve the main goal. According to the development task, the following main strategic development priorities are considered and analyzed: 1) development of new directions of activity; 2) development of new types of products; 3) entering new markets. Any of the chosen development priorities includes an analysis of the investment conditions, since either the new line of business, or the production of a new type of products, or even the organization of a dealer network in the new market, are connected with the study of the conditions for creating a complete set of alternatives (David, 2011). The calculation scheme for estimation of organization current activity is presented in Figure 3.

In conditions of vertical integration, all three levels of interaction are observed: connected organizations coordinate not only at the management level (have a common action policy and a single development strategy), but also coordinate sales, supply (associative level) and technology-related processes of producing one or multiple products. The solution to these problems is directly related to the improvement of organizational and economic mechanisms of interaction within the framework of vertical integration.

Recommendations

As a recommendation, we consider it necessary to mention that the methodology for assessing the level of innovation and investment activity for different forms of organizations may include an algorithm, that will consist of a final list of stages, including the elements of controlling, and methods of evaluating integrated marketing communications in terms of their influence on consumers, in order to promote products in the market.

The development of innovation and investment activity for different forms of organizations is proposed to be carried out using cluster technologies. An innovation cluster is a purposefully created group of organizations operating on the basis of centers: activation of scientific knowledge and business ideas, training of highly qualified specialists. The difference between the innovation cluster and other forms of economic associations, is that the cluster organizations do not carry out the full merger, but create a mechanism of interaction, that allows them to maintain the status of a legal entity and, at the same time, to cooperate with those, who form the cluster with other organizations and outside of it.

Conclusion

Thus, innovation potential is considered as a qualitative integral characteristic of its ability to provide realization of innovation-investment process for different types of organizations and achievement of strategic development goals by means of innovative economy. In this interpretation, innovation potential includes such types of potential as: technological, intellectual, informational, potential of innovation market capacity, etc. Evaluation of innovative potential combined with assessment of innovative opportunities and innovation-investment activity allows to developed proposals for its realization in the form of innovation-investment projects.

It is substantiated, that all system elements, within the organizational and economic mechanism of investment, should be aimed at determining the levels of investment objects profitability, identifying opportunities for reducing investment risks and managing them, developing management decisions and organizational forms of investment realization. For these purposes, it is proposed to apply controlling operations, also, to assess the effectiveness of innovation and investment activities using a system of balanced indicators.

References

- Arnold, G. (2010). Investing: the definitive companion to investment and the financial markets. Financial Times. New Jersey: Prentice–Hall.

- Bakan, J. (2004). The c orporation: The pathological pursuit of power and pro?t .

- David, F.R. (2011). Strategic management: concepts and case. Harlow.

- Drobyazko, S., Pavlova, H., Suhak, T., Kulyk, V., & Khodjimukhamedova, S. (2019). Formation of hybrid costing system accounting model at the enterprise.Academy of Accounting and Financial Studies Journal , 23 (6).

- Drobyazko, S., Vinichenko, O., Chayka, Y., Nechyporuk, N., & Khasanov, B. (2020). Increasing efficiency of entrepreneurial potential in service sector. Journal of Entrepreneurship Education, 23(S1).

- Garvey, G.T., Kazdin, J., Nash, J., LaFond, R., & Safa, H. (2016). A pitfall in ethical investing: ESG disclosures reflect vulnerabilities, not virtues. Journal of Investment Management 15 (2), 51-64.

- Grinold, R.C., & Kahn, R.N. (2000). Active portfolio management.

- Jones, B. (2011). Re-Thinking Asset Allocation: The role of risk-factor diversification. Deutsche Bank Global Markets Research.

- Lendel, V., & Varmus, M. (2014). Evaluation of the innovative business performance. Procedia-Social and Behavioral Sciences, 129, 504-511.

- Maringer, D., Pohl, W., & Vanini, P. (2016). Structured products: Performance, costs and investments. Costs and Investments.

- Metelenko, N.G., Kovalenko, O.V., Makedon, V., Merzhynskyi, Y.K., & Rudych, A.I. (2019). Infrastructure security of formation and development of sectoral corporate clusters. Journal of Security and Sustainability Issues, 9(1), 77-89.

- Pedersen, L.H. (2018). Sharpening the arithmetic of active management. Financial Analysts Journal, 74(1), 21-36.

- Skrypnyk, M., Radionova, N., Vlasiuk, T., Bondarenko, S., & Grygorevska, O. (2019). Mechanism of formation of the social component of sustainable development reporting. In Vision 2020: Sustainable Economic Development and Application of Innovation Management. Copyright.

- Stoyanova, T.A., Koev, S.R., Stoyanov, P.P., Zhyvko, Z., & Laptiev, V. (2019). Strategic management of the personnel development of industry companies. Academy of Strategic Management Journal, 18(3), 1-6.

- Tidd, J., & Bessant, J. (2014). Strategic innovation management. John Wiley & Sons.

- Vaccaro, I.G., Jansen, J.J., Van Den Bosch, F.A., & Volberda, H.W. (2012). Management innovation and leadership: The moderating role of organizational size. Journal of Management Studies, 49(1), 28-51.