Research Article: 2021 Vol: 20 Issue: 6S

Digital Currencies for Central Banks

Phan Thi Linh, Banking University Ho Chi Minh City (BUH)

Phan Dien Vy, Banking University Ho Chi Minh City (BUH)

Keywords

Block-Chain, Central Banks, Digital Currencies, Vietnam and BUH

Abstract

Along with the strong development of the Industrial Revolution 4.0, the digital currency was born and is used as a means of payment increasingly popular in many countries worldwide. As a result, many central banks worldwide have begun studying and implementing projects to develop their digital currencies. Moreover, they have increasingly collaborated to implement the actual evaluation. However, the development of a central bank’s digital currency should be done with the consideration of many aspects, in which security is the most critical factor. Therefore, this research paper presents the fundamentals of central bank digital currencies such as their definitions, functions, roles, legal issues, different formats, and whether central banks should issue a digital currency?

Introduction

The substantial advancement of science and technology has promoted strong development and transformation of currencies to catch up with social development. With the invention and widespread use of computers and the internet in recent years, a new form of currency has arisen, known as a digital currency.

Block chain was created by (Satoshi Nakamoto), who is also the creator of Bitcoin. Block chain technology is considered a technology of the 4.0 industry and a technology of the future world.

The most popular application of block chain in financial and banking activities includes payment and money transfer. Using block chain technology, customers can transfer money directly and securely to anyone worldwide almost instantly and for very low fees. Moreover, there are no intermediaries who may slow down the transfer. The second application of block chain is global payments. For example, ripple is a block chain network providing global payment solutions by connecting banks, payment service providers, businesses, and digital asset transactions, facilitating immediate, on-demand payment worldwide.

Crypto currencies are directly traded between senders and receivers via a peer-to-peer network based on block chain technology without the need for a trusted third party.

Literature Review

Definitions and Characteristics of Digital Currencies

According to (Bis, 2015), digital currencies are assets in the digitalized form, meaning that they are not issued under specific physical shapes like banknotes or coins. Digital currencies are divided into two types: electronic currencies and virtual currencies. According to ECB 2018, current digital currencies are not highly liquid from an economic perspective and have not reached the desired level of acceptance.

According to WB 2015, crypto currencies have their units, which are different from electronic currencies, and they are based on cryptographic techniques to reach a consensus. The most prominent representative of crypto currencies is Bitcoin, while alternative coins to Bitcoin are called altcoins, including Ethereum, Litecoin, and Ripple. These altcoins are also becoming increasingly popular.

(Bofinger, 2018) maintains that the future of money will be more digital than today. Digitalization will change the traditional forms of money and credit, leading to changes in the theory and practice of monetary policies. For example, possible changes may include

a) The replacement of cash by electronic currencies.

b) The replacement of traditional bank deposits and banknotes by electronic currencies

c) The replacement of bank deposits and bank debt notes by electronic currencies

d) The replacement of bank credit with peer-to-peer digital lending platforms.

Characteristics of Digital Currencies

According to BIS’s committee on payments and market infrastructures, three main characteristics of digital currencies are:

Based on digital platforms: The maximum money supply and methods when the virtual currency units are added to the system are determined by computer protocols (algorithms).

They are not a liability to anyone.

Peer-to-peer transaction: Digital currencies are directly traded between the sender and the receiver via a peer-to-peer network without the need for a trusted third party. To rule out the presence of a trusted third party, digital currencies are operated on block chain technology. This technology allows transactions on the system to be processed by the participants themselves.

| Table 1 A Comparison Between Traditional And Digital Currencies Of Central Banks |

||||

|---|---|---|---|---|

| Factors | Central bank traditional currencies | Central bank digital currencies | ||

| Cash | Reserve and payment | General-purpose | Trading | |

| 24/7 availability | Currently available | Unavailable | Currently available | May have |

| Anonymity | Currently available | Unavailable | May or May not have | May have |

| Peer-to-peer | Currently available | Unavailable | May or May not have | May have |

| Interest | No | May have | May have | May have |

| Limit | No | No | May have | May have |

(Source: BIS 2018)

Functions of Digital Currencies

According to (Ammous, 2018) digital currencies function as a store of value due to their tight commitment to limited supply. In addition, centralized control over the remaining digital currencies and their use as specialized applications makes it impossible for these types of currencies to function as traditional currencies.

Similar to (Ammous & Selgin, 2014) maintains that crypto currencies are not real money and will not be a currency in the future.

Research by (Mikolajewicz - Wozniak & Scheibe, 2015) suggests that crypto currencies reflect the current trend and become a popular means of payment, changing how financial services are provided and reducing and eliminating the role of financial intermediaries.

Studying central banks in the digital economy, Prasad 2018 suggests that central banks may face technical and operational challenges in their core monetary policy activities, or they will need to adapt to the development of financial technologies.

Financial institutions, especially banks, may face challenges to their traditional business models because new technologies enable organizations (or decentralized mechanisms) to perform financial intermediation functions and overcome information asymmetry problems. The emergence of new institutions and mechanisms may also improve financial intermediation, but at the same time, will pose significant challenges to regulatory and financial stability.

1) According to (Claeys et al., 2018) distributed ledger technology has enabled crypto currencies to become a new form of privately issued, digital, and based peer-to-peer transactions. However, these digital currencies cannot replace the official fiat currencies because (i) crypto currencies do not perform the role of currencies well as their value is very volatile and not guaranteed.

2) The management of crypto currencies is too simple compared to the requirements of modern currencies.

3) The most critical issue lies in legal constraints, especially regarding the central bank’s privilege to issue money and the profit from this activity.

The Role of Central Bank Digital Currencies

Central bank digital currencies will provide people with the convenience of cash and the security of a bank account (Dyson & Hodgson, 2016).

Comprehensive finance is a factor in which emerging economies are considering when issuing central bank retail digital currencies. However, many low-income people or rural areas cannot access commercial banking and internet services. Therefore, cash remains the primary payment method (Riksbank Sveriges, 2018).

Central bank retail digital currencies can promote digitalization of the economy and thus promote social and economic development. However, when considering issuing central bank digital currencies, emerging economies focus on comprehensive finance more than developed economies (Barontini & Holden, 2019).

Central bank digital currencies can improve payment systems, inter-bank payment, and cross-border payments in the following ways:

(i) Central bank digital currencies can provide an alternative to banknotes, checks, debit cards, credit cards, online transfers, etc. Central bank digital currencies can create competitiveness.

(ii) Central bank digital currencies can also be used for large-value payments between banks and companies and may become more competitive in large-value payments.

(iii) Central bank digital currencies can also enable many financial institutions or even non-bank enterprises to access the central bank’s balance sheet. Thus, helping these companies easily participate in the payment industry will promote the industry’s competition.

(iv) Central bank digital currencies help speed up and streamline clearing processes and reduce transaction costs and costs of developing and upgrading information technology systems.

Definitions and Formats of Central Bank Digital Currencies

Definitions

BIS (2018) defined central bank digital currencies as a digitized form of the central bank currency, but it is different from the balance on the reserve account or traditional payment.

The central bank’s digital currencies are that some central banks will issue new currencies using block chain technology (distributed ledger technology platform) used by individuals and non-bank organizations as a fiat currency. However, until then, the central bank digital currencies will be deemed as national cash.

Formats of Central Bank Digital Currencies

Central bank digital currencies are represented in two types of models: Account-based and value-based.

Account-based model: Individuals and businesses will have accounts at the central bank, and transactions between accounts will be verified and processed by the central bank. The central bank’s digital currency is considered an application of the interbank payment system at the scale of the whole economy. The central bank acts as an intermediary as a commercial bank performing transactions for accounts on the balance sheet.

The value-based model of the central bank digital currencies will be related to the values and can be transferred directly from the payer to the receiver, and a third party verifies the transaction.

Therefore, the central bank’s digital currency is issued in digital forms by the central bank, not in physical form. The central bank digital currency may be the account at the central bank (those are accounts of the public opened at the central bank), and central bank digital currencies can be accounts of financial institutions, which are only used for interbank payments.

According to Shirai (2019), central bank digital currencies are categorized into the following groups:

1. Central bank retail digital currencies, which are based on accounts without distributed ledger technology

2. Central bank retail digital currencies, which are based on value without distributed ledger technology

3. Central bank retail digital currencies which are based on distributed ledger technology

4. Central bank wholesale digital currencies which are based on distributed ledger technology.

Methods of Research

Research methods revolve around the general nature of things and phenomena that need to be considered and clarified. The scope of research does not depend on space and does not depend on research specialties. Although method ever is also the work, The subjective side of the method is the subject’s ability to perceive and experience creative activities, which manifests itself in being aware of the movement laws of the object and taking advantage of them to find the thing itself.

The method is the way to work on the subject, and the time also comes from the characteristics of the objects. Besides, processes are tied to the thing, and such methods have an objective. The objective side determines the choice of one way or another in the subject’s work—the characteristics of the object guide how to choose the method of operation. In scientific research, the subjective must comply with the objective. Objective laws are not a method by themselves, but it is through them that we discover the process. Therefore, the consciousness of human creativity must approach the objective laws of the world.

The method is ambitious because people’s work has goals. The intention to study scientific research topics directs the search and the choice of research methods and vice versa if the solution chooses the technique. The correct and appropriate way will make the research goal reach faster and sometimes even exceed the purpose’s requirements.

Research methods are closely related to the content of the issues to be researched. The technique is the dynamic form of content. The job content specifies the mode of operation. In every scientific topic are specific techniques, in every work of science with a particular methodology

This research is a mixed-method study conducted in two phases. First, this phase is qualitative research to explore research topics and build a research model of technical tape theory in-depth interviews with experts. Second, quantitative methods are applied to data collection and result from analysis.

Research Results

The Relationship between Digital Currencies and Financial Stability

(Nelson, 2018’s) study examines the relationship between crypto currencies and financial stability, primarily as financial investment assets.

The research focuses on two main directions: the price bubble of crypto currencies and the benefits of investment diversification. The research results show asset price bubbles for (Bitcoin & Ethereum) markets from 2009 to 2017. Thus, the emergence of crypto currencies leads to asset price bubbles, which reduces financial stability.

(Katsiampa, 2017) shows that the Bitcoin market is highly speculative, and GARCH econometric models can predict Bitcoin price movements. Thus, Bitcoin is also a valuable tool in risk management to help investors make better decisions. One of the relationships of Bitcoin emergence is the possibility of price bubbles like other financial assets.

However, there are also other studies evaluating the positive relationship between crypto currencies and financial stability.

Research by (Demir et al., 2018) analyzed the ability to predict Economic Policy Uncertainty (EPU) based on Bitcoin’s daily rate of return using the Bayesian Structural Vector Autoregressive model with OLS estimates and Quantile - on - Quantile regression. Research results show that EPU can predict the profitability of Bitcoin, and Bitcoin is a tool against uncertainty.

(Urquhart & Zhang, 2018) assess the relationship between Bitcoin and currencies of some countries on an hourly basis and find that Bitcoin can be a daily hedging tool for currencies like CHF, EUR, GBP but acts as a diversified tool for AUD CAD, JPY. The research also shows Bitcoin as a haven during CAD, CHF, and GBP during times of crisis.

Legal Issues Related to the Problem of Digital Currencies

According to (Dodgson et al., 2015) apart from benefits, crypto currencies also bring management risks and challenges such as reducing privacy and potential insecurity in individual transactions. For enterprises, the risks involve increasing uncertainty and complexity in the business environment. For society, the development of block chain-based crypto currencies raises the balance between freedom and the need for surveillance and regulation and cyber security issues and digital crime.

In the world, governments of various countries have responded differently to crypto currencies. However, all countries aim to prevent block chain-based crypto currencies from illegal activities such as money laundering, drug trafficking, tax evasion, terrorist financing to protect financial security.

Countries such as Belarus, Mexico have issued specific laws to approve and manage the crypto currency market to combat money laundering, financial terrorism, and organized crime.

Argentina treats income from trading crypto currencies similar to gain from stocks, while Switzerland treats crypto currencies as foreign currencies and taxes crypto currency transactions as foreign exchange transactions.

In some countries, such as Thailand, there is no regulation on the operation of crypto currencies and considers the procedure of crypto currencies in the financial market illegal. Indonesia claims that the use of Bitcoin violates many laws of Indonesia.

In general, countries around the world prohibit trading crypto currencies at different levels, such as

1. Prohibiting transactions of crypto currencies with a value exceeding a specific limit

2. Prohibiting the use of crypto currencies in retail transactions

3. Prohibiting the use of crypto currencies as financial instruments

4. Prohibiting trading crypto currency

5. Prohibiting financial intermediaries from trading crypto currencies.

An Overview of Laws Related to Crypto Currencies

Silk Road is an online black market used for drug trafficking. The website was put into use in 2011, and it requires sellers to buy an account through auction but would be later turned into a fixed fee. By 2013, the Silk Road was upgraded to version 2.0, but the FBI also captured its CEO. Silk Road accounted for nearly 5% of the total size of Bitcoin.

ICO (Initial Cryptocurrency Offering) was hacked online, while crypto exchanges and wallets were hacked in 2017.

DAO (Decentralized Autonomous Organization) exchange raised $ 150 million for the Ether token in May 2016 but was stolen in June 2016.

Bitfinex, a Hong Kong-based cryptocurrency exchange, was hacked in 2016 and stolen some cryptocurrencies worth $ 72 billion. Also, in 2016 Coincheck Inc was hacked and stolen $ 500 million of NEM cryptocurrency.

Gandal’s study (2018) states that “because of the anonymity of cryptocurrencies. They can be related to many types of crimes, including” facilitating markets for assassins, attacks to businesses, child abuse, corporate espionage, counterfeit money, drugs, forging identity documents and passports, high-profit investment plans, sexual exploitation, credit card theft, and war weapons.

Li (2017) proposes a framework for greater transparency for cryptocurrency users by reducing sensitive information such as transaction volumes using the Paillier encryption system to encrypt and decode to reduce attacks.

In general, the nature of cryptocurrencies is not appropriate when current anti-money laundering regulations between countries have little coherence and the uneven ability to apply science and technology between countries.

Therefore, countries around the world have issued warnings about the risks when trading cryptocurrencies. Central banks of countries like Germany, the Netherlands, and France have issued warnings about Bitcoin and the risks of Bitcoin, such as the lack of security and supervision of the authorities.

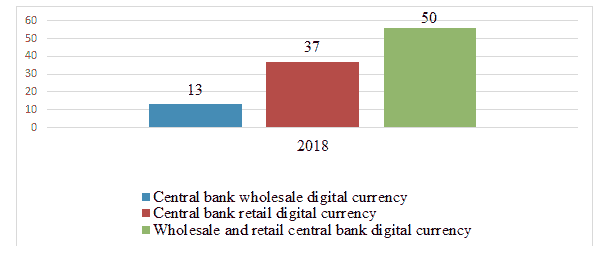

Figure 1: Different Formats Of Central Bank Digital Currencies Issued In 2018

(Source: Barontini và Holden 2019)According to Prasad (2018), it is expected that central banks will face technical and operational challenges to their core monetary policy activities, or at least they will need to adapt to the development of financial technologies. In a rapidly changing industry like financial technology, regulations and monitoring activities must be flexible to encourage projects to innovate and improve, avoiding barriers that could hinder hi-tech services in the future.

The creation and development of digital currencies also involve the rapid development of cybercrime in two respects:

1. Crime stemming from the use of crypto currencies;

2. Crime affects the structure of the crypto currency itself. The emergence of both types of crime has affected transactions of crypto currencies worldwide. And it is necessary to put in place strict legal regulations related to crypto currencies.

One of the challenges in issuing central bank crypto currencies is the balance between freedom and the need for surveillance and regulation and cyber security and digital crime.

Central banks need to ensure that they have enough money for the public to respond to the decline in cash use, ensure sovereignty and the central bank’s monetary ratio in the monetary system. According to Singh (2018), more and more retail stores do not accept cash payments which accounts for 13%, and it is forecast that cash will be eliminated by 2025. Moreover, if some private-sector issuers or cashless payment providers go bankrupt, people will suffer a great deal if there is no appropriate payment system. Therefore, central banks need to provide an equal, secure payment instrument for all financial institutions and citizens.

When issuing digital currencies, central banks will reduce banknotes and then profit from the issuance of banknotes because the profit of issuing banknotes will decrease when the value of banknotes declines. At this time, central banks usually rely on government funding, thus weakening their independence.

Central banks need to determine the optimal trade-off between promoting the development of crypto currencies for the effects of monetary policy and limiting the creation of new risks to financial stability.

Risks Involved with the Issue of Central Bank Digital Currencies

According to Meaning, et al., (2018), issuing central bank digital currencies includes converting crypto currencies and deposits and risks related to mass conversion to digital currencies. Specifically, these risks reduce the intermediary role of banks.

Allowing depositors to withdraw central bank digital currencies on demand affects banks’ funding and liquidity as they lose both deposits and digital currencies. As a result, central bank digital currencies are transferred to the digital currency account of non-bank groups at central banks.

Central banks need to consider the risks of reducing the intermediary role and depend on the readiness to replace the traditional role of commercial banks in providing electronic payment facilities.

When customers withdraw bank deposits and transfer to central bank digital currencies, it will reduce funding and reduce the central bank’s liquidity, forcing the central bank to compensate for their capital lost. This situation will affect the attractiveness of the central bank’s digital currencies and limit the ability to replace bank deposits.

Should Central Banks Issue Digital Currencies?

The recent development of crypto currencies has sparked debate about whether central banks should issue crypto currencies or not. If they do, the central bank crypto currencies will be understood as the national crypto currency.

There are main reasons for the need for central banks to issue crypto currencies as follows:

• Ensure sufficient money supply of the central bank for the public;

• Reduce the cost of printing and managing cash, and prevent violations;

• Promote comprehensive finance;

• Increasing efficiency and financial stability;

• Promote the competitiveness of the payment systems;

• Promote technology development

.

However, when issuing the central bank digital currency, the central bank will lack the cash to perform its functions. Therefore, the central bank may continue to provide cash, or government agencies can adjust suppliers’ operations to ensure competitiveness and reliability. In addition, the central bank can give some money, or people can invest in government securities as a safe store of value. Therefore, the central bank should consider carefully issuing digital currencies.

Conclusions and Policy Recommendations

Conclusions

The issue of central bank digital currencies can contribute to financial stability and promote comprehensive financing. In a modern banking system, commercial banks mobilize deposits and provide loans and investments through term conversion. If mass withdrawal occurs at a bank, they may not meet the needs of depositors due to a lack of liquidity. Such a mechanism explains why central banks play the role of the last lender, and deposit insurance is necessary to maintain financial stability.

If a central bank issues a digital currency and replaces bank deposits with this type of currency, banks will no longer perform the term conversion function. Therefore, central bank digital currencies can eliminate instabilities derived from banking term conversion, promoting comprehensive finance.

Policy Recommendations

The State Bank should coordinate with relevant ministries and sectors to develop and implement the “Strategy of financial education associated with the development of technology” to implement the financial education component of the Financial Strategy. Comprehensive national policy to 2025 and orientation to 2030. The Central Bank coordinates with relevant ministries and branches such as the Ministry of Finance, the General Department of Taxation, the Ministry of Industry and Trade, the Ministry of Information and Communications, and at the same time directing commercial banks, credit institutions, and related units to coordinate in guiding and disseminating knowledge about digital currency, its benefits/risks, and timely handling solutions.

Strengthen international cooperation in digital currency management: The Government and the State Bank need to coordinate with other countries; international organizations standardize issues related to the legal framework; participate in research coordination on coordinating with digital currency issuers, combat tax evasion, store, share, and secure information related to digital currency transactions following Vietnamese regulations and international law. In addition, strengthen information application, improve monitoring efficiency of cross-border payment activities related to digital currency, ensure commitment to integration and ensure safety, network security, and national financial safety. national and global.

The Central Bank and the Fintech Steering Committee coordinate with the Ministry of Finance, ministries, and branches to complete the legal corridor (including pilot form) so that Vietnamese people, organizations, and businesses can apply, exploit and control risks when using modern technology, block chain.

References

- Ammous. (2018). Can crypto currencies fulfill the functions of money? The Quarterly Review of Economics and Finance, 70.7-25.

- Bank for international settlements. (2015). Digital currencies.

- Bank for international settlements. (2018). Central bank digital currencies.

- Bofinger (2018). The digitalization of money and the future of monetary policy.

- Barontini, H. (2019). Proceeding with Caution – A survey on central bank digital currency. BIS Paper, 101.

- Barontini, H. (2019). Proceeding with learning models and bankruptcy prediction. Expert Systems with Applications, 83,405-417.

- Claeys, D., & Efstathiou. (2018). Cryptocurrencies and monetary policy. Policy Contribution, 10, 2018.

- Demir, G., & Lau, V. (2018). Does economic policy uncertainty predict the bitcoin returns? An empirical investigation. Finance Research Letters.

- Dodgson, G., Wladawsky, B., & Sultan, G. (2015). The Academy of Management Journal, 58(2), 325-333.

- Dyson, H. (2016). Digital cash: why the central bank should start issuing electronic money positive money.

- Gandal. (2018). Price manipulation in the Bitcoin ecosystem. Journal of Monetary Economics, 95, 86-96.

- European Central Bank - ECB (2018). Virtual Currency Schemes.

- Katsiampa. (2017). Volatility estimation for Bitcoin: A comparison of GARCH models. Economics Letters.

- Nelson. (2018). Financial stability and monetary policy issues associated with digital currencies. Journal of Economics and Business.

- Mikolajewicz – Wozniak, S. (2015). Virtual currency schemes-the future of financial services. Foresight, 17(4), 365-377.

- Meaning, D., & Barker, C. (2018). Broadening narrow money: Monetary policy with a central bank digital currency. Bank of England Working Papers, 724.

- Li. (2017). A survey on the security of block chain systems. Future Generation Computer Systems.

- Shirai. (2019). Money and central bank digital currency. ADB Institute.

- Prasad. (2018). Central banking in a digital age: Stocktaking and preliminary thoughts. Hutchins center on fiscal and monetary policy at brookings.

- Riksbank, S. (2018). The Riksbank’s e-krona project.

- Selgin. (2014). Synthetic commodity money. Journal of Financial Stability, 17, 92-99.

- Singh. (2018). Data and Technology: How information is consumed in the New Age.

- Urquhart, Z. (2018). Is bit coin a hedge or safe – a haven for currencies? An intraday analysis.

- W.B. (2015). Distributed Ledger Technology and Block chain. FinTech Note No.1.