Research Article: 2021 Vol: 24 Issue: 1S

Dissenters vs Debtors Bank Promise: A Review of Normative Juridical

Sriono, Universitas Labuhanbatu

Kusn, Universitas Labuhanbatu

Elviana Sagala, Universitas Labuhanbatu

Risdalina, Universitas Labuhanbatu

Wahyu Simon Tampubolon, Universitas Labuhanbatu

Keywords

Banking, Debtors, Defaults, Normative Juridical

Abstract

The purpose of this study is to analyze how the form p potential protective laws against bankers in Indonesia to provide financing to the debtor. The form of financing provided by banks to customers is through certain businesses (UKM). Legal protection in this case if the contract defaults. M etode used is y uridis n ormatif which refers to the provisions of positive law in Indonesia through Law concerning Mortgage Rights and Regulation of the Minister of Agrarian Affairs and Spatial Planning/Head of the National Land Agency of the Republic of Indonesia Number 22 of 2017 and other laws and regulations. H acyl analysis of the study revealed that legal protection against certain banks give enough credit to the Power of Attorney Imposing Mortgage are valid until the expiration of the debt. This is as regulated in Law No. 4 In 1996, Article 15 (5) and arranged further in the Minister of Agrarian And Spatial/Head of National Land Agency of the Republic of Indonesia Number 22 of 2017. However, if the discharge ur reneged or in default then The Power of Attorney Imposing Underwriting Rights will be followed by the Deed on the Underwriting Right and registered with the land office to obtain the Underwriting Certificate. This is done because the Power of Attorney Imposing Underwriting Rights is only in the form of granting power of attorney and does not constitute binding on the guarantee institution so that it does not have the power of execution. Registration into the Underwriting Right as an effort to execute collateral for the defaulted debtor.

Introduction

Legal protection is an important issue for banks, especially in terms of operation. Legal protection for banks in terms of lending and borrowing operations necessary to have a clear and firm rules so that banks can carry out legal action if the debtor reneged in the agreement of debts. The operations are carried out in terms of lending and borrowing agreement required the additional agreements are the agreement of a guarantee. Banks in Article 3 of the Law of the Republic of Indonesia Number 7 of 1992 concerning banking state that banks function as a collector and distributor of public funds. Collecting public funds in this case the bank can collect funds from the community through savings provided to the public. While the channelling of funds is the bank as a financial institution that is given the authority to channel funds to the public through credit or business banks.

With the bank's function as one of the sources of funding for a business activity which is ultimately a stimulus for driving the economy, the role of the banking sector is very important as a driving factor for economic activity. In the process of debtor's business activities many factors can affect so that the debtor has no ability to repay loans given by the banking world. Because the funds used by banks to extend credit to debtors are public funds, the bank is obliged to keep credit or loans given to those debtors back (Fauzi, 2010). The provision of credit by the bank as a creditor to the debtor begins with a credit agreement which is the basis of the agreement (Habib Adjie, 2018).

Guarantees submitted in the form of land because the land was an object of high economic value and does not degrade its value can even be an increase in price. Therefore, the state must regulate everything related to the land, with the aim of maximum use to the people's welfare (Sari, Uripno & Asrori, 2015). Land classified as immovable and can be used as collateral for the debt. Such term is defined in Act No. 4 of 1996 on Mortgage of Land Along Objects Relating to Land (hereinafter referred UUHT). In-Law No. 4 of 1996 on Mortgage which has the objective to provide a foundation for the rule of Mortgage institution. Provided that the institution were strong. It stipulated in the regulations of which the position of the Power of Attorney Imposing Mortgage (SKMHT). The function SKMHT namely in terms Mortgage providers cannot be present in front of the Land Deed Officer or Notary Deed in the manufacture of Encumbrances Encumbrance (Wiryanta & Mertha, 2016).

Security agency governed by legislation such as Law No. 4 of 1996 on Mortgage is a rule that provides protection and legal certainty for providers and recipients of such guarantee. Rachmadi Usman said that the credit givers and recipients and other relevant parties had protection through a strong institution and the security interest granted to provided legal certainty for all parties concerned (Usman, 2009). Indonesia is a large country and based on a people's economy. Where the development of democratic economy is expected to improve the welfare of the community in a broad sense. Micro, Small And Medium Enterprises (MSMEs) not only play a role in economic growth and employment, but also have a strategic position in supporting national economic development. Micro, Small and Medium Enterprises as the driving force of the populist economic system can reduce the problem of poverty and unemployment, besides those MSMEs also play a role in distributing the results of development (Hestanto).

The existence of MSMEs as the backbone of the Indonesian economy is no doubt. Its durability in dealing with the economic crisis which several times hit has also been tested. Such resilience is caused by MSMEs not having dependency on imported raw materials or foreign capital so that thirdly weakening of the rupiah, they are not affected. In fact, many of these MSMEs become export support. Either through direct export or as a provider of raw materials, the results of which will be exported. In addition, the majority of SMEs provide products and services at relatively cheap prices. Thus when there is a decline in people's purchasing power due to the crisis, MSMEs actually get a positive effect (Nisa, 2016). The data on the development of micro small and medium enterprises in 2017-2018 can be seen in table 1 below:

| Table 1 Development Of Data On Micro Small And Medium Enterprises And Large Businesses In 2017-2018 |

||||||||

|---|---|---|---|---|---|---|---|---|

| No | Indikator | Satuan | 2017 | 2018 | Developments for 2017-2018 | |||

| Amount | Share % | Amount | Share % | Amount | % | |||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 |

| Micro, Small and Medium Enterprises (MSMEs) | ||||||||

| 1 | Micro Business | Unit | 6,21,06,900 | 98.7 | 6,33,50,222 | 98.68 | 12,43,322 | 2 |

| 2 | Small Business | Unit | 7,57,090 | 1.2 | 7,83,132 | 1.22 | 26,043 | 3.44 |

| 3 | Medium Business | Unit | 58,627 | 0.09 | 60,702 | 0.09 | 2,075 | 3.54 |

| Total number | 6,29,22,617 | 99,99 | 6,41,94,057 | 99.99 | 12,71,440 | 2.02 | ||

| Big Business | ||||||||

| 1 | Big Business | Unit | 5,460 | 0.01 | 5,550 | 0.01 | 90 | 1.64 |

Based on the above data it is known that 98% more share is controlled by micro small and medium enterprises. But in terms of capital it is often a problem for micro and medium businesses. So that there is a need for regulations that can make it easier for micro and small businesses to get capital. Banks in carrying out their functions as suppliers in the form of credit certainly require the existence of guarantees from the debtor as a form of bank confidence in providing credit. Collateral is very important in the credit agreement so that there is a need for development of the guarantee system (Agnello, Castro & Sousa, 2019).

To support the development of micro small and medium enterprises in terms of getting bank credit. Indonesia through the Regulation of the Minister of Agrarian Affairs and Spatial Planning/Head of the National Land Agency Number 22 of 2017 makes it easy for certain business actors in terms of binding guarantees. Collateral that is bound as a form of debt repayment does not have to be registered with the Land Office in the form of liability for mortgages, but only enough to be bound by a Power of Attorney Imposing Mortgage Rights (SKMHT). Loans given by banks to debtors, especially to micro, small and medium enterprises, often experience problems. Problems that occur with the provision of credit given by banks in the event of a failure of payment from the debtor. Failure to pay in this case is called default.

Based on Minister of Agrarian and Spatial Planning/Head of National Land Agency of the Republic of Indonesia Number 22 of 2017 regarding the determination of the time limit the use of a power of attorney to charge encumbrance to guarantee repayment of certain loans. SKMHT under these rules can apply and used without the imposition of Mortgage Deed manufacture (APHT), but quite SKMHT until the end of the debt. SKMHT in this rule only applies to small businesses is often called by SMEs (Regulation of the Minister of Agrarian and Spatial Planning/Head of National Land Agency of the Republic of Indonesia Number 22 of 2017).

Regulation of the Minister of Agrarian and Spatial Planning/Head of National Land Agency of the Republic of Indonesia Number 22 of 2017 does not regulate in detail the legal protection if the debtor breaks a promise. Therefore, the Bank should be protected by law if the debtor break a promise. This legal protection in order to provide legal certainty for the Bank in Indonesia. According to Cahyo, et al., (2019) Time Limit Use of Power to weigh on Security in doing as set forth in PMA No. 22 2017 on Determination of deadline for use of a Power of Attorney to charge fees for Guaranteeing Mortgage Loans Settlement of Certain. Under these provisions, SKMHT used as collateral is apparent the need for legal reform SKMHT done to realize the objectives of the law as the basis of fairness, certainty and benefits to the community and stakeholders (Cahyo et al., 2019). Based on this, it was analyses by in-depth research on legal protection for Indonesian banks to SKMHT which is valid until the expiration of the debt.

Material and Methods

The research method is basically a series of systematic steps or methods used to find truth in a scientific work in this case is the writing of a dissertation, so as to produce a quality dissertation that is a dissertation that meets the research requirements. The method contains aspects including stages of activities carried out, materials and tools as well as ways used to collect data, process, and analyze to obtain answers to research questions (Soemitro, 1990).

Types of Research

The type of research used is liter or library research, meaning a study by examining books or books related to this research originating from the library (library material). All sources come from written materials (print) relating to research problems and other literature as well as electronics (Hadi, 1980).

Research Approach

The approach used in this study is a qualitative approach, which is an approach that in data processing and analysis does not use numbers, symbols and or mathematical variables but with a deep understanding (in depth analysis) by examining the problem in case cases. In the discussion the researcher uses a normative juridical approach, which is the type of approach using statutory provisions that apply to a country or the method of doctrinal legal approach that is legal theories and opinions of legal scientists, especially those related to the issues discussed (Soemitro, 1998). In his discussion of researchers early this approach yuridi normative (Mamudji, 1994), that kind of approach to the use of statutory provisions that apply to a State or approach doctrinal law that legal theories and opinions of legal scholars, especially with regard to issues discussed. The juridical-normative approach used in this study is the approach through legislation relating to the issues discussed.

Source or Material

Source or materials used in the pen elitian is bersumberkan on the source material of primary research and secondary research material sources, namely

a) Primary research material sources in the form of; basic norms, laws and regulations.

The regulations used as primary legal material are as follows:

1) Civil Code;

2) Law Number 4 of 1996 concerning Mortgage Rights and Land Related Items;

3) Law of the Republic I n donesia Number 20 Year 2008 on Micro, Small, and Medium Enterprises;

4) Regulation of the Minister of Agrarian and Spatial Planning/Head of the National Land Agency of the Republic of Indonesia Number 22 Year 2017 Regarding the Deadline for the Use of Power of Attorney Imposing Mortgage Rights to Guarantee Certain Credit Repayment;

5) Bank Indonesia Regulation Number 14/22/PBI/2012 Regarding Lending or Financing by Commercial Banks and Technical Assistance in the Context of Micro, Small and Medium Business Development.

b) Secondary research material sources in the form of: literature books, legal research reports namely written/scientific papers relating to the issues discussed, opinions/thoughts of experts, papers, newspapers, and other facilities that provide information services relating to the discussion of issues in this study.

Data Processing and Analysis Techniques

a) Data Processing Techniques

The techniques used to process data in this study are:

1) Data Editing: The process of selecting, focusing on simplifying, abstracting and transforming rough data arising from data that has been collected on the results of research, especially in terms of completeness, clarity of meaning, and suitability of data.

2) Organizing data, i.e. organizing and compiling data and grouping and categorizing in such a way as to produce complete and systematic material.

3) Presentation of data: i.e. presents a collection of data obtained presented in the form of a description arranged systematically and logically that allows the conclusion drawing.

Systematic, i.e. all data obtained will be linked to one another, adjusted to the subject matter examined so that it is a unified whole.

b) Data analysis

Once the data is collected it will be in the analyst is using qualitative data, the four stages to be used in analysing the data qualitatively, namely:

1) Collection, namely the collection of data obtained from materials collected related to legislation as well as books, books, scientific works, and other literatures.

2) Reduction, namely the selection and sorting of basic and important data needed in the preparation of research, so that the direction of discussion and flow is clear

3) Display, i.e. to insert the results of data reduction into patterns that are carried out in the form of a brief description. If the pattern has been found, then it is as a standard guideline which will then be displayed at the end of the study.

4) Conclusion, i.e. drawing temporary conclusions that may change if at the time of writing the research new data is found to support the research. In applying this stage, using two methods, namely:

a. Analysis of Inductive, the method of thinking that departs from the fact - the fact that special events are then drawn generalizations of a general nature.

b. Deductive Analysis, namely the mind-set that departs from general facts or events which are then drawn by generalizations that are special in nature.

Results and Discussion

According to Law No. 10 of 1998 on banking, the Bank is an entity that has the function to collect funds from the public in the form of savings and channel them to the public in the form of loans or other forms with the aim of improving the living standard of the people (Law of the Republic of Indonesia Number 10 of 1998). The decree states that the task of the bank one of them is doing lending to the public. Lending by banks would require the guarantee as a form of confidence of banks in providing credit/loans to customers/debtors. According to Susilo, Triandaru & Santoso (2006) is generally the bank's main function is to collect funds from the public and channel them back to the community to share the purpose or as a Financial Intermediary. Specifically the main functions of banks are:

Agent of Trust

The main basis of banking activities is trust, both in terms of raising funds and channelling funds. The public will want to leave their funds at the bank if there is an element of trust. The community believes that the money will not be misused by the bank, the money will be used properly, the bank will not go bankrupt, and at the time promised the deposit can be withdrawn from the bank. The bank itself will be willing to place or distribute funds to debtors or the public if based on the existence of an element of trust. The bank believes that the debtor will not abuse the loan, the debtor will manage the loan funds well, the debtor will have the ability to pay when due and the debtor has good intentions to repay the loan and other obligations when due.

Agent of Development

The economic activities of the people in the monetary sector and in the real sector cannot be separated. The two sectors always interact and influence each other. The real sector will not be able to perform well if the monetary sector does not work well. Bank activities in the form of fund raising and distribution are very necessary for the smooth running of economic activities in the real sector. The bank's activities enable the public to carry out investment, distribution, and consumption and service activities, bearing in mind that these activities cannot be separated from the use of money, the smooth running of these activities is nothing but a community economic development activity.

Agent of Service

In addition to conducting fundraising and distribution activities, banks also offer other banking services to the public. The services offered by this bank are closely related to the economic activities of the community in general. These services can include money transfer services, safekeeping of valuables, providing bank guarantees, and billing settlement.

Article 1 number 11 of Law No. 10 of 1998 concerning Banking, credit is the provision of money or bills that can be likened to it, based on agreements or loan agreements between banks and other parties that require the borrower to repay debt after a certain period of time with interest. According to Hermansah (2005) a credit agreement is a principal agreement (principle) that is real. As a principle-based agreement, the guarantee agreement is the assessor. The existence and termination of the guarantee agreement depends on the principal agreement. The real meaning is that the occurrence of a credit agreement is determined by the transfer of money by the bank to the debtor customer and the credit agreement has the following functions:

a. The credit agreement serves as the principal agreement;

b. The credit agreement serves as evidence of the limitations of rights and obligations between creditors and debtors;

c. Credit agreements serve as a tool for monitoring credit

The function of credit guarantees in order to award credit in respect of the seriousness of the borrower to meet its obligations to repay the loan in accordance with the agreement and use its funds properly and carefully. Both are expected to encourage the borrower to repay the debt so that it will be able to prevent disbursement of loan guarantees that may be unwanted because it has the value (price) is higher when compared with the borrower to the bank debt (Bahsan, 2007). Loans extended by banks one of which is the People's Business Credit (KUR). People's Business Credit (KUR) is a government program to support the empowerment of Micro, Small and Medium Enterprises (SMEs) and cooperatives. KUR as one form of credit to MSME needs to be monitored its implementation for each credit cannot be separated from the credit risk (Zahroh & Nuzula, 2014). Factors that can affect the profitability of SMEs in a country are based on the number of business units, level of education, type of business, family-run businesses, expertise, licenses, advertisements and bank accounts which are significant in influencing the profitability of SMEs. These factors can help the country in making a policy towards development for the better interests. As well as providing understanding for investors, investment banks and other financiers (Njanike, 2019).

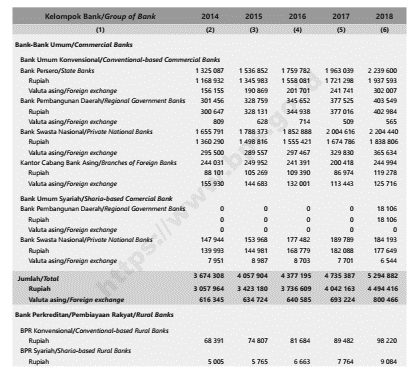

Based on the Law of the Republic of Indonesia Number 20 of 2008 concerning Micro, Small and Medium Enterprises, it provides an understanding of MSMEs. Article 1 number (1) Micro Business is productive business owned by individuals and/or individual business entities that meet the criteria for Micro Business as stipulated in this Law. Number (2), Small Business is a productive economic business that stands alone, which is carried out by an individual or business entity that is not a subsidiary or not a branch of a company that is owned, controlled, or is a part either directly or indirectly of a Medium-sized Business or Business Large companies that meet the Small Business criteria referred to in this Law. Number (3), Medium Business is a productive economic business that stands alone, which is carried out by an individual or business entity that is not a subsidiary or branch of a company that is owned, controlled, or is a part either directly or indirectly with a Small Business or Large Business with a net worth or annual sales results of less than Rp 50,000,000,000.00 (fifty billion rupiah). Liabilities of banks to provide credit and financing provided for in Article 2 paragraph (1) Bank Indonesia Regulations Number 14/22/PBI/2012 on Lending Or Financing by Commercial Banks and Technical Assistance in the Context of Development of Micro, Small, and Medium. Whereas in paragraph (2) banks are required to provide credit to MSMEs at a minimum of 20% (twenty percent) which is calculated based on the ratio of MSME Credit or Financing to total Credit or Financing. The development of lending by banks in Indonesia can be seen in Figure 1 below:

Figure 1 : Outstanding Of Micro, Small, And Medium Enterprises (Msmes) Credits Of Commercial Banks (Billion Rupiahs), 2016–2018

Based on the above data it can be seen that the realization of credit in the MSME sector is quite high. With the high realization of credit for MSMEs, of course it will also potentially have the risk of non-performing loans or debtors defaulting. Non-performing loans are also often referred to as Non Performing Loans (NPL). The factors for the occurrence of Non-Performing Loans (NPL) are caused by:

a. Lack of good faith from the debtor;

b. Policies from the government and Bank Indonesia;

c. Economic conditions.

Non-Performing Loans based on Bank Indonesia Regulation No. 6/10/PBI/2004 concerning the Rating System for Commercial Banks, stipulates that the ratio of non-performing loans (NPL) is 5%. The calculation formula for NPL is as follows:

Ratio NPL=(Total NPL/Total Credit) x 100 %

The following is the ratio between loans and Non-Performing Loans (NPL) which can be seen in the following figure 2:

Figure 2 : Detail Of SMES Credit And Detail Of Mkm Credit Based On Group Of Bank (Billion Rp) 2013-2018

Based on PBI No No. 6/10/PBI/2004 which requires a NPL of 5% so that banks in providing loans must pay attention to the principle of prudence. As regulated in Article 8 of Law Number 10 of 1998. Article 8 of Law No. 10 of 1998 states that in giving credit or financing berasarkan Sharia, Commercial Banks are required to have faith based or faith-depth analysis and the ability and responsibility of debtor untu k repay the debt or restore the financing referred to in accordance with the agreement.

According to Law No. 4 of 1996 on Mortgage, that the object of mortgage is land. Land used as collateral must be bound by the imposition of Mortgage Deed. But if the existence of a condition has not been met, it can be tied first with the Power of Attorney Imposing Mortgage (SKMHT). It is as specified in Article 15 paragraph (3) to (5) states that:

1. Paragraph (3) Power of Attorney Imposing Mortgage over land rights that has been registered shall be followed by the manufacture of Giving Encumbrance no later than one (1) month after given.

2. Paragraph (4) Letter of Authority Imposing Mortgage over land rights that have not been registered shall be followed by the manufacture of Giving Mortgage Deed no later than 3 (three) months after granted.

3. Paragraph (5) The provisions referred to in paragraph (3) and (4) does not apply in the case of the Power of Attorney Imposing Mortgage granted to certain credit guarantees set out in the legislation in force. Special credits referred to in paragraph (4) are micro by no-enterprises and small businesses.

The arrangement of the SKMHT valid until the expiration of the current debt stipulated in Minister of Agrarian and Spatial Planning Head of National Land Agency of the Republic of Indonesia No. 22 of 2017. The regulation has been in accordance with the provisions of Law No. 4 In 1996, Article 15 (5). Thus, the bankers have got a good legal protection against the use of SKMHT without APHT tied to credit for micro and small businesses as well as certain loans. In the Regulation of the Minister of Agrarian and Spatial Planning/Head of National Land Agency of the Republic of Indonesia Number 22 of 2017 SKMHT the entry into force until the expiration of the debt that is stipulated in Article 2, namely:

1. Financing or lending can only be granted to the micro and small enterprises that are productive business with individual and corporate ownership of individual businesses;

2. Financing or lending to housing provision is limited to:

a. Land with a maximum area of 200 m² and the building area is not more than 70 m² to the ownership or core home improvement, modest houses or flats with an area, and;

b. Ready to Build plot (BCC) with a land area of 54 m² up to 72 m² and special credit is only given to the improvement of the building.

3. To finance or other productive business loans with a ceiling of up to IDR 200,000,000.00 (two hundred million rupiah).

Under the provisions of the above is very clear that SKMHT be valid until the end of the debt, this is certainly a great help for the micro and small businesses to obtain capital fund or credit. Credit given to customers must be preceded by the existence of an agreement is a credit agreement. In the execution of the loan agreement made between the bank and its customers or businesses in the form of standard agreements. Bank credit agreement is a standard agreement whose contents are determined unilaterally by the bank, with the goal of efficiency. Small businesses with its unique characteristics, is in need of funds to develop their business so as to agree on what agreed in the credit agreement, although very burdensome. Credit agreements sometimes include a clause on the exoneration be added the rights and/or reduce the obligations of the bank, so the problem is how the application of the principle of balance in the manufacture of a bank loan agreement with small business customers. Bank in designing, formulating and establishing a credit agreement with a small business, required based on the provisions of the Financial Services Authority Circular No. 13/SEOJK.07/2014 About Baku Treaty. The credit agreement shall not contain the exoneration clause in the form of the transfer of bank liabilities to customers, and express authorization from the customer to the bank, either directly or indirectly shall not contain clauses that have indications of abuse situation.

Application of the principle balance of the parties to implement the credit agreement have been agreed in good faith, as the application of the principle of justice and fairness shall not contain a clause to the effect that the customer is subject to the new regulations, additional, secondary and changes made unilaterally by the bank, therefore the content of the agreement should not be complicated by using a simple Indonesian adapted to the type of loans, considering the characteristics and small businesses (Mulyati, 2016). SKMHT an agreement to provide power to the Bank of particular importance. It is stipulated in Article 15 paragraph (1) of Law No. 4 of 1996 on Mortgage of the requirements of SKMHT. The requirements in SKMHT namely:

a. Load power in the not to take legal actions in addition relates to impose Mortgage.

b. No substitutes (give power to others);

c. Mortgage load object clearly, the amount of debt and the name and identity of its creditor, the name and identity of the debtor if the debtor is not giving Encumbrance.

Because SKMHT only an authorization, then SKMHT only serves as an authorization of the debtor to the bank to take legal actions in order to charge a Mortgage. According to the Code of Civil Code Article 1792, the authorization is an agreement by which a person give power to someone else, who received it, for in his name conducting an affair in Kitab Undang-Undang Hukum Perdata (Burgerlijk Wetboek voor Indonesie). Imposition Mortgage is an agreement in order to guarantee a body to guarantee a loan or borrowing which is a security agency. According to Law No. 4 of 1996 that guarantees Mortgage has the force of law in the context of execution if the debtor break a promise while SKMHT not a security agency but solely as an institution of power which has not given a definite position as a preferred creditor.

Based on the above very clearly that SKMHT not have the force of law in carrying out execution if the debtor reneged in paying credit. Regulation of the Minister of Agrarian and Spatial Planning/Head of National Land Agency of the Republic of Indonesia Number 22 Year 2017 only regulates the entry into force SKMHT until the expiration of the debt, while if their reneged on the promise of the debtor then on the basis of the provisions of SKMHT that the Bank can as soon as possible of binding into Encumbrance. Under the provisions of Law No. 4 In 1996, Article 15 (6) i.e., when SKMHT the time of limit specified in the regulations are not followed by the granting of mortgage deed null and void. Secure rights to land as collateral and not registered if the debtor did break a promise when SKMHT ends, then the lender cannot be executed directly against the guarantee. SKMHT have been made null and void because it does not follow with APHT and land registration process is carried out until the end of the time period such SKMHT (Watikno & Imanullah, 2019).

Thus that Regulation of the Minister of Agrarian and Spatial Planning/Head of National Land Agency of the Republic of Indonesia Number 22 Year 2017 has provided certainty and legal protection of enactment SKMHT until the expiration of the debt only to provide convenience and relief for small businesses (SMEs) and entrepreneurs with the number of a particular loan, whereas in case of breaking a promise to be tied into a deed granting of mortgage and registered land office. The binding is accompanied by a certificate of registration will be given. In the certificate as the provisions set forth in Article 14 paragraph (3) of Law No. 4 of 1996 has executorial power, which has the same meaning as the court ruling that has obtained permanent legal force.

Conclusion

Based on the results of research and analysis we concluded that SKMHT has a function to loans to micro and small businesses as well as certain businessman are valid until the end of unmanageable debt in the Minister of Agrarian and Spatial Planning/Head of National Land Agency of the Republic of Indonesia Number 22 of 2017. Provisions it also complies with Article 15 (4) of Law No. 4 of 1996 on Mortgage. With the exclusion of the legislation then in force until the expiration SKMHT debt created to provide protection and legal certainty for Indonesian banks to provide credit to micro and small businesses as well as certain business. It is a form of government assistance through the banking system to make it easy for debtors among the micro and small businesses as well as certain business.

SKMHT valid until the expiration of the debt will be binding to the Deed of Encumbrances Encumbrance (APHT) if the debtor reneged and registered with the local land office. Making the imposition of mortgage deed and the registration is done with regard to the execution of collateral objects. SKMHT be followed binding encumbrance because SKMHT only for the provision of power and not an insurance agency. Making the imposition of mortgage deed and the registration is done with regard to the execution of collateral objects. SKMHT be followed binding encumbrance because SKMHT only for the provision of power and not an insurance agency. Making the imposition of mortgage deed and the registration is done with regard to the execution of collateral objects. SKMHT be followed binding encumbrance because SKMHT only for the provision of power and not an insurance agency, so it cannot be used as a basis for carrying out guarantees.

References

- Agnello, L., Castro, V., & Sousa, R.M. (2019). The housing cycle : What role for mortgage market development and housing finance ? Journal of Real Estate Finance & Economics.

- Bahsan, M. (2007). Indonesian banking credit guarantee and guarantee law. Jakarta: Rajagrafindo Persada,

- Cahyo, K.A., Poesoko, H., Susanti, D.O., & Harianto, A. (2019). Characteristics of power of attorney for mortgage rights on collateral law system in. Journal of Law, Policy and Globalization, 87(1), 192-207.

- Civil code (Burgerlijk wetboek voor Indonesie).

- Fauzi, A. (2010). Existence of mortgage rights in banking credit. Innovative | Journal of Legal Studies, 2(3), 87-101.

- Habib, A.B.P.P. (2018). Legal protection for creditors against deed of granting mortgage rights that are not registered at the land office. Al-Jinayah: Journal of Islamic Criminal Law, 4(1), 186-201.

- Hadi, S. (1980). Metodologi Riserch 1. Yogyakarta: Gajah Mada.

- Hermansah. (2005). Indonesian national banking law. Jakarta, Indonesia: Kencana Prenada Media Group.

- Hestanto. (n.d.). People's economic system. Retrieved January 4, 2020, from https://www.hestanto.web.id/sistem-ekonomi-kerakyatan/.

- Mulyati, E. (2016). Treatment of suporter anarchism through criminal policy (Case study persib bandung and persija jakarta). Jurnal Bina Mulia Hukum, 1(13), 36-42.

- Nisa, C. (2016). Policy impact analysis of lending to MSMES on the growth of MSMES financed by banks. DeReMa Jurnal Manajemen, 11(2), 212-234.

- Njanike, K. (2019). The factors influencing SMEs growth in Africa: A case of SMEs in Zimbabwe. In regional development in Africa. IntechOpen.

- Oka A.S.Z.Z.A., & Nuzula, N.F. (2014). Analysis of credit risk management in minimizing problemed credits on people's business credits (Study at bank jatim, mojokerto branch). Jurnal Administrasi Bisnis, 12(1), 84-86.

- Soekanto, S., & Mamudji, S., (1994). Normative legal research: A brief overview. Jakarta: Raja Grafindo Persada.

- Wiryanta, I.P.D., Mertha, I.K., & Puryatma, I.M. (2016). Power of attorney to charge dependent rights (skmht) in banking credit agreement in Kota Denpasar. Acta Comitas: Journal of Notary Law, 1(2).

- Bank indonesia regulation number 14/22/pbi/2012 concerning the provision of credit or financing by commercial banks and technical assistance in the context of development of micro, small and medium enterprises.

- Regulation of the minister of agrarian and spatial planning/head of the national land agency of the republic of Indonesia number 22 of 2017 concerning determination of time limits for the use of power of attorney imposing mortgage rights to guarantee repayment of certain loans.

- Sari, A.K., Uripno, D., & Asrori, M.H. (2015). Legal protection for creditors who are mortgage holders who are not registered at the land office. Repertorium, 161-173.

- Soemitro (1990). Legal research methodology. Jakarta: Rineka Cipta.

- Soemitro. (1998). Legal and jurimetric research methodology. Jakarta: Ghalia Indonesia.

- Susilo Sri, Y.S. & T.B.S. (2006). Banks and other financial institutions. Jakarta: Four Salemba.

- Law no. 4/1996 concerning mortgage rights to land and objects related to land.

- Law of the republic of Indonesia number 20 of 2008 concerning micro, small, and medium enterprises.

- Law of the republic of Indonesia number 10 of 1998 concerning amendments to law number 7 of 1992 concerning banking.

- Usman, R. (2009). Civil Guarantee Law. (II, p. 3). Jakarta: Sinar Grafika.

- Watikno, A.R., & Imanullah, M.N. (2019). Provision of credit or financing by commercial banks and technical assistance for the development of micro, small and medium enterprises. Jurnal Repertorium, 6(1), 15.