Research Article: 2022 Vol: 21 Issue: 1

Do the Implementation of Self Assessment Corporate Governance Increase Firm Performance?

Dini Wahjoe Hapsari, Padjadjaran University

Winwin Yadiati, Padjadjaran University

Harry Suharman, Padjadjaran University

Dini Rosdini, Padjadjaran University

Citation Information: Hapsari, D.W., Yadiati, W., Suharman, H., & Rosdini, D. (2022). Do the implementation of self assessment corporate governance increase firm performance?. Academy of Strategic Management Journal, 21(1), 1-10.

Abstract

The primary objectives of this paper are to comment upon the self-assessment system of state-owned enterprises in Indonesia, assess the relative importance of different cluster industry and provide detailed information on each corporate governance implementation. The population research was 72 non-financial Indonesian state-owned enterprises. The overall score of corporate governance is taken from the annual report in 2020. This study finds that the highest predicate of corporate result is the energy, oil and gas cluster, mineral and coal cluster, infrastructure clusters, logistics clusters. A very good predicate with a score of more than 90. The score assessment result for health cluster, logistic cluster, telecommunication cluster, tourism, and support cluster shows an 85-90 with a very good predicate. Manufacture cluster, tourism and support cluster achieve a good predicate. Empirical evidence shows that corporate governance has a positive and significant influence on Indonesian state-owned enterprises. However, this study is limited to only a sample of Indonesian state-owned enterprises. Further studies should be conducted to understand better the complexity of the multi-attribute nature of the corporate governance model in state-owned enterprises in developing countries. The population set is a unique combination of all non-financial SOEs. Hence, these firms' self-assessment corporate governance practices, as understood from the results of this study, can be benchmarked for all Indonesian SOEs. It is the first paper explaining all indicators of self-assessment corporate governance for Indonesian SOEs.

Keywords

Corporate Governance, Self-assessment Score, Indonesia SOEs

Introduction

State-owned enterprises (SOEs) are a significant component of the economy in emerging countries. SOEs are businesses in which the government holds at least 51% of the equity. SOE, like any other business, must have sound governance in its operations. Corporate governance include institutional shareholders, boards of directors and commissioners, performance-based management, the capital market as controlling shareholder, ownership structure, financial structure, connected investors, and product rivalry. State-owned enterprises are established to meet social needs, not to increase profit. However, when the number of stakeholders increased, some governments modified the governance system for state-owned enterprises to improve performance. (Parker, 2000) State-owned enterprises in Indonesia are expected to play a role in bringing the country's economic development in line with global economic trends. Citizens profit from state-owned enterprises since they enhance infrastructure and transportation, in particular. The government controls enterprises in the oil, gas, mining, and coal industries as a significant source of revenue. SOE contributed IDR 415 trillion to the Indonesian government in 2019, which equates to IDR 23 trillion in tax revenue, IDR 50 trillion in dividends, and IDR 135 trillion in other non-tax state revenues (PNBP). SOE's earnings contribution to PNBP increased from 10% to 19% between 2010 and 2019.

In Indonesia, state-owned businesses (SOEs) continue to play a significant role, and government share ownership has not decreased, as it has in other emerging countries. As a result, there has been and continues to be collusion among power holders in the business environment of state-owned enterprises. In order to communicate information in business entities, SOE must be transparent as a firm. In response, the Indonesian government created legislation governing state-owned firms engaged in commercial and economic activity. It is connected to agency theory, in which the company's corporate governance plays a role in minimizing conflicts of interest. When the manager, as an agent, operates the company, his or her interests differ from those of the owner, conflict ensues. Because of the agency perspective, Jensen & Meckling 1976) argue that state ownership and management of government-appointed managers are distinct. When the manager, a paid agent charged with representing the owners' best interests, pursues self-interest rather than the owners' best interests, the agency encounters issues.

According to SOE Minister Regulation No, companies as SOEs are required to measure GCG implementation by conducting assessments. PER-09/ MBU/2012 dated July 6, 2012, on Amendment to SOE State Minister Regulation No. PER-01/MBU/2011 dated August 1, 2011, on the Implementation of Good Corporate Governance in SOE Article 44. Every year, the company assesses its GCG implementation to establish its level of appropriateness. An external assessor conducts a Good Corporate Governance (GCG) assessment every 2 (two) years, interspersed with self-assessments completed by the company's internal assessors every succeeding year. An external assessor conducts the assessment on behalf of a third party outside of the company.

Bai & Xue (2005) argue that state-owned enterprises would also pursue objectives other than profitability and efficiency to improve their performance. Lu (2009) argues that a good governance system at SOE does not only make the company's performance healthy, but it can make the company survive despite the economic crisis. The study results (Khongmalai et al., 2010), who conducted SOE research in Thailand, stated that the corporate governance model shows that strategic human resources are the most strategic factor followed by information technology and risk management internal control, and internal audit in sequence. In the future, state-owned enterprises will have to face rapidly changing economic conditions, rapid technological developments, and government conditions for the next few years. Facing this change requires a change in corporate governance (Huang & Jing, 2019) Furthermore (Adel, 2021) argues that an application of GCG is also considered to reduce the risk of corporate business failure.

According to research conducted by Chung & Zhang (2011) on applying corporate governance in Indonesia, the Indonesian government can see a big committed institutional investor's ownership of state-owned firms. According to Murni & Nengzih (2018), effective corporate governance is predicted to increase firm performance in Indonesian state-owned firms. (Musallam 2020) claims that the larger the shareholders, particularly the state shareholders, the better the company's performance in Indonesia. However, the size of the government's shareholders has no bearing on the investors. Given the relevance of SOE corporate governance in supporting state development (Given the importance of state-owned enterprises in developing nations and corporate governance implementation, this study will focus on three objectives):

(1) Conduct a self-assessment analysis of corporate governance at Indonesian SOEs; (2) Providing detailed information on each parameter of corporate governance; (3) The effect of corporate governance on firm performance

Literature Review

Agency Theory

According to Jensen & Meckling (1976), agency theory is a contract between the manager (agent) and the owner (principal). For this contractual relationship to run smoothly, the owner will delegate decision-making authority to the manager. An agency relationship is a contract in which one or more people (employer or principal) employs another person (agent) to perform several services and delegates decision-making authority to the agent (Jensen & Meckling, 1976). The ownership of BUMN (government) shows the amount of government ownership in a company. Government ownership is more aimed at business units or agencies that affect the interests of many people or business units that serve the public at large. Government ownership is generally fully controlled by the state and only a small portion for other ownership structures. According to the Decree of the Minister of SOE in Indonesia Number Kep-117/M-MBU/2002, Corporate Governance is a process of structure used by BUMN organs to improve business success and corporate accountability to realize shareholder value in the long term while taking into account the interests of other stakeholders. Based on law, regulations, and ethical values.

Good Corporate Governance

Corporate governance is a process and structure used by company organs (shareholders, board of commissioners, and board of directors) to improve business success and corporate accountability in order to realize long-term shareholder value while taking into account the interests of other stakeholders, all while adhering to laws and ethical values. Business leaders, researchers, policymakers, and others are always interested in learning more about corporate governance. From time to time, our understanding of Corporate Governance practices evolves. GCG (good corporate governance) is a framework for regulating and controlling a company to add value to all stakeholders. This concept emphasizes two points: first, the importance of shareholders' right to receive accurate and timely information, and second, the company's commitment to providing accurate, timely, and transparent disclosures of all information on company performance, ownership, and ownership stakeholders. SOEs are required to implement good corporate governance under Law No.19 of 2003 concerning BUMN and the Decree of the Minister of State-Owned Enterprises of the Republic of Indonesia Number: KEP-117IMBU/2002 concerning the Implementation of Good Corporate Governance Practices in State-Owned Enterprises (Figure 1).

The company seeks to optimize the application of good corporate governance principles, namely transparency, accountability, responsibility, independence, and fairness in every operational activity. The implementation of good corporate governance will strengthen trust and increase value for shareholders and stakeholders.

Transparency is shown by the company ensuring access to pertinent information in a timely and accurate manner to Shareholders and other stakeholders. This always gets the attention of the company in order to ensure the fulfillment of the rights of the Shareholders and other stakeholders. Accountability is seen as how the company has regulated the function clarity, structures, systems, and responsibilities of each of the company's organs so that all business and operational activities of the company can run effectively and efficiently and can be accounted for transparently and fairly in order to realize sustainable performance. Responsibility means when the firm is always according to the applicable laws and regulations in carrying out every business activity and its daily operations to create a healthy and conducive business climate. In addition, as part of the community, the company also always does its social responsibilities towards society and the environment. Independency can be explained by the company ensuring that responsibilities are carried out, obligations and authorities of each organ of the company always run well without any intervention from other company organs or other parties who do not adhere to the regulation and policies from the government. Fairness where the company does not take discriminatory actions and guarantees the protection of the rights of shareholders and stakeholders following the regulation and policies from the government.

SOE is a company that must have good performance to carry out the policies issued by the government. Therefore, on the one hand, SOE must meet its performance targets; on the other hand, as a public sector company, it must provide services to the community according to the needs of the government. To achieve this goal, the Ministry of SOE, as the majority shareholder, made a self-assessment regulation in 2012. The goal is for SOE to more freely assess and integrate governance principles which are the key management processes to ensure performance achievement.

The assessment method uses a measuring instrument with six aspects and a specific weight as outlined in the above copy of the Ministry of SOE Secretary's Decision No. SK-16/S.MBU/2012 as follows:

1. Commitment aspects to the implementation of Good Corporate Governance Continuously: The first aspect assesses six indicators related to corporate governance guidelines (GCG code), and code of conduct, gratification control, and alleged corporate irregularities (whistleblowing system). The maximum score of the first aspect is 7.

2. Shareholders and GMS/Capital Owners: This aspect consists of 6 aspects related to the General Meeting Shareholders (GMSS) for the appointment or dismissal of the Board of Commissioners and the Board of Directors, ratification of the annual report, and the responsibility of shareholders in implementing corporate governance. The maximum score of the second aspect is 9.

3. Board of Commissioners/Supervisory aspects: All duties and responsibilities of the board of commissioners are regulated in 12 indicators with a maximum score is 35. The Board of Commissioners has the function of supervising the board of directors on implementing plans and policies. As a commissioner, he participated in training to improve his abilities.

4. Board of Directors: All duties and responsibilities of the board of commissioners are regulated in 13 indicators with a maximum score is 35. In addition, SOE Directors must attend ongoing training, develop work programs, implement them to achieve performance targets, maintain good relations with commissioners and stakeholders, ensure information disclosure, and hold annual GMS and others.

5. Information Disclosure and Transparency: Companies must provide information, access stakeholders, submit information on annual reports and financial reports, and participate in ARA. The maximum score is 9.

6. Other aspects: This aspect related to the company has become a benchmark for other companies in Indonesia. The maximum score is 5

These six parameters are based on corporate governance principles (transparency, accountability, responsibility, independence, fairness) adapted to Indonesian SOE. The core element of these five principles is the company’s performance improvement through monitoring of management performance and management accountability to the stakeholders, according to the applicable rules and regulations.

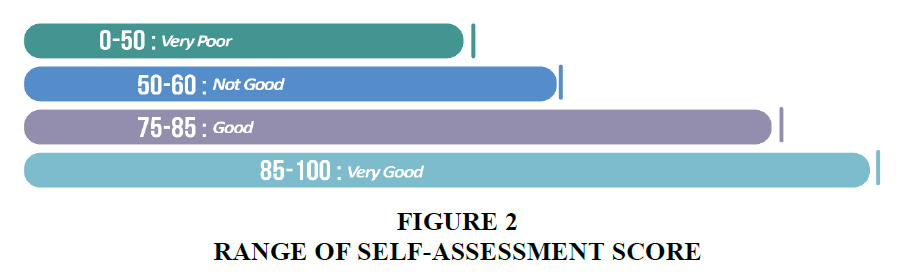

After assessing each aspect of the implementation of corporate governance, the appraiser adds up to 6 (six) aspects. The final step is to determine the assessment score and quality classification of the implementation of SOE corporate governance. The classification of the assessment is divided into 4 criteria. Very Good (85-100) is the highest rating, showing the achievement of corporate governance implementation above 85%. These results illustrate that the company has been able to implement all aspects very well. Therefore, the recommendation submitted is to keep the score, maintaining all aspects that the company can maintain and improving less value.

The predicate “Good” (75-85) describes the company that has implemented the governance within the good category, but there are still some weaknesses that the company must improve. The recommendations given are inputs from the external assessment team to improve the findings. Although it is hoped that the company will improve its achievement to reach a better score from each aspect in the next period, it is also expected to increase the predicate to “very good”.

The predicate “Not Good” (50-60) describes the company has not been able to apply all aspects of the assessment determined. Many things have to be improved by the company, carrying out all reviews from external appraisers to implement the next period. The lowest criterion is Very Poor (0-50), describing poor corporate governance in terms of the 6 aspects of the company.

The predicate of “not good” or “very poor” can be caused by the company not having implemented the criteria tested in the scope of aspects and aspects of corporate governance implementation. Therefore, when the appraiser reports the achievement of the self-assessment, it also provides recommendations in the form of a corrective action plan along with the target time for its implementation. So that in the next report, it is included from the recommendations that have been given what have been improved by the company in the next period.

Based on the overall score, can be made the predicate of self-assessment. A summary of the score and their predicate are presented in Figure 2.

Corporate Governance and Balanced Scorecard Measure

The performance of SOE can be measured in a variety of ways. A balance of financial and non-financial metrics is required for effective performance management. The balanced scorecard is a model that may assess both financial and non-financial performance. When short-term and long-term goals are considered, four views emerge. Four points of view can be examined in-depth:

1. From a financial perspective, profitability is frequently associated with financial metrics such as Return on Assets (ROA), Return on Equity (ROE), and Return on Investment (ROI). Financial performance measures organizational learning and growth, internal business processes, and customer perspective to provide a final result or bottom-line organizational improvement.

2. This area focuses on what must be done and what is most important to accomplish the mission from the customer's perspective.

3. Internal business processes: this perspective focuses on the activities that an organization must perform effectively to satisfy customer requirements.

4. Learning and growth perspective: this component focuses on how an organization can improve employee performance (through training), improve, and learn to support critical operations success.

Methodology

The sample includes 72 non-financial state-owned firms in Indonesia, with data from the year 2020. Self-assessment score is secondary data, and firm performance uses primary data. The data was collected through questionnaires. To answer the first question, research will be explained with the average self-assessment score in each cluster. Then, we analyze each aspect from the self-assessment in detail (Second question research). The six parameters of corporate governance (i.e., the company’s commitments for corporate governance implementation, shareholders, board of commissioners, directors, other aspects) were derived from the company at the corporate secretary division. Last, the data were analyzed using partial least squares structural equation modeling (PLS-SEM) to answer the third research question. The reasons for choosing PLS-SEM are: (1) the tools can be used for relatively small sample sizes, and (2) PLS can estimate the relationship between variables, both ordinal and ratio scales simultaneously.

Discussion

Factor Analysis and Identifying the Corporate Governance Practice

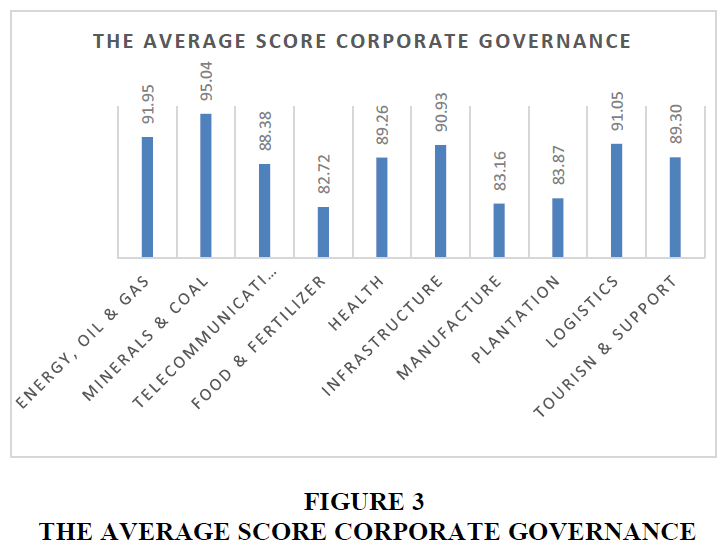

The average of self-assessment scores in each cluster is shown in Figure 3. Overall, the average self-assessment score is 88.57, indicating that SOE's corporate governance implementation is excellent.

The self-assessment score above 90 is obtained by energy, oil, gas, minerals and coal, infrastructure, and logistics clusters. The fact shows the four clusters have SOE with large firm size, and some have go public. For example, the energy, oil, and gas cluster has 2 companies with large firm sizes, namely PT Permatina and PT PLN, the only energy companies in Indonesia or monopoly companies in Indonesia. As large companies, Pertamina and PLN have a greater responsibility in implementing governance.

The mineral and coal cluster has three companies that have go public before becoming a holding company for the mineral and coal. PT Aneka Tambang, PT Timah, and PT Bukit Asam joined as Mining Industry Indonesia (Mining ID) members as a sub-holding. Holding mining ID is held by PT. Inalum.

In the infrastructure cluster, seven companies go public from eleven companies in this cluster. This cluster is one of the SOEs that supports government programs in developing infrastructure. For example, companies in this cluster assist the construction of buildings, dams, and high way.

The logistics cluster is also a cluster that helps the government program. They contribute to transportation and logistics. There are eight companies in this cluster and no companies that have go public.

Based on this explanation, the companies have large sizes, have go public, and have a relationship with development government programs more concerned with implementing corporate governance.

The next discussion is an analysis of forming a self-assessment score. The self-assessment is formed from six aspects. The calculation of each aspect can be seen in Table 1:

| Table 1 Score all Aspects of Corporate Governance Measurement | ||||||

| Cluster | Aspect 1 | Aspect 2 | Aspect 3 | Aspect 4 | Aspect 5 | Aspect 6 |

| Energy, Oil & Gas | 6,84 | 8,53 | 32,92 | 32,47 | 7,64 | 3,54 |

| Minerals & Coal | 6,58 | 8,75 | 33,90 | 33,65 | 8,46 | 3,70 |

| Telecommunication | 6,4 | 8,07 | 33,16 | 34 | 7 | 5 |

| Food & Fertilizer | 6,23 | 7,51 | 29,87 | 30,02 | 6,92 | 2,17 |

| Health | 6,73 | 8,37 | 31,96 | 32,84 | 7,05 | 2,29 |

| Infrastructure | 6,44 | 8,50 | 32,50 | 32,60 | 7,61 | 2,81 |

| Manufacture | 4,97 | 6,91 | 25,57 | 25,45 | 5,62 | 0,31 |

| Plantation | 5,62 | 7,16 | 26,62 | 27,17 | 6,13 | 1,00 |

| Logistics | 6,43 | 8,27 | 32,33 | 32,61 | 7,93 | 3,36 |

| Tourism & Support | 6,17 | 8,35 | 31,79 | 32,55 | 7,85 | 2,59 |

Table 1 shows an illustration of each aspect:

1. Aspect 1: dedication to the execution of long-term governance.

2. There were eight clusters of non-financial enterprises with scores of more than 6 (equivalent to 85 percent -90 percent performance), demonstrating SOE compliance in this area. Companies develop a GCG code, a code of conduct, and work to improve GCG implementation in the company's activities on a consistent and continuous basis. Two clusters received a score of 6 or 71 percent.

3. Aspect 2: Shareholders and the Annual General Meeting Shareholders (GMS); the company performs two times the GMS. GMS is held at least once a year regularly. The annual GME of shareholders considers the approval of the Annual Reports, which must include financial statements, reports on the company's activities, and reports on social and environmental responsibility implementation. In addition, extraordinary GMSs can be held at any time if the Board of Directors, Board of Commissioners, or Shareholders believe it important to address issues not addressed at the Annual GMS.

4. There are eight businesses with a score of more than 7.5. (more than 80 percent achievement). This result demonstrates that the organizations are committed to implementing corporate governance in compliance with existing rules and regulations.

5. Aspect 3: Board of Commissioners; The Board of Commissioners is responsible for overseeing and monitoring the application of corporate governance. The Shareholders are represented by the Board of Commissioners, which has an independent status and functions to oversee policies and management in general and provide advice to the Board of Directors.

6. There are eight companies with a score of greater than 30. (more than 80 percent achievement). That is to say, the Board of Commissioners' responsibility to GMS has been fulfilled, as have the rules.

7. Aspect 4, Board of Directors

8. The Board of Directors is fully responsible for managing the company for the company's interests and objectives following the provisions of the Article of Association. According to the Regulation of Ministry of State-Owned Enterprises, prospective members of the board of directors must meet formal and material requirements to be appointed as members of the Board of Directors.

9. 8 companies have scored more than 30 (more than 80% achievement). The Board of Directors at State-Owned Enterprise has carried out their functions and duties following the Ministry of State-Owned Enterprises regulation. They are appointed and dismissed by the GMS.

10. Aspect 5, Information disclosure and transparency;

11. Stated-Owned Enterprise provides a corporate website that is easily accessible by all stakeholders. The company's website is part of the disclosure of information conducted by the company so that all stakeholders can easily obtain the latest information related to the company. The company's information contains gratification control guidelines, an annual report, and a financial report.

12. 5 companies have score more than 30 (more than 85% achievement).

13. All State-Owned Enterprises have a website that can see for all stakeholders, but only 5 clusters have provided the complete important information.

14. Aspect 6, Other Aspects;

15. This aspect shows that SOE has been able to become an example for other SOEs; it turns out that the average achievement rate of 50% shows that there are still many SOEs that have not become examples. The highest achievement was achieved by the energy, oil, and gas cluster by 71% and the minerals and coal cluster by 74.

Dedication to the execution of long-term governance, GMS, Board of Commissioners, Board of Directors, Information disclosure and transparency, and other aspects are the components that must be implemented for SOEs. We can see which aspects are more dominantly applied by the companies.

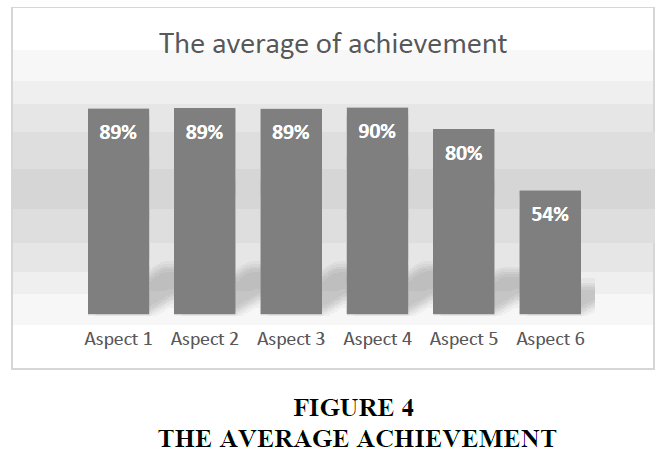

Figure 4 shows the percentage of achievement of each aspect for all non-financial SOEs. Aspect 4 shows the highest achievement score of 90%, indicating that the directors have carried out their duties following their functions and responsibilities in the company. Aspect 1, aspect two and aspect 3 reached 89%, indicating that SOE already has a GCG code and code of conduct and carries out continuous updates, conducts annual GMS for the appointment or dismissal of the Board of Commissioners and Board of Directors, gives approval and ratification of the annual report. The Board of Commissioners carries out its function as a supervisor for the running of the company.

The achievement of aspect 5 of 80% shows SOE's ability to provide information and access stakeholders, including information on annual reports and financial reports. It can be seen that currently, all non-financial SOEs have websites that provide complete information. The 6th aspect obtained the lowest score of 54%. SOEs that benchmark the implementation of governance are carried out by large companies or go public. The number of large SOEs is still low, and only 15 SOEs went public.

The Relationship Between Self-Assessment Corporate Governance With State-Owned Enterprise’s Performance

We create a multivariate cross-sectional model that tests the impact of self-assessment governance with SOE's performance, measured using the BSC approach. The SOE governance has been defined above as overall self-assessment score by 6 (six) aspects of 1)commitment to sustainable good corporate governance implementation; 2)shareholders and GMS/capital owners; 3)board of commissioners; 4)board of directors; 5)information disclosure and transparency; 6)other aspects.

SOE's performance is measured by a balanced scorecard (BSC). The balanced scorecard is a performance measurement system introduced by Kaplan and Norton (1992). As a result, IT gained increasing popularity as an effective management tool. BSC measures performance through an integrated multi-level Financial, Customer, Internal Business Processes and Learning and Growth perspectives.

The data in Table 2 shows the positive relationship between corporate governance and SOE’s performance. ( = 0.254; p-value < 0.001; t-value > 1.96).

| Table 2 Assessment Result | |||||

| Hypotheses | Path Analysis | p-value | t-value | Conclusion | |

| Corporate governance -> SOE Performance-BSC | 0.254 | 0.001 | 4,858 | + | Accepted |

Based on the result (Table 2), a statistically significant effect exists between the two constructs in a positive direction, indicating that the implementation of self-assessment corporate governance positively affects State-owned Enterprises Performance measured by a balanced scorecard. The result shows that when the companies can implement all aspects as good as the minister regulation, this increases their performance. This study’s result aligned with that reported (Bai & Xu, 2005).

Conclusion

From a theoretical perspective, this study describes the function of the elements of corporate governance, the aim of which is the existence of a governance measurement model for SOE. Judging from the self-assessment score, it can be seen that SOE in the minerals and coal cluster, energy, oil and gas cluster, logistics cluster, and infrastructure cluster has a score above 90. On the other hand, plantation clusters and manufacturing clusters have self-assessment scores below 85. The best implementation of corporate governance is the board of directors, a commitment to sustainable governance compliance, the GMS, the board of commissioners, information disclosure and transparency, and other aspects. It is important to note, although the board of directors is the main focus in implementing governance, in the literature and self-assessment, it ranks third in the assessment for SOE in Indonesia. The strategy needed is to continue to improve the ability of the board of directors to participate in training according to their field while in office. This result aligns with the existing policy in the fourth aspect; namely, continuous training is needed.

In addition, this study raises various self-assessment scores for each cluster. Klosters with large companies or go public companies or companies supporting government development have a high self-assessment score. Seen in the energy, oil, and gas cluster, Pertamina and PLN hold the monopoly on Indonesia's energy and electricity business. The minerals and coal cluster has four large companies, and three of them go public; in addition, SOE in this cluster maintains the availability of Natural Resources in Indonesia. The infrastructure cluster and logistics cluster are the SOEs that concern the government because they help developers in the infrastructure sector, namely the construction of toll roads throughout Indonesia and the transportation sector, to provide good services after the infrastructure is formed. The tourism and support cluster is classified as very good; this cluster supports government programs to increase domestic and international tourism. The health cluster consists of three pharmaceutical companies, and two of them have go public. Following the global health sector trend and disease in developing countries, which require a more solution that has to go public. Nevertheless, this is different from the food and fertilizer cluster, manufacturing cluster, and plantation cluster. Even though each self-assessment score is below 90, it is still classified as Good. Based on a managerial perspective, this paper has shown the achievements of governance implementation by companies under the Ministry of SOE. It is hoped that an assessment of corporate governance can be carried out in further studies concerning performance.

References

Lu, X. (2009). Governance of Shanghai state-owned enterprises: Deficiencies and recommendations. International Journal of Law and Management, 51(3), 169-178.

Parker, D. (2000). Utilities in the UK : performance and governance. International Journal of Public Sector Management, 12(3), 213-235.