Research Article: 2022 Vol: 26 Issue: 4

Does Accepting Risk Increase Profitability? Evidence across Industries in Vietnam

Hang Thi Thuy Dinh, Hoa Sen University, Vietnam

Kim Thi Nguyen, Hoa Sen University, Vietnam

Vi Thi Hoang Tran, Hoa Sen University, Vietnam

Hien Thi Ho, Nghe An University of Economics, Vietnam

Citation Information: Hang, D.T.T., Kim, N.T., Vi, T.T.H., & Hien, H.T. (2022). Does accepting risk increase profitability? Evidence across industries in vietnam. Academy of Accounting and Financial Studies Journal, 26(4), 1-14.

Abstract

Any analysis of the associations between risk and profitability would not be comprehensive if ignoring various assays across the sectors. The paper examines the effect of risk on the profitability of 711 firms from 8 different industries in Vietnam between 2014 and 2019. We applied a panel regression model with an estimation of Pooled Ordinary Least Square (OLS), Fixed Effects Model (FEM) and Random Effects Model (REM). Numerous technical tests among the Hausman, Chow, and Breusch & Pagan tests were utilized to determine which model is most suitable. The test results suggested that pooled OLS outperformed estimating the impact of risk on profitability. Empirical findings found that taking financial risks such as credit risk led to a decrease in profitability in most sectors such as Energy, Materials, Technology, Consumer discretionary, Utility and Health. Additionally, accepting business risk could be detrimental to Industrials, Consumer discretionary, and Utility profitability. However, accepting business risk did not affect technology, materials, energy, consumer staples, and health profitability.

Keywords

Financial Risk, Business Risk, Profitability, Return on Assets (ROA), Return on Equity (ROE).

JEL Classification Code

G32, G33, G34.

Introduction

Risk and return are two critical factors in making investment-decision. Most theoretical studies suggest that a high level of risk contributes to an increase in expected return (Richard & Mahajan, 1985, Jin, 2019) because risk could be compensated by higher return (David & Jacobson, 1987). However, in fact, this may be not true (Lemont, 1970; Bowman, 1980).

Numerous empirical researches have focused on evaluating the relationship between risk and profitability of firms to examine whether a high risk is responsible for high profitability. For instance, studies by Costner & Holland (1970), Amit & Wernerfelt (1990), Froster (1996), Zeitun & Tian (2007) and Serrasqueiro & Nunes (2008) have paid attention to business risk in assessing the profitability of firms. They used earnings volatility and cash flow volatility to measure business risk. Generally, their findings found that business risk significantly impacts profitability. Alternatively, Berrios (2013), Panigrahi (2013), Wani & Dar (2015), Onsongo et al. (2020), Munangi & Sibindi (2020), Limei et al. (2020) have focused on financial risk in evaluating the profitability. They used liquidity risk, credit risk and operational risk to predict the influence of financial risk on profitability. In general, their results revealed that financial risk significantly influences profitability. While past studies have concentrated on financial risk or business risk on profitability, few studies have considered the combination of business risk and financial risk to influence profitability. This argument implies a lack of a fuller picture of which risk affects profitability.

On the other hand, any critical analysis of the impact of risk on the profitability of firms would be not comprehensive without a differential assay across sectors. This is because that risk varies across the industries (Duc et al., 2019). This research attempts to analyze the impact of risk in financial and business risk on profitability among sectors. Our paper, utilizing data from the industries of the Vietnamese economy, builds on this study.

This research is expected to contribute to the literature by measuring the impact of business risk and financial risk on firms' profitability and investigating the difference in perspective among sectors on risk enhancing profitability.

The remainder of this paper is organized as follows. Section 2 shows a literature review relating to the outline of previous research. Then, section 3 presents the methodology to be used. Section 4 discusses the outcomes and findings. The implications and potential drawbacks of this research, as well as suggestions for future research, are given in section 5

Literature Review

Theoretical Review

The relationship between risk and profitability was supported by risk bearing theory of profit and agency theory. The risk-bearing theory of profit was found by (Hawley, 1893). This theory suggests that profit depends on risk-taking by the business owner. Accordingly, the degree of risk-bearing identifies the amount of profit that the entrepreneur earns. If an entrepreneur takes a higher risk, he can profit more significantly. This theory postulates that a firm faces various kinds of risks, in which some risks cannot be eliminated in any way. Thus, entrepreneurs have to conduct these risks and require profit as compensation for risk-bearing. In addition, no business owner wants to cover risks if he receives only an average profit. Hence, the premium for risk-taking should be greater than the actual value of the risk. In other words, the higher degree of risk, the larger the profit (Suratno et al., 2017).

The agency theory was established by (Ross, 1973). This theory states that the agency relationship occurs when shareholders (principal) hire managers (an agent) and delegate work. If shareholders and managers are utility maximizers, managers will act in their interest rather than stockholders' interest. To specify, they attempt to decrease the probability of loss to ensure their job security. Therefore, they will undertake action to reduce the risk that can cause damage to shareholders (Amihud & Lev, 1981). Accordingly, a positive relationship between risk and profit. The lower the risk, the smaller is the possibility of profit (Baum et al., 2009).

Empirical Review

The research of Amit & Wernerfelt (1990) examined the association between business risk and rate of return. They used a sample of 246 firms in the US in 1976 and found that reducing business risk allows firms to improve profitability. On the other hand, Serrasqueiro & Nunes (2008), using Portugal data between 1999 and 2003, found a negative effect of risk on the profitability of Small and Medium-Sized Companies. Specifically, keeping business risk low enables firms to increase profitability. The findings are similar to the research results of (Zeitun & Tian, 2007).

Another related paper is by Jia & Chen (2008), which measured the influence of business risk on the profitability of Logistic firms. The paper used data from 40 Chinese firms in the Logistic industry for 1993-2006 in China. They found that the firms with low business risk intend to get more profitability.

Froster (1996) used a sample of 56 Agribusiness firms during the period of 1984-1993 in the US and posited that the greater profitability is a result of risk-taking. This finding was in line with the study of Cuong et al. (2018), who used data from 30 building materials firms from 2011 to 2015 in Vietnam.

Onsongo et al. (2020) focused on the impact of financial risk on the profitability of commercial and service companies in Kenya. This study utilizes credit, liquidity, and operational risk as a presentation of financial risk in Kenya's commercial and service industry. The research results revealed that increased liquidity risk could translate to raised profitability, but credit and operational risk are not relevant to increased profitability.

In another study, Diby et al. (2019) implemented a study on a comparison between profitability and financial risk in non-financial firms in Morocco. They used a sample of 31 firms from 2000 to 2006. Their findings proved that a rise in credit risk led to a reduction in profitability.

Mazen (2013) examined the effect of credit risk on profitability in the trade sector in French. They used a sample of 2,325 firms from 1999 to 2001 and found that higher credit risk could be detrimental to profitability.

LiMei et al. (2020) conducted research on financial risk on profitability in 54 banks in South Africa from 2012 to 2018. This research employed Structural Equation Modeling to evaluate the impact of financial risk on profitability. It provided evidence that the negative association between profitability and financial risks is investigated for operational risk. The results are in line with those of the study by Basel & Mohammad. Based on afore above literature review, two hypotheses are formulated as follows:

Hypothesis 1:Financial risk has a significant positive impact on firms’ profitability

Hypothesis 2: Business risk has a significant positive impact on firms’ profitability

Methodology

Data

This research examines the effect of risk on the profitability of listed companies among industries in Vietnam. Our sample comprises a panel of listed firms from 8 different sectors on Vietnamese Stock Exchanges covering 2014 to 2019. The sample consists of 711 firms, with 37 in the Energy sector, 323 in the Industrials sector, 91 in Materials, 21 in technology, 34 Consumer discretionary, 129 in Consumer staples, 41 in Utility and 35 in Health.

Measurement of Variables

Profitability

According to theory, there are various ways to measure profitability. In our research, two alternative representatives of profitability were used, namely, return on assets (ROA) and Return on equity (ROE). ROA represents the return of stockholders, while ROA is considered managers' return. The usage of the two different proxies for profitability support the stakeholders as managers (ROA) and shareholders (ROE) having a comprehensive point-view on risk and return tradeoff. ROA is estimated by dividing earnings after tax by total assets, and ROE is calculated by dividing net income by total shareholders’ equity (Costner & Holland (1970).

Financial risk

Wruck (1990) argued that financial risk occurs when cash flow is not sufficient to meet financial commitments. This argument comes from the company's liquidity and credit risks (John, 2020). The term financial risk can be utilized "as a general term for various forms of financing risk" Basel and Mohammad, including liquidity risk, credit risk and operational risk (Onsongo et al., 2020; LiMei et al., 2020). Credit risk is gauged by the ratio of debt to income (Ephias & Athenia, 2020; Elder, 2016); operational risk is proxied by the ratio of cost to income (Wangalwa & Willy, 2018; Mathuva, 2009); while quick ratio, cash ratio and current ratio are used as indicators of liquidity risks (Zélia & Paulo, 2008; Bayaraa, 2017; Ana et al., 2021; Eugene & Michael, 2008; Mukesh & Mike, 2013).

Business risk

According to Mohad (2015), business risk is volatility in earnings when the environment is uncertain. For this analysis, business risk is considered as variability of operating income (earnings before taxes and interest) (Froster, 1996). Based on the research of John (1999), business risk is measured by the standard deviation of earnings before taxes and interest to total assets ratio, while Jayant et al. (1991) used the coefficient between the standard deviation of cash flow and mean of cash flow to estimate business risk. In this research, the function involved in computation taken from John (1999) and Jayant et al. (1991) are applied to measure business risk.

The functions of these risk variables are followed as:

1. First, liquidity ratio, defined as cash and its equivalents over short-term debt (cash ratio), is utilized to measure whether available funds of firms are enough to cover the payment of a short-term obligation. 2. Liquidity ratio, defined as cash, marketable securities and receivables over short-term debt (quick ratio), is utilized to measure the ability of firms to repay short-term debts. 3. Liquidity ratio, defined as current assets over current liabilities (current ratio), presents the ability of firms to meet near-term obligations. 4. Operational risk, defined as the cost to income, is used to gauge how income is sufficient to cover costs incurred. 5. Credit risk, defined as debt to income, is applied to measure the ability of firms to repay their financial commitments. 6. Business risk, defined as the standard deviation of Earnings before tax and interest over total assets, is used to measure the volatility of a firm's earnings. 7. Business risk, defined as the standard deviation of cash flow to the mean of cash flow, is used to measure the volatility of a firm's cash flow.

Empirical Model and Method

Empirical model

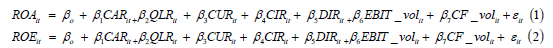

The research utilized a panel regression model to measure financial risk and business risk on profitability. Profitability (proxied by ROA and ROE) was selected as dependent variables, whereas financial risk and business risk were employed as independent variables. Financial risk is proxied by liquidity risk (cash ratio, quick ratio and current ratio), credit risk (debt to income ratio) and operational risk (cost to income ratio). Business risk is proxied by volatility of EBIT to assets and volatility of cash flow. The study model can be applied as follows:

Where, ROA: return on assets, ROE: return on equity, CAR: cash ratio, QR: quick ratio; CUR: current ratio; CIR: cost to income ratio; DIR: debt to income ratio; EBIT_vol: volatility of EBIT to assets; CF_vol: volatility of cash flow, βo: Constant term; β1–β6: coefficients of independent variables; εit: the error term at t time, i: the firm i, t: financial year.

Empirical Method

To estimate the function (1) and (2), we used the Pooled Ordinary Least Square (OLS), Fixed Effects Model (FEM) and Random effects model (REM). Then, numerous statistical tests were implemented to select the most appropriate model. In particular, the Hausman test determined which model between FEM and REM is more efficient. Chow test was used to examine whether FEM is more suitable than Pooled OLS. Alternatively, the Breusch-Pagan Lagrange multiplier test was applied to identify whether Pooled OLS is more convenient than REM (Ali & Oudat, 2020).

Empirical Results and Discussion

Descriptive Statistics and Correlation

Tables 1 & 2 represent the fluctuation of the profitability ratio. For 2014-2019, profitability ROA decreased by 79%, whereas ROE increased by 362%. Regarding sectors, we recorded a reduction in ROA in all industries except for Technology, Utility and Health. At the same time, there was an increase in ROE in all sectors except for Energy, Industry and Customer staples from 2014 to 2019. In addition, the negative mean value of ROA and ROE in the Consumer Staples sector indicated that some firms in this industry operated inefficiently over the period (Arif & Showket, 2015).

| Table 1 Fluctuation Of Profitability Roa During The Period 2014-2019 |

|||||||||

|---|---|---|---|---|---|---|---|---|---|

| Year | Total | Energy | Industrials | Materials | Technology | Consumer discretionary | Consumer staples | Utility | Health |

| 2014 | 0.045 | 0.068 | 0.041 | 0.048 | 0.023 | 0.033 | 0.041 | 0.057 | 0.066 |

| 2015 | 0.045 | 0.066 | 0.045 | 0.047 | 0.033 | 0.021 | 0.034 | 0.056 | 0.078 |

| 2016 | 0.032 | 0.054 | 0.036 | 0.059 | 0.014 | 0.032 | -0.023 | 0.057 | 0.087 |

| 2017 | 0.003 | 0.070 | 0.042 | 0.058 | 0.035 | 0.015 | -0.197 | 0.057 | 0.076 |

| 2018 | 0.040 | 0.065 | 0.039 | 0.040 | 0.050 | 0.015 | 0.025 | 0.057 | 0.082 |

| 2019 | 0.009 | 0.055 | -0.028 | 0.022 | 0.029 | 0.024 | 0.036 | 0.064 | 0.078 |

| Mean | 0.029 | 0.063 | 0.029 | 0.046 | 0.031 | 0.023 | -0.014 | 0.058 | 0.078 |

| Change (%) | -0.797 | -0.200 | -1.681 | -0.543 | 0.263 | -0.276 | -0.125 | 0.118 | 0.192 |

| SD | 0.502 | 0.090 | 0.430 | 0.080 | 0.079 | 0.144 | 0.954 | 0.069 | 0.072 |

Source: Authors’ result

| Table 2 Fluctuation Of Profitability Roa During The Period 2014-2019 |

|||||||||

|---|---|---|---|---|---|---|---|---|---|

| Year | Total | Energy | Industrials | Materials | Technology | Consumer discretionary | Consumer staples | Utility | Health |

| 2014 | 0.022 | 0.269 | -0.090 | 0.086 | 0.056 | 0.077 | 0.116 | 0.086 | 0.132 |

| 2015 | 0.038 | 0.145 | 0.088 | 0.082 | 0.069 | 0.155 | -0.219 | 0.078 | 0.119 |

| 2016 | 0.098 | -0.011 | 0.098 | 0.093 | 0.044 | 0.124 | 0.076 | 0.098 | 0.328 |

| 2017 | 0.022 | 0.179 | -0.050 | 0.041 | 0.096 | -0.189 | 0.126 | 0.094 | 0.165 |

| 2018 | 0.048 | 0.132 | 0.103 | 0.075 | 0.098 | 0.137 | -0.207 | 0.097 | 0.147 |

| 2019 | 0.101 | 0.101 | 0.095 | 0.115 | 0.060 | 0.130 | 0.092 | 0.110 | 0.138 |

| Mean | 0.055 | 0.136 | 0.041 | 0.082 | 0.070 | 0.072 | -0.002 | 0.094 | 0.171 |

| Change (%) | 3.620 | -0.623 | -2.058 | 0.338 | 0.069 | 0.695 | -0.203 | 0.277 | 0.049 |

| SD | 1.483 | 0.489 | 1.551 | 0.502 | 0.122 | 0.663 | 2.381 | 0.112 | 0.431 |

Source: Authors’ result

Table 3 shows the descriptive statistics of all risk variables during the period 2014-2019. Mean liquidity ratios were cash ratio 0.507, quick ratio 1.484, and current ratio 2.427, which implicates high liquidity. Accordingly, Consumer discretionary had the highest liquidity ratio while Utility had the smallest liquidity ratio. In other words, Utility faced the highest liquidity risk, whereas Consumer discretionary faced the lowest liquidity risk. Regarding credit risk (proxied by DIR-debt to cost ratio), technology had the most significant credit risk, with a mean value of 2.648, whereas health had the lowest credit risk, with a mean value of 0.459. The highest credit risk belonged to technology, while the lowest credit risk belonged to health.

| Table 3 Descriptive Statistics Of Independent Variables During The Period 2014-2019 |

||||||||

|---|---|---|---|---|---|---|---|---|

| CAR | QR | CUR | CIR | DIR | EBIT_vol | CF_vol | ||

| Total | Mean | 0.507 | 1.485 | 2.427 | 2,208 | 1.299 | 0.053 | 0.521 |

| Std. Dev. | 2.618 | 5.385 | 6.303 | 97,238 | 6.717 | 0.307 | 41.983 | |

| Median | 0.161 | 0.804 | 1.351 | 15.69 | 0.477 | 0.025 | 0.684 | |

| Energy | Mean | 0.616 | 1.336 | 2.104 | 5,461 | 1.346 | 0.040 | 2.595 |

| Std. Dev. | 1.179 | 1.430 | 2.340 | 82,010 | 1.985 | 0.035 | 19.867 | |

| Median | 0.329 | 1.108 | 1.410 | 8.36 | 0.519 | 0.029 | 0.511 | |

| Industrials | Mean | 0.563 | 1.623 | 2.498 | 621.1 | 1.375 | 0.039 | -0.733 |

| Std. Dev. | 3.738 | 6.889 | 8.058 | 14,25 | 4.172 | 0.164 | 54.384 | |

| Median | 0.141 | 0.807 | 1.273 | 16.42 | 0.642 | 0.022 | 0.644 | |

| Materials | Mean | 0.456 | 1.589 | 2.693 | 109 | 0.962 | 0.045 | 2.243 |

| Std. Dev. | 1.116 | 6.706 | 7.123 | 4,286 | 4.067 | 0.041 | 17.179 | |

| Median | 0.138 | 0.742 | 1.466 | 16.27 | 0.390 | 0.035 | 1.122 | |

| Technology | Mean | 0.338 | 1.887 | 2.758 | 55.45 | 2.648 | 0.031 | 0.271 |

| Std. Dev. | 0.508 | 2.821 | 3.840 | 129 | 19.592 | 0.042 | 7.523 | |

| Median | 0.178 | 1.107 | 1.548 | 23.11 | 0.544 | 0.015 | -0.065 | |

| Consumer discretionary | Mean | 0.667 | 1.976 | 3.015 | 128.38 | 1.460 | 0.051 | 4.843 |

| Std. Dev. | 1.376 | 3.773 | 4.529 | 1,092 | 6.342 | 0.056 | 76.412 | |

| Median | 0.276 | 0.983 | 1.351 | 19.187 | 0.252 | 0.031 | 0.531 | |

| Consumer staples | Mean | 0.396 | 1.100 | 2.222 | 8,765 | 1.290 | 0.114 | 0.553 |

| Std. Dev. | 0.877 | 1.642 | 3.130 | 222,82 | 10.878 | 0.667 | 20.137 | |

| Median | 0.129 | 0.652 | 1.374 | 16.103 | 0.370 | 0.029 | 0.793 | |

| Utility | Mean | 0.576 | 1.211 | 1.850 | 456 | 1.320 | 0.029 | 1.136 |

| Std. Dev. | 0.692 | 1.089 | 1.458 | 5,969 | 1.710 | 0.025 | 7.279 | |

| Median | 0.306 | 0.831 | 1.370 | 10.03 | 0.395 | 0.021 | 0.631 | |

| Health | Mean | 0.283 | 1.114 | 2.091 | 55 | 0.459 | 0.034 | 0.539 |

| Std. Dev. | 0.308 | 1.090 | 1.440 | 1,436 | 0.370 | 0.044 | 7.581 | |

| Median | 0.186 | 0.872 | 1.668 | 13.09 | 0.348 | 0.020 | 0.601 | |

Notes: CAR: cash ratio, QR: quick ratio; CUR: current ratio; CIR: cost to income ratio; DIR: debt to income ratio; EBIT_vol: volatility of EBIT to assets; CF_vol: volatility of cash flow

Source: Authors’ result

Furthermore, the operational risk (measured by CIR-cost to income ratio) had the most significant standard deviation, which presents a significant difference in operational risk among industries. However, there was little difference in business risk across sectors (gauged by EBIT's volatility over total assets). Accordingly, Industrials took the highest operational risk, whereas energy took the lowest. Alternatively, Consumer discretionary sector faced the most significant business risk, but health faced the most negligible business risk.

Table 4 shows the correlation matrix of variables, with significant correlations between EBIT_vol and profitability (ROA and ROE). In addition, high values in the matrix of correlation are found for CAR, CUR and QR. Since the Variance inflation factor (VIF) is less than 10, it can be concluded that there is no multicollinearity among independent variables.

| Table 4 Correlation Matrix |

|||||||||

|---|---|---|---|---|---|---|---|---|---|

| ROA | ROE | CAR | QR | CUR | CIR | DIR | EBIT_vol | CF_vol | |

| ROA | 1.000 | ||||||||

| ROE | 0.003 | 1.000 | |||||||

| CAR | 0.017 | 0.006 | 1.000 | ||||||

| QR | 0.012 | 0.003 | 0.602** | 1.000 | |||||

| CUR | 0.021 | 0.006 | 0.600** | 0.934** | 1.000 | ||||

| CIR | -0.071 | -0.012 | -0.024 | -0.026* | -0.038* | 1.000 | |||

| DIR | 0.003 | 0.002 | -0.003 | -0.004 | -0.005 | -0.003 | 1.000 | ||

| EBIT_vol | -0.676** | 0.027* | 0.002 | -0.007 | -0.009 | 0.135** | -0.002 | 1.000 | |

| CF_vol | -0.003 | -0.001 | 0.005 | 0.003 | 0.007 | -0.004 | 0.000 | 0.001 | 1.000 |

| VIF | 1.600 | 8.070 | 8.050 | 1.030 | 1.030 | 1.040 | 1.000 | ||

Notes: **, * indicate statistical significant at 1%, 5%, respectively

ROA=return on assets, ROE=return on equity, CAR: cash ratio, QR: quick ratio; CUR: current ratio; CIR: cost to income ratio; DIR: debt to income ratio; EBIT_vol: volatility of EBIT to assets; CF_vol: volatility of cash flow; VIF=Variance inflation factor

Source: Authors’ result

Econometric Outcome

Table 5 summarizes the regression results for profitability ROA estimated by Pooled OLS (column 1), REM (column 2) and FEM (column 3). Based on the Hausman test, Chow test and Breusch-Pagan Lagrange multiplier test, Pooled OLS outperformed to estimate the effect of risk on ROA. In addition, we applied the Newey-West standard error method to solve the problem of heteroskedasticity and autocorrelation (HAC). Column (4) in Table 5 shows the Pooled OLS result using the Newey-West standard error method, revealing that the model with ROA was statistically significant at the 1% level and R-square of 45.8%.

| Table 5 Regression For The Impact Of Risk On Profitability Roa |

||||

|---|---|---|---|---|

| Pooled OLS (1) |

Random Effects (2) | Fixed Effects (3) |

Pooled OLS Newey-West (4) |

|

| Intercept | 0.0809*** | 0.0809*** | 0.0886*** | 0.0809*** |

| (12.64) | (12.64) | (12.11) | (4.39) | |

| CAR | 0.00353 | 0.00353 | 0.00147 | 0.00353 |

| (1.29) | (1.29) | (0.48) | (1.63) | |

| QR | -0.00521 | -0.00521 | -0.00202 | -0.00521*** |

| (-1.75) | (-1.75) | (-0.44) | (-3.32) | |

| CUR | 0.00452 | 0.00452 | 0.00285 | 0.00452** |

| (1.77) | (1.77) | (0.76) | (2.98) | |

| CIR | 8.05E-09 | 8.05E-09 | 1.04E-08 | 8.05E-09 |

| (0.14) | (0.14) | (0.16) | (1.45) | |

| DIR | 0.00164 | 0.00164 | 0.00364*** | 0.00164 |

| (1.92) | (1.92) | (3.37) | (0.43) | |

| EBIT_vol | -1.111*** | -1.111*** | -1.299*** | -1.111* |

| (-59.61) | (-59.61) | (-46.71) | (-2.12) | |

| CF_vol | -3E-05 | -3E-05 | -2.4E-05 | -3E-05 |

| (-0.22) | (-0.22) | (-0.15) | (-1.30) | |

| Firm effects | None | Fixed | Random | None |

| Time effects | None | Fixed | Random | None |

| No of observations | 4,266 | 4,266 | 4,266 | 4,266 |

| Adj-R2 | 0.458 | 0.458 | 0.4574 | 0.458 |

| F-stat/Wald chi2 | 3,598.4*** | 3,598.4*** | 311.96*** | 32.49 *** |

| Hausman test | 0.000 | |||

| Lagrange multiplier test | 1.000 | |||

| Chow test | 1.000 | |||

Notes: ***, **, * indicate statistical significant at 1%, 5%, 10%, respectively

ROA: return on assets, CAR: cash ratio, QR: quick ratio; CUR: current ratio; CIR: cost to income ratio; DIR: debt to income ratio; EBIT_vol: volatility of EBIT to assets; CF_vol: volatility of cash flow

Source: Authors’ result

The regression results showed that the model was statistically insignificant in the model for ROE, with a probability value of 33% level and R-square of 0.3% (see Appendix 1). It implies that the ability to explain risk to variation of profitability proxied by ROE is not significant. Therefore, our interpretation was given on estimation results of the effect of risk on ROA through pooled OLS using Newey-West standard error method (Nguyen & Nguyen, 2020).

The estimation results for the effect of risk on profitability ROA are shown in column 4 of Table 5. The results associating Quick Ratio (QR) proxied for liquidity risk recorded a negative and significant correlation, while Current Ratio (CUR) proxied for liquidity risk recorded a positive and significant correlation. The smaller value of liquidity ratio indicates that the greater liquidity risk the firm takes and vice versa, these results implies that a rise in quick liquidity risk (QR) increases profitability ROA. In contrast, a reduction in Current Liquidity Risk (CUR) contributed to a decrease in profitability ROA. However, the estimated coefficient for debt to income (DIR) and Cost to Income (CIR) was statistically insignificant. That is, credit risk and operational risk did not impact the profitability ROA of firms. In addition, the results regarding business risk measured by volatility of EBIT to assets (EBIT_vol) were investigated negatively and significantly. Business risk had an adverse influence on profitability ROA. It means that an increase in business risk could decrease profitability ROA. The negative link between business risk and profitability was the same as the study outcome of Jia & Chen (2008), who proved a negative relationship between business risk and profitability. However, this result was opposite to Froster (1996), who provided evidence that there was a positive link between business risk and profitability.

| Table 6 Pooled Ols Results For The Effect Of Risk On Profitability Roa By Sectors |

||||||||

|---|---|---|---|---|---|---|---|---|

| Energy | Industrials | Materials | Technology | Consumer discretionary | Consumer staples | Utility | Health | |

| Intercept | 0.0785*** | 0.123*** | 0.0627*** | 0.0225* | 0.0794*** | 0.073 | 0.033*** | 0.111*** |

| -6.16 | -18.62 | -6.66 | -2.39 | -6.48 | -1.92 | -3.65 | -5.45 | |

| CAR | 0.021 | 0.003 | 0.012 | 0.017 | 0.014 | 0.038*** | 0.035*** | 0.070*** |

| -1.06 | -1.32 | -1.87 | -1.16 | -1.6 | -3.46 | -3.56 | -3.57 | |

| QR | -0.005 | 0.007*** | -0.002 | 0.009* | 0.010* | -0.001 | 0.003 | -0.01 |

| (-0.85) | -3.33 | (-1.00) | -2.31 | -2.57 | (-0.21) | -0.43 | (-1.73) | |

| CUR | 0.014 | -0.008*** | 0.002 | -0.021*** | -0.0131** | -0.002 | -0.001 | 0.005 |

| -0.76 | (-3.85) | -0.73 | (-3.67) | (-3.28) | (-0.24) | (-0.12) | -0.62 | |

| CIR | 7.82e-08*** | 0 | 0 | -0.0000600* | 0 | 0 | 0.00000182*** | 0 |

| -5.84 | -0.66 | -0.02 | (-2.06) | -1.96 | -0.99 | -10.86 | (-0.48) | |

| DIR | -0.00842*** | -0.002 | -0.00702* | -0.000514* | -0.00399** | 0.006 | -0.00868*** | -0.104*** |

| (-4.67) | (-0.90) | (-2.07) | (-2.17) | (-2.96) | -0.91 | (-5.97) | (-3.63) | |

| EBIT_vol | -0.664 | -2.476*** | -0.264 | 0.73 | -1.233*** | -0.923 | 0.363 | 0.3 |

| (-1.78) | (-14.86) | (-1.16) | -1.45 | (-4.17) | (-1.59) | -1.51 | -1.62 | |

| CF_vol | 0 | 0 | 0 | 0 | -0.0001*** | 0 | 0.001** | 0 |

| (-0.72) | (-0.88) | (-1.77) | -0.38 | (-5.59) | -1.02 | -2.69 | -1.02 | |

| No of observations | 222 | 1,938 | 546 | 126 | 204 | 774 | 246 | 210 |

| Adjusted R2 | 0.273 | 0.895 | 0.2 | 0.271 | 0.273 | 0.467 | 0.433 | 0.597 |

| P-value | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

Notes: ***, **, * indicate statistical significant at 1%, 5%, 10%, respectively

ROA= return on assets, CAR= cash ratio, QR= quick ratio; CUR= current ratio; CIR: cost to income ratio; DIR: debt to income ratio; EBIT_vol: volatility of EBIT to assets; CF_vol: volatility of cash flow Source: Authors’ result

Econometric Outcome by Sector

Table 6 summarizes pooled OLS results using the Newey-West standard error method for the effect of risk on ROA by sectors. The results revealed that the models with ROA for all sectors were statistically significant at a p-value of 0.000 and adjusted R-square ranging from 20.2% (Materials) to 59.7% (Health).

Regression results for energy reported that the correlation coefficient for Cash Ratio (CAR), Quick Ratio (QR), Current Ratio (CUR), volatility of EBIT to assets (EBIT_vol) and volatility of cash flow (CF_vol) was statistically insignificant. This means that liquidity risk and business risk did not impact profitability. On the other hand, the estimated coefficients for the cost to income ratio were statistically significant and positive. Operational risk influenced profitability ROA positively; a growth in operational risk caused an increase in profitability. Alternatively, the Debt To Income (DIR) results was statistically significant and negative. This implies that credit risk impacted profitability ROA negatively. Thereby, an increase in credit risk resulted in diminished profitability.

The estimation results for Industrials reported a significantly positive relationship between Quick Ratio (QR) and profitability ROA but a negative relationship between current ratio (CUR) and profitability ROA. It indicates that a decrease in Quick Liquidity Risk (QR) improved profitability ROA, whereas a reduction in Current Liquidity Risk (CUR) resulted in decrease in profitability ROA. The estimated correlation between Debt to Income (DIR) and Cost To Income (CIR) was statistically insignificant. This demonstrates that credit risk and operational risk did not impact profitability ROA. However, the coefficient for EBIT volatility to assets (EBIT_vol) was statistically significant and negative. This manifests that an increase in business risk translated to a reduction in profitability ROA.

The estimation results for Materials recorded that the correlation coefficient for debt to income (DIR) was statistically significant. That is, credit risk impacted profitability negatively. Thus increase in credit risk led to a decrease in profitability ROA. The coefficient correlation for liquidity ratios, Cost to Income (CIR), volatility of EBIT to assets (EBIT_vol) and volatility of cash flow (CF_vol) were statistically insignificant. This demonstrates that liquidity risk, operational risk and business risk did not influence profitability ROA

The regression results for technology revealed that the correlation coefficient for the current ratio was statistically significant and negative. It means an increase in current liquidity risk caused an increase in profitability ROA. The Cost to Income (CIR) and Debt To Income (DIR) estimates was statistically significant. Operational risk and credit risk impacted profitability negatively; an increase in operational risk or credit risk could cause a decrease in profitability. Alternatively, the parameter for the volatility of EBIT to assets (EBIT_vol) and volatility of cash flow (CF_vol) was not statistically significant. Hence, the business risk did not impact profitability ROA.

The estimation results for Consumer discretionary illustrated a significantly positive relationship between Quick Ratio (QR) and profitability ROA but a negative relationship between Current Ratio (CUR) and profitability ROA. These results indicate that a decrease in quick liquidity risk resulted in a growth in profitability ROA, while a decrease in current liquidity risk was responsible for reducing profitability ROA. In addition, the estimated parameter for Debt To Income (DIR), volatility of EBIT to assets (EBIT_vol) and volatility of cash flow (CF_vol) was negative and statistically significant. That is, credit risk and business risk harmed profitability ROA. Hence, an increase in credit or business risk led to diminished profitability ROA.

The regression results for Consumer staples showed that the estimated coefficient parameter for Current Ratio (CUR) was positive and statistically significant. It means that a decrease in current liquidity risk was responsible for the increase in profitability ROA. On the other hand, the estimated correlation for debt to income (DIR), the Cost To Income (CIR), volatility of EBIT to assets (EBIT_vol) and volatility of cash flow (CF_vol) were statistically insignificant. This demonstrates that credit, operational, and business risk did not improve profitability ROA.

The estimation results for the Utility sector revealed that the correlation coefficient for Cash Ratio (CAR) was positive and statistically significant. This implies that a decrease in liquidity risk led to an increase in profitability ROA. In addition, the estimated parameters for the Cost to Income (CIR), Debt To Income (DIR), and volatility of cash flow (CF_vol) were statistically significant. That is, credit risk impacted profitability negatively, but operational risk and business risk affected profitability positively. In particular, an increase in credit risk reduced profitability, whereas an increase in operational risks or business risk caused a rise in profitability.

Regression results for health reported that the coefficient for Cash Ratio (CAR) and Cost to Income (CIR) was statistically significant. That is, liquidity risk and credit risk influenced profitability ROA negatively. Hence, a rise in liquidity risk or operational risk translated to a decrease in profitability. On the other hand, the estimated parameters for Debt To Income (DIR), volatility of EBIT to assets (EBIT_vol) and volatility of cash flow (CF_vol) were not statistically significant. Therefore, credit risk and business risk did not impact profitability.

Many studies have been implemented to examine whether taking risks leads to higher profitability in past decades. However, any analysis of the associations between risk and profitability would not be comprehensive if ignoring various assays across the sectors. In this research, we focused on financial and business risk in comparison to profitability across industries. In particular, we utilized cash ratio, quick ratio, current ratio, the cost-income ratio and debt to income ratio as financial risk variables. Alternatively, we used volatility of EBIT to assets and volatility of cash flow to measure business risk. Our sample consisted of 711 firms from 8 different sectors with 4,262 observations from 2014 to 2019 in Vietnam.

This research applied a panel regression model with an estimation of Pooled OLS, REM and FEM. numerous technical tests among the Hausman, Chow, and Breusch and Pagan tests were used to determine which model is the most suitable. The test results suggested that pooled OLS outperformed estimating the impact of risk on profitability. Then we applied the Newey-West standard error method to solve the problem of autocorrelation and heteroscedasticity in the model.

Generally, the empirical results confirmed that higher financial and business risks could lead to lower profitability in specific sectors. Specifically, regarding liquidity risk, our findings revealed that accepting liquidity risks such as cash and quick liquidity could reduce profitability in sectors, namely: Industrials, Technology, Consumer discretionary, consumer staples, Utility and Health. However, accepting liquidity risks such as current liquidity could yield profitability in Industrials, Technology and Consumer staples. On the other hand, taking risks did not lead to profitability in the Energy and Materials sector. Accepting high risk enhanced profitability in Energy and Utility regarding operational risk but contributed to a decrease in profitability in technology. Meanwhile, accepting operational risk did not improve profitability in sectors, namely, Industrials, Materials, Consumer discretionary, consumer staples and Health. Regarding credit risk, accepting risk contributed to the reduction in profitability in sectors such as Energy, Materials, Technology, Consumer discretionary, Utility and Health. However, taking credit risk did not enhance profitability in Industrials and Consumer Staples, Industrials and Consumer staples. Finally, higher risk could cause lower profitability in Industrials, Consumer staples and Utility regarding business risk. Meanwhile, accepting business risk did not impact profitability in Energy, Technology, Materials, Consumer discretionary, and Health sectors.

Conclusion

This study makes an academic contribution by measuring the impact of business risk and financial risk on firms' profitability and investigating the difference in perspective among sectors on risk enhancing profitability.

The drawback of this research is the lack of consideration of the tradeoff between risk and profitability of firms across regional countries. Therefore, we intend to expand the database with more firms and more countries for future studies.

| Appendix 1 Regression For The Impact Of Risk On Profitability Roe |

|||

|---|---|---|---|

| Pooled OLS | REM | FEM | |

| Intercept | 0.0462 | 0.0462 | 0.0351 |

| (1.8) | (1.8) | (1.23) | |

| CAR | 0.003 | 0.00285 | 0.001 |

| -0.26 | (0.26) | (0.09) | |

| QR | -0.006 | -0.006 | -0.002 |

| (-0.49) | (-0.49) | (-0.10) | |

| CUR | 0.005* | 0.005 | 0.002 |

| (0.52) | (0.52) | (0.14) | |

| CIR | -0.003 | -0.003 | 0.001 |

| (-1.01) | (-1.01) | (0.11) | |

| DIR | 0.000 | 0.000 | 0.000 |

| (0.15) | (0.15) | (0.05) | |

| EBIT_vol | 0.142 | 0.142 | 0.309** |

| (1.9) | (1.9) | (2.84) | |

| CF_vol | -0.000 | -0.000 | -0.000 |

| (-0.10) | (-0.10) | (-0.00) | |

| No of observations | 4,262 | 4,262 | 4,262 |

| Adj-R2 | 0.001 | 0.001 | 0.0007 |

| F-stat/Wald chi2 | 4.69 | 4.69 | 1.17 |

| P-value | 0.698 | 0.698 | 0.317 |

Notes: **, * indicate statistical significant at 1%, 5%, respectively

ROE: return on equity, CAR: cash ratio, QR: quick ratio; CUR: current ratio; CIR: cost to income ratio; DIR: debt to income ratio; EBIT_vol: volatility of EBIT to assets; CF_vol: volatility of cash flow

Source: Authors’ result

References

Ali, B.J., & Oudat, M.S. (2020). Financial risk and the financial performance in listed commercial and investment banks in bahrain bourse. International Journal of Innovation, Creativity and Change, 13(12), 160-180.

Amihud, Y., & Lev, B. (1981). Risk reduction as a managerial motive for conglomerate mergers. The Bell Journal of Economics, 605-617.

Indexed at, Google Scholar, Cross Ref

Amit, R., & Wernerfelt, B. (1990). Why do firms reduce business risk?. Academy of Management Journal, 33(3), 520-533.

Indexed at, Google Scholar, Cross Ref

Ana, B.T.P., Younghwan, L., & Jeong, H.K. (2021). Leverage, Corporate Governance and Real Earnings Management: Evidence from the Korean Market. Global Business Review, 25(4), 51-72.

Indexed at, Google Scholar, Cross Ref

Arif, A.W., & Showket, A.D. (2015). Relationship between Financial Risk and Financial Performance: An Insight of Indian Insurance Industry. International Journal of Science and Research, 4(11), 2319-7064.

Indexed at, Google Scholar, Cross Ref

Baum, C.F., Stephan, A., & Talavera, O. (2009). The effects of uncertainty on the leverage of nonfinancial firms. Economic Inquiry, 47(2), 216-225.

Indexed at, Google Scholar, Cross Ref

Bayaraa, B. (2017). Financial Performance Determinants of Organizations: The Case of Mongolian Companies. Journal of Competitiveness, 9(3), 22-33.

Indexed at, Google Scholar, Cross Ref

Berrios, M.R. (2013). The relationship between bank credit and profitability and liquidity. The International Journal of Business and Finance Research, 7(3), 105-118.

Bowman, E.H. (1980). A Risk/Return Paradox for Strategic Management. Sloan Management Rev, (Spring), 17-31.

Costner, P.H., & Holland, D.M. (1970). Rate of Return and Business Risk. The Bell Journal of Economics and Management Science, 1(2), 211-226.

Indexed at, Google Scholar, Cross Ref

Cuong, D.P., Quan, X.T., & Lan, T.N.N. (2018). Effects of Internal Factors on Financial Performance of Listed Construction-Material Companies: The Case of Vietnam. Research Journal of Finance and Accounting, 9(10), 1-15.

Indexed at, Google Scholar, Cross Ref

David, A.A. & Jacobson, R. (1987). The role of Risk in Explaining Differences in Profitability. The Academy of Management Journal, 30(2), 277-296.

Indexed at, Google Scholar, Cross Ref

Diby, F.K., Dilesha, N.R., Pierre, A.L., & Ning, D. (2019). Market Risk and Financial Performance of Non-Financial Companies Listed on the Moroccan Stock Exchange. Risks, MDPI, Open Access Journal, 7, 1-29.

Indexed at, Google Scholar, Cross Ref

Duc, H.V., Binh, N.V.P., & Michael, M. (2019). Corporate Financial Distress of Industry Level Listings in Vietnam. Journal of Risk and Financial Management, 12(4), 1-17.

Indexed at, Google Scholar, Cross Ref

Elder, J. (2016). Emerging Credit Risks in 2016.

Ephias, M., & Athenia, S. (2020). An empirical analysis of the impact of credit risk on the financial performance of South African banks. Academy of Accounting and Financial Studies Journal, 24(3), 1-15.

Eugene, F.B., & Michael, C.E. (2008). Financial Management: Theory & Practice. 12 ed. s.l.: Harcourt College Publishers Series in Finance.

Froster, D.L. (1996). Capital Structure, Business Risk, and Investor Returns for Agribusiness. Agribusiness, 12(5), 429-442.

Indexed at, Google Scholar, Cross Ref

Hawley, F.B. (1893). The Risk Theory of Profit. The Quarterly Journal of Economics. https://www.jstor.org/stable/1882285, 7(4), 459-479.

Indexed at, Google Scholar, Cross Ref

Jayant, R.K., Thomas, H.N., & Gabriel, G.R. (1991). The Effect of Business Risk on Corporate Capital Structure: Theory and Evidence. The Journal of Finance, XLVI(5), 1693-1715.

Indexed at, Google Scholar, Cross Ref

Jia, W., & Chen, B. (2008). Financial Risk, Business Risk and Firm Value for Logistics Industry.Dalian, China, IEEE.

Indexed at, Google Scholar, Cross Ref

Jin, W.W. (2019). What Enables a High-Risk Project to Yield High Return from a Construction Contractor’s Perspective?. Sustainability, 11(5971), 1-17.

Indexed at, Google Scholar, Cross Ref

John, K.W. (1999). How firm characteristics affect capital structure: An international comparison. Journal of Financial Research, 22(2), 161-187.

Indexed at, Google Scholar, Cross Ref

John, U. (2020). Financial Risks Management and Bank Profitability in Nigeria: Case of Access Bank of Nigeria Plc. International Journal of Research and Innovation in Social Science, 4(9), 184-190.

Lemont, K.R. (1970). Do high risks lead to high returns. Financial analysts Journal, 26(2), 88-99.

Indexed at, Google Scholar, Cross Ref

Limei, C., Takyi, K.N., Ofori, C., & Abraham, L.A. (2020). Credit risk, operational risk, liquidity risk on profitability. A study on South Africa commercial banks. A PLS-SEM Analysis. Revista Argentina de Clínica Psicológica, XXIX(5), 5-15.

Indexed at, Google Scholar, Cross Ref

Mazen, K. (2013). Does debt a?ect profitability? An empirical study of French trade sector. SSRN Electronic Journal.

Indexed at, Google Scholar, Cross Ref

Mohad, I.M.A. (2015). Business Risk Impact on Capital Structure: A Case of Jordan Industrial Sector. Global Journal of Management and Business Research, 15(1), 1-9.

Mukesh, K., & Mike, G. (2013). An exploration of risk management in global industrial investment. Risk Management, 15(4), 272-300.

Indexed at, Google Scholar, Cross Ref

Munangi, E., & Sibindi, A.B. (2020). An Empirical Analysis of The Impact of Credit Risk on The Financial Performance of South African Banks. Academy of Accounting and Financial Studies Journal, 24(3), 1-15.

Nguyen, T.N.L., & Nguyen, V.C. (2020). The Determinants of Profitability in Listed Enterprises: A Study from Vietnamese Stock Exchange. The Journal of Asian Finance, Economics and Business, 7(1), 47-58.

Indexed at, Google Scholar, Cross Ref

Onsongo, S.K. Muathe, S.M & Mwangi, L.W. (2020). Financial risk and financial performance: Evidence and insights from Commercial and Services Listed Companies in Nairobi Securities Exchange, Kenya. International Journal of Financial Studies, 8(3), 1-15.

Indexed at, Google Scholar, Cross Ref

Panigrahi, A.K. (2013). Liquidity Management of Indian Cement Companies – A Comparative Study. Journal of Business and Management, 14(5), 49-61.

Indexed at, Google Scholar, Cross Ref

Richard, A.B., & Mahajan, V. (1985). Risk/Return Performance of Diversified Firms. Management Science, 31(7), 785-799.

Serrasqueiro, Z.S., & Nunes, P.M. (2008). Performance and size: empirical evidence from Portuguese SMEs. Small Business Economics, 31(2), 195-217.

Indexed at, Google Scholar, Cross Ref

Suratno, Syahril, D., & Imam, G. (2017). The Role of Business Risk and Non Debt Tax Shields to Debt to Equity Ratio on Pharmacy Listed Companies in Indonesia. International Journal of Economics and Financial Issues, 7(2), 73-80.

Wangalwa, M., & Willy, M. (2018). Effect of Financial Risk on Financial Performance of Large-Scale Supermarkets in Nairobi County, Kenya. International Journal of Social Science and Technology, 4(1), 574-591.

Wani, A.A., & Dar, S.A. (2015). Relationship Between Financial Risk and Financial Performance: An Insight of Indian Insurance Industry. International Journal of Science and Research, 4(11), 1424-1433.

Indexed at, Google Scholar, Cross Ref

Wruck, K.H. (1990). Financial distress, reorganization, and organizational efficiency. Journal of Financial Economics, 27, 419-444.

Indexed at, Google Scholar, Cross Ref

Zeitun, R., & Tian, G. (2007). Capital structure and corporate performance: Evidence from Jordan. Australian Accounting Business and Finance Journal, 1(4), 40-61.

Indexed at, Google Scholar, Cross Ref

Zélia, S.S., & Paulo, M.N. (2008). Performance and size: empirical evidence from Portuguese SMEs. Small Business Economics, 31, 195-217.

Indexed at, Google Scholar, Cross Ref

Received: 04-Apr-2022, Manuscript No. AAFSJ-22-11691; Editor assigned: 05-Apr-2022, PreQC No. AAFSJ-22-11691(PQ); Reviewed: 19-Apr-2022, QC No. AAFSJ-22-11691; Revised: 21-Apr-2022, Manuscript No. AAFSJ-22-11691(R); Published: 28-Apr-2022