Research Article: 2021 Vol: 20 Issue: 6S

Does asset management and audit quality affect the financial reporting quality and public service quality?

Ramses Pakpahan, Universitas Trisakti

Etty Murwaningsari, Universitas Trisakti

Abstract

The goal of this research is to determine how asset management and audit quality impact the public services quality with financial reporting quality as an intervening variable, in the context of developing an accural-based accounting system in Indonesian local governments. The Partial Least Squares-SmartPLS analytic approach is employed in this study, which comprises 1,828 observations from 457 district and municipal administrations in Indonesia from 2015 to 2018. The findings demonstrate this. The first is that asset management has a positive and significant effect on the financial reporting quality; the second is that audit quality has a positive and significant effect on the financial reporting quality; the third is that asset management has no long-term impact on the public service quality; and the fourth is that audit quality has a positive and significant impact on the public service quality. Fifth, financial reporting quality can help to mediate the impact of asset management on the quality of government services. Sixth, financial reporting quality can help to mediate the impact of audit quality on the public service quality. The study's findings suggest that local governments improve management to aid regional development, as well as streamline the role of internal auditors in completing follow-up audit recommendations and assisting external auditors in the audit process, in order to produce effective and constructive recommendations. One of the research's flaws is that it does not sufficiently analyze the public service quality as well as accounting and auditing. This study adds to our understanding of the link between asset management and audit quality in the context of an accrual-based accounting system and public service quality.

Keywords

Asset Management, Audit Quality, Financial Reporting Quality, Public Service Quality

Introduction

Indonesia is the world's biggest archipelago, with 17,504 islands and a variety of attractions such as rich mineral resources, culture and diversity, and tropical natural beauty. Indonesia's 1998 government reforms resulted in a number of important developments in the political, social, economic, and governance spheres (Asrini, 2017). Indonesian reforms aim to strengthen democracy and decentralization while also improving professionalism, accountability, and monitoring in the public sector, notably in institutions (Adiputra, Utama & Rossieta, 2018; Harun, Van-Peursem & Eggleton, 2015; De Vries & Sobis, 2016). The passage of Law No. 9/2015, the Second Amendment to Law No. 23/2014 on Regional Governance, has resulted in a fundamental and significant shift in government, notably the adoption of regional autonomy. One of the provided abilities is financial management. The delegation of financial management is supposed to persuade local governments to be more flexible in managing funds for development implementation in their regions. One of the effects of decentralization is the measurement of local government performance (Mangkunegara, 2015). As a result, it may eventually have an impact on the performance of the local government itself. Many Key Performance Indicators (KPI) are reported by institutions to fulfill compliance requirements rather than reflecting program performance, according to (Cameron, 2004). To achieve good performance in attaining community welfare, local governments must be able to manage their resources in line with the idiosyncrasies of each region. The characteristics of financial resource management may be characterized by asset and spending management (Abbas, et al., 2021b, 2021c; Mangkunegara, 2015). With increased demands for accountability implementation, it has an influence on public sector management's capacity to provide information to the public, one of which is financial reporting (Mardiasmo, 2009).

Research that thoroughly examines the link among the use of accounting systems and the quality of public services is relatively uncommon (Bruns, Christensen & Pilkington, 2020; Furqan et al., 2020). This study adds to the literature on the usage of specific forms of local government financial statements, particularly the components of operational financial statements that employ the accrual basis. Furthermore, the use of an accrual-based accounting system can give more complete and dependable financial information and performance in general (Abbas et al., 2021d). Asset management in the form of fixed assets is an essential topic that local governments must handle. Local governments' fixed assets are their most valuable assets. The audit findings linked to fixed asset management have the biggest effect in deciding the audit conclusion. As a result, substantial attention must be paid to managing these fixed assets so that they may have an influence on the quality of financial reports and, ultimately, have an impact on the long-term performance of local governments in the form of adjustments and service improvements (Bruns, Christensen & Pilkington, 2020). The concept of financial report quality remains varied, although in general, the quality of financial reports is synonymous with the quality of financial reporting. The asset sustainability ratio is one metric that may be used to assess the validity of financial reporting. This ratio is an estimate of the extent to which assets administered by local governments can be replaced after their useful lives have expired.

The study's novelty is that it attempts to develop a model for measuring the level of asset sustainability using a benchmarking approach to the model used by local governments in Western Australia that have successfully implemented full accrual-based accounting with adjustments to the characteristics of local government financial statements in Indonesia. Andriani, Kober & Ng (2010) discovered that accrual accounting information was more beneficial to Western Australian public sector managers than cash accounting information. Meanwhile, (Abbas et al., 2021a) emphasize that the quality of accrual-based government financial reporting is an essential indication of the government's New Public Management (MPM) program's performance in meeting the Global Sustainable Development Goals. Reporting information must be of high quality in order to be used in decision making (Siregar, 2012). The presentation of good financial accounts is a type of public sector accountability management that can help to minimize the culture of corruption and improve local government performance (Lestiawan & Jatmiko, 2015).

Literature Review

(Jensen & Meckling, 1976) popularized agency theory. When there is a contractual link between the agent and the principal, this hypothesis occurs. Because the principle has constraints in managing the firm, the principal delegated power to the agent to carry out the company's activities. The delegation of power in the company's management might result in agency difficulties in the form of asymmetric information (Halim, 2007). In the context of government, an agency relationship in which the legislative (principal) directs the executive (agent) to supply goods and services at a predetermined price set by contract. There is a lot of evidence to back up the concept that agents will seek their own personal interests at the expense of the principal.

The bonding mechanism, which binds the agent to work in the best interests of the principal, and the monitoring mechanism, which is carried out by internal and external parties of the organization against the agent, can be used to resolve agency conflicts. In addition to creating financial reports, agents must be able to offer quality financial reports (Martínez-Ferrero, 2014; Subramanyam Wild, 2010). Quality financial reporting can assist to address the issue of information asymmetry (Healy & Palepu, 2001; Verdi, 2008). An unbiased third party, such as an external auditor, is essential to avoid agency conflicts. External auditors, namely the Supreme Audit Agency of the Republic of Indonesia, are expected to oversee management's performance in managing local government budgets in line with the principle of interest via the financial statements that are generated. Financial statements may also be used to track and compare a company's financial performance (Mardiasmo, 2009).

According to (Paton, 1922), in entity theory, the organization is viewed as an autonomous commercial economic entity that works independently of the owner or other parties who become funds in the company, as well as the unit of focus of attention or point of view accountancy. There is a distinction between private and corporate interests, according to entity theory. Because the owners of capital have rights to the resources represented in the entity's financial accounts, financial statements can be used as a surrogate for ownership (Nguyen & Chau, 2017; Strier, 2005). The company's management and accountability theory, in which enterprises pay attention to the level of business and financial information for equity owners in order to satisfy legal obligations and maintain good relations with these equity holders in the goal of getting money in the future (Paton, 1922).

The public accountability process is the final phase in the public sector accounting cycle that determines how well public entities accomplish their goals. Furthermore, performance accountability has become one of the concerns mentioned in the legal foundation or organizational rules, so businesses are legally obligated to meet their organizational accountability with the performance they get.

Based on the research model framework given above, the hypothesis for this study is as follows:

• Does Asset management affect the financial reporting quality?

• Does audit quality affect the financial reporting quality?

• Does asset management affect the public service quality?

• Does audit quality affect the public service quality?

• Does the financial reporting quality mediate the related between of asset management on the public service quality?

• Does the financial reporting quality mediate the related between of audit quality on the public service quality?

Research Methods

The goal of this study was to look at the relationship between asset management and the quality of local government performance audits, with financial reporting quality acting as a an intervening variable. To test hypotheses, this study employs a quantitative strategy with a deductive approach. Districts and cities in each province, as well as the organizational unit of analysis, were employed in this study.

This study's population is Indonesia's district and city governments, comprising 508 local governments, with a sample of 457 local governments from 2015 to 2018, beginning with local governments that used accrual-based record keeping. The data utilized is secondary data obtained from the Supreme Audit Agency's official website, the Ministry of Home Affairs' official website, and every local government available for access. Local governments' financial reporting rules are used in the first half of the year audit, and local governments are audited yearly by the Ministry of Home Affairs. This study's data were reviewed in two stages: descriptive analysis and Partial Least Squares (PLS) analysis.

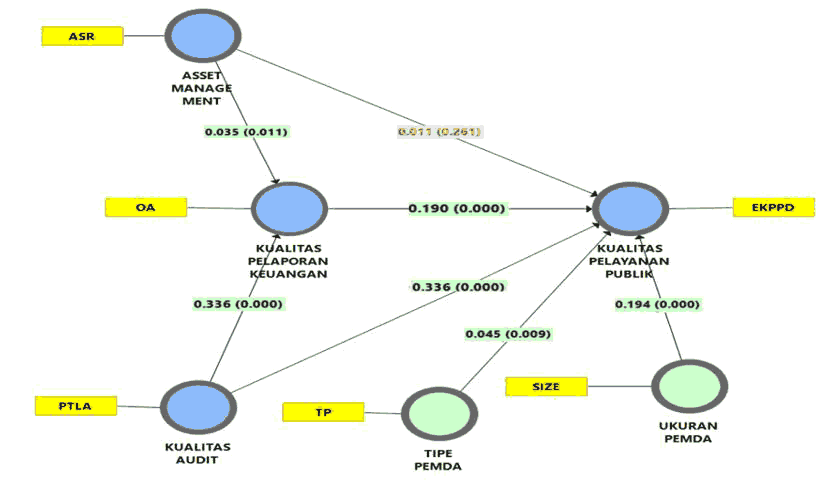

Coefficient of Determination Result

The coefficient of determination, as measured by the adjusted R square value, demonstrates that all exogenous factors contribute significantly to endogenous ones. Table 3 shows the adjusted R square value variable KPK is 0.114 and the R square value is 0.115, indicating that asset management and audit quality of local governments affect 11.4 percent of the variance in the KPK, while they affect up to 88.6 percent of the variance in KPK. The measurement error value is calculated using the value of R square e=√ (1-R^2)=0,941 and the structural equation for the financial reporting quality variable is as follows:

Model 1 KPK=0,035 AM+0,336 KA+0,941

Furthermore, the value of Adjusted R square of public service quality is 0.250, and R square implies that KPP supplied by local government influences the other 75% of variations. Variables other than financial reporting quality, asset management, and audit quality have an impact on local government public services. Based on the value of R square, the measurement error value is e=√ (1-R^2 )=0,865, and the structural equation for the variable of public service quality is as follows:

Model 2 KPP=0,011 AM+0,336 KA+0,190 KPK+0,194 Size+0,045 TP+0,865

Results and Discussion

The findings of this study's data analysis include descriptive analysis of the value of each research variable and PLS analysis, which will be utilized to evaluate the hypothesis.

Descriptive Statistics

| Table 1 Descriptive Statistics |

||||

|---|---|---|---|---|

| Variabel | Mean | Min | Max | Standard |

| Asset Management | 2.78 | -10.586 | 146.493 | 6.516 |

| Audit Quality | 0.737 | 0.043 | 1 | 0.15 |

| Financial Reporting Quality | 3.726 | 1 | 4 | 0.553 |

| Public Service Quality | 2.97 | 1.049 | 3.994 | 0.325 |

| Local Government Type | 0.2 | 0 | 1 | 0.4 |

| Local Government Size (Billion Rupiah) | 3154.481 | 1.719 | 42764.673 | 3872.913 |

Outer Model PLS

During the measurement model testing phase, Convergent Validity, Discriminant Validity, and Composite Reliability were all assessed. Table 2 displays the results of the external PLS model testing, which demonstrate that all indicators in the PLS model have a loading factor value larger than 0.7 and all constructs have an AVE greater than 0.5, showing that the PLS model has fulfilled the convergent validity constraints.

| Tabel 2 Outer Model PLS |

||||||

|---|---|---|---|---|---|---|

| Descriminant Validity | Convergent Validity & Reliability | |||||

| Variabel | Size | ASR | KA | KPK | Indicator | Cronbachs Alpha |

| Size | 1 | Size | 1 | |||

| AM | 0.001 | 1 | PTLA | 1 | ||

| KA | 0.048 | 0.038 | 1 | OA | 1 | |

| KPK | 0.078 | 0.047 | 0.337 | 1 | EKPPD | 1 |

| KPP | 0.235 | 0.035 | 0.413 | 0.323 | LGT | 1 |

| LGT | 0.22 | 0.053 | 0.072 | 0.081 | ASR | 1 |

Furthermore, in the discriminant validity test shown in Table 2, all constructs met the required discriminant validity criteria, such as the AVE square root value of all constructs exceeding the correlation between constructs with other constructs and the HTMT value of the constructs not exceeding 0.9, indicating that discriminant validity is met for each construct. Furthermore, the results of the composite reliability test in Table 2 show that all constructions met the requisite composite reliability criteria, as shown by Cronbach's alpha values>0.7 and composite reliability>0.7.

Path Coefficient Evaluation

| Table 3 Significance Test |

||||

|---|---|---|---|---|

| hypotheses Model 1 | Dirrect-Coefficient | Prob t | Prob sig | |

| · Size_LGT -> KPP | 0.194 | 10.977 | 0 | |

| · AM -> KPK | 0.035 | 2.285 | 0.011 | |

| · AM -> KPP | 0.011 | 0.64 | 0.261 | |

| · KA -> KPK | 0.336 | 15.171 | 0 | |

| · KA -> KPP | 0.336 | 15.713 | 0 | |

| · KPK -> KPP | 0.19 | 7.361 | 0 | |

| · LGT -> KPP | 0.045 | 2.366 | 0.009 | |

| hypotheses Model II | Indirrect-Coefficient | Prob t | Prob sig | |

| · KA -> KPK -> KPP | 0.064 | 6.519 | 0 | |

| · AM -> KPK -> KPP | 0.007 | 2.143 | 0.016 | |

| Significant level 5%; coefficient jalur significant if Prob sig<0.05 and Prob t>1.96 | ||||

| Endogen Variable | Goodness of fit Model Parameter | |||

| R-Square | Adjusted R-Square | Q-Square | SRMR | |

| KPK | 0.115 | 0.114 | 0.113 | 0.019 |

| KPP | 0.252 | 0.25 | 0.248 | |

The path coefficient evaluation results in Table 3 show that audit quality other than asset management, Variable Size, and TP are the most influential factors affecting KPK and KPP provided by local governments to the public.

As shown in the figure below, the resulting model estimation results serve as an incentive to present the overall conclusions of the PLS analysis:

Table 3 has a full description of the hypothesis testing findings, which reveal that one of the hypotheses regarding the direct effect of asset management on public service quality is not substantiated.

| Table 4 Summary-of-Hypothesis-Testing-Results |

|||

|---|---|---|---|

| No | Hypothesis | Result | Conclusion |

| 1 | Does Asset management affect the financial reporting quality? | Path Coeff=0.035; T stat=2,285; p value=0,011 | Accepted |

| 2 | Does audit quality affect the financial reporting quality? | Path Coeff=0.336; T stat=15,1717; p value=0,000 | Accepted |

| 3 | Does asset management affect the quality of public services? | Path Coeff=0.011; T stat=0,640; p value=0,261 | Denied |

| 4 | Does audit quality affect the public service quality? | Path Coeff=0.336; T stat=15,713; p value=0,000 | Accepted |

| 5 | Does the financial reporting quality mediate the related between of asset management on the the public service quality? | Path Coeff=0.007; T stat=2,143; p value=0,016 | Accepted |

| 6 | Does the financial reporting quality mediate the related between of audit quality on the public service quality? | Path Coeff=0.064; T stat=6,519; p value=0,000 | Accepted |

Discussion

The Asset Management (AM) affect the Financial Reporting Quality (KPK)

According to the study's findings, asset management has a favorable and considerable impact on financial reporting quality. Putry & Badrudin (2017) show that regional financial performance has a positive and significant influence on government audits. One of the most important aspects of regional financial management is optimal asset management. Capital expenditure increase, according to Sudarsana & Rahardjo (2013), shows the building of a substantial quantity of infrastructure and facilities.

The findings of this research are congruent with those of (Mulyadita, Ratnawati & Silfi 2019). Which shows that asset management has a positive and large impact on the quality of local government reports, and (Niliani, 2019) study showing that asset management has a positive and significant impact on the quality of financial reporting and financial reporting. The quality of information on local government asset reports is affected by asset administration (Sari et al., 2018). This illustrates that the higher the degree of financial reporting, the better the asset management. Local governments that correctly manage their assets are more likely to have accurate financial reporting.

The Audit Quality (KA) Affects the Financial Reporting Quality (KPK)

The study's findings indicate that audit quality has a favorable and significant effect on financial reporting quality. According to (Patterson, 2019), audit quality requirements have risen, encouraging managers to respond by lowering reporting bias. A high-quality audit must be capable of assuring that financial statements are free of significant misstatements due to mistakes or fraud, as well as that financial reports are of high quality (Wallace, Zinkin & John, 2005).

Several previous studies on the impact of audit quality on report quality include one by (DeFond & Zhang, 2014), which found that audit quality is a greater assurance of financial reporting quality, and hence audit quality can improve financial statements. This is congruent with the findings of (Djanegara et al., 2017) research, which revealed that audit quality is a post-audit follow-up that has a substantial and positive effect on raising the quality of local government financial reports. The scope of the benefits of audit work is defined by the effective implementation of the audited company's follow-up solutions (Tandiontong, 2016). Similarly, (Setyaningrum, 2017) revealed that audit results proposals had a positive and significant influence on financial statement quality.

The Asset Management (AM) not Affect the Public Service Quality (KPP)

There is no evidence that asset management affects the quality of public services, according to this research. This demonstrates that the success of local government financial management has little impact on the quality of public services. This runs counter to the findings. (Giroux & Shields 1993) on city governments in the United States, who observed that audit views (which characterize the quality of financial reporting) may improve future public expenditure efficiency. According to, excellent asset management (Hasan, 2019), may assist to increase asset performance, government institution performance, and regional development. To fulfill the government's objectives and visits in delivering a big and sustainable public service, all asset-related activities must be enhanced.

The Audit Quality (KA) Affect the Public Service Quality (KPP)

According to the study's findings, audit quality has a positive and significant impact on the quality of public services. This corresponds to the results of (Furqan et al., 2020) who discovered that audit quality, as evaluated by follow-up audit recommendations, had a favorable impact on the quality of government services As a result, the higher the level of auditing, the better the level of government service quality. In contrast to the findings of (Harun, Van-Peursem & Eggleton, 2015) the audit system reform in Indonesian local governments did not improve internal audit function quality or minimize corruption.

The Financial Reporting Quality (KPK) Mediate the Related between of Asset Management (AM) on the Public Service Quality (KPP)

According to the study's conclusions, the effect of assets on the quality of public services may be reduced through improving financial reporting. The quality of local financial governance, according to (Karlinda et al., 2015), can have an influence on output and yields. According to (Natrini & Taufiq Ritonga, 2017), the government's financial condition in general refers to the government's ability to keep its obligations in terms of delivering community services and repaying creditors in a timely and sustainable manner. This is congruent with the findings of (Furqan et al., 2020), who observed that using an accrual-based accounting system and producing high-quality financial reporting increases the quality of public services. The more the government's economic might, the better its governance. Special capital expenditures to improve public services in the education and health sectors in order to improve human resource quality.

The Financial Reporting Quality (KPK) Mediate the Related between of Audit Quality (KA) on the Public Service Quality (KPP)

Results according to the study, financial reporting quality can reduce the impact of audit quality on the public service quality. According to the audit recommendations, offering fines, penalties, and other audit recommendations (Liu & Lin, 2012), auditees are restrained, resulting in more audit recommendations that limit corruption in the next term. Local governments that do not act on audit recommendations may face a reduction in performance.

(Furqan et al., 2020) It was determined that the quality of audit rules had a positive influence on financial reporting and government services. Local government finance management will become more responsible in the coming years if the audit recommendations are successfully monitored and implemented. This implies that the higher the quality of financial reporting supplied by local governments, the better local governments' performance toward continuous development. On the other hand, the lower the audit, the lower the quality of reports supplied by the local government, lowering the local government's performance toward improvement.

Conclusion

The primary goal of this research is to investigate the link between the adoption of accrual-based accounting and the quality of public sector audits and services. The goal of this study is to investigate the influence of asset management and audit quality on the quality of reporting and, more specifically, the quality of public services. The study's findings show that: first, asset management has a positive and significant effect on financial reporting quality; second, audit quality has a positive and significant effect on financial reporting quality; third, asset management cannot directly affect the public service quality; fourth, audit quality has a positive and significant effect on the public service quality; and fifth, financial reporting quality can mediate the efficacy of public services. Sixth, the effect of audit quality on service quality can be mitigated by financial reporting quality. According to study findings, the most effective method for local governments to improve the quality of public services delivered to the community is to improve reporting quality. Local governments must enhance asset management in order to assist regional development finance, as well as strengthen the role of internal auditors in executing follow-up audit recommendations and mentoring, in order to create successful audits and constructive suggestions. External auditors are involved in the auditing process. One of the study's weaknesses is that it does not adequately assess the quality of public services as well as accounting and auditing. Furthermore, rather than a single government organization, public services are now provided by a number of departments and agencies, as well as the private sector. This study focuses only on the quality of financial reporting in the context of accrual-based accounting systems, asset management, and audit quality in terms of audit follow-up. Other areas where management accounting and behavioral accounting may have a greater impact on the quality of government services are still to be determined.

References

- Abbas, D.S., Tubagus, I., Muhamad, T., & Helmi, Y. (2021a). Analysis of audit opinion based on cost & benefit sustainability reporting in determining the sustainability of mining companies (state-owned enterprise) in Indonesia. Turkish Online Journal of Qualitative Inquiry (TOJQI), 12(7), 617–27.

- Disusun, S.A., Liebenberg, A.P., & Hoyt, R.E. (2021b). Determinants of enterprise risk management disclosures: Evidence from Insurance Industry. Accounting, 7(6), 13–38.

- Abbas, D.S., Tubagus, I., Muhamad, T., & Helmi, Y. (2021c). Systematic mapping in the topic of knowledge management: Based on bibliometric analysis 2015-2021. Library Philosophy and Practice (e-journal), 6242.

- Abbas, D.S., Tubagus, I., Muhamad, T., & Helmi, Y. (2021d). The influence of independent commissioners, audit committee and company size on the integrity of financial statements.

- Adiputra, I., Made, P., Sidharta, U., & Hilda, R. (2018). Transparency of local government in Indonesia. Asian Journal of Accounting Research, 3(1), 123–138.

- Andriani, Y., Ralph, K., & Juliana, Ng. (2010). Decision usefulness of cash and accrual information: Public sector managers’ perceptions. Australian Accounting Review, 20(2), 144–53.

- Asrini, A. (2017). The influence of public accountability, clarity of budget targets and participation in budgeting on the performance of skpd in the palu city government. Catalog, 5(1), 52–58.

- Bruns, H.J., Mark, C., & Alan, P. (2020). 33 accounting, auditing and accountability journal intellectual heritages of post-1990 public sector accounting research: An exploration.

- Cameron, W. (2004). Public accountability: Effectiveness, equity, ethics. Australian Journal of Public Administration, 63(4), 59–67.

- DeFond, M., & Jieying, Z. (2014). A review of archival auditing research. Journal of Accounting and Economics 58(2–3), 275–326.

- Djanegara, M.S., Dosen, S., Tinggi, I., & Ekonomi, K. (2017). Effect of audit quality on report quality. Accounting Journal, XXI(03), 461-483.

- Furqan, A.C., Ratna, W., Dwi, M., & Dyah, S. (2020). The effect of audit findings and audit recommendation follow-up on the financial report and public service quality in Indonesia. International Journal of Public Sector Management, 33(5), 535-559.

- Giroux, G., & David, S. (1993). Accounting controls and bureaucratic strategies in municipal government. Journal of Accounting and Public Policy, 12(3), 239–262.

- Halim, A. (2007). Regional financial public sector accounting. Jakarta: Four Salemba.

- Harun, H., Karen, V.P., & Ian, R.C.E. (2015). Indonesian public sector accounting reforms: Dialogic aspirations a step too far? Accounting, Auditing & Accountability Journal, 28(5), 706-738.

- Hasan, W.A. (2019). Fixed asset management system at the regional secretariat of Buton regency. Scientific Journal of Management Accounting, 2(1), 27–38.

- Healy, P.M., & Krishna, G.P. (2001). Information asymmetry, corporate disclosure, and the capital markets: A review of the empirical disclosure literature. Journal of Accounting and Economics, 31(1–3), 405–445.

- Jensen, C., & Meckling, H. (1976). Theory of the firm?: Managerial behavior, agency costs and ownership structure.

- Karlinda, E. (2015). Fiscal optimization for regional economic growth: The role of operational expenditures and capital expenditures in the regional budget.

- Lestiawan, H.Y., & Bambang, J. (2015). Key success factor good government governance and its effect on government performance. Maximum, 5(1), 32-49.

- Liu, J., & Bin Article, L. (2012). Government auditing and corruption control: Evidence from China’s provincial panel data. China Journal of Accounting Research, 5(2), 163–86.

- Mangkunegara, I. (2015). The effect of financial characteristics and examination results on community welfare in north Sumatra province. Journal of State Financial Governance and Accountability, 1(2), 141-155.

- Mardiasmo, M. (2009). Public sector accounting. Yogyakarta, Andi.

- Martínez-Ferrero, J. (2014). Consequences of financial reporting quality on corporate performance. Economics Studies, 41(1), 49–88.

- Mulyadita, R., Vince, R., & Alfiati, S. (2019). The influence of human resource capacity, technology utilization, asset management on the quality of local government financial reports with internal control systems and organizational commitment as moderating variables. Economic Journal, 27(1), 82–91.

- Natrini, N.D., & Irwan Taufiq, R. (2017). Design and analysis of financial condition local government java and Bali (2013-2014). SHS Web of Conferences, 34, 03003.

- Nguyen, V.C., & Ngoc Tuan, C. (2017). Research framework for the impact of total quality management on competitive advantage: The mediating role of innovation performance. Review of International Business and Strategy, 27(3), 335–351.

- Niliani, D. (2019). Implementation of asset management, asset management human resources, and government internal control systems and their influence on the quality of financial reporting. Tirtayasa Journal of Accounting Research, 4(2), 102–113.

- Paton, W.A. (1922). Accounting theory with special reference to the corporate enterprise.

- Patterson, E.R. (2019). The interrelation between audit quality and managerial reporting choices and its effects on financial reporting quality. Contemporary Accounting Research, 36(3), 1861–1882.

- Putry, N.A.C., & Rudy, B. (2017). The influence of regional financial performance on audit opinion and community welfare in the special region of Yogyakarta. Journal of Management and Business Research, 12(1), 25-34.

- Sari, K.R. (2018). Influence of management commitment, asset administrator competencies, internal control and administration of asset on information quality of local government asset report. International Journal of Scientific and Research Publications (IJSRP), 8(6), 563–570.

- Setyaningrum, D. (2017). The direct and mediating effects of an auditor’s quality and the legislative’s oversight on the follow-up of audit recommendation and audit opinion. International Journal of Economic Research, 14(13), 269–292.

- Siregar, S.R. (2012). “Factors affecting the consideration of auditor's opinion on the financial statements of the special region of Yogyakarta”. Accounting Analysis Journal, 1(2), 1-8.

- Sobis, M.D., & Vries, I. (2016). “Increasing transparency is not always the Panacea: An overview of alternative.” Journal of Public Sector Management, 29(3), 255–270.

- Strier, F. (2005). In corporate governance.

- Subramanyam, W. (2010). Financial statement analysis.

- Sudarsana, H.S., & Shiddiq, N.R. (2013). The influence of local government characteristics and bpk audit findings on local government performance. Diponegoro Journal of Accounting, 2(4), 1-13.

- Tandiontong, M. (2016). Audit quality and its measurement. Bandung: Alphabeta, 1–248.

- Verdi, R.S. (2008). Financial reporting quality and investment efficiency. Tehran Stock Exchange Quarterly, 3(12), 96–109.

- Wallace, Z., & John, P. (2005). Corporate governance. Singapore: John Wiley.