Research Article: 2019 Vol: 18 Issue: 2

Does CEOs Power Moderate the Effect of Audit Committee Objectivity on Financial Reporting Quality in the Nigerian Banking Sector?

Ojeka Stephen A., Covenant University

Fakile Adeniran S., Landmark University

Iyoha Francis O., Covenant University

Adegboye Alex, Covenant University

Olokoyo Felicia, Covenant University

Abstract

This study empirically examined the impact of audit committee objectivity (contingent on CEO Power) on the quality of financial reporting in the Nigerian Banking Sector. The study adopted a survey research approach and secondary data extracted from financial statement. The OLS and LSDV analysis were used to investigate the impact of Audit Committee objectivity on the quality of financial reporting with or without CEO power and influence. The findings showed, that, while audit committee independence impact positively on the relevance and reliability of financial report, the same cannot be said when there was CEO power. CEO power in the audit committee mitigated the benefits of independence and caused its overall effects on financial reporting quality of no significant in terms of relevance and reliability. The study therefore recommended that having a majority of independent directors would increase the quality of board oversight, lessen the possibility of damaging conflicts of interest and helps to repose inventors’ confidence especially foreign investors that would invariably draft in FDI. This will align boards’ decisions with the interests of shareholders they represent. This will reduce significantly the ability of the CEO overbearing influence on the committee activities in ensuring financial reporting quality.

Keywords

Audit Committee Objectivity, CEO Power, Financial Reporting Quality, Banking Sector, Nigeria.

Introduction

Over the last two decades, the governance of companies has witnessed diverse reforms, which were largely influenced by the high-profile corporate fiascos characterized by weak governance structure. The global response has emphasized on the introduction of stouter governance structure with the motive to further prevent scandals and promote financial reporting quality. In Nigeria for instance, a code of corporate governance for Banks was issued following the consolidation programme in 2005, which was targeted to enhance the corporate governance structure in the banking industry. Prior this event, the corporate governance structures were considered to be notably weak while board members were unaware of their responsibilities both statutory and fiduciary duties (Nigerian Corporate Governance, 2011). Interestingly, audit committees have been recognized as a prominent mechanism to enhance transparency and integrity in reporting of firms (Sarbanes-Oxley, 2002). These committees are basically saddled with the responsibility to “independently verify and safeguard the integrity of their financial reporting” duties (Nigerian Corporate Governance, 2011).

Over the last two decades, the governance of companies has witnessed diverse reforms, which were largely influenced by the high-profile corporate fiascos characterized by weak governance structure. The global response has emphasized on the introduction of stouter governance structure with the motive to further prevent scandals and promote financial reporting quality. In Nigeria for instance, a code of corporate governance for Banks was issued following the consolidation programme in 2005, which was targeted to enhance the corporate governance structure in the banking industry. Prior this event, the corporate governance structures were considered to be notably weak while board members were unaware of their responsibilities both statutory and fiduciary duties (Nigerian Corporate Governance Code, 2011). Interestingly, audit committees have been recognized as a prominent mechanism to enhance transparency and integrity in reporting of firms (Sarbanes-Oxley, 2002). These committees are basically saddled with the responsibility to “independently verify and safeguard the integrity of their financial reporting” duties (Nigerian Corporate Governance, 2011).

In Nigeria, the Security and Exchange Commission Code 2003 recognized the presence of the CEO or any of its family members on the audit committee. Of course, this led to various financial scandals (motivated by the CEOs and other managements) which brought about the reduction of money deposit banks from 89 to 25 through consolidation. However, the 2011 SEC Code sought to improve on the previous code by ensuring that CEOs or their family members are not represented on the audit committee board (Ojeka et al., 2015). But as interesting as this new provision may be, the CEOs in Nigeria especially in the banking sector (termed “powerful”) still continues to constantly seek to interfere in what the audit committee does. This assertion could also be attributed to the fact that, some of the CEOs were the promoters/founders of those banks and they still maintain controlling interests. This could be due to the fact that, the nomination of an audit committee members which is seeing as “juicy” position, are masterminded by the CEOs hence the ability to sustain the loyalty of the members who have been saddled with the responsibility to provide controls, checks and ensure that the interests of stakeholders are protected.

Following the evolution of audit committee governance, a strand of literature has sought to examine the audit committee effectiveness, the influence of CEOs and the quality of financial reporting in developed and newly industrialized economies (Carcello et al., 2011; Ojeka et al., 2017; Abbott & Peters, 2000; Iyoha et al., 2017). Those researches are highly motivated by the increased governance regulations and the importance of the audit committee’s effectiveness through identifying the number of the audit committee’s mechanism to enhance financial quality. As noted by Carcello et al. (2011) in their survey, the top management influence determines the audit committees’ effectiveness. They further affirm that although the CEOs are exempted from the nomination processes of the audit committees in the post-SOX era, they can indirectly influence the selected members on the committee, which could further impair the financial reporting quality. Therefore, a powerful CEO would not want to be tailored or monitored, financial expertise on the audit committee therefore are unlikely to effectively perform the monitoring function because the information sources they rely on are likely to be distorted by the CEO. Similarly, Lisic et al. (2011) argued that, when CEO power is sufficiently strong, even an audit committee with a financial expert might not be able to effectively perform its monitoring duty in substance. In this case, financial expertise might not translate into higher monitoring quality.

This study is undertaken to empirically examine the influence of audit committee objectivity in respect to the CEOs position on financial reporting quality in the Nigeria Banking Sector. Our study further contributes to the existing knowledge on these following instances. First, to our knowledge, this is the first Nigerian study to focus on the affluence of CEOs in the selection of audit committee’s member, which could impair the quality of the financial reporting in Nigerian banking sector. This is prominent since Nigerian governance regulations operate amidst of weak regulatory enforcement bodies, which could give the sector liberty to implement Code of Corporate Governance partially. Second, existing literature tends to focus solely on the CEOs power in the nomination process of the audit committees. However, this study further examines the scenario where the CEOs power is exempted, which compares where the CEO is directly or indirectly involved in the nomination processes and where the CEO is totally exempted. Finally, this study is not limited only to academic literature but it is also useful to the policymakers in Nigeria and elsewhere who continue to encourage their firms to aspire for higher standards. Therefore, by undertaking the comprehensive relationship between the audit committee effectiveness contingents on CEO Power on the quality of financial reporting in Nigerian Banking Sector, our findings can help policymakers to make further evidence-based verdicts onward.

The rest of the paper is organized as follows: section 2 discusses the literature and hypothesis development and section 3 research methods; section 4 discusses the analysis and implications of findings while section 5 is the conclusion and recommendations.

Literature Review

CEO Power, Audit Committee Objectivity and Quality of Financial Reporting

In response to recent major accounting scandals and corporate frauds around the world, there have been an increasing concern especially by the regulators about the effectiveness of audit committees in monitoring corporate financial reporting. One of the key significant reforms and intervention is the improvement of audit committee quality focuses on the financial expertise of audit committee members. The Blue-Ribbon Committee (BRC) in 1999 on improving the effectiveness of Corporate Audit Committees came up and recommends that each audit committee should have at least one financial expert. Following the BRC’s suggestion, Sarbanes Oxley Act further recognizes the importance of audit committee financial expertise in monitoring financial reporting by specifically requiring a company to disclose whether there is at least one financial expert on the audit committee and, if not, to explain why not. The Act also recommended that the audit committee be comprised of 100 percent independent directors (Lisic et al., 2011).

In Nigeria, the Securities and Exchange Commission in 2003 support the inclusion of at least a member with financial expertise but with the inclusion of one director in the committee which was reversed in the 2011 code to non-executive director. However, the CBN Code of 2006 said the composition of the audit committee must be 100 percent non-executive directors which do not hold more that 0.1% of the paid-up capital in the organization. These are various measures to ensure the independence and expertise of the audit committee members in ensuring the quality of financial reporting which has been a challenge in Nigeria.

Prior studies focused primarily according to Lisic et al. (2011) on the form of audit committee financial expertise where they measure audit committee financial expertise as the proportion (or number) of financial experts on the audit committee or as an indicator variable for whether there is at least one financial expert on the audit committee and the impact on financial reporting quality without taken cognizance of the substance of the financial expertise. Beasley et al. (2009) in their survey evidence posited that it is top management that ultimately determines the effectiveness of audit committees. They further said that although Chief Executive Officer’s (hereafter CEOs) are not directly involved in the nomination process in the post-SOX era, they can still significantly influence who gets selected to serve on audit committees such that the governance process for improving financial reporting quality may be compromised. More so, a powerful CEO would not want to be tailored or monitored, financial expertise on the audit committee therefore are unlikely to effectively perform the monitoring function because the information sources they rely on are likely to be distorted by the CEO. Lisic et al. (2011) argued that, when CEO power is sufficiently strong, even an audit committee with a financial expert might not be able to effectively perform its monitoring duty in substance. In this case, financial expertise might not translate into higher monitoring quality.

The process of selecting members, particularly the role of the CEO as posited by Carcello et al. (2011) can affect whether an audit committee substantially function independently since audit committee are selected from the board and Klein (2002a) finds that board characteristics have a significant influence on audit committee characteristics. They therefore posit that CEO involvement in selecting board members including directors who are subsequently appointed to the audit committee board diminishes the audit committee independence and in turn reduces the effectiveness of seemingly independent audit committee members and of audit committee financial expertise.

In Nigeria, there is no such provision in both the Securities and Exchange Commission (2011) and the CBN Code (2006). The code is silent about who is responsible for the nomination. It is therefore presumed that the full board is responsible for the nomination of audit committee members. Attempt has also been made in Nigeria that the Board should comprise a mix of executive and non-executive directors, headed by a Chairman. The code went further to state that the board should be independent of the management to enable it carries out its oversight function in an objective and effective manner; the majority of board members should be non-executive directors, at least one of whom should be independent director (Ojeka et al., 2017).

The substance of audit committee characteristics was looked into in (Carcello et al., 2011, Iyoha et al., 2016). This has been seeing as notable exception in the literature (Lisic et al., 2011). They made use of pre-SOX data to establish how the CEO’s direct involvement in selecting board members affects the association between audit committee independence and financial expertise and restatements. They found that independent audit committee and the presence of financial experts are only associated with fewer restatements when the CEO is not involved in the director selection process and when CEO is involved, the associations are insignificant. Agrawal & Chadha (2005) maintained that a CEO’s influence on the board can reduce the board’s effectiveness in monitoring managers. The greater a CEO’s influence on the board, the less likely the board is to suspect irregularities that a more independent board may have caught. In the same light the presence of financial experts on the audit committee is only associated with fewer restatements when the CEO is not involved in the director selection process. When the CEO is involved, the associations are insignificant.

Agrawal & Chadha (2005) and Ojeka et al. (2015) also maintained that the appearance of independence and financial expertise do not necessarily translate into substance depending on whether the CEO is involved in selecting the board members. Shivdasani & Yermack (1999) found that when CEO is involved, firms appoint fewer independent outside director and more gray outsiders. They also find that market reaction to independent director appointments is significantly negative when the CEO is involved in the director selection and that nominees that are unlikely to monitor are chosen when CEOs are involved in the selection and whether there the CEO serves on the nominating or no nominating committee exists, firms appoint fewer independent director into the board.

Bebchuk et al. (2007) found that CEO power (measured by the fraction of aggregate compensation of the top-five executive team captured as CEO) is associated with lower firm value and Ashbaugh-Skaife et al. (2006) also made known that CEO power (measured by CEOChairman duality and compensation and audit committee memberships) is negatively associated with firms’ credit rating. Lisic et al. (2011) in their findings submitted that having at least one financial expert on the audit committee is negatively associated with the incidence of restatements when the proxy for CEO power is low. The association turns insignificant when CEO power is moderate. Moreover, as CEO power reaches high, the association becomes positive. They however maintained that having a financial expert on the audit committee in form does not automatically translate into more effective monitoring in substance and that the regulatory changes prohibiting CEOs from being directly involved in the nomination process may not have been sufficient to ensure audit committee effectiveness. Rather, CEO power continues to have an impact on the effectiveness of audit committee financial expertise in the post-consolidation era

This can be seen in the statement of Sanusi (2010) that some banks’ chairmen/CEOs were seen too often have an overbearing influence on the board, and that some boards lacked independence; the directors often failed to make meaningful contributions to safeguard the growth and development of the bank and had weak ethical standards; the board committees were also often ineffective or dormant. Hence the reason for the failure in the banking sector that led to the removal of eight CEOs in Nigeria in 2010 by the apex body.

Hypothesis

This paper therefore hypothesized that:

H1: There is no significant impact of audit committee objectivity/independence on the quality of financial reporting in the absence of CEO interference.

Research Methodology

This study made use of items in the financial report to ascertain the impact of audit committee independence (contingent on CEO involvement) on the quality of financial reporting with reference to relevance, reliability and timeliness consistent with Rich (2009). The study adopted a census whereby the population size is the sample size. This represents the 15 money deposit banks listed on the Nigerian Stock Exchange. Data used were accessed on the Nigerian Stock Exchange Fact book and the sampled banks’ websites, which contained useful information for the study’s data analysis. This study focused on the banking sector because it is a very crucial sector in the Nigerian economy in term of its market capitalization. Least Square Dummy Variable (LSDV) was adopted to test the postulated hypotheses using the pooled the time series and cross-sectional data. The study also separated the financial reporting quality into relevance and reliability. “Relevance” was measured by calculating interval of days between the balance sheet closing date and the signed date of the auditor’s report stated in the annual report (Iyoha et al., 2013). The second quality of financial reporting is “Reliability” which is proxied by accrual quality.

This study adopted accrual quality as calculated by adopting the formula used by (Leuz et al., 2003; Iyoha et al., 2013, Ojeka et al., 2015). The total accrual method adopted by these studies has been argued by McNicholas (2000) as flexible and allows for control of corporate governance and external audit attributes as additional variables. Therefore, a positive index of accrual quality suggests that the firm is engaging in income decreasing strategies and a negative accrual index indicates income increasing strategies. That is, the higher the index of accruals, the poorer the quality of financial reporting and the closer the index to zero, the better is the quality of financial reporting.

CEO Power, Audit Committee Objectivity and Quality of Financial Reporting

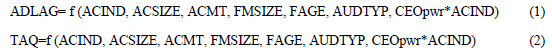

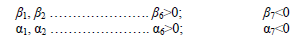

This is the model that measures the impact of audit committee independence on the quality of financial reporting in term of relevance and reliability in the absence of CEO influence. Using both Ordinary Least Square (OLS) and Panel Data Estimation technique that is, Least Square Dummy Variable (LSDV), this model can be stated in functional form as:

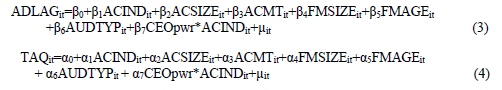

Models 1 and 2 can now be stated explicitly in the following form:

Using LSDV (Panel Data Estimation), the equations therefore becomes:

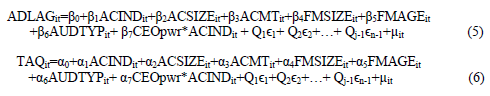

The parameters of the model are such that:

and,

Table 1 shows the definition of variables used the specified models.

| Table 1: Defination Of Variables | ||

| Variables | Acronym | Measurement |

|---|---|---|

| Dependent Variables | ||

| Reliability (Total Accrual Quality) | TAQ | See Appendix. |

| Relevance (Audit Report Lag) | ADLAG | Interval of days between the balance sheet closing date and the signed date of the auditor’s report stated in the annual report. |

| Independent Variables | ||

| Audit Committee Independence | ACIND | This is measured by the percentage of non-executive directors to the total number of audit committee members. |

| CEO Power | CEOPWR | Five measures are used to capture this variable (i.e. g=1,?,5): Ownership power (Shareown), measured as the number of share owned by the CEO; Founders status (Founder), measured as a dummy variable where 1 is for a company with the CEO as the founder and 0 otherwise; if the CEO serves on the board’s nominating committee or if no nominating committee exists; 0, otherwise; Family affiliation (Faffill) measured as a dummy variable where 1 is for family member of the CEO and 0 otherwise. |

| Control Variables | ||

| Audit Committee Size | ACSIZE | Whether the audit committee has three or more members. |

| Firm Size | FMSIZE | This is measured as the book value of the total asset of the firm at the end of financial year. |

| Audit Committee Meetings | ACMT | Whether the audit committee meets at least 4 times annually. |

| Firm Age | FAGE | This is measured as the number of years the company has been publicly traded. |

| Audit Type | AUDTYP | Type of auditor the firm is engaging. |

Source: Adapted from Ojeka et al. (2014).

Results and Discussion

The data presented involved tables and figures which were used for the descriptive statistics and correlation analysis and regression analysis for the hypotheses testing.

Descriptive Statistics

The Table 2 above shows that out of the population, only 4 banks had a sample of six years while others had a sample of nine years. The affected banks with uncompleted financial reports undertook mergers and acquisitions between 2003 and 2011. Hence, completed financial reports could not be found.

| Table 2: Banks Sampled | |

| Banks | Number of Years Sampled |

|---|---|

| Access | 9 |

| Diamond | 9 |

| ECO | 9 |

| FCMB | 6 |

| First Bank | 9 |

| Fidelity | 9 |

| GTB | 9 |

| Skye | 6 |

| Stanbic IBTC | 9 |

| Sterling | 6 |

| UBA | 9 |

| Union | 9 |

| Unity | 6 |

| Wema | 9 |

| Zenith | 9 |

| TOTAL | 123 |

Source: Field Study (2013).

Table 3 gives the accrual quality of the sampled banks. The indicators demonstrate that some banks engage in earnings management and losses management in one form or the other. The mean accrual manipulations are 0.04, -0.01, 0.09, 0.09, 0.00, 0.01, 0.01, -0.01, -0.25, 0.00, - 0.14, -0.05, 0.03, -0.01, 0.00 for all the banks respectively. The minimum range demonstrated negative sign for all the banks sampled that is, at one point in time within (2003-2011) all the banks engaged in income increasing strategy. This could be the impact of 17-man committee set up by Atedo Peterside in the year 2000 to identify the weaknesses of corporate governance practices with respect to public companies. In summary, the manipulations as revealed by statistics are income increasing and income decreasing effects because the signs of the indices are negative and positive.

| Table 3: Accural Quality By Banks | ||||

| Variables | Mean | Minimum | Maximum | Standard Deviation |

|---|---|---|---|---|

| Access | 0.038725564 | -0.0187597 | 0.236804 | 0.078884 |

| Diamond | -0.01158999 | -0.0850108 | 0.025115 | 0.030577 |

| ECOBANk | 0.08725166 | -0.0065349 | 0.447793 | 0.150425 |

| FCMB | 0.088934902 | -0.0033456 | 0.360823 | 0.149351 |

| Fidelity | 0.000678792 | -0.072637 | 0.059941 | 0.040913 |

| First | 0.00920971 | -0.0047697 | 0.080799 | 0.02698 |

| GTB | 0.011350174 | -0.0179838 | 0.106441 | 0.037131 |

| Skye | -0.00959967 | -0.0717172 | 0.010834 | 0.031075 |

| Stanbic IBTC | -0.25965129 | -2.4725091 | 0.091385 | 0.830402 |

| Sterling | 0.003635555 | -0.0053488 | 0.030942 | 0.014196 |

| UBA | -0.13899607 | -0.8179627 | 0.001021 | 0.290373 |

| Union | -0.0451395 | -1.3552905 | 0.953806 | 0.583981 |

| Unity | 0.02734439 | -0.0045257 | 0.148972 | 0.059879 |

| Wema | -0.00378739 | -0.0193588 | 0.01285 | 0.011485 |

| Zenith | 0.001991674 | -0.0049333 | 0.019595 | 0.007217 |

Source: Field Survey (2013).

From the Table 4, as expected, we find a significant positive coefficient between audit committee independence and relevance (ADLAG) when CEO interference in the activities of the audit committee is present. This means, even though the audit committee independence can enhance the relevance of financial reporting, however this impact is mitigated when the CEO power is feasible in the audit committee. That is, audit committee member with the appearance of independent may in fact only be independent when their selection to the board and audit committee was not influence by the CEO (Carcello et al., 2011). This also point to the fact that when CEO interference and power is rubbed off on seemingly audit committee independence, the audit report lag days is increased, thereby making the financial report less relevant to the users of the report. The value is significant at 10% level.

| Table 4: Ordinary Least Square (Ols) And Least Square Dummy Variable (Lsdv) Regression Analysis Of Audit Committee Independence, Presence Of Ceo Power And Financial Reporting Quality | ||||

| OLS | LSDV | |||

| 1 | 2 | 1 | 2 | |

| Independent Variables | Reliability (TAQ) | Relevance (ADLAG) |

Reliability (TAQ) | Relevance (ADLAG) |

| Coefficient | Coefficient | Coefficient | Coefficient | |

| (t-statistics) | (t-statistics) | (t-statistics) | (t-statistics) | |

| p-value | p-value | p-value | p-value | |

| CEOpwr*ACIND | 0.007 (0.132) 0.894 |

0.482** (0.041) 0.046 |

0.003 (0.065) 0.947 |

25.852*** (3.441) 0.000 |

| Control Variables | ||||

| FAGE | 0.048 (0.854) 0.394 |

26.950** (2.440) 0.016 |

0.047 (0.837) 0.404 |

-27.055 (-0.687) 0.493 |

| ACMT | 0.114 (1.484) 0.140 |

19.237** (2.076) 0.040 |

0.109 (1.408) 0.161 |

26.435*** (4.883) 0.000 |

| ACSIZE | -0.058** (-2.296) 0.023 |

2.696 (0.311) 0.756 |

-0.063** (-2.396) 0.018 |

5.877* (1.651) 0.100 |

| AUDTYPE | -0.130 (-1.503) 0.135 |

46.968 (0.843) 0.400 |

-0.113 (-1.359) 0.176 |

117.131*** (3.772) 0.000 |

| FSIZE | -0.015 (-1.407) 0.161 |

-3.812 (-0.859) 0.391 |

-0.019* (-1.802) 0.074 |

7.848* (1.638) 0.100 |

| p-value F-test No of Obs. |

0.582 (0.786) 128 |

0.081 (1.928) 128 |

0.058 (0.795) 128 |

0.000 (543.172) 128 |

| Keys: ***, **, * Significant at the 1%, 5% and 10% levels respectively. Note: Numbers in each cell are arranged in the following order- Coefficient, t-values (in parenthesis), p-values and Std. ß. |

||||

Carcello et al. (2011) posited that the appearance of independence does not necessarily translate into substance depending on whether the CEO is involved in selecting the board members or present at every board meeting. This finding as reflected invariably supports the proposition of Carcello et al. (2011) and Lisic et al. (2011) which states that there is no significant relation between audit committee independence and restatement when there is CEO interference.

Comparing the sign of the β coefficients showed that Audit Committee Meeting (ACMT), audit committee size (ACSIZE) and auditor type (AUDTYP) were all positive but not significant at 1%, 5% and 10% apart from AGE that was positive and significant. However, firm size showed an insignificant negative effect on relevance of financial reporting.

In term of Total Accrual Quality (TAQ), the only significant variables were Audit Committee Size (ACSIZE). As expected, CEO Power (CEOpwr) on audit committee independence has a positive coefficient with reliability (Accrual Quality) of financial reporting. The implication of this is that, the higher the CEO interference (CEOpwr/interference) the higher the accrual quality and hence the less the reliability of the financial reporting. The result supported the proposition of Lisic et al. (2011) that when the CEO is involved, the associations are insignificant. Firm AGE and Audit Committee Meeting (ACMEET) were insignificantly positive against accrual quality while Audit types (AUDTYP); Audit Committee Size (ACSIZE) and Firm Size (FMSIZE) had insignificantly negative coefficients against reliability (Accrual Quality) while Audit Committee Size (ACSIZE) was negative and significant.

However, the LSDV results (in term of Relevance) in Table 4, shows that Audit Committee Independence (ACINDP) when CEO interfered was positive and significant at 1%, 5% and 10%. This means that CEO interference in the audit committee significantly reduces the benefit of having an independent audit committee. It also means that, CEO interference makes it difficult for the audit committee to operate independently because they need the CEO to get job done faster and accurately. The CEO cooperation towards the success of the audit committee cannot be over-emphasised. Consistent with Klein (2002a); Bédard et al. (2004); Irma & Abdul (2019) and Vafeas (2005) where they found that audit committee independence is associated with earning quality however the presence of the CEO can damage this benefit. In addition, Klein (2002a) posited that CEO interference in the audit committee activities can lead to board captivity. Lisic et al. (2011) also posited that when the CEO is involved, the associations are insignificant. The table further revealed that the control variables AUDTYP, ACMT, ACSIZE and FMSIZE positive significant coefficients while AGE showed a negative sign but not significant. But in the overall, the result was significant against the relevance of financial reporting.

However, using reliability as the dependent variable, audit committee independence with CEO interference showed a positive sign but not significant. Though, the CEOpwr as a variable from Table 4 showed that it was not significant at 1%, 5% and 10 %, however, the sign was positive. This means the higher the CEOpwr, the higher the accrual and the lower the reliability of the financial report. In this study it is revealed that CEO interference in the audit committee independence reduces the reliability of financial report. Specifically, CEO interference significantly reduces the benefits of having an independent audit committee.

In addition, comparing the coefficient with when there is CEO interference, it was discovered that, audit committee independence would reduce the reporting lag much more than when there is CEO interference. This indicates that financial reporting becomes more relevant when there is no CEO interference. For the control variables, AGE and AUDMT have significant positive result, but ACSIZE is positive and not significant while FMSIZE has a significant negative effect on relevance.

Using reliability as the dependent variable in Table 5, the Audit Committee Independence (ACINDP) has a significant and negative relationship with reliability (accrual quality) of financial reporting in the absence of CEO interference. The p-value stood at 0.0263. While the pvalue when CEO is involved is significant at 5%, it was significant at 10% when CEO interfered. In the overall results, it showed that audit committee independence impacts the financial reporting quality from the two models. The result also supports the assertion of Carcello et al. (2011); Abbott & Peters (2000) and Iyoha et al. (2013) that CEO interference in the activities of the audit committee does not generally appear to be directly associated with financial reporting quality. Audit Size (ACSIZE) and Firm Size (FMSIZE) are significant and negatively sign, while AGE is positive but not significant. ACMT is significantly positive.

| Table 5: Ordinary Least Square (Ols) And Least Square Dummy Variable Regression (Lsdv) Analysis Of Audit Committee Independence, Absence Of Ceo Power And Financial Reporting Quality | ||||

| OLS | LSDV | |||

|---|---|---|---|---|

| 1 | 2 | 1 | 2 | |

| Independent Variables | Reliability (TAQ) | Relevance (ADLAG) | Reliability (TAQ) | Relevance (ADLAG) |

| Coefficient | Coefficient | Coefficient | Coefficient | |

| (t-statistics) | (t-statistics) | (t-statistics) | (t-statistics) | |

| p-value | p-value | p-value | p-value | |

| ACIND | -0.341** (-2.25) 0.026 |

-15.725** (-0.469) 0.064 |

-0.31107** (-2.139) 0.034 |

-38.466** (-1.310) 0.019 |

| Control Variables | ||||

| FAGE | 0.024 (0.419) 0.675 |

36.926*** (4.478) 0.000 |

0.020 (0.631) 0.529 |

41.294*** (5.862) 0.000 |

| ACMT | 0.135 (1.531) 0.128 |

24.150** (2.198) 0.029 |

0.174** (2.284) 0.024 |

5.241 (0.514) 0.607 |

| ACSIZE | -0.071 (-1.296) 0.197 |

1.239 (0.139) 0.889 |

-0.051** (-1.783) 0.077 |

-6.044 (-0.786) 0.433 |

| AUDTYPE | -0.147 (-1.495) 0.137 |

-22.463 (-0.728) 0.467 |

-0.247** (-2.408) 0.017 |

19.630 (0.707) 0.481 |

| FSIZE | -0.008 (-0.717) 0.474 |

-13.155** (-2.835) 0.052 |

0.027 (0.888) 0.376 |

-37.161*** (-6.867) 0.000 |

| p-value F-test No of Obs. |

0.103 (1.355) 128 |

0.000 (4.208) 128 |

0.031 (1.156) 128 |

0.000 (6.405) 128 |

|

Keys: ***, **, * Significant at the 1%, 5% and 10% levels respectively. |

||||

However, the LSDV results (using relevance) indicated that the dependent variable is consistent with our expectation showed that audit committee independence has a negative coefficient and significant at 0.0347 (p<0.05). Whereas under the CEO interference in Table 4, the coefficient was not significant at 1%, 5% and 10% level. The implication of this is that, when the CEO interference is removed from the activities of the audit committee, their independence can reduce the audit report lag days by 38 days, the impact that would make financial report more relevant for users to make whatever decision they want to make.

| Table 6: Correlation Test Of Impact Of Ceo Power Audit Committee Independence And The Quality Of Financial Reporting | |||

| ACindp | Ceo_pwr | ||

|---|---|---|---|

| ACindp | Pearson Correlation | 1 | -0.006 |

| Sig. (2-tailed) | 0.946 | ||

| Ceo_pwr | Pearson Correlation | -0.006 | 1 |

| Sig. (2-tailed) | 0.946 | ||

The LSDV result using reliability (accrual quality) as the dependent variable, consistent with our expectation, we found significant negative relationship between audit committee independence on the reliability of financial report in the absence of CEO interference (p<0.05). The implication of this is that, audit committee independence would reduce the level of accruals of a firm only if the CEO interference is curtailed. Once accrual is reduced, the reliability of the financial report is enhanced. The Audit Committee Size (ACSIZE) and AUDTYP showed significant negative coefficients with reliability with (Accrual Quality) (p<0.1 and 0.5 respectively). This implies that an increase in the ACSIZE will reduce accrual quality to make it more reliable and AUDTYP which are the big4 auditing firms that are known for their quality service would positively affect the financial reporting in the absence of CEO interference. AGE and Firm Size (FMSIZE) also showed significant positive coefficients with reliability of financial reporting.

These findings are in tandem with growing literatures for example, Bebchuk et al. (2007); Coles et al. (2007); Carcello et al. (2011) and Lisic et al. (2011) where they all agree that higher CEO power is associated with negative economic consequences. Audit committee independence is therefore seen as the most veritable quality in determining board effectiveness and it is critical to the ability of the executive directors to monitor management (Hermalin & Weisbach, 2003). Though, Agrawal & Chadha (2005) failed to find a relation between audit committee independence and financial reporting quality, but they do find a significant negative relation between financial expertise and quality of financial reporting consistent with our findings. Financial reporting therefore becomes more relevant and reliable for investment decisions of the users when CEO interference in the activities of the audit committee which is saddled with the responsibilities of ensuring transparency and sound corporate reporting is reduced.

Therefore, to determine the relationship between CEO interference (CEOpwr) and audit committee independence and how CEOpwr mitigate the roles and functions of the audit committee, a correlation test was carried out. The result is hereby presented in the table below.

The Table 6 above showed the correlation test and the level of significance of the CEO power/interference on the audit committee independence. From the table, a negative relationship was observed between the two variables. The result shows an r of -0.006 though not significant. This shows the weakening effect of CEOpwr on audit committee independence.

The result of the empirical analysis in Table 4 showed the (Pooled OLS and LSDV regression) of Audit Committee Independence and Financial Reporting Quality when CEO interference is present with a coefficient of 0.007 and 0.003 (for TAQ) and 0.482 and 25.582 (ADLAG) and p-value of 0.894 and 0.947 (TAQ) and 0.096 and 0.000 (ADLAG) respectively. The combine effect in table (4.08) shows (ACINDP coefficient of -37429 and p-value of 0.008). Therefore, the null hypothesis which stated that there is no significant impact of audit committee independence on quality of financial reporting in the absence of CEO interference cannot hold and is therefore rejected.

Conclusion And Recommendation

Using both Ordinary Least Square and the Panel Data Estimator (LSDV) for 15 Money Deposit Banks in Nigeria over the period of nine years 2003-2011, this study examined empirically the impact of audit committee objectivity (contingent on CEO Power) on the quality of financial reporting in the Nigerian Banking Sector while controlling for other audit characteristics and firms’ characteristic. A strand of literature has sought to examine the audit committee effectiveness, the influence of CEOs and the quality of financial reporting in developed and newly industrialized economies. Those researches are highly motivated by the increased governance regulations and the importance of the audit committee’s effectiveness through identifying the number of the audit committee’s mechanism to enhance financial quality. Focusing our study on Nigeria would help policymakers to make further evidence-based verdicts onward as regards to comprehensive relationship between the audit committee effectiveness contingents on CEO Power on the quality of financial reporting in Nigerian Banking Sector.

The study revealed no significant impact of audit committee independence when the CEO interference exists. This indicates that CEO interference (CEO Power) damage the independence of audit committee functions. Audit committee independence is a pre-requisite to the success of the board. Functions and duties must be discharged without fear or favor but the overbearing influence of the CEO might compromise this stand. However, there is a significant influence of audit committee independence on the quality of financial reporting in the Nigerian Banking Sector in term of relevance and reliability in the absence of Chief Executive Officer (CEO) interference (CEO Power). Whereas audit committee independence impact positively on the relevance and reliability of financial report, the same cannot be said when there is CEO interference. CEO interference in the audit committee mitigate the benefits of independence and cause its overall effect on financial reporting quality of no significant as it relates to relevance and reliability. In addition, for audit committee independence to have a significant impact even in the absence of the CEO, it has to be composed of one hundred percent of non-executive directors free from the influence of the CEO.

The study therefore recommends that, although, audit committee independence enhances the quality of financial reporting in the Nigerian Banking Sector in the absence of CEO interference (CEO Power), more emphasis should be placed on ensuring that all the directors are independent directors. For example, the NYSE Corporate Accountability and Listing Standards Committee, convened in 2002 to recommend ways to enhance the accountability, integrity and transparency of NYSE-listed companies, stated its belief that having a majority of independent directors would increase the quality of board oversight and lessen the possibility of damaging conflicts of interest. This will result in boards of public companies having a substantial representation of outside directors who do not have conflicts of interest with the company or its external auditor. The reason for this is to be able to align boards with the interests of shareholders they represent. This will reduce significantly the ability of the CEO overbearing influence on the committee activities in ensuring financial reporting quality.

Even though, this study has contributed largely to literatures on the implication of CEOs power on audit committee independence, it therefore also has its limitations which are considered as gateway for further research work in this area especially in Nigeria where this paper is a pioneer. The authors expect that caution should be taken when drawing conclusions from the findings. In the first instance, this study only captured the banking sector in Nigeria. Other studies could therefore look at other sectors that significantly contribute to the economy.

References

- Abbott, L., Park, J., & Parker, S. (2000). The effects of audit committee activity and independence on corporate fraud. Managerial Finance, 26(26), 55-67.

- Agrawal, A., & Chadha, S. (2005). Corporate governance and accounting scandals. Journal of Law and Economics, 48(2), 371-406.

- Ashbaugh-Skaife, H., Collins, D.W., & LaFond, R. (2006). The effects of corporate governance on firms? credit ratings. Journal of Accounting and Economics, 42(1-2), 203-243.

- Beasley, M.S., Carcello, J.V., Hermanson, D.R., & Neal T.L. (2009). The audit committee oversight process. Contemporary Accounting Research, 26(1), 65-122.

- Bebchuk, L.A., Cremers, M., & Peyer, U. (2007). CEO centrality. Working Paper. Harvard University. Retrieved from http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1030107

- Bédard, J., Chtourou, S.M., & Courteau, L. (2004). The Effect of audit committee expertise, independence, and activity on aggressive earnings management. Auditing: A Journal of Practice and Theory, 23(2), 13-35.

- Blue Ribbon Committee (1999). Report and recommendations of the blue ribbon committee on improving the effectiveness of corporate audit committee. New York Stock Exchange.

- Carcello, J.V., Neal, T.L., Palmrose, Z.V., & Scholz, S. (2011). CEO involvement in selecting board members, audit committee effectiveness, and restatements. Contemporary Accounting Research, 28, 396-430.

- Central Bank of Nigeria (CBN) (2006) Code of corporate governance for banks in Nigeria post consolidation. Retrieved from http://www.cenbank.org/OUT/PUBLICATIONS/BSD/2006/CORPGOV-POSCONSO.PDF

- Coles, J.L., Daniel, N.D., & Naveen L. (2008). Boards: Does one size fit all? Journal of Financial Economics, 87, 329-356.

- Hermalin, B., & Weisbach, M. (2003) Board of directors as an endogenously determined illusion, Federal Reserve Bank of New York. Economic Policy Review, 9(1), 1-20.

- Iyoha, F., Jinadu, O., Ayo, C., Gberevbie, D., & Ojeka, S. (2016). E-government adoption and environmental bonuses: A study of Nigeria and United Kingdom. In Proceedings of the European Conference on e-Government, ECEG 2016.

- Iyoha, F.O., Ojeka, S., & Ajayi, A. (2013). Impact of state institutions on the quality of accounting practice in Nigeria creating global competitive economies: 2020 vision planning and implementation. In Proceedings of the 22nd International Business Information Management Association Conference, IBIMA 2013.

- Iyoha, F.O., Ojeka, S.A., & Ogundana O.M. (2017). Bankers? perspectives on Integrated Reporting for value creation: Evidence from Nigeria. Banks and Bank Systems, 12(2), 100-105.

- Klein, A. (2002a). Audit committee, board of director characteristics, and earnings management. Journal of Accounting and Economics, 33(3), 375-400.

- Leuz, C., Dhananjay N., & Peter D.W. (2003). Earnings management and investor protection: An international comparison. Journal of Financial Economic, 69, 505-527.

- Lisic, L.L., Neal, T.L., & Zhang, Y. (2011). The continuing impact of CEO power on audit committee effectiveness in the post-sox era.

- McNicholas, M. (2000). Research design issues in earnings management studies. Journal of Accounting and Public Policy, 19(4/5), 313-345.

- Nigerian Corporate Governance. (2011). Code of corporate governance for public companies.

- Ojeka S.A., Fakile S.A., Anijesu A., & Owolabi I. (2017). Examining the quality of financial reporting in the banking sector in Nigeria: Does audit committee accounting expertise matter? Journal of Internet Banking and Commerce, 21(3), 1-18.

- Ojeka S.A., Fakile, A.S., Ikpefan O.A., & Achugamonu B.U. (2016). Institutional shareholder engagement, corporate governance and firm?s financial performance in Nigeria: Does any relationship exist? Journal of Internet Banking and Commerce, 21(2), 1-10.

- Ojeka S.A., Iyoha F.O., & Ikpefan, O.A. (2017). Does the reformed code of corporate governance 2011 enhance market performance of firms in Nigeria? International Journal of Economic Perspectives, 11(1), 155-164.

- Ojeka, S.A., Iyoha, F.O., & Asaolu, T. (2015). Audit committee financial expertise: Antidote for financial reporting quality? Mediterrean Journal of Social Sciences, 6(1) 150-160.

- Owolabi, A., & Ogbechie, C. (2010). Audit committee reports and corporate governance in Nigeria. International Journal of Critical Accounting, 2(1), 64-78.

- Rich, K.T. (2009). Audit committee accounting expertise and changes in financial reporting quality. Ph.D Dissertation, University of Oregun.

- Sanusi, L. (2010). CBN?s report on the examination of banks. Press Release,

- Sarbanes-Oxley Act (SOX), (2002). Public Law No. 107-204, 116 Stat. 745, sec. 1-1107. GPO, Washington, DC.

- Securities & Exchange Commission Code (2003). Final rule: disclosure required by sections 406 and 407 of the Sarbanes-Oxley Act of 2002. Washington, DC: SEC

- Securities and Exchange Commission Code. (2011). Code of corporate governance in Nigeria. Retrieved from http://www.sec.gov.ng.com/governance.htm

- Shivdasani, A., & Yermack, D. (1999). CEO involvement in the selection of new board members: An empirical analysis. The Journal of Finance, 54(5), 1829-1853.

- Vafeas N. (2005) Audit committees, boards and the quality of reported earnings. Contemporary Accounting Research, 22(4), 1093-1122.