Research Article: 2022 Vol: 21 Issue: 1

Does Creating Shared Value Has an Implication on Corporate Performance

Wiyas Yulias Hasbu, Universitas Padjadjaran

Wahyudin Zarkasyi, Universitas Padjadjaran

Harry Suharman, Universitas Padjadjaran

Citation Information: Hasbu, W.Y., Zarkasyi, W., Suharman, H., & Poulus, S. (2022). Does creating shared value has an implication on corporate performance. Academy of Strategic Management Journal, 21(1), 1-12.

Abstract

Creating Shared Value (CSV) is a corporate strategy that aims to achieve sustainable growth on a long-term basis by coexisting with society rather than merely maximizing short-term profit. Financial, societal, and environmental benefits can be achieved simultaneously. Creating shared value poses two kinds of value - business and social – that should be brought together through corporate strategy, bringing it into alignment with its core activities This study presents a research model clarifying the role of Creating Shared Value (CSV) and its impact on corporate performance. Further, we reveal the mediating role of Corporate Social Responsibility (CSR) by the various organization activities which relate to economic and social value to enhance corporate performance. The proposed research model addresses three difference proposals indicating that by creating shared value (CSV) approach, organizations can create both economic and social values simultaneously. Ultimately driving improvement and enhance corporate performance as a whole.

Keywords

Creating Shared Value, CSR, Corporate Performance.

Introduction

Over decades, the concept of corporate social responsibility (CSR) has continued to grow in importance and significant. The idea that business enterprises have some responsibilities to society beyond that of making profit for the shareholders has been around for centuries (Carrol & Shabana, 2010). The goal of CSR is to embrace responsibility for the company's action encourages a positive impact through its activities on the environment, consumers, employees, communities, stakeholders, and all other members of the public.

The cases against the concept of CSR typically begin with the classical economist argument articulated most forcefully by Milton Friedman. Friedman held that management has one responsibility and that is to maximize the profits of its owners or shareholders. Milton Friedman critique of the whole notion of corporate social responsibility that business contribute to society by making profit, which support employment, wages, purchase, investments, and taxes.

Most of the corporations embrace philanthropic activities and CSR as a response to external social pressure in which corporation tries to solve the societal issues at the periphery, not to the core. Corporation can use their charitable efforts to improve their competitive context. Using philanthropy to enhance context brings social and economic goals into alignment and improves a company long term business prospect. Company began to use philanthropy to achieve both social and economic gains. Related to CSR, philanthropy practice should be tied with CSR in order to gain social impact and strengthen the firm’s long-term competitiveness.

The concept of shared value can be defined as policies and operating practices that enhance a company's competitiveness while simultaneously advancing the economic and social conditions in the communities in which it operates. A business needs a successful community, not only to create demand for its products but also to provide critical public assets and supportive environment. A community needs successful business to provide jobs and wealth creation opportunities for it citizens. Companies can create economic value by creating share value. Shared value creation focuses on identifying and expanding the conditions between societal and economic groups. The share value positively impacts society, the environment, finance, and all parties involved.

Government and NGO’s will be most effective if they think in value terms-considering benefits relative to costs-and focus on the results achieved rather than the funds and effort expended. The principle of share value creation cuts across the traditional divide between the responsibilities of business and those of government or civil society (Porter & Kramer, 2011). Further Porter & Kramer argued, from society’s perspective, it does not matter what types of organizations created the value. It means benefits are delivered by those organizations-or combinations of organizations-that are best positioned to achieve the most impact for the last cost..

The right kind of government regulation can encourage companies to pursue shared value and these regulations enhance share value set goals and stimulate innovation. They highlight a societal objective and create a level playing field to encourage companies to invest in shared value rather than maximize short-term profit.

Some private foundation has begun to see the power of working with businesses to create share value. Foundation can also serve as honest broker and allay fears by mitigating power imbalance between small enterprise, NGOs, governments and companies. These efforts will require a new assumption that shared value can come as a result of effective collaboration among all parties.

Business operating in any region, industry and market, regardless of their products are tasked with one major objective, which is to make efficient use their resources deliberately which aims of increasing their profit. Social issues are seen as peripheral to management challenges. One of the theoretical propositions that strive to solve the aforementioned is the concept of creating shared value (CSV), introduced by Porter & Kramer (2011), as value created by and for a company as well as its stakeholders simultaneously.

CSV is an action-oriented concept that attempts to translate CSR into business practise. Porter & Kramer (2011) has stated CSV rest on the premise that both economic and social progress must be addressed using value principles and value is as benefit relative to costs not just benefit alone. There are three distinct ways to do by reconceiving products and market, redefining productivity in the value chain, and building supportive industry clusters at the company's locations (Porter & Kramer, 2011). As a result of the main problem that has come to the question of how pursuing CSV affects corporate performance. Porter & Kramer (2011) have presented the approach of CSV and the positive impact on corporate performance in a broad concept.

This study presents an initial overview on shared value approach and how CSV generates economic and social value. Porter & Kramer (2011) introduced creating shared value that value created by and for a company as well as its stakeholders simultaneously. Hence, the aim of this research is to answer the question of whether these two factors - CSV and corporate performance - are related. Some of questions are as follows:

1. What company do to formulate strategy in created value relate to economic and social value,

2. What company do to execute and creating shared value in all company’s activities,

3. What its implications on corporate performance.

The remainder of the paper is organized as follows: The second section presents the literature review. The third section presents research model proposition. The fourth section will be presented conclusion.

Literature Review

Strategic Corporate Social Responsibility

Milton Friedman and Archie Carroll offer two contrasting views of the responsibilities of business firms to society. Friedman argues against the concept of social responsibility as a function of business. According to Friedman, a business person who acts responsibly by cutting the price of the firm’s product to aid the poor, or by making expenditures to reduce pollution, by hiring the hard-core unemployed, is spending the shareholder’s money for a general social interest. Archie Carrol proposed that the managers of business organization have four responsibilities: economic, legal, ethical, and discretionary (Wheelen et al., 2018). Carroll list four responsibilities in order priority. A business firm must first make a profit to satisfy its economic responsibilities and to continue in existence the firm must follow the laws. Having satisfied the two basic responsibilities, a firm should look to fulfilling its social responsibilities.

The expenditures on CSR activities are typically intended as long-term investments that are likely to yield financial returns. Corporations “give back” to their constituencies because they believe it to be in their best financial interest to do so. CSR strategies which add value to the business and disregard others activities which do not add value to the business. Accordingly, strategic CSR could increase the financial performance of businesses and society (Porter & Kramer, 2011).

The profit maximization objective of a business organization has served as underlying feature of the debate on CSR. There is an underlying assumption that the business organization’s objective should not be exclusively economic but the social effect of their operations should be taken into perception, such that the greater good of society is placed above that of the business organization (Carroll, 1979; Angelova, 2019). CSR activities can in actual sense foster the business organization’s profit maximization objective through its ability to serve as a strategic tool for gaining competitive advantage, as measured through the stakeholder perception of the organization, which is reflected through loyalty from their various stakeholders.

CSR can bring a competitive advantage if there is appropriate relationship with multiple stakeholders. Therefore, it is in the interest of business to engage in ongoing communications and dialogue with employees, customers, marketplace and societal groups.

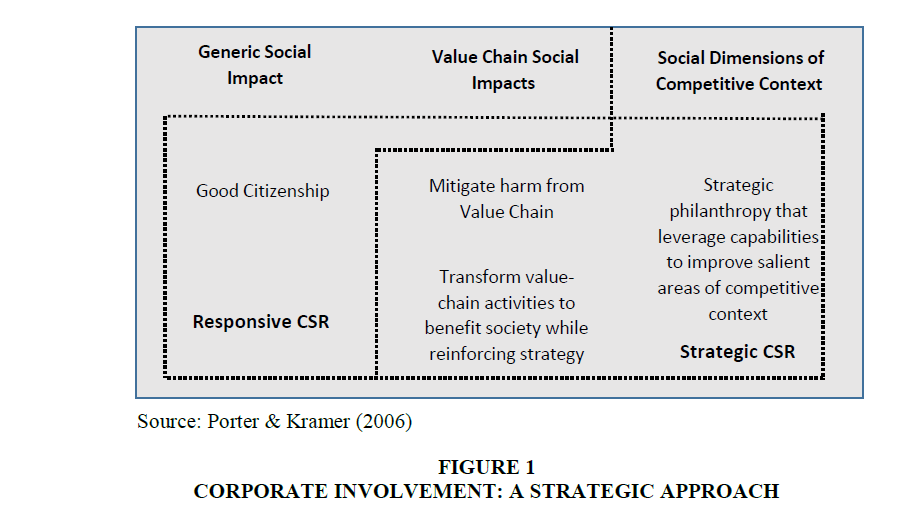

Porter & Kramer (2006) advocated that through strategic CSR the company will make a significant impact in the community and will also reap the greatest business benefit. They suggested that strategic CSR goes beyond best practice. The company may be trigger to doing things differently from competitors, in a way that lower cost. The authors went on to say that strategic CSR involves both inside-out and outside-in dimensions, working in tandem. Porter & Kramer (2006) indicate that there are opportunities for “shared value” through strategic CSR. The companies are urged to strengthen their competitiveness by investing in social and environmental aspect, as feature in Figure 1.

Stakeholder and Shared Value

The actual word stakeholder first appeared in management literature in an internal memorandum at the Stanford Research Institute (SRI), in 1963. The term was meant to generalize the notion of stockholder as the only group to whom management need be responsive (Freeman, 2010; Freeman et al., 2010). Freeman (1984) defines a stakeholder as “any group or individual who can affect or is affected by the achievement of the firm’s objectives”. Freeman definition suggests a two-way relationship between a firm (that is, its management) and its stakeholders. Each element of this relationship represents the foundation for a model of stakeholder management. First, if stakeholders can affect the achievement of firm’s objectives, it follows that firm’s decisions, and hence its performance, may be affected by activities of its stakeholders. Second, if stakeholders are affected by achievement of the firm objectives, it follows that the firm’s which in turn suggests the possibility as normative obligation to stakeholder on firm’s part. A major objective of the firm was to attain the ability to balance the conflicting demands of various stakeholders in the firm. The behaviour of various stakeholders group is considered a constraint on the strategy that is developed by management to best match corporate resources with its environment.

Managing the relationships with stakeholders will hold both tangible and intangible long-term rewards for the corporation. Corporation and managers should understand that stakeholders having raising expectation. Internal stakeholders – the employees – are likely to expect at steady income and regular salary increases. External stakeholders – the community – for example – might expect the corporation to act more sustainability towards their immediate natural environment. Furthermore, a corporation might empower community by involving them in a certain project, or have a meeting a community leader to get inputs and opinions from them. This also requires the stakeholders to be moved to the centre of management’s vision, as well as co-operative spirit that should be used in building stakeholder relationship. Maintaining and managing the relationships with stakeholders in a sustainable manner also requires certain drivers. These drivers are intangible asset that form part of the share value and social capital of a business.

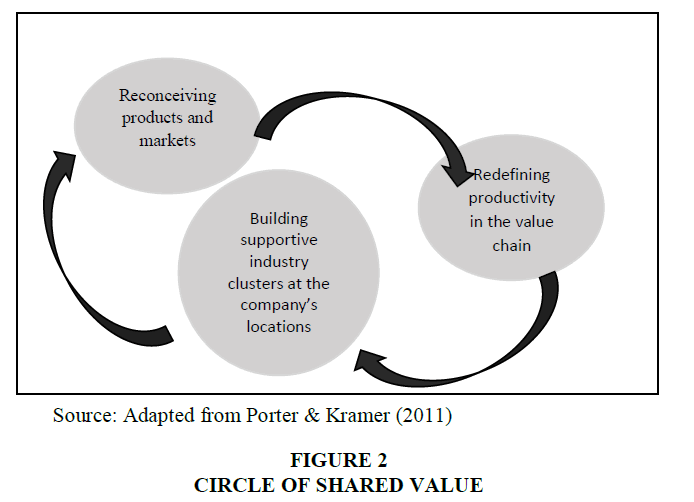

The concept of shared value involves creating economic value in a way that also creates value for society by addressing its needs and challenges. The virtuous circle of shared value in Figure 2 indicates that improving value in one area will give rise to opportunities to others.

CSR Strategy and Creating Shared Value

Given the enormous tug towards CSR, without the accompanying discipline, the question for corporation is not where to engage in CSR but what the best way forward is for crafting CSR programs that reflect a company’s business value, while addressing social, humanitarian and environmental challenges. The fundamental problem with CSR practice is that companies usually don’t have a CSR strategy, but rather numerous disparate CSR programs and initiatives. Every corporation should have a CSR strategy that unifies the diverse range of a company’s philanthropic giving, supply chain, “cause” marketing, and system level initiatives all under one umbrella.

For any company, strategy must go beyond best practices. It is about choosing a unique position – doing things differently from competitors in a way that lowers cost or better serves a particular set of customer needs. Strategic CSR moves beyond good corporate citizenship and mitigating harmful value chain impacts to mount a small number of initiatives whose social and business benefits are large and distinctive (Porter & Kramer, 2006).

The concept of shared value can be defined as policies and operating practices that enhance a company's competitiveness while simultaneously advancing the economic and social conditions in the communities in which it operates. Shared value creation focuses on identifying and expanding the conditions between societal and economic groups (Porter & Kramer, 2011).

Companies can create economic value by creating share value. The share value positively impacts society, the environment, finance, and all parties involved. There are three distinct ways to do this: by reconceiving products and market, redefining productivity in the value chain and building supportive industry clusters at the company's locations. Each of these is part of the virtuous circle of shared value; improving value in the area gives rise to opportunities in the others (Porter & Kramer, 2011).

Today, Creating Shared Value have been evolving and working with corporations to prove these concepts. There are numerous large global companies such as Google, Nestle, GE, J&J, IBM etc. have proven and measured the enormous economic and social benefits of creating shared value.

As mention above, there are mainly basic approaches to create value:

1. Reconceiving Products and Market

2. Companies should focus on unmet needs of society, innovate new products through which business get significant level of opportunities and society gains greater benefits. Creating Shared Value will help the companies to find a new market in the countries that still don’t have the modern infrastructure or products & services to meet basic human needs.

3. Redefining productivity in value chain

4. A company’s value chain inevitably affects and is affected by numerous societal issues, such as natural resources and water use, health and safety, working conditions and equal treatment in the workplace. Opportunities to create shared value arise because societal problems can create economic costs on the firm’s value chain. A holistic evaluation of the value chain productivity in terms of energy use, logistic, resource use, procurement, distribution, location and employee productivity is carried out. Companies can improve the quality, quantity, cost, and reliability of inputs of inputs and distribution while they simultaneously act as steward for essential natural resources and drive economic and social development.

5. Enabling local cluster

6. The success of every company is affected by supporting companies and infrastructure around it. Productivity and innovation are strongly influenced by “cluster”, or geographic concentrations of firm, related businesses, suppliers, service providers, and logistical infrastructure in particular field such as IT in Silicon Valley. Cluster is prominent in all successful and growing regional economies. Deficiencies in the framework conditions surrounding the cluster also create internal costs for firms. Firms create shared value by building clusters to improve company productivity while addressing gaps or failure in framework conditions surrounding cluster (Porter & Kramer, 2011)

Corporate expenditure does not mean it will bring a social benefit or that every social benefit will improve competitiveness. Most corporate expenditures produce benefits only for the business, and charitable contributions unrelated to the business generated only social benefit. The more a social improvement relates to a company's business, the more it leads to economic benefit. In the long run, social and economic goals are not inherently conflicting but integrally connected (Porter & Kramer, 2002). Furthermore, Porter and Kramer said that competitiveness today depends on how companies can use labour, capital, and natural resources to produce high-quality goods and services. Competitive advantages that arise from creating shared value will often be more sustainable than conventional cost and quality improvements (Porter & Kramer, 2011).

Strategic philanthropy must find the place of overlap where the philanthropy provides both social and economic benefits. Strategic philanthropy must be congruent with a company's competitive context CSR. Focused business would proactively promote the public interest by encouraging community growth and development and voluntarily eliminating practices that harm the public sphere. The role of philanthropy has been a key focus in the development of Creating Shared Value (CSV). Philanthropy has played and continues to play an important role in CSR the overall presence of business in society (Aakhus & Bazdak, 2012; Allan & Emma, 2007). Porter & Kramer (2011) criticize philanthropic foundations for falling to create societal value due to their lack of strategy. Porter & Kramer continue with arguing including philanthropy and social initiatives in the core business strategy will enhance that company’s competitive context.

CSR can bring a competitive advantage if there is a good relationship with stakeholders. A business needs a thriving community to create demand for its products and provide critical public assets and a supportive environment. Corporate Social Responsibility (CSR) and corporate philanthropy are an expression of the interference between the company its societal environment (von Schnurbein & Stühlinger, 2015). Creating share value poses two kinds of value - business and social – that should be brought together through corporate strategy, bringing its philanthropy and Corporate Social Responsibility (CSR) activities into alignment with its core activities.

Porter & Kramer (2011) argued that as a result of the modern business, which characterized by increased competition, where organizations are seeking ways to remain competitive while being socially responsible. It thus becomes necessary for managers to seek ways of committing to their social responsibility obligation, while ensuring they are performing their economic obligation, thereby creating a shift in CSR from philanthropy giveaway to strategy.

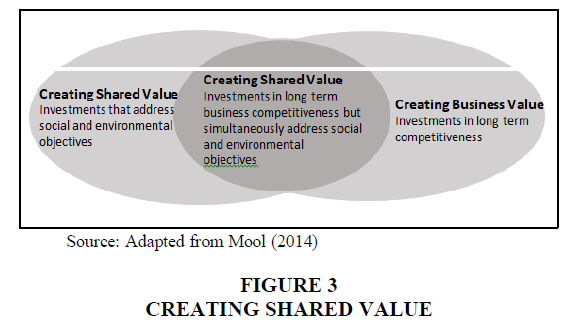

Figure 3 showed that creating shared value should supersede corporate social responsibility (CSR) in guiding companies' investment in their communities. CSR programs focus primarily on reputation and have only a limited connection to the business, making them hard to justify and maintain over the long run. In contrast, creating shared value is integral to a company's profitability and competitive position. It leverages the unique resources and expertise of the company to create economic value by creating social value (Porter & Kramer, 2011).

Creating shared value should supersede CSR in guiding the investments of companies in their communities. Even though, these concepts have a similar objective as performing social responsibility in order to achieve long-term corporate goals. How these two concepts are fundamentally different to each other (Table 1). CSV starts from different view than CSR, rather than considering how portion of corporation profit can be used to address social issues, shared value identifies and uses business strategies to find solutions to social problems and simultaneously achieve economic goals (Porter & Kramer, 2011). Figure 3 showed how share value differs from CSR.

| Table 1 Csr vs. Csv |

|

|---|---|

| Corporate Social Responsibility | Creating Shared Value |

| Value: doing good | Value: Economic and societal benefits relative to cost |

| Citizenship, philanthropy, sustainability | Joint company and community value creation |

| Discretionary or in response or in response to external pressure | Integral to competing |

| Separate from profit maximization | Integral to profit maximization |

| Agenda is determined by external reporting and personal preference | Agenda is company specific and internally generated |

| Impact limited by corporate footprint and CSR budget | Realigns the entire company budget |

| Example: Fair trade purchasing | Example: Transforming procurement to increase quality and yield |

The equal perspective view social responsibility and financial performance in synergy and this perspective maintains that high social performance leads to better financial performance, which again leads to better social performance. Waddock and Graves, indicate that better financial performance may lead to improve social performance and better social performance leads to increase financial performance (Van Wyk, 2018).

Creating Shared Value and Value Chain

The priority in this realm of CSR is increasing business opportunities and profitability, while also creating social and environmental benefit, by improving operational effectiveness throughout the value chain be it upstream in the supply chain or downstream in the distribution chain.

A company’s value chain inevitably affects-and are affected by-numerous societal issues, such as natural resources and water use, health and safety, working conditions, and equal treatment in the workplace. Opportunities to create shared value arise because societal problems can create economic costs in the firm’s value chain (Porter & Kramer, 2011).

According to Porter & Kramer (2011), shared value creation is a way of re-connecting a company with the society it is embedded in, through identifying and expanding the society the connection between societal and economic progress. It means recognizing societal needs no exclusively as a burden on the business that only brings higher costs, but as a way to improve business performance while creating added value for society as well. Hence, creating social value is a way of doing business that considers the society and environment not just as external settings that a company is operating in, but as an integral part of the business.

Porter & Kramer (2006) argued pioneering value chain innovations and addressing social constraints to competitiveness are each powerful tools for creating economic and social value. Activities in the value chain can be performed I ways that reinforce improvement in the social dimension of context. At the same time, investments in competitive context have a potential to reduce constraints on a company’s value chain activities. Not every company can build its entire value proposition around social issues but adding a social dimension to the value proposition offers a new frontier in competitive positioning. As a result, the number of industries and companies whose competitive advantage can involve social value proposition is constantly growing (Porter & Kramer, 2006).

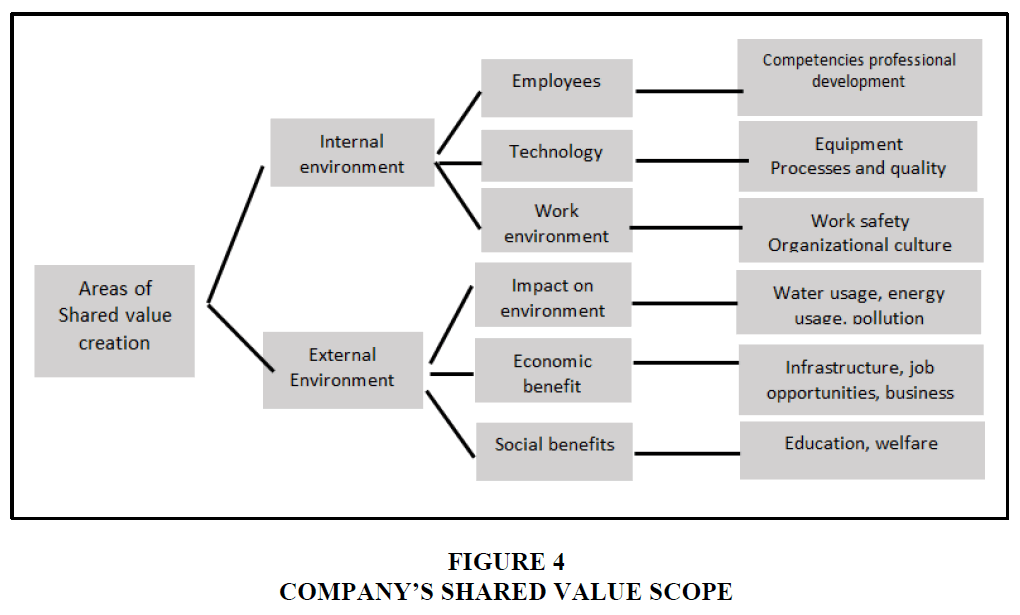

The potential areas of shared value creation are depicted in Figure 4.

Creating Shared Value and Corporate Performance

Carroll (1979) stated, for a definition of social responsibility to fully address the entire range of obligations business has to society, it must embody the economic, legal, ethical and discretionary categories of business performance. To think about CSR is to identify the different categories of CSR and sort company’s activities in terms of these different types, classes or kinds of CSR (Carroll & Shabana, 2010). Using this approach, Carroll employ four different categories of CSR, which include businesses fulfilment of economic, legal, ethical and discretionary/philanthropy responsibilities? These four categories are not mutually exclusive, nor are they intended to portray a continuum with economic concern on one end and social concerns on the other (Carroll, 1979; Carroll, 1998; Carroll, 2016; Carroll & Buchholtz, 2009).

Most of the corporation embraces philanthropic activities and CSR as a response to external social pressure not to the core. Hence, CSR has been a part of business model but it was never considered as a core business strategy. Porter & Kramer (2011) have presented the approaches of CSV and its positive impact on corporate performance.

Successful Corporation need a healthy society. Healthy society creates expanding demand for business. At the same time, a healthy society needs successful companies. The mutual dependence of corporations and society implies that both business decisions and social policies must follow the principle of shared value (Porter & Kramer, 2006). Porter & Kramer further stated that share value creation is a way of re-connecting a company with the society it is embedded in, through identifying and expanding the connection between societal and economic progress. This means recognizing societal needs not exclusively as a burden on the business performance while creating added value for society as well.

Performance is an accumulation of the result of all activities achieved by management within an organization by carrying out a series of corporate activities as measured by a certain measuring instrument. Performance is also called the end result of an activity stated that the financial performance of the company is ultimately reflected in the profit generated. Return on Investment (ROI), Return on Asset (ROA) and Return on Equity (ROE) are the most commonly used measures of profitability.

Proponents of stakeholder theory of the corporation argue that favourable social performance is a requirement for business legitimacy and that social and financial performance tends to be positively associated over the long term (Freeman, 1984). Positive association between social and financial performance, and this result was subsequently confirmed by Spencer & Taylor.

According to Karyawati et al. (2018), previous research on the relationship between CSR and financial performance showed inconsistent results. Among those researches, some proved and indicated positive relationship between the two variables. However, some research found inconsistent relationship between CSR and financial performance (Godfrey, 2005; Griffin & Mahon, 1997).

Research Model Proposition

Based on literature review, we concluded that creating shared value is more strategic than CSR. Now, how do the economic and social performance of the company can be achieved simultaneously by creating shared value through CSR program. Therefore, we interest to examine as the aim of this research in which the company’s activities may include in strategic CSR to execute creating shared value.

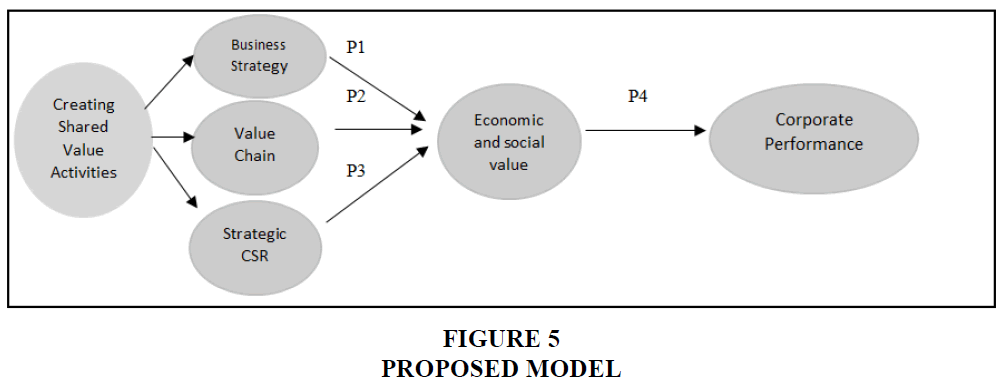

In this proposed model, we can see that by integrating CSV activities in an organization can achieve both economic and social value. We have discussed how shared value help business to identify and initiate in those areas where can create business value and social value.

According to the mention above below the research model propositions can be developed as follows (Figure 5):

H1 Business strategy affect to economic and social value

Economic and social value are interconnected and indivisible (Freeman, 1984). Company must take the lead in bringing business and society back together. Businesses must reconnect company success with social progress (Porter & Kramer, 2011). So, the trade - off between social and economic value which leads to a zero-sum game is a misconception, because these values are integrated with each other, or blended.

H2 Value chain affect to economic and social value

Company can create economic value by creating social value and there are three distinct ways to do this: by reconceiving products and markets, redefining productivity in the value chain and building supportive industry clusters at the company’s locations. Strategy theory holds that to be successful, a company must create a distinctive value proposition that meets the needs of a chosen set of customers. The firm gains competitive advantage from how it configures the value chain or the set of activities involved in creating, producing, selling, delivering, and supporting its products or services (Porter & Kramer, 2011).

H3 Strategic CSR affect to economic and social value

CSR activities can in actual sense foster the business organization’s profit maximization objective through its ability to serve as a strategic tool for gaining competitive advantage, as measured through the stakeholder perception of the organization, which is reflected through loyalty from their various stakeholders. CSR can bring a competitive advantage if there is appropriate relationship with multiple stakeholders. CSR strategies which add value to the business and disregard others activities which do not add value to the business (Lapina et al., 2012; Millon, 2011; Rivai & Pagalung, 2014).

H4 Economic and social value affect to corporate performance

Companies can create economic value by creating social value (Porter & Kramer, 2011). The equal perspective view social responsibility and financial performance in synergy. This perspective maintains that high social performance leads to better financial performance, which again leads to better social performance.

Conclusion

Companies can create economic value by creating social value. Opportunities to create shared value arise because societal problems can create economic costs in the firm’s value chain. There are three distinct ways to do this by reconceiving products and markets, redefining productivity in the value chain and building supportive industry clusters at company’s location which is as the virtuous circle of shared value that improving value in one area will give rise to opportunities to others.

Strategy theory holds that to be successful, a company must create a distinctive value proposition that meets the needs of chosen set of customers. The firm gains competitive advantage from how it configures the value chain or the set of activities involved in creating, producing, selling, delivering, and supporting its products and services.

Creating Shared Value (CSV) is a corporate strategy that aims to achieve sustainable growth on a long-term basis by coexisting with society rather than merely maximizing short-term profit. Financial, societal, and environmental benefits can be achieved simultaneously.

Creating share value should supersede CSR in guiding the investment of companies in their communities. CSR programs focus mostly on reputation and have only a limited connection to the business, maintain over the long run. CSR can bring a competitive advantage if there is appropriate relationship with multiple stakeholders. Porter & Kramer (2006) affirmed that through strategic CSR engagement business may achieve a competitive advantage. This perspective maintains that high social performance leads to better financial performance, which again leads to better social performance.

A framework is proposed for empirical studies to show the link between create shared value and Corporate Performance with relationship other links between society and business can be made much stronger through implementation of Creating Share Value. Creating Shared Value action will have greater positive impact on overall business goals and society.

References

Allan, B., & Emma, B. (2007). Business Research Methods.

Angelova, R. (2019). About the similarities and differences between shared value and corporate social responsibility. Trakia Journal of Sciences, 17(1), 186-188.

Carroll, A.B., & Buchholtz, A.K. (2009). Business & Society, Ethics and Stakeholder Management (7th Edn.) South-Western, Cengage Learning, 200

Freeman, R.E. (2010). Strategic management: A stakeholder approach. Cambridge university press.

Freeman, R.E., Harrison, J.S., Wicks, A.C., Parmar, B.L., & Colle, S.D. (2010). Stakeholder theory, the state of art, Cambridge University Press, University Printing House, Cambridge CB2 8BS, United Kingdom.

Millon, D. (2011). Two models of corporate social responsibility. Wake Forest Law Review, 46, 523.

Mool, P. (2014). The effect of CSV (Creating Shared Value) on corporate performance: Focusing on the mechanism of economic and social value. Business and Innovation Research, 7(2), 37-48.

Porter, M.E., & Kramer, M.R. (2002). The advantage of corporate philanthropy. Harvard Business Review.

Porter, M.E., & Kramer, M.R. (2006). Strategy and society: The link between competitive advantage and corporate social responsibility. Harvard Business Review.

Porter, M.E., & Kramer, M.R. (2011). The big idea, creating shared value. Harvard Business Review, 89(1-2), 62-77.

Von Schnurbein, G., & Stühlinger, S. (2015). Revisiting the relationship of CSR and corporate philanthropy by using alignment theory (No. 6). CEPS Working Paper Series.

Wheelen, T.L., Hunger, J.D., Hoffman, A.N., Bamford, C.E. (2018) Strategic management and business policy, globalization, Innovation, and Sustainability (15th Edn.), Pearson Education Limited, UK.