Research Article: 2019 Vol: 18 Issue: 2

Does Labour Costs Matter for the Airline Industry?

Vikniswari Vija Kumaran, Universiti Tunku Rahman, Kampar Campus

Alwin Oh Jin Neng, Universiti Tunku Rahman, Kampar Campus

Chai Shen Nam, Universiti Tunku Rahman, Kampar Campus

Tan Kian Tat, Universiti Tunku Rahman, Kampar Campus

Jensen Fong, Universiti Tunku Rahman, Kampar Campus

Abdullahi Hassan Gorondutse, Universiti Utara Malaysia

Syamsulang Sariffudin, ELM Business School, HELP University

Abstract

The world has entered a new paradigm in air travel which has enabled anyone to travel to any corner of the globe in a matter of hours. The objective of this paper is to examine the technical efficiency level of US (United States) airlines and how internal factors affect the technical efficiency of these airlines. The paper utilized the Cobb Douglas production function to estimate the efficiency level of the US airline industry. The findings reveal that the average technical efficiency of US airlines over the period from 2005 to 2016 was 54.3% with the technical efficiency score steadily decreasing from 56.9% in 2005 to 46.4% in 2016. Labour costs have a significant impact on airline performance due to the relationship between reductions in labour cost and the increase in productivity levels which inherently affectthe overall technical efficiency of US airlines.

Keywords

Internal Factors, Labor Cost, Technical Efficiency, Stochastic Frontier Analysis, Airline Industry.

Introduction

US airline industry have raise the concern of investor due to their rapidly development. IATA (2014) stated that from the moment of history, the whole world has entered a new stage, and air travel will have the ability to deliver anyone to any corner of the globe in a matter of hours. Therefore, throughout these years, numerous studies have been carried out to examine the relationship among issues that affect the technical efficiency of United States airlines industry. According to the research we have done, we found that airline technical efficiency affected by both external and internal factor. According to the U.S. Department of Transportation’s, the United States airlines industry's collective net profit in year 2015 increased to $25.6 billion, higher than $7.5 billion in year 2014. Hence, this study will examine the technical efficiency level of United States airlines and how internal factors affect technical efficiency of US airlines.

Literature Review

The whole world has entered a new stage, and air travel will have the ability to deliver anyone to any corner of the globe in a matter of hours (IATA, 2014). In addition to the contribution to tourism and tourism, air transport represents an important industry. Hence, US airlines technical efficiency is a topic that worthy of attention.

Researcher Carlos et al. (2013) conducted a study by exploring the use of the B-convex model as a tool for assessing the technical efficiency of US airlines, by combining operational and financial data. Carlos et al. (2013) stated that since the terrorist attacks in September 11, 2001, the US airline industry has been in the financial crisis in the near future (Lai & Lu, 2005). The result shows a sharp decline in passenger demand, and the cost of a substantial increase. Some airlines merged with the name, such as the Eastern, TWA, Pan Am, Republic, Piedmont, Ozark and Texas Air disappeared from the market. After the September 11th terrorist attacks, one of the major difficulties that the airline industry faced came about, the problem that airlines industry faced after the attacks was government required them to pay the enormous costs for security precautions and this caused airline prices increase drastically (Kahn, 2004). Besides, Santosuosso (2014) said that “ROA is progressively less dependent on factors that could affect technical efficiency and increasingly influenced by many other firm and market variables.”

In addition, Return On Equity (ROE), as one the performance models, a strategic key performance indicator on demonstrating the level of airline technical efficiency. Moreover, on time consider as service quality of airline and a significant loyalty factor, according to Choi et al. (2015), integrates service quality would be critically important for various service industries, while we strengthen service quality, it leads to higher level of customer satisfaction, and therefore airlines perform better. Based on Tsionas et al. (2017) research, we can conclude that there is cause-effect relationship between technical efficiency and flight delays, higher technical efficiency levels are correlated with lower delays. Besides, customer are willing to pay a high amount to avoid the schedule delay (Zhang, 2012), which means customer regard this as important issue. In fact, this factor has a negative effect on customer complaints; it will affect airline’s reputation. Based on Tsionas et al. (2017), we can conclude that delays consider as an undesirable output within the ambit of airport operations.

Airlines reduce their labour cost to achieve competitive advantage over competitors, and also employees are willing to accept lower real wage. Meanwhile, airlines encourage employees to comply with cost-control strategies (Chang & Shao, 2011). Airlines might control employee working hours to lower the real wage of employee and avoid overtime pay. Consequently, the profit of airline industry will increase through reduction in labour cost. Major of literature reviews studied within this scope of area and industry applied exogenous variables as inputs including costs and expenditures, then result in term of performance and efficiency of airlines, as the endogenous variable. The paper written by Yayla-Kullu & Tansitpong (2013) studied about whether the labour expenses and operating expenses can be used as inputs to turn them into a good quality services, eventually boost up the airline technical efficiency.

Methodology

In this study we attempt to use the Cobb Douglas production function to estimate the technical efficiency level of United States airline industry as follows, where Yt is the output at the time of t; Kt is capital input of production at the time of t; Lt is the labor input of production at the time of t. They mentions that the A is assume to be constant while the μt is the error term with the assumption of random error term.

Based on the study did by Coelli et al. (2005), Cobb-Douglas production function can be presented in the form of either short run or long run production function. From the perspective of economist, short run is explained as a short time horizon and input such as capital is needed to be fixed. While the long run production function is referred to a long-time horizon with input that is not necessary to be fixed (Coelli, 1998).

By substituting the chosen variable into Cobb-Douglas production function as following:

Where,

i = 1, 2, 3…7 ; t = 1, 2, 3……..12,ln TE= Technical efficiency ,ln OR=The operating revenue, ln PA=The number of passenger, ln AS=The available seat-miles , ln OC=The operating cost.

Stochastic Frontier Analysis

Unit’s inefficiency can result from allocative inefficiency or technical inefficiency. Technical inefficiency and allocative inefficiency are included under economic inefficiency. In general, there are two methods based on effective frontier which are nonparametric method like Data Envelopment Analysis (DEA) and parametric method such as Stochastic Frontier Analysis (SFA).

Stochastic Frontier Analysis (SFA) is a parametric method of economic modeling. It was independently introduced by Aigner et al. (1977) and Meeusen & Van denk Broeck (1977) and this econometric theory is used to estimate pre-specified functional form and inefficiency is modeled as an additional stochastic term. The stochastic frontier method treats the deviation of the production function as both the random error (white noise) and the inefficiency (Mortimer & Peacock, 2002). This enables a distinction between a random symmetrical component which accounts for measurement errors and stochastic effects (e.g. due to weather influences) and a symmetric deviation component which represents the inefficiency. The SFA as a parametric approach requires assuming a specific function form a priori, the frontier is estimated econometrically by some variant of last squares or maximum likelihood (Coelli et al., 2005). SFA is based on econometric regression model, frontier is smooth, curved and appropriately.

The SFA is a model for generating technical efficiency scores and methodologies that seek sources of inefficiency. SFA determines the lowest cost incurred. In order to achieve the high operational efficiency of domestic airlines, airline managers must strive to reduce operating expenses (input) while increasing operating income (output). This can be achieved by implementing the SFA model for the efficiency estimation from those airlines’ performances in term of technical while analysts’ attempts are to achieve one of the concepts from SFA saying that producing the output at the optimal level with using the least amount of input.

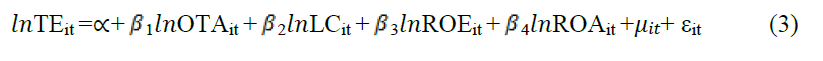

Second Stage Analysis

Besides that, our study will provide method that contributes to the estimation which is the two-stage analysis which the first stage is to generate the technical efficiency score by inserting the input and output factors; while the second stage is to form the linear regression by serving the technical efficiency as the dependent variable, internal and macroeconomic factors as the independent variables that could explain the relationship among both sides of the variables. For second stage analysis, panel data (fixed and random effect model were employed) to test relationship between internal factors and technical efficiency of US airlines. The model as follows:

Where,

i = 1, 2, 3…7 ; t = 1, 2, 3……..12, ln TE= Technical efficiency,ln OTA=The on time arrival, ln LC=The labour cost, ln ROE=The return on equity, ln ROA=The return on assets,ln MS=1 if ith airline is a low cost carrier.

Results And Discussion

Table 1 show that the average technical efficiency score of US airlines over the period from 2005 to 2016 is 54.3%. Thus, on average technical efficiency cause actual airline services to fall below maximum potential service by slightly less than 50%. The technical efficiency score steadily decreased from 56.9% in 2005 to 46.4% in 2016. Southwest Airlines is one of the airlines with most fluctuation in terms of technical efficiency score and lowest mean technical efficiency among the selected 7 airlines. The highest technical efficiency score obtained in Southwest Airlines throughout observation years falls in 2005 scored at 0.7297, ranked at fourth. The second observation year 2007 that is ranked at fourth rank of technical efficiency score. The following observation years are mostly below score of 5, fifth and sixth rank in the technical efficiency score which is considered airline under inefficiency operation.

| Table 1: The Technical Efficiency Score Of Each Airlines From 2005 To 2016 | ||||||||

| American | Delta | United | US | Southwest | Jetblue | Frontier | Average Yearly | |

|---|---|---|---|---|---|---|---|---|

| 2005 | 0.302 | 1.36E-08 | 0.575 | 0.913 | 0.219 | 0.985 | 0.986 | 0.569 |

| 2006 | 0.311 | 1.32E-08 | 0.542 | 0.957 | 0.174 | 0.982 | 1 | 0.567 |

| 2007 | 0.311 | 7.18E-09 | 0.558 | 0.913 | 0.15 | 0.98 | 0.987 | 0.557 |

| 2008 | 0.36 | 1.62E-08 | 0.646 | 0.706 | 0.15 | 0.98 | 0.987 | 0.547 |

| 2009 | 0.417 | 4.25E-08 | 0.769 | 0.791 | 0.15 | 0.98 | 0.987 | 0.585 |

| 2010 | 0.429 | 3.09E-08 | 0.812 | 0.769 | 0.13 | 0.979 | 0.987 | 0.587 |

| 2011 | 0.429 | 2.37E-08 | 0.887 | 0.748 | 0.115 | 0.978 | 0.987 | 0.592 |

| 2012 | 0.429 | 2.11E-08 | 0.405 | 0.726 | 0.109 | 0.975 | 0.987 | 0.519 |

| 2013 | 0.429 | 1.94E-08 | 0.429 | 0.686 | 0.1 | 0.973 | 0.986 | 0.515 |

| 2014 | 0.417 | 1.18E-08 | 0.442 | 0.666 | 0.072 | 0.971 | 0.986 | 0.508 |

| 2015 | 0.189 | 4.37E-09 | 0.382 | 0.975 | 0.045 | 0.967 | 0.985 | 0.506 |

| 2016 | 0.097 | 2.24E-09 | 0.34 | 0.833 | 0.038 | 0.956 | 0.985 | 0.464 |

| Average | 0.343 | 1.71825E-08 | 0.565 | 0.806 | 0.121 | 0.975 | 0.987 | 0.543 |

| Rank | 5 | 7 | 4 | 3 | 6 | 2 | 1 | |

Overall technical efficiency decreased in 2012. This is due to 2012 Southwest Airlines and other low-cost carriers have brought in negative pressure on setting the airfares. In addition, according to Field (2016), legacy carrier faced a falling trend in period from 2009 to 2010 due to presence of Southwest Airlines and dragged in airfare reduction by 24% compared to a second legacy entered into the airline industry which it only affected the airfare by 3.4%. He also mentioned this effect also presented in Southwest Airlines within its own market as its own airfare has been dropped on average of 10%. Southwest Airlines’ technical efficiency score is achieved at lowest level which indicates as inefficient.

To interpret the technical efficiency, it refers how productive a business can be given by least amount of inputs or resources which is required to produce the product or to offer the service. It also can be defined as the effectiveness of input to produce output over the business. So, among these airlines, only Frontier Airlines, JetBlue Airlines and US Airway are determined at well level of technical efficiency and other airlines are with low technical efficiency especially in Southwest Airline. All the airlines dropped their efficiency scores in recent year between 2015 and 2016. It means that the input or resources to produce output, which is the flight services, were not at well optimization.

To conclude the above discussion, after conducting the SFA to determine the technical efficiency score, the results showed that, after the merger and consolidation of passengers, available seat miles and operating costs, the operating revenue has implied low efficiency across the subsequent years. However, in some years for the respective airlines (Frontier Airlines and JetBlue Airlines), the technical efficiency of the airline performance has reached at optimum score of 1.000 due to the adequacy of the inputs. The other airlines should improve the inadequacy in optimizing of those inputs to drive well of level of technical efficiency.

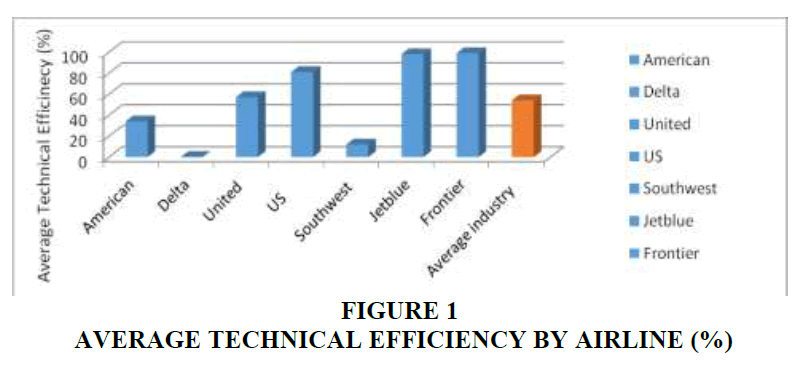

Figure 1 shows the technical efficiency score, the Frontier airline is one average the most efficient airline, with an average technical efficiency equal to 98.75%. The JetBlue airline follows with 97.55% and then the US airline with 80.69%, while the Delta airline with less than 10% is the least efficient.

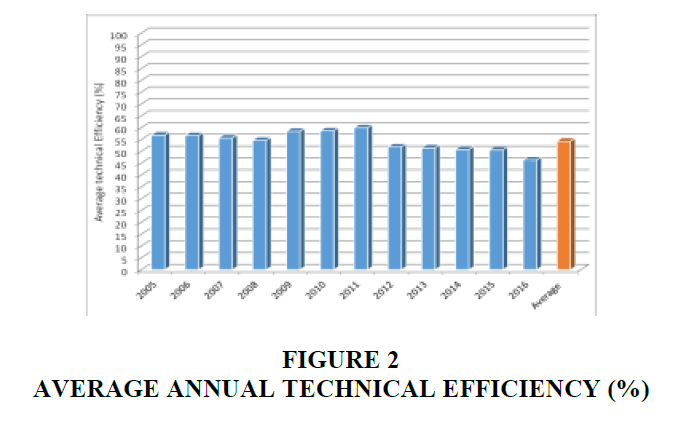

Next, Figure 2 suggests that the time period 2005 to 2016 could be separated in two sub periods. First, in the 2005 to 2011 time span, in which there is a steadily increase in technical efficiency from an average 56.9% (2005) to 59.2% (2011), corresponding to an 0.38% average annual increase, and the 2011 to 2016 time span, in which there is decrease in the technical efficiency from 59.2% (2011) to 46.4% (2016), corresponding to an 2.56% average annual decrease. In the time span 2009 to 2011 we observe the highest values in terms of technical efficiency.

Furthermore, this study also includes the Hausman test to determine which regression model is more appropriate to carry out this study. Based on unit root test analysis, all variables are stationary in level and first difference. We run the random effect model and fixed effect model to determine which regression model is best model to explain the technical efficiency (Table 2). To determine which regression model is preferred we used the Hausman test. For the internal model, the result of Hausman test indicates that random effect model is preferred. Thus, we chosen the random effect model as it among 4 variable 3 are significant which is labor cost, return on assets, and return on equity.

| Table 2: Fixed Effect Model And Random Effect Model | ||

| Variable | Fixed Effect Model | Random Effect Model |

|---|---|---|

| LC | -4.42E-06*** (9.58E-07) |

-4.80E-06*** (9.53E-07) |

| OT | 4.96E-03* (2.82E-03) |

4.20E-03 (2.81E-03) |

| ROA | 1.92E-03** (9.59E-04) |

1.82E-03* (9.57E-04) |

| ROE | -5.66E-03*** (1.85E-03) |

-4.99E-03*** (1.84E-03) |

| C | 0.466** (0.204) |

0.546** (0.211) |

| R2 | 0.961 | 0.210 |

| Adjusted R2 | 0.956 | 0.170 |

| F-statistic | 181.536 | 5.262 |

| D-W test statistic | 1.2741 | 0.826 |

| Hausman Test (P-value) | - | 1.0000 |

Notes: *, ** and *** implies that the rejection of the null hypothesis of non-stationary at 10%, 5% and 1% significance level respectively.

However, ROA show as weak significant to explain the technical efficiency at the 10% of significant value. For the other two variables, labor cost and return on equity show a strong significant in explaining the model at the 1% of significant value. Major of literature reviews apply exogenous variables as inputs including costs and expenditures, then result in term of performance and technical efficiency of airlines, as the endogenous variable. Most of airlines by carrying on with low cost carriers which consist of cost cutting from aspect of labour as well as airline operation tend to be efficient compare to others. It has been proven that by cutting off of labour cost could bring the airline a more efficient performance. ROA as a measure that provides superior annual stability as compared with other measures and identified ROA as particularly valuable in multiple industry studies.

Conclusion

In a nutshell, internal factors consist of on-time arrival, labour cost, Return On Equity (ROE) and Return On Assets (ROA), after conducted the Hausman test, we can conclude that both the on-time arrival and ROA have a positive relationship to the technical efficiency of the airline. On the other hand, labour cost and ROE are inclined to the opposite direction of movement to the technical efficiency.

The significance among those internal factors to our measurement concern, technical efficiency, by order from least significance to high significance starts from on-time arrival, followed by ROA, labour cost and ROE where both labour cost and ROE have the identical level of significance. The null hypothesis of Hausman test has been rejected implying that FEM is preferable in explaining the result based on those internal factors. By considering the importance of technical efficiency level of airlines in the country, policy makers and government are playing a very important role in developing strategies and policies to stimulate the technical efficiency level in airline industries.

For internal aspect, government should take actions to improve the airlines performance based on the significant criteria that we found in our study. First of all, government should regulate the schedule of airlines within the nation. Government should regulate both ways of route from the hub to the destination and back again. This policy is to isolate weather issues from certain geographical areas. For instance, by implementing this method, weather in Chicago will not affect the rest of routes. Thus, on-time arrival will be improved. On the other hand, government should regulate overbooking problem and protect the right of passengers. Legislators can also write a law to govern airlines that person who has purchased the ticket cannot be forced off due to overbooking issue. With this regulation, passengers are under law protection, thus services of airlines can be guaranteed to be consumed. Therefore, ROE and ROA of airline firm will increase; eventually enhance airlines’ technical efficiency.

References

- Aigner, D., Lovell, C.K., & Schmidt, P. (1977). Formulation and estimation of stochastic frontier production function models.Journal of Econometrics,6(1), 21-37.

- Barros, C.P., Liang, Q.B., & Peypoch, N. (2013). The technical efficiency of US Airlines.Transportation Research Part A: Policy and Practice,50, 139-148.

- Chang, Y.H., & Shao, P.C. (2011). Operating cost control strategies for airlines.African Journal of Business Management,5(26), 10396-10409.

- Choi, K., Lee, D., & Olson, D.L. (2015). Service quality and productivity in the US airline industry: A service quality-adjusted DEA model.Service Business,9(1), 137-160.

- Coeli, T., Parsada, R., & Battese, E. (1998). An introduction to efficiency and productivity analysis. Bostone.

- Coelli, T.J., & Rao, D.P. (2005). Total factor productivity growth in agriculture: A Malmquist index analysis of 93 countries.Agricultural Economics,32, 115-134.

- Field, S. (2015). Southwest airlines and the impact of low-cost carriers on airline ticket prices.FUSIO, 1(1), 1-23.

- IATA (2014). Fact sheet: Economic and social benefits of air transport. Retrieved from http://www.iata.org/pressroom/facts_figures/fact_sheets/pages/economic-socialbenefits.aspx

- Kahn, A.E. (2004).Lessons from deregulation: Telecommunications and airlines after the crunch. Brookings Institution Press.

- Lai, S.L., & Lu, W.L. (2005). Impact analysis of September 11 on air travel demand in the USA.Journal of Air Transport Management,11(6), 455-458.

- Meeusen, W., & van Den Broeck, J. (1977). Efficiency estimation from Cobb-Douglas production functions with composed error.International Economic Review, 18, 435-444.

- Mortimer, D., & Peacock, S. (2002).Hospital efficiency measurement: Simple ratios vs. frontier methods. Melbourne, Victoria, Australia: Centre for health program evaluation.

- Santosuosso, G. (2014).Socialism in a liberal paradigm. Editorial Galac.

- Tsionas, M.G., Chen, Z., & Wanke, P. (2017). A structural vector autoregressive model of technical efficiency and delays with an application to Chinese airlines.Transportation Research Part A: Policy and Practice,101, 1-10.

- Yayla-Küllü, H.M., Parlaktürk, A.K., & Swaminathan, J.M. (2013). Multi-product quality competition: Impact of resource constraints.Production and Operations Management,22(3), 603-614.

- Zhang, Y. (2012). Are Chinese passengers willing to pay more for better air services?Journal of Air Transport Management,25, 5-7.